Adecco Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adecco Group Bundle

Navigate the dynamic world of staffing with our PESTLE analysis of Adecco Group. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the future of work and impacting Adecco's strategic decisions. Gain a competitive advantage by leveraging these critical insights. Download the full PESTLE analysis now for actionable intelligence to inform your business strategy.

Political factors

Changes in government labor policies, such as minimum wage adjustments and regulations on gig work, directly influence Adecco's operational expenses and the attractiveness of temporary staffing for businesses. For instance, an increase in the federal minimum wage, which saw a slight upward trend in various sectors through 2024, can elevate Adecco's payroll costs and potentially decrease client demand if they seek to control labor expenses.

Favorable government stances on labor flexibility, like streamlined processes for hiring contingent workers, can boost Adecco's market opportunities by making it easier for clients to engage temporary staff. Conversely, stricter regulations on worker classification or increased social security contributions for temporary employees, as debated in several European countries throughout 2024, could add complexity and cost, impacting Adecco's competitive pricing and service offerings.

Immigration and visa regulations significantly impact Adecco's ability to source international talent, particularly in areas with high demand for specialized skills. Stricter policies can shrink the available candidate pool and slow down the placement process for clients, affecting Adecco's operational efficiency and revenue. For instance, changes in work permit requirements in key markets like Germany or the UK could directly alter the flow of skilled workers Adecco places.

Political stability within Adecco Group's key operating markets, such as Germany and the United States, is crucial for maintaining a predictable business environment. For instance, the 2024 German federal budget, while indicating fiscal prudence, also signals potential policy shifts that could affect labor market regulations and thus Adecco's operational landscape.

Geopolitical tensions, like those impacting global shipping routes in early 2025, can significantly disrupt supply chains and dampen business confidence. This uncertainty directly influences hiring volumes, as companies become more cautious about expanding their workforce, a trend Adecco closely monitors.

Changes in trade relations, such as potential new tariffs or trade agreements being debated in mid-2025, create volatility. These shifts can impact cross-border recruitment and the demand for temporary staff in sectors reliant on international trade, directly affecting Adecco's global business model and client certainty.

Public Sector Spending on Employment

Government investments in employment programs and workforce development are crucial for Adecco. These initiatives, often backed by substantial public funding, directly translate into demand for Adecco's core services in recruitment, training, and talent management. For instance, in 2024, many governments continued to prioritize reskilling and upskilling initiatives to address evolving labor market needs, potentially increasing contract opportunities for staffing firms like Adecco.

Public sector hiring itself can also be a significant market. When governments expand their workforce, whether in healthcare, education, or administration, they often rely on external staffing partners to manage the influx of new employees efficiently. This trend was evident in 2024 as many public services saw increased demand, leading to a greater need for outsourced recruitment solutions.

Key areas of government spending impacting Adecco include:

- Workforce Training and Reskilling Programs: Governments investing in programs to equip citizens with in-demand skills create direct opportunities for Adecco's training and development divisions. For example, the European Union's NextGenerationEU recovery fund includes significant allocations for digital skills and green transition training, areas where Adecco is actively involved.

- Public Sector Job Creation Initiatives: Direct government hiring or subsidies for job creation in public services generate demand for Adecco's recruitment and onboarding services. In the US, federal and state initiatives aimed at bolstering public sector employment in areas like infrastructure and healthcare are notable.

- Support for Youth Employment and Apprenticeships: Government-backed schemes focused on youth employment and apprenticeships often partner with staffing agencies to connect young talent with employers, a core competency for Adecco. Many countries reported increased funding for these programs in 2024 to combat youth unemployment.

Regulatory Environment for Staffing Industry

The staffing industry operates within a complex web of regulations that directly affect Adecco Group. These include licensing requirements, worker protection laws, and data privacy mandates, all of which shape compliance obligations and operational efficiency. For instance, in 2024, many European countries continued to refine regulations around gig economy workers and temporary employment, potentially increasing Adecco's administrative burden and compliance costs.

Stricter enforcement of labor laws, such as those concerning minimum wage, working hours, and benefits for temporary staff, can lead to higher operational expenses for Adecco. Conversely, a predictable and transparent regulatory landscape fosters smoother operations and reduces the risk of penalties.

- Worker Protection Laws: Adecco must adhere to varying national laws regarding worker rights, safety, and fair treatment, impacting payroll and benefit administration.

- Data Privacy Regulations: Compliance with GDPR and similar data protection laws is crucial, as Adecco handles sensitive candidate and client information.

- Licensing and Permitting: Operating in different jurisdictions often requires specific licenses, adding to the complexity of global operations.

Government fiscal policies and public spending directly influence Adecco's market. Increased investment in workforce development and employment programs, as seen with initiatives like the EU's NextGenerationEU in 2024, creates demand for Adecco's services. Public sector hiring also presents opportunities, with many governments expanding workforces in healthcare and education throughout 2024, often utilizing external staffing partners.

