Acuity Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acuity Brands Bundle

Uncover the critical external forces shaping Acuity Brands's future with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand how these factors create both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full report now for a complete breakdown.

Political factors

Significant federal investments, like those from the Infrastructure Investment and Jobs Act (IIJA), are directing billions into U.S. infrastructure projects through 2026. This funding fuels upgrades in transportation, energy grids, and broadband networks.

These infrastructure improvements directly boost demand for Acuity Brands' lighting and building management systems, especially in new construction and retrofitting projects. Public sector initiatives increasingly favor energy-efficient and smart building technologies.

For instance, the IIJA allocated $110 billion for roads, bridges, and major infrastructure projects, with a substantial portion impacting construction and the need for advanced electrical and lighting components. Acuity Brands is positioned to capitalize on this surge in government-backed development.

Governments worldwide are tightening energy efficiency standards for buildings, directly impacting companies like Acuity Brands. For instance, the California Energy Commission's 2025 Building Energy Efficiency Standards are set to increase energy performance requirements for new construction and major renovations. Similarly, ASHRAE 90.1-2022, a widely adopted energy standard, also mandates more stringent energy performance for buildings.

These evolving regulations create a significant demand for Acuity Brands' advanced LED lighting solutions and intelligent building control systems. As buildings must achieve higher energy performance, products that optimize energy consumption become essential. Acuity Brands, with its focus on smart lighting and controls, is well-positioned to benefit from this trend.

Compliance with these increasingly rigorous codes is not just about environmental responsibility; it's a critical factor for market access and maintaining a competitive edge. Companies that can demonstrate adherence to and exceed these standards, through innovative products, will likely see increased sales and market share in the coming years.

Global trade policies, including tariffs and ongoing geopolitical tensions, significantly impact supply chain stability and the cost of raw materials for companies like Acuity Brands. For instance, the U.S. imposed tariffs on certain goods from China, affecting imported components used in lighting manufacturing. This necessitates careful management of international trade relationships and sourcing strategies.

The LED lighting sector is actively responding to these trade dynamics by pursuing geographic diversification and increasing localized manufacturing. This approach helps to reduce reliance on single sourcing regions and mitigate risks stemming from international trade disputes. Companies are investing in domestic production capabilities to ensure more predictable supply chains.

Acuity Brands must employ agile supply chain strategies to maintain consistent product availability and competitive pricing in this evolving trade landscape. For example, in 2023, disruptions in global shipping and increased freight costs, partly due to geopolitical events, added pressure on manufacturers' margins. Adapting to these challenges is crucial for sustained market performance.

Government Initiatives for Smart Cities

Global government initiatives aimed at fostering smart city development and sustainable urban infrastructure are a significant tailwind for Acuity Brands. These programs frequently emphasize energy efficiency, enhanced public safety, and improved connectivity, directly aligning with Acuity Brands' integrated lighting and building management systems. For instance, the U.S. Department of Energy's Better Buildings Initiative, with its ongoing efforts to reduce energy consumption in buildings, creates a favorable policy environment. Acuity Brands' participation in these government-backed projects provides a platform to demonstrate its technological prowess and secure substantial, long-term contracts, thereby expanding its market reach.

These initiatives translate into tangible market opportunities:

- Increased demand for energy-efficient lighting solutions, driven by government mandates and incentives for reducing carbon footprints in urban areas.

- Growth in smart building technology adoption, as cities invest in integrated systems for better operational efficiency and citizen services.

- Opportunities for large-scale project deployment, where Acuity Brands can leverage its expertise in providing comprehensive smart city infrastructure.

- Government funding and grants supporting smart city projects, which can de-risk investments and accelerate the adoption of Acuity Brands' technologies.

Federal Tax Incentives for Green Buildings

Federal tax incentives for green buildings significantly boost investment in sustainable upgrades for both commercial and residential properties. These deductions and credits, such as the Investment Tax Credit (ITC) for solar energy, encourage the adoption of energy-efficient technologies. For instance, the Inflation Reduction Act of 2022 extended and enhanced tax credits for energy-efficient commercial buildings (like the 179D deduction) and residential energy property, making it more attractive for owners to invest in advanced lighting and building management systems. This directly benefits Acuity Brands by increasing demand for their energy-saving solutions.

Acuity Brands' sales and marketing strategies can effectively leverage these incentives to drive adoption of their smart lighting and building controls. By highlighting how their products qualify for these federal benefits, the company can present a compelling value proposition to customers. For example, the 179D deduction allows for significant deductions based on energy savings, directly impacting a building owner's bottom line when Acuity Brands' systems are installed.

