Accel Entertainment SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accel Entertainment Bundle

Accel Entertainment's market position is shaped by a unique blend of strengths, like its established network, and potential weaknesses, such as regulatory dependence. Understanding these dynamics is crucial for anyone looking to invest or strategize within the amusement and entertainment sector.

Want the full story behind Accel Entertainment's growth drivers and competitive landscape? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Accel Entertainment holds a leading position as a distributed gaming operator in the United States, boasting a substantial operational scale. As of the second quarter of 2025, the company managed over 27,000 gaming terminals strategically placed in more than 4,400 locations across several states. This broad reach solidifies its market leadership, especially within its primary market of Illinois, offering significant competitive advantages.

Accel Entertainment's strength lies in its extensive network of local business partnerships, forming the bedrock of its operations. These aren't just casual associations; they are long-term, exclusive contracts with a wide array of establishments like bars, restaurants, and truck stops. This B2B strategy cultivates exceptionally stable and recurring revenue, highlighting the deep loyalty and retention Accel enjoys from its partners.

This symbiotic relationship is key. Accel's gaming and amusement services directly contribute incremental profits to these partner businesses, creating a mutually beneficial ecosystem. For instance, in Q1 2024, Accel reported that its gaming revenue per location averaged $2,144, showcasing the tangible financial benefit these partnerships provide.

Accel Entertainment boasts a robust revenue model, drawing income not just from video gaming terminals (VGTs) but also from amusement devices and ATM services. This diversification across multiple revenue streams provides a significant advantage, reducing reliance on any single income source. For instance, in the first quarter of 2024, Accel reported net revenue of $240.4 million, a notable increase from the previous year, showcasing the strength of its multifaceted approach.

Strategic Acquisitions and Geographic Expansion

Accel Entertainment has a proven track record of growth driven by a disciplined approach to strategic acquisitions. This has allowed the company to expand its footprint into new and promising markets. For instance, their acquisition of Toucan Gaming significantly bolstered their presence in Louisiana, a key growth area.

Further demonstrating this commitment, Accel acquired the FanDuel Sportsbook & Horse Racing at Fairmount Park in Illinois. This move not only broadens their entertainment portfolio but also strengthens their operational density in an already established market. These strategic moves are crucial for fortifying their competitive position.

- Disciplined Acquisition Strategy: Accel consistently seeks out opportunities to acquire businesses that align with its growth objectives and enhance its market presence.

- Geographic Expansion: Recent acquisitions, like Toucan Gaming in Louisiana, highlight a focused effort to enter and capitalize on new, attractive geographic markets.

- Portfolio Enhancement: The acquisition of FanDuel Sportsbook & Horse Racing at Fairmount Park in Illinois signifies an expansion of service offerings and a strengthening of existing market positions.

- Route Density: These acquisitions contribute to increased route density, which is vital for operational efficiency and market penetration in the video gaming terminal industry.

Operational Expertise and Turnkey Solutions

Accel Entertainment's operational expertise shines through its comprehensive, turnkey gaming-as-a-service platform. This end-to-end approach covers everything from VGT installation and maintenance to round-the-clock customer support, data analytics, and secure cash logistics for its local partners.

The company's strategic investment in digital infrastructure, notably Ticket-In/Ticket-Out (TITO) systems, significantly streamlines operations. This not only enhances the player experience through increased convenience but also drives overall efficiency, a crucial factor in the competitive amusement and gaming sector.

- Turnkey Solution: Accel provides a complete gaming-as-a-service model, simplifying operations for partners.

- End-to-End Support: Services include installation, maintenance, 24/7 customer service, data analysis, and cash logistics.

- Digital Infrastructure: Investments in TITO systems improve player convenience and operational efficiency.

Accel Entertainment's market leadership is underscored by its extensive operational scale, managing over 27,000 gaming terminals across more than 4,400 locations as of Q2 2025. This broad reach, particularly in its core Illinois market, provides a significant competitive edge.

The company's strength lies in its deep network of exclusive, long-term partnerships with businesses like bars and restaurants, fostering stable, recurring revenue and high partner retention. Accel's gaming services demonstrably boost partner profits, as evidenced by an average of $2,144 in gaming revenue per location in Q1 2024.