Political stability is paramount for predictable operations. Geopolitical tensions and shifts in trade relations, particularly those impacting global supply chains in early 2025, can dampen business confidence and hiring volumes. Changes in immigration and visa regulations also significantly affect Adecco's ability to source international talent, impacting operational efficiency.

Labor policies, including minimum wage adjustments and gig work regulations, directly impact Adecco's operational costs and client demand. For example, higher minimum wages in 2024 could increase payroll expenses. Conversely, favorable government stances on labor flexibility can boost market opportunities.

The regulatory environment, encompassing worker protection laws, data privacy, and licensing, shapes Adecco's compliance obligations. Stricter enforcement of labor laws can raise operational expenses, while a transparent regulatory landscape facilitates smoother operations.

| Policy Area | Impact on Adecco | Example (2024/2025) |

|---|---|---|

| Workforce Development Funding | Increased demand for training and recruitment services. | EU's NextGenerationEU allocating funds for digital and green skills. |

| Public Sector Hiring | Opportunities for recruitment and onboarding services. | Expansion of healthcare and education workforces in various countries. |

| Labor Regulations (e.g., Minimum Wage) | Potential increase in operational costs, influence on client demand. | Federal minimum wage adjustments in the US impacting payroll. |

| Immigration Policies | Affects talent pool availability and placement speed. | Changes in work permit requirements in Germany and the UK. |

What is included in the product

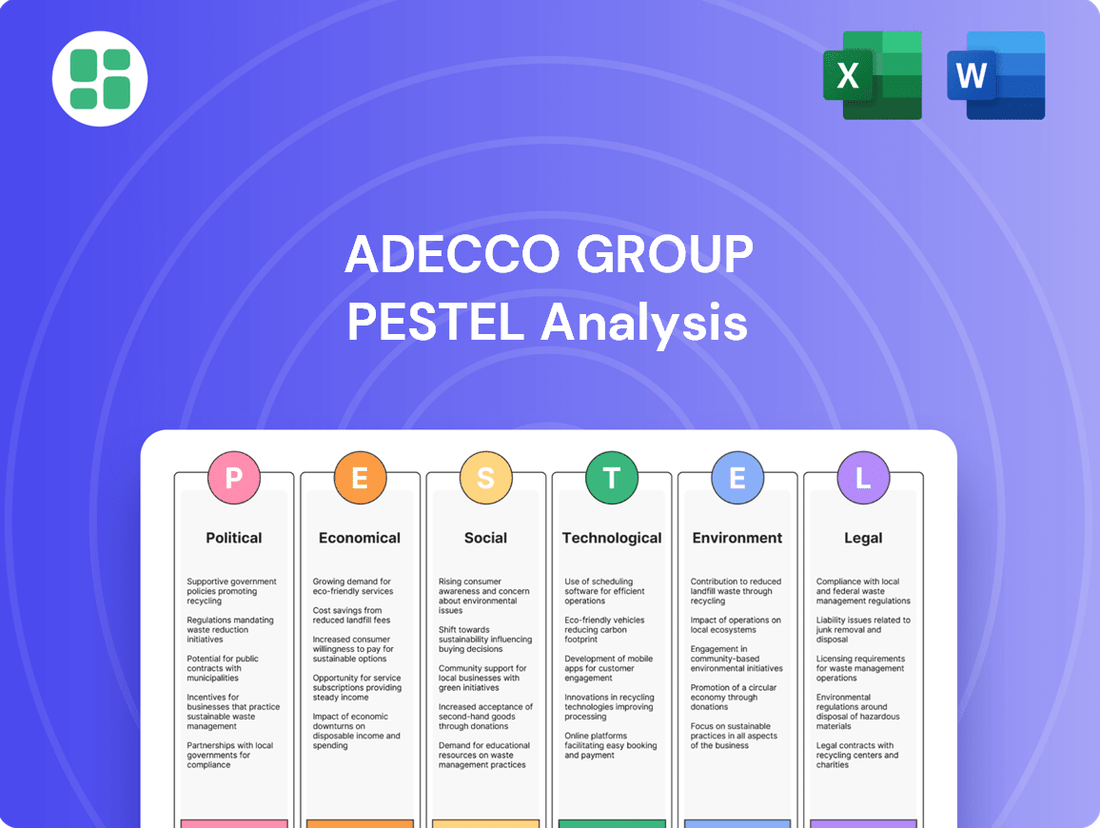

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Adecco Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting key trends and their potential impact on the global staffing and HR solutions leader.

A PESTLE analysis for the Adecco Group offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic discussions.

Economic factors

The global economic outlook for 2024 and 2025 is a critical factor for Adecco Group. While the IMF projected global growth to be 3.2% in 2024, a slight slowdown from 2023, it anticipates a modest acceleration to 3.5% in 2025. This growth trajectory directly impacts Adecco's core business, as a healthier economy generally translates to increased business investment and, consequently, a greater demand for flexible workforce solutions and talent acquisition services.

