Adani Power Limited PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

Adani Power Limited operates within a dynamic external environment, shaped by evolving political landscapes, fluctuating economic conditions, and rapid technological advancements. Understanding these forces is crucial for strategic planning and identifying future opportunities. Gain a competitive edge with our comprehensive PESTLE analysis, offering actionable intelligence to navigate these complexities. Download the full version now and unlock critical insights.

Political factors

The Indian government's ongoing commitment to coal for base-load power generation remains a critical factor for Adani Power. This reliance is evident as coal continues to dominate India's energy mix, projected to remain significant even with renewable energy growth. For instance, in FY23, coal-fired power plants accounted for approximately 70% of India's total electricity generation, underscoring the continued importance of coal for meeting energy demands.

Policies that bolster domestic coal production and streamline coal supply agreements directly benefit Adani Power by ensuring fuel availability and potentially stabilizing operational expenses. The government's focus on rationalizing coal linkages aims to improve the efficiency of fuel sourcing for thermal power producers. Financial incentives, such as those related to power purchase agreements for thermal projects, also play a role in supporting the company's operational framework.

However, any future policy shifts towards more aggressive decarbonization targets could present a long-term strategic challenge for Adani Power. While India has ambitious renewable energy goals, the pace of transition and potential phase-out timelines for coal power will be key considerations for the company's future investments and operational strategies.

India's commitment to ambitious renewable energy targets, such as achieving 500 GW of non-fossil fuel-based energy capacity by 2030, presents a significant political factor for Adani Power. While Adani Power has historically focused on thermal power, these government mandates exert pressure to decarbonize the energy sector.

This political push could translate into policies that disincentivize further investment in new coal-fired power plants or impose more stringent environmental regulations on existing thermal assets. Such shifts directly influence Adani Power's strategic planning regarding capital allocation and future growth.

The speed and direction of India's energy transition, heavily influenced by political will and policy implementation, will critically shape Adani Power's investment decisions and its long-term market positioning.

The political landscape significantly influences Adani Power Limited through its regulatory framework. Decisions on electricity tariffs, the terms of power purchase agreements (PPAs), and grid stability regulations are all politically driven, directly impacting revenue streams and operational costs.

Reforms aimed at strengthening the financial standing of electricity distribution companies (discoms) or implementing competitive bidding for power procurement can create both opportunities and challenges for Adani Power. For instance, the Indian government's UDAY scheme (Ujwal DISCOM Assurance Yojana), launched in 2015 and continuing its impact into 2024-2025, aims to improve discom finances, which could lead to more stable payments for power generators like Adani Power.

Policy stability within India's power sector is paramount for Adani Power's long-term investment strategies. Unpredictable policy shifts can deter capital investment and affect the viability of large-scale power projects. The government's commitment to renewable energy targets, as seen in the National Solar Mission and its ongoing updates through 2025, also shapes the competitive environment and investment focus for companies like Adani Power.

Geopolitical Influences on Fuel Supply

Global geopolitical shifts significantly impact Adani Power's operational costs, particularly concerning imported coal. For instance, the ongoing Russia-Ukraine conflict, which intensified in early 2022, led to widespread supply chain disruptions and price volatility for energy commodities, including coal, affecting procurement for many power producers. Adani Power, like others, may face increased expenses if it relies on imports from regions experiencing instability or subject to international sanctions.

Trade relations and foreign policy are crucial for securing stable fuel supplies. India's efforts to diversify its energy import sources, as seen in its engagement with countries like Australia and Indonesia, aim to mitigate risks associated with reliance on a single region. For example, in 2023, India continued to explore long-term coal supply agreements with various nations to ensure energy security, a move that directly benefits companies like Adani Power by potentially stabilizing input costs and availability.

- Supply Chain Volatility: Geopolitical tensions, such as those experienced in 2022-2024, have demonstrated how conflicts and sanctions can disrupt the global flow of commodities like coal, leading to price spikes.

- Trade Agreements: India's active pursuit of bilateral trade agreements and energy partnerships in 2023-2024 aims to create more resilient and cost-effective fuel sourcing channels for its power sector.

- Diversification Strategy: Adani Power's reliance on imported coal means its fuel costs are directly influenced by the success of national policies promoting diversification of energy import origins.

State Government Policies and Local Issues

Adani Power Limited's operations are deeply intertwined with state government policies across India, creating a complex regulatory landscape. For instance, the company must navigate differing environmental clearance processes and land acquisition norms in states like Gujarat, Rajasthan, and Maharashtra. These state-specific regulations directly impact project timelines and costs.