Accel's diversified revenue streams, including amusement devices and ATM services, alongside its VGT operations, create a resilient financial model. This multifaceted approach contributed to net revenues of $240.4 million in Q1 2024, reflecting robust growth.

A disciplined acquisition strategy fuels Accel's expansion, with recent moves like the Toucan Gaming acquisition in Louisiana and the purchase of FanDuel Sportsbook & Horse Racing at Fairmount Park in Illinois bolstering its market presence and service offerings.

| Metric | Q1 2024 | Q2 2025 (Estimate) | Significance |

|---|---|---|---|

| Gaming Terminals | N/A | 27,000+ | Market leadership and scale |

| Locations | N/A | 4,400+ | Extensive geographic coverage |

| Avg. Gaming Revenue/Location | $2,144 | N/A | Partner profitability and revenue stability |

| Net Revenue | $240.4 million | N/A | Financial strength and growth |

What is included in the product

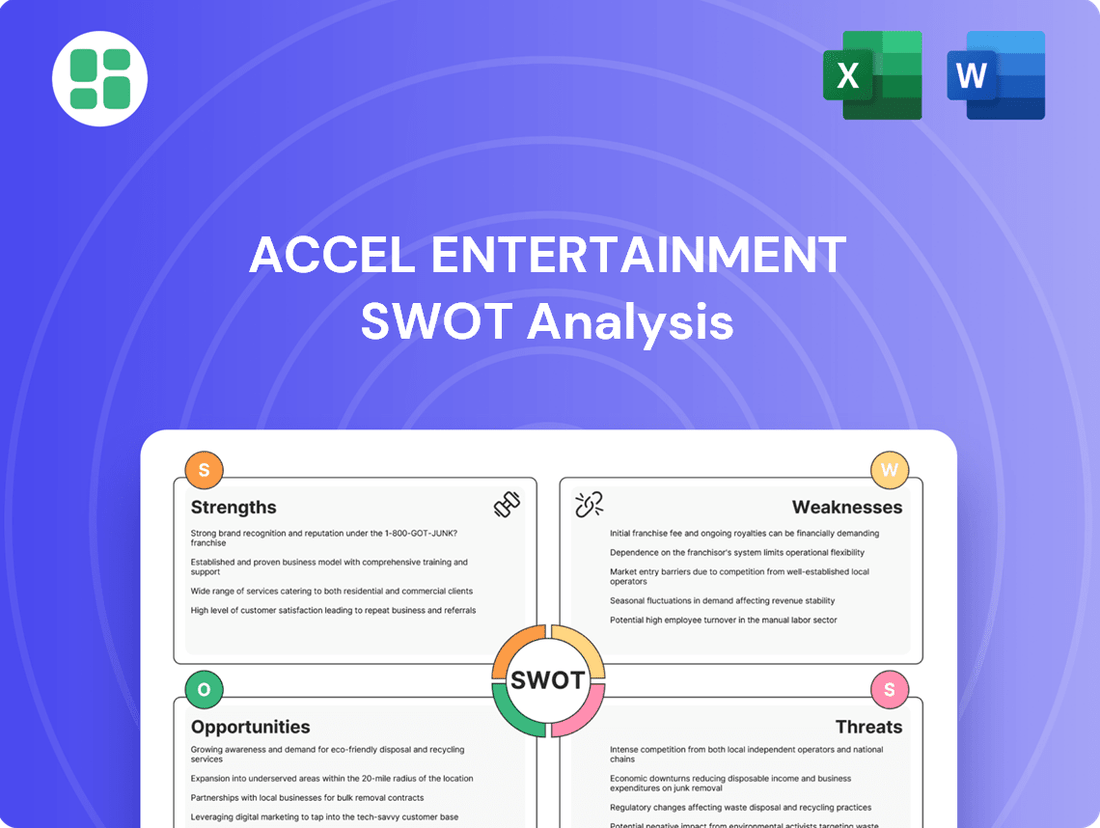

Provides a strategic overview of Accel Entertainment’s internal strengths and weaknesses, alongside external opportunities and threats in the competitive amusement and entertainment landscape.

