Accel Entertainment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accel Entertainment Bundle

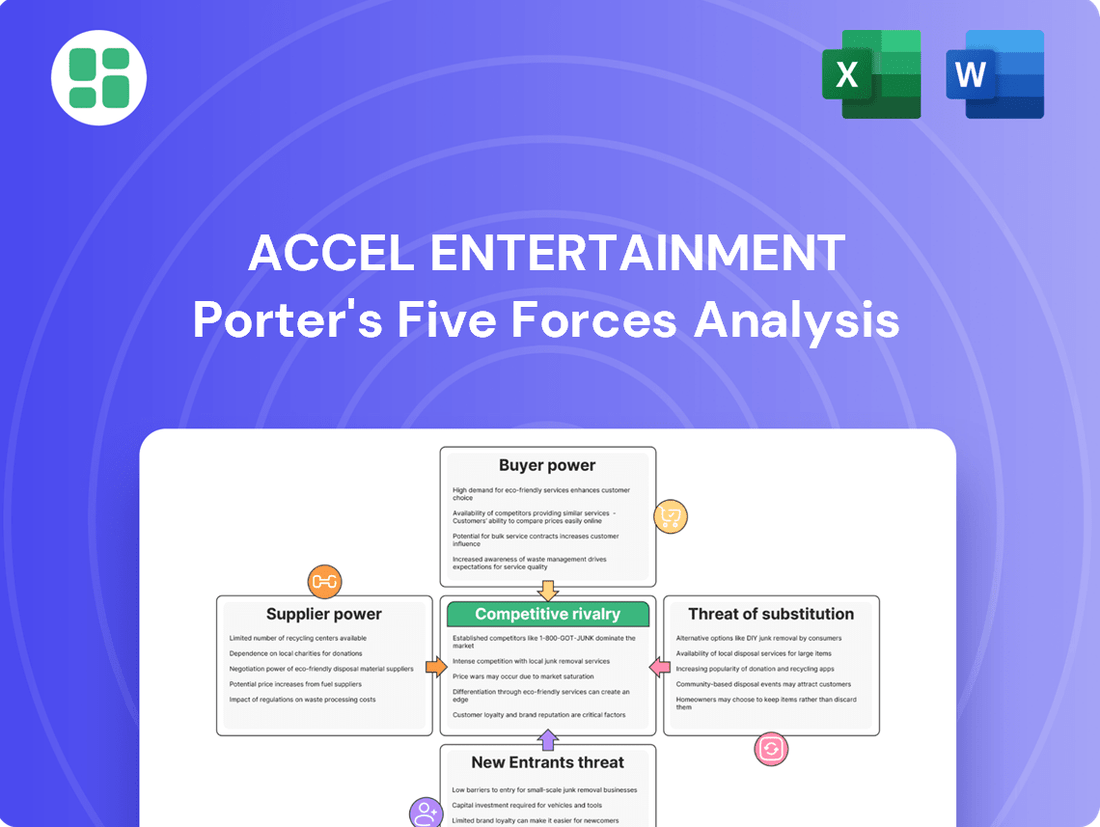

Accel Entertainment navigates a landscape shaped by moderate buyer power and the looming threat of new entrants, while supplier power and the intensity of rivalry present significant considerations. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Accel Entertainment’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Accel Entertainment, particularly VGT manufacturers and software providers, is a key factor. A limited number of dominant suppliers can dictate terms and pricing, potentially squeezing Accel’s margins. For instance, in 2023, the VGT market saw consolidation, with companies like Aristocrat Leisure continuing to expand their offerings, potentially increasing their leverage.

However, Accel Entertainment's significant market presence, as one of the largest VGT operators in Illinois, provides a substantial counterbalance. This scale allows Accel to negotiate more favorable terms with suppliers, leveraging its substantial order volume. This is crucial as VGT technology and game content are essential for maintaining competitive advantage and player engagement.

The cost and complexity associated with switching video gaming terminal (VGT) manufacturers or software providers significantly bolster supplier power. For Accel Entertainment, transitioning to a new key supplier would likely incur substantial expenses, including the installation of new equipment, seamless software integration, and comprehensive training for their maintenance staff.

