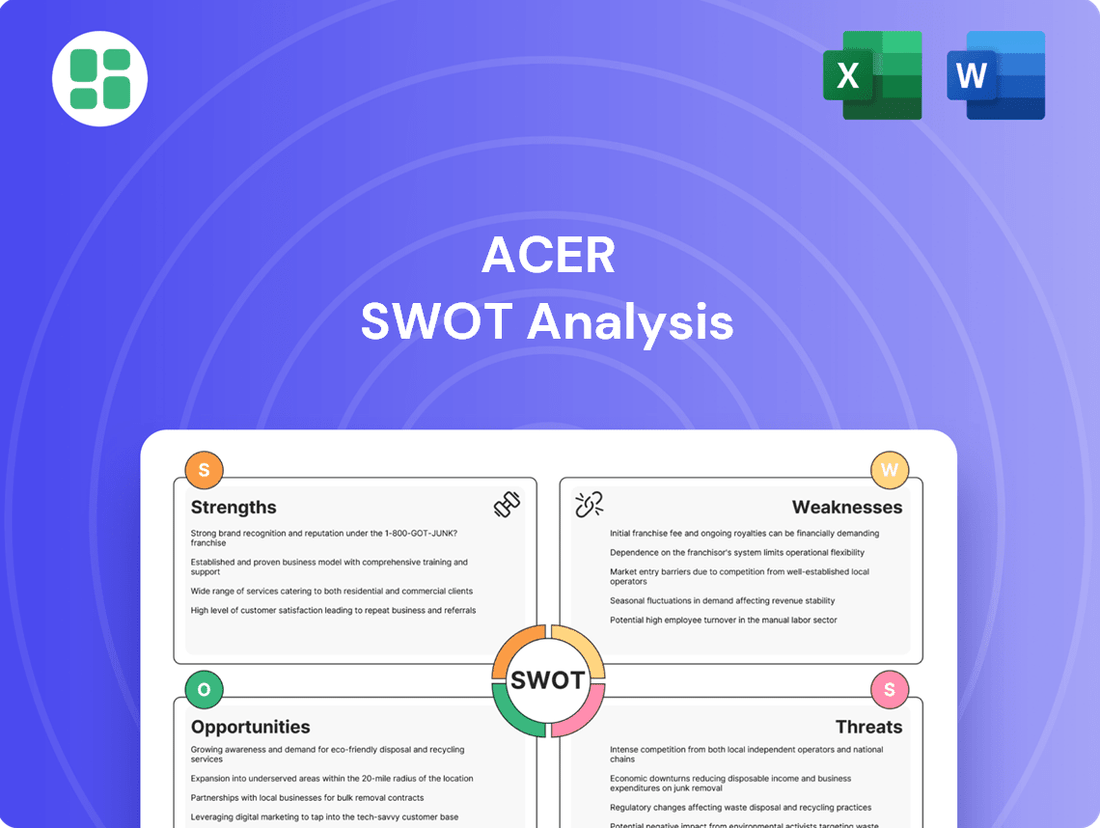

Acer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acer Bundle

Acer's innovative product development and strong brand recognition are key strengths, but intense competition and supply chain disruptions pose significant threats. Understanding these dynamics is crucial for navigating the tech landscape.

Want the full story behind Acer's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Acer's diverse product portfolio, encompassing everything from laptops and desktops to tablets, servers, displays, and even virtual reality devices, positions it strongly in the market. This wide array of offerings allows Acer to serve a broad customer base and mitigate risks associated with reliance on a single product category.

The company's expansive global reach, with operations in over 160 countries, is a significant strength, enabling it to tap into various regional markets and maintain stability even during localized economic downturns. This international presence is crucial for sustained growth and market penetration.

Acer's strategic focus on expanding beyond its traditional PC and display businesses is already showing results, with these newer ventures contributing meaningfully to its overall revenue in 2024. This diversification strategy is key to building multiple revenue streams and ensuring long-term resilience.

Acer has demonstrated impressive performance in key areas, notably in the gaming notebook segment where it commands a significant market share, particularly in the Philippines. This strong showing highlights Acer's ability to cater to a growing and demanding consumer base.

Further solidifying its market presence, Acer achieved the No. 3 position among PC brands in India during the first quarter of 2024. This success is attributed to robust demand across both commercial and consumer sectors, indicating broad appeal and effective market penetration.