- Federal tax deductions and credits for energy-efficient buildings are readily available.

- These incentives accelerate the adoption of advanced lighting and building management technologies.

- The Inflation Reduction Act of 2022 significantly enhanced these green building tax credits.

- Acuity Brands can leverage these incentives in its sales and marketing efforts.

Government infrastructure spending, like the $110 billion allocated for roads and bridges by the IIJA, directly stimulates demand for Acuity Brands' lighting and building management systems. Furthermore, escalating energy efficiency standards, such as California's 2025 Building Energy Efficiency Standards and ASHRAE 90.1-2022, necessitate advanced solutions like those offered by Acuity Brands. Global smart city initiatives also present substantial opportunities, with government funding and grants accelerating the adoption of integrated lighting and control systems.

What is included in the product

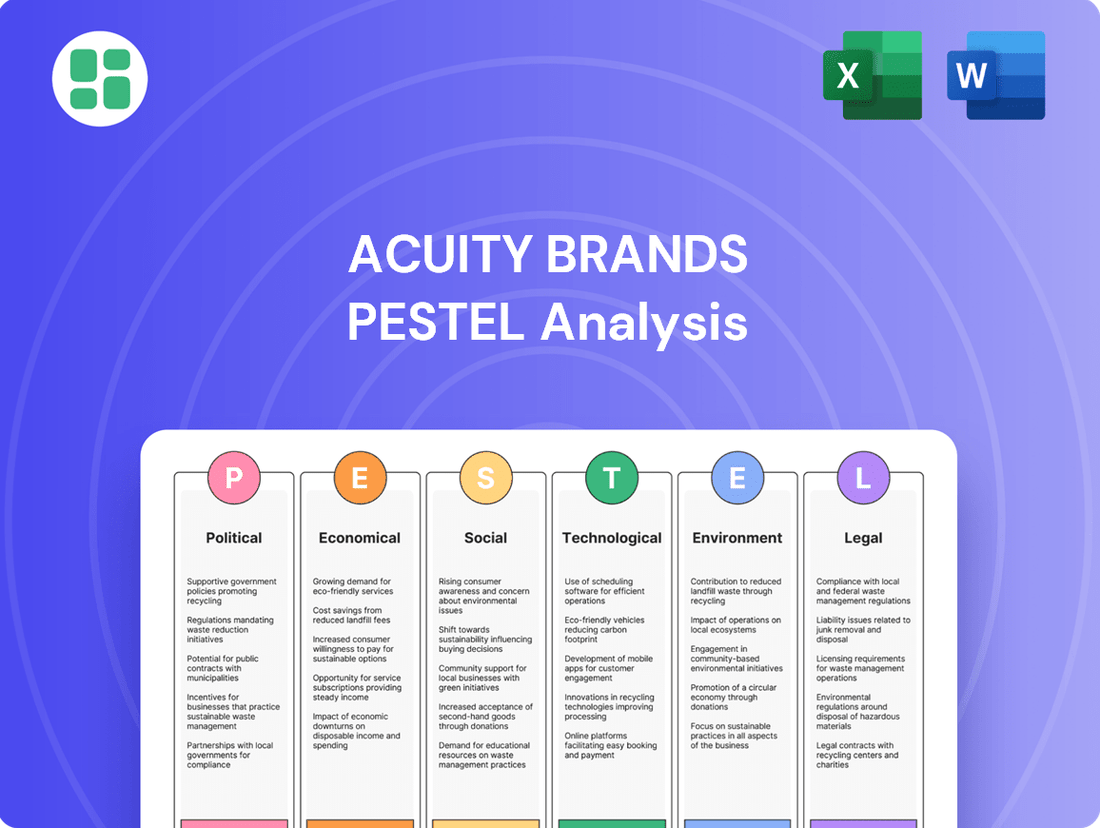

This Acuity Brands PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors influence the company's strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Acuity Brands.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the external landscape impacting Acuity Brands.

Economic factors

The overall economic climate is a primary driver for Acuity Brands. A strong economy typically fuels growth across commercial, institutional, and residential construction sectors, directly benefiting Acuity Brands through increased demand for its lighting and building management systems. For instance, in 2024, the U.S. construction industry experienced mixed signals, with nonresidential construction showing some resilience while residential construction faced headwinds from higher interest rates.

