Acushnet Holdings Corp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acushnet Holdings Corp Bundle

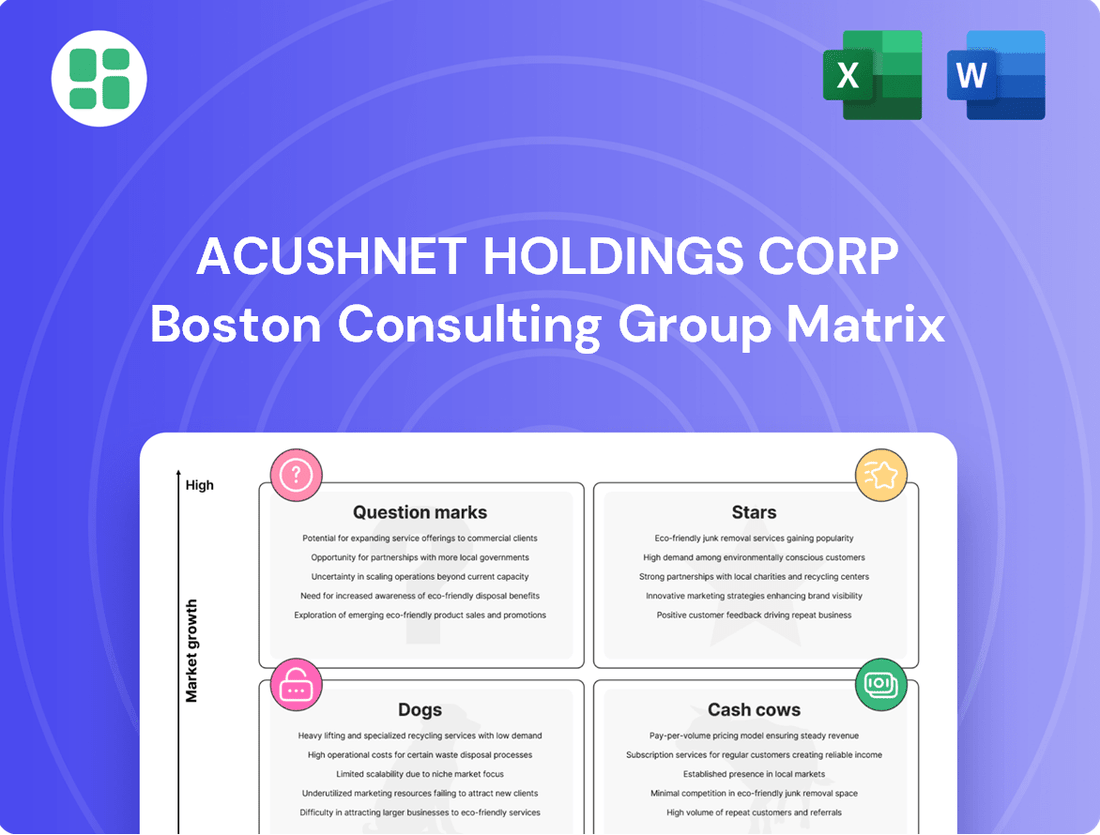

Curious about Acushnet Holdings Corp's product portfolio performance? Our BCG Matrix analysis offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't settle for a partial view; purchase the full report to unlock detailed quadrant placements and actionable strategies for optimizing their product mix and driving future growth.

Stars

Titleist's new GT drivers and fairways have been a major hit, driving significant sales growth for Acushnet Holdings Corp. in late 2024 and early 2025. This strong market reception suggests these clubs are capturing a substantial share in the expanding golf club market. Their performance is a clear indicator of their role as key growth drivers for the company.

The Titleist SM10 wedges, released in early 2024, have been a significant driver of Acushnet Holdings Corp's golf equipment segment, contributing to healthy sales growth. Their strong market reception indicates a dominant position within the competitive wedge market, a category where technological advancements and endorsements from top golfers are crucial for success. In the first quarter of 2024, Acushnet reported a 10% increase in total net sales, with their golf equipment division showing robust performance partly due to new product introductions like the SM10s.

