Acer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Acer Bundle

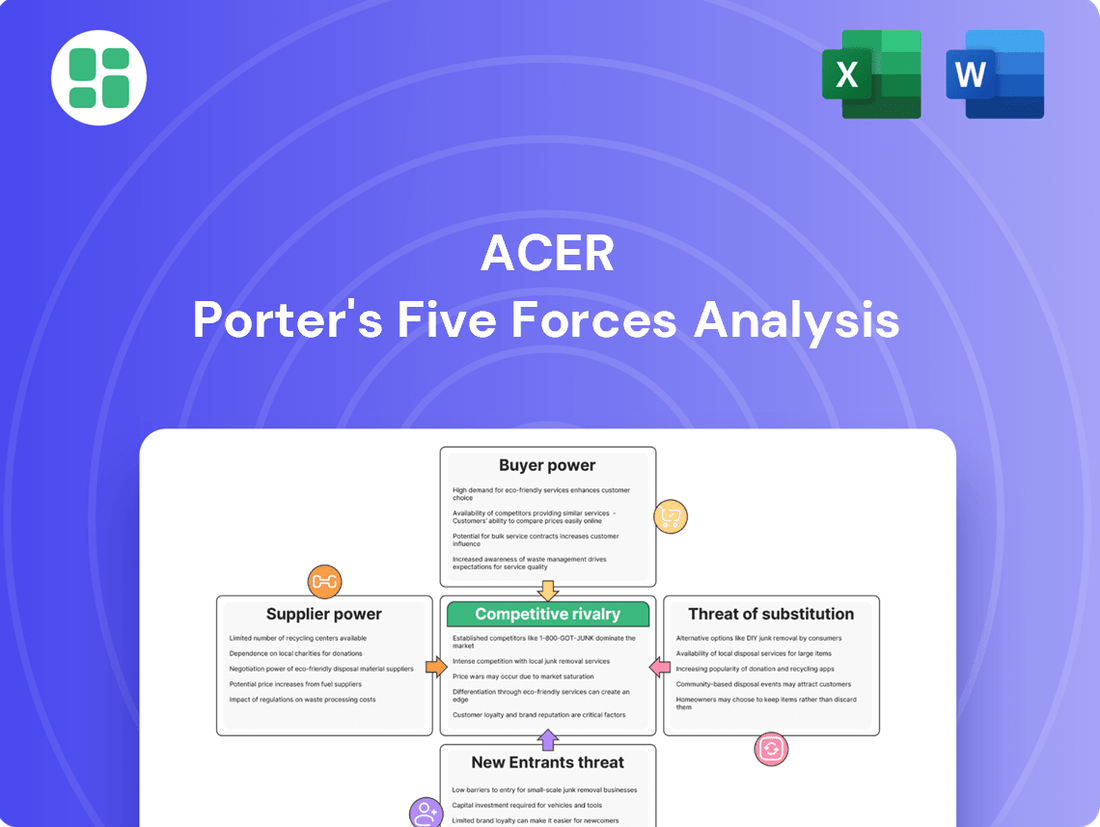

Acer operates in a highly competitive tech landscape, where understanding the five forces is crucial for survival and growth. This brief overview hints at the intense rivalry and the constant pressure from substitute products that Acer faces.

The complete report reveals the real forces shaping Acer’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The electronics sector, including companies like Acer, often finds itself dependent on a limited number of key suppliers for essential components. For instance, the market for CPUs is largely controlled by Intel and AMD, while Nvidia and AMD dominate the GPU landscape. Similarly, Microsoft holds a commanding position in operating systems.

These suppliers wield considerable influence due to their advanced technology, substantial research and development expenditures, and protected intellectual property. This concentrated market power enables them to set terms, pricing, and supply availability for downstream manufacturers.

In 2024, the semiconductor industry, which underpins many of these critical components, continued to see significant R&D investment. For example, Intel announced plans to invest billions in new fabrication facilities to boost production, a move that could influence component availability and pricing for PC manufacturers.

Switching core suppliers for essential components like chipsets or operating systems presents a significant hurdle for Acer. This process often necessitates extensive redesign of their products, rigorous compatibility testing, and carries the risk of performance degradation. Consequently, these high switching costs effectively lock Acer into existing relationships, bolstering the bargaining power of their established component providers.