Specific trends within these construction segments are crucial. A booming commercial construction market, characterized by new office buildings, retail spaces, and data centers, directly translates to higher sales opportunities for Acuity Brands. Similarly, institutional projects like schools and hospitals, and a healthy residential market, all contribute to Acuity Brands' revenue streams. In early 2025, analysts projected a modest recovery in residential construction starts, which could offer a tailwind for companies like Acuity Brands.

Acuity Brands faces persistent inflationary pressures, which directly impact its operational expenses. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in 2024, reflecting higher costs for raw materials like metals and electronic components essential for lighting and building management solutions. This surge in input costs, coupled with rising labor wages in manufacturing sectors, puts pressure on Acuity Brands' profit margins.

Managing these escalating costs is paramount for Acuity Brands' profitability. The company's focus on supply chain optimization, including diversifying suppliers and exploring alternative materials, is crucial. Furthermore, strategic pricing adjustments are necessary to offset increased expenses while maintaining market competitiveness. The challenge lies in balancing the need to pass on costs to customers with the risk of losing market share to competitors who may absorb them or have more resilient supply chains.

Interest rates significantly influence Acuity Brands' customer base, as higher borrowing costs can curb investment in new construction and renovation projects. For instance, the Federal Reserve's benchmark interest rate, which influences mortgage rates and commercial lending, saw increases throughout 2023 and into early 2024, impacting the affordability of large-scale building endeavors. This directly translates to potentially slower demand for Acuity Brands' lighting and building management solutions.

Furthermore, Acuity Brands itself faces the direct impact of capital availability and financing costs on its strategic initiatives. In 2023, the company's cost of debt likely rose due to the prevailing interest rate environment, potentially affecting its capacity for research and development, strategic acquisitions, and overall operational expansion. This financial dynamic is crucial for Acuity Brands' long-term growth and competitive positioning.

Acuity Brands' Financial Performance

Acuity Brands' financial performance indicates robust economic health and a solid market standing. For fiscal year 2024, the company reported improved operating performance and generated strong cash flow, a testament to its operational efficiency. This positive trend continued into the first quarter of fiscal year 2025, where Acuity Brands surpassed earnings per share (EPS) expectations, signaling its resilience and ability to create shareholder value amidst evolving market dynamics.

Key financial highlights underscore Acuity Brands' economic strength:

- Net Sales Growth: While specific Q1 2025 net sales figures are pending release closer to July 2025, the trend from FY2024 suggests continued top-line momentum.

- Operating Profit Improvement: The company's FY2024 results showed an upward trajectory in operating profit, reflecting effective cost management and pricing strategies.

- Earnings Per Share (EPS): Acuity Brands exceeded EPS estimates in Q1 2025, demonstrating enhanced profitability and operational leverage.

- Strong Cash Flow Generation: Robust cash flow in FY2024 provides financial flexibility for investments, debt reduction, and shareholder returns.

Market Growth for LED and Smart Building Solutions

The global LED lighting market is anticipated to experience robust expansion, with projections indicating continued growth through 2033. This upward trend is largely fueled by an escalating demand for energy-efficient lighting solutions and the increasing adoption of smart building technologies. For Acuity Brands, this translates into a fertile ground for expanding its established lighting business and its burgeoning intelligent building solutions segment.

The smart building technology market itself is witnessing a rapid acceleration, characterized by the deeper integration of the Internet of Things (IoT) and artificial intelligence (AI). This technological convergence is creating more sophisticated and interconnected building environments. Acuity Brands is well-positioned to capitalize on this trend by offering integrated solutions that enhance building performance and occupant experience.

- Global LED lighting market projected for significant growth through 2033.

- Smart building technology market expanding rapidly with IoT and AI integration.

- Increased demand for energy efficiency is a key market driver.

- Opportunities exist for Acuity Brands in both lighting and intelligent building solutions.

Economic growth directly impacts Acuity Brands' demand, as construction activity drives sales of lighting and building management systems. While 2024 saw mixed signals in U.S. construction, with residential facing interest rate challenges, projections for early 2025 suggested a modest recovery, potentially boosting Acuity Brands' revenue. Persistent inflation in 2024 increased input costs for raw materials and labor, pressuring profit margins, necessitating strategic pricing and supply chain management.