Offers a clear, actionable framework to identify and address market vulnerabilities, turning potential threats into strategic advantages.

Weaknesses

Accel Entertainment's primary weakness lies in its substantial reliance on state-specific gaming regulations. The company's operational success is directly tied to the varying legal landscapes across different states, creating a complex and fragmented operating environment.

These regulations are not static; they are subject to frequent amendments and potential shifts. For instance, in 2024, states like Illinois continued to refine their Video Gaming Terminal (VGT) regulations, impacting revenue share and operational requirements for companies like Accel. Such changes necessitate continuous adaptation and can introduce significant uncertainty into future revenue projections and strategic planning.

The constant need to navigate and comply with diverse and evolving state laws also incurs substantial compliance costs. Furthermore, adverse regulatory changes, such as increased taxation or stricter operational limitations, pose an ongoing challenge, potentially impacting profitability and market access.

Accel Entertainment's reliance on consumer discretionary spending is a significant weakness. When the economy tightens, people tend to cut back on non-essential activities like gaming. For instance, if inflation continues to rise through 2024 and into 2025, consumers will have less disposable income, directly impacting the volume of play on Accel's video gaming terminals (VGTs) and other amusement devices.

This sensitivity means Accel's financial performance is closely linked to broader economic health. An economic downturn or even persistent inflationary pressures can reduce the amount of money people are willing or able to spend on entertainment, thereby hurting Accel's revenue streams. This makes the company's results vulnerable to macroeconomic shifts beyond its direct control.

Accel Entertainment has faced challenges with net income volatility, even as its revenue grows. For example, in the second quarter of 2025, the company reported a significant 50.2% drop in net income when compared to the same period in 2024.

This dip in profitability is partly due to non-operational factors like losses stemming from changes in the fair value of contingent earnout shares. Additionally, rising operating expenses have put pressure on the bottom line, making it difficult to translate top-line growth into consistent net income gains.

The company's strategy of aggressive expansion appears to be creating a tension with its ability to maintain healthy profit margins. Effectively managing both growth initiatives and cost controls will be crucial for stabilizing net income in the future.

Integration Challenges with Acquired Businesses

Accel Entertainment's growth strategy heavily relies on acquisitions, but integrating these new entities, like the Toucan Gaming acquisition, poses significant hurdles. These challenges span operational alignment and cultural assimilation, demanding substantial management focus and resources to ensure smooth transitions and synergy realization.

Ineffective integration can directly impact financial performance. For instance, if the anticipated cost savings or revenue enhancements from an acquisition are not achieved due to integration issues, it can dilute overall profitability and operational efficiency. Accel Entertainment needs robust post-acquisition integration plans to mitigate these risks.

- Operational Integration: Merging IT systems, standardizing operational procedures, and aligning compliance frameworks across acquired businesses can be complex and time-consuming.

- Cultural Assimilation: Bridging different corporate cultures, employee expectations, and management styles is crucial for retaining talent and maintaining productivity post-acquisition.

- Synergy Realization: The failure to achieve projected cost synergies or revenue growth from acquisitions, such as those targeted with Toucan Gaming, directly impacts the return on investment and overall financial health.

Capital-Intensive Growth Strategy

Accel Entertainment's growth strategy, which involves expanding into new markets and developing significant projects like the Fairmount Park Casino & Racing, demands considerable financial resources. This capital-intensive approach means substantial upfront investments.

For instance, the company reported capital expenditures of $26 million in the second quarter of 2025. This figure represents a notable 49% increase compared to the same period in the previous year, highlighting the escalating investment required for its expansion initiatives.

- Significant Capital Outlay: Accel's expansion strategy necessitates large investments in new markets and major projects.

- Rising Expenditures: Q2 2025 capital expenditures reached $26 million, a 49% year-over-year increase.

- Financial Strain Potential: Continuous high investment can strain free cash flow and potentially increase debt.

- Management Challenge: Careful financial oversight is crucial to manage the impact of these capital requirements.

