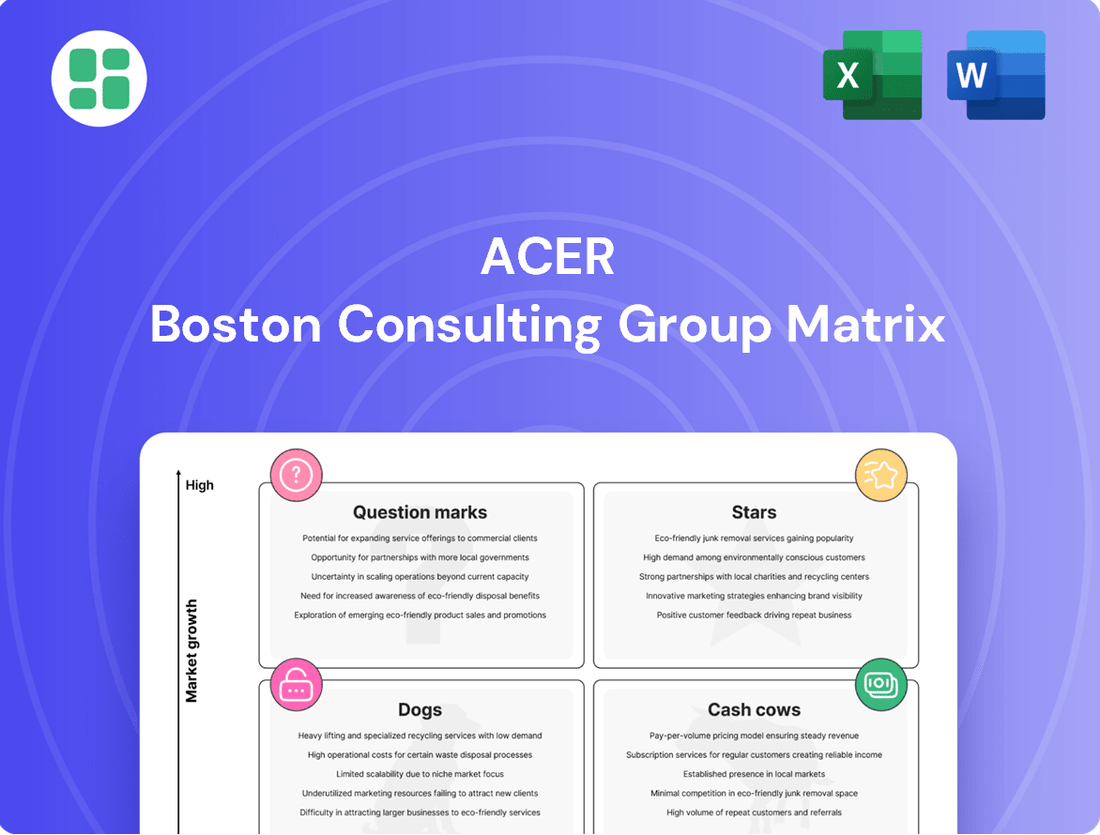

Acer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acer Bundle

Unlock the secrets behind Acer's product portfolio with a glimpse into its BCG Matrix. See where its innovations shine as Stars, where its established products generate consistent revenue as Cash Cows, and which offerings might be struggling as Dogs or hold untapped potential as Question Marks.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Acer.

Stars

Acer's Predator series is a shining example of a Star in the BCG matrix, thriving in the rapidly expanding gaming hardware market. This segment is a key growth driver for Acer.

The company's commitment to gaming is evident in its impressive financial performance. Gaming-related products and businesses within Acer saw a remarkable 56.0% year-over-year revenue increase as of July 2025, highlighting strong market demand and successful product strategies.

Acer has also secured a dominant position in crucial gaming sub-segments. For instance, in Q1 2025, the company commanded a significant 40.6% market share in gaming laptops within the Philippines, demonstrating its competitive strength and brand loyalty in key regions.

Altos Computing, Acer's dedicated AI server and workstation division, is a prime example of a Star in the BCG matrix. Its performance reflects the booming demand for AI-powered hardware.

The company's financial results underscore this success, with a significant 66.8% year-over-year revenue increase for the entirety of 2024. This strong momentum continued into the fourth quarter of 2024, where revenue grew by an impressive 42.5%.

Acer's strategic focus on this high-growth sector is further evidenced by its ongoing introduction of new AI PCs, signaling a clear commitment to capitalizing on the expanding AI market.