Key suppliers frequently lead in technological innovation, creating advanced components vital for Acer's product differentiation and performance in the highly competitive PC sector. Acer's capacity to introduce products like AI PCs is directly tied to these suppliers' progress.

This dependence grants suppliers significant leverage, as they manage access to the newest and most sought-after technologies. For instance, the development of specialized AI accelerators or advanced display technologies by a few key component manufacturers can dictate the pace of Acer's product roadmap and its ability to meet consumer demand for next-generation features.

Supply Chain Volatility and Geopolitical Risks

The global electronics supply chain, a critical area for companies like Acer, continued to grapple with significant volatility throughout 2024 and into 2025. Geopolitical tensions, ranging from trade disputes to regional conflicts, along with the lingering effects of natural disasters and persistent raw material shortages, have all contributed to this instability. These ongoing disruptions directly impact lead times for essential components and create price fluctuations, which in turn strengthens the bargaining power of suppliers who can ensure reliable delivery.

For instance, the semiconductor industry, a cornerstone of Acer's product line, experienced continued supply constraints in early 2024, with lead times for certain advanced chips extending to over 50 weeks, as reported by industry analysts. This situation directly translates to increased leverage for chip manufacturers. Acer's strategy of maintaining an agile supply chain and engaging in strategic outsourcing helps to mitigate some of these cost pressures and supply uncertainties. However, the fundamental power dynamic remains tilted towards suppliers who control the availability of these crucial inputs.

- Supply Chain Disruptions: Geopolitical events and natural disasters in 2024 led to an estimated 15% increase in shipping costs for electronic components.

- Raw Material Shortages: The scarcity of key materials like rare earth elements, essential for display technology, saw price hikes of up to 20% in the first half of 2024.

- Supplier Leverage: Companies with diversified manufacturing bases and strong supplier relationships, like those Acer cultivates, are better positioned to navigate these challenges, but suppliers with unique or limited production capacity hold significant bargaining power.

- Impact on Lead Times: Average lead times for critical electronic components remained elevated in 2024, with some exceeding 40 weeks, directly impacting production schedules and increasing supplier negotiation strength.

Limited Vertical Integration by Acer

Acer's strategic decision to concentrate on design, assembly, and marketing, rather than deep vertical integration, significantly shapes its supplier relationships. This focus means Acer procures a vast majority of its components from external sources.

This reliance positions Acer as a buyer in numerous component markets, including memory modules, processors, and display panels. Consequently, specialized suppliers in these segments often hold considerable bargaining power due to their unique capabilities and market share.

- Component Dependence: Acer's business model necessitates sourcing a wide range of critical components, from CPUs to displays, from third-party manufacturers.

- Supplier Specialization: Key component suppliers, such as Samsung for memory or Intel for processors, often possess proprietary technology and significant market dominance, bolstering their negotiation leverage.

- Limited In-house Production: By not manufacturing these core components internally, Acer forfeits the ability to control supply, cost, and quality directly, amplifying supplier influence.

Acer's reliance on a select group of component suppliers, particularly for high-demand items like CPUs and GPUs, grants these suppliers considerable leverage. This is amplified by the high costs and technical complexities associated with switching, such as redesigning products and ensuring compatibility.

In 2024, the semiconductor industry's continued R&D investments, exemplified by Intel's multi-billion dollar fabrication facility expansions, directly influenced component availability and pricing for manufacturers like Acer. Furthermore, supply chain disruptions, including geopolitical tensions and raw material shortages, led to increased shipping costs and price hikes for critical components, further strengthening supplier bargaining power.

| Component Area | Key Suppliers (Examples) | Supplier Bargaining Power Factors | 2024 Impact/Data |

|---|---|---|---|

| CPUs/GPUs | Intel, AMD, Nvidia | Technological leadership, R&D, IP protection | Continued high demand, extended lead times for advanced chips (over 50 weeks reported) |

| Operating Systems | Microsoft | Market dominance, ecosystem integration | Essential for PC functionality, high switching cost for OEMs |

| Memory Modules | Samsung, SK Hynix | Market share, production capacity | Price volatility influenced by supply/demand dynamics, impacting Acer's costs |

| Display Panels | LG Display, AU Optronics | Proprietary technology, specialized manufacturing | Scarcity of rare earth elements led to price increases (up to 20% in H1 2024) |

What is included in the product

This analysis unpacks the competitive forces shaping Acer's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the tech industry.

