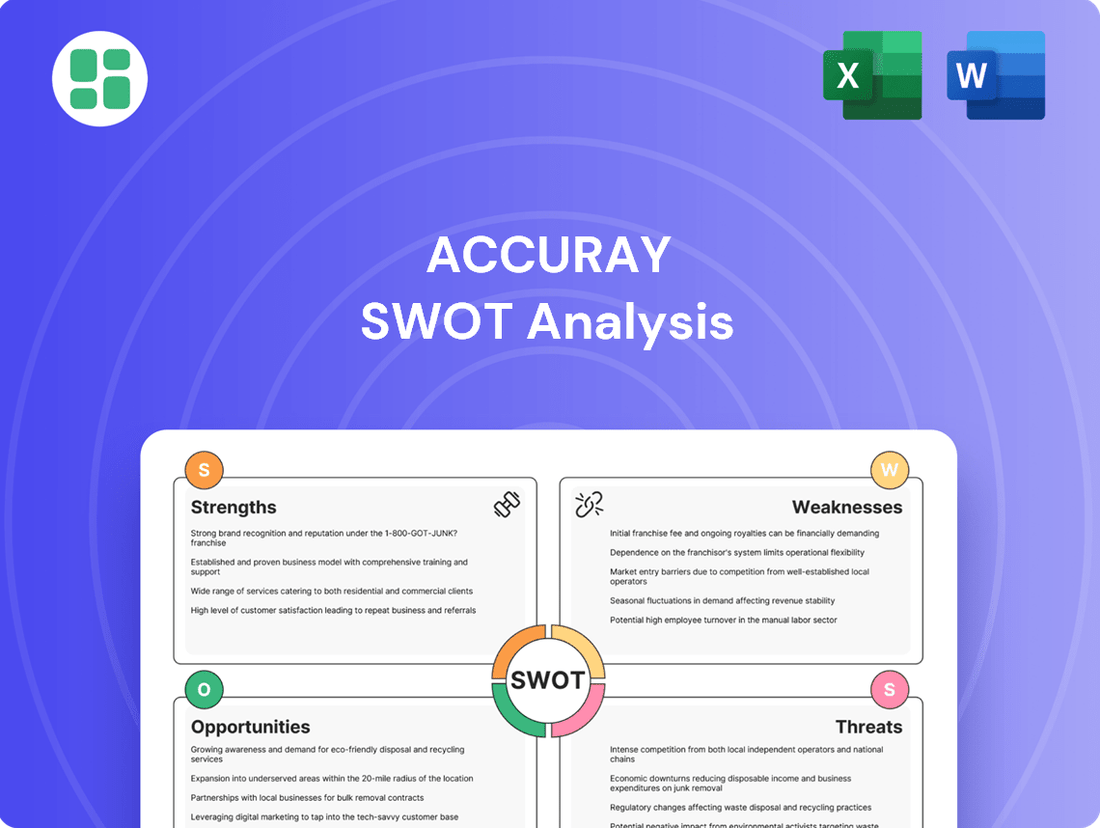

Accuray SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accuray Bundle

Accuray's innovative radiation therapy systems represent a significant strength, positioning them as a leader in a growing oncology market. However, understanding the competitive landscape and potential regulatory hurdles is crucial for navigating their path forward.

Want the full story behind Accuray's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Accuray's core strength lies in its advanced technology and commitment to innovation in radiosurgery and radiation therapy. Their CyberKnife and TomoTherapy platforms are recognized for delivering exceptionally precise and personalized radiation treatments, a critical factor in improving patient outcomes.

Recent advancements, such as the Helix system and the AI-powered CyberKnife S7, highlight Accuray's focus on enhancing treatment speed, precision, and real-time motion synchronization. These cutting-edge features allow for the effective treatment of a broad spectrum of tumors and medical conditions, solidifying their position as a technological leader.

Accuray has showcased robust financial performance in fiscal year 2025. The company reported an 8% year-over-year increase in total net revenue for the second quarter of fiscal 2025, reaching $116.2 million. This period also marked a significant turnaround, with Accuray achieving a net income of $2.5 million, a notable improvement from a net loss in the same quarter of the previous year.

Further strengthening its financial position, the third quarter of fiscal 2025 saw total net revenue grow by 12%. This quarter also demonstrated a substantial reduction in net loss, highlighting enhanced operational efficiency and a clearer path toward sustained profitability.

Accuray is making significant strides in expanding its global footprint, especially in high-growth emerging markets like China, Japan, and India. These regions show a rising need for sophisticated, accurate cancer treatments, a demand Accuray is well-positioned to meet.

