Acushnet Holdings Corp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acushnet Holdings Corp Bundle

Acushnet Holdings Corp. boasts strong brand recognition and a dominant market share in golf equipment, but faces challenges from evolving consumer preferences and intense competition.

Want the full story behind Acushnet's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Acushnet Holdings Corp. boasts a powerful stable of well-respected brands, including Titleist and FootJoy, which are synonymous with quality and high performance in the golf world. Titleist consistently ranks as the leading golf ball brand, a testament to its enduring appeal and product excellence.

FootJoy further solidifies Acushnet's market dominance, capturing an impressive 65.3% of the premium golf footwear market. This strong brand equity, cultivated through decades of quality and association with top professional athletes, fosters deep customer loyalty and secures the company's leadership position, especially within the crucial golf equipment sector.

Acushnet Holdings Corp. exhibits robust financial performance, evidenced by its full-year 2024 net sales of $2.46 billion, a 3.2% increase. The company's net income attributable to Acushnet Holdings Corp. reached $214.3 million, showcasing strong profitability.

Further demonstrating this trend, Acushnet reported a 17.1% rise in net income for Q1 2025 and a 5.9% increase in Q2 2025. This consistent profitability, maintained over 11 years, underscores the company's financial stability and effective management.

The company's operational efficiency is further highlighted by its healthy gross margins, which stood at 48.3% for the full year 2024 and improved to 49.2% in Q2 2025. These figures reflect Acushnet's ability to manage costs effectively while generating substantial revenue.

Acushnet Holdings Corp demonstrates a strong commitment to innovation, consistently channeling resources into research and development. This focus fuels a robust pipeline of high-performance products designed to meet the exacting standards of golfers worldwide.

In 2023, Acushnet saw significant success with the introduction of new iterations of its iconic Pro V1 and Pro V1x golf balls. The company also launched new GT drivers, fairways, and hybrids, alongside Scotty Cameron Studio Style putters and the highly anticipated FootJoy HyperFlex golf shoes, underscoring their dedication to continuous product evolution.

This relentless pursuit of improvement and the regular introduction of cutting-edge products serve as a critical competitive advantage for Acushnet. It ensures they not only meet but often exceed the expectations of serious golfers, thereby sustaining sales momentum and reinforcing brand loyalty.

Durable and Regionally Diverse Supply Chain

Acushnet Holdings Corp benefits from a robust and geographically diverse supply chain, a critical strength in today's unpredictable global trade environment. This diversification acts as a buffer against issues like tariffs, allowing the company to strategically adjust its manufacturing and sourcing locations to maintain cost-effectiveness and product flow. For instance, Acushnet's ability to leverage multiple manufacturing sites globally, including facilities in Asia and North America, minimizes reliance on any single region.

This resilience is further enhanced by vendor-sharing programs, which foster collaboration and shared risk among key suppliers. Such programs ensure that even if one supplier faces disruption, others can often step in, maintaining production continuity. This proactive approach helps guarantee product availability and supports Acushnet's commitment to delivering its leading golf products consistently to customers worldwide, underpinning its market position.

- Geographic Diversification: Acushnet operates manufacturing facilities and sources materials from various regions, reducing vulnerability to localized disruptions or trade policy changes.

- Trade Challenge Navigation: The company's diversified supply chain enables it to adapt to evolving trade dynamics, such as tariffs, by optimizing sourcing and production footprints.

- Product Availability: This robust network ensures consistent product availability, a key factor in maintaining customer satisfaction and market share in the competitive golf industry.

- Resilience Against Disruptions: Acushnet's supply chain is designed to withstand external shocks, from geopolitical events to natural disasters, ensuring business continuity.

Focus on Dedicated Golfers and Premium Channels

Acushnet Holdings Corp. strategically targets dedicated golfers by offering premium products through specialized golf shops and an extensive global fitting network. This approach resonates with a core demographic that demonstrates consistent engagement and investment in the sport.