These considerable switching costs inherently reduce Accel's flexibility and bargaining leverage when negotiating with existing or potential vendors, effectively strengthening the suppliers' position in the market.

Suppliers who provide highly specialized or essential components, like unique gaming software or advanced security features for video gaming terminals (VGTs), naturally hold more sway. Accel Entertainment’s operations depend heavily on the reliability and quality of its equipment to maintain smooth service and meet strict regulatory standards.

For instance, a key supplier of VGT cabinets or payment processing systems could exert significant pressure if Accel has limited alternative sources. In 2023, Accel Entertainment reported that its cost of goods sold, which includes equipment and related services, represented a substantial portion of its operating expenses, highlighting the financial impact of supplier relationships.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, such as VGT manufacturers or software developers, could increase their bargaining power if they were to enter the distributed gaming operation market directly. This would allow them to capture more of the value chain.

However, the barriers to such integration are substantial. The gaming industry is heavily regulated, requiring extensive licensing and compliance with state-specific rules. For example, obtaining a gaming license in Illinois, a key market for Accel Entertainment, involves a rigorous application process and significant ongoing oversight.

Furthermore, establishing the necessary local business networks and operational infrastructure to run gaming establishments presents another considerable challenge for potential entrants. These factors collectively limit the practical ability of suppliers to effectively integrate forward into Accel's core business.

- Supplier Forward Integration Difficulty: Significant regulatory hurdles and licensing requirements in states like Illinois act as a major deterrent for VGT manufacturers or software developers looking to enter the distributed gaming operation market.

- Network and Infrastructure Demands: Building the required local business relationships and operational infrastructure for gaming establishments is a complex and resource-intensive undertaking, further complicating direct supplier entry.

- Impact on Bargaining Power: The high barriers to forward integration mean that suppliers' ability to exert greater bargaining power through this channel is currently limited, benefiting Accel Entertainment.

Regulatory Impact on Supplier Landscape

The highly regulated nature of the gaming industry, particularly distributed gaming, significantly shapes the supplier landscape for companies like Accel Entertainment. This regulatory environment necessitates that manufacturers and distributors obtain specific licenses, a process that can be both time-consuming and costly. For instance, in 2024, navigating the licensing requirements across multiple states where Accel operates is a critical operational factor.

This stringent licensing can effectively limit the pool of eligible suppliers, thereby potentially enhancing the bargaining power of those who have successfully met all regulatory hurdles. Accel must therefore maintain a vigilant approach to ensure all its chosen suppliers not only meet operational needs but also adhere strictly to all state and local gaming board requirements, a crucial compliance aspect in 2024.

- Supplier Licensing: Gaming industry regulations mandate licenses for manufacturers and distributors, restricting the available supplier base.

- Increased Supplier Power: A limited number of licensed suppliers can translate to greater leverage in negotiations.

- Accel's Compliance Burden: Accel Entertainment is responsible for ensuring its suppliers meet all state and local gaming board regulations.

The bargaining power of suppliers for Accel Entertainment, primarily VGT manufacturers and software providers, is influenced by market concentration and switching costs. While Accel's scale in Illinois, a key market, offers leverage, a limited number of dominant suppliers can still dictate terms, impacting margins. For example, in 2023, continued consolidation in the VGT market, with companies like Aristocrat Leisure expanding, potentially increased their leverage over operators.

The substantial costs and complexity associated with switching VGT manufacturers or software providers significantly reinforce supplier power. Accel Entertainment faces considerable expenses for new equipment installation, software integration, and staff training, which limits its negotiation flexibility. These high switching costs mean that suppliers hold a stronger position when negotiating pricing and terms with Accel.

Suppliers of specialized or essential components, such as unique gaming software or advanced VGT security features, possess considerable influence. Accel's operations rely heavily on the quality and reliability of these components to maintain smooth service and comply with stringent regulations. In 2023, Accel’s cost of goods sold, which includes equipment and services, represented a significant portion of its operating expenses, underscoring the financial impact of supplier relationships.

