Adani Power Limited Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

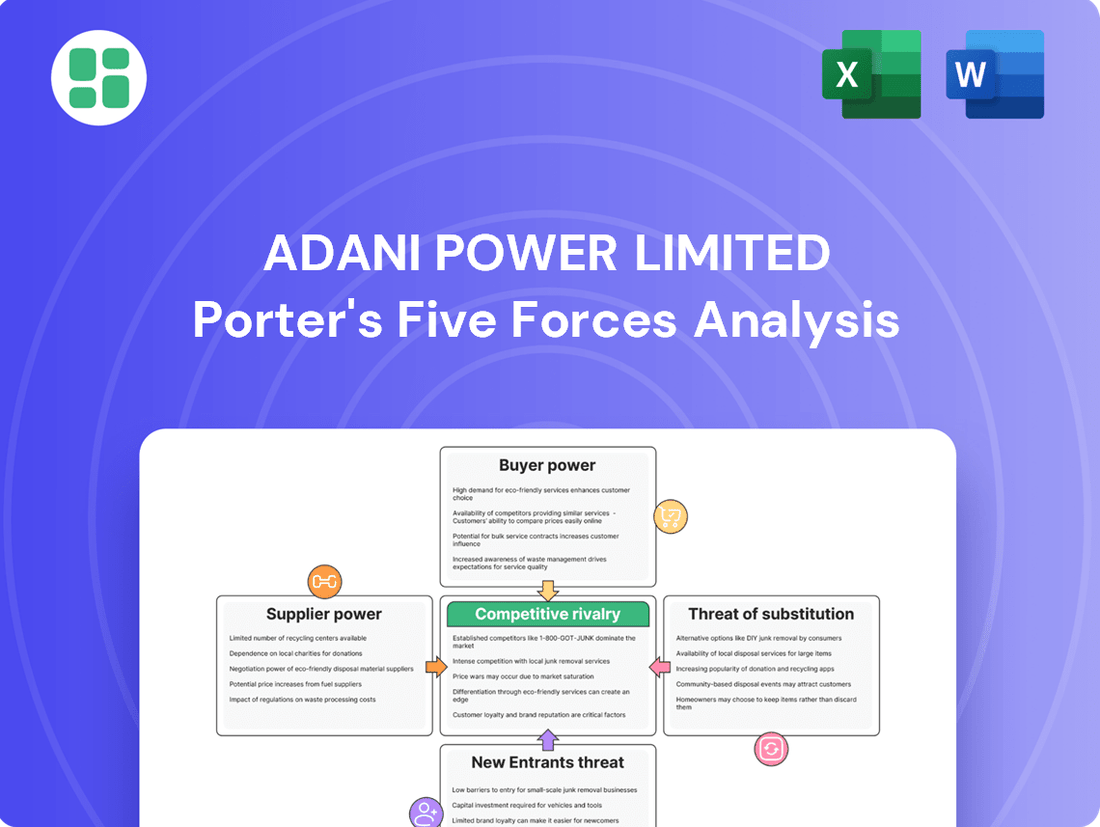

Adani Power Limited navigates a complex energy landscape where supplier power is moderate due to diverse fuel sources, while buyer power is significant given the presence of large industrial consumers and government regulations. The threat of substitutes, though present in renewable energy, is currently limited for baseload power. The intense rivalry within the power generation sector, coupled with the substantial barriers to entry for new players, shapes Adani Power's strategic positioning.

The complete report reveals the real forces shaping Adani Power Limited’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Adani Power's reliance on coal as its primary fuel means that the availability and pricing of this commodity are critical determinants of supplier power. Fluctuations in global coal prices, as seen with the Brent crude oil price reaching $85.71 per barrel in early 2024, can directly impact Adani Power's generation costs and, consequently, its profitability. The company's dependence on both domestic coal linkages and international markets exposes it to price volatility.

Government policies concerning coal allocation and mining operations also significantly influence the leverage held by coal suppliers. For instance, any changes in domestic production quotas or import duties on coal can alter the supply-demand dynamics, thereby affecting Adani Power's input costs. In 2023, India's coal production reached approximately 900 million tonnes, underscoring the importance of domestic supply stability.

The bargaining power of suppliers in logistics and transportation for Adani Power Limited hinges on the efficiency and cost-effectiveness of moving coal, their primary fuel source. Railways and ports are key conduits, and any limitations in their infrastructure or high freight charges from providers can significantly bolster supplier leverage. For instance, in 2023, Indian Railways saw freight revenue increase by 10.5% year-on-year, indicating a potential upward pressure on transportation costs for bulk commodities like coal.

