Accuray PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accuray Bundle

Unlock the forces shaping Accuray's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its market. This expertly crafted report provides the critical intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now for actionable insights.

Political factors

Government healthcare spending significantly influences the financial capacity of healthcare providers to invest in sophisticated medical technology. For instance, in 2024, the US Medicare reimbursement rates for radiation oncology services are subject to ongoing review, impacting the economic viability of adopting advanced treatment systems. Favorable reimbursement policies, such as those supporting innovative cancer treatments, directly correlate with increased demand for Accuray's radiation therapy solutions, as seen in the growing adoption of its CyberKnife and Radixact systems in facilities that can leverage these policies.

Accuray's global operations are directly influenced by international trade relations and evolving tariff landscapes. For instance, ongoing trade tensions between major economies in 2024 and 2025 could introduce new import duties on critical medical device components, potentially raising Accuray's cost of goods sold and affecting its pricing strategies in affected markets.

The imposition of tariffs, as seen in various trade disputes over the past few years, can significantly disrupt supply chains for companies like Accuray, which rely on a global network for manufacturing and distribution. A 10% tariff on specialized radiation therapy system parts, for example, could add millions to production costs, impacting the affordability and competitive positioning of their products in key export markets.

Conversely, stable and predictable trade agreements are crucial for Accuray to maintain efficient operations and expand market access. A favorable trade pact, such as one that reduces or eliminates tariffs on medical equipment, would streamline Accuray's ability to deliver its advanced cancer treatment solutions to patients worldwide, fostering growth and market penetration in 2025.

Regulatory bodies like the US FDA and Europe's CE Mark are crucial gatekeepers for medical devices, directly impacting Accuray's product launches. Delays in obtaining these approvals for new radiation therapy systems can significantly push back revenue streams. For example, in 2024, the average FDA approval time for novel medical devices saw fluctuations, with some categories experiencing longer review periods due to increased scrutiny.

The evolving landscape, such as the EU AI Act classifying AI-enabled medical devices as high-risk, introduces further complexity. This necessitates robust evidence of security, accuracy, and transparency, potentially extending development and approval timelines for Accuray's advanced treatment platforms. This regulatory environment can influence Accuray's R&D investment priorities and market entry strategies for innovative technologies.

Political Stability in Key Markets

Political stability in Accuray's key markets significantly influences its operational landscape. Geopolitical tensions or instability in regions where Accuray has a presence or is considering expansion can directly impact its ability to conduct sales, manage distribution networks, and provide essential after-sales service. For instance, the ongoing geopolitical situation in Eastern Europe, which intensified in 2022 and continued through 2023 and into 2024, has created supply chain disruptions and economic uncertainty for many global companies, including those in the medical technology sector. This instability can also hinder the development of robust healthcare infrastructure and slow down investment in cutting-edge medical technologies like those offered by Accuray.

Emerging markets present a dual-edged sword for Accuray. While they offer substantial growth potential due to increasing healthcare needs and a growing middle class, these markets often come with a higher degree of political risk. Factors such as changes in government policy, regulatory shifts, or social unrest can create an unpredictable business environment. For example, in 2024, several emerging economies are navigating significant political transitions, which could lead to altered healthcare spending priorities or new regulatory hurdles for medical device manufacturers.

- Geopolitical Risk: Increased geopolitical tensions in regions like the Middle East and parts of Africa in early 2024 could impact global supply chains and investment sentiment in healthcare infrastructure.

- Emerging Market Volatility: Political transitions in key emerging markets, such as certain Latin American or Southeast Asian countries during 2024, may lead to shifts in healthcare policy and procurement.

- Regulatory Uncertainty: Evolving political landscapes can result in unpredictable regulatory changes, potentially affecting market access and product approvals for advanced medical technologies.

- Healthcare Investment: Political stability is crucial for sustained government investment in healthcare, directly influencing the adoption rates of sophisticated treatment systems like Accuray's radiation therapy solutions.

National Cancer Control Plans and Initiatives

Government-led national cancer control plans significantly shape the market for radiation therapy equipment. For instance, the US National Cancer Moonshot initiative, aiming to accelerate cancer research and improve patient outcomes, drives investment in advanced technologies. Similarly, European countries' national health strategies often include substantial allocations for cancer screening and treatment infrastructure, directly impacting demand for companies like Accuray.

These government commitments foster a favorable ecosystem for radiation oncology providers. A strong national focus on enhancing cancer care, as seen in many OECD countries, translates into increased adoption of precise treatment modalities. For example, the UK's Cancer Strategy 2021-2030 emphasizes early diagnosis and advanced treatments, creating opportunities for innovative solutions.

Key political factors influencing Accuray's market include:

- Government funding for cancer research and development: Increased R&D budgets, such as the projected $7.1 billion for the National Institutes of Health in FY2024, can spur innovation in radiation therapy.