The financial health and strategic direction of Adani Power are significantly influenced by state-level decisions on power tariffs, fuel sourcing policies, and power purchase agreements (PPAs). Changes in these areas, such as revised tariff structures or stricter fuel import regulations, can alter revenue streams and operational efficiency. For example, a state government's decision to renegotiate existing PPAs could have a material impact on Adani Power's profitability.

- State-Specific Environmental Regulations: Adani Power must adhere to varying environmental impact assessment (EIA) requirements and emission standards mandated by different state pollution control boards.

- Land Acquisition Challenges: The pace and cost of acquiring land for new power projects or expansions are heavily dependent on state government policies and local community engagement.

- Power Distribution Policies: State-level electricity distribution companies (discoms) are key off-takers for Adani Power's electricity, making their financial stability and payment security crucial.

- Fiscal Incentives and Taxation: State governments may offer tax holidays or other incentives for power projects, which can influence investment decisions and the overall cost of capital.

India's strong commitment to coal for base-load power generation, with coal accounting for approximately 70% of electricity generation in FY23, directly supports Adani Power's thermal assets. Government policies aimed at boosting domestic coal production and streamlining supply chains are crucial for ensuring fuel availability and stabilizing operational costs. While India has ambitious renewable energy targets, such as 500 GW by 2030, the pace of transition away from coal will be a key factor shaping Adani Power's future strategic investments.

What is included in the product

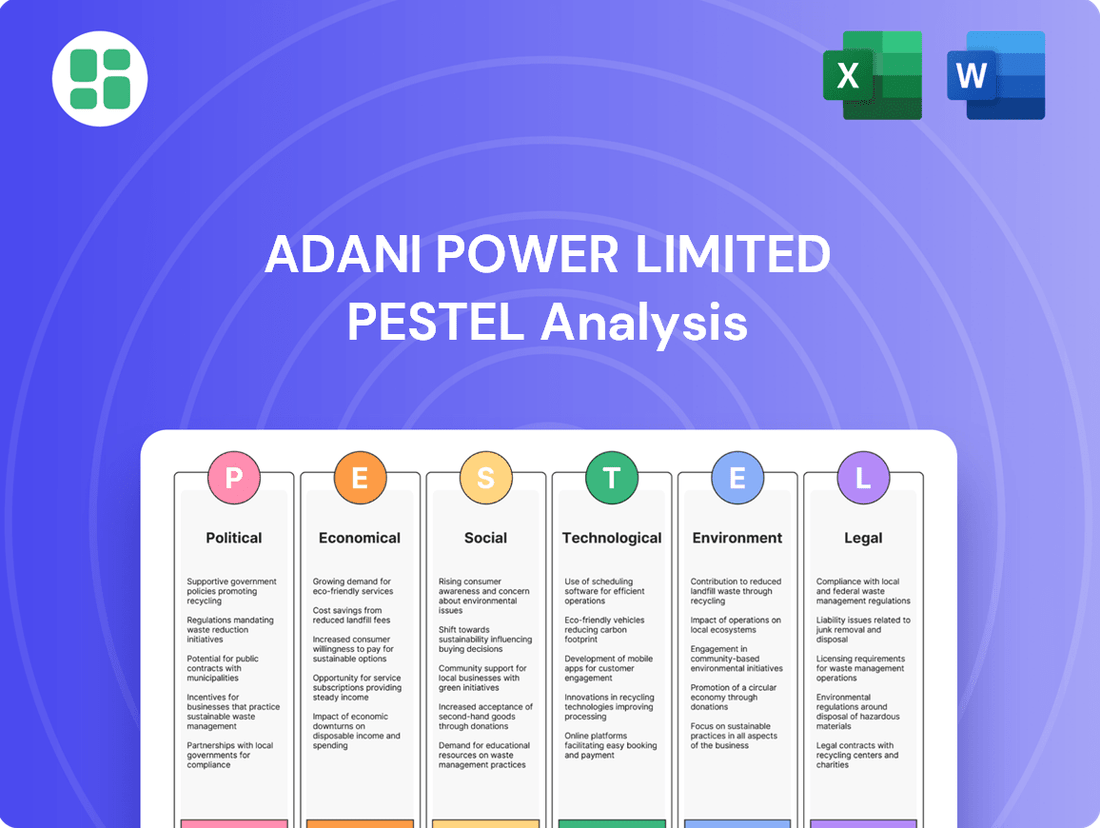

This PESTLE analysis examines the external macro-environmental factors impacting Adani Power Limited across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces shape the company's operational landscape, identifying potential threats and opportunities for strategic decision-making.

A PESTLE analysis of Adani Power Limited offers a clear, summarized version of external factors, relieving the pain point of navigating complex market dynamics by providing easy referencing during meetings and presentations.