Acer's strategic focus is further evidenced by its leadership in specific Indian market niches. The company leads in the very large enterprise desktop PC segment and maintains its top position in the education PC segment in India, underscoring its capability to execute targeted strategies in competitive landscapes.

Acer is demonstrating a strong commitment to sustainability, aiming for 100% renewable electricity by 2035 and net-zero emissions by 2050. This forward-thinking approach is integrated into its core business operations.

The company's eco-conscious Vero product line, which prominently features post-consumer recycled plastics and innovative materials like bio-based oyster shell, is gaining traction. For instance, the Aspire Vero 16 was recognized as a CES Innovations 2025 honoree, highlighting the practical application of these sustainable efforts.

This dedication to environmental responsibility not only strengthens Acer's brand reputation but also resonates with a growing segment of consumers who prioritize eco-friendly purchasing decisions.

Innovation in AI-Powered Devices and Solutions

Acer is significantly investing in AI, launching innovative products like AI PCs and Copilot+ PCs. This strategic move aims to capitalize on the growing demand for intelligent computing solutions, with the company projecting AI PCs to hit their peak by the third quarter of 2025. This positions Acer to potentially invigorate the tech market.

The company's AI focus isn't limited to personal computers; it extends to smart home devices and edge AI solutions. This diversified approach to AI integration demonstrates Acer's commitment to future-proofing its product portfolio and capturing new market segments.

- AI PC Market Anticipation: Acer expects AI PCs to reach their prime by Q3 2025, signaling a strong belief in AI's ability to drive consumer demand.

- Product Diversification: Beyond traditional PCs, Acer is developing AI capabilities for smart home devices and edge AI, broadening its AI ecosystem.

- Industry Revitalization: Acer views AI as a key driver for stimulating demand and revitalizing the broader technology industry.

Operational Efficiency and Cost Advantage

Acer has historically leveraged operational efficiency to maintain a significant cost advantage, enabling competitive pricing for its reliable products. This strategy appeals broadly to budget-conscious consumers, including students and professionals, who seek value without compromising functionality. In 2023, Acer continued to focus on optimizing its supply chain, a critical component in managing costs amidst global economic fluctuations.

The company's extensive global manufacturing and distribution network allows for substantial economies of scale. This scale directly translates into a lower cost per unit, reinforcing Acer's ability to offer attractive price points. For instance, Acer's Chromebooks have consistently been among the most affordable options in the market, a testament to this operational strength.

- Cost Leadership: Acer's operational efficiency underpins its ability to compete on price, a key differentiator in the PC market.

- Supply Chain Optimization: Continuous efforts to streamline supply chain processes in 2023 helped mitigate rising component costs.

- Economies of Scale: Acer's large production volumes contribute to lower manufacturing costs, facilitating aggressive pricing strategies.

- Market Penetration: The cost advantage allows Acer to capture market share, particularly in price-sensitive segments like education.

Acer's diverse product range, from laptops to VR, allows it to cater to a wide audience and reduce reliance on any single product category.

Its extensive global presence, operating in over 160 countries, provides market stability and growth opportunities. Acer's strategic expansion into new ventures beyond PCs is already contributing to revenue in 2024, showcasing a commitment to diversification.

The company holds a strong position in the gaming notebook market, particularly in the Philippines, and achieved the No. 3 spot for PC brands in India in Q1 2024, demonstrating broad market appeal and effective penetration.

What is included in the product

Analyzes Acer’s competitive position through key internal and external factors, detailing its strengths in brand recognition and product innovation alongside weaknesses in market share and supply chain management.

Identifies key competitive advantages and potential threats, enabling proactive risk mitigation and opportunity capitalization.

Weaknesses

Acer's primary revenue stream still hinges on the personal computer and display sector. This market is notoriously cutthroat, with demand often unpredictable. While Acer saw growth in its PC and display segments in 2024, the broader PC market's expansion is often modest, posing a hurdle for significant, sustained growth.

The intense competition from giants like Lenovo, HP, Dell, and Apple means that maintaining market share and achieving rapid expansion requires constant innovation and aggressive pricing strategies. This reliance on a mature and highly contested market presents a significant weakness for Acer's long-term growth prospects.

Acer's aggressive pricing strategy, a key driver of its market share, can inadvertently create a perception of lower quality. When products are consistently priced below premium competitors, consumers may associate this affordability with compromises in materials, performance, or longevity, even if the actual quality is high.