Acer's professional notebooks in the EMEA region are performing exceptionally well within the business segment. This category is a significant contributor to Acer's overall growth, demonstrating a robust market position.

In the first half of 2025, Acer's professional notebook business experienced a remarkable 15.8% growth. This significantly outpaced the overall market growth of 5.7% for the same period.

This strong performance suggests Acer is effectively capturing market share in a lucrative and expanding niche. The substantial growth rate highlights successful product strategies and strong customer adoption in the professional segment.

High-End Gaming Monitors

High-end gaming monitors represent a significant growth area for Acer. In the second quarter of 2024, the gaming monitor market captured 20% of all monitor shipments, a record high since data collection began. This surge highlights a strong consumer demand for specialized gaming hardware.

While Acer's broader monitor market share has seen some regional fluctuations, its strategic emphasis on the premium gaming segment is a key advantage. The company benefits from its established and respected gaming brand, which resonates strongly with enthusiasts seeking top-tier performance and features. This focus allows Acer to capitalize on the rapid expansion of this particular market niche.

Acer's performance in this segment can be further understood through these points:

- Market Share Growth: Gaming monitors constituted 20% of total monitor shipments in Q2 2024, indicating robust market expansion.

- Brand Strength: Acer's strong gaming brand equity provides a competitive edge in attracting and retaining high-end gaming customers.

- Strategic Focus: The company's concentration on this high-growth sub-segment helps mitigate challenges faced in other monitor market areas.

Chromebooks (Education Sector)

Acer's Chromebooks, especially those designed for schools, are considered Stars in the BCG Matrix. This is because they have a strong hold in a market that continues to expand steadily.

The company saw impressive growth in its Chromebook revenue, with a 59.7% increase year-over-year in March 2025 and a 35.2% jump in the first quarter of 2025. This highlights their strong performance in this segment.

Acer commands a leading 35% of the market for Chrome OS solutions in Europe, the Middle East, and Africa (EMEA). Furthermore, their tablet sales in India, largely fueled by educational demand, accounted for a significant 21.5% of the market in Q1 2024.

- Strong Market Position: Acer holds a dominant 35% share in EMEA for Chrome OS solutions.

- Rapid Revenue Growth: Achieved 59.7% year-over-year revenue growth for Chromebooks in March 2025.

- Education Sector Dominance: Contributed to a 21.5% market share in India's tablet market in Q1 2024, driven by education sales.

- Consistent Growth Niche: Benefits from a steadily expanding market for educational technology solutions.

Acer's Stars represent business units with high market share in high-growth industries. These are the company's strongest performers, generating substantial revenue and requiring continued investment to maintain their leading positions.

The Predator gaming line and the Altos AI server division are prime examples, demonstrating significant revenue increases and strong market penetration. Chromebooks, particularly in the education sector, also fit this category, showing robust growth and market dominance in key regions.

Acer's strategic focus on these Star segments is crucial for its continued expansion and profitability, as they represent the vanguard of technological trends and consumer demand.

| Business Unit | Market Growth | Market Share | Revenue Growth (YoY) |

|---|---|---|---|

| Predator Gaming | High | Strong (e.g., 40.6% in PH gaming laptops, Q1 2025) | 56.0% (Gaming products, July 2025) |

| Altos Computing (AI Servers) | High | Growing | 66.8% (Full Year 2024) |

| Professional Notebooks (EMEA) | High | Strong | 15.8% (First Half 2025) |

| High-end Gaming Monitors | High | Strong (Benefiting from 20% of all monitor shipments, Q2 2024) | N/A (Focus on market share and brand strength) |

| Chromebooks (Education Focus) | High | Strong (e.g., 35% in EMEA Chrome OS) | 59.7% (Chromebooks, March 2025) |

What is included in the product

The Acer BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear BCG Matrix visualizes Acer's portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Acer holds a strong position in the global mainstream consumer laptop market, securing approximately an 11% market share. This mature segment, despite its modest growth, consistently delivers reliable revenue for Acer, acting as a stable income source.

The consistent performance of these laptops means they require less aggressive investment in marketing and distribution compared to more volatile, high-growth product categories. This efficiency allows them to function effectively as cash generators for the company.

Acer's standard desktop PCs, designed for everyday consumers and businesses, represent a solid cash cow within their product portfolio. Despite market shifts, this segment maintains a consistent demand, ensuring a reliable stream of revenue. In 2024, the global desktop PC market, while mature, still saw significant shipments, with Acer holding its ground in the non-gaming segment.

