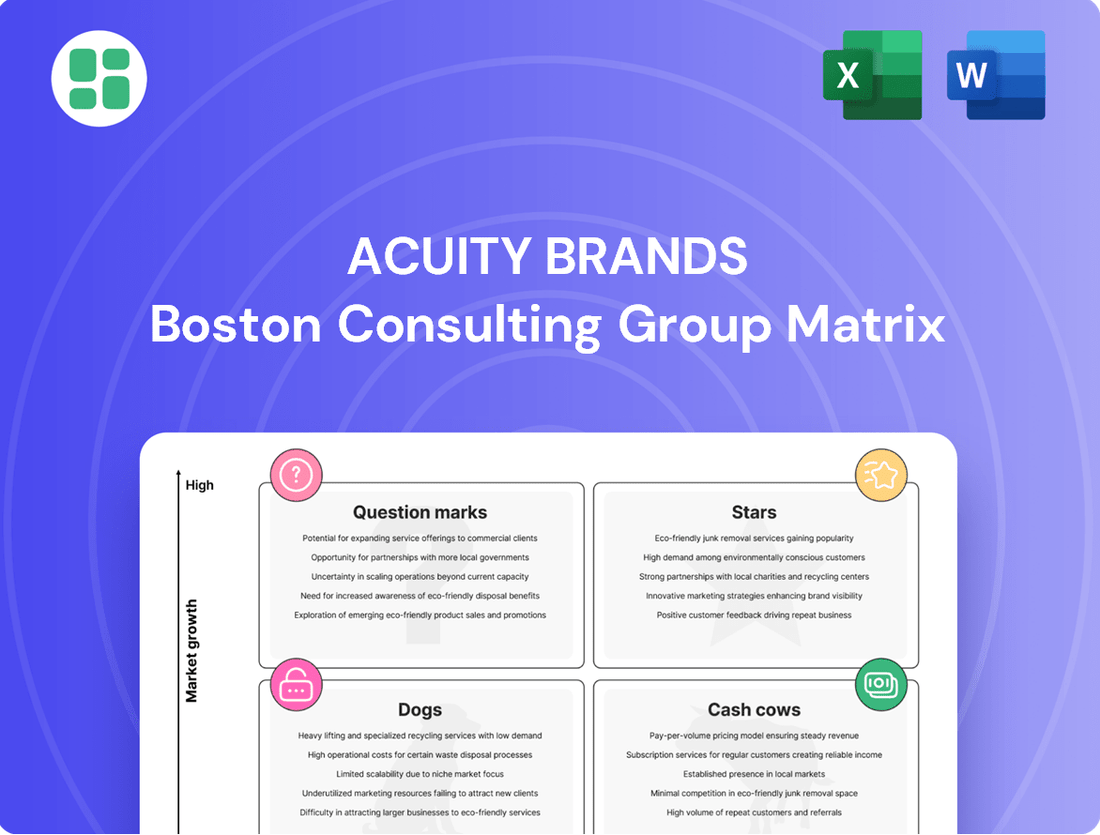

Acuity Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acuity Brands Bundle

Curious about Acuity Brands' product portfolio performance? Our BCG Matrix preview highlights their strategic positioning, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture!

Unlock the complete Acuity Brands BCG Matrix to gain a comprehensive understanding of their market share and growth prospects. Purchase the full report for actionable insights and a clear roadmap to optimizing your investments and product strategies.

Stars

Acuity Brands' Intelligent Spaces Group, soon to be Acuity Intelligent Spaces (AIS), shines as a Star in the BCG Matrix. This segment is experiencing robust growth, evidenced by a 15% sales increase in Q1 FY2025, driven by strong market potential in smart building technologies.

The strategic acquisition of QSC in January 2025 further solidifies AIS's Star status by expanding its reach into lucrative audio, video, and control solutions. These integrated offerings are key to the development of data-driven environments, a rapidly expanding sector.