Economic factors

India's projected economic growth of 6.5% for FY25, as anticipated by the Reserve Bank of India, directly translates into escalating electricity demand. This surge is driven by an expanding industrial sector and increasing urbanization, creating a robust market for Adani Power's output.

The nation's focus on manufacturing, exemplified by initiatives like 'Make in India', coupled with significant infrastructure investments, heightens the need for consistent and cost-effective power. This sustained demand underpins Adani Power's market position and revenue potential.

Adani Power, as a significant thermal power generator, faces substantial risk from coal price swings. In 2024, global coal prices, particularly for thermal coal, have seen continued volatility influenced by factors like the ongoing Russia-Ukraine conflict and increased demand from Asian economies. This directly affects Adani Power's fuel expenditure, impacting its bottom line.

The availability of coal is equally crucial. In early 2025, concerns persist regarding consistent domestic coal supply due to logistical bottlenecks and the need for increased imports. Adani Power's ability to secure affordable and reliable coal linkages, both domestically and internationally, is paramount for maintaining its operational efficiency and competitive energy tariffs.

Adani Power Limited's large-scale power projects necessitate significant capital investment, making the company highly susceptible to fluctuations in interest rates and the overall cost of borrowing. In 2024 and projected into 2025, sustained higher interest rates, such as those seen with the Reserve Bank of India's policy repo rate holding steady around 6.50% for an extended period, directly translate to increased financing expenses for Adani Power's ongoing and future development endeavors.

Access to capital is paramount for Adani Power's growth strategy, encompassing the funding of new power plant construction and the expansion of existing facilities. A supportive interest rate environment coupled with readily available long-term financing from both domestic institutions like Indian banks and international capital markets is critical for managing existing debt and securing funds for ambitious expansion plans. For instance, the ability to secure competitive loan terms in the 2024-2025 period will significantly influence the economic viability of their planned capacity additions.

Inflationary Pressures on Operational Costs

Inflationary trends across the Indian economy significantly impact Adani Power's operational expenditures. Rising costs for essential inputs like coal, manpower, and spare parts directly translate to higher operational and maintenance expenses. For instance, the average price of imported coal, a key fuel for many power plants, saw substantial increases throughout 2023 and into early 2024, directly affecting Adani Power's cost structure.

Managing these escalating input costs becomes particularly challenging when Adani Power must adhere to regulated tariffs set by authorities. This mismatch between rising operational expenses and fixed revenue streams can compress profit margins. The company’s ability to negotiate favorable long-term fuel supply agreements and implement efficient energy generation technologies is crucial for mitigating these pressures.

Effective cost management strategies are paramount for Adani Power to maintain profitability amidst inflationary headwinds. This includes optimizing fuel procurement, enhancing plant efficiency to reduce consumption, and stringent control over other operational overheads. The company's focus on operational excellence and strategic sourcing plays a vital role in navigating these economic conditions.

- Increased Fuel Costs: Imported coal prices, a significant operational expense, experienced volatility, impacting Adani Power's cost of generation.

- Labor and Maintenance Expenses: Wage inflation and the rising cost of specialized maintenance services contribute to higher overall operating expenditures.

- Regulatory Tariff Constraints: The inability to immediately pass on increased costs to consumers due to regulated tariffs puts pressure on the company's profit margins.

- Strategic Cost Mitigation: Adani Power's emphasis on fuel efficiency and long-term supply contracts are key strategies to counter inflationary pressures.

Power Purchase Agreement (PPA) Realizations

Adani Power Limited's financial performance is significantly tied to the timely payments it receives from state-owned electricity distribution companies (discoms) under existing Power Purchase Agreements (PPAs). These agreements are the bedrock of the company's revenue stream.

Delays or outright defaults in payments by financially weak discoms directly squeeze Adani Power's cash flow and strain its working capital. This situation can hinder operational efficiency and future investment plans.

The overall economic health of the Indian utility sector, particularly the financial stability of its discoms, is a critical determinant of Adani Power's revenue assurance and, consequently, its profitability.

- PPA Realizations: Adani Power's revenue is largely secured through long-term PPAs, providing a predictable income base.

- Discom Financial Health: The ability of state discoms to meet their payment obligations under PPAs is crucial for Adani Power's financial stability.

- Cash Flow Impact: Payment delays from discoms directly affect Adani Power's liquidity and working capital management.

- Revenue Assurance: The economic viability of the power sector, especially the discom segment, directly underpins Adani Power's revenue assurance.