- National screening and early detection programs: Policies promoting widespread cancer screening, like expanded mammography access, indirectly boost the need for subsequent treatment technologies.

- Investment in healthcare infrastructure: Government initiatives to build or upgrade cancer treatment centers, often seen in developing economies aiming to improve healthcare access, directly benefit equipment manufacturers.

- Regulatory frameworks for medical devices: Approval processes and reimbursement policies set by health authorities, like the FDA in the US, dictate market access and adoption rates for new radiation therapy systems.

Government healthcare spending and policy directly impact Accuray's revenue potential, with reimbursement rates for radiation oncology services being a critical determinant. For instance, the 2024 Medicare Physician Fee Schedule in the US continues to influence how providers are compensated for advanced treatments, directly affecting their willingness to invest in Accuray's systems.

Trade policies and tariffs significantly influence Accuray's cost of goods sold and market access. Ongoing trade discussions in 2024 and into 2025, particularly concerning global supply chains for medical components, could introduce new cost pressures or market barriers.

Regulatory approvals are paramount for Accuray's product lifecycle, with agencies like the FDA and EMA setting the pace for market entry. Delays in 2024 for novel medical device clearances, driven by increased scrutiny on AI integration, can impact revenue timelines for Accuray's advanced platforms.

Political stability in key markets is essential for consistent demand and operational continuity. Geopolitical tensions in regions like Eastern Europe, persisting into 2024, can disrupt supply chains and slow healthcare infrastructure development, impacting Accuray's growth prospects.

What is included in the product

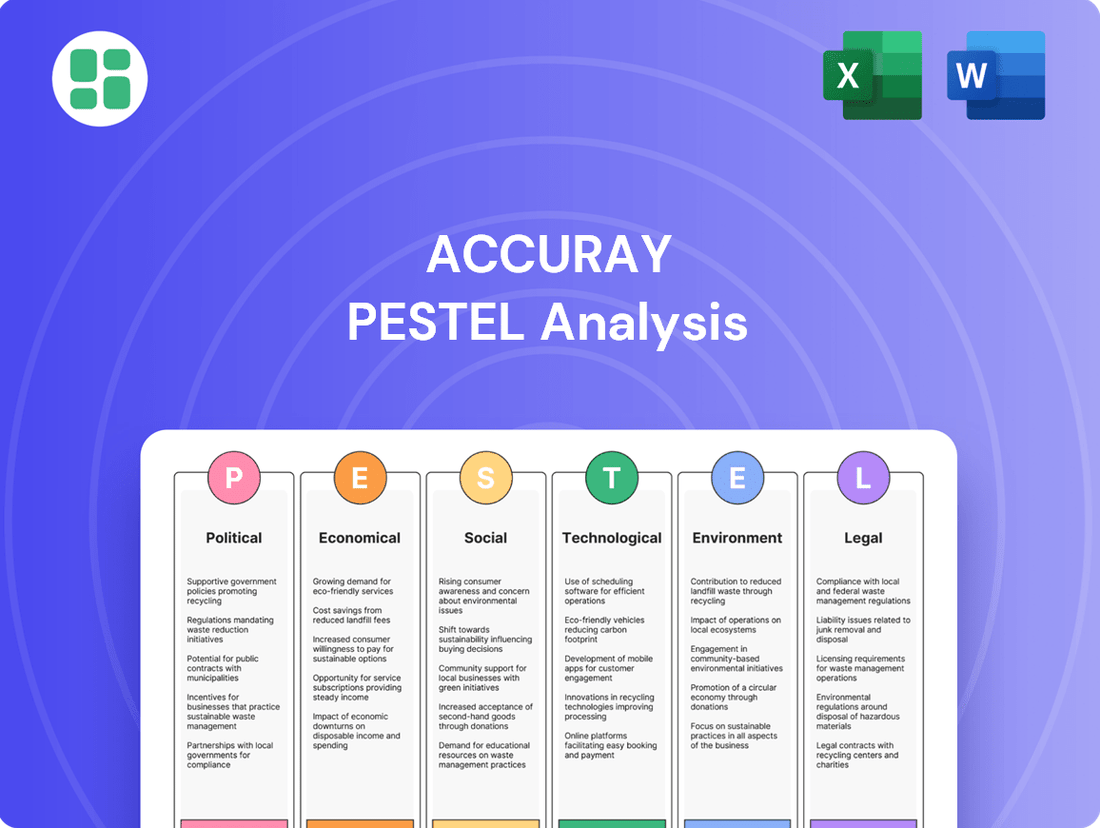

Accuray's PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining external factor assessment.

Economic factors

Global healthcare expenditure is on a significant upward trajectory, with projections indicating an average growth rate of 10.4% in 2025. This trend suggests a robust and expanding market for medical technology, directly benefiting companies like Accuray that provide advanced treatment solutions.