Accel Entertainment's dependence on consumer discretionary spending makes it vulnerable to economic downturns. As inflation persisted into 2024 and 2025, consumers had less disposable income, directly impacting spending on Accel's video gaming terminals. This sensitivity to macroeconomic shifts means the company's revenue can fluctuate significantly based on broader economic health.

The company's net income has shown volatility, even with revenue growth. For example, in Q2 2025, net income dropped by 50.2% year-over-year, partly due to non-operational factors like changes in the fair value of contingent earnout shares and rising operating expenses, hindering the translation of top-line growth into consistent profits.

Accel's aggressive acquisition strategy, exemplified by the Toucan Gaming deal, presents integration challenges. Merging operations, IT systems, and corporate cultures requires significant resources and management attention, with potential negative impacts on profitability if synergies are not realized effectively.

The company's expansion into new markets and projects like Fairmount Park Casino & Racing demands substantial capital. Q2 2025 capital expenditures reached $26 million, a 49% increase year-over-year, indicating a growing financial commitment that could strain free cash flow and increase debt levels.

| Weakness | Description | Impact Example |

|---|---|---|

| Regulatory Reliance | Heavy dependence on state-specific gaming regulations, which are subject to frequent changes and amendments. | Illinois VGT regulations in 2024 necessitated continuous adaptation and introduced uncertainty. |

| Economic Sensitivity | Vulnerability to consumer discretionary spending, directly affected by economic conditions and inflation. | Persistent inflation through 2024-2025 reduced disposable income, impacting VGT play. |

| Net Income Volatility | Inconsistent profitability despite revenue growth, influenced by non-operational factors and rising costs. | Q2 2025 net income fell 50.2% YoY due to earnout share adjustments and increased operating expenses. |

| Acquisition Integration Risk | Challenges in integrating acquired businesses, impacting operational alignment and synergy realization. | Ineffective integration of Toucan Gaming could dilute profitability and efficiency. |

| Capital Intensive Growth | Significant upfront investments required for expansion, potentially straining financial resources. | Q2 2025 capital expenditures rose 49% YoY to $26 million, increasing financial pressure. |

Preview the Actual Deliverable

Accel Entertainment SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Accel Entertainment SWOT analysis, providing key insights into their Strengths, Weaknesses, Opportunities, and Threats. The full, detailed report is unlocked immediately upon purchase.

Opportunities

Accel Entertainment has a clear opportunity to grow by entering new states where video gaming is becoming legal or where the rules are still being established. This is a chance to get in early and capture market share.

The company has already shown it can succeed in new territories, like its recent moves into Louisiana, Georgia, and Nebraska. These expansions prove their strategy works.

By actively pursuing these emerging markets, Accel can find significant growth opportunities that go beyond the areas where they already have a strong presence.

The distributed gaming sector is still quite fragmented in many places, and this really opens the door for Accel to buy up smaller companies. By doing this, Accel can boost its presence in existing areas, add more gaming terminals, and even move into new territories, which will help it become an even bigger player and operate more efficiently.

Accel Entertainment's commitment to technological innovation is a key opportunity. By investing in and deploying advanced gaming technologies and digital solutions, the company can significantly boost its operational efficiency and elevate the player experience. This forward-thinking approach is crucial in today's rapidly evolving market.

The successful adoption of Ticket-In/Ticket-Out (TITO) systems in Illinois demonstrates the tangible benefits of digital transformation. This technology streamlines transactions, reduces operational friction, and enhances convenience for players. Accel's development of proprietary gaming content in Montana further highlights this strategy, aiming to create unique offerings that can attract and retain a wider player base.

Diversification into Related Entertainment Ventures

Accel Entertainment can expand its reach by venturing into entertainment areas that complement its existing video gaming terminal (VGT) business. This strategic move aims to capture a wider audience and tap into new market segments within the broader gaming and entertainment landscape.

The April 2025 launch of casino and racing operations at Fairmount Park Casino & Racing is a prime example of this diversification strategy in action. This development signifies Accel's commitment to evolving its entertainment portfolio beyond VGTs, creating a more comprehensive offering for consumers.

This expansion allows Accel to leverage its operational expertise in new, related ventures, potentially increasing revenue streams and market share. The company is positioning itself to benefit from the synergies between different entertainment formats.