Interest rates significantly affect Acuity Brands' customers by influencing construction investment. Higher rates in 2023 and early 2024 increased borrowing costs, potentially slowing demand for building projects. The company's own financing costs also likely rose, impacting its ability to invest in R&D and expansion. Acuity Brands demonstrated financial resilience, reporting improved operating performance and strong cash flow in FY2024, with Q1 2025 EPS exceeding expectations.

The global LED lighting market is set for substantial growth through 2033, driven by energy efficiency demands and smart building adoption. Acuity Brands is well-positioned to benefit from this expansion in both its lighting and intelligent building solutions segments. The rapid integration of IoT and AI in smart buildings creates opportunities for Acuity Brands to offer advanced, interconnected solutions.

What You See Is What You Get

Acuity Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Acuity Brands PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

Sociological factors

Societal awareness for energy efficiency is surging, directly impacting purchasing habits for both consumers and businesses. Acuity Brands' commitment to sustainable solutions, like their advanced LED luminaires and smart building technologies, directly addresses this growing demand. These offerings enable clients to significantly cut energy usage and minimize their environmental impact.

Acuity Brands' dedication to environmental, social, and governance (ESG) principles is clearly articulated in their EarthLIGHT Report. This focus resonates strongly with a market increasingly prioritizing sustainability, making Acuity Brands an attractive partner for environmentally conscious organizations.

There's a significant push in commercial and institutional spaces to create environments that are not just functional but actively promote occupant health and comfort. This translates into a demand for lighting that goes beyond basic illumination, aiming to improve visual comfort and even support natural biological cycles. For instance, studies consistently show that improved lighting quality can reduce eye strain and fatigue, leading to increased productivity.

This trend is driving the need for lighting solutions that can integrate with other building systems, like HVAC, to optimize air quality and overall indoor environmental conditions. Acuity Brands' product portfolio, particularly its intelligent building solutions featuring sophisticated controls and sensors, is well-positioned to address this growing market focus on occupant well-being. The company's offerings allow for dynamic adjustments to lighting based on occupancy, time of day, and even external conditions, contributing to a healthier and more responsive building environment.

Global urbanization continues at a rapid pace, with the UN projecting that 68% of the world's population will live in urban areas by 2050, up from 56% in 2021. This trend fuels a constant demand for new construction and the upgrading of existing structures, directly benefiting companies like Acuity Brands that supply lighting and building management solutions.

Infrastructural development, particularly in smart city initiatives, is a key driver. For example, investments in smart city infrastructure globally are expected to reach $327 billion by 2026, according to Statista. Acuity Brands' integrated systems for lighting control and building automation are well-positioned to capitalize on this growth, offering efficiency and connectivity for modern urban environments.

Changing Work and Lifestyle Environments

The widespread adoption of hybrid work models, accelerated by events in 2020, continues to redefine the purpose and design of commercial spaces. This shift means buildings must now cater to a blend of in-office collaboration and remote accessibility, demanding greater flexibility in their infrastructure. For instance, a significant portion of the workforce, estimated to be around 50% in many developed economies by late 2024, now operates under some form of hybrid arrangement, impacting how office environments are utilized and therefore designed.

Evolving lifestyle preferences are also a major sociological driver, with individuals seeking more personalized and health-conscious environments. This translates into a demand for spaces that offer enhanced control over lighting, temperature, and air quality, fostering well-being and productivity. The integration of smart technologies, enabling such granular control, is becoming a key differentiator in both commercial and residential real estate.

Acuity Brands is well-positioned to capitalize on these trends through its intelligent spaces solutions. These offerings provide adaptable lighting layouts and integrated smart building technologies that can respond to changing occupancy patterns and user needs. For example, Acuity Brands’ recent product developments focus on creating responsive environments that optimize energy usage and occupant comfort, directly addressing the need for more dynamic and user-centric buildings.

- Hybrid Work Impact: Approximately 50% of the workforce in developed nations are expected to be in hybrid roles by the end of 2024, increasing demand for adaptable office spaces.

- Lifestyle Demands: Consumers increasingly prioritize personalized environments with greater control over lighting, temperature, and air quality for improved well-being.

- Smart Technology Integration: Buildings are increasingly expected to feature integrated smart technologies that enable responsive and efficient operations.

- Acuity Brands' Solutions: Intelligent spaces offerings from Acuity Brands provide flexible lighting and smart systems to meet these evolving user and environmental needs.

