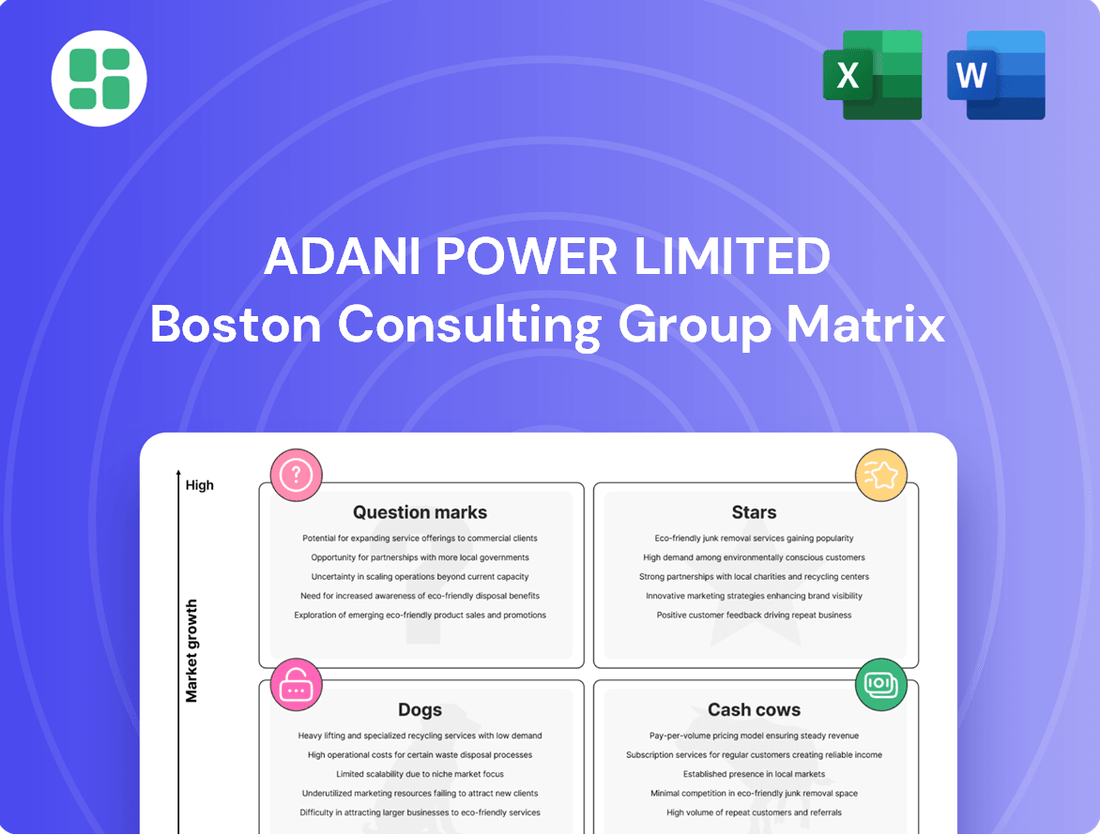

Adani Power Limited Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Adani Power Limited Bundle

Adani Power Limited's BCG Matrix offers a fascinating glimpse into its diverse portfolio, highlighting potential growth areas and stable revenue generators. Understanding where its power plants and projects fit—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed investment decisions.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Adani Power.

Stars

Adani Power Limited's new greenfield thermal power projects, like the 2,400 MW facility in Bihar and a 1,500 MW plant in Uttar Pradesh, are positioned as stars in its BCG matrix. These are significant investments, with the Bihar project alone representing a $3 billion commitment, slated for commissioning between 2029 and 2030.

These ventures are strategically placed in regions experiencing escalating power needs and benefit from long-term Power Supply Agreements (PSAs). This secures a substantial future market share within India's rapidly growing energy sector, reflecting high growth potential and market leadership.

Adani Power Limited's aggressive expansion through strategic acquisitions is a key driver of its growth. The company recently acquired the 1,200 MW Moxie Power Generation, 600 MW Korba Power, and 500 MW Adani Dahanu Thermal Power Station. These moves significantly bolster its operational capacity and solidify its status as India's largest private thermal power producer.

Adani Power is currently developing significant ultra-supercritical (USC) thermal power projects, including 1,600 MW facilities in Mahan, Raipur, and Raigarh.

These advanced, low-emission plants are key to satisfying India's growing energy needs and are projected to contribute substantially to the company's future market share.