The threat of forward integration by suppliers is mitigated by significant barriers in the highly regulated gaming industry. Obtaining extensive licenses and complying with state-specific rules, like those in Illinois, is a rigorous and costly process. Furthermore, establishing the necessary local business networks and operational infrastructure presents a substantial challenge, limiting suppliers’ ability to directly compete with Accel's core business.

| Factor | Impact on Accel Entertainment | 2023/2024 Context |

|---|---|---|

| Supplier Concentration | Limited suppliers can increase pricing power. | VGT market consolidation continued in 2023. |

| Switching Costs | High costs for Accel limit negotiation flexibility. | Installation, integration, and training are significant expenses. |

| Supplier Specialization | Essential component suppliers hold more sway. | Reliability is key for smooth operations and regulatory compliance. |

| Forward Integration Threat | Barriers (regulation, licensing) limit this threat. | Rigorous licensing in Illinois and other states is a major deterrent. |

What is included in the product

This analysis of Accel Entertainment's competitive landscape reveals the intensity of rivalry, the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and its implications for profitability.

Eliminate the guesswork in competitive strategy by instantly visualizing Accel Entertainment's market position against all five forces.

Confidently navigate industry shifts with pre-built scenarios that highlight potential threats and opportunities for Accel Entertainment.

Customers Bargaining Power

Accel Entertainment's partner establishments, primarily bars and restaurants, experience significant switching costs when considering a change in their video gaming terminal (VGT) operator. These costs are substantial, encompassing the logistical challenges of removing existing VGTs and installing new ones, which can lead to a temporary halt in gaming operations and associated revenue streams. For instance, in 2024, the average downtime for VGT replacement can range from several days to over a week, directly impacting a partner's profitability.

Beyond the physical installation, partners must also account for the administrative burden of negotiating new contracts, integrating new software and payment systems, and retraining staff on any updated procedures. Accel's comprehensive, turnkey approach ensures its services are deeply woven into the fabric of its partners' daily operations, making disengagement a complex and costly endeavor, thereby reinforcing Accel's bargaining power.

Many local businesses, particularly bars and restaurants, depend heavily on the revenue generated from video gaming terminals (VGTs). This reliance makes Accel Entertainment's services crucial for their financial health, as these machines often represent a significant portion of their income.

For example, in Illinois, a key market for Accel, bars and restaurants averaged over $9,300 in gross gaming revenue per establishment in April 2024. This substantial income stream highlights how vital VGTs are to these businesses' operational success and profitability.

Consequently, the high dependence on VGT revenue significantly curtails the bargaining power of these businesses as customers. They need Accel's reliable service and equipment to maintain this critical income, giving Accel a stronger position in negotiations.

Accel Entertainment's customer base is highly fragmented, comprising a vast network of local businesses like bars, restaurants, and truck stops spread across several states. This diversity means that no single client represents a significant portion of Accel's revenue. For example, in 2023, Accel operated across Illinois, Indiana, Ohio, and Missouri, serving thousands of such establishments.

Due to this widespread distribution, each individual business customer possesses minimal bargaining power. Their ability to negotiate terms or pricing is substantially limited because they are just one of many small to medium-sized establishments relying on Accel's services. This fragmentation is a key factor in maintaining Accel's pricing power and profitability.

Long-Term Contracts and Exclusive Agreements

Accel Entertainment frequently enters into long-term contracts and exclusive agreements with the establishments where its video gaming terminals are located. This strategy significantly diminishes the bargaining power of individual customers, such as patrons of bars or truck stops, as their choices are indirectly influenced by these agreements.

These binding contracts provide Accel with a predictable and stable revenue stream, making it difficult for partner locations to switch to a different terminal operator. In fact, licensed video gaming locations are legally mandated to have a signed Use Agreement with a licensed terminal operator, reinforcing Accel's position.

- Reduced Customer Choice: Long-term contracts limit the ability of partner locations to offer alternative gaming options, thereby reducing the direct bargaining power of end-users.

- Revenue Stability: Exclusive agreements ensure a consistent revenue flow for Accel, as partner locations are contractually obligated to utilize their services.