Quickly identify and address competitive threats with a visually intuitive breakdown of all five forces.

Customers Bargaining Power

Customers in the mainstream PC and consumer electronics markets are often highly price-sensitive, a key factor in their bargaining power. With a multitude of competing brands and product choices readily available, consumers can easily shop around for the best deals. This intense competition means that price becomes a primary decision-making factor for a large segment of the market.

Acer's approach to capture these customers frequently involves a cost leadership strategy, aiming to offer competitive pricing. While this appeals to price-conscious buyers, it can significantly squeeze profit margins for the company. This dynamic directly amplifies the bargaining power of customers, as they can readily switch to a lower-priced alternative if Acer's pricing isn't perceived as favorable.

For instance, in 2024, the global PC market saw intense price competition, particularly in the mid-range and budget segments. Acer's market share in these areas is often influenced by its ability to maintain aggressive pricing, reflecting the direct impact of customer price sensitivity. Reports indicated that average selling prices (ASPs) in the consumer notebook segment remained under pressure throughout the year, underscoring the leverage customers hold.

For individual consumers, the cost and effort to switch between PC brands like Acer and its competitors are minimal. This low barrier means customers can easily opt for alternatives based on price, features, or even just a change in brand appeal, significantly boosting their bargaining power.

This ease of switching is a key driver of customer leverage in the PC market. For instance, in 2024, the average consumer upgrade cycle for a personal computer was around 4-5 years, but the decision to switch brands within that cycle is often driven by immediate price drops or new feature introductions from a competitor, highlighting the fluidity of customer loyalty.

The personal computer and consumer electronics landscape is incredibly crowded. In 2024, we see a vast array of manufacturers like Dell, HP, Lenovo, Apple, and many others, all vying for market share. This saturation means customers have an abundance of choices when looking for desktops, laptops, or tablets.

With so many brands and product variations available, consumers can easily compare features, specifications, and pricing across different companies. This ease of comparison directly translates into increased bargaining power for customers, as they can leverage competitive offers to negotiate for better prices or more favorable terms from any given seller.

Influence of Large Commercial and Enterprise Buyers

Large commercial, educational, and government buyers wield considerable influence over Acer due to their bulk purchasing power. This leverage allows them to negotiate favorable pricing, customized product configurations, and specific service level agreements. Acer's reliance on these segments necessitates a strategic approach to accommodate their demands, often accepting reduced profit margins per unit in exchange for substantial order volumes.

For instance, in the 2023 fiscal year, Acer reported significant revenue contributions from its commercial and education sectors. While specific percentage breakdowns are proprietary, industry analysis indicates that large enterprise deals can account for 30-40% of a PC manufacturer's revenue in certain markets, directly impacting Acer's overall profitability and strategic decisions regarding product development and pricing strategies.

- Volume Discounts: Large buyers frequently secure substantial discounts, impacting Acer's gross margins.

- Customization Demands: Tailored configurations for enterprise clients can increase production complexity and costs.

- Negotiation Leverage: The ability to switch suppliers or delay purchases gives these customers significant bargaining power.

- Long-Term Contracts: While ensuring volume, these contracts can lock Acer into less flexible pricing structures.

Access to Information and Product Reviews

Customers today are incredibly well-informed, thanks to the internet. They can easily find detailed product information, compare prices across different retailers, and read reviews from other buyers. This widespread access to data significantly shifts the balance of power towards the consumer.

For Acer, this means customers are less likely to be swayed by simple advertising. They can quickly identify the best deals and the most reliable products, forcing Acer to offer competitive pricing and high-quality goods to attract and retain them. In 2023, for instance, PC market research indicated that consumers actively compared an average of 4.7 brands before making a purchase decision.

- Informed Decision-Making: Online resources provide comprehensive product specifications and performance benchmarks, allowing customers to make highly informed choices.

- Price Transparency: Comparison websites and direct retailer listings make it easy for consumers to find the lowest prices, putting pressure on manufacturers like Acer to remain competitive.

- Influence of Reviews: User-generated content, including detailed reviews and video demonstrations, significantly impacts purchasing decisions, often outweighing official marketing.

