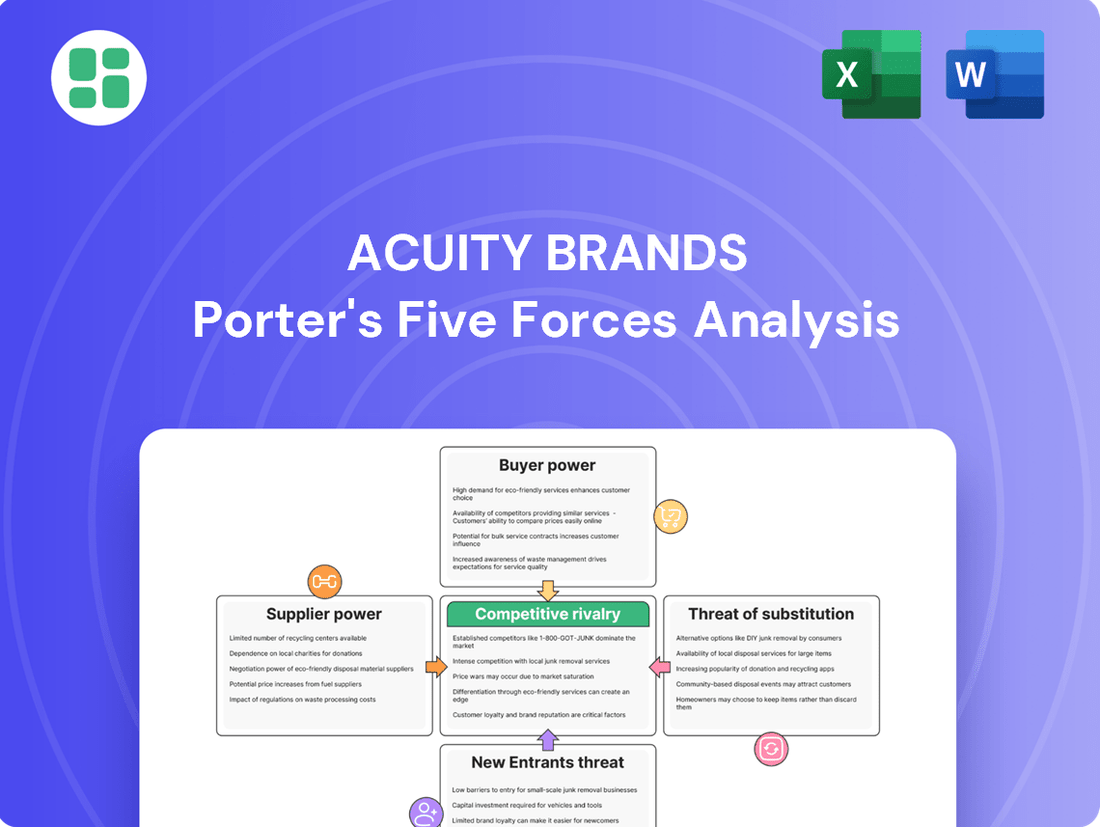

Acuity Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acuity Brands Bundle

Acuity Brands navigates a competitive landscape shaped by moderate buyer and supplier power, and a significant threat from new entrants in the lighting and building management solutions sector. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Acuity Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Acuity Brands' reliance on specialized components like advanced LED chips and sophisticated sensors places significant power in the hands of their suppliers. These critical parts, often developed with proprietary technology, may only be available from a handful of manufacturers, giving those suppliers considerable leverage over pricing and contract terms. For instance, the demand for high-efficiency LED chips, a core component in Acuity Brands' lighting solutions, has seen pricing fluctuations driven by limited advanced manufacturing capacity, impacting cost structures.

Acuity Brands utilizes a dual-qualification sourcing strategy for its critical components. This means they identify and approve at least two suppliers for essential parts, significantly lessening the leverage any single supplier holds over the company. This diversification directly combats the bargaining power of suppliers.

By having multiple qualified sources, Acuity Brands can switch between vendors if one attempts to raise prices or impose unfavorable terms. This approach ensures business continuity and reduces the risk of production disruptions, a key factor in supplier negotiations. For instance, in 2024, the company's commitment to supply chain resilience was evident as they navigated global component shortages by leveraging their established alternative sourcing channels.