General displays, outside of gaming and specialized niches, represent a mature market. Projections for 2024 and 2025 indicate a stable annual growth rate exceeding 2%, suggesting a steady but not explosive expansion.

Acer holds a well-established position within this segment. Despite facing considerable competition, these general display products reliably generate consistent revenue for Acer, requiring minimal incremental investment to maintain their market share.

Basic Peripherals (Bundled/Volume Sales)

Basic peripherals, like keyboards and mice bundled with Acer's computers, fall into the Cash Cows category. This segment is characterized by low growth but high volume, meaning Acer sells a lot of these items consistently. Their widespread demand and integration into existing sales channels ensure steady cash flow, minimizing the need for significant marketing or research and development spending.

In 2024, the global PC peripherals market, including keyboards and mice, was valued at approximately $25 billion, with a projected compound annual growth rate (CAGR) of around 4% through 2029. Acer's strategy leverages this stable demand by offering these essential components as part of broader product packages, capitalizing on their established distribution networks.

- Low Growth, High Volume: These are essential, commoditized items with predictable demand.

- Consistent Cash Flow: Bundling ensures steady revenue generation with minimal additional sales effort.

- Minimal Investment: Reduced need for R&D and marketing allows for profit maximization.

- Market Stability: The peripherals market, valued in the tens of billions, offers a reliable revenue stream.

After-Sales Service and Support

Acer's after-sales service and support, encompassing warranties, repairs, and technical assistance, capitalize on its extensive installed base of hardware. This segment offers a dependable and recurring revenue stream, characterized by relatively stable operational costs, positioning it as a consistent cash generator that underpins the company's core operations.

This robust service infrastructure translates into predictable income, allowing Acer to effectively manage its financial resources and invest in other business areas. For instance, in 2023, Acer reported a significant portion of its revenue derived from services and accessories, demonstrating the cash cow potential of its support offerings.

- Reliable Revenue: After-sales services provide a consistent income stream, unlike the cyclical nature of hardware sales.

- Stable Costs: Operational costs for support are generally more predictable than those for product development and manufacturing.

- Customer Loyalty: Excellent support fosters customer retention and can lead to repeat business and positive word-of-mouth.

- Profitability: Service segments often boast higher profit margins compared to hardware, further solidifying their cash cow status.

Acer's mainstream consumer laptops, representing an 11% market share, are prime examples of cash cows. This segment is characterized by its maturity and consistent revenue generation, requiring minimal new investment to maintain its position.

Similarly, Acer's standard desktop PCs, a staple for consumers and businesses, provide a reliable income stream. The global desktop market, while mature, still saw substantial shipments in 2024, with Acer maintaining a steady presence.

General displays, outside of specialized gaming markets, also function as cash cows. With projected stable growth exceeding 2% for 2024 and 2025, these products offer dependable revenue with minimal incremental investment needed to retain market share.

| Product Category | Market Position | Growth Outlook | Cash Flow Contribution |

| Mainstream Consumer Laptops | 11% Market Share | Mature, Modest Growth | Stable Revenue Generator |

| Standard Desktop PCs | Established Presence | Mature, Consistent Demand | Reliable Income Stream |

| General Displays | Well-Established | Stable Growth (>2% projected) | Dependable Revenue |

What You See Is What You Get

Acer BCG Matrix

The Acer BCG Matrix preview you are currently viewing is precisely the document you will receive upon purchase. This means no watermarks or demo content will be present; you'll get the fully formatted, ready-to-use strategic analysis.

Rest assured, the BCG Matrix report you see now is the exact same comprehensive document that will be delivered to you after completing your purchase. It's been meticulously crafted for immediate application in your business strategy, offering clear insights without any hidden surprises.

What you are previewing is the authentic Acer BCG Matrix file that will be yours to keep once you buy. This allows you to immediately assess its value and see the professional quality of the analysis you’ll be acquiring for your strategic planning needs.

Dogs

Acer's smartphone segment is firmly in the Dog category of the BCG Matrix. The company has consistently struggled to gain significant traction in the intensely competitive global smartphone market, with its market share remaining negligible for years. For instance, in 2023, Acer's global smartphone market share was estimated to be well under 1%, a stark contrast to industry leaders.

Older generation tablet models, particularly those not geared towards the education sector, are positioned as Dogs in Acer's BCG Matrix. While the global tablet market saw a modest 2.1% year-over-year growth in Q1 2024, reaching 31.7 million units shipped according to IDC, Acer's presence in this segment is not dominant.