While this growth signals increased investment in healthcare infrastructure and services, it also intensifies the focus on cost-efficiency for healthcare providers. Accuray must navigate this environment by demonstrating the long-term value and economic benefits of its technologies to justify the initial investment for its customers.

Global economic growth is a key driver for Accuray, as higher GDP per capita in target markets directly correlates with increased healthcare spending and the affordability of its advanced radiation therapy systems. For instance, in 2024, projected global GDP growth is around 2.7%, with developed economies showing more moderate growth compared to emerging markets which often represent significant future potential for medical technology adoption.

In 2025, continued economic expansion, particularly in regions with rising disposable incomes and a growing middle class, will likely boost demand for sophisticated medical equipment like Accuray's CyberKnife and TomoTherapy platforms. Countries with robust GDP per capita, such as the United States and several Western European nations, are already significant markets, but sustained economic health is crucial for continued investment in these high-value healthcare solutions.

As a global company, Accuray's financial health is significantly influenced by shifts in currency exchange rates. For instance, if the US dollar strengthens, Accuray's medical systems become pricier for international buyers, potentially dampening sales and impacting profitability.

In 2024, the US dollar experienced notable volatility against major currencies. For example, the euro traded around 1.08-1.10 against the dollar for much of the year, while the Japanese yen saw greater fluctuations, impacting Accuray's revenue generated in these regions.

Effectively managing these currency exposures is therefore a critical component of Accuray's strategy to ensure financial resilience and predictable earnings in its diverse international markets.

Healthcare Infrastructure Investment

Global healthcare infrastructure investment is a significant driver for companies like Accuray. The expansion of healthcare facilities, especially in emerging markets, directly translates into increased demand for advanced medical equipment, including radiation therapy systems. For instance, the World Health Organization projects that healthcare spending in low- and middle-income countries will need to increase substantially to meet population needs by 2030, creating a fertile ground for infrastructure development.

Government initiatives and private sector capital are crucial for this expansion. Many nations are prioritizing healthcare system upgrades to improve patient outcomes and accessibility. This focus can lead to substantial investments in new hospitals, specialized cancer centers, and the modernization of existing facilities, thereby creating direct market opportunities for Accuray's CyberKnife and Radixact systems.

- Increased Healthcare Spending: Global healthcare spending reached an estimated $9 trillion in 2023, with a significant portion allocated to infrastructure development.

- Emerging Market Growth: Developing economies are expected to see a compound annual growth rate of over 6% in healthcare infrastructure investment through 2028.

- Oncology Center Expansion: The number of dedicated cancer treatment centers is projected to grow by 15% globally by 2027, requiring advanced radiotherapy equipment.

- Public-Private Partnerships: Governments are increasingly partnering with private entities to fund and build new healthcare facilities, accelerating infrastructure projects.

Insurance Coverage and Patient Affordability

The landscape of insurance coverage significantly shapes patient access to advanced radiation therapies, directly impacting the demand for Accuray's sophisticated treatment systems. In 2024, a substantial portion of the U.S. population relies on insurance for healthcare, with Medicare and Medicaid covering millions, while private insurance remains the primary source for the working-age population. For instance, Medicare Part B typically covers radiation therapy when medically necessary, but coverage details for newer, more complex techniques can vary by payer and by specific treatment protocols.

High out-of-pocket expenses present a considerable barrier for many patients, potentially limiting their treatment choices and affecting the volume of procedures performed. In 2024, deductibles and co-insurance rates for specialized cancer treatments can run into thousands of dollars. This financial strain can lead patients to opt for less advanced, more affordable treatment options, thereby impacting the utilization rates of Accuray's high-end equipment and influencing sales volumes.

Key considerations regarding insurance and affordability include:

- Insurance Penetration: In 2024, approximately 92% of Americans had health insurance, but the specifics of coverage for advanced radiation oncology vary widely.

- Out-of-Pocket Costs: For patients without comprehensive coverage, out-of-pocket expenses for radiation therapy can range from $5,000 to over $30,000 per course of treatment, depending on the technology used and the patient's insurance plan.

- Payer Policies: Decisions by major insurers and government programs on reimbursement rates and coverage mandates for technologies like Accuray's CyberKnife or Radixact systems directly influence market adoption.

- Economic Sensitivity: Economic downturns or periods of high inflation can exacerbate affordability issues, leading to decreased patient demand for elective or advanced medical procedures.

Economic stability and growth directly influence healthcare spending, a critical factor for Accuray. In 2024, global GDP growth was projected around 2.7%, with variations across regions impacting the affordability of advanced medical technologies. Continued economic expansion in 2025, especially in emerging markets with rising incomes, is expected to boost demand for sophisticated radiation therapy systems like Accuray's CyberKnife.