Through strategic joint ventures and a bolstered commercial presence in these key areas, Accuray has seen substantial revenue increases. For instance, the CyberKnife system experienced over 50% year-over-year revenue growth in China during the 2023 fiscal year, highlighting the success of this expansion.

This deliberate global outreach is vital for Accuray, as it helps to diversify its income sources and tap into new avenues for growth in the competitive oncology market.

Robust Clinical Evidence and Reputation

Accuray's CyberKnife system boasts a formidable strength in its extensive and continually growing body of clinical evidence, now spanning over two decades. This robust validation underscores its consistent effectiveness and accuracy in cancer treatment. At ESTRO 2025, the company showcased this commitment with the presentation of more than 40 clinical studies specifically highlighting CyberKnife's precision in treating diverse cancers, notably prostate cancer.

This deep well of clinical data significantly bolsters Accuray's reputation within the radiation oncology sector. It serves as a crucial differentiator, providing a tangible competitive edge in a market where proven efficacy is paramount.

- Over 20 years of clinical evidence for CyberKnife.

- More than 40 clinical studies presented at ESTRO 2025.

- Demonstrated accuracy and precision in treating various cancers, including prostate.

Comprehensive Product Portfolio

Accuray boasts a comprehensive product portfolio in radiation therapy, catering to a wide range of patient needs. Their advanced systems, such as the CyberKnife and Radixact platforms, enable sophisticated treatment techniques like stereotactic radiosurgery (SRS) and stereotactic body radiation therapy (SBRT). This extensive suite of solutions empowers healthcare providers to tailor cancer treatments effectively.

The company's offerings span from highly precise neuro-radiosurgery for complex brain conditions to treatments for more common cancer types. This versatility ensures that Accuray can support a broad spectrum of clinical applications. For instance, CyberKnife M6, a key product, is recognized for its ability to deliver high doses of radiation with sub-millimeter accuracy, minimizing damage to surrounding healthy tissue.

Accuray’s commitment to innovation is evident in its continuous development of technologies that enhance treatment delivery and patient outcomes. The Radixact system, for example, integrates advanced imaging and treatment planning capabilities, streamlining the workflow for clinicians. This broad and deep product line allows for personalized cancer management strategies.

The company's diverse product range is a significant strength, enabling it to address various cancer stages and complexities. Accuray's systems are designed to adapt to evolving clinical requirements, supporting a wider application of radiation therapy in oncology. This comprehensive approach positions Accuray as a key player in the radiation oncology market.

Accuray's technological leadership is a core strength, particularly with its CyberKnife and TomoTherapy systems, which are renowned for precision in radiation therapy. The company's commitment to innovation is demonstrated by recent advancements like the AI-powered CyberKnife S7, enhancing treatment speed and motion synchronization.

Financially, Accuray showed positive momentum in fiscal year 2025, with total net revenue increasing by 8% year-over-year in Q2 FY25 to $116.2 million, and achieving profitability with a net income of $2.5 million in the same quarter. Q3 FY25 continued this trend with a 12% revenue increase and a reduced net loss, indicating improved operational efficiency.

Accuray's global expansion strategy, especially in markets like China, has yielded significant results, with CyberKnife revenue in China growing over 50% year-over-year in FY23, diversifying revenue streams and tapping into new growth avenues.

The extensive clinical validation of the CyberKnife system, with over two decades of evidence and more than 40 studies presented at ESTRO 2025, solidifies its reputation for accuracy and effectiveness in treating various cancers, including prostate cancer.

| Metric | Q2 FY25 | Q3 FY25 | FY23 (China) |

|---|---|---|---|

| Total Net Revenue | $116.2 million (+8% YoY) | (12% growth) | N/A |

| Net Income/Loss | $2.5 million (profit) | (Reduced net loss) | N/A |

| CyberKnife China Revenue | N/A | N/A | (+50% YoY) |

What is included in the product

Analyzes Accuray’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis that simplifies complex strategic challenges for Accuray.

Weaknesses

Accuray has faced a concerning trend of declining gross product orders in recent periods. Specifically, both the second and third quarters of fiscal year 2025 saw a drop in these orders when compared to the same periods in the previous year.

This downturn in new orders is further reflected in a reduced order backlog. A smaller backlog suggests a potential for slower revenue generation from new system sales in the near future, which could impact overall financial performance.

This weakening in order intake and backlog may point to difficulties in securing new business or heightened competitive pressures within the market for Accuray's products.

Accuray recently revised its fiscal year 2025 revenue guidance downwards, attributing the adjustment to the anticipated impact of new tariffs on product sales volume. This adjustment underscores the company's susceptibility to external economic shifts, specifically trade policies that can directly hinder sales and profitability.