India's robust economic growth, with the RBI projecting 6.5% for FY25, fuels a substantial increase in electricity demand. This upward trend is amplified by government initiatives like 'Make in India' and significant infrastructure development, creating a favorable market environment for Adani Power. However, the company's profitability is closely monitored against the backdrop of fluctuating global coal prices, a key input. For instance, thermal coal prices remained volatile in early 2024 due to geopolitical factors and strong Asian demand, directly impacting Adani Power's fuel expenditure.

Adani Power's substantial capital requirements make it sensitive to interest rate movements. The Reserve Bank of India's repo rate holding steady at 6.50% through much of 2024 indicates a sustained higher cost of borrowing, impacting financing expenses for new projects. Furthermore, inflationary pressures on inputs like coal and maintenance services, coupled with regulated tariffs, compress profit margins. The company's ability to secure timely payments from state discoms under Power Purchase Agreements remains a critical factor for its financial health and operational continuity.

| Economic Factor | Impact on Adani Power | Data/Trend (2024-2025) |

|---|---|---|

| Economic Growth | Increased electricity demand | India GDP growth projected at 6.5% (FY25) by RBI |

| Fuel Costs (Coal) | Higher operational expenditure | Volatility in thermal coal prices due to global demand and geopolitical factors |

| Interest Rates | Increased financing costs | RBI Repo Rate stable around 6.50% |

| Inflation | Higher input and operational costs | Rising costs for coal, labor, and maintenance services |

| Discom Payments | Impact on cash flow and revenue | Dependence on timely payments from state electricity distribution companies |

Full Version Awaits

Adani Power Limited PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Adani Power Limited PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook. You'll gain critical insights into market dynamics and potential challenges.

Sociological factors

Public perception of coal power is a significant sociological factor for Adani Power Limited. There's a growing global and domestic awareness of the environmental impact of coal-fired power plants, leading to increased public scrutiny. This heightened awareness means Adani Power faces challenges in managing its public image, particularly concerning air pollution, carbon emissions, and the broader issue of climate change.

These perceptions directly influence stakeholder relations, investor sentiment, and consumer preferences, which are increasingly leaning towards cleaner energy sources. For instance, by the end of 2023, India's renewable energy capacity had surpassed 179 GW, indicating a strong market shift that public opinion often reflects and amplifies. Such shifts can impact Adani Power's market position and its ability to secure future investments or maintain social license to operate.

Adani Power's large-scale projects, such as its thermal power plants, necessitate substantial land acquisition. For instance, the company's Mundra plant in Gujarat, a significant asset, involved extensive land procurement. This process often creates friction with local communities, who may face displacement and concerns over their livelihoods and environmental impact.

Managing these community relations is crucial for Adani Power. The company must address issues of fair compensation, rehabilitation, and environmental justice to mitigate potential opposition. Failure to do so can lead to project delays, legal battles, and damage to its public image, impacting overall operational efficiency and investor confidence.

In 2023, Adani Power continued to navigate these challenges across its various project sites. While specific figures on land acquisition disputes are not always publicly detailed, the broader Adani Group has faced scrutiny regarding its community engagement practices, underscoring the importance of proactive and transparent stakeholder management for infrastructure developers.

Adani Power Limited's power plant development and operations are significant drivers of local employment, creating jobs directly in construction and plant management, and indirectly through supply chains and support services. For instance, during the construction phase of its Godda plant, the company aimed to provide substantial local employment, contributing to the economic upliftment of the region.

The company's focus on local hiring and investing in skill development programs for the surrounding communities strengthens its social license to operate. This approach fosters positive community relations and ensures a stable workforce, crucial for the long-term success of its power generation facilities.

Health and Safety Concerns

Adani Power Limited, like all thermal power operators, faces significant health and safety concerns. The very nature of burning fossil fuels to generate electricity carries inherent risks for its workforce and can impact the health of communities living near its plants through emissions. This necessitates strict adherence to evolving safety protocols and proactive measures to minimize exposure to pollutants.

Public perception and concern over health impacts are a major sociological factor. For instance, in 2023, India's Central Pollution Control Board reported that several major cities exceeded national ambient air quality standards for particulate matter, a common byproduct of thermal power generation. This heightened awareness can translate into public opposition, leading to protests and increased pressure on companies like Adani Power to adopt cleaner technologies and more rigorous emission control measures.

The company must continuously invest in and demonstrate its commitment to mitigating these risks. This includes:

- Implementing advanced emission control technologies, such as flue-gas desulfurization (FGD) systems, to reduce sulfur dioxide emissions.

- Ensuring robust occupational health and safety programs for employees, aligned with international best practices.

- Engaging transparently with local communities regarding environmental performance and health impact assessments.