This price-driven positioning can alienate a segment of the market that prioritizes perceived prestige and cutting-edge features, potentially limiting Acer's appeal to customers seeking top-tier, luxury electronics. For instance, in 2024, while Acer maintained a strong presence in the mid-range laptop market, its market share in the premium segment remained considerably smaller than brands known for higher price points and perceived superior build quality.

Acer's footprint in the business-to-business (B2B) sector lags behind key rivals such as Dell and Lenovo. While Acer has made strides in commercial markets, particularly in India and the EMEA region, its B2B product offerings, especially for mid-sized enterprises, are often seen as less comprehensive, potentially hindering its expansion in this profitable market segment.

Vulnerability to Foreign Exchange Fluctuations

Acer's profitability faces a significant headwind from foreign exchange fluctuations. For instance, in the first quarter of 2025, the company reported substantial foreign exchange losses that effectively wiped out a considerable portion of its operating profit, highlighting the direct impact on its bottom line.

The ongoing appreciation of the New Taiwan dollar presents a persistent financial risk. This currency strength can translate into escalating losses related to foreign exchange transactions, directly impacting Acer's net income and overall financial performance.

- Q1 2025 Forex Losses: Erased a significant portion of operating profit.

- New Taiwan Dollar Appreciation: Leads to escalating currency-related losses.

- Financial Risk: Directly impacts net income and overall profitability.

Slower Shipment Growth Compared to Top Competitors

While Acer successfully climbed to fifth place in the global PC market share during the first quarter of 2025, its shipment growth presented a point of concern. The company reported a year-over-year growth of only 1.9%.

This figure was notably the slowest among the top six vendors in the market. Such a pace suggests Acer is expanding more gradually than some of its key competitors.

In a PC market that is showing signs of recovery but still demands caution from consumers, this slower growth rate could hinder Acer's ability to quickly capture a larger portion of market share.

- Acer's Q1 2025 global PC market share reached fifth place.

- Year-over-year shipment growth was 1.9%.

- This growth rate was the lowest among the top six PC vendors.

- Slower expansion may limit rapid market share gains in a recovering PC market.

Acer's reliance on the highly competitive PC market, where growth is often modest, limits its expansion potential. Intense rivalry from major players like Lenovo and HP necessitates constant innovation and aggressive pricing, which can also dilute brand perception. Furthermore, Acer's weaker presence in the lucrative B2B sector compared to competitors like Dell hinders its ability to tap into a significant revenue stream.

Preview the Actual Deliverable

Acer SWOT Analysis

This is the actual Acer SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Acer's strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use for your business planning needs.

Opportunities

The burgeoning market for AI PCs, expected to hit its stride by Q3 2025, offers a substantial avenue for Acer's expansion. Acer is strategically positioning itself by introducing AI-enhanced devices and broadening its reach into smart home and edge AI technologies, directly addressing the increasing consumer and enterprise appetite for intelligent, user-friendly technology.

This technological shift is poised to drive significant product refresh cycles, encouraging consumers to upgrade their existing hardware. Furthermore, Acer's foray into smart home and edge AI solutions opens up entirely new revenue streams, capitalizing on the growing demand for integrated and intelligent living and working environments.

Acer's established presence in the gaming notebook sector, particularly with its Predator brand, presents a significant opportunity. The global gaming market, valued at over $200 billion in 2023, continues its robust expansion, and Acer is well-positioned to capture a larger share of this growth.

The burgeoning virtual reality (VR) market, projected to reach tens of billions of dollars by 2027, offers another avenue for Acer. By leveraging its gaming expertise and investing in VR-compatible hardware and experiences, Acer can tap into this innovative and rapidly evolving technology segment.

Acer's dedication to sustainability, exemplified by its carbon-neutral products and ambitious renewable energy targets, presents a significant opportunity to bolster its brand image. This commitment resonates strongly with the growing segment of environmentally aware consumers and businesses actively seeking sustainable partnerships.

By highlighting initiatives like 'Acer as a Service' and its trade-in programs, Acer can showcase its adoption of circular economy principles. These programs not only offer flexible and sustainable IT management solutions but also pave the way for innovative new business models that align with global environmental objectives.

