Acushnet Holdings Corp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acushnet Holdings Corp Bundle

Acushnet Holdings Corp navigates a competitive landscape shaped by moderate buyer power and intense rivalry from established golf brands. While the threat of new entrants is somewhat mitigated by brand loyalty and distribution channels, the availability of substitutes in sporting goods presents a persistent challenge. Supplier power is generally low due to the commoditized nature of many raw materials.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Acushnet Holdings Corp’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Acushnet Holdings Corp. relies on specialized raw materials for its golf balls and club components, such as urethane for covers and specific polymers for cores. The uniqueness or limited availability of certain high-performance materials, like advanced dimple pattern technologies or proprietary resin formulations, can grant specific suppliers significant leverage. This dependency is amplified if alternative material sources are scarce or if switching costs for Acushnet are prohibitively high, potentially impacting pricing and supply chain stability.

Acushnet Holdings Corp's reliance on specialized manufacturing inputs for its high-performance golf equipment, such as patented graphite composites for club shafts or advanced synthetic materials for ball cores, grants significant bargaining power to its suppliers. These unique components are not easily substituted, meaning Acushnet's product innovation and quality are directly influenced by the terms these suppliers dictate. For instance, the development of Titleist's T-series irons, known for their precision engineering, depends heavily on specific metal alloys and manufacturing processes provided by a limited number of specialized metalworking firms.

Acushnet Holdings Corp. might face challenges if only a few suppliers can provide essential, advanced technologies or specialized manufacturing processes. This scarcity can translate into higher costs and less flexible contract terms for Acushnet, as these suppliers have greater leverage. For instance, if a critical component for their high-performance golf equipment relies on a patented material only produced by a handful of companies, Acushnet's bargaining power is diminished.

Brand-Specific Component Sourcing

Acushnet's commitment to maintaining the unique performance attributes of its premium brands, such as Titleist golf clubs and FootJoy golf shoes, often requires sourcing specialized components from a limited number of suppliers. This reliance on brand-specific sourcing, particularly for high-performance golf equipment, can diminish Acushnet's negotiating leverage and consequently empower these suppliers.

The imperative for uncompromising quality and consistent performance in Acushnet's product lines frequently outweighs purely cost-driven decisions when selecting component suppliers. For instance, in 2024, Acushnet continued its focus on material science innovations for its golf balls, necessitating partnerships with suppliers capable of delivering highly specialized urethane compounds that are critical to product performance and brand reputation.

- Brand Differentiation: Sourcing unique materials or components for Titleist and FootJoy enhances product performance and brand identity, making it difficult to substitute suppliers without impacting quality.

- Supplier Dependence: For certain high-specification components, Acushnet may be dependent on a small pool of suppliers who possess the proprietary technology or manufacturing capabilities.

- Quality Over Cost: The premium nature of Acushnet's products means that the cost of components is secondary to their ability to meet stringent quality and performance standards.

- Innovation Partnerships: Acushnet often collaborates with suppliers on research and development, fostering relationships that can solidify supplier power due to shared intellectual property and development cycles.

Global Supply Chain Disruptions

Global supply chain disruptions, exacerbated by geopolitical tensions and events like the COVID-19 pandemic, significantly bolster supplier bargaining power. When production or logistics are interrupted, suppliers who can maintain operations gain leverage, potentially increasing prices or dictating terms. For instance, in 2023, the semiconductor shortage, a direct result of supply chain fragilities, led to widespread production delays and increased costs across numerous industries.

Acushnet Holdings Corp's strategy to maintain a durable and regionally diverse supply chain is a critical defense against these external shocks. This diversification helps mitigate risks associated with tariffs and general supply uncertainties. However, even with these precautions, widespread global events can still affect the cost and availability of raw materials and finished goods, impacting Acushnet's operational efficiency and profitability.

- Geopolitical Instability: Events such as trade wars or regional conflicts can restrict the flow of goods, empowering suppliers in unaffected or strategically important regions.

- Pandemic Impacts: The lingering effects of global health crises continue to reveal vulnerabilities, allowing suppliers with robust health and safety protocols to command better terms.