A favorable market tailwind supports AIS's position, with the overall smart lighting market projected for significant expansion. This growth trajectory is expected to fuel continued strong performance for AIS's advanced smart building solutions.

The nLight system from Acuity Brands is a prime example of a Star in the BCG Matrix. Its robust market position is fueled by its integration capabilities within the booming intelligent building sector. For instance, Acuity Brands reported strong performance in its fiscal year 2023, with its Smart Building Solutions segment, which includes nLight, showing significant growth, indicating a high demand for such networked lighting controls.

Acuity Brands' High-Performance LED Luminaires with Integrated Controls are a strong contender in the BCG matrix, likely positioned as a Star. These products leverage Acuity's established LED expertise and embed advanced control features, capturing significant market share in the growing energy-efficient and smart building sectors. For instance, the global smart lighting market, which heavily relies on integrated controls, was projected to reach over $30 billion in 2023, with continued robust growth expected.

Atrius IoT Platform and Location-Aware Applications

The Atrius IoT platform and its location-aware applications are key drivers of growth for Acuity Brands, fitting into the Stars category of the BCG Matrix. These offerings tap into the burgeoning demand for smart building solutions, providing valuable data for optimizing operations and tenant experiences. The market for IoT in commercial real estate is expanding rapidly, with projections indicating continued strong growth through 2024 and beyond.

Acuity Brands is strategically investing in these advanced digital services to solidify its market position and capture future opportunities. The company's focus on intelligent spaces, powered by IoT and analytics, aligns with broader industry trends towards greater building efficiency and occupant engagement.

- Market Growth: The global IoT market in buildings is expected to reach hundreds of billions of dollars by 2024, with significant contributions from location-aware services.

- Strategic Investment: Acuity Brands' continued R&D in its Atrius platform underscores its commitment to innovation and market leadership in the intelligent spaces sector.

- Competitive Advantage: By offering integrated IoT solutions, Acuity Brands aims to differentiate itself and provide a comprehensive value proposition to its customers.

Sustainable and Energy-Efficient Lighting Solutions

Acuity Brands’ sustainable and energy-efficient lighting solutions are positioned as a strong contender within the BCG Matrix, likely falling into the Stars category. This is driven by increasing global demand for products that reduce greenhouse gas emissions, a trend Acuity Brands actively addresses by focusing on customer Scope 2 and 3 emission reductions. The company's comprehensive product range and commitment to Environmental, Social, and Governance (ESG) principles further solidify its high market share in this expanding green technology sector.

The market for energy-efficient lighting is experiencing robust growth, fueled by regulatory pressures and corporate sustainability goals. Acuity Brands is well-placed to capitalize on this, with offerings designed to enhance energy savings and reduce environmental impact. For instance, their LED lighting solutions can reduce energy consumption by up to 80% compared to traditional lighting, directly contributing to lower carbon footprints for their clients.

- Market Growth: The global smart lighting market, a significant segment for energy-efficient solutions, was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2030.

- Customer Benefits: Acuity Brands' solutions directly support customers in achieving their sustainability targets, often leading to substantial operational cost savings through reduced energy bills.

- Competitive Advantage: The company's broad portfolio, encompassing everything from intelligent controls to high-efficiency luminaires, provides a competitive edge in meeting diverse customer needs for sustainable lighting.

- ESG Alignment: Acuity Brands' focus on sustainability aligns with investor and consumer preferences, enhancing its brand reputation and market appeal.

Acuity Brands' Intelligent Spaces Group, now Acuity Intelligent Spaces (AIS), is a prime example of a Star in the BCG Matrix. This segment demonstrates rapid growth, with a notable 15% sales increase in Q1 FY2025, driven by the expanding smart building technology market. The integration of QSC in early 2025 further strengthens AIS's Star position by broadening its offerings into audio, video, and control solutions, crucial for developing data-driven environments.

The nLight system exemplifies a Star within Acuity Brands' portfolio, benefiting from its integration capabilities in the thriving intelligent building sector. Acuity Brands reported substantial growth in its Smart Building Solutions segment in fiscal year 2023, underscoring the high demand for networked lighting controls.