Growth in Emerging Markets and Tier 2/3 Cities

Acer's strategic push into emerging markets, especially within India's tier 2 and tier 3 cities, presents a significant avenue for growth. This focus taps into a burgeoning demand for accessible and dependable technology solutions.

These regions are experiencing rapid economic development, leading to a rising middle class with increasing disposable income and a strong appetite for personal computing devices. Acer's established brand recognition and robust distribution networks are well-positioned to capitalize on this trend.

- India's PC Market Growth: Projections indicate continued expansion in the Indian PC market, with tier 2 and 3 cities expected to be key drivers of this growth. For instance, reports from late 2023 and early 2024 suggested double-digit percentage growth in PC shipments to these non-metro areas.

- Affordability and Value Proposition: Acer's reputation for offering competitive pricing and reliable products aligns perfectly with the purchasing power and preferences of consumers in these developing urban centers.

- Digitalization Initiatives: Government-led digitalization drives and increased internet penetration in these cities further fuel the demand for laptops and desktops for education, small business, and personal use.

Diversification into Non-PC and Display Businesses

Acer's strategic push to diversify beyond its traditional PC and display segments presents a significant opportunity for sustained growth and reduced market volatility. This expansion into new business areas is already demonstrating positive traction, contributing to the company's overall financial health.

Key growth drivers include Acer's ventures into AI servers through Altos Computing Inc. and smart solutions via Acer ITS Inc. and Acerpure. These segments are experiencing robust year-over-year expansion, effectively lessening the company's dependence on the cyclical PC market.

- AI Servers: Altos Computing Inc. is a prime example of this diversification, targeting the rapidly growing AI infrastructure market.

- Smart Solutions: Acer ITS Inc. and Acerpure are developing and marketing innovative smart technologies and lifestyle products, tapping into new consumer demands.

- Revenue Contribution: The increasing revenue and operating income from these non-PC businesses in 2024 highlight the success of Acer's diversification strategy.

- Reduced Reliance: This strategic shift aims to create a more resilient business model, less susceptible to fluctuations in the global PC demand.

Acer is well-positioned to capitalize on the growing demand for AI PCs, a market expected to see significant traction by Q3 2025, with Acer introducing AI-enhanced devices and expanding into smart home and edge AI technologies.

The company's strong presence in the gaming sector, bolstered by its Predator brand, allows it to tap into the global gaming market, which surpassed $200 billion in 2023 and continues its upward trajectory.

Furthermore, Acer's strategic diversification into areas like AI servers through Altos Computing Inc. and smart solutions via Acer ITS Inc. and Acerpure is successfully reducing its reliance on the traditional PC market, showing robust year-over-year expansion in these new ventures.

Acer's commitment to sustainability, demonstrated through carbon-neutral products and renewable energy targets, enhances its brand image and appeals to environmentally conscious consumers and businesses.

| Opportunity Area | Market Trend/Data | Acer's Strategic Alignment |

|---|---|---|

| AI PCs | Market poised for growth by Q3 2025 | Introduction of AI-enhanced devices, expansion into smart home and edge AI |

| Gaming Market | Global market valued over $200 billion (2023) | Strong presence with Predator brand |

| Diversification (AI Servers, Smart Solutions) | Robust year-over-year expansion in new ventures | Altos Computing Inc., Acer ITS Inc., Acerpure |

| Sustainability | Growing consumer demand for eco-friendly products | Carbon-neutral products, renewable energy targets |

Threats

Acer faces a fiercely competitive landscape in the global PC and electronics sector, where giants like Lenovo, HP, Dell, and Apple command significant market share. Emerging regional brands also intensify this rivalry, often competing on price. This dynamic can squeeze Acer's profit margins and make it challenging to expand its footprint.

Global supply chain vulnerabilities, amplified by ongoing geopolitical tensions and trade disputes, present a significant threat to Acer's manufacturing and distribution capabilities. These disruptions can lead to increased lead times and higher operational costs, impacting Acer's ability to meet market demand efficiently.

Concerns over potential tariff hikes, a direct consequence of trade disputes, can compel vendors to build up inventories. This practice not only ties up capital but also creates market dynamics where pricing can become volatile, ultimately affecting Acer's profitability and competitive pricing strategies. For instance, the ongoing semiconductor shortage, a prime example of supply chain fragility, has impacted the entire tech industry, including Acer, throughout 2024.