This focus on committed golfers, a segment known for its resilience and willingness to spend on equipment, solidifies Acushnet's market position. For instance, in 2023, Acushnet's Titleist brand continued to dominate professional tours, with over 1,700 players using Titleist golf balls on major tours, indicating strong brand preference among elite golfers.

- Targeted Audience: Caters to discerning golfers, a segment with high spending propensity.

- Distribution Channels: Leverages premium golf shops and a global fitting network for enhanced customer experience.

- Brand Loyalty: Nurtures strong brand loyalty within a committed and passionate golfer base.

- Market Positioning: Reinforces its high-value market segment through specialized offerings.

Acushnet's brand portfolio, featuring Titleist and FootJoy, is a significant strength, appealing to a core demographic of dedicated golfers. Titleist's consistent leadership in golf ball sales, coupled with FootJoy's commanding 65.3% share of the premium golf footwear market, highlights deep customer loyalty and brand equity cultivated over decades.

The company's financial health is robust, with full-year 2024 net sales reaching $2.46 billion, marking a 3.2% increase, and net income of $214.3 million. This profitability trend continued into 2025, with Q1 net income up 17.1% and Q2 up 5.9%, demonstrating sustained financial stability and effective management over an 11-year period.

Acushnet's commitment to innovation is evident in its continuous R&D investment, leading to successful product launches like new Pro V1 and Pro V1x golf balls and GT drivers in 2023. This focus on high-performance product evolution is a key competitive advantage, ensuring they meet and exceed golfer expectations.

A diversified global supply chain, with manufacturing in Asia and North America, provides resilience against trade disruptions and ensures product availability. This strategic sourcing, supported by vendor-sharing programs, minimizes reliance on single regions and maintains production continuity.

Acushnet's strategic focus on dedicated golfers, reinforced by Titleist's dominance on professional tours with over 1,700 players using their golf balls in 2023, solidifies its premium market positioning and brand loyalty.