Disruptions in this critical supply chain, whether due to infrastructure bottlenecks or increased freight rates, directly translate to higher fuel delivery expenses for Adani Power. This elevated supplier leverage can impact operational costs and, consequently, the company's profitability. The reliance on a few key logistics providers for such a vital input means these entities can command greater influence over pricing and service terms.

Equipment manufacturers for specialized power plant components like turbines and generators wield substantial bargaining power. This stems from the high cost and intricate technical nature of these essential parts, limiting the pool of capable suppliers. For instance, major turbine manufacturers often have dominant market shares, giving them leverage in negotiations.

Adani Power faces considerable switching costs when dealing with these specialized suppliers. The expense and complexity involved in changing manufacturers for critical equipment during new project development or for essential maintenance and upgrades mean that these suppliers can exert significant influence over pricing and terms. This is particularly true for proprietary technology where alternatives are scarce.

Technology Providers

The bargaining power of technology providers for Adani Power is significant, especially as the company seeks to integrate advanced, efficient, and environmentally compliant generation technologies. As of early 2024, the global push for decarbonization means that providers of cutting-edge solutions for emission control and efficiency upgrades hold considerable sway. Adani Power's reliance on these specialized suppliers for proprietary technologies or critical components for new plant development or retrofitting allows these providers to command higher prices or more favorable contract terms.

- Specialized Expertise: Providers offering unique, patented technologies for areas like supercritical or ultra-supercritical coal power, or advanced renewable energy integration, have a strong position.

- High Switching Costs: Once a specific technology is integrated into a power plant's design, switching to an alternative supplier can be prohibitively expensive and time-consuming due to compatibility issues and re-engineering needs.

- Limited Supplier Pool: For highly specialized or novel power generation technologies, the number of qualified and capable suppliers can be limited, concentrating power in the hands of a few.

- Emerging Technologies: As Adani Power explores next-generation technologies, such as advanced battery storage or carbon capture, early-stage providers of these innovations often have substantial bargaining power due to the novelty and demand for their solutions.

Skilled Labor & Expertise

The power sector, including Adani Power Limited, relies heavily on a specialized workforce. This includes plant operators, engineers, and maintenance technicians who possess critical skills. A shortage of such expertise can significantly shift bargaining power towards the labor force.

The presence of strong labor unions can further amplify this power. Unions can negotiate for higher wages, improved benefits, and better working conditions, potentially increasing operational costs for Adani Power. For instance, in 2023, the Indian power sector saw various discussions around workforce skill development and retention, highlighting the importance of this human capital.

- High Demand for Specialized Skills: The operation and maintenance of power plants require a niche skill set, making skilled labor a valuable asset.

- Potential for Wage Inflation: Scarcity of qualified professionals can drive up labor costs as companies compete for talent.

- Union Influence: Organized labor can exert considerable influence on wage structures and employment terms, impacting Adani Power's cost base.

Adani Power's bargaining power with its suppliers is influenced by several factors, including the availability and cost of coal, the efficiency of logistics providers, and the specialized nature of equipment and technology suppliers. Labor also represents a significant supplier group, with skilled workers and unions capable of exerting considerable influence.

The company's reliance on coal, with India's coal production around 900 million tonnes in 2023, makes coal suppliers powerful, especially with global energy price volatility. Similarly, transportation providers can leverage infrastructure limitations, as seen with Indian Railways' 10.5% freight revenue increase in 2023, impacting Adani Power's input costs.

Specialized equipment and technology providers, often holding patents or limited supplier pools, command strong bargaining power due to high switching costs for Adani Power. This is particularly true for advanced generation technologies and emission control systems, where a few key players dominate.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Adani Power |

|---|---|---|

| Coal Suppliers | Global price volatility (e.g., Brent crude at $85.71/barrel in early 2024), domestic production stability (India produced ~900 million tonnes in 2023), government policies on allocation and imports. | Direct impact on fuel costs and profitability. |

| Logistics & Transportation | Infrastructure efficiency (railways, ports), freight charges (Indian Railways freight revenue up 10.5% in 2023), reliance on key providers. | Increases operational costs and delivery expenses. |

| Equipment Manufacturers | High cost and technical complexity of specialized parts (turbines, generators), dominant market shares of key manufacturers. | Leverage in pricing and terms for critical plant components. |

| Technology Providers | Proprietary technologies, limited supplier pool for advanced solutions (emission control, renewables integration), high switching costs. | Ability to command higher prices for cutting-edge or essential technologies. |

| Skilled Labor | Demand for specialized skills (operators, engineers), potential for wage inflation, union influence on wages and benefits. | Can increase operational costs and affect workforce stability. |

What is included in the product

This analysis of Adani Power Limited reveals how intense industry rivalry, significant buyer power, and the threat of substitutes shape its market position.