Consumer and Commercial Adoption of Smart Technologies

Growing comfort with smart devices in homes and offices is a major driver for intelligent lighting and building management systems. Consumers and businesses are actively looking for ways to improve convenience, cut down on energy costs, and enhance connectivity, making Acuity Brands' IoT and AI-driven offerings increasingly appealing.

This trend is clearly reflected in market growth figures. For instance, the global smart home market was projected to reach over $130 billion by 2024, with smart lighting being a significant segment. Similarly, the commercial building automation market is also expanding rapidly, with estimates suggesting it will surpass $50 billion by 2025, driven by demand for energy efficiency and operational improvements.

Acuity Brands is well-positioned to capitalize on this societal shift. Their focus on integrated solutions that leverage the Internet of Things (IoT) and artificial intelligence (AI) directly addresses the demand for smarter, more connected environments. This widespread acceptance of technology fuels the company's strategic expansion into intelligent spaces.

- Consumer Familiarity: Over 70% of U.S. households are expected to have at least one smart home device by the end of 2024, indicating a strong societal acceptance.

- Energy Efficiency Focus: Businesses are increasingly prioritizing energy savings, with smart building technologies projected to reduce energy consumption in commercial real estate by up to 30% in some cases.

- Connectivity Demand: The proliferation of connected devices, with the global IoT market expected to exceed $1.5 trillion by 2025, creates a receptive environment for integrated smart building solutions.

Societal comfort with smart devices is a significant driver for intelligent lighting and building management systems, fueling demand for Acuity Brands' IoT and AI-driven offerings. The global smart home market is anticipated to exceed $130 billion by 2024, with smart lighting a key component, while the commercial building automation market is projected to surpass $50 billion by 2025, driven by energy efficiency needs.

Acuity Brands' integrated solutions leverage IoT and AI, directly addressing the growing preference for smarter, connected environments. Over 70% of U.S. households are expected to own a smart home device by the end of 2024, showcasing strong societal acceptance of these technologies.

| Societal Factor | Impact on Acuity Brands | Supporting Data (2024/2025 Projections) |

| Smart Device Comfort | Increased demand for IoT/AI-driven lighting and building management. | Global smart home market > $130 billion (2024); Over 70% US households with smart devices (end of 2024). |

| Energy Efficiency Focus | Businesses prioritize smart tech for energy savings. | Commercial building automation market > $50 billion (2025); Smart tech can reduce commercial energy consumption by up to 30%. |

| Connectivity Demand | Receptive market for integrated smart building solutions. | Global IoT market expected to exceed $1.5 trillion (2025). |

Technological factors

Continuous innovation in LED technology is a major factor, with ongoing improvements in efficiency, color rendering, and miniaturization directly fueling product development and boosting market demand for lighting solutions. This relentless progress in LED performance is a core driver for Acuity Brands.

The burgeoning smart LED lighting sector, which seamlessly integrates with the Internet of Things (IoT) to offer sophisticated features like remote control and automated scheduling, represents a significant technological catalyst for Acuity Brands. Companies that can effectively harness these smart capabilities are poised for growth.

Acuity Brands' capacity to effectively integrate and capitalize on these technological advancements, particularly in smart lighting and advanced LED capabilities, is absolutely critical for sustaining and enhancing its competitive advantage in the dynamic lighting market.

The fusion of IoT and AI is revolutionizing building management, creating dynamic and predictive environments. Acuity Brands leverages this by embedding IoT sensors to gather real-time data, which AI then analyzes to optimize energy consumption, enhance occupant comfort, and bolster security measures. This synergy is key to developing truly intelligent buildings and boosting overall operational efficiency.

Digital twin technology is revolutionizing building operations by enabling real-time simulation and monitoring, leading to predictive maintenance and optimized performance. This advancement allows for a dynamic, virtual replica of a physical building, facilitating continuous analysis and proactive adjustments.

Acuity Brands is well-positioned to integrate its sophisticated lighting and building control systems into these emerging digital twin platforms. This integration provides clients with unprecedented visibility and granular control over their building assets, fostering more intelligent and responsive environments.

The adoption of digital twins is projected to significantly boost operational efficiency. For instance, studies suggest that predictive maintenance enabled by digital twins can reduce downtime by up to 30% and cut maintenance costs by 25%, offering substantial savings for building owners and operators.

Development of New Product Innovations and Control Systems

Acuity Brands' commitment to technological advancement is evident in its continuous stream of new product innovations and control systems. The company secured multiple design awards and patent grants throughout 2024 and into 2025, highlighting its focus on cutting-edge solutions. These advancements, like the Hydrel's Flame Lighting Technique, bolster product competitiveness and market differentiation.