Economic expansion fuels business confidence, encouraging companies to hire more readily, both on a temporary and permanent basis. This upward trend benefits Adecco by increasing the volume of placements and associated service fees. Conversely, any deceleration or contraction in global economic activity, such as the higher inflation and interest rate environment experienced in late 2023 and early 2024, can lead to hiring freezes or reductions, directly impacting Adecco's revenue streams and profitability.

In the US, the unemployment rate stood at a remarkably low 3.9% in April 2024, signaling a tight labor market. This environment presents a dual challenge for Adecco Group: while demand for their recruitment services may surge as companies struggle to fill roles, sourcing qualified candidates becomes significantly more difficult, potentially impacting placement volumes and service delivery efficiency.

Conversely, a hypothetical rise in unemployment to, say, 6% could create an oversupply of available talent. While this might seem beneficial for recruitment agencies, it often correlates with decreased employer confidence and reduced hiring budgets, which could ultimately dampen demand for Adecco's services and lower overall placement numbers.

Rising wage inflation, a persistent economic factor, directly impacts Adecco's operational landscape. For instance, in the United States, average hourly earnings saw a 4.1% increase year-over-year as of April 2024, a trend that pressures clients to manage labor expenses more efficiently. This often translates into a greater reliance on flexible staffing models, a core offering of Adecco, as businesses seek to control their fixed labor costs.

This wage growth also presents a dual challenge for Adecco itself. If the company cannot effectively pass these escalating labor costs onto its clients, its own profit margins could be squeezed. Simultaneously, higher wage inflation sets new benchmarks for candidate compensation expectations, requiring Adecco to adjust its remuneration strategies to attract and retain talent in a competitive market.

Interest Rates and Access to Capital

Fluctuations in interest rates directly impact the cost of capital for businesses. For instance, the US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024, a level that increases borrowing expenses for companies. This can make businesses more hesitant to expand their operations or invest in new projects, indirectly affecting their demand for staffing and workforce solutions, which is a core business for Adecco Group.

Higher borrowing costs can lead clients to postpone or scale back workforce expansion plans. This directly influences Adecco's service demand, as fewer companies are likely to engage in large-scale hiring or transformation projects when capital is more expensive. For example, if a client’s cost of debt rises significantly, their budget for new hires or temporary staff might be reduced.

The accessibility of capital is also a key consideration. When interest rates are high, lenders may tighten credit standards, making it harder for businesses, particularly smaller ones, to secure loans. This reduced access to capital can hinder their ability to fund growth initiatives, which in turn limits their need for Adecco's services.

- Interest Rate Environment: Central banks globally, including the European Central Bank, have navigated a complex interest rate landscape in 2024, with rates remaining elevated compared to pre-2022 levels, impacting corporate borrowing costs.

- Client Investment Capacity: Higher interest rates reduce the disposable income and investment capacity of Adecco’s clients, potentially leading to decreased spending on recruitment and talent management services.

- Capital Access for SMEs: Small and medium-sized enterprises (SMEs), a significant client segment for staffing firms, often face greater challenges in accessing capital during periods of rising interest rates, potentially dampening their hiring needs.

Industry-Specific Economic Trends

The economic performance of key sectors like technology, healthcare, and manufacturing significantly shapes Adecco Group's operational landscape. For instance, a robust expansion in the IT sector, as seen with projected global IT spending reaching $5.1 trillion in 2024 according to Gartner, directly translates to increased demand for specialized IT talent, a core area for Adecco's staffing solutions.

Conversely, downturns in manufacturing, which experienced fluctuating global output in late 2023 and early 2024 due to supply chain adjustments and geopolitical factors, can lead to a contraction in demand for Adecco's industrial workforce services. This creates a direct correlation between industry-specific economic health and Adecco's revenue streams.

Sector-specific trends also influence the types of skills in demand. The growing healthcare sector, driven by an aging global population and advancements in medical technology, presents continuous opportunities for Adecco to supply skilled medical professionals. For example, the global healthcare staffing market is expected to grow at a compound annual growth rate of over 10% through 2028, highlighting this trend.

- IT Sector Growth: Global IT spending projected to reach $5.1 trillion in 2024, boosting demand for tech talent.

- Manufacturing Volatility: Fluctuations in manufacturing output impact demand for industrial staffing.

- Healthcare Expansion: Aging demographics and tech advancements fuel growth in healthcare staffing needs, with the market expected to grow over 10% annually through 2028.

The global economic outlook for 2024 and 2025 presents a mixed but generally positive picture for Adecco Group. While the IMF projected global growth to be 3.2% in 2024, a slight slowdown from 2023, it anticipates a modest acceleration to 3.5% in 2025. This growth trajectory directly impacts Adecco's core business, as a healthier economy generally translates to increased business investment and, consequently, a greater demand for flexible workforce solutions and talent acquisition services.

Rising wage inflation, a persistent economic factor, directly impacts Adecco's operational landscape. For instance, in the United States, average hourly earnings saw a 4.1% increase year-over-year as of April 2024, a trend that pressures clients to manage labor expenses more efficiently, often leading to a greater reliance on flexible staffing models.