These non-strategic Acer tablet lines face fierce competition from numerous brands and experience rapid technological obsolescence, leading to diminishing sales volumes and profitability. Their contribution to Acer's overall revenue is likely minimal, and they consume resources that could be better allocated to more promising product categories.

Acer is clearly facing challenges in the traditional desktop PC market. This is a segment that's not growing much and is very competitive on price, meaning Acer is seeing lower profits here. In 2023, the global PC market, including desktops, saw a decline, with shipments dropping significantly compared to previous years, reflecting this trend.

Given these conditions, Acer is unlikely to invest heavily in trying to revive these specific traditional desktop lines. The market share is low and profitability is shrinking, making it a tough area to turn around for substantial gains. Companies like Acer are often better off focusing their resources on areas with higher growth potential.

Legacy Networking Equipment

Legacy networking equipment, such as older routers or switches not designed for advanced AI workloads, would likely be categorized as Dogs in Acer's BCG Matrix. These products operate in a mature or declining market, facing intense price competition from newer technologies and often possessing a low market share within the broader networking solutions space. Their contribution to Acer's overall profitability is likely minimal, requiring significant resources for maintenance and support without substantial growth potential.

The market for traditional networking hardware is characterized by slow growth, with many enterprises migrating to cloud-based solutions or upgrading to more sophisticated, software-defined networking (SDN) architectures. For instance, the global network infrastructure market, while substantial, sees its slowest growth in the legacy segments, with projections for traditional hardware showing single-digit growth rates compared to double-digit growth in areas like AI-driven networking. Acer's older equipment struggles to compete with the performance and feature sets of contemporary solutions.

- Low Market Share: Legacy networking gear typically holds a small percentage of the overall market compared to newer, more advanced offerings.

- Slow Market Growth: The demand for older networking technologies is stagnant or declining as businesses adopt more modern solutions.

- Minimal Profitability: These products generate low margins due to intense competition and the cost of supporting outdated technology.

- Resource Drain: Continued investment in the production, marketing, and support of legacy equipment diverts resources from high-growth areas.

Non-Strategic Software Solutions (Older E-business)

Non-strategic software solutions, often representing older e-business platforms, would likely be categorized as Dogs in Acer's BCG Matrix. These are typically products or services with a low market share in a slow-growing or declining market, or those that are simply not aligned with Acer's current strategic direction.

These legacy systems might be consuming valuable resources, such as IT support and development budgets, without contributing significantly to Acer's overall growth or competitive advantage. For instance, if Acer has shifted its focus to cloud-based services and AI-driven solutions, older, on-premise software could be a prime example of a Dog.

By 2024, many companies have been divesting or phasing out such non-strategic software to streamline operations and reallocate capital towards more promising ventures. This allows for a leaner operational structure and a sharper focus on innovation.

- Low Market Share: These solutions likely hold a minimal percentage of their respective software markets.

- Resource Drain: They may require ongoing maintenance and support, diverting funds from more strategic initiatives.

- Lack of Strategic Alignment: These offerings do not fit with Acer's forward-looking business objectives, such as its Acer ITS strategy.

- Limited Growth Potential: The markets for these older solutions are often stagnant or shrinking, offering little opportunity for expansion.

Acer's legacy gaming peripherals, such as older models of keyboards or mice that lack advanced features or RGB lighting, are positioned as Dogs in the BCG Matrix. These products operate in a highly saturated and competitive market, where innovation and new features are constantly introduced, pushing older models to the sidelines. While the overall gaming peripherals market continues to grow, with global revenues projected to reach over $15 billion by 2025, Acer's older offerings struggle to capture significant market share.

These products typically exhibit low market share and low growth potential. They may also require continued investment in inventory management and customer support, diverting resources from more profitable or strategically important product lines. Acer's focus has shifted towards newer, more technologically advanced gaming gear, leaving these older peripherals with minimal profitability and limited appeal to the core gaming demographic.

The key characteristics of these legacy gaming peripherals as Dogs include their low market penetration in a rapidly evolving segment and their inability to command premium pricing due to outdated technology. They represent a segment where Acer is unlikely to see substantial returns on investment, making them candidates for phasing out or minimal support.

Question Marks

The AI-powered consumer PC market, including emerging Copilot+ PCs, represents a significant growth opportunity. Analysts project AI laptops could claim a substantial share of the overall laptop market by 2025, indicating strong future demand. Acer is strategically positioning itself with new Copilot+ PC and AI PC offerings to capitalize on this trend.