Ongoing investment in research and development is crucial for Acuity Brands to maintain its leadership position. This strategic focus ensures the company can adapt to evolving technological landscapes and anticipate future market needs. Key areas of innovation include advanced optical designs and integrated smart building technologies, which are increasingly sought after by customers.

- Product Innovation: Acuity Brands consistently introduces new lighting products and control systems, garnering design awards and patent grants in 2024-2025.

- Market Differentiation: Innovations like Hydrel's Flame Lighting Technique and advanced optical designs enhance product appeal and set Acuity Brands apart.

- R&D Investment: Continued investment in research and development is essential for staying ahead of technological advancements and market trends.

- Smart Building Integration: Focus on smart building technologies and integrated control systems addresses growing demand for connected and efficient environments.

Open-Source Platforms and Interoperability

The increasing adoption of open-source platforms and a push for greater interoperability are significantly easing the integration of smart building technologies, a major hurdle previously limiting widespread use. Acuity Brands' nLight network control system exemplifies this by offering adaptable and forward-looking solutions, aiming to connect diverse devices. This move towards open standards is crucial for Acuity Brands to broaden market reach and foster a more robust ecosystem, especially as the smart building market is projected to reach $75.1 billion by 2026, growing at a CAGR of 13.2% from 2021.

Key aspects of this trend include:

- Reduced Vendor Lock-in: Open-source solutions empower users with more choice and flexibility in selecting and integrating different smart building components.

- Enhanced Integration Capabilities: Interoperability standards, like those promoted by the Connectivity Standards Alliance (CSA) for Matter, allow devices from various manufacturers to communicate seamlessly.

- Cost Efficiency and Innovation: Open-source development often leads to faster innovation cycles and can reduce overall system costs for adopters.

- Future-Proofing Investments: By embracing open standards, Acuity Brands can ensure its solutions remain compatible with evolving technologies, protecting customer investments.

Technological advancements in LED efficiency and smart controls are paramount for Acuity Brands. The company's commitment to innovation is reflected in its numerous design awards and patent grants throughout 2024 and early 2025, underscoring its focus on cutting-edge solutions like the Hydrel's Flame Lighting Technique. Continued investment in R&D, particularly in advanced optics and integrated smart building technologies, is vital for maintaining market leadership and adapting to evolving customer demands.

| Technological Factor | Impact on Acuity Brands | Data/Trend |

|---|---|---|

| LED Efficiency & Performance | Drives product development and market demand. | Continuous improvement in lumens per watt and color rendering. |

| Smart Lighting & IoT Integration | Enables remote control, automation, and data analytics for buildings. | Smart building market projected to reach $75.1 billion by 2026 (CAGR 13.2%). |

| Digital Twin Technology | Facilitates predictive maintenance and optimized building operations. | Potential to reduce downtime by up to 30% and maintenance costs by 25%. |

| Open-Source & Interoperability | Reduces vendor lock-in and enhances system integration. | Acquisition of companies and development of platforms supporting open standards. |

Legal factors

Acuity Brands navigates a complex legal landscape shaped by increasingly stringent building energy efficiency standards and mandates. These regulations, enacted at local, state, and federal levels, directly impact product development and market access.

Compliance with codes such as California's 2025 Energy Code and the ASHRAE 90.1-2022 standard is not optional; it is a prerequisite for Acuity Brands' lighting and control solutions to be specified and installed in new construction and major renovations.

While these mandates create a significant market opportunity for energy-saving technologies, they also compel Acuity Brands to invest heavily in ongoing product innovation and adaptation to meet evolving performance requirements and reporting obligations.

Commercial building owners are increasingly subject to mandatory carbon emission reporting, with non-compliance carrying potential penalties. For instance, the European Union's Energy Performance of Buildings Directive (EPBD) is evolving to include more stringent reporting and potential carbon pricing mechanisms for buildings.

This legal landscape directly fuels demand for advanced intelligent building management systems capable of precisely monitoring and reporting energy consumption and carbon footprints. Acuity Brands' portfolio, designed to facilitate greenhouse gas reduction, positions them to assist clients in navigating these evolving and rigorous reporting mandates.

Acuity Brands navigates a complex web of product safety standards and certifications, crucial for its lighting and building management systems. For instance, in North America, products must meet standards set by organizations like UL (Underwriters Laboratories) and ETL (Intertek), ensuring electrical and fire safety. Failure to obtain these certifications can prevent market entry.