- Responding proactively to regulatory demands for improved air quality and reduced environmental footprint.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are increasingly influencing how companies like Adani Power operate. There's a growing demand for engagement in community development, environmental stewardship, and transparent, ethical business conduct. Demonstrating robust CSR initiatives, going beyond basic regulatory compliance, is becoming vital for building a positive corporate reputation and fostering stakeholder trust.

Adani Power's commitment to sustainability and community welfare is a key aspect of its CSR strategy. For instance, in the fiscal year 2023-24, the company reported significant investments in various social welfare programs, including education and healthcare initiatives in the regions where it operates. These efforts aim to create shared value and contribute to local socio-economic development.

- Community Development: Adani Power actively invests in local infrastructure and livelihood enhancement projects, contributing to the well-being of communities surrounding its power plants.

- Environmental Conservation: The company is focused on implementing sustainable practices, including water conservation and emission reduction technologies, to minimize its environmental footprint.

- Ethical Business Practices: Adherence to strong ethical standards and transparent governance is a cornerstone of Adani Power's operations, building confidence among investors and the public.

- Stakeholder Engagement: Proactive engagement with local communities, government bodies, and NGOs helps Adani Power understand and address societal expectations effectively.

Public concern over the health impacts of thermal power generation is a significant sociological factor for Adani Power. The company must address public perception regarding emissions and their link to respiratory illnesses and other health issues, especially as India's air quality remains a national concern. For example, by the end of 2023, numerous Indian cities continued to report air quality levels that exceeded national standards for pollutants like PM2.5, directly impacting public sentiment towards coal-fired power plants.

Adani Power's commitment to corporate social responsibility (CSR) is increasingly scrutinized by stakeholders. There is a growing societal expectation for companies to actively contribute to community development and environmental stewardship beyond mere regulatory compliance. In fiscal year 2023-24, Adani Power reported investments in social welfare programs, including education and healthcare, aiming to foster positive community relations and enhance its social license to operate.

Societal shifts towards cleaner energy sources directly influence Adani Power's market perception and operational strategies. The growing public and investor preference for renewables, evidenced by India's renewable energy capacity surpassing 179 GW by the close of 2023, creates pressure on thermal power operators to demonstrate environmental responsibility and transition plans.

Technological factors

Adani Power Limited benefits significantly from advancements in thermal power efficiency, particularly through supercritical and ultra-supercritical combustion technologies. These innovations allow for greater electricity generation from coal with less fuel, directly impacting operational costs and reducing the environmental footprint per megawatt-hour produced.

By adopting and continually upgrading to these cutting-edge technologies, Adani Power can enhance its operational performance, leading to lower fuel expenses and improved compliance with environmental regulations. For instance, ultra-supercritical plants can achieve efficiencies exceeding 45%, a substantial improvement over older subcritical technologies that typically operate below 40% efficiency.

The increasing global push for decarbonization makes Carbon Capture and Storage (CCS) technologies a critical technological factor for Adani Power. While CCS is still developing and carries significant costs, advancements could enable coal power plants to drastically cut emissions, a key consideration for Adani Power's future operations.

The commercialization of CCS is gaining momentum, with projects worldwide aiming to capture CO2. For instance, the International Energy Agency (IEA) reported in late 2024 that global CCS capacity is projected to grow substantially by 2030, driven by policy support and technological improvements, directly impacting the viability of coal-reliant energy producers like Adani Power.

Adani Power must closely monitor CCS developments and explore potential investments. The strategic integration of these technologies could be crucial for maintaining operational flexibility and meeting evolving environmental regulations in the coming years.

Adani Power is increasingly integrating smart grid technologies and digitalization into its operations. This move is crucial for enhancing efficiency and reliability in power generation. By adopting these advancements, the company aims to improve predictive maintenance, a key factor in reducing operational costs and ensuring consistent power supply.

Leveraging data analytics, artificial intelligence (AI), and the Internet of Things (IoT) allows Adani Power to optimize plant performance. This digital transformation directly translates to reduced downtime and better overall operational control, which is vital in the competitive energy sector. For instance, in 2023, Adani Power reported a significant improvement in plant load factor (PLF) across its thermal power plants, partly attributed to these technological upgrades.

Renewable Energy Technology Evolution

Technological advancements in renewable energy are rapidly decreasing costs. For instance, the global average levelized cost of electricity (LCOE) for utility-scale solar PV fell by approximately 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA). This trend continues, with further reductions anticipated through 2024 and 2025 due to improved manufacturing efficiencies and supply chain optimizations.

Adani Power, while investing in renewables, still relies heavily on thermal power. The accelerating adoption of solar and wind power, driven by these cost reductions, presents a long-term competitive threat. This could lead to reduced demand and downward pressure on the pricing of electricity generated from Adani Power's thermal assets in the coming years.