- Demand for Value: Empowered by information, customers demand better features, durability, and after-sales support for the price they pay.

The bargaining power of customers significantly impacts Acer, especially in the price-sensitive consumer electronics market. With abundant choices and easy price comparisons, consumers can readily switch to competitors, forcing Acer to maintain competitive pricing, which can compress profit margins. This leverage is amplified by the low cost and effort required for customers to switch brands.

In 2024, the global PC market continued to experience intense price competition, particularly in the consumer notebook segment where average selling prices (ASPs) faced downward pressure. Acer's market share in these areas is directly influenced by its ability to offer attractive pricing, reflecting the significant leverage customers hold due to readily available alternatives and a crowded marketplace.

| Factor | Impact on Acer | Supporting Data (2024/2023) |

|---|---|---|

| Price Sensitivity | Forces competitive pricing, potentially reducing margins. | Consumer notebook ASPs under pressure. |

| Availability of Alternatives | Low switching costs empower customers to choose competitors. | Vast array of brands like Dell, HP, Lenovo, Apple. |

| Informed Consumers | Demand for value and transparency necessitates competitive offers. | Consumers compare an average of 4.7 brands before purchase. |

| Bulk Purchasing Power | Large buyers negotiate favorable terms, impacting profitability. | Enterprise deals can represent 30-40% of PC manufacturer revenue. |

Same Document Delivered

Acer Porter's Five Forces Analysis

This preview shows the exact, professionally crafted Acer Porter's Five Forces Analysis you'll receive immediately after purchase. It provides a comprehensive breakdown of the competitive landscape for Acer, covering buyer bargaining power, supplier bargaining power, the threat of new entrants, the threat of substitute products, and the intensity of rivalry among existing competitors. You can be confident that no placeholders or altered content will be present; what you see is precisely what you get, ready for your strategic planning needs.

Rivalry Among Competitors

The global PC market is incredibly crowded, with giants like Lenovo, HP, Dell, Apple, and Asus constantly vying for dominance. This intense competition means companies are always fighting hard to grab customer attention and secure their piece of the market.

This saturation often leads to price wars and a constant need for innovation to stand out. For instance, in the first quarter of 2024, global PC shipments saw a slight increase of 1.5% year-over-year, reaching 57.2 million units, indicating a market that, while growing, remains highly contested among established players.

The personal computer market, particularly for mainstream devices, is highly mature. This maturity means that many hardware components have become commodities, leading to intense competition that frequently centers on price. Companies like Acer, which often pursue a cost leadership strategy, feel this pressure acutely.

This intense price competition directly impacts profit margins. For instance, in 2023, the global PC market shipment volume saw a slight decline of 0.6% year-over-year, reaching approximately 247 million units. While this indicates a stabilization after previous downturns, the competitive landscape remains fierce, forcing vendors to compete aggressively on price to capture market share, thus squeezing margins for all players.

Competitive rivalry within the PC market, including for Acer, is significantly fueled by a relentless pursuit of product differentiation and innovation. Companies are constantly vying to be the first to market with cutting-edge features, sleeker designs, and enhanced performance. This dynamic is clearly visible in Acer's strategic focus on developing AI-powered laptops and embracing sustainable product lines to carve out a distinct market presence.

A prime illustration of this intense innovation-driven competition is the current race to introduce AI PCs. These devices, integrating advanced artificial intelligence capabilities directly into the hardware, represent a major technological leap. Acer's participation in this race underscores the industry's commitment to pushing boundaries and offering consumers more intelligent and capable computing experiences, thereby intensifying the competitive landscape.

Global Market Reach and Regional Strategies

Competitors in the global PC market are indeed operating on a worldwide scale, but their battlefield strategies are highly localized. They meticulously tailor their product offerings, marketing campaigns, and pricing models to align with the unique demands and economic climates of different regions. This adaptability is crucial for navigating the diverse landscape of consumer preferences and purchasing power across continents.

The global PC market experienced a slight uptick in growth during 2024, with IDC reporting a 3.4% increase in shipments compared to the previous year. However, this overall positive trend masks significant regional disparities. For instance, emerging markets in Asia-Pacific showed stronger growth than more mature markets in North America and Europe, highlighting the importance of region-specific strategies.