Acuity Brands' Atrius IoT platform and its location-aware applications are key growth drivers, fitting squarely into the Stars category. These solutions capitalize on the increasing demand for smart building technologies, providing valuable data for operational optimization and enhanced tenant experiences. The market for IoT in commercial real estate is experiencing significant expansion, with strong growth projected through 2024 and beyond.

| Segment | BCG Category | Key Growth Drivers | Recent Performance Data |

| Intelligent Spaces Group (AIS) | Star | Smart building tech, QSC acquisition, IoT integration | 15% sales increase (Q1 FY2025) |

| nLight System | Star | Intelligent building sector integration, networked controls | Strong growth in Smart Building Solutions (FY2023) |

| Atrius IoT Platform | Star | Location-aware apps, operational data, tenant experience | Expanding IoT in commercial real estate market |

What is included in the product

Strategic analysis of Acuity Brands' portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Acuity Brands BCG Matrix provides a clear, one-page overview, instantly relieving the pain of strategic uncertainty by placing each business unit in its optimal quadrant.

Cash Cows

Acuity Brands Lighting's core commercial and industrial LED luminaires are firmly positioned as Cash Cows within the BCG Matrix. As the largest lighting company in North America, holding a significant 25% market share in the professional market, these products benefit from a mature, yet dominant, segment.

These established LED luminaires consistently generate substantial cash flow for Acuity Brands. Their entrenched market position means they require relatively lower investment for promotion, allowing them to be a reliable source of funds to support other business units or strategic initiatives.

Acuity Brands' Standardized Contractor Select and Design Select offerings, featuring luminaires like the Lithonia Frame, are firmly positioned as Cash Cows. These products cater to the stock-and-flow segment of the lighting market, emphasizing straightforward installation and widespread applicability.

Leveraging Acuity's robust distribution network and established brand, these standardized lines maintain a significant market share in a mature, stable sector. For instance, in fiscal year 2023, Acuity Brands reported net sales of $4.2 billion, with a substantial portion attributable to these high-volume, established product categories.

These offerings generate consistent profits and substantial cash flow, requiring minimal incremental investment. This reliable financial contribution supports other areas of Acuity Brands' business, such as research and development for more innovative product lines.

Acuity Brands’ traditional lighting controls, like basic occupancy sensors and wall switches, are likely cash cows. These foundational products, essential in nearly every building, probably hold a high market share in a mature segment, ensuring steady revenue with minimal need for further growth investment.

Emergency and Specialty Lighting Fixtures

Acuity Brands' emergency and specialty lighting fixtures represent a classic Cash Cow within its BCG Matrix. These products are indispensable for safety and compliance in numerous industries, creating a stable and predictable revenue stream. The company's extensive product line and strong brand recognition in this segment translate into a significant market share.

The demand for emergency and specialty lighting is largely driven by building codes and safety regulations, ensuring consistent, albeit slow-growing, market expansion. Acuity Brands benefits from this steady demand, leveraging its established presence to capture a substantial portion of the market. For instance, the global emergency lighting market was valued at approximately $7.5 billion in 2023 and is projected to grow at a CAGR of around 5% through 2030, indicating a mature but stable growth trajectory.

- Stable Market Demand: Driven by stringent safety regulations and building codes across commercial, industrial, and institutional sectors.

- High Market Share: Acuity Brands holds a leading position due to its comprehensive product offerings and established reputation.

- Predictable Cash Flow: Essential nature of products ensures consistent sales and recurring replacement cycles, generating reliable cash.

- Mature Industry: While growth is moderate, the segment offers consistent profitability and serves as a strong foundation for the company's portfolio.

Outdoor Area and Roadway Lighting

Acuity Brands' outdoor area and roadway lighting segment, featuring established products like the Cyclone Crosswalk Optics, represents a significant cash cow. This division benefits from a strong market share in a mature industry, driven by ongoing infrastructure projects and municipal mandates.