| Metric | 2024 | Q1 2025 | Q2 2025 |

| Net Sales | $2.46 Billion | N/A | N/A |

| Net Income | $214.3 Million | +17.1% | +5.9% |

| Gross Margin | 48.3% | N/A | 49.2% |

| Footwear Market Share (Premium) | 65.3% (FootJoy) | N/A | N/A |

What is included in the product

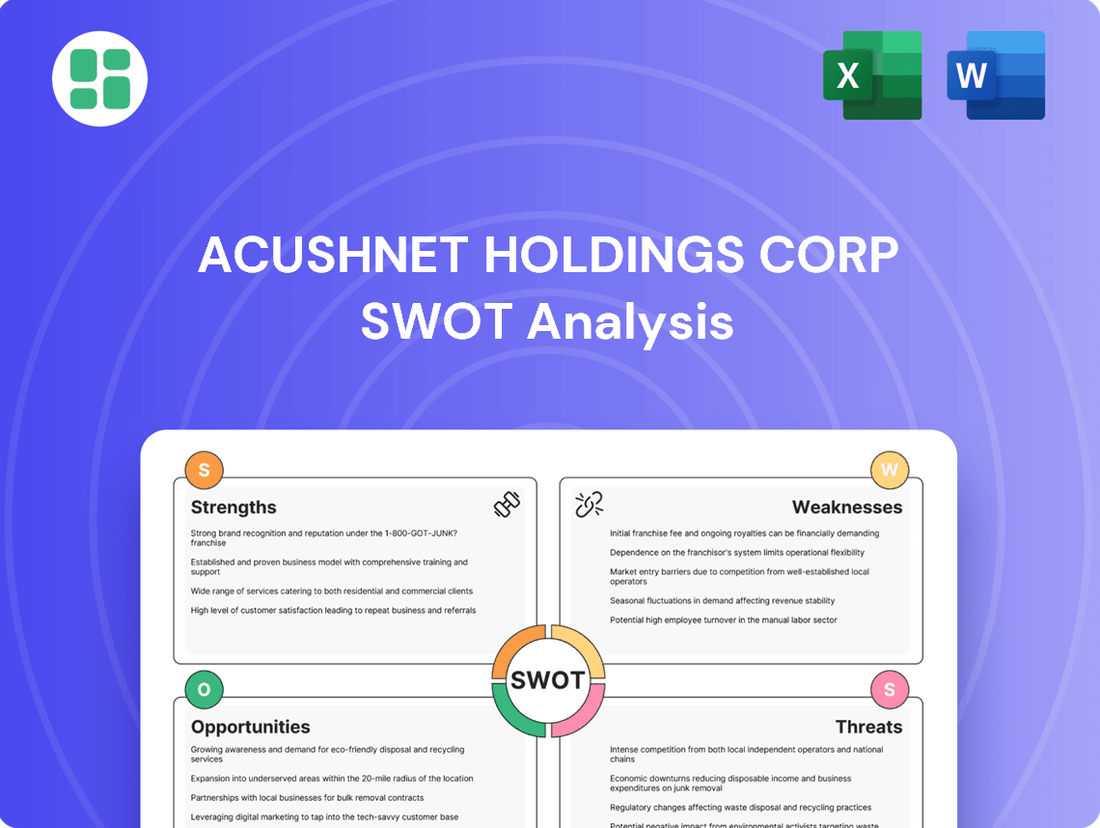

Delivers a strategic overview of Acushnet Holdings Corp’s internal and external business factors, highlighting its strong brand recognition and market leadership in golf equipment, while also identifying potential threats from economic downturns and increased competition.

Identifies critical vulnerabilities and competitive advantages for proactive risk mitigation and opportunity capitalization.

Weaknesses

Despite Acushnet's overall robust performance, the FootJoy golf wear segment faced headwinds. Sales saw a notable 6.6% dip in the first quarter of 2025, followed by a 1.3% decrease in the second quarter of 2025. This downturn is largely attributed to reduced sales volumes in both footwear and apparel categories.

Management points to a deliberate strategy of focusing on premium performance footwear and a conscious effort to decrease sales of discounted closeout items as contributing factors to these figures. This strategic pivot aims to strengthen the brand's premium positioning over the long term.

Acushnet's financial footing shows some strain with rising debt and shrinking cash from operations. As of June 30, 2025, the company's total debt had climbed to $933 million, a notable increase from $764 million at the close of 2024. This has pushed their net leverage ratio to 2.0x.

Adding to these concerns, cash generated from the company's core business activities saw a sharp decline. For the first half of 2025, operating cash flow was only $32 million, a significant drop from the $102 million reported in the corresponding period of 2024. These trends could signal heightened financial risk or potential difficulties in managing day-to-day working capital needs.

Acushnet Holdings Corp. experienced a notable weakness in its Q2 2025 performance, with its Earnings Per Share (EPS) of $1.25 missing the analyst consensus forecast of $1.32. This 5.3% negative surprise, even with revenue exceeding expectations, indicates potential headwinds in cost control or profit margin management. Such misses can dampen investor confidence, despite the top-line growth.

Market Correction in Specific Regional Segments

Acushnet Holdings Corp. has faced a noticeable market correction, especially within its Asian apparel segment. This downturn highlights potential regional vulnerabilities in its sales strategy.

The company continued to experience challenges in the Korean market, with a reported 4.4% decline in sales during the second quarter of 2025. This specific regional weakness underscores the need for adaptive market strategies.

- Asian Apparel Segment Correction: A noted downturn in the Asian apparel market presents a significant weakness.

- Korean Market Challenges: Continued difficulties in South Korea, evidenced by a 4.4% sales drop in Q2 2025, point to regional operational hurdles.

- Regional Sales Imbalances: The company's performance suggests potential imbalances between golf course supply and demand in specific international markets, impacting overall sales.

Impact of Increased Operational Costs

The broader golf industry, including clubs and facilities, is grappling with escalating operational expenses, a trend anticipated to persist through 2025. This inflationary environment puts pressure on Acushnet's trade partners.