Strategic diversification into a larger renewable energy portfolio is therefore critical for Adani Power's sustained competitiveness. By 2023, India's installed renewable energy capacity had surpassed 179 GW, with solar and wind dominating this growth, highlighting the market's clear direction.

- Falling Renewable Costs: Global LCOE for solar PV dropped by nearly 90% from 2010 to 2022, with ongoing cost reductions expected.

- Market Shift: India's renewable capacity exceeded 179 GW by 2023, signaling a strong market preference for non-fossil fuels.

- Competitive Challenge: The rise of affordable renewables poses a long-term threat to the demand and pricing of traditional thermal power.

- Strategic Imperative: Adani Power must continue diversifying its renewable energy assets to navigate this technological evolution.

Waste Heat Recovery and Resource Optimization

Adani Power Limited is increasingly exploring waste heat recovery systems to boost efficiency. For instance, integrating technologies that capture and reuse exhaust heat from their thermal power plants can significantly lower fuel consumption. This not only cuts operational costs but also aligns with their sustainability goals by reducing greenhouse gas emissions.

Innovations in resource optimization are also critical. Adani Power is looking into advanced water management technologies to minimize water usage, a key resource in thermal power generation. By adopting solutions that treat and recycle wastewater, they can achieve substantial cost savings and improve their environmental footprint, contributing to a more circular economy model.

- Waste Heat Recovery: Adani Power's focus on capturing residual heat from processes like flue gas can improve overall plant efficiency by an estimated 5-15%.

- Resource Optimization: Implementing advanced water recycling technologies can reduce freshwater intake by up to 30% in thermal power plants.

- Circular Economy: By converting waste streams into usable energy or materials, Adani Power can create new revenue streams and reduce disposal costs.

- Operational Efficiency: These technological advancements directly translate to lower operating expenses and a more competitive cost structure for Adani Power.

Adani Power is leveraging advancements in thermal efficiency, such as supercritical and ultra-supercritical technologies, to boost output and reduce fuel costs. These technologies can achieve efficiencies over 45%, a significant leap from older subcritical plants operating below 40%.

The company is also integrating digitalization, AI, and IoT for smarter operations, aiming for improved predictive maintenance and reduced downtime. This focus on operational efficiency was reflected in improved plant load factors across its thermal assets in 2023.

The rapid decline in renewable energy costs, with solar PV LCOE falling by nearly 90% between 2010 and 2022, presents a competitive challenge. India's installed renewable capacity surpassed 179 GW by 2023, underscoring the market's shift towards cleaner energy sources.

Adani Power is also exploring waste heat recovery and advanced water management technologies to further optimize resource utilization and reduce operational expenses, contributing to a more sustainable operational model.

Legal factors

Adani Power Limited navigates a complex web of environmental regulations and emission standards, primarily dictated by India's central and state pollution control boards. These laws set strict limits on air and water pollutants, impacting power plant operations significantly.

Staying compliant, especially with evolving standards for particulate matter, sulfur oxides (SOx), and nitrogen oxides (NOx), necessitates ongoing capital expenditure on advanced pollution control technologies. For instance, the push towards cleaner energy sources and stricter emission norms, as seen in various policy updates throughout 2024 and projected into 2025, directly influences Adani Power's operational costs and investment strategies.

Failure to meet these environmental mandates can result in substantial financial penalties and, in severe cases, temporary or permanent operational suspensions, underscoring the critical importance of proactive environmental management for Adani Power.

The legal framework surrounding Power Purchase Agreements (PPAs) is fundamental to Adani Power's revenue generation, dictating crucial elements like tariffs, payment schedules, and operational responsibilities. For instance, Adani Power's significant capacity, like its 4,620 MW Mundra thermal power project, relies heavily on these PPAs with state utilities. Any legal challenges or renegotiations of these long-term agreements pose a direct risk to the company's financial health and predictability.

Adani Power Limited's expansion plans are significantly influenced by land acquisition laws. Acquiring land for new power projects or expansions necessitates navigating intricate regulations, with potential legal hurdles arising from landowners or local communities. For instance, in 2023, delays in land acquisition for a new project in Gujarat were attributed to protracted negotiations and legal challenges, impacting the initial construction timeline by an estimated six months.

Compliance with land reforms, fair compensation standards, and environmental clearances is crucial. Failure to adhere to these legal frameworks can lead to substantial project delays and increased expenditures. Adani Power's ongoing projects require meticulous attention to these legal facets to ensure smooth progress and avoid costly litigation, which can divert capital from operational improvements.