- Logistical Bottlenecks: Port congestion and shipping container shortages, which were prominent in 2023, granted significant power to shipping companies and those controlling key transportation hubs.

- Raw Material Scarcity: Disruptions in the extraction or processing of essential materials, like rare earth minerals, can give upstream suppliers considerable pricing power.

Acushnet's reliance on specialized materials, like proprietary urethane for golf ball covers, means suppliers of these unique inputs hold considerable sway. This is particularly true when alternative suppliers are scarce or switching costs are high, as seen in 2024 with continued demand for advanced ball technologies. The premium nature of Acushnet's brands, such as Titleist, also means quality and performance often trump cost, further empowering suppliers who can meet stringent specifications.

The bargaining power of suppliers for Acushnet Holdings Corp. is moderately high due to the specialized nature of golf equipment components and the company's emphasis on premium quality. For instance, the development of advanced golf ball dimple patterns or specific graphite composites for club shafts often requires proprietary technology or unique manufacturing capabilities possessed by a limited number of firms. This dependence, coupled with the high cost of switching suppliers for these critical inputs, grants these suppliers significant leverage in negotiations.

Global supply chain disruptions, a continuing concern through 2023 and into 2024, have also amplified supplier power. Events like logistical bottlenecks and raw material scarcity, which impacted industries broadly, can give suppliers who maintain stable operations and supply chains a stronger negotiating position. Acushnet's strategy of supply chain diversification aims to mitigate these risks, but the fundamental dependence on specialized inputs remains a key factor influencing supplier bargaining power.

| Factor | Impact on Acushnet | Supplier Leverage |

|---|---|---|

| Specialized Materials (e.g., Urethane) | High dependence for product performance | Moderate to High |

| Proprietary Technology/Manufacturing | Essential for product innovation (e.g., club shafts) | Moderate to High |

| Limited Supplier Pool | Reduces Acushnet's negotiation options | Moderate to High |

| Quality Over Cost Imperative | Prioritizes supplier capabilities over price | Moderate to High |

| Supply Chain Disruptions (2023-2024) | Increases risk of price hikes and availability issues | Moderate to High |