Adani Power's Porter's Five Forces analysis provides a crucial pain point reliever by offering a clear, actionable framework to navigate the intense competitive landscape, effectively mitigating risks associated with supplier power and the threat of substitutes.

Customers Bargaining Power

Adani Power's reliance on long-term Power Purchase Agreements (PPAs) with state-owned distribution companies (Discoms) significantly influences customer bargaining power. While these PPAs offer predictable revenue streams, they often lock in pricing, reducing Adani Power's ability to adjust tariffs based on market fluctuations. For instance, in 2023-24, Adani Power's revenue was heavily dependent on such agreements, highlighting the Discoms' considerable leverage in setting terms.

The bargaining power of customers is significantly influenced by regulatory frameworks, particularly concerning electricity tariffs in India. State and central electricity regulatory commissions have substantial oversight, limiting Adani Power's flexibility in adjusting prices to reflect rising operational costs.

This regulatory environment empowers distribution companies (discoms) to negotiate for lower tariffs. For instance, in 2023-24, the average tariff discovered for solar power in India ranged from INR 2.40 to INR 2.70 per unit, showcasing the price sensitivity and regulatory intervention in the sector.

Customer concentration is a key factor in Adani Power's bargaining power of customers. A significant portion of its electricity sales is often tied to a few large state-owned distribution companies (Discoms).

This concentration gives these major buyers considerable leverage. For instance, if one of these key Discoms were to reduce its power purchase or renegotiate terms unfavorably, it could substantially affect Adani Power's revenue streams and profitability.

In FY23, Adani Power's revenue from contracts with key state Discoms represented a large majority of its total income, highlighting the dependency and the power these customers hold in contract negotiations.

Availability of Alternative Power Sources

The increasing availability of alternative power sources significantly bolsters the bargaining power of Adani Power Limited's customers. Large industrial users, in particular, are exploring and adopting options like captive power generation or sourcing electricity from renewable energy projects. This diversification of energy supply means customers can credibly threaten to switch providers if Adani Power's pricing or terms are not competitive, directly impacting Adani Power's ability to dictate terms.

For instance, in 2024, India's renewable energy capacity continued its robust expansion, with solar and wind power offering increasingly viable alternatives for industrial consumers seeking to reduce reliance on traditional grid power. This trend puts pressure on conventional power producers like Adani Power to maintain competitive tariffs and service quality.

- Customers can leverage the growing feasibility of captive power plants to meet their energy needs independently.

- The expanding renewable energy sector provides alternative electricity sources, reducing dependence on single suppliers.

- This increased choice empowers customers to negotiate better terms and pricing with Adani Power.

- A credible threat of switching to alternatives directly diminishes Adani Power's pricing power.

Financial Health of Discoms

The financial fragility of many Indian state distribution companies (Discoms) significantly bolsters their bargaining power against power generators like Adani Power. This precarious state often leads to delayed payments, requests for renegotiating Power Purchase Agreements (PPAs), or demands for other concessions.

This dynamic can force Adani Power to shoulder financial risks or agree to more accommodating terms to secure prompt payments and preserve crucial business relationships. For instance, as of early 2024, the aggregate outstanding dues from Discoms to power generators remained a substantial concern, impacting the cash flow of the entire sector.

- Discoms' Financial Strain: Many state Discoms grapple with mounting debt and operational inefficiencies, weakening their ability to meet payment obligations promptly.

- Impact on Generators: This financial weakness translates into increased bargaining power for Discoms, allowing them to influence PPA terms and payment schedules.

- Risk Mitigation for Adani Power: Adani Power must strategically manage these customer relationships to mitigate payment delays and potential renegotiations, ensuring stable revenue streams.