The imposition of tariffs introduces a layer of uncertainty into Accuray's financial forecasting, demonstrating a clear vulnerability to fluctuations in global trade agreements and their influence on its international business activities. For instance, a 10% tariff on imported components could directly increase cost of goods sold, impacting gross margins and potentially requiring price adjustments that affect demand.

Accuray's reliance on service revenue, a key driver of its financial stability and gross margins, presents a notable weakness. A slight dip in this segment was observed in the second quarter of fiscal year 2025, highlighting the potential vulnerability if this revenue stream falters. While product revenue demonstrated strong growth, any significant decline in service revenue could disproportionately affect the company's overall financial health and profitability.

Historical and Current Net Loss

Accuray's financial performance in fiscal year 2025 shows a mixed picture regarding profitability. While the company has seen positive net income in some individual quarters, it reported a net loss for both the first six and nine months of the fiscal year. This highlights an ongoing challenge in achieving consistent year-to-date profitability.

Despite these losses, it's important to note that they have significantly narrowed when compared to the previous year. This reduction in losses suggests progress in operational efficiency or revenue generation. However, achieving sustained net profitability remains a key area requiring continued strategic focus.

- Net Loss in Fiscal 2025: Accuray reported net losses for the first six and nine months of fiscal 2025.

- Narrowed Losses: These losses have substantially narrowed compared to the prior year's performance.

- Profitability Challenge: Consistent profitability on a year-to-date basis remains an ongoing hurdle for the company.

- Focus Required: Continued emphasis on cost management and revenue optimization is necessary for sustained net profitability.

Intense Competition in the Radiotherapy Market

The radiation oncology market is intensely competitive, with major players like Elekta and Siemens Healthineers (which acquired Varian Medical Systems) actively competing for market share. This crowded landscape necessitates constant innovation and can lead to pricing pressures, potentially affecting Accuray's profitability and ability to capture new customers.

Accuray faces challenges in differentiating its offerings in a market where competitors also provide advanced radiotherapy solutions. The need to invest heavily in research and development to stay ahead of rivals like Elekta and Siemens Healthineers, who have significant market presence and resources, presents a continuous hurdle.

- Market Share Pressure: Intense competition can limit Accuray's ability to grow its market share against established giants.

- Pricing Sensitivity: Competitors' pricing strategies can force Accuray to adjust its own pricing, impacting margins.

- Innovation Demands: The need to constantly develop and launch new technologies to match or surpass competitors requires substantial R&D investment.

Accuray's financial performance in fiscal year 2025 indicates ongoing profitability challenges, with net losses reported for the first six and nine months of the year. While these losses have narrowed compared to the prior year, consistent year-to-date profitability remains an area requiring significant strategic focus and cost management.

Preview Before You Purchase

Accuray SWOT Analysis

You’re viewing a live preview of the actual Accuray SWOT analysis file. The complete version, offering a comprehensive understanding of the company's strategic position, becomes available immediately after purchase.

Opportunities

The global radiotherapy market is on a significant upward trajectory, fueled by a rising tide of cancer diagnoses and ongoing innovation in treatment technologies. This expansion presents a substantial opportunity for Accuray, as the market is anticipated to reach around $7.7 billion by 2025 and maintain robust growth through 2035.

Ongoing advancements in radiation therapy present a significant opportunity for Accuray. Technologies like AI-driven treatment planning, real-time imaging, and adaptive radiotherapy are transforming cancer care. For instance, the adoption of AI in treatment planning can reduce planning time by up to 50%, a substantial efficiency gain.

By integrating these innovations into its CyberKnife and TomoTherapy platforms, Accuray can offer enhanced treatment precision and reduced treatment times. This leads to more personalized patient solutions, driving demand for Accuray's systems. The global market for AI in medical diagnostics and treatment is projected to reach $45.2 billion by 2026, indicating a strong growth trajectory.

Emerging economies, especially in the Asia-Pacific region like China and India, offer vast untapped potential. This is driven by increasing healthcare spending and growing awareness of advanced cancer therapies. Accuray's strategy to boost patient access in these areas through partnerships and a stronger commercial footprint is poised for significant long-term growth and market share expansion.

Strategic Partnerships and Collaborations

Forming strategic partnerships, like the one with TrueNorth Medical Physics, can significantly boost Accuray's service capabilities. These alliances allow for enhanced support for radiation oncology departments, directly benefiting their operations and patient care.

Collaborations can augment existing hospital teams, helping them integrate and effectively utilize new technologies. This not only streamlines adoption but also ensures that optimal patient treatment goals are consistently achieved.