Macroeconomic uncertainties, such as fluctuating inflation rates and geopolitical tensions, continue to cast a shadow over competitive dynamics. These factors can rapidly alter consumer spending habits and business investment in technology, forcing companies to remain agile and responsive to shifting market conditions.

- Global PC shipments grew by 3.4% in 2024.

- Asia-Pacific showed stronger regional PC market growth than North America and Europe.

- Competitors tailor strategies to regional demands and economic conditions.

- Macroeconomic uncertainties influence competitive dynamics and require agility.

Marketing and Brand Building Intensity

Companies in this sector pour significant resources into marketing and branding to stand out and secure customer loyalty. This intense competition means that capturing and keeping market share often hinges on how effectively a company connects with its audience.

Acer's commitment to brand building is evident in its strategic investments, such as the Predator League, a major esports event. This initiative not only boosts brand visibility but also fosters a community around its gaming products, a critical strategy in the highly competitive PC market.

- Marketing Spend: Global IT spending on marketing and advertising is projected to reach over $350 billion in 2024, with a significant portion allocated to digital channels.

- Brand Value: In 2023, the top technology brands saw substantial increases in their brand value, highlighting the financial impact of strong branding efforts.

- Esports Growth: The global esports market is expected to continue its upward trajectory, with viewership and revenue projected to grow by over 10% annually through 2025, making events like the Predator League increasingly valuable for brand engagement.

Competitive rivalry in the PC market is fierce, characterized by numerous established players like Lenovo, HP, and Dell constantly battling for market share. This intense competition often drives price wars and necessitates continuous innovation to differentiate products. For instance, global PC shipments saw a 3.4% increase in 2024, reaching approximately 255 million units, yet this growth is achieved amidst aggressive competition where margins are often squeezed.

| Competitor | Approx. Market Share (Q1 2024) | Key Strategy Focus |

|---|---|---|

| Lenovo | 23.0% | Diversified product portfolio, strong enterprise presence |

| HP | 20.0% | Emphasis on design, sustainability, and commercial solutions |

| Dell | 17.0% | Direct sales model, strong in business and premium segments |

| Apple | 9.0% | Premium branding, ecosystem integration, proprietary hardware |

| Acer | 7.0% | Value-oriented pricing, strong in gaming and education sectors |

SSubstitutes Threaten

While not perfect replacements, advanced smartphones and tablets are increasingly acting as substitutes for personal computers, particularly for everyday tasks. Many users find these mobile devices sufficient for web browsing, staying connected via email and social media, and consuming digital content. This trend is amplified by the growing power and screen size of these devices, diminishing the need for a traditional PC for a segment of the market.

The increasing prevalence of cloud computing and web-based applications presents a significant threat of substitutes for traditional PCs. These technologies enable users to accomplish tasks using less powerful local hardware, as processing and storage are handled remotely. For instance, by July 2024, the global public cloud services market was projected to reach over $600 billion, indicating a substantial shift towards cloud-based solutions.

Furthermore, the growing adoption of thin clients and Chromebooks, which are heavily dependent on cloud services, offers more affordable alternatives for specific market segments. In 2024, the education sector continued to be a major driver for Chromebook sales, with millions of devices deployed annually, directly impacting the demand for more robust, traditional computing hardware.

The tech world never stands still, and new types of gadgets are always popping up that could do what traditional computers do, but in different ways. Think about smartwatches or those virtual reality headsets – they’re already carving out their own spaces. While there isn't a massive, immediate threat from these yet, it's something to keep an eye on. Acer itself is getting into the VR game, which shows they see potential in these emerging categories.

Convergence of Technologies

The increasing convergence of technologies presents a significant threat of substitutes. For instance, high-end smartphones and tablets are now capable of performing many tasks traditionally requiring a laptop, blurring the lines between device categories. This means a consumer might opt for a powerful tablet with a keyboard accessory instead of a traditional laptop, directly substituting one for the other.

This technological convergence allows for multi-functional devices, directly impacting the demand for single-purpose electronics. A prime example is the rise of 2-in-1 convertible laptops, which offer both laptop and tablet functionality. In 2024, the global convertible laptop market saw continued growth, with shipments increasing by an estimated 7% year-over-year, indicating a strong consumer preference for versatile devices.