What is included in the product

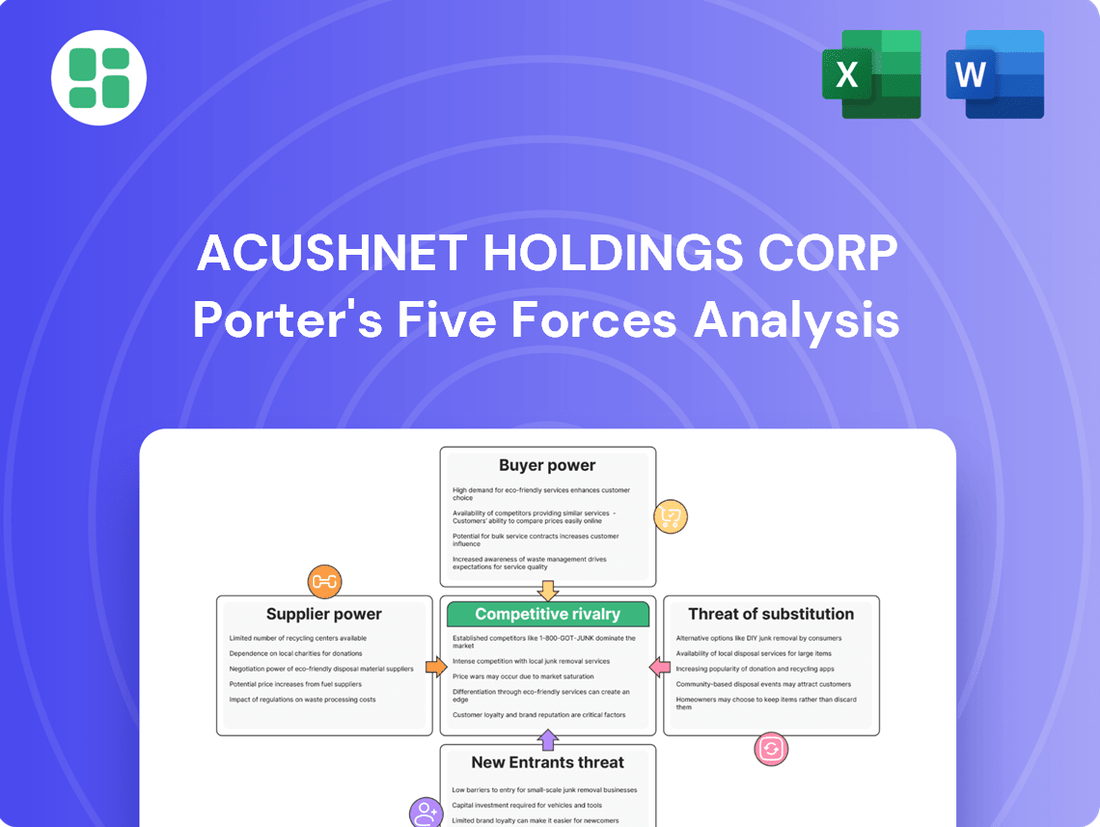

This analysis examines the competitive forces shaping Acushnet Holdings Corp's golf industry, focusing on buyer power, supplier leverage, threat of new entrants, substitutes, and industry rivalry.

Acushnet Holdings Corp's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making regarding competitive pressures in the golf industry.

This analysis allows for instant understanding of strategic pressure with a powerful spider/radar chart, simplifying complex market dynamics for Acushnet.

Customers Bargaining Power

Acushnet's powerful brands, particularly Titleist and FootJoy, foster deep loyalty among dedicated golfers. These enthusiasts often prioritize performance and quality over price, making them less likely to switch based on cost alone. For instance, Titleist consistently ranks as a top choice for drivers and golf balls among amateur golfers, demonstrating this enduring brand appeal.

Major golf retailers and large sporting goods chains represent a substantial portion of Acushnet's revenue streams, granting them significant leverage. For instance, in 2023, Acushnet's largest single customer accounted for 10.5% of net sales, highlighting the concentrated nature of some of their retail relationships.

These powerful buyers can leverage their order volumes to negotiate favorable terms, including volume discounts, extended payment schedules, and requests for co-op advertising or promotional support. This dynamic forces Acushnet to carefully manage its pricing strategies and customer relationships to safeguard profitability.

The proliferation of online retail and sophisticated price comparison tools has significantly amplified price transparency for consumers in the golf equipment market. Individual golfers can now effortlessly benchmark prices for clubs, balls, and apparel across numerous brands and retailers, creating substantial downward pressure on pricing. This heightened transparency necessitates that Acushnet Holdings Corp. maintain rigorous cost management and competitive pricing strategies to retain market share.

Product Differentiation and Performance

Acushnet's strong product differentiation, particularly with its Titleist golf balls and FootJoy golf shoes, significantly limits customer bargaining power. The brand's reputation for superior performance and innovation means golfers often prioritize these attributes over price. For instance, Titleist consistently leads in market share for premium golf balls, indicating a strong customer preference that reduces price sensitivity.

- Product Superiority: Titleist golf balls are often perceived as the industry standard for performance, influencing purchasing decisions.

- Brand Loyalty: FootJoy's established brand loyalty in golf footwear means customers are less likely to switch for minor price differences.

- Innovation Investment: Acushnet's continuous investment in R&D for product improvement reinforces its differentiated offering.

Availability of Financing and Promotions

Customers, particularly those investing in premium golf equipment, frequently look for financing arrangements or attractive promotional packages. This demand for financing and bundled deals can give buyers more leverage, as they can readily compare offers across different brands and retailers. For instance, in 2023, consumer credit offerings for sporting goods, including golf equipment, continued to be a significant factor in purchasing decisions, with many retailers actively promoting buy-now-pay-later options.

The necessity for Acushnet and its retail partners to provide these incentives to stimulate sales can, however, put pressure on profit margins. The widespread availability of such promotions empowers customers to actively seek out the most advantageous deals, potentially leading to price sensitivity and a greater bargaining power.