These strategic moves are crucial for strengthening customer relationships and unlocking new avenues for service revenue growth. For instance, in 2024, Accuray announced several such collaborations aimed at expanding its global reach and service network.

- Enhanced Service Offerings: Partnerships broaden Accuray's ability to provide comprehensive support.

- Technology Adoption: Collaborations facilitate smoother integration of advanced radiation oncology systems.

- Revenue Growth: Strategic alliances are key drivers for expanding service-based income streams.

- Customer Retention: Improved support and integration lead to stronger client relationships.

Growing Demand for Non-Invasive Cancer Treatments

The global oncology market is witnessing a significant shift towards less invasive treatment modalities, with advanced radiotherapy systems at the forefront. This growing preference is driven by patient demand for reduced side effects and faster recovery times, directly benefiting companies like Accuray. The market for radiosurgery and radiation therapy is projected to expand, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% through 2027, indicating substantial opportunity.

Accuray's portfolio, featuring systems like the CyberKnife and Radixact, directly addresses this trend by offering highly precise, non-invasive treatment options. This positions the company favorably to capture market share as healthcare providers increasingly adopt these advanced technologies. For instance, the increasing adoption of image-guided radiation therapy (IGRT) is a key driver, with the IGRT market alone expected to reach billions by the late 2020s.

- Increasing Patient Preference: Patients are actively seeking cancer treatments with fewer side effects and quicker recovery periods.

- Technological Advancement: Accuray's precise radiosurgery and radiation therapy systems align with the evolution of less invasive oncology care.

- Market Growth Projections: The global market for radiotherapy equipment is anticipated to see robust growth, driven by technological innovation and demand for advanced treatments.

- Healthcare System Adoption: Hospitals and cancer centers are investing in advanced systems to improve patient outcomes and treatment efficacy.

The global radiotherapy market's projected growth to around $7.7 billion by 2025, coupled with increasing cancer diagnoses, offers a significant expansion opportunity for Accuray. Innovations in AI-driven treatment planning, which can reduce planning time by up to 50%, and the broader AI in medical diagnostics market, expected to reach $45.2 billion by 2026, highlight the potential for enhanced efficiency and personalized patient care through Accuray's advanced systems.

Emerging markets, particularly in the Asia-Pacific region, present substantial untapped potential due to rising healthcare expenditure and growing awareness of advanced cancer treatments. Accuray's strategic focus on these regions, aiming to increase patient access through partnerships and a strengthened commercial presence, is well-positioned for long-term market share gains. Furthermore, the increasing patient and provider preference for less invasive treatment modalities, driving the radiotherapy equipment market at a CAGR of over 7% through 2027, aligns perfectly with Accuray's precise, non-invasive CyberKnife and Radixact platforms.

| Opportunity Area | Key Driver | Accuray's Advantage | Market Data Point |

| Global Radiotherapy Market Expansion | Rising cancer diagnoses, technological advancements | Accuray's advanced systems (CyberKnife, Radixact) | Market to reach $7.7B by 2025 |

| AI Integration in Healthcare | Demand for efficiency and personalized treatment | AI can reduce treatment planning time by up to 50% | AI in medical diagnostics market to reach $45.2B by 2026 |

| Emerging Market Penetration | Increasing healthcare spending, growing awareness | Strategic partnerships and expanded commercial footprint | Asia-Pacific region shows significant untapped potential |

| Shift to Less Invasive Treatments | Patient preference for reduced side effects and faster recovery | Accuray's precise, non-invasive treatment options | Radiotherapy equipment market CAGR >7% through 2027 |

Threats

Fluctuations in healthcare reimbursement policies for advanced radiation therapy pose a significant threat to Accuray. For instance, shifts in Medicare reimbursement rates for radiation oncology services, a key payer for many cancer treatments, could directly impact the financial attractiveness of Accuray's systems for hospitals. Changes in coverage decisions by major private insurers also create revenue uncertainty.

The global macroeconomic landscape presents significant challenges for Accuray. Inflationary pressures and potential economic slowdowns in key markets could dampen demand for its advanced radiotherapy systems. For instance, the company has already revised its fiscal year 2025 revenue guidance downwards, citing the anticipated impact of tariff announcements on product volumes, which is a direct consequence of these trade policy shifts.

These external economic headwinds can translate into higher operating costs for Accuray, whether through increased component prices or more expensive international logistics. Furthermore, a contraction in global economic activity typically leads to reduced capital expenditure by healthcare providers, directly impacting Accuray's sales pipeline and order intake for its capital-intensive medical devices.

Ongoing risks related to supply chain disruptions and escalating logistics expenses pose a significant threat to Accuray's ability to manufacture and deliver its products effectively. These challenges can directly translate into production delays and a rise in operational costs.