While Acushnet has demonstrated proficiency in managing its own costs, these industry-wide challenges could indirectly dampen demand for its premium golf products. For instance, rising costs for greenskeeping and staffing at golf courses might lead to reduced marketing budgets or a more conservative approach to inventory for retailers and clubs.

- Industry-wide inflation impacting golf course operating budgets.

- Potential for reduced marketing or inventory investment by trade partners.

- Indirect pressure on Acushnet's premium product demand.

Acushnet's FootJoy brand experienced a sales decline of 6.6% in Q1 2025 and 1.3% in Q2 2025, primarily due to lower volumes in footwear and apparel, a result partly from a strategic shift away from discounted items.

The company's financial health shows increasing debt, with total debt rising to $933 million by June 30, 2025, and a significant drop in operating cash flow to $32 million in H1 2025 from $102 million in H1 2024, indicating potential financial risks.

Acushnet's Q2 2025 EPS of $1.25 missed analyst expectations of $1.32, suggesting possible issues with cost management or profit margins, which could affect investor confidence despite revenue growth.

Regional weaknesses are evident, particularly in the Asian apparel segment, with South Korea seeing a 4.4% sales decrease in Q2 2025, highlighting the need for more localized market strategies.

| Metric | Q1 2025 | Q2 2025 | H1 2025 | H1 2024 |

|---|---|---|---|---|

| FootJoy Sales Change | -6.6% | -1.3% | ||

| Total Debt (as of June 30) | $933 million | $764 million (as of Dec 31, 2024) | ||

| Operating Cash Flow | $32 million | $102 million | ||

| EPS vs. Consensus | -5.3% (Miss) | |||

| South Korea Sales Change | -4.4% |

Preview the Actual Deliverable

Acushnet Holdings Corp SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain immediate access to the comprehensive SWOT analysis of Acushnet Holdings Corp, detailing its Strengths, Weaknesses, Opportunities, and Threats.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This includes an in-depth examination of Acushnet's competitive landscape and strategic positioning.

Opportunities

The golf industry is experiencing a significant upswing, with 1.5 million new participants in the U.S. during 2024 alone, continuing a seven-year growth trend. This expansion is further bolstered by a 2% increase in global rounds played in the first half of 2025.

Younger demographics, particularly Gen Z and Millennials, are showing a heightened interest in golf, indicating a sustainable expansion of the player base. This growing engagement presents a prime opportunity for Acushnet to enhance its market penetration and boost sales across its diverse product lines.

The golf industry's embrace of technology presents significant opportunities for Acushnet. E-commerce growth, for instance, saw Acushnet's direct-to-consumer sales increase, reflecting a broader trend in online purchasing. Smart wearables and digital platforms for booking and simulation are also expanding the game's accessibility and engagement.

Acushnet has a prime opportunity to grow its footprint in emerging international markets where golf's popularity is on the rise. The company's strong brand recognition, including Titleist and FootJoy, positions it favorably to tap into these growing segments and serve a global audience that values premium golf equipment and apparel. This expansion can drive significant revenue growth and mitigate risks associated with over-reliance on established markets.

Strategic Investments in Infrastructure and Capabilities

Acushnet Holdings Corp is strategically investing in its future, with plans for 2025 focusing on key areas like expanding its global fitting network. This expansion aims to reach more golfers worldwide, enhancing their experience and access to Acushnet's custom fitting services. For example, the company noted in its 2023 annual report that it continued to invest in its retail footprint and direct-to-consumer channels.

Enhancing digital capabilities is another significant opportunity. This includes improving e-commerce platforms and leveraging data analytics to better understand customer preferences and market trends. The implementation of a global cloud-based enterprise resource planning (ERP) platform is also on the horizon, designed to streamline operations and improve efficiency across the entire organization.

These investments are geared towards tangible benefits: elevating service to global partners, supporting ambitious future growth plans, and driving operational excellence. By strengthening its infrastructure and digital tools, Acushnet is positioning itself for sustained long-term success in a competitive market.

- Global Fitting Network Expansion: Increasing reach and accessibility for custom golf club fitting.

- Digital Capabilities Enhancement: Improving online presence, e-commerce, and data utilization.