Acuity Brands' strategic shift of production from high-tariff areas like China to Mexico and the United States directly impacts supplier bargaining power. By diversifying its manufacturing footprint, the company mitigates risks associated with trade policies and can potentially negotiate more favorable terms with suppliers in these new locations.

This relocation can weaken the leverage of suppliers in previously dominant regions. For instance, if a significant portion of production previously reliant on Chinese suppliers moves, those suppliers may see reduced demand, thereby diminishing their ability to dictate terms. In 2023, global trade disruptions continued to highlight the importance of such supply chain resilience strategies.

Impact of Raw Material Costs

Fluctuations in the cost of essential raw materials like metals and rare earth elements, critical for Acuity Brands' lighting and electronic components, directly influence supplier pricing power. For instance, the price of copper, a key component in electrical wiring, saw significant volatility in 2024, with prices experiencing periods of sharp increases due to global supply chain disruptions and increased demand from the energy sector. While Acuity Brands actively pursues operational efficiencies, substantial hikes in these foundational material costs can indeed be passed on by suppliers, thereby impacting the company's overall cost of goods sold.

The bargaining power of suppliers is further amplified by the concentration of key material producers. For example, the global supply of certain rare earth elements, vital for advanced LED technology, is heavily concentrated among a few countries. This limited supply base grants these suppliers considerable leverage. Acuity Brands' ability to mitigate these impacts relies on strategic sourcing and long-term supplier relationships, but the inherent market dynamics for these commodities remain a significant factor influencing their pricing power.

- Raw Material Cost Volatility: Prices for metals like copper and aluminum experienced notable fluctuations throughout 2024, driven by geopolitical events and industrial demand.

- Concentrated Supply Chains: The market for certain rare earth elements, crucial for high-efficiency lighting, is dominated by a limited number of global suppliers, increasing their pricing leverage.

- Impact on Cost of Goods: Significant increases in raw material expenses can directly translate to higher production costs for Acuity Brands if these costs are passed on by suppliers.

Supplier Market Concentration

While the general LED market is quite crowded, the supply chain for Acuity Brands can face concentration when it comes to specialized, high-performance LED components or sophisticated sensor technologies. This can give major suppliers, such as Samsung, Cree, or OSRAM, significant leverage. Acuity Brands' capacity for product innovation is often tied to its access to these advanced components.

For instance, in 2024, the global LED market was valued at approximately $71.8 billion, but the market for specific, cutting-edge components within that can be much smaller and dominated by a few key manufacturers. This concentration means that if a critical supplier experiences production issues or decides to increase prices, Acuity Brands might have limited alternatives.

- Concentrated Component Markets: While the overall LED market is competitive, Acuity Brands may rely on a few suppliers for advanced, specialized components crucial for its innovative products.

- Supplier Leverage: This concentration grants significant bargaining power to suppliers of high-performance LEDs and advanced sensors, potentially impacting Acuity Brands' costs and innovation timelines.

- Impact on Innovation: Acuity Brands' ability to develop and launch new, technologically advanced lighting solutions is directly influenced by the availability and pricing of these critical components from a limited supplier base.

Acuity Brands faces supplier bargaining power primarily due to reliance on specialized, high-performance components and raw materials. While the company employs strategies like dual-sourcing and supply chain diversification, the concentrated nature of certain component markets and raw material producers can still grant suppliers significant leverage over pricing and terms. For example, the market for advanced LED chips and rare earth elements often features a limited number of key manufacturers, impacting Acuity Brands' cost structure and innovation timelines.

| Factor | Description | Impact on Acuity Brands | 2024 Data/Observation |

| Component Specialization | Reliance on proprietary, high-performance LED chips and sensors. | Increases supplier leverage due to limited alternatives. | The market for advanced LED components can be dominated by a few key players, potentially leading to price sensitivity. |

| Raw Material Concentration | Dependence on materials like copper and rare earth elements. | Concentrated supply chains for critical materials grant suppliers pricing power. | Copper prices experienced volatility in 2024, influenced by global demand and supply chain disruptions. |

| Supplier Diversification | Dual-qualification sourcing strategy and manufacturing footprint shifts. | Mitigates individual supplier power and reduces disruption risk. | The company's proactive supply chain resilience efforts in 2024 helped navigate component shortages. |

What is included in the product

This analysis dissects the competitive landscape for Acuity Brands, evaluating the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and how these forces shape the lighting and building management solutions market.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of Acuity Brands' Porter's Five Forces, streamlining strategic planning.