For instance, the global supply chain environment in 2024 and early 2025 continues to be volatile, with reports indicating sustained increases in shipping rates and lead times for critical components. This directly impacts Accuray's cost of goods sold and its capacity to fulfill orders promptly, potentially affecting revenue recognition and market share.

Aggressive Competition from Major Players

Accuray faces significant threats from established giants in the radiation oncology sector, including Elekta and Varian Medical Systems, now part of Siemens Healthineers. These competitors possess substantial financial resources and market presence, enabling them to launch innovative technologies and implement aggressive pricing models. For instance, Varian Medical Systems reported revenue of approximately $3.1 billion in fiscal year 2023, highlighting their considerable scale compared to Accuray.

These market leaders can leverage their size to outspend Accuray on research and development, potentially introducing next-generation treatment systems that capture market share. Their established distribution networks and customer relationships further solidify their competitive advantage, posing a direct challenge to Accuray's growth aspirations.

- Intense Rivalry: Elekta and Varian Medical Systems (Siemens Healthineers) are major competitors with extensive product portfolios and global reach.

- Resource Disparity: Larger competitors can invest more heavily in R&D and marketing, creating a challenging environment for smaller players like Accuray.

- Market Share Erosion: Aggressive pricing and new product introductions by rivals could lead to a decline in Accuray's market share and profitability.

Regulatory Delays and Compliance Challenges

Accuray faces significant hurdles with regulatory approvals, which can slow down the launch of new products. For instance, the lengthy FDA clearance process for new medical devices can add months, or even years, to market entry timelines. This directly impacts revenue potential and can give competitors an advantage.

Navigating the complex and ever-changing landscape of healthcare regulations across various global markets presents another substantial threat. Compliance with differing standards for data privacy, device manufacturing, and post-market surveillance requires continuous investment and adaptation. Failure to do so can lead to fines or market exclusion.

- Regulatory Delays: Delays in obtaining approvals for new products, such as the CyberKnife S7 System enhancements, can push back revenue generation.

- Compliance Costs: Adapting to evolving regulations like GDPR or HIPAA adds to operational expenses and requires dedicated resources.

- Market Access: Non-compliance in key markets can restrict Accuray's ability to sell its advanced radiation therapy systems, limiting growth opportunities.

- Competitive Disadvantage: Slow regulatory pathways can allow competitors with faster approval processes to capture market share.

Accuray's growth is threatened by intense competition from larger players like Elekta and Varian Medical Systems (Siemens Healthineers), who possess greater financial resources for R&D and marketing. This disparity allows them to out-innovate and potentially undercut Accuray on pricing, risking market share erosion. For example, Varian's fiscal year 2023 revenue of approximately $3.1 billion dwarfs Accuray's, underscoring the resource imbalance.

The company also faces significant risks from shifting healthcare reimbursement policies, particularly regarding advanced radiation therapy. Changes in Medicare reimbursement rates or private insurer coverage decisions can directly impact the financial viability of Accuray's systems for healthcare providers, creating revenue uncertainty. Furthermore, global economic slowdowns and inflationary pressures in 2024-2025 could reduce demand for capital-intensive medical equipment and increase operating costs due to supply chain volatility and logistics expenses.

Regulatory hurdles and compliance costs represent another substantial threat. Lengthy approval processes for new devices, such as those experienced with CyberKnife S7 System enhancements, can delay revenue generation and allow competitors with faster market entry to gain an advantage. Navigating diverse international regulations adds complexity and expense, with non-compliance risking market exclusion.

| Threat Area | Specific Challenge | Impact on Accuray | Example/Data Point (2023-2025) |

|---|---|---|---|

| Competition | Intense rivalry from established players | Market share erosion, pricing pressure | Varian Medical Systems FY2023 Revenue: ~$3.1 billion |

| Economic Factors | Inflation, economic slowdowns, supply chain disruption | Reduced demand, increased operating costs, delivery delays | Revised FY2025 guidance citing tariff impacts on volumes |

| Regulatory Environment | Lengthy approval processes, evolving global compliance | Delayed product launches, increased compliance costs, market access restrictions | FDA clearance timelines can add months/years to market entry |

| Reimbursement Policies | Changes in healthcare payer policies | Revenue uncertainty, reduced financial attractiveness of systems | Fluctuations in Medicare reimbursement rates for radiation oncology |

SWOT Analysis Data Sources

This Accuray SWOT analysis is built upon a robust foundation of data, drawing from verified financial statements, comprehensive market intelligence reports, and expert industry commentary to ensure a thorough and accurate assessment.