Adani Power's customers, primarily state-owned distribution companies (Discoms), wield significant bargaining power due to long-term Power Purchase Agreements (PPAs) that often fix tariffs, limiting Adani's pricing flexibility. The regulatory environment in India, with oversight from electricity commissions, further empowers these Discoms to negotiate for lower tariffs, as seen in 2023-24 with competitive solar tariffs around INR 2.40-2.70 per unit.

Furthermore, the concentration of Adani Power's sales with a few large Discoms amplifies their leverage, as evidenced by FY23 revenue heavily relying on these key customers. The growing availability of alternative energy sources, such as captive power and renewables, also strengthens customer bargaining power by providing credible threats to switch providers if terms are unfavorable, a trend amplified by India's expanding renewable capacity in 2024.

| Customer Type | Bargaining Power Factors | Impact on Adani Power | Example Data/Trend |

| State Discoms (via PPAs) | Fixed tariffs, regulatory oversight | Limited pricing flexibility, revenue predictability | 2023-24: PPAs formed majority of revenue |

| Large Industrial Users | Access to captive power, renewable alternatives | Increased negotiation leverage, potential switching | 2024: Robust growth in renewable capacity |

| Financially Strained Discoms | Payment delays, requests for concessions | Risk of renegotiations, cash flow impact | Early 2024: Substantial outstanding dues from Discoms |

Full Version Awaits

Adani Power Limited Porter's Five Forces Analysis

This preview showcases the complete Adani Power Limited Porter's Five Forces analysis, detailing the competitive landscape including threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, offering actionable insights into Adani Power's strategic positioning within the Indian power sector.

Rivalry Among Competitors

Adani Power Limited operates in a fiercely competitive Indian power sector. Major private players like Tata Power, JSW Energy, and Reliance Power, along with public sector giants such as NTPC, create a crowded marketplace.

This intense rivalry translates into aggressive bidding for new power projects and existing Power Purchase Agreements (PPAs). For instance, in 2023, the Indian power sector saw significant capacity additions driven by both public and private entities, intensifying the fight for market share and favorable contract terms.

The pressure on pricing is continuous as companies vie for contracts, impacting profit margins and requiring efficient operational management. This competitive dynamic necessitates strategic pricing and cost optimization to maintain profitability.

Periods of excess generation capacity in India's power sector can significantly ramp up competitive rivalry. When there's more power available than is currently needed, companies often have to lower their prices to attract buyers. This can lead to lower Plant Load Factors (PLFs), meaning power plants aren't running at their full potential, and can put downward pressure on electricity tariffs.

Companies like Adani Power Limited are therefore keen to secure Power Purchase Agreements (PPAs) to guarantee a buyer for their electricity. This competition to lock in PPAs intensifies rivalry as firms vie for stable revenue streams and aim to keep their expensive assets utilized. In 2023, India's overall PLF for thermal power plants hovered around 60-65%, indicating room for improvement and highlighting the ongoing competition for demand.

In India, the awarding of new power projects and long-term power supply agreements is predominantly driven by intensely competitive bidding processes. This environment naturally intensifies rivalry among power generation companies.

To secure these crucial contracts, generators are compelled to present the most attractive tariffs. This often necessitates accepting narrower profit margins or less advantageous contract terms, directly impacting their profitability and operational flexibility.

For instance, in 2023, bids for solar power projects in India frequently saw tariffs fall below ₹2.50 per kilowatt-hour, showcasing the aggressive pricing strategies employed by developers to win projects.

Diversification into Renewables

Adani Power Limited, like many traditional thermal power generators, is actively expanding into renewable energy. This strategic move intensifies competition as companies now battle for dominance across both thermal and burgeoning renewable energy markets. For instance, by the end of 2023, Adani Green Energy Limited, a related entity, had a significant renewable capacity, showcasing this diversification trend.

This diversification means Adani Power faces new rivals in the renewable space, including dedicated renewable energy developers and other traditional power companies making similar transitions. The competition is fierce for prime locations, government incentives, and securing long-term power purchase agreements in the solar and wind sectors. For example, India's renewable energy sector saw substantial capacity additions in 2023, highlighting the competitive landscape.

- Renewable Capacity Growth: India added over 15 GW of renewable capacity in FY23, indicating rapid market expansion and competition.

- Diversification Strategy: Adani Power's move into renewables mirrors industry-wide trends, increasing the number of players vying for market share.

- New Competitive Arena: Competition now extends beyond thermal efficiency to include renewable project development, technology adoption, and grid integration capabilities.