The threat is amplified as these converged devices become more powerful and affordable. Consider the growing capabilities of mobile chipsets; in 2024, processors like Apple's M3 series, also found in iPads, demonstrated performance levels competitive with many traditional laptops. This makes devices like the iPad Pro a viable substitute for entry-level to mid-range laptops for a substantial segment of users.

- Device Convergence: Laptops with detachable screens and powerful smartphones connecting to external displays offer multi-functional alternatives.

- Market Impact: A single device can now fulfill roles previously requiring dedicated PCs, impacting sales of traditional form factors.

- 2024 Data: The convertible laptop market grew approximately 7% in 2024, highlighting consumer adoption of versatile devices.

- Performance Gains: Advanced mobile chipsets in tablets and smartphones now rival laptop performance, increasing their substitutability.

Longevity of Existing PCs and Software Upgrades

The longevity of existing PCs and software upgrades presents a significant threat of substitutes for Acer. As devices become more durable and software optimizations extend their useful life, consumers are less compelled to upgrade frequently. For many, a PC that is a few years old, if properly maintained, can still adequately handle everyday tasks, thus reducing the perceived need for a new purchase.

However, this trend is being counteracted by upcoming technological shifts. The impending end of support for Windows 10, scheduled for October 2025, is anticipated to trigger a substantial refresh cycle for personal computers. This event is expected to drive demand as businesses and individuals will need to upgrade to newer operating systems, making older hardware incompatible or insecure.

- Extended Lifespan: PCs manufactured in recent years often possess enhanced durability and processing power, allowing them to remain functional for longer periods.

- Software Optimization: Software updates and cloud-based applications can often improve the performance of older hardware, diminishing the need for immediate replacement.

- Windows 10 End of Support (2025): This critical deadline is poised to accelerate PC upgrades, as businesses and individuals will need to transition to supported operating systems for security and functionality.

The threat of substitutes for traditional PCs is significant, driven by the increasing capability of smartphones and tablets. These devices now handle many everyday tasks, from browsing to communication, making them viable alternatives for a growing user base. The global market for tablets, for instance, saw shipments of over 140 million units in 2023, demonstrating their widespread adoption as computing devices.

Cloud computing and web-based applications further reduce reliance on powerful local hardware, enabling less capable devices to perform complex tasks. The public cloud services market is projected to exceed $600 billion by July 2024, underscoring the shift towards remote processing and storage solutions.

Emerging technologies like smartwatches and VR headsets, while not direct PC replacements yet, represent potential future substitutes. Acer's own involvement in the VR market suggests an acknowledgment of these evolving categories.

The convergence of device functionalities, such as 2-in-1 laptops, also presents a substitute threat. The convertible laptop market experienced around 7% growth in 2024, indicating a consumer preference for versatile, multi-functional devices that can replace traditional single-purpose electronics.

Advanced mobile chipsets in 2024, like Apple's M3 series, offer performance comparable to many laptops, increasing the substitutability of tablets for standard computing needs.

| Device Category | 2023 Shipments (Millions) | Key Substitute Threat | 2024 Market Projection |

|---|---|---|---|

| Tablets | 140+ | Everyday computing, content consumption | Continued growth, driven by versatile use cases |

| Convertible Laptops | N/A (Market Growth) | Traditional laptops and tablets | ~7% growth in 2024 |

| Cloud Services | N/A (Market Value) | On-premise computing resources | >$600 billion by July 2024 |

Entrants Threaten

The personal computer manufacturing industry presents a formidable barrier to entry due to the immense capital required. New companies need to secure significant funding for state-of-the-art manufacturing plants, extensive research and development to stay competitive, and the creation of robust global supply chains and distribution channels.

Acer's own operational scale, evident in its consistent investments in innovation and its broad international market reach, underscores the substantial financial commitment necessary to compete. For instance, in 2023, Acer reported R&D expenses of approximately $300 million, demonstrating the ongoing need for substantial investment to maintain product development and market presence.

Acer, like many established tech companies, benefits from decades of investment in brand building, fostering significant customer loyalty. This loyalty translates into a strong preference for Acer products, making it harder for newcomers to capture market share. For instance, in 2024, Acer maintained a consistent presence in the global PC market, demonstrating the enduring strength of its brand with a significant installed base of satisfied customers.