Fluctuations in interest rates directly impact the cost of capital for businesses. The US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024, a level that increases borrowing expenses for companies and can make them more hesitant to expand operations, indirectly affecting their demand for staffing solutions.

| Economic Indicator | Value/Trend | Implication for Adecco |

|---|---|---|

| Global GDP Growth (IMF) | 3.2% (2024), 3.5% (2025) | Higher growth generally increases demand for staffing services. |

| US Unemployment Rate | 3.9% (April 2024) | Tight labor market increases demand for recruitment but challenges candidate sourcing. |

| US Average Hourly Earnings Growth | 4.1% YoY (April 2024) | Drives demand for flexible staffing to manage labor costs. |

| US Federal Funds Rate | 5.25%-5.50% (mid-2024) | Elevated rates increase borrowing costs for clients, potentially reducing hiring budgets. |

| Global IT Spending | $5.1 trillion (2024) | Robust IT sector growth boosts demand for specialized tech talent. |

Preview the Actual Deliverable

Adecco Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of the Adecco Group offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the external landscape shaping the global workforce solutions market with this in-depth report.

Sociological factors

The workforce increasingly values flexibility, with many seeking remote or hybrid roles. This shift fuels the gig economy, where independent contractors perform tasks on a project basis. For Adecco, this trend means both expanding its service offerings to match these preferences and adapting its recruitment strategies to access this growing talent pool.

In 2024, the demand for flexible work continues to be a dominant theme. Reports indicate that a significant percentage of the global workforce prefers hybrid or fully remote arrangements. This growing preference directly impacts staffing agencies like Adecco, necessitating a pivot towards managing contingent workers and offering a broader spectrum of employment solutions to meet client needs in this dynamic labor market.

Many developed nations are experiencing aging populations, which means fewer people are entering the traditional workforce. This demographic shift creates a higher demand for experienced and skilled professionals. For instance, in 2023, the median age in the OECD countries continued to rise, putting pressure on labor supply.

Simultaneously, younger generations entering the job market have distinct expectations. They often prioritize career growth opportunities and a healthy work-life balance. Adecco must evolve its strategies for finding and developing talent to meet these changing needs, focusing on upskilling and reskilling programs to bridge skill gaps.

Persistent talent shortages are a defining feature of the current labor market, impacting critical sectors like technology, healthcare, and skilled trades. For instance, a 2024 report indicated that over 80% of employers faced challenges filling open positions, with a significant portion citing a lack of qualified candidates. This directly fuels the need for organizations like Adecco to actively identify, train, and place individuals possessing the in-demand skills.

The evolving nature of work, driven by technological advancements and changing industry demands, means that skill requirements are constantly shifting. Adecco's ability to adapt its talent development programs and recruitment strategies to bridge these widening skill gaps is paramount to its value proposition for businesses seeking to maintain operational efficiency and competitive advantage.

Diversity, Equity, and Inclusion (DEI) Focus

Societal and corporate pressures are significantly boosting the focus on Diversity, Equity, and Inclusion (DEI). This trend directly influences Adecco Group, as it increases the demand for the company to source diverse talent and implement inclusive hiring strategies for its clients. Adecco's proactive stance on DEI is therefore crucial for its market positioning.

Adecco's dedication to DEI principles is not just about reflecting contemporary societal values; it's a strategic advantage. By embracing DEI, the company broadens its appeal to a wider pool of job seekers and effectively meets the growing client demand for diverse and inclusive workforces. For instance, Adecco's 2023 Global Talent Trends report highlighted that 85% of workers consider DEI important when choosing an employer, underscoring this critical business imperative.

- Growing Workforce Expectations: A significant majority of the global workforce, estimated at over 70% by recent surveys, now expects employers to demonstrate a strong commitment to DEI.

- Client Demand for Diverse Talent: Businesses are increasingly seeking staffing partners that can deliver diverse candidate pipelines, with many corporate clients setting specific DEI targets for their contingent workforce.

- Reputational Enhancement: Strong DEI initiatives positively impact Adecco's brand image, attracting both talent and clients who prioritize ethical and inclusive business practices.

Education and Workforce Development Trends

The way people learn and develop skills is changing rapidly, and this directly affects how Adecco Group helps people find jobs and transition careers. With the rise of automation and new technologies, there's a growing demand for continuous learning and upskilling. For instance, the World Economic Forum's Future of Jobs Report 2023 highlighted that analytical thinking and creative thinking are among the top skills needed for the future workforce, with a significant portion of the workforce expected to require reskilling by 2027.

Adecco needs to keep up with these educational shifts. This means working closely with universities, colleges, and online learning platforms to make sure their training programs and services are relevant. By doing so, Adecco can better prepare individuals for emerging roles and industries, ensuring they have the necessary competencies for the evolving job market. For example, Adecco's own investments in digital learning platforms aim to bridge these skill gaps, offering accessible training to a wider audience.

- Evolving Skill Demands: Reports indicate a significant percentage of the global workforce will require reskilling in the coming years due to technological advancements.