- ERP Platform Implementation: Streamlining global operations for greater efficiency and integration.

- Long-Term Growth & Operational Excellence: Investing to support future expansion and improve business processes.

Focus on Sustainability and ESG Initiatives

Acushnet has a significant opportunity to leverage the growing industry focus on sustainability and Environmental, Social, and Governance (ESG) initiatives to boost its brand image. By amplifying its current eco-friendly practices, such as waste reduction, solar energy utilization, and water conservation in manufacturing, the company can attract environmentally aware consumers and investors. For instance, in 2023, Acushnet reported a 15% reduction in waste sent to landfills across its key facilities, a metric that can be further highlighted.

Expanding and actively promoting these ESG efforts presents a clear path to differentiate Acushnet in a competitive market. This strategic focus can resonate deeply with a growing segment of consumers who prioritize purchasing from brands demonstrating a commitment to environmental stewardship. The company's 2024 sustainability report indicated a 10% increase in renewable energy usage for its operations, a positive trend to build upon.

Further investment and transparent communication regarding these initiatives can enhance stakeholder trust and loyalty. Acushnet can explore partnerships or certifications that validate its ESG commitments, potentially attracting new capital and strengthening its market position. By showcasing tangible progress, such as a projected 5% decrease in water consumption per unit produced by the end of 2025, Acushnet can solidify its standing as a responsible industry leader.

- Highlighting existing waste minimization programs to appeal to eco-conscious consumers.

- Promoting the use of solar energy in manufacturing facilities to showcase a commitment to renewables.

- Expanding water management strategies and communicating their positive impact.

- Increasing transparency around ESG reporting, potentially including Scope 1, 2, and 3 emissions data for 2024.

Acushnet is well-positioned to capitalize on the golf industry's robust growth, with 1.5 million new U.S. participants in 2024 and a 2% rise in global rounds played in early 2025. The increasing interest from Gen Z and Millennials signals a sustained expansion of the golf demographic, offering Acushnet significant opportunities for market penetration and sales growth across its brands like Titleist and FootJoy. Furthermore, the company's strategic investments in expanding its global fitting network and enhancing digital capabilities, including e-commerce and data analytics, are set to streamline operations and improve customer engagement. By focusing on these areas, Acushnet aims to drive operational excellence and support its long-term expansion plans.

| Opportunity Area | 2024/2025 Data/Trend | Acushnet's Action/Benefit |

|---|---|---|

| Industry Growth | 1.5M new U.S. golfers in 2024; +2% global rounds (H1 2025) | Increased market size and sales potential. |

| Demographic Shift | Growing Gen Z & Millennial interest | Sustainable customer base expansion. |

| Digital Transformation | E-commerce growth; ERP platform implementation | Enhanced customer reach and operational efficiency. |

| Global Expansion | Rising golf popularity in emerging markets | Diversified revenue streams and market share growth. |

Threats

Acushnet is exposed to the risk of fluctuating tariffs and trade policies, which could directly affect its cost of goods sold and overall profitability. For the full year 2025, the estimated gross impact of these tariffs is around $35 million, with $30 million expected in the latter half of the year.

While Acushnet is actively pursuing mitigation efforts, including refining its supply chain and making strategic pricing adjustments, the full offset of these increased costs remains a challenge. Any failure to completely neutralize the tariff impact could lead to reduced margins and a potential dampening of financial performance.

The golf industry, including Acushnet, faces significant headwinds from macroeconomic shifts impacting consumer spending. Slower growth in real disposable income, a trend observed through 2024 and projected into 2025, directly affects how much consumers can allocate to leisure activities like golf. As economic uncertainty persists, consumers are likely to prioritize essential spending, potentially reducing demand for premium golf equipment and apparel.

This heightened sensitivity to economic cycles means Acushnet's sales performance can fluctuate considerably with broader economic conditions. For instance, a slowdown in consumer confidence, as indicated by various economic sentiment surveys throughout 2024, often correlates with a decrease in spending on high-ticket leisure items. This makes forecasting and managing inventory particularly challenging for companies reliant on discretionary purchases.