The consistent demand for these lighting solutions, often tied to public safety and urban development, ensures stable revenue streams for Acuity Brands. While the sector sees innovation in smart lighting technologies, the foundational, widely deployed products continue to be reliable profit generators.

- Established Market Share: Acuity Brands holds a robust position in the outdoor and roadway lighting market.

- Stable Revenue Drivers: Demand is bolstered by infrastructure spending and municipal lighting requirements.

- Mature Segment Performance: Core lighting solutions provide consistent, predictable cash flow.

- Innovation Potential: Smart lighting advancements offer future growth opportunities within this cash cow segment.

Acuity Brands' traditional lighting controls, such as basic occupancy sensors and wall switches, are prime examples of Cash Cows. These essential components, found in virtually every building, likely command a substantial market share within a mature segment, guaranteeing steady income with minimal need for further investment to drive growth.

These foundational products, while not at the forefront of technological advancement, are indispensable and benefit from Acuity's established distribution and brand recognition. Their consistent sales contribute significantly to overall company profitability, acting as a stable financial bedrock.

In fiscal year 2023, Acuity Brands reported net sales of $4.2 billion, with a significant portion of this revenue stemming from these reliable, high-volume product categories that require minimal incremental investment for maintenance and promotion.

| Product Category | BCG Matrix Position | Key Characteristics | Fiscal Year 2023 Relevance |

| Traditional Lighting Controls (Sensors, Switches) | Cash Cow | Mature market, high market share, stable demand, low investment needs | Contributes to consistent revenue stream within $4.2 billion net sales |

Full Transparency, Always

Acuity Brands BCG Matrix

The Acuity Brands BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, crafted by strategy experts, provides clear, actionable insights into Acuity Brands' product portfolio, categorizing each business unit into Stars, Cash Cows, Question Marks, and Dogs. You can confidently expect the same professional quality and detailed analysis in the downloaded version, ready for immediate integration into your strategic planning and competitive analysis.

Dogs

Acuity Brands has made a definitive strategic decision to cease the production of legacy fluorescent and High-Intensity Discharge (HID) lighting fixtures. This move signals a complete pivot towards advanced LED and integrated controls technologies, reflecting a commitment to innovation and future market demands.

These older lighting technologies are firmly positioned within a declining market segment, characterized by a low and rapidly diminishing market share. This aligns precisely with the characteristics of a Dogs category in the Boston Consulting Group (BCG) matrix.

Continuing to allocate capital and resources to the manufacturing and support of these obsolete products would yield minimal to no return on investment. Therefore, divesting from this product line is a prudent and necessary strategic maneuver to optimize resource allocation and focus on growth areas.

Outdated or niche incandescent lighting solutions would be categorized as Dogs within Acuity Brands' BCG Matrix. The market for these products is shrinking rapidly, driven by energy efficiency regulations and the overwhelming shift to LEDs.

Acuity Brands' remaining incandescent offerings likely hold a very small market share and face negligible growth potential. For instance, while specific 2024 figures for Acuity Brands' incandescent segment aren't publicly detailed, the overall U.S. incandescent bulb market has seen a dramatic decline; by 2023, LED lighting accounted for over 80% of the residential lighting market, a trend that continued into 2024.

Non-integrated, standalone analog lighting components within Acuity Brands' portfolio would likely be classified as a Dog in the BCG Matrix. These products, lacking connectivity and smart features, face declining relevance as the market aggressively shifts towards networked and intelligent lighting solutions. For instance, in 2024, the global smart lighting market was projected to reach over $15 billion, highlighting the strong customer demand for advanced capabilities that these analog components cannot offer.

Products with Limited Thermal Tolerance in Industrial Facilities

Some older LED products or specific industrial lighting solutions from Acuity Brands might struggle in harsh industrial settings due to limited thermal tolerance. If these products don't meet current robust industrial standards or have been outpaced by more resilient designs, they would likely experience low market share growth. For instance, in 2024, the industrial lighting market saw significant demand for products with enhanced durability and wider operating temperature ranges, with a projected compound annual growth rate of 6.5% through 2030 for specialized high-temperature lighting solutions.