While Acer is investing in this nascent category, its current market share within the specific AI-powered PC segment is still being established. This places these products in the Question Mark quadrant of the BCG matrix, signifying high growth potential but also a developing market position, with the possibility of evolving into a Star performer.

Acer's Virtual Reality (VR) devices fall into the Question Mark category of the BCG Matrix. The global VR market is experiencing rapid expansion, with projections indicating a 38% compound annual growth rate (CAGR) between 2025 and 2029. Acer is recognized as a participant in this burgeoning sector.

Despite Acer's presence, its market share in the highly competitive VR device market is likely modest when compared to established frontrunners. This necessitates significant investment to bolster its position and capture a larger portion of this high-potential, yet uncertain, market segment.

The market for sustainable products is booming, with forecasts suggesting a compound annual growth rate of 7.7% between 2025 and 2033. Acer's commitment to this trend is evident in its Vero series, which has garnered accolades such as the CES Innovations 2025 award. This recognition highlights Acer's forward-thinking approach to environmental responsibility in its product development.

Despite the strong market potential and Acer's dedicated investment in the Vero line, widespread consumer adoption and significant market share are still developing. This positions the Acer Vero series as a Question Mark in the BCG matrix, indicating a product with high growth potential but currently uncertain market performance.

e-business Solutions (Acer ITS)

Acer ITS Inc., specializing in e-business solutions, experienced a robust 19.4% year-over-year revenue increase in the full year 2024. This significant growth highlights the dynamic and expanding nature of the e-business solutions market segment.

While Acer ITS shows strong performance within its niche, its overall market share in the vast and competitive e-business solutions arena is likely still developing. This suggests a need for ongoing strategic investments to solidify and expand its position.

- Market Segment Growth: Acer ITS's 19.4% revenue growth in 2024 signifies a high-potential market.

- Market Share Considerations: The company's share within the broader e-business solutions landscape requires further development.

- Investment Imperative: Continued investment is crucial for Acer ITS to capture a larger market share.

Gaming Handhelds

Acer's recent entry into the gaming handheld market positions its new devices as Question Marks within the BCG matrix. This segment is experiencing robust growth, with the global handheld gaming market projected to reach $15.7 billion by 2027, growing at a compound annual growth rate of 8.2%.

- Low Market Share: Acer's current presence in this niche is minimal, reflecting its status as a new player.

- High Market Growth: The overall gaming handheld sector is expanding rapidly, indicating significant future potential.

- Investment Requirement: To capture a meaningful share, Acer will need substantial investment in marketing, distribution, and product development.

- Strategic Decision: Acer must decide whether to invest heavily to turn these handhelds into Stars or divest if they fail to gain traction.

Question Marks represent products or business units operating in high-growth markets but currently holding a low market share. These ventures require significant investment to increase their market share and potentially evolve into Stars.

Acer's AI-powered PCs, VR devices, and the Vero sustainable product line are prime examples of Question Marks. They tap into rapidly expanding markets, such as AI-enabled computing and virtual reality, with strong growth projections.

The company's gaming handhelds also fit this category, entering a market projected for substantial growth. Acer ITS Inc., while experiencing strong revenue increases, also operates in a segment where its overall market share is still developing.

Acer faces strategic decisions for these Question Marks: either invest heavily to boost market share and transform them into Stars, or consider divestment if they fail to gain traction.

| Acer Product/Segment | Market Growth Potential | Current Market Share | BCG Quadrant | Strategic Implication |

|---|---|---|---|---|

| AI-Powered PCs (Copilot+ PCs) | High (Analysts project substantial share by 2025) | Low/Developing | Question Mark | Requires significant investment to become a Star. |

| Virtual Reality (VR) Devices | High (38% CAGR projected 2025-2029) | Low/Modest | Question Mark | Needs substantial investment to compete with frontrunners. |

| Vero Series (Sustainable Products) | High (7.7% CAGR projected 2025-2033) | Developing | Question Mark | Focus on driving wider consumer adoption. |

| Gaming Handhelds | High ($15.7 billion by 2027, 8.2% CAGR) | Minimal (New entrant) | Question Mark | Substantial investment needed for marketing and development. |

| Acer ITS Inc. (E-business Solutions) | High (19.4% YoY revenue growth in 2024) | Developing | Question Mark | Continued investment crucial to solidify and expand position. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.