- Lifelong Learning Imperative: The traditional model of education is being supplemented by a continuous learning approach, with individuals needing to update their skills regularly.

- Digitalization of Education: Online learning platforms and digital credentials are becoming increasingly important for workforce development, offering flexible and accessible training opportunities.

- Industry-Academia Collaboration: Partnerships between staffing firms like Adecco and educational institutions are crucial to align training with current and future job market needs.

Societal shifts, particularly the growing emphasis on work-life balance and flexible working arrangements, continue to shape Adecco's operational landscape. A significant portion of the global workforce, estimated at over 70% in 2024 surveys, now prioritizes flexible schedules, impacting how Adecco sources and places talent. Furthermore, the increasing demand for Diversity, Equity, and Inclusion (DEI) initiatives is a powerful driver, with 85% of workers in Adecco's 2023 Global Talent Trends report indicating DEI's importance in employer choice.

The demographic trend of aging populations in many developed nations, as evidenced by the rising median age in OECD countries in 2023, creates persistent talent shortages for experienced professionals. Concurrently, younger generations entering the workforce, like Gen Z, place a high value on career progression and work-life integration, necessitating adaptive recruitment and development strategies from Adecco.

The evolving nature of work and skills, driven by technological advancements, means continuous learning is paramount. The World Economic Forum's 2023 Future of Jobs report highlights the need for reskilling, with analytical and creative thinking identified as crucial future skills. Adecco's engagement with educational institutions and investment in digital learning platforms are therefore vital to bridge these emerging skill gaps and prepare individuals for the future job market.

Technological factors

The recruitment industry is rapidly embracing automation and AI. For Adecco Group, this means AI-powered tools can significantly speed up candidate sourcing and initial screening, potentially improving efficiency by 20-30% in certain high-volume roles. This technology allows for faster matching of candidates to job requirements, a crucial factor in today's fast-paced market.

While these advancements offer clear benefits, Adecco must strategically integrate them. Maintaining the human element is paramount, especially in executive search or roles requiring nuanced understanding of client needs and company culture. For instance, a 2024 report indicated that while AI can handle initial resume filtering, human recruiters are still critical for assessing soft skills and cultural fit in over 75% of placements.

The rise of digital platforms has fundamentally changed how Adecco connects talent with opportunities. In 2024, approximately 85% of job seekers utilized online job boards and professional networking sites, highlighting the critical need for Adecco to maintain a robust digital presence. These platforms are essential for sourcing candidates globally and streamlining the recruitment process, including virtual interviews and onboarding, which are now standard practice for many businesses.

Remote work tools are no longer a niche offering but a core requirement for effective talent management. Adecco's ability to support clients in implementing and managing remote or hybrid workforces, leveraging collaboration software and digital HR solutions, directly impacts its value proposition. By 2025, it's projected that over 30% of the global workforce will be engaged in some form of remote or hybrid work, making Adecco's proficiency in these areas crucial for market leadership.

Advanced data analytics is a game-changer for Adecco, offering deep insights into labor market dynamics, the availability of skilled workers, and how well candidates perform. This allows Adecco to help its clients plan their workforces more strategically. For instance, by analyzing vast datasets, Adecco can pinpoint emerging skill gaps and anticipate future talent demands, ensuring clients are always ahead of the curve.

The smart application of data significantly boosts Adecco's predictive capabilities, allowing them to forecast talent needs with greater accuracy. This translates into optimized recruitment processes, reducing time-to-hire and improving candidate quality. Furthermore, this data-driven approach empowers Adecco to provide clients with invaluable advisory services, helping them navigate complex workforce challenges and build resilient teams.

Cybersecurity and Data Privacy

Adecco, like all companies in the staffing and HR sector, faces significant technological challenges related to cybersecurity and data privacy. The increasing volume of sensitive personal data handled necessitates robust security protocols and adherence to evolving global regulations. Failure to protect this data can lead to severe financial penalties and reputational damage.

The digital transformation in the HR industry means Adecco must continuously invest in advanced cybersecurity infrastructure to safeguard client and candidate information. This includes protecting against data breaches, ransomware attacks, and ensuring compliance with regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

- Data Breach Costs: The average cost of a data breach in 2024 is projected to reach $5.29 million globally.

- GDPR Fines: Companies can face fines up to 4% of their annual global revenue or €20 million, whichever is higher, for GDPR violations.

- Cybersecurity Investment: Global spending on cybersecurity solutions is expected to exceed $200 billion in 2024, highlighting the critical nature of these investments.

HR Technology Innovation

The HR technology landscape is evolving at a breakneck pace, with innovations in Applicant Tracking Systems (ATS), Human Capital Management (HCM) software, and talent management platforms directly impacting how Adecco Group operates and the value it delivers. For instance, the global HR tech market was valued at approximately $24.3 billion in 2023 and is projected to reach $39.5 billion by 2028, demonstrating significant growth and investment in these areas.