Geographical Market Overlap

Adani Power Limited's competitive rivalry is intensified by significant geographical market overlap across India. The company frequently finds itself in direct competition with the same major power producers in multiple states, creating a consistently high level of pressure.

This widespread presence means that competitors are not just vying for dominance in one region, but across several, leading to a more entrenched and pervasive competitive landscape. For instance, Adani Power competes with players like NTPC Limited and Tata Power in key states such as Gujarat, Maharashtra, and Rajasthan, where all three have substantial operational footprints.

- Geographical Overlap: Adani Power's plants are spread across multiple Indian states, leading to frequent encounters with the same core competitors.

- Intensified Rivalry: This overlap means competitors are constantly battling for the same power supply contracts and market share within these shared regions.

- Key Competitors: Major rivals like NTPC Limited and Tata Power also operate extensively in these overlapping states, amplifying the competitive pressure.

- Market Share Battles: The continuous struggle for market share in these common geographical areas drives sustained and pervasive competitive actions.

The Indian power sector is characterized by intense competition, with Adani Power Limited facing formidable rivals like NTPC, Tata Power, and JSW Energy. This rivalry is evident in aggressive bidding for power projects and Power Purchase Agreements (PPAs), often leading to compressed profit margins.

The drive to secure PPAs is a major factor, as companies aim for stable revenue streams. Periods of overcapacity further exacerbate this, forcing price reductions and impacting operational efficiency, as seen with thermal plant PLFs hovering around 60-65% in 2023.

| Key Competitor | Estimated Capacity (GW, as of early 2024) | Key Market Presence |

|---|---|---|

| NTPC Limited | ~74 GW | Pan-India, strong in thermal and expanding renewables |

| Tata Power | ~16 GW | Pan-India, diversified across thermal, renewables, and distribution |

| JSW Energy | ~10 GW | Primarily thermal and renewables, expanding capacity |

| Reliance Power | ~6 GW | Thermal and renewable projects, facing financial restructuring |

SSubstitutes Threaten

The rapid growth of renewable energy sources like solar and wind power presents a significant threat of substitution for Adani Power Limited. These technologies are becoming increasingly cost-competitive with traditional thermal power, largely due to falling manufacturing costs and supportive government policies. For instance, global solar PV installation capacity reached over 1,100 GW by the end of 2023, demonstrating a substantial shift towards renewables.

This trend means that consumers and electricity distribution companies are increasingly opting for cleaner and often more economical renewable energy alternatives. As renewable energy penetration grows, it directly challenges the market share and profitability of Adani Power's existing coal-fired power plants, potentially leading to reduced demand for their output.

The Indian government's aggressive push for green energy, with a target of 500 GW of non-fossil fuel energy capacity by 2030, significantly strengthens the threat of substitutes for conventional power sources like those operated by Adani Power. Policies such as the National Green Hydrogen Mission and Production Linked Incentives for solar PV manufacturing directly encourage the adoption and cost reduction of renewable alternatives.

The growing emphasis on energy efficiency and demand-side management (DSM) presents a significant threat of substitutes for Adani Power. As consumers and industries become more adept at reducing their energy consumption, the overall demand for electricity, particularly from traditional sources like thermal power, can decrease. This shift directly impacts Adani Power's core business by potentially lowering plant utilization rates and revenue.

For instance, in 2023, India's Bureau of Energy Efficiency (BEE) reported that various energy conservation measures across sectors could lead to substantial energy savings. Programs promoting efficient lighting, appliances, and industrial processes are actively encouraged by government policies, making them readily available alternatives to simply consuming more grid-supplied power. This trend is expected to continue, with projections indicating further gains in efficiency by 2025.

Battery Storage & Distributed Generation

The increasing sophistication and affordability of battery storage systems, coupled with the widespread adoption of distributed generation like rooftop solar, present a significant threat of substitutes for traditional, centralized power providers such as Adani Power Limited. These technologies empower consumers to produce and store their own electricity, thereby diminishing their dependence on the grid and, consequently, on large-scale power generators.

This shift is particularly impactful as the cost of battery storage continues to decline. For instance, by the end of 2023, the global average cost for lithium-ion battery packs had fallen significantly compared to previous years, making self-generation and storage more economically viable for a broader range of consumers. This trend is expected to accelerate, further eroding the market share of conventional power utilities.