Growing Merchant Power Sales

Adani Power Limited's merchant power sales are demonstrating robust growth, positioning them as a strong contender in the dynamic power trading sector. This segment is crucial for the company's overall performance.

The company has seen a notable uptick in power sales through short-term contracts and the open merchant market. Specifically, merchant sales experienced a significant rise of 7.7% in the first quarter of fiscal year 2026.

This expansion highlights Adani Power's strategic advantage in leveraging volatile market prices and meeting the increasing demand during peak periods. Such agility is key in the fast-paced power trading environment.

- Merchant Sales Growth: Adani Power recorded a 7.7% increase in merchant sales during Q1 FY26.

- Market Responsiveness: The company effectively capitalizes on fluctuating power prices.

- Demand Capture: Growth is driven by the ability to meet peak demand in the merchant market.

- Strategic Positioning: Merchant sales represent a high-growth, dynamic segment for Adani Power.

Revival and Commissioning of Stressed Assets

Adani Power Limited's strategic revival of stressed assets is a key driver in its growth. The recommencement of the 1,320 MW Korba Supercritical power project, after securing environmental clearance, exemplifies this strategy. This move allows Adani Power to quickly integrate previously stalled capacities, significantly expanding its generation base.

Bringing these large-scale assets back online enables the company to capture additional market share. For instance, in Q4 FY24, Adani Power's total installed capacity reached 15,210 MW, a substantial increase driven by such strategic acquisitions and revivals.

- Revival of Korba Project: The 1,320 MW Korba Supercritical power project is a prime example of Adani Power's ability to bring stalled capacities back to life.

- Capacity Expansion: Successfully recommissioning such projects allows for rapid expansion of the company's overall generation capacity.

- Market Share Growth: This expansion directly translates into an increased ability to capture market share by supplying power from newly operational assets.

- FY24 Capacity: By the end of FY24, Adani Power's total installed capacity stood at 15,210 MW, showcasing the impact of these revival efforts.

Adani Power Limited's new greenfield projects and strategic acquisitions are positioned as stars in its BCG matrix, indicating high growth and market share. The company's focus on ultra-supercritical technology and the revival of stressed assets further solidifies its position in high-growth segments. Merchant sales, showing a 7.7% increase in Q1 FY26, also contribute to this star status by capitalizing on market dynamics and demand.

| Project/Segment | Capacity (MW) | Status/Driver | BCG Classification |

|---|---|---|---|

| Bihar Greenfield Project | 2,400 | New Greenfield, High Growth Potential | Star |

| Uttar Pradesh Greenfield Project | 1,500 | New Greenfield, High Growth Potential | Star |

| Moxie Power Generation Acquisition | 1,200 | Strategic Acquisition, Capacity Expansion | Star |

| Korba Power Acquisition | 600 | Strategic Acquisition, Capacity Expansion | Star |

| Adani Dahanu Thermal Power Station Acquisition | 500 | Strategic Acquisition, Capacity Expansion | Star |

| Mahan, Raipur, Raigarh USC Projects | 1,600 each | Ultra-Supercritical, Low Emission, Future Demand | Star |

| Merchant Sales | N/A (Segment) | 7.7% growth Q1 FY26, Market Responsiveness | Star |

| Korba Supercritical Project Revival | 1,320 | Revival of Stressed Asset, Capacity Integration | Star |

What is included in the product

Adani Power's BCG Matrix likely analyzes its diverse power generation assets, categorizing them based on market growth and share.

Adani Power's BCG Matrix offers a clear, actionable overview of its business units, simplifying strategic decisions and relieving the pain of complex portfolio analysis.

Cash Cows

Adani Power Limited's established long-term PPA-based thermal plants are the company's undisputed cash cows. These fully operational assets benefit from secured revenue streams through Power Purchase Agreements, ensuring consistent and predictable cash flow with minimal need for further investment in market development. For instance, in the fiscal year ending March 31, 2024, Adani Power reported a consolidated revenue of ₹52,898 crore, with its thermal power segment forming the backbone of this performance.

The 1,600 MW Godda Ultra-supercritical Thermal Power Plant, operating under Adani Power Limited, stands as a quintessential cash cow. Its secure, long-term power purchase agreement with the Bangladesh Power Development Board ensures consistent revenue streams and robust profitability, significantly bolstering Adani Power's financial performance.