Customers Bargaining Power

Acuity Brands benefits from a broad customer base spanning commercial, institutional, industrial, infrastructure, and residential markets. This wide reach means that the company isn't overly reliant on any single customer segment. In 2024, Acuity Brands reported net sales of $4.2 billion, demonstrating the scale and diversity of its revenue streams.

Customers, particularly in commercial and institutional markets, increasingly focus on energy efficiency, advanced features, and comprehensive building management systems, often valuing these over the absolute lowest price. Acuity Brands strategically positions itself by highlighting 'higher value products,' aiming to compete on the overall benefits and performance delivered, which in turn moderates the direct price-driven bargaining power of buyers.

The growing market trend toward smart buildings and integrated solutions significantly boosts customer bargaining power. Customers now expect seamless integration across lighting, HVAC, and security systems, pushing providers to offer comprehensive, interoperable platforms. This demand favors companies like Acuity Brands that possess broad product portfolios capable of delivering these end-to-end solutions.

Switching Costs in Building Management

For large-scale building management systems, the initial implementation of a solution can lead to substantial switching costs. These costs arise from the intricate integration required with existing infrastructure, the necessary training for personnel to operate the new systems, and the significant upfront investment in new hardware and software. This integration complexity effectively locks in existing customers, thereby diminishing their immediate bargaining power when it comes to negotiating terms for ongoing services or future system expansions.

Acuity Brands' customers, particularly those with extensive deployments of their integrated building management solutions, face these high switching costs. For instance, a large commercial real estate firm that has standardized on Acuity's platform for lighting control, HVAC management, and security across multiple properties would incur considerable expense and operational disruption if they were to switch to a competitor. This includes the cost of new hardware, software licenses, extensive re-training of facilities staff, and the potential for system downtime during the transition. This lock-in effect means that customers are less likely to switch providers solely based on minor price increases for maintenance or support contracts, as the cost and effort of changing systems outweigh the immediate savings.

- High Integration Complexity: Transitioning from an established Acuity Brands building management system often requires extensive reconfiguration of existing electrical, mechanical, and IT infrastructure, making it a complex and time-consuming undertaking.

- Training and Expertise Investment: Facilities management teams become proficient in operating and maintaining specific Acuity Brands platforms, necessitating significant retraining and potential loss of productivity if a new system is adopted.

- Infrastructure Capital Outlay: The initial investment in Acuity Brands' hardware, sensors, and control units represents a sunk cost, and replacing this infrastructure with a new vendor's offerings requires a substantial new capital expenditure.

- Reduced Customer Bargaining Power: Due to the aforementioned factors, customers are less inclined to switch, granting Acuity Brands a degree of pricing power for ongoing services and upgrades, as the cost of switching outweighs immediate negotiation leverage.

Influence of Sustainability and Regulations

Government regulations are increasingly pushing for energy conservation and sustainability, directly impacting customer demand. For instance, in 2024, many municipalities and states continued to implement stricter building codes mandating higher energy efficiency standards for new constructions and renovations. This trend significantly boosts the bargaining power of customers, especially in the commercial and public sectors, as they can now demand solutions that meet these regulatory requirements.

Customers are actively seeking smart city initiatives and energy-efficient lighting and control systems. Acuity Brands, with its focus on these areas, is well-positioned to meet this demand. However, this also means customers are empowered to negotiate for more advanced features and guaranteed compliance, leveraging the regulatory landscape to their advantage.

- Regulatory Push: Government mandates for energy efficiency in 2024, such as updated ASHRAE standards, compel customers to adopt compliant solutions.