The golf industry is a crowded space, with many established and emerging brands competing fiercely for consumer attention and dollars. Acushnet, known for its Titleist and FootJoy brands, faces constant pressure from competitors offering a wide range of equipment, apparel, and accessories. This intense rivalry means Acushnet must consistently invest in research and development to stay ahead, a significant undertaking that can affect its bottom line.

Seasonality and Adverse Weather Conditions

The golf industry's reliance on favorable weather creates a significant threat. Acushnet, like its peers, is susceptible to disruptions from poor weather, which can directly curtail consumer activity and purchasing. For example, reports indicated that poor spring weather in 2025 negatively affected golf rounds played across the U.S. and Asia during the first quarter, and globally in the first half of the year. This reduction in playable days translates into lower sales volumes for Acushnet's core product categories, including clubs, balls, and apparel.

These weather-related impacts can be particularly pronounced during peak playing seasons. A prolonged period of rain or unseasonably cold temperatures can deter golfers from engaging in the sport, thereby reducing demand for new equipment and accessories. This seasonality is a persistent challenge that necessitates careful inventory management and sales forecasting by Acushnet to mitigate potential revenue shortfalls.

- Impact on Playable Days: Adverse weather, such as heavy rain or unseasonable cold, directly reduces the number of days golfers can play.

- Sales Volume Reduction: Fewer rounds played lead to decreased demand for golf equipment, apparel, and accessories.

- 2025 Weather Effects: Q1 2025 saw negative impacts on U.S. and Asian golf rounds due to poor spring weather, with global effects noted in H1 2025.

Fluctuations in Foreign Currency Exchange Rates

Acushnet's significant international presence means it's susceptible to shifts in foreign currency exchange rates. These fluctuations can directly affect the company's reported net sales, creating a degree of financial uncertainty. For 2025, Acushnet has projected a negative impact from these currency movements to be around $35 million, underscoring a risk that is largely outside of its operational control.

This exposure to currency volatility presents a key threat:

- Foreign Exchange Rate Risk: Fluctuations in currency values can erode the reported value of international sales.

- 2025 Projected Impact: Acushnet anticipates approximately $35 million in negative impact from foreign currency rates in 2025.

- Uncontrollable Factor: The company has limited ability to directly influence or hedge against these currency movements.

Acushnet faces threats from increasing tariffs, with an estimated $35 million gross impact projected for 2025, particularly $30 million in the latter half of the year. Macroeconomic shifts, such as slower disposable income growth in 2024 and into 2025, also pose a risk by potentially reducing consumer spending on golf. Intense competition within the golf industry necessitates continuous R&D investment, impacting profitability.

Adverse weather conditions present another significant challenge, as evidenced by poor spring weather in 2025 negatively impacting golf rounds played in the U.S. and Asia, with global effects noted in the first half of the year. This directly reduces sales volumes for Acushnet's products. Furthermore, foreign currency exchange rate fluctuations are projected to have a negative impact of approximately $35 million in 2025, a factor largely outside of the company's direct control.

| Threat Category | Specific Impact | Projected Financial Impact (2025) | Key Contributing Factor |

|---|---|---|---|

| Trade Policy & Tariffs | Increased cost of goods sold, reduced profitability | ~$35 million gross impact (>$30 million in H2) | Fluctuating international trade policies |

| Macroeconomic Conditions | Reduced consumer spending on discretionary items | N/A (indirect impact on sales volume) | Slower real disposable income growth |

| Competitive Landscape | Pressure on pricing and market share, increased R&D costs | N/A (ongoing operational cost) | Numerous established and emerging brands |

| Weather Dependency | Decreased golf rounds played, lower sales volumes | N/A (impact on sales volume) | Unfavorable weather patterns (e.g., poor spring 2025) |

| Foreign Exchange Rates | Erosion of reported international sales value | ~$35 million negative impact | Currency market volatility |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, including Acushnet Holdings Corp.'s official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic view.