Adani Power Limited's operational efficiency is a cornerstone of its cash cow status. The company consistently achieves a high Plant Load Factor (PLF), meaning its power plants are running at or near their maximum capacity. For instance, in the fiscal year 2023-24, Adani Power's PLF across its fleet averaged an impressive 66.7%, a significant increase from previous periods, demonstrating effective management and high asset utilization.

This high PLF translates directly into robust cash generation. By minimizing idle time and maximizing power output from its mature operational fleet, Adani Power ensures a steady and predictable revenue stream. This operational excellence reduces per-unit generation costs and enhances profitability, solidifying these assets as reliable cash cows for the company.

Integrated Fuel Supply Chain

Adani Power Limited's integrated fuel supply chain is a significant strength, acting as a cash cow within its business portfolio. This integration allows for more efficient and cost-effective coal sourcing and logistics for its thermal power plants, directly impacting profitability. In FY24, Adani Power reported a substantial increase in its consolidated profit after tax, reaching ₹5,732 crore, partly driven by these operational efficiencies.

This strategic advantage translates into higher profit margins and consistent, robust cash flows from its thermal generation segment, which holds a considerable market share. The company's ability to manage fuel costs effectively provides a competitive edge, ensuring stable earnings even in fluctuating market conditions. For instance, the company's total income for FY24 stood at ₹44,307 crore, showcasing the scale of its operations.

- Reduced Fuel Costs: The integrated supply chain minimizes expenses related to coal procurement and transportation.

- Higher Profit Margins: Lower operating costs directly boost the profitability of its thermal power generation.

- Robust Cash Flows: Consistent earnings from a dominant market position generate strong and reliable cash.

- FY24 Performance: Adani Power's profit after tax of ₹5,732 crore in FY24 highlights the financial strength of its operations.

Strong Balance Sheet and Reduced Debt

Adani Power Limited's strengthening balance sheet and a deliberate focus on prudent capital management have led to a significant reduction in its net debt. This financial discipline underscores the robust cash-generating capability of its core power generation operations.

The company's reduced net debt, standing at approximately ₹37,477 crore as of March 31, 2024, compared to ₹47,976 crore in the previous fiscal year, highlights its commitment to deleveraging. This financial health provides ample capacity to self-fund new growth opportunities, such as expanding its renewable energy portfolio, while simultaneously ensuring consistent returns for its investors.

- Strengthened Financial Position: Adani Power's net debt has decreased, indicating improved financial stability.

- Cash Generation: The core business is effectively generating surplus cash, a hallmark of a cash cow.

- Funding Growth: Financial strength enables investment in new ventures without compromising existing operations.

- Shareholder Returns: The company is well-positioned to maintain stable dividends and value for shareholders.

Adani Power Limited's established thermal power plants, operating under long-term Power Purchase Agreements (PPAs), are its primary cash cows. These assets benefit from secured revenue streams, minimizing market risk and ensuring predictable cash flow. For instance, in FY24, Adani Power reported consolidated revenue of ₹52,898 crore, with thermal generation being the significant contributor.

The company's high Plant Load Factor (PLF) is a testament to its operational efficiency, directly translating into robust cash generation from its mature fleet. In FY23-24, Adani Power achieved an average PLF of 66.7%, showcasing effective asset utilization and cost-efficient operations. This operational strength underpins the consistent earnings from its thermal segment.

Furthermore, Adani Power's integrated fuel supply chain enhances profitability by reducing coal procurement and logistics costs. This strategic advantage, coupled with a dominant market position, ensures higher profit margins and stable cash flows. The company's profit after tax for FY24 was ₹5,732 crore, reflecting the financial health of these operations.

Adani Power's prudent capital management and deleveraging efforts have further solidified its cash cow status. A reduction in net debt to approximately ₹37,477 crore as of March 31, 2024, demonstrates strong cash generation capabilities, allowing for self-funding of growth initiatives and shareholder returns.

| Key Financials (FY24) | Value (₹ Crore) | Significance |

| Consolidated Revenue | 52,898 | Demonstrates scale of operations, driven by thermal segment. |

| Profit After Tax | 5,732 | Highlights profitability and cash generation from core assets. |

| Net Debt (as of Mar 31, 2024) | 37,477 | Indicates strong cash flow for debt reduction and future investment. |

| Average Plant Load Factor (FY23-24) | 66.7% | Shows high operational efficiency and asset utilization. |

Full Transparency, Always

Adani Power Limited BCG Matrix

The preview you see details the Adani Power Limited BCG Matrix, and this exact, fully formatted report will be delivered to you upon purchase. You'll receive the complete strategic analysis, ready for immediate use in your business planning or investor presentations, with no watermarks or demo content.