- Diversification into new entertainment verticals.

- Leveraging existing operational expertise in complementary businesses.

- Attracting a broader customer demographic.

- Capitalizing on the April 2025 Fairmount Park Casino & Racing launch as a precedent.

Optimization of Existing Locations and Terminal Performance

Accel Entertainment can unlock significant organic growth by strategically evaluating its existing footprint. This involves identifying and potentially exiting underperforming locations, a process often referred to as 'pruning.' For instance, in Q1 2024, Accel reported a 10.3% increase in revenue per terminal, demonstrating the positive impact of focusing on optimizing the performance of its active sites.

By concentrating resources on high-potential venues and enhancing operational efficiency at each location, Accel can boost overall profitability. The company's commitment to data analytics allows for granular insights into terminal performance, enabling data-driven decisions to maximize revenue and Adjusted EBITDA across its network. This optimization strategy is crucial for sustained financial health, especially considering the competitive landscape.

Key aspects of this optimization include:

- Strategic location review: Identifying and closing or relocating underperforming video gaming terminals (VGTs) and locations.

- Revenue per terminal enhancement: Implementing strategies to increase the average revenue generated by each VGT.

- Data-driven operational improvements: Utilizing analytics to refine game mix, staffing, and marketing efforts at each site.

- Focus on Adjusted EBITDA: Ensuring that operational improvements translate directly into increased profitability.

Accel Entertainment can capitalize on the ongoing expansion of video gaming regulations in new and existing markets. The company's proven ability to navigate diverse regulatory environments, as demonstrated by its successful entry into Louisiana, Georgia, and Nebraska, positions it well for further geographic growth. This strategy is supported by the increasing legalization of gaming in various U.S. states, creating a fertile ground for Accel's business model.

The fragmented nature of the distributed gaming sector presents a significant opportunity for Accel to pursue strategic acquisitions. By integrating smaller operators, Accel can enhance its market presence, expand its terminal count, and achieve greater operational efficiencies. This consolidation strategy is a key driver for increasing market share and competitive advantage.

Accel's investment in technological innovation, particularly in proprietary gaming content and digital solutions, offers a pathway to improved player experiences and operational streamlining. The successful implementation of Ticket-In/Ticket-Out (TITO) systems in Illinois underscores the value of such advancements. Furthermore, the company's diversification into broader entertainment offerings, exemplified by the April 2025 Fairmount Park Casino & Racing launch, broadens its revenue potential and market appeal.

Optimizing its existing network by focusing on high-performing locations and potentially divesting underperforming ones is another key opportunity. Accel's Q1 2024 performance, showing a 10.3% increase in revenue per terminal, highlights the effectiveness of this data-driven approach to site selection and operational enhancement.

| Opportunity Area | Supporting Fact/Data | Potential Impact |

|---|---|---|

| Geographic Expansion | Entry into Louisiana, Georgia, Nebraska | Increased market share and revenue |

| Mergers & Acquisitions | Fragmented distributed gaming sector | Enhanced scale and operational efficiency |

| Technological Innovation | TITO system success in Illinois; proprietary content development | Improved player experience and operational streamlining |

| Network Optimization | 10.3% revenue per terminal increase (Q1 2024) | Boosted profitability and Adjusted EBITDA |

Threats

The gaming sector is inherently vulnerable to shifts in government oversight, which could manifest as higher taxes on gaming income, more stringent licensing protocols, or even outright bans. For Accel Entertainment, this means that changes in state or federal laws could directly impact their bottom line and how they operate.

For instance, ongoing legislative debates in several states, such as potential tax increases on sports betting and online gaming, present a tangible threat. These proposed tax hikes could significantly reduce Accel's profit margins and limit its ability to expand or adapt its business model in key operating regions. In 2024, some states saw discussions around increasing gaming taxes by several percentage points, which could directly affect companies like Accel.

The distributed gaming sector, though currently somewhat fragmented, faces the looming threat of new entrants or the expansion of established casino and entertainment giants into the market. This influx of competition could significantly alter the landscape for companies like Accel Entertainment.