- Customer Leverage: The availability of energy-efficient and smart technologies, driven by regulations, allows customers to demand better pricing and enhanced features from suppliers like Acuity Brands.

- Market Alignment: Acuity Brands' product portfolio aligns with these sustainability trends, but this alignment also intensifies customer expectations for innovation and performance.

Acuity Brands faces moderate bargaining power from its customers. While the company's broad product range and focus on integrated solutions like smart buildings can reduce price sensitivity, customers in specific sectors, particularly large commercial and institutional buyers, can exert influence. The increasing demand for energy efficiency and compliance with regulations in 2024 means customers can leverage these requirements to negotiate for better terms and advanced features.

The significant switching costs associated with Acuity Brands' integrated building management systems, stemming from complex integration, training, and capital outlay, generally limit customer bargaining power. Once a system is implemented, the effort and expense required to transition to a competitor are substantial, creating a lock-in effect that reduces a customer's immediate leverage for price negotiations on ongoing services or upgrades.

| Customer Characteristic | Impact on Bargaining Power | Acuity Brands' Response |

|---|---|---|

| Switching Costs (High) | Reduces bargaining power due to integration complexity and training investment. | Focus on integrated solutions and platform standardization. |

| Demand for Energy Efficiency & Smart Features | Increases bargaining power as customers seek compliant and advanced solutions. | Product development aligned with smart building trends and regulatory compliance. |

| Customer Base Diversity | Moderates overall bargaining power by reducing reliance on single customer segments. | Broad market reach across commercial, institutional, industrial, and residential sectors. |

Full Version Awaits

Acuity Brands Porter's Five Forces Analysis

This preview showcases the complete Acuity Brands Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the lighting and building management industry. You're viewing the exact, professionally formatted document you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

Acuity Brands navigates a fiercely competitive arena, populated by formidable global lighting manufacturers and diversified industrial conglomerates. Key rivals such as Signify, Eaton Corporation, and Hubbell Incorporated present significant challenges, compelling Acuity Brands to prioritize relentless innovation and distinct strategic positioning to maintain its market standing.

While Acuity Brands focuses on delivering value, the lighting market, especially for general LED products, sees intense price competition. A trend of consumers "downgrading" their purchases in this segment means rivals often battle for market share using aggressive pricing and budget-friendly options.

Competitive rivalry in the lighting industry, particularly for companies like Acuity Brands, is fierce due to a relentless innovation and technology race. The rapid advancements in LED technology, the integration of the Internet of Things (IoT) for smart building solutions, and the increasing application of artificial intelligence (AI) are key drivers of this intense competition.

To stay ahead, companies are compelled to make substantial and continuous investments in research and development (R&D). This commitment is crucial for the consistent introduction of new and improved products and sophisticated systems. Acuity Brands, for instance, emphasizes product vitality and makes strategic investments in innovation to maintain its market position and offer cutting-edge solutions.

Strategic Acquisitions and Market Consolidation

Competitive rivalry is intensifying as key players, including Acuity Brands, pursue strategic acquisitions. These moves aim to broaden product offerings, secure greater market share, and penetrate emerging sectors. For instance, Acuity's acquisition of QSC in 2023 exemplifies this trend, signaling a push for integrated solutions in commercial and entertainment markets.

This wave of mergers and acquisitions is driving market consolidation. As larger entities absorb smaller ones, the competitive landscape becomes dominated by fewer, more powerful players. This consolidation escalates the intensity of rivalry among the remaining major companies, forcing them to innovate and compete more aggressively on price, product features, and service quality.

- Acuity Brands' acquisition of QSC in 2023: This strategic move aimed to enhance Acuity's capabilities in networked lighting controls and audio-visual integration.

- Market Consolidation Trend: The lighting and building technology sectors have seen significant M&A activity, leading to fewer, larger competitors.

- Increased Scale of Rivalry: As companies grow through acquisition, they gain economies of scale and broader market reach, intensifying competition with peers.

Diversified Portfolios and Integrated Solutions

Competitors are increasingly bundling lighting with building management systems, much like Acuity Brands does with its lighting, controls, and intelligent solutions. This means the competition isn't just about selling lights anymore; it's about offering complete, integrated building solutions.