- Decreasing Battery Costs: Global average costs for lithium-ion battery packs saw a substantial decrease by the end of 2023, making distributed storage solutions more accessible.

- Rooftop Solar Growth: The installed capacity of rooftop solar globally has seen consistent year-over-year growth, indicating increasing consumer adoption of distributed generation.

- Reduced Grid Dependence: As more consumers adopt behind-the-meter solutions, their reliance on grid-supplied electricity, and thus on large generators, is reduced.

- Energy Independence: Consumers are increasingly seeking energy independence and resilience, driving demand for self-generation and storage technologies.

Emerging Technologies & Fuels

The threat of substitutes for Adani Power Limited, particularly concerning emerging technologies and fuels, is a growing consideration. While conventional thermal power remains dominant, advancements in areas like green hydrogen and advanced nuclear reactors present potential long-term alternatives. For instance, by 2024, global investment in clean energy technologies continues to surge, with significant capital flowing into hydrogen production and small modular nuclear reactors (SMRs), indicating a clear shift in the energy landscape.

These evolving technologies could eventually offer competitive energy solutions, potentially impacting the demand for Adani Power's current thermal generation assets. The pace of innovation is rapid; for example, projections suggest that green hydrogen could become cost-competitive with natural gas in certain applications by the late 2020s or early 2030s. This ongoing technological evolution creates an uncertain but present threat to the established thermal power sector.

- Emerging Technologies: Green hydrogen and advanced nuclear reactors are developing as potential long-term substitutes for thermal power.

- Investment Trends: Global investment in clean energy, including hydrogen and SMRs, is increasing significantly, signaling a market shift.

- Cost Competitiveness: Green hydrogen is projected to become cost-competitive with fossil fuels in the coming years.

- Uncertainty Factor: Continuous innovation in the energy sector poses an evolving and uncertain threat to conventional thermal power generation.

The increasing viability of renewable energy sources, coupled with advancements in energy storage and efficiency, poses a significant threat of substitution for Adani Power Limited. Consumers and businesses are increasingly adopting solar, wind, and battery storage solutions, reducing reliance on traditional thermal power. For instance, India's renewable energy capacity crossed 180 GW by early 2024, showcasing a strong market shift.

| Substitute Technology | Key Trend | Impact on Adani Power |

|---|---|---|

| Solar & Wind Power | Falling costs, government incentives | Reduced demand for thermal power output |

| Battery Storage | Decreasing costs, increased adoption | Enables distributed generation, less grid reliance |

| Energy Efficiency | Technological advancements, policy support | Lower overall electricity demand |

| Green Hydrogen | Growing investment, future cost parity | Potential long-term alternative fuel |

Entrants Threaten

The sheer scale of setting up thermal power plants necessitates billions in capital, with Adani Power's own projects, like the Godda Ultra Mega Power Plant, involving significant upfront investment. These massive outlays, coupled with construction and commissioning timelines that can stretch for years, create a formidable financial barrier. For instance, the initial phase of Godda was reported to cost over $1.5 billion.

The Indian power sector's stringent regulatory framework, demanding extensive permits and environmental clearances, acts as a significant barrier to new entrants. Obtaining these approvals is often a protracted and complex process, frequently involving politically charged considerations.

For instance, projects require clearances from bodies like the Ministry of Environment, Forest and Climate Change (MoEFCC) and state pollution control boards, with timelines that can extend for years. This intricate web of compliance significantly escalates initial project costs and introduces substantial delays, deterring potential new players.

New companies entering the power sector face significant hurdles in securing essential fuel and transmission infrastructure. For instance, obtaining reliable coal linkages, a primary fuel for many power plants, can be difficult for newcomers, whereas established entities like Adani Power have historically leveraged long-term contracts and relationships to ensure supply stability.

Access to the power transmission grid is another major barrier. New entrants often struggle to gain timely and cost-effective access to existing transmission lines, which are crucial for delivering electricity to consumers. Adani Power, having invested heavily in its own transmission infrastructure, possesses a distinct advantage in this regard, reducing its reliance on third-party networks.

Economies of Scale & Experience Curve

The threat of new entrants for Adani Power Limited is significantly mitigated by the substantial economies of scale enjoyed by existing, large players. Adani Power, with its vast operational footprint, benefits from bulk purchasing power for fuel and equipment, leading to lower per-unit costs. This scale also translates into operational efficiencies and optimized maintenance schedules, creating a cost barrier that new, smaller entrants would find challenging to overcome.