- Barriers to Switching: The requirement for signed Use Agreements with licensed terminal operators creates a barrier for locations looking to change providers, further solidifying Accel's customer base.

Availability of Alternative Operators

The bargaining power of customers, particularly the partner locations for distributed gaming operators like Accel Entertainment, is influenced by the availability of alternatives. While Accel is a significant player, these locations can consider other operators such as JJ Ventures, Gold Rush Gaming, and GEM if they find better terms or services elsewhere. This competitive landscape means Accel must continually demonstrate superior value.

Accel Entertainment distinguishes itself through its high-quality service, advanced technological solutions, and attractive revenue-sharing models. These factors are crucial in retaining partner locations and mitigating the risk of them switching to competitors. For example, Accel's investment in modern gaming equipment and efficient payout systems directly addresses potential customer pain points.

- Alternative Operators: JJ Ventures, Gold Rush Gaming, and GEM represent direct competitors for Accel Entertainment's partner locations.

- Service Differentiation: Accel's focus on service quality, including reliable maintenance and customer support, is a key factor in customer retention.

- Technological Edge: The company's investment in up-to-date gaming technology and payment systems can provide a competitive advantage.

- Revenue Sharing: Favorable revenue-sharing agreements are a primary consideration for partner locations when choosing an operator.

Accel Entertainment's partner establishments, primarily bars and restaurants, face significant switching costs when considering a change in their video gaming terminal (VGT) operator. These costs, including installation and administrative burdens, make it complex and costly to disengage, thereby reinforcing Accel's bargaining power.

The fragmented nature of Accel's customer base, consisting of thousands of small businesses across multiple states, means each individual client has minimal leverage. This widespread distribution limits their ability to negotiate terms, solidifying Accel's pricing power.

Long-term contracts and exclusive agreements further diminish customer bargaining power by restricting choices and creating barriers to switching providers. For instance, licensed video gaming locations are legally required to have a signed Use Agreement with a licensed terminal operator, a factor that strengthens Accel's position.

While competitors like JJ Ventures and Gold Rush Gaming exist, Accel differentiates itself through superior service, technology, and favorable revenue-sharing models, mitigating customer churn and maintaining its competitive edge.

| Factor | Impact on Accel's Bargaining Power with Customers | Supporting Data/Example |

|---|---|---|

| Switching Costs | High, reducing customer incentive to switch | Downtime for VGT replacement can range from several days to over a week in 2024. |

| Customer Fragmentation | Low individual customer leverage | Thousands of small establishments across multiple states (e.g., IL, IN, OH, MO in 2023). |

| Contractual Agreements | Strongly limits customer options and facilitates retention | Legal requirement for Use Agreements with licensed terminal operators. |

| Availability of Alternatives | Mitigated by service differentiation | Competitors include JJ Ventures, Gold Rush Gaming; Accel focuses on service quality and technology. |

Full Version Awaits

Accel Entertainment Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Accel Entertainment, providing an in-depth examination of industry competition and profitability. The document you see here is the exact, professionally formatted report you will receive instantly upon purchase, offering immediate strategic insights. You can trust that this detailed analysis, covering threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry, is precisely what you'll download and utilize.

Rivalry Among Competitors

The distributed gaming sector is seeing a trend toward consolidation, with Accel Entertainment standing out as a major player and one of the largest terminal operators across the United States. This consolidation inherently lessens the intensity of direct competition as the market matures.

Accel's proactive approach to acquisitions, such as its recent moves to integrate Toucan Gaming in Louisiana and FanDuel Sportsbook & Horse Racing in Illinois, directly diminishes the competitive landscape. These strategic integrations absorb rivals, thereby reducing the number of direct competitors Accel faces.

The gaming industry, particularly video gaming terminals (VGTs), faces substantial regulatory hurdles. Strict licensing processes for operators, as seen with Accel Entertainment being licensed by the Illinois Gaming Board since 2012, significantly limit the number of potential new entrants. This robust regulatory framework acts as a natural deterrent, effectively reducing the intensity of competitive rivalry by keeping the field of viable competitors relatively contained.