To remain competitive and offer clients the most advanced solutions, Adecco must consistently assess and integrate new HR tech. This includes leveraging AI-powered recruitment tools, advanced analytics for workforce planning, and sophisticated employee engagement platforms. These technologies are crucial for streamlining Adecco's internal operations, from candidate sourcing and onboarding to performance management and retention strategies.

The adoption of these technologies also allows Adecco to enhance its service offerings to clients. By utilizing cutting-edge HR tech, Adecco can provide more efficient, data-driven recruitment processes and strategic workforce solutions, thereby strengthening its position as a leader in the global talent solutions market.

- ATS and HCM Software: These platforms are becoming more integrated, offering end-to-end solutions for the employee lifecycle.

- AI in Recruitment: AI tools are increasingly used for resume screening, candidate matching, and even initial candidate engagement, improving efficiency by up to 30% in some recruitment stages.

- Talent Management Platforms: Focus is shifting towards continuous learning, skills development, and internal mobility, supported by advanced analytics.

- Data Analytics: HR analytics are critical for identifying trends, predicting workforce needs, and measuring the ROI of HR initiatives.

Technological advancements, particularly in AI and automation, are reshaping the recruitment landscape. Adecco Group is leveraging AI-powered tools to enhance candidate sourcing and screening, aiming for efficiency gains of 20-30% in high-volume recruitment. The company must balance these technological integrations with the essential human element, as 2024 data shows human recruiters remain critical for assessing soft skills in over 75% of placements.

Digital platforms are now central to Adecco's operations, with approximately 85% of job seekers utilizing online channels in 2024. Furthermore, the increasing prevalence of remote and hybrid work models, projected to involve over 30% of the global workforce by 2025, necessitates Adecco's expertise in digital HR solutions and collaboration software.

Adecco must also navigate significant cybersecurity challenges to protect sensitive data, with the average cost of a data breach in 2024 estimated at $5.29 million globally. The HR tech market, valued at $24.3 billion in 2023, is rapidly growing, with AI in recruitment alone expected to improve efficiency by up to 30% in certain stages.

| Technological Factor | Impact on Adecco Group | Key Data/Trends (2024-2025) |

| AI & Automation | Enhanced candidate sourcing, screening, and matching efficiency | Potential 20-30% efficiency gain in high-volume roles; AI crucial for initial screening, human touch for soft skills. |

| Digital Platforms | Global candidate reach, streamlined recruitment processes | 85% of job seekers use online channels; virtual interviews and onboarding are standard. |

| Remote Work Tools | Support for hybrid/remote workforce management | Over 30% of global workforce expected in remote/hybrid models by 2025. |

| Data Analytics | Strategic workforce planning, identification of skill gaps | Predictive capabilities for talent needs, optimized recruitment. |

| Cybersecurity | Protection of sensitive client/candidate data | Average data breach cost: $5.29 million (2024); strict adherence to GDPR/CCPA vital. |

| HR Tech Market Growth | Integration of advanced ATS, HCM, and talent management platforms | HR tech market: $24.3 billion (2023), projected $39.5 billion by 2028. |

Legal factors

Adecco, as a global staffing leader, navigates a complex web of employment and labor laws across its operating countries. This includes stringent regulations on working hours, minimum wage requirements, and specific rights afforded to temporary and contract workers, which can vary significantly. For instance, in 2024, many European nations continued to update their directives on worker classification and the rights of platform workers, directly impacting Adecco's business model.

Ensuring compliance with these diverse legal frameworks is paramount to avoiding costly litigation and maintaining its reputation. Failure to adhere to termination procedures, for example, can lead to substantial penalties. Adecco's 2024 annual report highlighted ongoing investments in legal compliance training and technology to manage these risks effectively across its vast international operations.

Global data privacy regulations like GDPR and CCPA impose strict rules on how Adecco handles personal data. Adecco must ensure robust data protection measures are in place for candidate and employee information, impacting recruitment and HR processes. Failure to comply can lead to significant penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million, whichever is higher.

Adecco's operations are fundamentally built upon a vast network of contracts with both clients seeking staffing solutions and candidates looking for employment. These agreements, often including stringent Service Level Agreements (SLAs), are critical for defining performance expectations, outlining responsibilities, and establishing measurable metrics for service delivery. For instance, in 2023, Adecco reported a significant portion of its revenue was generated through these contractual relationships, underscoring the importance of their legal soundness.

Strict adherence to contract law and the development of resilient legal frameworks for these agreements are paramount for fostering transparent business relationships and ensuring effective dispute resolution mechanisms are in place. This legal scaffolding protects Adecco and its stakeholders by providing clarity and enforceability, minimizing the risk of costly disagreements and maintaining operational stability.

Health and Safety Regulations

Adecco, as a staffing giant, shoulders significant responsibility for the well-being of its deployed workforce. This means adhering to a complex web of health and safety regulations across diverse industries. For instance, in sectors like construction or manufacturing, compliance with specific safety standards is not just a legal requirement but a critical operational imperative. Adecco must conduct thorough risk assessments of client sites to ensure safe working conditions, often necessitating the provision of appropriate personal protective equipment (PPE) and safety training to temporary staff. Failure to do so can result in substantial fines and reputational damage, impacting their ability to secure contracts and attract talent.