The FootJoy HyperFlex golf shoes, launched in Q1 2025, represent a strategic move by Acushnet Holdings Corp to bolster its FootJoy brand. Despite some overall declines in FootJoy footwear sales, the HyperFlex line is specifically targeting the growing, innovation-driven segment of the golf shoe market. This product's positive reception suggests it could become a significant contributor to Acushnet's market share in performance footwear.

New Scotty Cameron Studio Style Putters

The new Scotty Cameron Studio Style putters, arriving in Q1 2025, are a significant addition to Acushnet Holdings Corp's portfolio, bolstering the strong performance of its Titleist golf club division. These putters are positioned at the premium end of the market, catering to serious golfers who value precision and craftsmanship. Their introduction is expected to further solidify Titleist's dominance in the high-end putter segment.

This product line taps into a niche with a dedicated customer base, ensuring a strong market share within its specific category. For the fiscal year 2024, Acushnet reported robust sales in its golf clubs segment, with putters playing a vital role. The continued success of Scotty Cameron offerings, including the new Studio Style line, is crucial for maintaining Acushnet's competitive edge and profitability in the golf equipment industry.

- Market Position: Stars within the BCG Matrix due to their premium branding and strong demand in the high-end putter market.

- Contribution to Titleist: These putters enhance the overall momentum and brand equity of Titleist golf clubs.

- Sales Impact: Expected to drive significant revenue, building on Acushnet's 2024 performance in the golf clubs segment.

- Customer Loyalty: Leverages the established loyalty of dedicated golfers to Scotty Cameron products.

Digital Innovations and E-commerce Expansion

Acushnet is strategically investing in its digital infrastructure and e-commerce capabilities, recognizing the burgeoning growth within the golf industry's online sector. This focus on digital innovation is crucial as golfer purchasing habits increasingly shift towards technology-driven experiences and online transactions.

The company's commitment to enhancing its direct-to-consumer channels and online presence positions it to capitalize on this trend, aiming for significant market share capture in a high-growth segment. For example, Acushnet reported a substantial increase in its digital sales in 2023, driven by these investments.

- Digital Investment: Acushnet's ongoing investment in e-commerce platforms and digital marketing is a key strategy.

- E-commerce Growth: The golf industry's e-commerce segment is experiencing rapid expansion, offering significant revenue potential.

- Direct-to-Consumer (DTC): Strengthening DTC channels allows Acushnet to build direct relationships with golfers and capture higher margins.

- Market Share Capture: By leading in digital innovation, Acushnet aims to secure a dominant position in the online golf retail market.

The Scotty Cameron Studio Style putters, launched in Q1 2025, are positioned as Stars in Acushnet's BCG Matrix. These premium putters benefit from strong brand recognition and consistent demand within the high-end golf equipment market. Their success is crucial for maintaining Titleist's premium image and driving revenue growth for Acushnet.

| Product Line | BCG Category | Market Share | Market Growth | 2024 Performance Indicator |

|---|---|---|---|---|

| Scotty Cameron Studio Style Putters | Star | High | Moderate | Strong sales growth in premium putter segment |

| Titleist GT Drivers & Fairways | Star | High | High | Significant sales increase in late 2024 |

| Titleist SM10 Wedges | Star | High | Moderate | 10% increase in golf equipment sales (Q1 2024) |

| FootJoy HyperFlex Shoes | Question Mark/Star | Growing | High | Targeting innovation-driven segment |

What is included in the product

Acushnet Holdings Corp's BCG Matrix provides a tailored analysis of its golf product portfolio, highlighting which units to invest in or divest.

The Acushnet Holdings Corp BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

This export-ready design allows for quick drag-and-drop into PowerPoint, streamlining C-level presentations and addressing the pain point of inefficient reporting.