- Financing Options: Golf equipment, often a significant purchase, sees customers actively seeking installment plans or credit options.

- Promotional Bundles: The bundling of products, such as clubs with accessories or lessons, is a common tactic that influences customer purchasing power.

- Margin Erosion: The cost of offering financing and promotions can directly impact Acushnet's profitability.

- Price Sensitivity: A market saturated with deals increases customer sensitivity to price, enhancing their bargaining position.

While Acushnet's strong brands like Titleist and FootJoy create significant customer loyalty, limiting their bargaining power, the company must still navigate the influence of large retail partners. These key accounts, with a single customer representing 10.5% of net sales in 2023, can negotiate favorable terms due to their volume. Furthermore, increased price transparency driven by online comparison tools puts downward pressure on pricing, requiring Acushnet to maintain competitive strategies to retain market share.

| Customer Segment | Bargaining Power Factors | Impact on Acushnet |

|---|---|---|

| Brand Loyal Golfers (e.g., Titleist enthusiasts) | High perceived product quality, brand reputation, performance focus | Low bargaining power; less price sensitive |

| Major Golf Retailers & Sporting Goods Chains | Significant order volumes, concentrated purchasing power | Moderate to High bargaining power; can negotiate terms and discounts |

| Price-Conscious Consumers | Access to price comparison tools, demand for financing/promotions | Moderate bargaining power; sensitive to deals and financing options |

Same Document Delivered

Acushnet Holdings Corp Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Acushnet Holdings Corp, detailing the competitive landscape, including bargaining power of buyers and suppliers, threat of new entrants, threat of substitutes, and intensity of rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This in-depth analysis provides actionable insights into the strategic positioning of Acushnet within the golf industry.

Rivalry Among Competitors

Acushnet Holdings Corp. faces fierce competition in the global golf market. Major rivals like Callaway Golf, TaylorMade Golf, and PING are significant players across all product segments, including golf balls, clubs, apparel, and accessories. This intense rivalry necessitates continuous innovation and strategic pricing to maintain market share.

Acushnet faces intense competition fueled by a relentless pace of innovation and new product introductions, especially in golf clubs and balls. Companies are pouring significant resources into research and development to bring cutting-edge, technologically superior products to market.

To maintain its leadership, Acushnet must sustain its commitment to R&D, ensuring its offerings remain at the forefront of performance and design. For instance, in 2023, Acushnet's R&D expenses were approximately $105 million, reflecting this dedication to innovation.

The golf industry's competitive landscape is heavily shaped by marketing and endorsement battles, with brands pouring substantial resources into extensive campaigns and high-profile professional golfer endorsements. Acushnet, through its flagship Titleist brand, actively engages in these wars, understanding that a strong brand image and influence over consumer choices are paramount. For instance, in 2023, Acushnet's total marketing and sales expenses amounted to $480.3 million, a significant portion of which is allocated to these crucial competitive tools. This investment is vital for maintaining Titleist's premium market position and driving sales amidst fierce competition from rivals like Callaway and TaylorMade, who also invest heavily in similar strategies.

Pricing Strategies and Promotional Activities

Acushnet, known for its premium golf equipment brands like Titleist and FootJoy, faces intense rivalry. Competitors frequently employ aggressive pricing, offering discounts and promotional bundles to capture market share, particularly in more standardized product categories.

This competitive pressure can trigger price wars, impacting profitability for all players. For instance, during 2023, the golf equipment market saw increased promotional activity from various brands aiming to gain traction.

- Aggressive Pricing: Competitors often undercut premium pricing with discounts.

- Promotional Bundles: Offering package deals to attract price-sensitive consumers.

- Price Wars: Potential for reduced margins due to competitive discounting.

- Market Share vs. Profitability: Acushnet must balance protecting its market position with maintaining healthy profit margins.