Such increased competition can directly translate into pricing pressures, forcing Accel to lower its revenue share from gaming terminals. Furthermore, securing prime locations for its machines may become more challenging and expensive as more players vie for limited opportunities, potentially impacting Accel's growth trajectory and profitability.

For instance, if a major casino operator with substantial capital and existing customer relationships were to enter Accel's key markets, it could quickly capture market share. This scenario, coupled with potential regulatory changes that might favor larger, more established entities, poses a significant risk to Accel's current market position and its ability to maintain its revenue streams and profit margins in the coming years.

Economic downturns, such as a potential recession in late 2024 or 2025, could significantly shrink consumer discretionary spending. This directly impacts industries like gaming and entertainment, where Accel Entertainment operates.

During such periods, consumers tend to cut back on non-essential activities, leading to reduced usage of Video Gaming Terminals (VGTs) and amusement devices. This reduction in play directly translates to lower revenue streams for Accel Entertainment.

For instance, if inflation remains elevated through 2025, consumers may have less disposable income for entertainment, potentially decreasing Accel's per-terminal earnings and overall profitability.

Shifts in Consumer Preferences Towards Online Gaming (iGaming)

The rapid expansion of iGaming and mobile betting platforms poses a significant threat to Accel Entertainment. As more states legalize online gambling, consumers have increasingly convenient alternatives to physical video gaming terminals (VGTs). This shift could draw players away from Accel's established locations, potentially impacting revenue streams if the company doesn't adapt.

For instance, the U.S. online gambling market is projected to reach $33.16 billion by 2028, indicating a substantial migration towards digital channels. This trend directly challenges traditional VGT operators like Accel.

- Growing iGaming Market: The U.S. iGaming market is experiencing robust growth, with revenue expected to climb significantly in the coming years.

- Mobile Accessibility: The convenience of mobile gaming further accelerates the shift away from physical locations.

- Legalization Trends: Increasing state-level legalization of online sports betting and casino games creates more competitive digital options.

- Player Diversion: Consumers may opt for the ease and accessibility of online platforms over traditional VGT establishments.

Negative Public Perception or Social Opposition to Gaming

Negative public perception stemming from concerns about problem gambling or the increasing visibility of gaming machines in local communities poses a significant threat. This societal unease can translate into intensified pressure for more stringent regulations, leading to potential operational hurdles or limitations for Accel Entertainment.

Community opposition to new gaming locations, fueled by these social concerns, could hinder expansion efforts and impact revenue growth. For instance, in 2024, several states saw increased debate around the social impact of video gaming terminals (VGTs), with some municipalities enacting stricter zoning laws or moratoriums on new placements.

A general decline in the social acceptance of distributed gaming could erode the market for Accel Entertainment's services. This trend is observable in public opinion polls, where a growing segment of the population expresses reservations about the proliferation of gaming, impacting the overall business environment.

- Societal concerns regarding problem gambling are a persistent threat to the gaming industry.

- Increased public pressure for stricter regulations can directly impact operational models.

- Community opposition to new locations can stifle expansion and market penetration.

- A decline in social acceptance can lead to a less favorable market for distributed gaming.

Changes in government regulations, such as increased taxes or stricter licensing, pose a significant threat to Accel Entertainment's profitability and operations, as seen in ongoing legislative discussions in several states regarding gaming tax hikes in 2024.

Increased competition from new entrants or established casino operators could lead to pricing pressures and make securing prime locations more challenging, potentially impacting Accel's growth and profitability.

Economic downturns, like a potential recession in late 2024 or 2025, could reduce consumer discretionary spending, directly affecting Accel's revenue from video gaming terminals.

The rapid growth of iGaming and mobile betting platforms presents a threat as consumers increasingly opt for convenient digital alternatives over physical VGTs, a trend projected to see the U.S. online gambling market reach $33.16 billion by 2028.

Negative public perception surrounding problem gambling and the visibility of gaming machines can lead to stricter regulations and community opposition, hindering expansion and impacting the overall market for distributed gaming.

SWOT Analysis Data Sources

This Accel Entertainment SWOT analysis is built on a foundation of reliable data, drawing from their official financial filings, comprehensive market research reports, and expert industry commentary to provide a clear and actionable strategic overview.