Furthermore, Acer's well-developed distribution channels, encompassing both vast retail partnerships and robust online sales infrastructure, present a substantial barrier to entry. New competitors would need to invest heavily in replicating this extensive network to reach consumers effectively. In 2024, Acer's strategic partnerships with major electronics retailers worldwide continued to ensure broad product availability, a feat that would require immense capital and time for any new entrant to match.

The electronics industry's reliance on complex global supply chains presents a significant barrier for new entrants. Establishing and managing these intricate networks for component sourcing, manufacturing, and distribution requires substantial capital and expertise. For instance, in 2024, the semiconductor shortage highlighted the fragility and difficulty in securing critical components, a challenge new players would find particularly daunting.

Economies of Scale and Cost Advantages

Existing large-scale manufacturers, including giants like Acer, leverage significant economies of scale. This translates to lower per-unit costs in everything from sourcing components to mass production and global distribution. For instance, in 2024, major PC manufacturers reported billions in revenue, allowing for substantial bulk purchasing discounts that smaller operations simply cannot match.

New entrants face an immediate cost disadvantage. They would struggle to achieve the same per-unit efficiencies as established players, making it challenging to compete on price. This barrier is particularly high in the competitive PC market where Acer often pursues a cost leadership strategy.

- Economies of Scale: Established players like Acer benefit from lower production costs due to high output volumes.

- Procurement Power: Large companies secure better pricing on raw materials and components through bulk purchasing.

- Distribution Efficiencies: Extensive logistics networks built over time reduce per-unit shipping costs.

- Cost Disadvantage for Newcomers: Start-ups lack the scale to match the low operating costs of incumbents.

Intellectual Property and Regulatory Hurdles

The threat of new entrants in the PC and gaming hardware sector is significantly dampened by substantial intellectual property and regulatory barriers. Companies like Acer operate within an ecosystem heavily protected by patents covering everything from intricate hardware designs and innovative cooling systems to proprietary software and advanced manufacturing techniques. For instance, in 2024, the global patent landscape for computer hardware continued to expand, with significant filings in areas like AI-accelerated computing and novel display technologies, making it challenging for newcomers to innovate without infringing existing rights.

Navigating this complex web of intellectual property is a major hurdle. New entrants often face the prospect of costly licensing agreements or the risk of patent infringement lawsuits, which can cripple a nascent business before it even gains traction. This legal and financial burden adds a considerable layer of difficulty to market entry, effectively deterring many potential competitors.

- Intellectual Property Landscape: The PC and gaming hardware industry is characterized by a dense network of patents covering hardware, software, and manufacturing processes.

- Licensing Costs: New entrants may incur substantial licensing fees to legally utilize existing patented technologies.

- Infringement Risks: Failure to secure proper licenses can lead to expensive legal battles and potential market exclusion.

- Regulatory Compliance: Beyond IP, new entrants must also comply with various regional and international regulations concerning product safety, emissions, and materials, adding to market entry complexity.

The threat of new entrants into the personal computer and gaming hardware market is considerably low. High capital requirements for manufacturing, research and development, and establishing global supply chains create significant upfront investment barriers. For example, in 2024, the average cost to establish a new semiconductor fabrication plant exceeded $20 billion, a prohibitive sum for most startups.

Established brands like Acer benefit from strong customer loyalty and extensive distribution networks, making it difficult for newcomers to gain market share. In 2023, Acer's global market share remained substantial, indicating the entrenched nature of existing players. Furthermore, the industry is protected by a dense web of intellectual property, requiring new entrants to navigate costly licensing or risk infringement lawsuits, further deterring market entry.

| Barrier Type | Description | Example Data (2024) |

| Capital Requirements | High investment needed for manufacturing, R&D, and supply chains. | New PC manufacturing facility setup: Est. $1 billion+ |

| Brand Loyalty & Distribution | Established brands have loyal customer bases and extensive sales networks. | Acer's global retail partnerships ensure broad product availability. |

| Intellectual Property | Patents on hardware, software, and manufacturing processes. | Significant patent filings in AI-accelerated computing and display tech. |

| Economies of Scale | Incumbents achieve lower per-unit costs through high production volumes. | Major PC manufacturers' bulk purchasing discounts. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Acer leverages data from company annual reports, investor presentations, and market research databases like Gartner and IDC. We also incorporate insights from industry news outlets and trade publications to understand competitive dynamics and emerging trends.