This shift forces companies to be experts in more than just lighting. They need to understand how lighting interacts with HVAC, security, and other building functions to provide truly comprehensive offerings.

- Broadening Competition: The competitive landscape now encompasses companies offering integrated lighting and building management systems.

- Solution-Oriented Approach: Competitors are mirroring Acuity Brands' strategy of combining lighting with controls and intelligent systems.

- Demand for Expertise: This expansion requires companies to possess expertise across multiple domains, not just individual product lines.

Competitive rivalry is intense for Acuity Brands, driven by rapid technological advancements like LED and IoT integration, forcing continuous R&D investment to maintain market leadership. The market is characterized by significant price competition, particularly in general LED products, as companies battle for share by offering more budget-friendly options.

Market consolidation through mergers and acquisitions, such as Acuity's 2023 acquisition of QSC, is intensifying rivalry by creating larger, more powerful competitors. This trend necessitates a broadening of expertise beyond lighting to encompass integrated building management systems, mirroring Acuity's own strategic direction.

| Competitor | Approximate 2023 Revenue (USD Billions) | Key Focus Areas |

|---|---|---|

| Signify | ~7.2 | Professional & Consumer Luminaires, Connected Lighting |

| Eaton Corporation | ~23.2 (Electrical Sector) | Power Distribution, Lighting, Controls |

| Hubbell Incorporated | ~4.8 | Electrical Systems, Lighting Fixtures |

SSubstitutes Threaten

While Acuity Brands is a leader in LED lighting, the increasing efficiency of these lights, coupled with smart controls and daylight harvesting, presents a threat. These advancements can decrease the overall need for artificial lighting, thereby substituting for more extensive lighting systems that Acuity Brands offers. For instance, advancements in tunable white LEDs can mimic natural daylight cycles, further reducing reliance on traditional lighting throughout the day.

Architectural shifts toward passive building design, prioritizing natural light and thermal efficiency, present a significant threat of substitution for Acuity Brands. These strategies inherently reduce reliance on artificial lighting and sophisticated HVAC systems, directly impacting the demand for advanced lighting controls and building management solutions. For instance, the increasing adoption of net-zero energy building standards, which gained significant traction in 2024 with new regulations in several key markets, emphasizes passive design principles.

While Acuity Brands focuses on advanced smart building solutions, some customers may still choose less integrated or manual building management methods. This can be driven by budget constraints or a perceived complexity of sophisticated systems, particularly for smaller or legacy structures. For instance, a small retail store might opt for basic timers and thermostats instead of a full IoT-based energy management system, viewing these simpler options as viable substitutes.

Energy-Saving Retrofits and Insulation

Investments in building envelope improvements, such as enhanced insulation, high-performance windows, or renewable energy sources like solar panels, can significantly reduce a building's energy consumption. These measures indirectly substitute for the energy savings offered by advanced lighting and building controls, potentially limiting Acuity Brands' market share in energy efficiency solutions.

For instance, the U.S. Department of Energy reported in 2024 that retrofitting existing buildings with improved insulation could reduce heating and cooling energy use by up to 30%. This highlights a significant threat as building owners may prioritize these envelope upgrades over smart lighting systems if the return on investment appears more favorable or immediate.

- Reduced Demand for Lighting Controls: As buildings become more energy-efficient through insulation and windows, the need for advanced lighting controls to manage energy consumption may decrease.

- Focus on Building Envelope: Property owners are increasingly investing in the building envelope as a primary strategy for energy savings, diverting capital that might otherwise be spent on lighting and control systems.

- Cost-Effectiveness of Alternatives: In many cases, the upfront cost and long-term savings associated with insulation and window upgrades can be perceived as more compelling than those of sophisticated lighting retrofits.

Do-It-Yourself (DIY) Smart Home Solutions

The rise of DIY smart home and lighting solutions presents a significant threat of substitutes, particularly in the residential market and smaller commercial spaces. These consumer-focused products, often more affordable and easier to install, can directly replace the need for professionally integrated systems. For instance, the global smart home market was valued at approximately $107.1 billion in 2023 and is projected to reach $268.6 billion by 2030, indicating substantial growth in accessible alternatives.