Furthermore, Adani Power's extensive experience curve provides a distinct competitive advantage. Years of operating large-scale power plants have honed their processes, improved efficiency, and reduced operational risks. This accumulated knowledge allows for better cost management and higher plant availability, making it difficult for newcomers to match their cost-effectiveness and reliability from the outset.

For instance, as of the fiscal year ending March 2024, Adani Power's total installed capacity stood at approximately 15,250 MW, demonstrating a significant scale of operations. This immense capacity allows them to negotiate favorable terms with suppliers and lenders, further solidifying their cost advantage. New entrants would need to invest heavily to achieve comparable scale and experience, a daunting prospect in the capital-intensive power sector.

- Economies of Scale: Adani Power's large operational capacity (approx. 15,250 MW as of FY24) allows for bulk procurement of fuel and equipment, significantly lowering per-unit costs compared to smaller competitors.

- Experience Curve Advantage: Decades of operational experience have optimized Adani Power's processes, leading to enhanced efficiency and reduced operational expenditures, a benefit difficult for new entrants to replicate quickly.

- Capital Intensity: The power sector requires massive upfront capital investment, creating a high barrier to entry that deters potential new players, especially those without established financial backing.

- Regulatory Hurdles: Navigating complex regulatory approvals and compliance requirements for new power projects is a time-consuming and costly process, further discouraging new entrants.

Competitive Bidding & PPA Landscape

The threat of new entrants in the power sector, particularly for Adani Power Limited, is significantly influenced by the competitive bidding process for Power Purchase Agreements (PPAs). New companies entering the market must immediately contend with established players who have already achieved economies of scale and refined their operational efficiencies. This intense price competition makes it difficult for newcomers to secure lucrative, long-term contracts and establish a stable financial footing.

For instance, in 2024, many renewable energy tenders, a key growth area, saw bids that were aggressively priced, often reaching record lows. This trend underscores the pressure on new entrants to offer highly competitive tariffs from the outset. Adani Power, with its existing large-scale operational capacity and established supply chain relationships, benefits from a cost advantage that new entrants struggle to replicate quickly.

- High Capital Requirements: Building new power generation facilities, whether thermal or renewable, demands substantial upfront capital investment, creating a significant barrier for potential new entrants.

- Regulatory Hurdles: Navigating complex and evolving regulatory frameworks for power generation, transmission, and PPA approvals requires specialized knowledge and significant time, deterring many new players.

- Established Infrastructure and Scale: Existing players like Adani Power benefit from established grid connectivity, optimized fuel sourcing, and operational expertise, which are difficult and time-consuming for new entrants to match.

- PPA Securitization Challenges: New entrants face greater difficulty in securing long-term PPAs with creditworthy off-takers, as utilities often prefer to contract with established, financially stable generators.

The threat of new entrants for Adani Power Limited is considerably low due to the immense capital required to establish power generation facilities, with new projects often costing billions. For example, the development of large-scale power plants involves extensive upfront investment in land, equipment, and construction, creating a substantial financial barrier. Furthermore, the sector is heavily regulated, demanding numerous permits and environmental clearances that are both time-consuming and costly to obtain, adding to the initial investment hurdle.

New companies also face significant challenges in securing essential resources like fuel and transmission access. Adani Power, with its established infrastructure and long-term fuel supply contracts, possesses a distinct advantage that newcomers would struggle to replicate. The competitive bidding for Power Purchase Agreements (PPAs) further intensifies this, as established players with economies of scale can offer more aggressive tariffs, making it difficult for new entrants to secure stable contracts.

| Barrier Type | Description | Impact on New Entrants |

| Capital Intensity | Massive upfront investment required for power plant construction. | High; deters new players without substantial financial backing. |

| Regulatory Hurdles | Complex and lengthy process for permits and environmental clearances. | High; increases costs and timelines, discouraging entry. |

| Economies of Scale | Established players benefit from bulk purchasing and operational efficiencies. | High; new entrants struggle to match cost-effectiveness. |

| Infrastructure Access | Securing fuel linkages and grid transmission access is challenging. | High; requires significant investment and negotiation power. |

Porter's Five Forces Analysis Data Sources

Our Adani Power Limited Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Adani Power's annual reports, investor presentations, and regulatory filings with the Ministry of Corporate Affairs. We also incorporate insights from reputable industry research reports and financial news outlets to capture the competitive landscape and market dynamics.