Currency fluctuations also play a significant role, as seen with the US dollar's volatility in 2024, affecting international sales. For instance, the euro's trading range against the dollar impacted Accuray's revenue from European markets.

Insurance coverage and patient affordability are key determinants of demand. In 2024, while US insurance penetration was high, out-of-pocket costs for advanced cancer treatments could range from $5,000 to over $30,000, potentially limiting patient access to high-end equipment.

| Economic Factor | 2024/2025 Data Point | Impact on Accuray |

|---|---|---|

| Global GDP Growth (Projected) | ~2.7% (2024) | Higher GDP correlates with increased healthcare spending and affordability of advanced systems. |

| Healthcare Spending Growth (Projected) | 10.4% average growth (2025) | Indicates a robust market for medical technology providers like Accuray. |

| US Dollar vs. Euro (2024) | ~1.08-1.10 | Volatility impacts international sales revenue and profitability. |

| Patient Out-of-Pocket Costs (Radiation Therapy) | $5,000 - $30,000+ | High costs can limit patient access to advanced, high-cost treatment systems. |

What You See Is What You Get

Accuray PESTLE Analysis

The preview shown here is the exact Accuray PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises regarding its comprehensive PESTLE breakdown.

The content and structure shown in the preview is the same Accuray PESTLE Analysis document you’ll download after payment, providing a complete strategic overview.

Sociological factors

The world's population is getting older, and as people age, the likelihood of developing cancer increases. This demographic shift is a major factor influencing the market for cancer treatment technologies.

This trend directly boosts the demand for sophisticated treatment options like Accuray's advanced radiosurgery and radiation therapy systems. With cancer incidence closely tied to age, an aging global population naturally translates to a larger potential patient base.

Projections show a significant rise in cancer cases, with the global prevalence expected to climb by 60% by 2040. This substantial increase underscores the growing need for effective cancer care solutions.

Growing health awareness, particularly around cancer symptoms and the importance of early diagnosis, is significantly boosting demand for advanced treatment solutions. Public health initiatives and strong patient advocacy are instrumental in driving this trend, encouraging individuals to seek timely medical attention.

This heightened awareness translates directly into higher diagnosis rates and a greater patient pool seeking effective therapies. For instance, the American Cancer Society projected over 2 million new cancer cases in the US for 2024, underscoring the impact of increased detection and awareness.

Societal trends increasingly favor medical interventions that are less invasive, aiming to reduce patient discomfort and speed up recovery. Accuray's advanced radiation therapy systems, like the CyberKnife S7, are designed for pinpoint accuracy, directly addressing this preference by minimizing damage to surrounding healthy tissue. This focus on precision is a key driver for the growing adoption of techniques such as stereotactic radiosurgery (SRS) and stereotactic body radiation therapy (SBRT).

Lifestyle Changes and Disease Prevalence

Modern lifestyles are unfortunately contributing to an increase in various diseases, including different types of cancer. This trend directly impacts the demand for advanced medical technologies like those offered by Accuray, as more sophisticated oncology treatments become necessary. For instance, a significant portion of cancer cases are linked to modifiable lifestyle factors, highlighting the ongoing need for effective treatment solutions.

Factors such as dietary habits, levels of physical activity, and environmental exposures play a crucial role in influencing cancer rates. These societal shifts mean that companies like Accuray must continually innovate to meet the evolving needs of cancer care. The World Health Organization (WHO) has noted that unhealthy diets and lack of physical activity are major risk factors for noncommunicable diseases, including many cancers.

- Rising Cancer Incidence: Globally, cancer remains a leading cause of death, with new diagnoses continuing to be a significant public health concern.

- Lifestyle Correlation: Research consistently links lifestyle choices, such as poor diet and sedentary behavior, to increased cancer risk, driving demand for advanced therapies.

- Technological Demand: The growing prevalence of these lifestyle-related diseases necessitates cutting-edge treatment modalities, creating a sustained market for Accuray's precision radiation oncology systems.

- Innovation Imperative: Accuray's focus on developing innovative solutions is crucial to address the complex challenges posed by an aging population and changing disease patterns.

Healthcare Workforce Availability and Training

The availability of skilled healthcare professionals, such as radiation oncologists, medical physicists, and radiation therapists, directly impacts the successful implementation and utilization of sophisticated radiation therapy equipment like Accuray's. A scarcity of these specialists can hinder healthcare providers' ability to fully leverage such advanced technologies.

Workforce shortages have been a persistent challenge. For instance, the Association of American Medical Colleges (AAMC) projected a shortage of between 61,700 and 121,900 physicians by 2034, a figure that includes specialties like oncology. This directly affects the pool of qualified personnel needed to operate and oversee Accuray's systems.