Companies like Acuity Brands, which offer professional-grade lighting and building management systems, face competition from these readily available DIY options. The increasing sophistication of products from brands such as Google Nest, Amazon Alexa, and Apple HomeKit allows consumers to create personalized smart environments without relying on specialized installers. This trend can erode market share for companies focused on more complex, integrated solutions.

- Consumer Accessibility: DIY smart home technology is becoming increasingly user-friendly, lowering the barrier to entry for homeowners and small businesses.

- Cost-Effectiveness: Compared to professionally installed systems, DIY solutions often offer a lower upfront cost, making them an attractive substitute.

- Market Growth: The rapid expansion of the smart home sector, with an estimated compound annual growth rate (CAGR) of 11.5% from 2023 to 2030, highlights the growing consumer adoption of these alternative solutions.

The increasing efficiency of LED lighting, coupled with smart controls and daylight harvesting, poses a threat by reducing the overall need for extensive artificial lighting systems. Advancements in tunable white LEDs, for example, can mimic natural daylight, further diminishing reliance on traditional lighting solutions.

Architectural trends favoring passive building design, which prioritize natural light and thermal efficiency, directly impact Acuity Brands. These approaches lessen the demand for artificial lighting and sophisticated building management systems, a trend amplified by the growing adoption of net-zero energy building standards in 2024.

Investments in building envelope improvements, such as enhanced insulation and high-performance windows, offer an alternative path to energy savings. In 2024, the U.S. Department of Energy noted that improved insulation retrofits could cut heating and cooling energy use by up to 30%, potentially diverting capital from lighting system upgrades.

The DIY smart home market, valued at approximately $107.1 billion in 2023, presents accessible and cost-effective substitutes for professionally integrated systems. This sector's projected growth, with an estimated CAGR of 11.5% from 2023 to 2030, underscores the increasing consumer adoption of these alternatives.

| Threat of Substitutes | Description | Impact on Acuity Brands | Key Factors | Supporting Data |

| Energy-Efficient Building Design | Passive design and improved building envelopes reduce overall energy needs. | Decreased demand for advanced lighting controls and systems. | Net-zero building standards, focus on insulation and windows. | Insulation retrofits can reduce heating/cooling energy by up to 30% (DOE, 2024). |

| DIY Smart Home Technology | Consumer-grade, easy-to-install smart lighting and home automation. | Erosion of market share for professional-grade integrated solutions. | Lower upfront cost, user-friendliness, growing product sophistication. | Global smart home market valued at $107.1 billion in 2023, projected to reach $268.6 billion by 2030. |

| Advancements in Lighting Technology | Increased LED efficiency and tunable white capabilities. | Reduced need for prolonged artificial lighting use. | Daylight harvesting, mimicking natural light cycles. | Tunable white LEDs can simulate natural daylight patterns. |

Entrants Threaten

Entering the lighting and building management sector, particularly for comprehensive, integrated solutions like those offered by Acuity Brands, requires significant upfront investment. This includes substantial outlays for research and development to innovate new technologies, building and equipping advanced manufacturing facilities, and establishing robust distribution channels to reach a wide customer base. For instance, in 2023, Acuity Brands reported capital expenditures of $134.7 million, illustrating the ongoing investment needed to maintain and grow operations in this capital-intensive industry.

Established brand reputation and customer trust pose a significant barrier for new entrants in the lighting and building management solutions industry. Acuity Brands, for instance, has cultivated decades of trust and loyalty among its customer base, making it difficult for newcomers to gain traction. This deep-seated trust translates into repeat business and a preference for proven solutions, a hurdle new companies must overcome.

The increasing technological complexity in intelligent lighting and smart building solutions presents a significant barrier to new entrants. Companies need substantial expertise in areas like the Internet of Things (IoT), artificial intelligence (AI), and sophisticated software integration. For instance, Acuity Brands' focus on connected lighting systems and data analytics demands considerable investment in research and development to stay ahead.