Accel Entertainment stands out by providing a complete, end-to-end service for amusement and gaming operations. This includes not just the installation of video gaming terminals (VGTs) and amusement devices, but also their ongoing maintenance, operation, and even ATM solutions.

Their commitment extends to 24/7 customer support and advanced data analytics, offering partners a truly integrated experience. This comprehensive, hands-on approach fosters strong loyalty among their local partners, effectively sidestepping direct price wars with competitors who offer less integrated services.

Industry Growth and Geographic Expansion

The distributed gaming market is seeing robust growth, which is a key factor influencing competitive rivalry. This expansion allows companies like Accel Entertainment to grow without directly impacting their rivals' existing market share, potentially softening the intensity of competition.

Accel's strategic expansion into new states, such as Louisiana, exemplifies this trend. In 2023, Accel reported revenue of $381.9 million, a significant increase from $298.6 million in 2022, showcasing the opportunities available in emerging markets.

- Market Growth: The overall distributed gaming market's expansion provides room for multiple players to grow simultaneously.

- Geographic Expansion: Accel's entry into new states like Louisiana allows for market penetration without direct confrontation in established territories.

- Reduced Direct Competition: In growing markets, competitors can expand their operations without necessarily needing to steal market share from incumbents, thus tempering rivalry.

- Acquisition Strategy: Accel's use of acquisitions to enter new markets also plays a role, potentially consolidating smaller players rather than intensifying head-to-head competition.

Exit Barriers for Competitors

Significant exit barriers can keep competitors entrenched in the video gaming terminal (VGT) market. High upfront costs for gaming equipment, often running into tens of thousands of dollars per unit, and long-term contracts for prime locations create substantial financial commitments. Furthermore, obtaining and maintaining state and local gaming licenses involves rigorous processes and ongoing compliance, adding to the cost and complexity of exiting the business.

These barriers mean that even underperforming operators may continue to compete rather than incur substantial losses from exiting. For instance, in Illinois, a key market for Accel, the renewal of gaming licenses involves significant fees and adherence to evolving regulations. This environment can lead to sustained competitive pressure, as firms are incentivized to operate at reduced profitability to recover their investments.

Accel Entertainment's financial strength and strategic acquisitions, however, position it favorably. With reported revenue growth and a solid balance sheet, Accel demonstrates an ability to navigate this landscape. Their acquisition of smaller operators, such as their 2023 acquisition of Gold Rush Amusements, showcases a strategy to consolidate market share and absorb potential competitors, rather than being hindered by their presence.

- High Fixed Costs: Gaming equipment can cost upwards of $20,000-$30,000 per terminal, representing a substantial initial investment.

- Location Contracts: Long-term agreements with bars and restaurants lock operators into specific venues, making relocation or divestment difficult.

- Licensing Requirements: Obtaining and maintaining gaming licenses involves significant compliance costs and regulatory hurdles, varying by state. For example, Illinois gaming license renewal fees can be substantial.

- Accel's Strategy: Accel's robust financial performance and strategic acquisitions, like the Gold Rush Amusements deal in 2023, allow it to absorb or outmaneuver competitors facing these exit barriers.

Competitive rivalry within the distributed gaming sector, where Accel Entertainment operates, is influenced by market growth and consolidation trends. Accel's strategic acquisitions, like the 2023 integration of Gold Rush Amusements, actively reduce the number of direct competitors. Furthermore, stringent licensing requirements, such as those enforced by the Illinois Gaming Board, limit new entrants, thereby tempering overall rivalry.

| Factor | Impact on Rivalry | Accel's Position |

|---|---|---|

| Market Growth | Allows multiple players to expand without direct conflict. | Accel benefits from expansion into new states like Louisiana, reporting $381.9 million in revenue for 2023. |

| Consolidation | Reduces the number of independent competitors. | Accel is a leading consolidator, absorbing smaller operators. |

| Regulatory Barriers | High licensing costs and compliance limit new entrants. | Accel's established licenses, like in Illinois since 2012, create a barrier for rivals. |

| Exit Barriers | High costs for equipment ($20k-$30k per unit) and contracts keep firms in the market. | Accel's financial strength allows it to outmaneuver competitors facing these barriers. |

SSubstitutes Threaten

The most significant threat of substitution for Accel Entertainment's video gaming terminal (VGT) business stems from the potential expansion of online gambling, often referred to as iGaming. This is particularly relevant in key operational markets like Illinois.