Compliance extends globally, with Acuity Brands needing to adhere to standards like CE marking in Europe, indicating conformity with health, safety, and environmental protection legislation. In 2024, the company's commitment to these rigorous requirements underpins its ability to serve diverse international markets and maintain consumer trust.

Intellectual Property Laws and Protection

Acuity Brands relies heavily on intellectual property laws to protect its innovations, particularly its patents for advanced lighting technologies. For example, the company holds patents related to its Hydrel brand's unique Flame Lighting Technique, which is vital for maintaining its competitive edge in the market. These legal protections are essential for recouping significant research and development expenditures and preventing competitors from exploiting Acuity Brands' proprietary designs and functionalities without authorization.

The company's commitment to safeguarding its intellectual property is demonstrated by its active pursuit of legal remedies against any instances of infringement. This proactive approach ensures that Acuity Brands can continue to invest in developing cutting-edge solutions, knowing its creations are legally protected. As of the latest available data, Acuity Brands has a robust portfolio of patents across its various product lines, underscoring the importance of IP in its business strategy.

- Patent Portfolio Strength: Acuity Brands maintains a significant number of active patents, covering a wide range of lighting and building management technologies.

- R&D Investment Protection: Intellectual property laws enable Acuity Brands to protect the substantial investments made in research and development, fostering continued innovation.

- Market Differentiation: Patented technologies, like those in the Hydrel line, provide Acuity Brands with unique selling propositions and a distinct market advantage.

- Enforcement Actions: The company actively monitors for and takes legal action against any unauthorized use or infringement of its intellectual property to preserve its market position.

Data Privacy and Security Regulations

As Acuity Brands' intelligent building systems gather and process vast amounts of data, strict adherence to data privacy and security regulations is essential. Laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) directly influence how data within smart building environments is collected, stored, and utilized.

Acuity Brands must implement robust cybersecurity measures and ensure compliance with these evolving data protection mandates. Failure to do so could jeopardize customer trust and expose the company to significant legal liabilities. For instance, in 2023, data breaches across various industries resulted in billions of dollars in fines and remediation costs, highlighting the financial risks associated with non-compliance.

- GDPR Fines: Companies can face penalties up to 4% of global annual turnover or €20 million, whichever is higher.

- CCPA Impact: Consumers have the right to know what personal data is collected and to opt-out of its sale, affecting data monetization strategies.

- Cybersecurity Investment: The global cybersecurity market was projected to reach over $200 billion in 2024, reflecting the growing importance of data protection.

Acuity Brands operates under stringent product safety standards, exemplified by UL and ETL certifications in North America, ensuring electrical and fire safety. Globally, compliance with regulations like CE marking is vital for market access and consumer trust, with ongoing adherence to these requirements being critical for 2024 operations.

Environmental factors

The increasing global focus on sustainability is fueling a robust demand for eco-friendly lighting and building technologies. Acuity Brands' commitment to energy-efficient LED solutions and smart building systems aligns perfectly with this trend, enabling clients to meet their environmental targets.

In 2023, the global smart lighting market, a key area for Acuity Brands, was valued at approximately $15 billion and is projected to grow significantly. This indicates a strong market preference for solutions that reduce energy consumption and environmental impact, directly benefiting Acuity Brands' product portfolio.

The lighting sector is increasingly embracing circular economy principles, aiming to cut waste and conserve resources. Acuity Brands is actively incorporating these ideas into its design and manufacturing, focusing on making products that can be reused, repaired, and recycled.

A key aspect of this shift involves designing products with modularity and upgradability in mind. This approach, coupled with careful material selection, helps Acuity Brands build a more sustainable product line, aligning with growing environmental expectations.

Governments and companies worldwide are setting aggressive greenhouse gas emission reduction targets, a trend that directly influences the market for energy-efficient building technologies, a core area for Acuity Brands. For instance, the US aims to cut emissions by 50-52% below 2005 levels by 2030, and the EU has a target of at least a 55% net reduction by 2030 compared to 1990 levels.

Acuity Brands' smart lighting and building management solutions are designed to help customers achieve substantial GHG avoidance. Their products contribute to reducing energy consumption in buildings, thereby supporting these broader climate objectives.

Internally, Acuity Brands actively monitors and reports its own operational emissions, demonstrating a commitment to sustainability that aligns with global climate action initiatives. This internal focus is crucial as companies increasingly face scrutiny regarding their environmental footprint.