Effective training and robust educational programs are therefore paramount for the broader adoption of Accuray's solutions. Without adequate training, healthcare facilities may struggle to integrate and maximize the benefits of their advanced radiation therapy offerings.

- Workforce Shortages: Projections indicate significant physician shortages in the US by 2034, impacting specialized fields like radiation oncology.

- Specialized Skills: Radiation oncologists, medical physicists, and radiation therapists are critical for operating advanced systems.

- Training Imperative: Comprehensive training programs are essential for healthcare facilities to effectively adopt and utilize complex radiation therapy technology.

Societal shifts, including an aging global population and increased health awareness, are driving demand for advanced cancer treatments. Lifestyle factors also contribute to rising cancer rates, necessitating sophisticated oncology solutions.

The growing preference for less invasive medical procedures aligns with Accuray's precision radiation therapy systems, such as the CyberKnife S7. This trend is further amplified by public health initiatives promoting early diagnosis, leading to more patients seeking effective therapies.

A shortage of skilled healthcare professionals, particularly in specialized fields like radiation oncology, presents a challenge for the widespread adoption of advanced medical technologies. Ensuring adequate training for these professionals is crucial for maximizing the benefits of Accuray's systems.

The US is projected to face a significant physician shortage by 2034, impacting critical specialties like oncology, which directly affects the availability of personnel to operate advanced radiation therapy equipment. This underscores the need for robust educational and training programs to support the effective utilization of Accuray's innovative solutions.

Technological factors

Continuous innovation in radiation oncology, particularly in precision, imaging, and treatment delivery, is paramount for Accuray's market position. The global radiation therapy market, projected to reach $12.5 billion by 2027, underscores the demand for advanced solutions.

Emerging techniques like Intensity-Modulated Radiation Therapy (IMRT) and Image-Guided Radiation Therapy (IGRT) are significantly improving treatment accuracy, thereby reducing collateral damage to healthy tissues. Accuray's strategic investment in its CyberKnife and TomoTherapy platforms places it as a key player in these technological advancements.

Artificial intelligence and machine learning are rapidly reshaping medical devices, particularly in areas like treatment planning and image analysis. This advancement is crucial for Accuray as AI-assisted planning and radiomics are becoming central to the radiosurgery and radiotherapy robotics market, directly impacting accuracy and efficiency.

For instance, the global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to grow significantly, with a compound annual growth rate (CAGR) of over 37% expected between 2024 and 2030. Accuray's ability to integrate these sophisticated AI capabilities into its systems will be a key differentiator in this evolving landscape, ensuring it remains at the forefront of technological innovation.

The increasing connectivity of medical devices, including Accuray's radiation therapy systems, amplifies cybersecurity risks to patient data and operational integrity. A 2024 report indicated that the healthcare sector remains a prime target for cyberattacks, with ransomware incidents alone costing billions annually.

Regulatory bodies are responding to these threats. For instance, the FDA's updated cybersecurity guidance for medical devices (released in 2023) and the EU's Cyber Resilience Act (expected to be fully implemented in 2025) impose stringent security requirements on manufacturers like Accuray. Non-compliance could lead to significant penalties and reputational damage.

Accuray must therefore prioritize robust cybersecurity measures to protect its connected devices and sensitive patient information. This involves continuous monitoring, regular software updates, and adherence to evolving global security standards to maintain trust and operational continuity in a digitally driven healthcare landscape.

Telehealth and Remote Operation Capabilities

The increasing adoption of telehealth and remote healthcare services is poised to reshape how radiation therapy systems are designed and implemented. Accuray can leverage this trend by developing systems that support remote monitoring of patient treatment and potentially remote adjustments for certain operational aspects. This could significantly improve patient access, especially in underserved areas, and boost overall operational efficiency within healthcare facilities. For instance, by mid-2024, the global telehealth market was projected to reach over $200 billion, indicating a strong demand for digitally enabled healthcare solutions.

This technological shift presents opportunities for Accuray to innovate its service models. Imagine systems that allow clinicians to remotely oversee treatment delivery or manage system diagnostics, reducing the need for on-site personnel for every task. Such advancements could lead to more flexible staffing models and quicker response times to system issues. The continued growth in connected medical devices, with an estimated 70% of healthcare organizations planning to increase their investment in remote patient monitoring by 2025, underscores the viability of these remote capabilities.

- Enhanced Accessibility: Remote capabilities can extend specialized radiation therapy services to patients in rural or remote locations, overcoming geographical barriers.

- Improved Efficiency: Streamlined workflows through remote monitoring and diagnostics can reduce downtime and optimize resource allocation in cancer treatment centers.

- New Service Revenue Streams: Accuray can develop subscription-based services for remote system management, data analytics, and virtual support, creating recurring revenue.