Dogs

Older, less efficient thermal units within Adani Power Limited's portfolio, while still contributing to capacity, may be categorized as Question Marks. These legacy plants, often operating at lower thermal efficiency rates, can incur higher fuel costs and maintenance expenses. For instance, while Adani Power's overall capacity utilization was around 63% in FY23, older units might have lower individual utilization and profitability.

Underutilized or stressed smaller assets within Adani Power Limited's portfolio could be categorized as Dogs. These might include older, less efficient plants or those in regions with consistently low power demand, leading to low capacity utilization rates. For instance, if a particular plant consistently operates below 50% capacity for extended periods, it could represent a Dog asset.

Adani Power Limited's older thermal power plants are increasingly facing scrutiny under India's tightening environmental regulations. These assets, particularly those needing significant capital for emission control upgrades, could become problematic if profitability prospects remain dim. For instance, the push for lower sulfur dioxide and nitrogen oxide emissions necessitates substantial investment, and without a clear return on that investment, these plants risk becoming cash traps.

Projects with Persistent Regulatory or Litigation Challenges

Adani Power Limited's portfolio, when viewed through a BCG matrix lens, likely contains projects facing significant hurdles. Those projects bogged down by persistent regulatory disputes, contractual issues, or ongoing litigation, with no clear path to resolution, would fall into the question mark category. These situations inherently lead to prolonged delays and substantial cost overruns, drastically reducing their potential return on invested capital.

For instance, projects experiencing lengthy environmental clearances or land acquisition disputes can remain in limbo for years. These delays not only tie up capital but also expose the company to escalating costs and potential penalties. Without a clear and timely resolution, the future profitability of such ventures becomes highly uncertain, making them prime candidates for the question mark quadrant.

- Regulatory Delays: Projects held up by environmental impact assessments or approvals from regulatory bodies, leading to extended construction timelines.

- Contractual Disputes: Ongoing disagreements with suppliers, contractors, or off-takers that result in arbitration or legal proceedings, halting progress.

- Litigation Impact: Court cases challenging project permits, land rights, or power purchase agreements that create significant uncertainty and financial strain.

- Cost Overruns: The accumulation of additional expenses due to project delays, increased material costs, and extended financing charges, eroding profitability.

Non-Core Divested Businesses

Non-core divested businesses in Adani Power Limited's BCG Matrix would represent segments or assets that the company has sold off or is considering selling because they are not performing well or don't align with its main strategic goals. While Adani Power has largely focused on expanding its core operations, any smaller, peripheral units that have been deemed non-essential could fall into this category. For instance, if Adani Power were to divest a minor, legacy power generation asset that consistently underperformed and required significant capital without a clear path to improvement, it would be classified as a Dog. This strategic pruning helps the company concentrate resources on its high-growth areas.

Underperforming or divested assets within Adani Power Limited's portfolio would be classified as Dogs. These are typically older, less efficient units or those in markets with consistently low demand, resulting in low capacity utilization. For example, a power plant consistently operating below 50% capacity for an extended period, like in FY23 where overall capacity utilization was around 63%, could represent a Dog asset. These assets drain resources without significant returns.

Question Marks

Adani Power Limited's direct solar power generation capacity, such as its 40 MW solar plant in Gujarat, represents a nascent stage within its broader energy portfolio. This capacity is dwarfed by its substantial thermal power assets, highlighting a significant disparity in current operational scale.

Despite India's booming solar energy market, Adani Power's relatively small footprint in direct solar generation places it in the 'Question Mark' category of the BCG matrix. This classification signifies high growth potential in the sector, yet Adani Power's current market share in direct solar investments suggests an uncertain future contribution from this specific segment.

Adani Power Limited's potential direct ventures into pumped hydro storage are positioned as Stars in the BCG matrix. These initiatives align with the Adani Group's expansive energy vision, aiming to bolster grid flexibility and integrate renewable energy sources. While currently in early development for Adani Power, the sector itself shows substantial growth potential.