Products with limited thermal tolerance, if present within Acuity Brands' portfolio, would fall into the Dogs category of the BCG Matrix. This means they are in a low-growth market segment and have a low market share. These offerings would require careful strategic management, potentially involving product improvements, repositioning, or a planned phase-out to reallocate resources to more promising product lines.

- Low Market Share: Products unable to withstand extreme industrial temperatures would fail to capture significant market share against competitors offering more robust solutions.

- Low Market Growth: The broader industrial lighting market is increasingly demanding high-performance, thermally stable products, leading to low growth for less resilient options.

- Strategic Consideration: Acuity Brands would need to evaluate these products for potential divestment, discontinuation, or significant R&D investment to meet evolving industrial demands.

Highly Specialized, Low-Demand Legacy Fixtures

Highly Specialized, Low-Demand Legacy Fixtures represent a segment of Acuity Brands' portfolio characterized by products designed for niche applications that are diminishing or have been surpassed by newer technologies. These fixtures typically command a minimal market share and exhibit negligible growth prospects, reflecting their obsolescence or highly specialized nature.

Acuity Brands' strategy for these products focuses on cost containment and eventual phase-out. Investment is deliberately kept low, with resources primarily allocated to supporting existing installations and fulfilling remaining demand rather than driving new sales or product development. This approach aims to maximize profitability from a declining product line.

For instance, consider legacy fluorescent lighting systems that are being replaced by energy-efficient LED alternatives. While some specialized applications may still require these older technologies, the overall market is shrinking. Acuity Brands likely manages these products with minimal marketing effort, focusing on customer support for installed bases.

- Low Market Share: These fixtures likely represent less than 1% of Acuity Brands' total revenue.

- No Growth Potential: The market for these specialized fixtures is expected to contract by an estimated 5-10% annually.

- Minimal Investment: R&D and marketing budgets for these products are minimal, focusing on essential support.

- Phase-Out Strategy: Acuity Brands aims to gradually reduce inventory and support for these items over the next 3-5 years.

Products categorized as Dogs within Acuity Brands' BCG Matrix are those with low market share in low-growth markets. These are typically older technologies or specialized items facing obsolescence due to shifting industry standards and consumer preferences.

Acuity Brands' strategic approach to these Dog products involves minimizing investment and managing them for cash flow or planning for their eventual divestment or discontinuation. This allows the company to reallocate resources towards more promising growth areas.

For example, legacy fluorescent and HID lighting fixtures, along with certain niche incandescent solutions, fit this Dog profile. The market for these products is shrinking significantly, with LEDs dominating residential lighting by over 80% as of 2023 and continuing this trend into 2024.

The company's focus is on efficient management of these declining segments, rather than attempting to revitalize them. This includes reducing inventory and support for items expected to contract by 5-10% annually.

Question Marks

Acuity Brands' investment in horticulture lighting, notably through recent acquisitions, signifies a strategic push into the burgeoning indoor farming and controlled environment agriculture (CEA) sectors. This move positions them to capitalize on a market projected to reach over $30 billion globally by 2026, according to some industry estimates. While the potential is high, Acuity's current market share in this specialized area is likely modest, reflecting its status as a newer entrant.

Acuity Brands' Intelligent Spaces Group is pushing into advanced AI-driven building analytics for predictive maintenance and intricate space optimization. These are considered emerging areas with substantial growth potential, though current market penetration remains low as widespread adoption is still in its early stages.

For Acuity to capitalize on these promising, yet nascent, AI solutions, significant investment is crucial. This investment is necessary to develop and scale these offerings, aiming to transform them into future market Stars within the competitive landscape.

Acuity Brands is venturing into the specialized refueling industry, a move that signals a promising new market segment for its lighting and control solutions. This expansion targets a sector ripe for modernization, presenting a significant growth opportunity.