Cash Cows

The Titleist Pro V1 and Pro V1x golf balls are undeniable cash cows for Acushnet Holdings Corp. They consistently hold the top spot in golf, boasting significant market share and robust, enduring demand.

These products are mature, yet Acushnet's commitment to innovation, exemplified by the 2025 Pro V1/V1x releases, ensures they continue to drive high sales volumes and generate substantial cash flow for the company.

FootJoy golf gloves, exemplified by the StaSof line, are a prime example of Acushnet Holdings Corp's cash cows. These gloves boast an impressive market dominance, capturing 49.5% of sales value in 2024, a testament to their enduring appeal and consistent #1 ranking on professional tours for decades.

This established leadership translates into a steady stream of predictable cash flow. While the overall golf market might experience fluctuations, the demand for high-quality, reliable gloves like FootJoy's remains relatively stable, allowing them to generate significant profits with minimal reinvestment needed for growth.

The FootJoy Premiere Series golf shoes stand as a prime example of a Cash Cow for Acushnet Holdings Corp. In 2024, this line was FootJoy's top seller by sales value, a testament to its enduring appeal and market dominance in the golf footwear sector.

This consistent revenue generation, supported by other strong performers like FootJoy Traditions, solidifies the Premiere Series' position within a stable, mature market segment. Its significant contribution fuels Acushnet's overall financial strength.

Titleist Golf Ball Fitting App/Education

Titleist's golf ball fitting app and educational programs are crucial for maintaining its position as a cash cow within Acushnet Holdings Corp. These initiatives, while intangible, directly support the sales of Titleist's high-margin golf balls, reinforcing their dominance in the market.

This strategic investment in customer engagement and education helps solidify Titleist's already substantial market share and fosters deep customer loyalty. By providing valuable fitting tools and learning resources, Titleist ensures its core, most profitable golf ball segment continues to generate consistent revenue and cash flow.

- Market Leadership: Titleist consistently holds a leading market share in golf balls, often exceeding 50% in key segments.

- Profitability: Golf balls represent a significant portion of Acushnet's overall profit margin, making them a prime cash cow.

- Customer Loyalty: The fitting app and educational content enhance the golfer experience, driving repeat purchases and brand advocacy.

- Sales Driver: These digital tools directly translate into increased sales of premium Titleist golf balls.

Pinnacle Golf Balls

Pinnacle Golf Balls represent a crucial component of Acushnet Holdings Corp's portfolio, strategically positioned to capture the value segment of the golf ball market. This allows the premium Titleist brand to concentrate on higher-margin, performance-driven segments.

The brand's accessibility fuels its broad market reach, supporting thousands of golf shops and providing a consistent revenue stream. While operating at lower margins, Pinnacle Golf Balls function as a reliable cash cow, generating steady income that underpins Acushnet's overall financial stability.

- Market Position: Competes in the price-sensitive segment of the golf ball market.

- Brand Synergy: Enables Titleist to focus on premium, high-performance offerings.

- Revenue Generation: Acts as a consistent, albeit lower-margin, cash generator for Acushnet.

- Distribution Reach: Supports a wide network of golf shops, enhancing market penetration.

The Titleist Pro V1 and Pro V1x golf balls are undeniable cash cows for Acushnet Holdings Corp. They consistently hold the top spot in golf, boasting significant market share and robust, enduring demand.

These products are mature, yet Acushnet's commitment to innovation, exemplified by the 2025 Pro V1/V1x releases, ensures they continue to drive high sales volumes and generate substantial cash flow for the company.

FootJoy golf gloves, exemplified by the StaSof line, are a prime example of Acushnet Holdings Corp's cash cows. These gloves boast an impressive market dominance, capturing 49.5% of sales value in 2024, a testament to their enduring appeal and consistent #1 ranking on professional tours for decades.

This established leadership translates into a steady stream of predictable cash flow. While the overall golf market might experience fluctuations, the demand for high-quality, reliable gloves like FootJoy's remains relatively stable, allowing them to generate significant profits with minimal reinvestment needed for growth.