- Data-Driven Insights: Remote data collection can provide valuable insights into system performance and treatment outcomes, informing future product development and clinical best practices.

Competitive Landscape and R&D Investment

The medical device sector is intensely competitive, demanding significant and ongoing investment in research and development to maintain a leading position. For Accuray, this means consistently allocating resources to innovation to counter the rapid technological advancements made by its rivals.

Competitors' breakthroughs can swiftly alter market dynamics, compelling Accuray to continuously enhance and modernize its radiation therapy systems. For instance, in 2023, the global medical device market was valued at approximately $600 billion, with a substantial portion dedicated to R&D by major players.

Maintaining a robust R&D pipeline is therefore essential for Accuray's sustained growth and market relevance. Key areas of focus for competitors often include AI-driven treatment planning and advanced robotic delivery systems, pushing Accuray to invest in similar or superior technologies to remain competitive.

- R&D Investment: Companies in the oncology device space often invest 10-15% of their revenue back into R&D.

- Market Shift: Competitors launching next-generation linear accelerators or proton therapy solutions can quickly capture market share.

- Innovation Pipeline: Accuray's ability to bring new features like enhanced precision targeting or improved patient comfort to market is directly tied to its R&D output.

- Competitive Pressure: The need to match or exceed competitors' technological capabilities drives the strategic imperative for continuous innovation.

Accuray's technological prowess is central to its success, particularly in the rapidly evolving field of radiation oncology. The company's investment in advanced platforms like CyberKnife and TomoTherapy positions it to capitalize on the growing demand for precision treatments, a market segment expected to see substantial growth. The integration of artificial intelligence and machine learning is also a critical factor, with AI in healthcare projected to expand dramatically, offering enhanced treatment planning and diagnostic capabilities.

The increasing connectivity of medical devices, including Accuray's systems, introduces significant cybersecurity challenges. With the healthcare sector facing billions in annual losses due to cyberattacks, robust security measures are non-negotiable. Evolving regulations, such as the EU's Cyber Resilience Act, mandate stringent security standards for manufacturers like Accuray, highlighting the importance of proactive cybersecurity investments to maintain trust and operational continuity.

The rise of telehealth and remote healthcare services presents an opportunity for Accuray to innovate its service delivery models. By developing systems that support remote monitoring and diagnostics, Accuray can improve patient access, especially in underserved regions, and enhance operational efficiency. This trend is supported by the significant growth in the telehealth market, with many healthcare organizations planning to increase their investment in remote patient monitoring technologies by 2025.

| Technology Area | Impact on Accuray | Market Data/Projections |

|---|---|---|

| Precision Radiation Oncology | Drives demand for Accuray's CyberKnife and TomoTherapy platforms. | Global radiation therapy market projected to reach $12.5 billion by 2027. |

| Artificial Intelligence (AI) in Healthcare | Enhances treatment planning, image analysis, and operational efficiency. | AI in healthcare market valued at ~$15.4 billion in 2023, with CAGR >37% (2024-2030). |

| Cybersecurity for Connected Devices | Requires robust security measures to protect patient data and system integrity. | Healthcare sector a prime target for cyberattacks; billions lost annually. FDA and EU regulations impose stringent security requirements. |

| Telehealth & Remote Monitoring | Enables new service models for remote patient care and system management. | Global telehealth market projected to exceed $200 billion by mid-2024; 70% of healthcare orgs plan increased remote monitoring investment by 2025. |

Legal factors

Accuray navigates a complex global regulatory landscape, with key frameworks like the US FDA's Quality Management System Regulation (QMSR) and the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) being paramount. These regulations are evolving, with significant updates expected by 2025, placing a greater emphasis on proactive risk management and robust post-market surveillance to ensure patient safety and product efficacy.

Failure to comply with these evolving medical device regulations can result in severe consequences, including significant financial penalties and, critically, the inability to access key markets. For instance, as of early 2024, the EU MDR has already led to many older devices being withdrawn from the market due to the high cost and complexity of recertification, a trend that is likely to continue as the 2025 deadlines approach.

Protecting its proprietary technology through patents and intellectual property rights is critical for Accuray. The legal framework surrounding IP ensures that Accuray's innovations are safeguarded from infringement, maintaining its competitive advantage in the oncology market. For instance, as of early 2024, Accuray holds numerous patents covering its radiation therapy systems and software, a key differentiator.

However, litigation related to IP infringement can be costly and disruptive. Accuray, like other medical device companies, faces the risk of patent disputes, which can divert resources and impact operational focus. The cost of defending or pursuing patent litigation can run into millions of dollars, affecting profitability.

Accuray's operations are significantly shaped by data privacy and security laws. Compliance with regulations like HIPAA in the United States and GDPR in Europe is critical, as the company handles sensitive patient health information. These laws mandate strong data security protocols and transparent data handling, with substantial financial penalties for non-compliance, as evidenced by the increasing number of data breach fines globally, which reached billions of dollars in recent years.