Distribution Channel Access and Relationships

Competitive rivalry is intense when it comes to securing prime shelf space in retail stores and fostering strong relationships with golf professionals and pro shops. Acushnet Holdings Corp. leverages its established network, which includes over 13,000 on-course golf shops globally, to maintain a strong presence. This extensive reach is a significant advantage in a market where visibility is paramount.

The competition also plays out in the digital realm, with companies vying for effective online distribution and favorable terms across all sales channels. Acushnet's commitment to its direct-to-consumer e-commerce platform, alongside its wholesale partnerships, allows it to capture a broad customer base. In 2023, Acushnet reported net sales of $2.37 billion, underscoring the importance of a robust distribution strategy.

- Shelf Space Competition: Rivalry centers on gaining prominent placement in physical retail environments, a critical factor for brand visibility and sales.

- Pro Shop Relationships: Strong ties with golf professionals and pro shops are essential for influencing purchasing decisions and ensuring product availability at the point of play.

- Online Distribution: Companies compete for effective e-commerce strategies and digital visibility to reach a wider audience and cater to evolving consumer shopping habits.

- Favorable Terms: Negotiating advantageous terms and securing consistent visibility across all distribution channels is a key battleground for market share.

Acushnet Holdings Corp. operates in a highly competitive golf market, facing significant rivalry from established players like Callaway Golf, TaylorMade Golf, and PING. This intense competition is driven by continuous innovation, aggressive marketing, and strategic pricing, particularly in golf clubs and balls.

The company must constantly invest in research and development to maintain its edge, as seen in its $105 million R&D expenditure in 2023. Furthermore, Acushnet dedicates substantial resources to marketing and endorsements, with $480.3 million spent in 2023, to solidify its premium brand image and influence consumer purchasing decisions amidst aggressive promotional activities from competitors.

| Competitor | Key Product Segments | 2023 Estimated Revenue (USD Billions) |

|---|---|---|

| Callaway Golf (now Topgolf Callaway Brands) | Golf Clubs, Balls, Apparel, Equipment | ~3.3 |

| TaylorMade Golf | Golf Clubs, Balls, Apparel | ~1.5 |

| PING | Golf Clubs, Apparel | ~0.6 |

SSubstitutes Threaten

The threat of substitutes for golf is significant, as consumers have a wide array of leisure and sports activities competing for their limited discretionary time and income. Activities such as tennis, cycling, hiking, and even the burgeoning world of esports offer alternative forms of recreation that can draw potential golfers away. A decline in overall golf participation, influenced by these substitutes, directly impacts the demand for Acushnet's golf equipment and apparel.

The expanding market for pre-owned golf equipment presents a significant threat of substitutes for Acushnet. Consumers increasingly turn to well-maintained used clubs as a more budget-friendly alternative to purchasing new models, especially for drivers and irons.

This trend directly challenges Acushnet's new product sales and pricing power. For instance, the used golf club market saw substantial growth, with online platforms reporting a 20% year-over-year increase in transactions for pre-owned equipment in 2023, demonstrating a clear consumer preference for value.

Rental and shared equipment models pose a threat by offering alternatives to purchasing golf clubs. For instance, many golf courses provide club rentals, catering to casual players or tourists who don't own their gear. This can directly reduce the demand for new equipment sales, impacting Acushnet's core business.

The growth of rental services, especially in popular tourist destinations, means individuals might opt for renting clubs for a few rounds rather than investing in their own set. This is particularly relevant for infrequent golfers. In 2024, the golf equipment rental market continued to see steady demand, with many facilities reporting increased utilization of their rental fleets, indicating a persistent substitute for outright ownership.

Generic or Lower-Cost Apparel Options

The threat of substitutes for Acushnet's apparel, particularly its FootJoy brand, is elevated by the availability of generic or lower-cost athletic wear. While FootJoy caters to dedicated golfers with specialized features, casual players might opt for more affordable, non-golf specific athletic apparel and footwear. This can include brands found in department stores or online retailers that offer comparable comfort and style for recreational rounds, thereby siphoning demand away from Acushnet's higher-priced offerings.