Legislation aimed at legalizing internet casino gaming has been introduced in Illinois for consideration in 2025. Historically, proponents of VGTs have voiced strong opposition to such iGaming bills, recognizing the direct competitive threat they represent to their existing business model.

Consumers can opt for traditional brick-and-mortar casinos or online sports betting platforms as alternatives to distributed gaming. This presents a significant threat of substitutes for Accel Entertainment's core business model.

Accel Entertainment is actively addressing this threat by diversifying its offerings. The acquisition and operation of Fairmount Park Casino & Racing, which commenced operations in April 2025, is a key strategic move. This expansion into a physical casino and racing facility broadens Accel's gaming portfolio, offering a more comprehensive entertainment experience that can appeal to a wider customer base and potentially reduce reliance on distributed gaming alone.

Accel Entertainment's video gaming terminals (VGTs) face competition from a broad spectrum of alternative entertainment and leisure activities. Consumers can choose from movie theaters, live music events, sporting contests, or even passive leisure like streaming services. These diverse options represent a significant threat, as consumer spending on entertainment is often discretionary and can be reallocated based on evolving preferences and economic conditions.

The convenience and accessibility of VGTs are key differentiators for Accel Entertainment. However, the allure of unique experiences or social engagement offered by other leisure pursuits can draw consumers away. For instance, in 2024, consumer spending on live events and entertainment saw a notable rebound, indicating a strong demand for experiential leisure that VGTs must contend with.

In-Home Gaming and Mobile Gaming

The rise of in-home and mobile gaming presents a significant threat of substitutes for Accel Entertainment's Video Gaming Terminal (VGT) business. The convenience and decreasing cost of consoles, PCs, and smartphones make these attractive alternatives for entertainment. This is particularly true as mobile gaming continues its dominance in the broader gaming market.

Mobile gaming alone accounted for a substantial portion of the global games market, with projections indicating continued growth. For instance, in 2024, the mobile gaming segment was estimated to represent over 50% of the total gaming revenue worldwide, reaching billions of dollars. This widespread accessibility directly competes for consumers' leisure time and discretionary spending, which could otherwise be allocated to VGTs.

- Mobile gaming's market share is projected to remain dominant in 2024, capturing over half of the global gaming revenue.

- The increasing sophistication and affordability of home gaming consoles and PCs offer compelling entertainment alternatives.

- Consumers' leisure time and disposable income are finite resources, creating direct competition for spending on entertainment options.

- The accessibility and variety of mobile games provide a readily available substitute for the out-of-home VGT experience.

Regulatory Landscape and Substitution Impact

The threat of substitutes for Accel Entertainment's video gaming terminal (VGT) business is significantly shaped by the evolving regulatory landscape. Decisions made by state legislatures regarding the legalization and expansion of other forms of gambling, particularly online, can introduce powerful substitutes that divert consumer spending away from VGTs. For instance, the ongoing discussions in Illinois concerning the legalization of iGaming, with potential implementation in 2025, represent a direct legislative risk. This development could offer consumers more convenient and accessible alternatives to physical VGT locations, thereby increasing the substitutability threat.

The impact of these regulatory shifts is tangible. As states consider or implement broader online gambling frameworks, the appeal of VGTs may diminish. This is especially true if online platforms offer a wider variety of games, better odds, or more integrated loyalty programs. The potential for increased competition from these substitutes necessitates that Accel Entertainment remains agile and responsive to legislative changes, potentially exploring diversification strategies or enhancing the in-venue VGT experience to maintain its market position.

- Regulatory Uncertainty: Legislative debates around iGaming, like those in Illinois for 2025, directly impact substitute threats.

- Online Gambling Expansion: Legalization of online casinos and sports betting offers convenient alternatives to VGTs.