Product Liability and Safety Standards

Accuray operates under stringent product liability laws, necessitating that its advanced radiation therapy systems consistently meet high safety and efficacy benchmarks. Failure to do so can result in significant legal repercussions.

The company must maintain rigorous adherence to safety protocols and conduct thorough post-market surveillance to mitigate risks. Any reported adverse events or system malfunctions could trigger costly legal actions, product recalls, and substantial damage to its reputation.

- Regulatory Compliance: Accuray's commitment to meeting FDA (U.S. Food and Drug Administration) regulations and similar international standards is paramount for market access and continued operation. For instance, the FDA’s Center for Devices and Radiological Health oversees medical device safety and effectiveness.

- Product Recalls: In the event of a product defect, Accuray could face mandatory recalls, impacting sales and requiring significant financial resources for remediation. For example, in 2023, the medical device industry saw numerous recalls, highlighting the pervasive nature of these risks.

- Litigation Costs: Product liability lawsuits can lead to substantial legal fees, settlement payouts, and judgments, directly affecting profitability. The average cost of defending a product liability claim can run into millions of dollars.

- Reputational Impact: Adverse events or recalls can erode customer trust and damage Accuray's brand image, potentially leading to a loss of market share to competitors. A strong safety record is a key differentiator in the medical technology sector.

Antitrust and Competition Laws

Accuray must meticulously adhere to antitrust and competition laws to maintain fair market practices. This is crucial for preventing monopolistic behavior and fostering a dynamic, competitive landscape within the medical device industry.

Any strategic moves, such as mergers or acquisitions, require careful navigation of these regulations to avoid legal challenges and significant penalties. For instance, in 2023, several major technology companies faced increased scrutiny from antitrust bodies globally, highlighting the evolving regulatory environment.

- Regulatory Compliance: Accuray's business strategies, particularly those involving market expansion or consolidation, must align with global antitrust frameworks.

- Market Dominance: Actions that could be perceived as establishing market dominance are subject to review by competition authorities to ensure fair play.

- Mergers & Acquisitions: Proposed mergers or acquisitions by Accuray would undergo rigorous review to assess their impact on market competition.

- Avoiding Fines: Non-compliance can lead to substantial fines, as seen in past antitrust cases where companies were penalized billions for violating competition rules.

Accuray's legal landscape is dominated by stringent medical device regulations, such as the FDA's QMSR and the EU's MDR/IVDR, with evolving requirements by 2025 emphasizing proactive risk management. Failure to comply, as seen with older devices withdrawn from the EU market in early 2024 due to recertification costs, can block market access and incur severe penalties, impacting global sales potential.

Intellectual property law is crucial for Accuray, safeguarding its innovations through patents, as demonstrated by its numerous patents on radiation therapy systems as of early 2024. However, the risk of costly patent litigation, potentially running into millions of dollars, remains a significant operational and financial consideration.

Data privacy laws like HIPAA and GDPR are critical for Accuray due to handling sensitive patient data, with global data breach fines reaching billions in recent years underscoring the penalties for non-compliance with robust security protocols.

Product liability laws necessitate Accuray's adherence to high safety standards, as any adverse events or malfunctions could trigger costly legal actions, recalls, and reputational damage, impacting its market position.

Antitrust and competition laws govern Accuray's market practices, with increased global scrutiny on major tech companies in 2023 highlighting the importance of compliance for mergers, acquisitions, and avoiding substantial fines.

| Legal Factor | Impact on Accuray | Example/Data Point (as of early 2024/2025) |

|---|---|---|

| Regulatory Compliance (FDA, EU MDR/IVDR) | Market access, product approval, operational continuity | EU MDR recertification challenges led to older device withdrawals in 2024; upcoming 2025 deadlines intensify focus. |

| Intellectual Property (Patents) | Competitive advantage, protection of innovation | Accuray holds numerous patents on its systems as of early 2024; patent litigation costs can reach millions. |

| Data Privacy (HIPAA, GDPR) | Data security, patient trust, avoidance of fines | Global data breach fines have reached billions; strict adherence to data handling is mandatory. |

| Product Liability | Product safety, risk mitigation, reputation management | Adverse event reporting can trigger recalls and legal actions; industry recalls were prevalent in 2023. |

| Antitrust & Competition Law | Fair market practices, M&A approvals, fine avoidance | Increased regulatory scrutiny on market dominance in 2023; non-compliance can result in multi-billion dollar fines. |

Environmental factors

Accuray faces increasing pressure from regulators, customers, and public opinion to adopt sustainable manufacturing processes. This push is evident in evolving environmental regulations and growing consumer preference for eco-friendly products. For instance, the medical device industry, in general, is seeing a trend towards circular economy principles, aiming to reduce waste by 25% by 2030 according to some industry projections.