For instance, the broader athletic apparel market, valued at billions globally, presents a constant stream of accessible alternatives. In 2024, the global sportswear market was projected to reach over $200 billion, indicating a vast landscape of competitors beyond the specialized golf industry. These readily available options can be particularly appealing to the segment of golfers who prioritize value and functionality over brand-specific golf performance wear.

- Increased competition from general athletic wear brands.

- Price sensitivity among casual golfers favoring lower-cost alternatives.

- Potential for reduced market share in the casual golf apparel segment.

- FootJoy's premium positioning faces pressure from accessible substitutes.

Virtual Golf and Simulation Technologies

The growing sophistication of virtual golf and simulation technologies presents a notable threat of substitutes for Acushnet Holdings Corp. These advanced simulators, including immersive virtual reality experiences, provide an alternative to traditional outdoor golf, particularly appealing to urban dwellers or those facing inclement weather. While these don't directly replace Acushnet's golf equipment, they can decrease the demand for rounds played on actual courses, potentially leading to a slower pace of equipment replacement for certain customer segments.

For instance, the global golf simulator market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating increased consumer adoption. This trend could impact Acushnet's sales volumes for balls, clubs, and apparel if consumers opt for more frequent virtual play over physical rounds. Acushnet's strategy may need to consider how to engage with this evolving landscape, perhaps through partnerships or by highlighting the unique benefits of their high-performance equipment in real-world play.

- Virtual Golf Market Growth: The global golf simulator market is expanding, with projections indicating continued strong growth through 2028, driven by technological advancements and increased accessibility.

- Impact on Equipment Sales: While not a direct equipment substitute, the rise of virtual golf can reduce the frequency of traditional golf play, potentially affecting the upgrade cycle for golf clubs and balls.

- Consumer Behavior Shift: Urbanization and changing lifestyle preferences are contributing to a greater reliance on indoor entertainment, including sophisticated golf simulations, which could divert spending from outdoor golf activities.

- Acushnet's Competitive Response: Acushnet may need to adapt by emphasizing the superior performance and experience of its products in actual play or explore integration with emerging virtual golf platforms.

The threat of substitutes for Acushnet's core golf products is multifaceted, encompassing alternative leisure activities and evolving consumer preferences for value. The burgeoning market for pre-owned golf equipment, which saw a notable 20% year-over-year increase in online transactions in 2023, directly challenges new sales. Furthermore, the widespread availability of affordable, non-golf specific athletic apparel, within a global sportswear market projected to exceed $200 billion in 2024, pressures Acushnet's FootJoy brand by offering comparable comfort and style at lower price points.

The increasing sophistication and accessibility of virtual golf simulators also present a significant substitute. The global golf simulator market, valued around $1.5 billion in 2023, offers an alternative to physical play, particularly for urban dwellers or those facing weather constraints. While not a direct equipment replacement, this trend can reduce the frequency of traditional golf rounds, potentially impacting the demand for new equipment and accessories.

| Substitute Category | Key Characteristics | Impact on Acushnet | 2023/2024 Data Point |

| Alternative Leisure Activities | Broad range of sports and recreational options | Diversion of discretionary time and income from golf | N/A (Broad market) |

| Pre-owned Golf Equipment | Budget-friendly, well-maintained used clubs | Reduced demand for new equipment, price pressure | 20% YoY increase in online used equipment transactions (2023) |

| Generic Athletic Apparel | Lower cost, comparable comfort/style | Erosion of market share in casual golf apparel segment | Global sportswear market projected >$200 billion (2024) |

| Virtual Golf Simulators | Indoor, weather-independent golf experience | Potential decrease in physical rounds played, impacting equipment upgrade cycles | Global golf simulator market ~$1.5 billion (2023) |

Entrants Threaten

The golf equipment industry, especially for high-performance clubs and balls, demands significant upfront investment in research and development. For instance, companies like Acushnet Holdings Corp invest heavily in material science and aerodynamic testing to create their Titleist and FootJoy products. This R&D expenditure, coupled with the need for sophisticated manufacturing plants and substantial inventory, creates a formidable capital barrier for any new player looking to enter the market and compete effectively.