The evolving regulatory landscape presents ongoing challenges. For example, new legislation or updated guidelines concerning workplace ergonomics or exposure to hazardous materials can require swift adaptation. Adecco's 2024 and 2025 strategies likely include robust compliance frameworks and continuous training programs to navigate these changes effectively. Their investment in health and safety management systems is crucial, as evidenced by the increasing emphasis on corporate social responsibility reporting, which often highlights worker safety metrics. A proactive approach to regulatory compliance is therefore fundamental to Adecco's operational integrity and long-term success.

Anti-discrimination and Equal Opportunity Laws

Anti-discrimination and equal opportunity laws significantly shape Adecco's recruitment and placement strategies, mandating unbiased selection processes. Compliance with regulations preventing discrimination based on race, gender, age, disability, and other protected characteristics is paramount for Adecco's operations and technological implementations.

These legal frameworks require Adecco to actively promote diversity and inclusion within its workforce and among the candidates it places. For instance, in the European Union, the **Gender Equality Index for 2023** showed a score of 66.4 out of 100, indicating ongoing disparities that Adecco must navigate. Similarly, in the United States, the **Equal Employment Opportunity Commission (EEOC)** reported receiving over 65,000 private sector discrimination charges in the fiscal year 2023, highlighting the continuous need for vigilance.

- Global Compliance: Adecco must adhere to a patchwork of national and international anti-discrimination laws, such as the Equality Act 2010 in the UK and Title VII of the Civil Rights Act of 1964 in the US.

- AI and Bias: Ensuring recruitment technologies, including AI-powered tools, do not perpetuate or introduce bias is a critical legal and ethical challenge.

- Reporting and Auditing: Adecco likely engages in regular internal audits and may be subject to external reporting requirements to demonstrate compliance with equal opportunity mandates.

- Candidate Protection: These laws protect candidates from unfair treatment during the hiring and application process, influencing how Adecco designs its client services and candidate experience.

Adecco operates under a complex global legal framework governing employment, data privacy, and worker safety, necessitating robust compliance strategies. For instance, in 2024, European directives on platform worker rights and classification continued to evolve, directly impacting Adecco's operational models. The company's 2024 annual report indicated significant investment in legal compliance training and technology to mitigate risks associated with varying international labor laws and contract enforcement.

Data privacy regulations, such as GDPR and CCPA, impose strict requirements on handling candidate and employee information, with non-compliance potentially leading to fines up to 4% of global annual revenue. Adecco's commitment to health and safety is legally mandated, requiring adherence to diverse industry-specific standards and proactive risk assessments of client sites, as highlighted by increasing emphasis on corporate social responsibility reporting metrics for worker safety.

Anti-discrimination laws are critical, mandating unbiased recruitment processes and promoting diversity and inclusion. The European Union's Gender Equality Index for 2023 at 66.4 and the US EEOC's receipt of over 65,000 discrimination charges in FY2023 underscore the continuous need for vigilance in this area, particularly with the integration of AI in recruitment.

Environmental factors

Stakeholders are increasingly scrutinizing Adecco's commitment to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) factors. This growing emphasis directly impacts operational strategies and brand perception, pushing the company to align with evolving societal expectations for ethical conduct and sustainability.

Adecco faces mounting pressure to showcase robust adherence to fair labor standards, environmental stewardship, and positive social contributions across its own business and its extensive supply chain. For instance, in 2023, Adecco Group reported a 14% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating progress in environmental efforts.

Clients are increasingly prioritizing sustainability, impacting their demand for Adecco's staffing solutions. This trend is particularly evident in the growing need for talent in 'green jobs' and expertise in sustainable workforce management. For instance, in 2024, the global demand for renewable energy professionals saw a significant uptick, with reports indicating a 20% year-over-year increase in job postings for roles like solar panel installers and wind turbine technicians.

Adecco must adapt its service portfolio to align with these evolving client environmental objectives. This includes not only sourcing talent for green initiatives but also providing advisory services on building more sustainable workforces. The company's own commitment to reducing its carbon footprint is also becoming a critical factor in client perception and partnership decisions, with many large corporations setting ambitious net-zero targets for their supply chains by 2030.

Climate change poses significant operational risks to Adecco's client industries. Extreme weather events, such as the record-breaking heatwaves and floods experienced globally in 2024, disrupt supply chains and production, directly impacting hiring demands and workforce needs. Resource scarcity, particularly in sectors reliant on natural resources, can lead to reduced output and, consequently, fewer employment opportunities.

These environmental shifts necessitate a strategic adaptation for Adecco. For instance, the increasing frequency of climate-related disasters might drive demand for temporary staff in recovery and reconstruction efforts, while also potentially decreasing hiring in sectors heavily impacted by drought or rising sea levels. Adecco must monitor geographical shifts in economic activity driven by climate adaptation or mitigation strategies, as this will influence where talent is needed.