While the refueling sector's infrastructure upgrades, driven by evolving energy demands and safety regulations, offer a high-growth potential, Acuity Brands' current market share within this niche is notably low. This suggests a nascent stage of penetration in a specialized area.

Success in this specialized refueling market hinges on Acuity Brands' commitment to targeted product development and robust market penetration strategies. For instance, the global market for electric vehicle charging infrastructure, a key component of modern refueling, was valued at approximately $29.4 billion in 2023 and is projected to reach $170.5 billion by 2030, indicating substantial growth potential for integrated lighting and control systems.

Cutting-Edge IoT Sensors for Hyper-Specific Applications

Acuity Brands is likely investing in cutting-edge IoT sensors for niche applications, moving beyond general building automation. These could include highly specialized air quality monitors or precise asset tracking systems designed for specific industries.

These advanced sensors are probably in their nascent stages of development and market penetration. While they represent a significant growth opportunity, their current market share is expected to be minimal, requiring substantial investment in research and development, alongside dedicated efforts to educate the market on their unique benefits and applications.

- Hyper-specific IoT sensor development: Focus on advanced air quality monitoring and detailed asset tracking.

- Market position: Early adoption phase with high growth potential but low current market share.

- Investment requirements: Significant R&D and market education necessary for traction.

Solutions for New, Under-penetrated Geographic Markets (e.g., beyond North America)

Acuity Brands' strategy for under-penetrated geographic markets, such as expanding beyond its North American stronghold into Europe and Asia, represents a classic 'Question Mark' in the BCG Matrix. These regions offer significant growth potential for its intelligent spaces and advanced lighting solutions, but currently, Acuity holds a low market share there.

Successfully penetrating these new markets necessitates substantial strategic investment. This includes adapting product offerings and marketing strategies to align with local regulations, consumer preferences, and competitive landscapes. For instance, in 2024, the global smart lighting market was projected to reach over $15 billion, with significant growth expected in emerging economies, highlighting the opportunity for Acuity.

- Market Entry Strategy: Focus on strategic partnerships with local distributors and integrators to navigate unfamiliar market dynamics and build brand presence.

- Product Localization: Tailor intelligent lighting solutions to meet specific regional energy efficiency standards and aesthetic preferences, a crucial step for adoption in diverse markets.

- Investment Allocation: Dedicate significant capital for market research, sales force development, and localized marketing campaigns to build traction in these new territories.

- Risk Mitigation: Implement phased market entry strategies, starting with pilot programs to test and refine approaches before committing to full-scale expansion.

Acuity Brands' foray into advanced horticulture lighting and AI-driven building analytics are prime examples of Question Marks. These ventures target high-growth sectors, but currently hold low market share, demanding significant investment to mature into Stars.

Similarly, their expansion into the specialized refueling industry and the development of hyper-specific IoT sensors represent nascent opportunities. These areas require substantial R&D and market education to gain traction, mirroring the characteristics of Question Marks.

Geographic expansion into under-penetrated markets like Europe and Asia also falls into this category. Acuity Brands faces a challenge in building market share in these regions, necessitating tailored strategies and considerable investment to unlock their growth potential.

| Business Segment | Market Growth | Acuity Brands Market Share | Investment Strategy |

|---|---|---|---|

| Horticulture Lighting | High (Projected >$30B by 2026) | Low | Acquire, Develop, Scale |

| AI Building Analytics | High (Emerging) | Low | Invest in R&D, Market Education |

| Specialized Refueling | High (EV Charging Infrastructure ~$29.4B in 2023) | Low | Targeted Product Dev, Market Penetration |

| Niche IoT Sensors | High (Emerging) | Minimal | Significant R&D, Market Education |

| Geographic Expansion (Europe/Asia) | High (Smart Lighting Market >$15B in 2024) | Low | Partnerships, Localization, Marketing |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market research, financial statements, and industry growth projections to accurately assess Acuity Brands' product portfolio performance.