Corporate Governance and Compliance

Adani Power Limited, being a publicly traded entity, operates under a stringent framework of corporate governance and compliance. This includes adhering to regulations set by bodies like the Securities and Exchange Board of India (SEBI), various company law provisions, and anti-corruption statutes. Maintaining transparency, upholding ethical business practices, and implementing strong internal controls are paramount for the company's sustained operations and market standing.

Failure to comply with these legal and regulatory requirements can result in significant repercussions. These can range from substantial legal penalties and fines to severe reputational damage, which can erode investor confidence and impact market valuation. For instance, in the fiscal year 2023-24, Adani Power reported a consolidated net profit of ₹5,598 crore, highlighting the importance of maintaining a clean compliance record to safeguard such financial performance.

- Adherence to SEBI Regulations: Ensuring compliance with SEBI's listing obligations and disclosure requirements is critical for maintaining market trust.

- Company Law Compliance: Adherence to the Companies Act, 2013, including provisions related to board composition, shareholder rights, and financial reporting, is mandatory.

- Anti-Corruption Laws: Strict observance of laws like the Prevention of Corruption Act is vital to prevent legal entanglements and maintain ethical operations.

- Impact of Non-Compliance: Breaches can lead to penalties, including financial sanctions and potential de-listing, severely impacting investor sentiment and share price.

Labor Laws and Industrial Relations

Adani Power Limited, like all major corporations in India, must meticulously adhere to a complex web of labor laws. These regulations cover everything from minimum wages and working hours to stringent industrial safety standards and comprehensive employee welfare provisions. For instance, the Code on Wages, 2019, aims to simplify and rationalize wage and bonus payments, impacting how Adani Power compensates its workforce. Ensuring compliance across its numerous power plants is not just a legal obligation but a cornerstone of responsible operations.

Maintaining positive industrial relations is paramount for Adani Power to avoid disruptions that could impact its energy generation and supply. Unresolved labor disputes can lead to strikes or lockouts, directly affecting operational continuity and profitability. The company's approach to employee engagement and grievance redressal, often guided by acts like the Industrial Disputes Act, 1947, plays a critical role in fostering a stable working environment. As of early 2024, reports indicate a general trend of increasing labor union activity across various industrial sectors in India, underscoring the importance of proactive management.

The company's human resource management practices are intrinsically linked to its legal framework. Adherence to labor laws ensures fair treatment of employees, which in turn can boost morale and productivity. This includes compliance with regulations concerning contract labor, as stipulated by the Contract Labour (Regulation and Abolition) Act, 1970, and ensuring safe working conditions as mandated by the Occupational Safety, Health and Working Conditions Code, 2020. In 2023, the Indian government continued its focus on implementing these labor codes, signaling a stricter enforcement environment.

- Compliance with Indian labor laws, including the Code on Wages, 2019 and the Occupational Safety, Health and Working Conditions Code, 2020, is essential for Adani Power's operational integrity.

- Preventing labor disputes through effective industrial relations management is critical to ensuring uninterrupted power generation and supply.

- Adani Power's human resource strategies must align with legal mandates regarding employee wages, working conditions, and safety, particularly concerning contract labor.

- The evolving regulatory landscape in India, with ongoing implementation of new labor codes, requires continuous adaptation and vigilance in HR practices.

Adani Power Limited's financial performance and strategic decisions are heavily influenced by the legal and regulatory environment. Compliance with environmental laws, including emission standards set by pollution control boards, is crucial, with ongoing capital expenditure required for pollution control technologies. For instance, in FY23, Adani Power reported a consolidated net profit of ₹5,598 crore, underscoring the importance of a clean compliance record to safeguard such financial achievements.

The company's revenue generation is directly tied to Power Purchase Agreements (PPAs) with state utilities, making any legal challenges or renegotiations of these contracts a significant risk. Furthermore, land acquisition for new projects is governed by complex land laws, and delays due to legal hurdles, as seen in a Gujarat project in 2023, can impact construction timelines. Adherence to corporate governance regulations from bodies like SEBI and compliance with anti-corruption statutes are also vital for maintaining investor confidence and market standing.

Labor laws, including the Code on Wages, 2019, and the Occupational Safety, Health and Working Conditions Code, 2020, dictate employee compensation, working conditions, and safety standards. Proactive management of industrial relations is essential to prevent disruptions from labor disputes, which can impact operational continuity. The ongoing implementation of new labor codes in India necessitates continuous adaptation and vigilance in HR practices.

Environmental factors

Global and national climate change policies, including commitments to reduce carbon emissions and achieve net-zero targets, directly impact Adani Power's coal-heavy operations. For instance, India's commitment to achieving net-zero emissions by 2070 and its increasing renewable energy targets create a challenging environment for traditional fossil fuel power generation.