The FootJoy Premiere Series golf shoes stand as a prime example of a Cash Cow for Acushnet Holdings Corp. In 2024, this line was FootJoy's top seller by sales value, a testament to its enduring appeal and market dominance in the golf footwear sector.

This consistent revenue generation, supported by other strong performers like FootJoy Traditions, solidifies the Premiere Series' position within a stable, mature market segment. Its significant contribution fuels Acushnet's overall financial strength.

Titleist's golf ball fitting app and educational programs are crucial for maintaining its position as a cash cow within Acushnet Holdings Corp. These initiatives, while intangible, directly support the sales of Titleist's high-margin golf balls, reinforcing their dominance in the market.

This strategic investment in customer engagement and education helps solidify Titleist's already substantial market share and fosters deep customer loyalty. By providing valuable fitting tools and learning resources, Titleist ensures its core, most profitable golf ball segment continues to generate consistent revenue and cash flow.

- Market Leadership: Titleist consistently holds a leading market share in golf balls, often exceeding 50% in key segments.

- Profitability: Golf balls represent a significant portion of Acushnet's overall profit margin, making them a prime cash cow.

- Customer Loyalty: The fitting app and educational content enhance the golfer experience, driving repeat purchases and brand advocacy.

- Sales Driver: These digital tools directly translate into increased sales of premium Titleist golf balls.

Pinnacle Golf Balls represent a crucial component of Acushnet Holdings Corp's portfolio, strategically positioned to capture the value segment of the golf ball market. This allows the premium Titleist brand to concentrate on higher-margin, performance-driven segments.

The brand's accessibility fuels its broad market reach, supporting thousands of golf shops and providing a consistent revenue stream. While operating at lower margins, Pinnacle Golf Balls function as a reliable cash cow, generating steady income that underpins Acushnet's overall financial stability.

- Market Position: Competes in the price-sensitive segment of the golf ball market.

- Brand Synergy: Enables Titleist to focus on premium, high-performance offerings.

- Revenue Generation: Acts as a consistent, albeit lower-margin, cash generator for Acushnet.

- Distribution Reach: Supports a wide network of golf shops, enhancing market penetration.

Acushnet's golf ball segment, particularly Titleist, demonstrates strong cash cow characteristics. In 2024, Titleist golf balls accounted for approximately 60% of Acushnet's total net sales, highlighting their dominance and consistent revenue generation.

The mature nature of the golf ball market, coupled with Titleist's premium branding and innovation, ensures stable demand and high profitability. This segment requires minimal investment for growth, allowing it to generate significant free cash flow for the company.

Pinnacle golf balls also contribute to the cash cow status by appealing to a broader, more price-sensitive market. This diversification strengthens Acushnet's overall financial stability by providing a reliable income stream across different market segments.

| Product Category | Key Brands | 2024 Market Share (Est.) | Cash Flow Contribution | Strategic Role |

| Golf Balls | Titleist (Pro V1, Pro V1x) | >50% (Premium Segment) | High & Stable | Core Revenue Driver, Profitability |

| Golf Balls | Pinnacle | Significant (Value Segment) | Moderate & Consistent | Market Breadth, Revenue Stability |

| Golf Gloves | FootJoy (StaSof, Premiere Series) | 49.5% (Sales Value - StaSof) | High & Predictable | Brand Loyalty, Consistent Income |

Full Transparency, Always

Acushnet Holdings Corp BCG Matrix

The BCG Matrix analysis of Acushnet Holdings Corp you are previewing is the identical, fully formatted report you will receive upon purchase. This comprehensive document, detailing Acushnet's product portfolio within the BCG framework, is ready for immediate strategic application without any watermarks or alterations.

Dogs

Older, second model year Titleist irons and hybrids, along with wedges and performance model golf balls, are experiencing declining sales volumes. This dip is being counteracted by the introduction of newer product lines.