To meet these demands, Accuray can focus on minimizing waste generation throughout its production lifecycle, optimizing energy consumption in its facilities, and actively exploring the use of recycled content in its materials where feasible and compliant with medical device standards. These efforts not only address environmental concerns but also present an opportunity for Accuray to enhance its brand image by showcasing its commitment to eco-conscious practices.

Strict regulations govern the disposal of medical devices, especially those with hazardous materials or electronics, impacting Accuray's end-of-life product management. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive mandates that producers finance recycling programs, a significant consideration for Accuray's global operations.

Accuray must integrate environmental responsibility across its entire product lifecycle, from sourcing to disposal, to comply with evolving waste management standards and minimize its ecological footprint. This includes planning for the responsible handling of components in their radiation therapy systems, ensuring compliance with directives like the WEEE Directive which aims to increase the collection and recycling rates of electronic waste.

The significant energy demands of advanced medical equipment, such as Accuray's radiation therapy systems, directly impact its environmental footprint. For instance, a single linear accelerator can consume a substantial amount of electricity during operation, contributing to greenhouse gas emissions. Companies like Accuray are increasingly focused on improving the energy efficiency of their products, recognizing that this not only reduces environmental impact but also lowers long-term operational costs for healthcare providers.

Supply Chain Environmental Footprint

Accuray's global supply chain, encompassing transportation and logistics, presents a significant environmental challenge, particularly concerning Scope 3 emissions. As regulatory scrutiny and stakeholder expectations around indirect emissions intensify, managing this footprint becomes crucial. For instance, the International Energy Agency reported in 2024 that global freight transport emissions reached new highs, underscoring the systemic nature of this issue.

Mitigating Accuray's supply chain environmental footprint involves strategic initiatives like optimizing shipping routes and embracing more fuel-efficient transportation modes. Engaging with suppliers who demonstrate a commitment to sustainability and actively work to reduce their own emissions is also paramount. These actions directly address the growing demand for corporate accountability in value chain emissions, a trend highlighted by the increasing adoption of ESG reporting frameworks by major corporations in 2024.

- Scope 3 Emissions Focus: Growing pressure on companies to report and reduce indirect emissions from their value chains.

- Logistics Optimization: Implementing strategies to minimize the environmental impact of transporting goods.

- Sustainable Sourcing: Partnering with suppliers committed to environmental responsibility.

Corporate Social Responsibility and ESG Reporting

Growing investor and public interest in Environmental, Social, and Governance (ESG) performance is a significant environmental factor. This trend pressures companies like Accuray to showcase their dedication to environmental stewardship. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, highlighting the substantial capital allocated to ESG-compliant businesses.

Accuray's commitment to sustainability initiatives and transparent ESG reporting can attract responsible investors and bolster its corporate reputation. Companies with strong ESG scores often experience lower costs of capital and greater access to funding. In 2023, a study revealed that companies with top-quartile ESG performance saw a 1.5% higher valuation multiple compared to their peers.

- Growing investor demand for ESG: Over 70% of institutional investors consider ESG factors in their investment decisions.

- Accuray's sustainability focus: Demonstrating progress in areas like reducing operational carbon footprint and waste management is crucial.

- Enhanced corporate reputation: Strong ESG reporting can lead to improved brand loyalty and a more positive public image.

- Attracting responsible capital: Companies with robust ESG frameworks are better positioned to secure investments from funds focused on sustainable practices.

Environmental regulations are increasingly shaping Accuray's operational landscape, demanding greater attention to waste management and emissions. For instance, the European Union's stringent WEEE Directive impacts how Accuray handles electronic waste from its medical devices. The company's energy consumption, particularly from its radiation therapy systems, also contributes to its carbon footprint, prompting a focus on energy efficiency improvements. Furthermore, global supply chain logistics, a significant source of Scope 3 emissions, require strategic optimization to meet evolving stakeholder expectations for sustainability.

| Environmental Factor | Impact on Accuray | Key Data/Trend |

| Regulatory Compliance | Adherence to waste disposal and emissions standards (e.g., WEEE Directive). | EU WEEE Directive mandates producer financing for recycling programs. |

| Energy Consumption | Operational energy use of radiation therapy systems contributes to carbon footprint. | Linear accelerators consume substantial electricity during operation. |

| Supply Chain Emissions | Scope 3 emissions from transportation and logistics. | Global freight transport emissions reached new highs in 2024. |

| Investor & Public Scrutiny | Growing demand for ESG performance and corporate sustainability. | Global sustainable investment market reached an estimated $37.4 trillion in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Accuray is built on a robust foundation of data from reputable sources including government health and regulatory bodies, leading market research firms, and established industry associations. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the medical device sector.