Adani Power Limited's exploration into emerging energy technologies, such as advanced battery storage or green hydrogen, would place these ventures in the 'Question Marks' category of the BCG matrix. These are high-risk, capital-intensive projects with uncertain market adoption and currently minimal market share, requiring significant investment to gauge their future potential. For instance, by the end of fiscal year 2024, Adani Green Energy Limited, a related entity, announced plans to invest significantly in renewable energy projects, including those exploring innovative storage solutions, signaling a commitment to these nascent areas.

New International Market Entry (Early Stages)

Adani Power Limited's strategy for new international market entry in its early stages, particularly with nascent, small-scale projects, aligns with a 'Question Mark' positioning in the BCG Matrix. These ventures, while holding significant growth potential, begin with a low market share and demand substantial capital for development and scaling. For instance, Adani Power's recent international ventures in regions like Bangladesh have demonstrated this dynamic, requiring initial investments to establish a foothold before achieving significant market penetration.

Pursuing such early-stage projects allows Adani Power to explore untapped markets and build a presence before competitors. However, the inherent risks include regulatory hurdles, political instability, and the need for substantial upfront investment, which can strain financial resources. The company's financial reports for the fiscal year ending March 31, 2024, indicate a robust capital expenditure program, which would need to accommodate these high-risk, high-reward international expansions.

- Growth Potential: Entering nascent markets offers Adani Power the opportunity to capture significant market share as these economies develop and their power demands increase.

- Investment Requirements: These projects necessitate considerable capital outlay for infrastructure development, technology acquisition, and operational setup, impacting Adani Power's balance sheet.

- Market Share: Initially, Adani Power will hold a small market share in these new territories, reflecting the early stage of its operations and the need for market penetration.

- Risk Factors: Challenges such as political risks, currency fluctuations, and regulatory uncertainties are inherent in early-stage international market entries, requiring careful risk management.

Digitalization and Smart Grid Pilot Projects

Adani Power Limited's investments in digitalization and smart grid pilot projects fall into the 'Question Marks' category of the BCG matrix. These initiatives, such as piloting advanced analytics for plant performance or exploring demand-side management technologies, are characterized by high investment and uncertain, nascent market adoption. For instance, Adani Power has been exploring digital twin technology for its thermal power plants to enhance operational efficiency, a move that requires significant upfront capital with no immediate guaranteed return.

These projects are crucial for Adani Power's long-term strategy, aiming to build future capabilities in a rapidly evolving energy landscape. While these pilots, like the integration of IoT sensors for real-time grid monitoring, currently have a low market impact and generate minimal revenue, they are designed to foster innovation and secure future market leadership. The company's focus in 2024 on such experimental technologies underscores their placement in the Question Marks quadrant, requiring careful strategic evaluation.

- High Investment, Low Market Share: Pilot projects in digitalization and smart grids require substantial capital expenditure with currently unproven market acceptance and low immediate commercial returns.

- Future Growth Potential: These initiatives are strategically positioned to enhance operational efficiency, enable new service offerings, and drive future market leadership in the power sector.

- Strategic R&D Focus: Adani Power's exploration of technologies like AI-driven predictive maintenance and blockchain for energy trading exemplifies their commitment to R&D, characteristic of Question Mark investments.

- Uncertainty in Returns: The success and scalability of these advanced technologies are subject to regulatory frameworks, technological maturity, and customer adoption rates, creating inherent uncertainty in future revenue streams.

Adani Power's nascent solar ventures, like its 40 MW Gujarat plant, are classified as Question Marks due to their high growth potential in India's expanding solar market but currently low market share within Adani Power's overall portfolio. These investments require significant capital to scale and compete effectively.

Emerging energy technologies such as battery storage and green hydrogen also fall into the Question Mark category. These are capital-intensive with uncertain market adoption, demanding substantial investment to gauge future viability, as indicated by Adani Green Energy's significant renewable investment plans for fiscal year 2024.

Early-stage international market entries by Adani Power, characterized by small-scale projects and low initial market share, are also Question Marks. These ventures, like those in Bangladesh, offer high growth potential but carry inherent risks such as regulatory hurdles and political instability, necessitating substantial upfront investment as seen in their 2024 capital expenditure plans.

Digitalization and smart grid pilot projects, including AI for plant efficiency and IoT for grid monitoring, are Question Marks for Adani Power. These require considerable investment with uncertain market acceptance and immediate returns, though they are strategically vital for future operational efficiency and market leadership, a focus evident in their 2024 initiatives.

BCG Matrix Data Sources

Our Adani Power BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on power sector growth, and official company disclosures.