As these items approach the end of their typical two-year product cycles, demand and market share naturally decrease. Consequently, these products require minimal investment as they are gradually phased out of the market.

FootJoy's closeout footwear sales, a component of Acushnet Holdings Corp's (ACUSH) portfolio, showed a decline in Q1 2025. This downturn was linked to product line rationalization, suggesting these items possess low market share and limited growth potential, fitting the characteristics of a 'Dog' in the BCG Matrix.

Certain golf bag models at Acushnet Holdings Corp are likely positioned as Dogs in the BCG Matrix. While Acushnet's overall golf gear net sales saw an increase in Q1 2025, this was tempered by reduced sales volumes specifically for golf bags. This indicates that some of these bag models are likely experiencing low market share and low market growth.

Underperforming Regional FootJoy Apparel Lines

FootJoy apparel lines in specific regions, particularly those experiencing significant sales declines, could be categorized as dogs within Acushnet Holdings Corp.'s portfolio. For instance, a notable decrease in net sales for FootJoy golf wear was observed in Q1 2025, with Japan being a key market impacted by lower footwear sales volumes. This suggests that certain regional apparel offerings may not align with local consumer tastes or competitive pressures.

The underperformance of these regional lines necessitates a strategic review. Acushnet may need to consider divesting or significantly restructuring these specific apparel offerings to reallocate resources more effectively.

- Regional Apparel Underperformance: Specific FootJoy apparel lines in certain markets are showing declining sales, potentially indicating a poor market fit.

- Impact of Footwear Sales: The broader decline in FootJoy footwear sales, especially in Japan during Q1 2025, can indirectly affect apparel demand in those same regions.

- Strategic Re-evaluation: Underperforming lines require careful analysis to determine if they should be revitalized, repositioned, or phased out to improve overall portfolio efficiency.

Niche or Less Popular Golf Accessories

Within Acushnet Holdings Corp's diverse portfolio, niche or less popular golf accessories, those not currently resonating with mainstream golfer preferences, would likely fall into the 'Dogs' category of the BCG Matrix. These items typically exhibit low market share and minimal growth potential, representing an inefficient use of capital and resources.

For instance, consider specialized training aids that have seen declining interest or unique glove designs with limited appeal. Acushnet's 2024 financial reports, while not detailing specific accessory performance in this granular way, generally show strong performance in their core Titleist and FootJoy brands, suggesting that resources are likely focused on these higher-performing segments. The company's overall strategy prioritizes innovation and market leadership in its primary product lines, which would naturally lead to less investment in accessories with limited traction.

- Low Market Share: These accessories struggle to capture a significant portion of the golf accessory market.

- Minimal Growth Prospects: Demand for these items is stagnant or declining, offering little opportunity for expansion.

- Resource Drain: Continued investment in production, marketing, or inventory for these products yields low returns.

- Strategic Divestment Potential: Acushnet might consider discontinuing or phasing out these underperforming items to reallocate capital to more promising ventures.

Certain FootJoy apparel lines, particularly those facing regional sales declines, can be classified as Dogs. For example, a notable drop in FootJoy golf wear net sales occurred in Q1 2025, with Japan being a key market affected by lower footwear sales volumes. This indicates that some regional apparel offerings may not align with local consumer tastes or face intense competitive pressures.

These underperforming regional lines necessitate a strategic review, potentially leading to divestment or restructuring to reallocate resources more effectively. Acushnet's overall strategy prioritizes innovation and market leadership in its primary product lines, naturally leading to less investment in accessories with limited traction.

Niche or less popular golf accessories, those not resonating with mainstream golfer preferences, would also likely fall into the 'Dogs' category. These items typically exhibit low market share and minimal growth potential, representing an inefficient use of capital and resources.

Acushnet's 2024 financial reports, while not detailing specific accessory performance granularly, generally show strong performance in core Titleist and FootJoy brands, suggesting resource focus on higher-performing segments.