Acushnet Holdings Corp benefits significantly from deeply entrenched brand loyalty, particularly with its flagship brands like Titleist and FootJoy. These brands have cultivated decades of trust and a reputation for superior performance within the golfing community, creating a substantial hurdle for any new entrants aiming to capture market share. For instance, Titleist consistently ranks as a top choice for golf balls among professionals and amateurs alike, a testament to its enduring appeal that marketing alone struggles to replicate.

Acushnet Holdings Corp. benefits from deeply entrenched global distribution networks, including strong ties with golf pro shops, specialty retailers, and major sporting goods chains. New entrants face a formidable challenge in replicating these established relationships and securing coveted shelf space. For instance, in 2023, Acushnet's net sales reached $2.3 billion, underscoring the scale and effectiveness of its distribution reach, making it difficult for newcomers to gain comparable market access.

Professional Endorsements and Tour Presence

The threat of new entrants in the golf equipment market, specifically concerning professional endorsements and tour presence, is significantly mitigated by Acushnet Holdings Corp's established advantages. Securing endorsements from top professional golfers and maintaining a strong presence on professional tours are crucial for brand credibility and visibility. This necessitates substantial financial investment and deep-seated industry connections, resources that new entrants typically struggle to amass, thus limiting their ability to compete effectively against established players like Acushnet.

Acushnet's Titleist brand, for instance, consistently leads in tour seeding. In 2024, Titleist golf balls were used by an overwhelming majority of players on the PGA Tour, often exceeding 60% of the field, demonstrating a powerful and entrenched market position. This dominance is a direct result of long-term investment in player relationships and marketing, creating a formidable barrier for any newcomer attempting to replicate this level of tour penetration and athlete endorsement.

- High Cost of Endorsements: Top-tier golfer endorsements can cost millions of dollars annually, a significant hurdle for new companies.

- Established Tour Relationships: Acushnet has decades of experience building and maintaining relationships with professional tours and their governing bodies.

- Brand Loyalty: The loyalty of professional golfers to specific equipment, often built over years, makes switching brands difficult and costly.

- Visibility and Credibility: Tour presence provides unparalleled visibility and credibility, which new entrants find extremely difficult and expensive to achieve quickly.

Intellectual Property and Patents

The golf equipment industry is a hotbed of innovation, with a significant amount of intellectual property protecting everything from golf ball dimple patterns to club head aerodynamics and advanced apparel materials. Acushnet Holdings Corp., for instance, boasts a substantial portfolio of patents, a common characteristic among established players in this sector.

This strong IP landscape presents a considerable barrier to entry for newcomers. Developing novel golf equipment often requires navigating a complex web of existing patents. New entrants risk infringing on these protected technologies, which can lead to costly legal battles or necessitate expensive licensing agreements. For example, the development of advanced ball core materials or clubface technologies is heavily patented, making it challenging to create competitive products without significant R&D investment or IP acquisition.

- Extensive Patent Portfolios: Major golf equipment manufacturers, including Acushnet, possess numerous patents covering various aspects of product design and manufacturing.

- Innovation Challenges: New entrants face hurdles in developing unique technologies without infringing on existing intellectual property.

- Licensing Costs: Acquiring licenses for patented technologies can be prohibitively expensive for smaller, emerging companies.

- R&D Investment: Significant investment in research and development is required to create truly innovative products that can compete with established brands.

The threat of new entrants for Acushnet Holdings Corp. is relatively low due to substantial capital requirements, established brand loyalty, and extensive distribution networks. Acushnet's significant investments in R&D, manufacturing, and marketing create high entry barriers. For instance, in 2023, Acushnet's net sales were $2.3 billion, reflecting its scale and market penetration, which newcomers would find difficult to match. Furthermore, the company's strong intellectual property portfolio, with numerous patents protecting its innovative technologies, adds another layer of defense against potential competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Acushnet Holdings Corp is built upon a foundation of comprehensive data, including their annual reports, SEC filings, and investor relations materials. We also incorporate insights from reputable industry research firms and market intelligence platforms to capture a holistic view of the golf equipment industry.