Waste Management and Resource Efficiency

Adecco Group, a global leader in workforce solutions, acknowledges its environmental impact stemming from extensive office operations and employee travel. The company focuses on enhancing its environmental performance by integrating efficient waste management and resource conservation into its daily practices, aligning with its overarching sustainability commitments.

In 2023, Adecco Group reported a 3% reduction in waste generated per employee compared to 2022, a testament to their ongoing efforts. This focus on resource efficiency extends to their digital infrastructure and supply chain, aiming to minimize their carbon footprint across all operations.

- Waste Reduction Targets: Adecco aims for a 10% reduction in non-recyclable waste by the end of 2025.

- Energy Efficiency: The company is investing in energy-efficient technologies for its global office spaces, targeting a 5% decrease in energy consumption in 2024.

- Sustainable Sourcing: Adecco is increasing its procurement of recycled and sustainably sourced office supplies.

- Employee Engagement: Initiatives are in place to educate and involve employees in waste segregation and resource conservation efforts.

Green Talent and Circular Economy

The global shift towards a circular economy is rapidly reshaping labor markets, driving a significant demand for specialized skills. Industries focused on renewable energy, sustainable manufacturing, and environmental consulting are experiencing robust growth, requiring a new breed of 'green talent.' For instance, the International Renewable Energy Agency (IRENA) projected that the renewable energy sector could employ 43 million people globally by 2030, up from 12.7 million in 2019. This presents a substantial opportunity for Adecco Group to strategically position itself as a crucial partner in identifying, sourcing, and upskilling workforces for these burgeoning sectors.

Adecco can leverage its extensive network and expertise to address this talent gap. By developing targeted training programs and recruitment strategies, the company can help clients build teams equipped for the demands of a sustainable economy. This includes roles such as solar panel installers, wind turbine technicians, circular economy consultants, and sustainable product designers. Adecco's proactive engagement in this space can solidify its role as a facilitator of the green transition, offering both economic value to its clients and contributing to broader environmental goals.

The market for green jobs is expanding considerably. According to the International Labour Organization (ILO) in their 2024 report, the transition to a net-zero economy is expected to create 24 million new jobs worldwide by 2030. Adecco's ability to connect businesses with this growing pool of environmentally conscious and skilled professionals will be a key differentiator.

- Growing Demand: The renewable energy sector is projected to employ 43 million globally by 2030 (IRENA).

- Job Creation: A net-zero economy could generate 24 million new jobs globally by 2030 (ILO).

- Strategic Partnership: Adecco can become a vital link in sourcing and developing 'green talent' for clients.

- Skill Development: Opportunities exist in areas like renewable energy installation, sustainable manufacturing, and environmental consulting.

Environmental factors significantly influence Adecco's operations and strategy, driven by global sustainability trends and climate change impacts. Stakeholder scrutiny on ESG performance is intensifying, pushing Adecco to demonstrate robust environmental stewardship across its business and supply chain. For instance, the company reported a 14% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 compared to a 2019 baseline.

The growing demand for 'green jobs' presents a substantial opportunity for Adecco, with projections indicating 24 million new jobs globally by 2030 due to the net-zero transition, according to the ILO. Adecco's ability to source and develop talent for sectors like renewable energy, where employment could reach 43 million by 2030 (IRENA), is crucial for its market positioning.

Climate change also poses risks, with extreme weather events in 2024 disrupting client operations and thus impacting hiring needs. Adecco must adapt to these shifts, potentially seeing increased demand for temporary staff in recovery efforts while monitoring geographical economic changes driven by climate adaptation strategies.

Adecco is actively working to improve its own environmental performance, focusing on waste reduction and energy efficiency. In 2023, they achieved a 3% reduction in waste per employee, and targets include a 10% reduction in non-recyclable waste by the end of 2025 and a 5% decrease in energy consumption in 2024 through investments in efficient technologies.

| Environmental Factor | Impact on Adecco | Data/Target (2023-2025) |

|---|---|---|

| Green Job Growth | Increased demand for specialized talent; opportunity for Adecco to provide staffing solutions. | 24 million new jobs by 2030 (ILO); 43 million in renewables by 2030 (IRENA). |

| Climate Change Risks | Disruption to client operations, affecting hiring; potential for recovery-related staffing needs. | Record heatwaves and floods in 2024 impacting supply chains. |

| Corporate Sustainability | Stakeholder pressure for ESG; need to align with client environmental objectives. | 14% reduction in Scope 1 & 2 GHG emissions (2023 vs 2019). |

| Operational Efficiency | Focus on reducing own environmental footprint. | 3% waste reduction per employee (2023); Target 10% non-recyclable waste reduction by end-2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Adecco Group is built on a robust foundation of data from reputable sources including the World Economic Forum, International Labour Organization, and leading financial news outlets. We incorporate insights from government economic reports, industry-specific market research, and technological innovation forecasts.