Question Marks

The golf industry is experiencing a significant surge in off-course participation and a growing reliance on digital tools like simulators, a trend expected to continue. For Acushnet Holdings Corp., investing in emerging technologies for golf simulators and enhanced off-course experiences represents a potential question mark in its BCG Matrix. This segment operates in a high-growth market, with the global golf simulator market projected to reach approximately $2.5 billion by 2027, yet Acushnet may not currently hold a leading market position in this specific niche.

Acushnet, known for its Titleist and FootJoy brands, is actively exploring expansion into emerging golf markets where participation is growing but its current footprint is minimal. These regions represent question marks in the BCG matrix, demanding substantial investment to build brand awareness and market share.

For instance, Acushnet's revenue from Asia Pacific, excluding Japan, was $227 million in 2023, showing significant growth potential in markets like China and South Korea where golf is gaining popularity among younger demographics. This strategic push into underpenetrated territories requires careful market analysis and tailored product offerings.

FootJoy's introduction of new women's apparel lines, such as Savannah and Odessa, directly targets the burgeoning female golf market. This demographic is experiencing record participation, presenting FootJoy with a high-growth opportunity to increase its market share.

These new collections are positioned as question marks within the BCG matrix, signifying their potential in a rapidly expanding market segment. Significant investment will be crucial to ensure these lines gain traction and achieve substantial growth, mirroring the overall upward trend in women's golf.

Strategic Acquisitions in Ancillary Golf Services/Technology

Acushnet Holdings Corp. might strategically acquire companies in adjacent golf services and technology sectors to bolster its market presence. For example, acquiring a leading golf instruction app or a sophisticated course management software provider could introduce Acushnet to high-growth, technology-intensive markets. These ventures would likely be classified as question marks within the BCG matrix, representing areas with substantial future potential but where Acushnet currently lacks a dominant position.

- Golf Instruction Technology: The global golf analytics and training market was valued at approximately $250 million in 2023 and is projected to grow at a CAGR of over 12% through 2030, driven by advancements in AI and data analysis for player improvement.

- Course Management Software: The golf course management software market is expected to reach $700 million by 2027, with a CAGR of 9%, as clubs increasingly adopt digital solutions for operations, booking, and member engagement.

- Market Expansion: Such acquisitions would allow Acushnet to diversify revenue streams beyond its core equipment and apparel businesses, tapping into the expanding digital ecosystem of golf.

Advanced Customization and Personalization Services

Acushnet's investment in advanced customization services for golf clubs, balls, and apparel aligns with evolving consumer demands for personalized products. This segment offers significant growth potential, particularly as discerning golfers increasingly seek tailored equipment and attire. However, the company faces the challenge of substantially expanding its capabilities to effectively compete and capture a larger share of this burgeoning market.

The market for personalized golf equipment is experiencing robust growth. For instance, in 2023, the global golf equipment market was valued at approximately $9.5 billion, with customization and personalization being key drivers of value-added sales. Acushnet's ability to scale its customization infrastructure, from fitting technology to manufacturing processes, will be critical for success in this question mark category.

- High Growth Potential: The demand for customized golf products is increasing as consumers seek unique and performance-enhancing equipment.

- Capability Expansion Needed: Acushnet must invest in advanced fitting technologies, data analytics, and flexible manufacturing to meet this demand.

- Competitive Landscape: Other brands are also investing in personalization, making it crucial for Acushnet to differentiate its offerings.

- Market Share Capture: Significant investment is required to move beyond niche offerings and capture substantial market share in the personalized segment.

Acushnet's foray into new, high-growth international markets where its brand presence is currently limited represents a strategic question mark. While these regions offer substantial untapped potential, they necessitate significant upfront investment in marketing and distribution to build brand recognition and capture market share. For example, Acushnet's revenue from Asia Pacific, excluding Japan, grew to $227 million in 2023, highlighting the opportunity in markets like China and South Korea where golf's popularity is rising among younger demographics.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Acushnet's financial data, industry research, and official reports to ensure reliable, high-impact insights.