Increasing carbon taxes or stricter emission caps, if implemented more broadly in India or globally where Adani Power operates, could significantly raise operational costs and necessitate substantial investments in decarbonization technologies. This pressure to transition away from fossil fuels represents a significant environmental factor influencing Adani Power's long-term strategy and financial performance.

Adani Power Limited's thermal power plants are significant water consumers, making the company susceptible to water scarcity, particularly in arid regions of India. For instance, in 2023, India faced widespread water stress, impacting various industries.

Stricter regulations on water withdrawal and discharge, coupled with growing competition for this vital resource from agriculture and other sectors, demand robust water management. Adani Power’s operational efficiency is directly tied to its ability to secure and manage water resources sustainably.

The company's commitment to investing in advanced water recycling and conservation technologies, such as zero liquid discharge (ZLD) systems, is therefore critical for mitigating risks and ensuring continued operations. Such investments are becoming increasingly non-negotiable for long-term viability in the power sector.

Adani Power Limited, like other coal-fired power generators, deals with significant volumes of fly ash and bottom ash. For instance, in the fiscal year 2023-24, the company's thermal power plants produced substantial quantities of ash, necessitating robust management strategies. Regulations in India, such as those from the Ministry of Environment, Forest and Climate Change, mandate specific ash utilization percentages and proper disposal methods to prevent environmental harm, particularly to groundwater.

The company's commitment to sustainability hinges on its ability to manage this ash effectively. Adani Power has been investing in technologies and partnerships to increase ash utilization, often converting it into building materials like bricks and cement. This not only addresses disposal challenges but also aligns with the government's push for a circular economy. As of early 2025, the push for higher ash utilization remains a key focus for the sector.

Air Quality and Pollution Control

Adani Power's operations, particularly its reliance on coal-fired power plants, directly impact air quality through emissions like particulate matter, sulfur dioxide, and nitrogen oxides. Meeting increasingly stringent air quality standards necessitates continuous investment in and effective operation of advanced pollution control technologies.

The company faces persistent environmental challenges stemming from public and regulatory demands for emission reductions. For instance, in 2023, India's Ministry of Environment, Forest and Climate Change continued to emphasize stricter emission norms for thermal power plants, pushing companies like Adani Power to upgrade their pollution control infrastructure.

- Emissions: Coal-fired plants release particulate matter, SO2, and NOx, contributing to air pollution.

- Investment: Adani Power must consistently invest in advanced pollution control equipment.

- Regulatory Pressure: Evolving air quality standards and public scrutiny drive the need for emission reduction.

- Compliance: Adherence to India's updated emission norms, such as those reinforced in 2023, is critical.

Biodiversity Impact and Conservation

Adani Power Limited's operations, particularly the siting and functioning of its substantial power generation facilities, can significantly affect local ecosystems. This includes impacts on plant and animal life, as well as their natural environments. The company is obligated to perform comprehensive environmental impact assessments to understand and address these potential disruptions.

Minimizing ecological disruption is a key responsibility. Adani Power must actively implement mitigation strategies to reduce the footprint of its activities on biodiversity. This often involves careful site selection, habitat restoration efforts, and managing operational impacts like water usage and emissions.

Adherence to biodiversity conservation legislation is paramount for responsible environmental management. In 2023, India's Ministry of Environment, Forest and Climate Change continued to emphasize the importance of ecological impact assessments for large infrastructure projects. Adani Power's commitment to sustainable land use and biodiversity protection is therefore crucial for its long-term license to operate and its reputation as an environmental steward.

- Environmental Impact Assessments: Adani Power must conduct thorough EIAs for all new projects and expansions, as mandated by Indian environmental regulations.

- Mitigation Measures: Implementing strategies such as green belts around facilities, wildlife corridors, and responsible waste management to lessen ecological impact.

- Regulatory Compliance: Adhering to national and international biodiversity laws and conservation guidelines, including those related to protected areas and endangered species.

- Land Use Practices: Employing responsible land management to minimize habitat fragmentation and support local ecological health.

Adani Power faces significant pressure from India's net-zero targets by 2070, impacting its coal-heavy portfolio. Stricter emission regulations and potential carbon taxes in 2024-2025 could increase operational costs, driving the need for decarbonization investments. The company's water usage is also a concern, with India experiencing water stress, necessitating efficient water management and recycling technologies like ZLD systems to ensure operational continuity.

PESTLE Analysis Data Sources

Our Adani Power Limited PESTLE Analysis is built on a robust foundation of data sourced from official government publications, reputable financial news outlets, and industry-specific research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.