The tech industry moves at lightning speed, meaning Acer's products can become outdated almost as soon as they're released. This constant need for innovation requires significant and ongoing investment in research and development to keep pace. For example, the global PC market saw a slight decline in shipments in early 2024 compared to the previous year, highlighting the pressure to adapt to evolving demands.

Furthermore, consumer tastes are always changing. A prime example is the slowing growth in the traditional PC market, which forces companies like Acer to pivot and explore new product categories or enhance existing ones with features that better align with current user needs and desires. Failure to adapt swiftly to these shifts can lead to a loss of market share and reduced profitability.

Economic Slowdowns and Currency Volatility

Economic slowdowns pose a significant threat to Acer. A downturn in global economies, particularly in key markets, can lead to reduced consumer discretionary spending, directly impacting sales volumes for electronics. This was evident in early 2025, where a projected global GDP growth slowdown to around 2.5% from earlier forecasts created headwinds for durable goods purchases.

Currency volatility presents another substantial risk. For a multinational company like Acer, significant fluctuations in foreign exchange rates can lead to substantial losses, as demonstrated by Acer's reported foreign exchange losses in Q1 2025. These losses directly erode profitability and can impact the company's financial performance, especially when dealing with multiple currencies for revenue and operational costs.

- Reduced Consumer Spending: Economic downturns typically decrease disposable income, leading consumers to postpone or cancel purchases of non-essential items like laptops and monitors.

- Supply Chain Disruptions: Global economic instability can exacerbate existing supply chain issues, leading to increased costs and potential shortages of critical components.

- Currency Exchange Losses: Acer's reliance on international sales means that unfavorable currency movements can significantly reduce the value of repatriated earnings. For instance, a strengthening US dollar against the Taiwanese dollar (Acer's home currency) can negatively impact reported profits.

- Increased Competition in Weak Markets: During economic slowdowns, price-sensitive consumers may shift to lower-cost competitors, intensifying market competition for Acer.

Dependence on Key Component Suppliers

Acer, like many in the hardware sector, faces a significant threat from its reliance on a select group of suppliers for essential components like CPUs, RAM, and screens. Disruptions from these critical vendors, or substantial price hikes, can directly hinder Acer's manufacturing output, inflate its costs, and compromise its capacity to satisfy market demand.

For instance, the global semiconductor shortage experienced through 2021-2023 significantly impacted production for many tech companies, including those in the PC market. While the situation has eased, the concentration of power among a few chip manufacturers like Intel and AMD remains a persistent vulnerability for companies like Acer.

- Supply Chain Concentration: A small number of dominant suppliers control the production of crucial components, creating a bottleneck risk.

- Price Volatility: Fluctuations in raw material costs or supplier pricing strategies can directly impact Acer's cost of goods sold.

- Geopolitical Risks: Tensions or trade disputes affecting key manufacturing regions for components can lead to supply interruptions.

Acer operates in a highly competitive market, facing intense pressure from established rivals and emerging players, which can compress profit margins. Supply chain disruptions, exacerbated by geopolitical instability and trade disputes, pose a significant risk to manufacturing and distribution, potentially increasing costs and lead times. Economic slowdowns and currency volatility further threaten Acer's performance by reducing consumer spending and impacting repatriated earnings, as seen in early 2025 with projected global GDP growth moderation.

| Threat Category | Specific Threat | Impact on Acer | Example/Data Point (2024-2025) |

|---|---|---|---|

| Market Competition | Intense rivalry from global and regional brands | Pressure on pricing, reduced market share | PC market shipments saw a slight decline in early 2024, intensifying competition. |

| Supply Chain Vulnerabilities | Geopolitical tensions, trade disputes, component shortages | Increased costs, longer lead times, production delays | Ongoing semiconductor shortages continued to affect the tech industry through 2024. |

| Economic Factors | Global economic slowdowns, reduced consumer spending | Lower sales volumes for discretionary electronics | Projected global GDP growth slowdown to ~2.5% in early 2025 impacted durable goods purchases. |

| Currency Fluctuations | Volatility in foreign exchange rates | Reduced value of repatriated earnings, profit erosion | Acer reported foreign exchange losses in Q1 2025 due to currency movements. |

SWOT Analysis Data Sources

This Acer SWOT analysis is built upon a foundation of credible data, including publicly available financial reports, comprehensive market research, and expert industry analysis to provide a robust strategic overview.