Resource Reduction in Building Operations

There's a significant global drive to cut down on energy, water, and waste in commercial and institutional buildings. This environmental pressure directly impacts building operations and the technologies that manage them.

Acuity Brands' intelligent building management systems are designed to address this by offering real-time monitoring and optimization of resource consumption. These systems help building owners and operators identify inefficiencies and implement strategies for reduction.

The company's commitment extends to its own operations, where it actively implements water-saving practices and invests in improving energy efficiency within its production facilities. For instance, Acuity Brands reported a 4% reduction in energy intensity across its manufacturing sites in 2023 compared to its 2020 baseline.

Key aspects of Acuity Brands' approach to resource reduction include:

- Intelligent Systems: Providing technology for real-time monitoring and optimization of energy, water, and waste.

- Operational Efficiency: Implementing water-saving measures and investing in energy efficiency at its own manufacturing plants.

- Data-Driven Insights: Enabling customers to track and manage their environmental footprint more effectively.

- Regulatory Compliance: Supporting building owners in meeting increasingly stringent environmental regulations and sustainability goals.

Supply Chain Sustainability and Responsible Sourcing

Environmental concerns now stretch across the entire supply chain, with a growing demand for responsible material sourcing and eco-friendly manufacturing. Acuity Brands faces the significant task of ensuring its supply chain partners meet environmental standards, reduce waste, and engage in ethical sourcing practices. For instance, as of 2024, many companies are reporting increased customer demand for transparency in their product's origins, with some studies showing over 70% of consumers consider sustainability when making purchasing decisions.

Building a robust and sustainable supply chain is paramount for Acuity Brands' long-term environmental performance and maintaining its brand reputation. This involves rigorous supplier audits and collaborations to drive improvements in areas like energy efficiency and waste reduction. By 2025, regulatory bodies are expected to further tighten requirements on supply chain environmental impact reporting, making proactive measures essential for compliance and competitive advantage.

- Responsible Sourcing: Acuity Brands must verify that raw materials are sourced ethically and sustainably, minimizing environmental degradation.

- Waste Minimization: Implementing strategies with supply chain partners to reduce manufacturing waste and promote recycling or circular economy principles.

- Supplier Compliance: Ensuring all partners adhere to environmental regulations and company-specific sustainability targets, with increasing focus on Scope 3 emissions.

- Brand Integrity: A transparent and sustainable supply chain enhances brand trust and can be a key differentiator in the market, especially as ESG (Environmental, Social, and Governance) factors become more critical for investors.

Environmental regulations are tightening globally, pushing companies like Acuity Brands to prioritize energy efficiency and reduced emissions in their product offerings and operations. This trend is amplified by consumer and investor demand for sustainable practices, impacting market preferences and corporate strategy.

Acuity Brands' focus on smart lighting and building management systems directly addresses these environmental pressures by enabling significant energy savings for its clients. The company's own operational improvements, such as a 4% reduction in energy intensity in 2023, further demonstrate its commitment to sustainability.

The company's proactive approach to supply chain sustainability, including responsible sourcing and waste minimization, is crucial as environmental scrutiny extends across the entire value chain. By 2025, stricter regulations on supply chain environmental reporting are anticipated, making these efforts vital for compliance and brand reputation.

| Environmental Factor | Impact on Acuity Brands | Supporting Data (2023/2024/2025 Projections) |

|---|---|---|

| Sustainability Demand | Drives demand for energy-efficient solutions. | Global smart lighting market valued at ~$15 billion in 2023, with strong growth projections. |

| Emission Reduction Targets | Creates market opportunities for GHG avoidance technologies. | US and EU targets for emission cuts by 2030 directly benefit energy-efficient building tech. |

| Resource Efficiency | Increases need for intelligent building management systems. | Acuity Brands achieved a 4% reduction in energy intensity across manufacturing sites in 2023. |

| Supply Chain Scrutiny | Requires focus on responsible sourcing and waste reduction. | Over 70% of consumers consider sustainability in purchasing decisions (as of 2024); stricter reporting expected by 2025. |

PESTLE Analysis Data Sources

Our Acuity Brands PESTLE Analysis is informed by a comprehensive review of industry-specific reports, market research data, and regulatory updates from relevant government bodies. We also incorporate insights from financial news outlets and economic forecasts to ensure a well-rounded understanding of the macro-environment.