New players would need to rapidly acquire or develop these advanced capabilities, a process that is both time-consuming and capital-intensive. The high R&D intensity required to innovate in areas such as predictive maintenance for lighting systems or energy optimization through AI means that only well-funded and technologically adept companies can realistically enter and compete effectively.

Extensive Distribution Channels

Acuity Brands benefits from an extensive distribution network, encompassing an independent sales network, a direct sales network, and various retail channels. This multi-faceted approach makes it challenging for new entrants to replicate, as building and maintaining such diverse and effective channels demands substantial capital, time, and established industry connections.

The cost and complexity of developing comparable distribution infrastructure present a significant barrier. For instance, in 2023, Acuity Brands' net sales reached $4.1 billion, underscoring the scale of operations required to support such a broad market reach.

- Independent Sales Network: Relies on established relationships and market penetration.

- Direct Sales Network: Requires significant investment in sales force and logistics.

- Retail Channels: Demands partnerships and shelf space, often with high upfront costs.

- Market Access: New entrants face difficulty gaining comparable access to customers.

Regulatory and Certification Hurdles

The threat of new entrants into the lighting and building management solutions industry, particularly for a company like Acuity Brands, is significantly shaped by regulatory and certification hurdles. Existing players have already invested in understanding and complying with these complex frameworks, creating a barrier for newcomers. For instance, the increasing focus on energy efficiency means that new products must meet stringent standards, such as those set by ENERGY STAR or the Department of Energy’s Solid-State Lighting (SSL) program. In 2024, the push for sustainability in construction continues, with certifications like LEED (Leadership in Energy and Environmental Design) becoming increasingly important for building projects. Companies aiming to enter this market must not only develop compliant products but also secure the necessary certifications, which can be a time-consuming and costly process, effectively deterring many potential new competitors.

Navigating this intricate web of regulations adds substantial upfront costs and delays market entry. New companies must dedicate resources to research, product development, and testing to ensure compliance with evolving energy efficiency standards and building codes. Furthermore, obtaining certifications like LEED or ENERGY STAR requires rigorous documentation and verification, adding another layer of complexity and expense. This can be a significant deterrent for smaller or less capitalized entrants who may struggle to absorb these initial investments. For example, the average cost to achieve LEED certification for a commercial building can range from $0.50 to $2.00 per square foot, a cost that indirectly impacts the demand for compliant products and thus the ease of entry for manufacturers.

- Evolving Standards: New entrants must adapt to changing energy efficiency mandates and building codes, which are continually updated to promote sustainability.

- Certification Requirements: Obtaining certifications like LEED and ENERGY STAR is often crucial for product adoption in new construction and retrofits, adding significant cost and time to market entry.

- Increased Development Costs: The need to meet stringent performance and safety regulations necessitates higher research and development expenditures for new companies.

- Competitive Advantage for Incumbents: Established players like Acuity Brands possess existing certifications and a deep understanding of regulatory compliance, providing them with a competitive edge against potential new entrants.

The threat of new entrants in the lighting and building management sector is moderate, largely due to high capital requirements and established brand loyalty. Acuity Brands' significant investments in R&D and manufacturing, exemplified by $134.7 million in capital expenditures in 2023, create a substantial barrier. Furthermore, their established reputation and extensive distribution network, which generated $4.1 billion in net sales in 2023, make it difficult for newcomers to gain market share.

| Factor | Impact on New Entrants | Acuity Brands' Position |

|---|---|---|

| Capital Requirements | High (R&D, Manufacturing) | Established infrastructure and financial capacity |

| Brand Reputation | Significant hurdle to overcome | Decades of customer trust and loyalty |

| Technological Complexity | Requires advanced expertise (IoT, AI) | Leader in connected lighting and data analytics |

| Distribution Network | Costly and time-consuming to replicate | Extensive independent, direct, and retail channels |

| Regulatory Compliance | Demands investment in certifications (LEED, ENERGY STAR) | Existing compliance and understanding of standards |

Porter's Five Forces Analysis Data Sources

Our Acuity Brands Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research from firms like IBISWorld and Statista.