- Consumer Behavior Shifts: Increased accessibility of online gambling could draw players away from physical VGT locations.

- Competitive Landscape: New digital platforms can offer diverse gaming options, potentially eroding VGT market share.

The threat of substitutes for Accel Entertainment's VGTs is substantial, primarily from online gambling and other leisure activities. In 2024, mobile gaming alone captured over 50% of the global gaming revenue, highlighting the significant competition for consumer attention and spending. Furthermore, the growing availability and appeal of home gaming consoles and PCs offer compelling alternatives that directly vie for discretionary entertainment budgets.

Accel's strategic move to acquire Fairmount Park Casino & Racing in April 2025 aims to mitigate this by diversifying its entertainment portfolio. However, the ease of access and variety offered by digital substitutes, coupled with potential legislative shifts like iGaming legalization in Illinois by 2025, continue to pose a direct challenge to the traditional VGT model.

| Substitute Category | Key Characteristics | Impact on Accel VGTs | 2024/2025 Relevance |

|---|---|---|---|

| Online Gambling (iGaming) | Convenience, accessibility, variety of games | Direct diversion of consumer spending | Illinois considering legalization in 2025; mobile gaming >50% global revenue in 2024 |

| Home Gaming (Consoles/PCs) | High-quality graphics, immersive experiences, social play | Competes for leisure time and discretionary spending | Increasing affordability and sophistication of hardware |

| Other Leisure Activities | Experiential, social engagement, diverse entertainment options | Reallocation of entertainment budgets | Strong consumer demand for live events and experiences in 2024 |

Entrants Threaten

Entering the distributed gaming sector demands considerable financial outlay. Newcomers must invest heavily in acquiring and maintaining video gaming terminals, creating sophisticated software, and building the necessary operational groundwork across a wide network of venues. Accel Entertainment's impressive footprint, boasting over 27,000 terminals in more than 4,300 locations, underscores the sheer scale of investment needed to compete effectively.

The threat of new entrants for Accel Entertainment is significantly mitigated by strict regulatory and licensing hurdles. State gaming boards impose a complex web of requirements for terminal operation, manufacturing, and distribution licenses. These processes demand extensive background checks and ongoing compliance, creating substantial time and financial commitments for any aspiring competitor.

Accel Entertainment's advantage is its vast network of thousands of partner locations, locked in by long-term, often exclusive, contracts. This established infrastructure presents a significant barrier for any new competitor looking to replicate its reach and operational scale.

For a new entrant, developing a comparable network would demand substantial investment in time, capital, and the cultivation of trust with a multitude of businesses. This process is inherently slow and resource-intensive, making it difficult to quickly gain market traction against Accel's entrenched position.

Economies of Scale and Operational Efficiency

Accel Entertainment's substantial operational scale creates significant economies of scale. This is evident in their bulk purchasing of amusement and video gaming terminals, centralized maintenance, and efficient cash logistics. For instance, in 2023, Accel operated over 15,000 amusement and gaming terminals across more than 2,000 locations.

These economies of scale translate into lower per-unit costs, enabling Accel to offer attractive revenue-sharing agreements to their business partners. This cost advantage makes it challenging for new entrants to compete effectively, as they would need to achieve a similar volume of terminals and locations to match Accel's operational efficiency and pricing power.

- Economies of Scale: Accel's large operational footprint allows for cost savings in equipment, maintenance, and logistics.

- Competitive Pricing: This efficiency enables competitive revenue-sharing models for venue partners.

- Barrier to Entry: New entrants face difficulties matching Accel's cost structure without comparable scale.

Brand Recognition and Trust

Accel Entertainment has cultivated significant brand recognition and trust within the amusement and entertainment venue sector. This established reputation as a dependable, full-service operator presents a considerable barrier for potential new entrants. In 2024, building such trust typically requires substantial upfront investment in marketing and direct engagement to secure partnerships.

New competitors would face the challenge of displacing Accel's existing relationships, which are often built on years of consistent performance and reliable service delivery. Overcoming this ingrained trust necessitates a robust strategy to demonstrate equivalent or superior value, a feat that demands considerable resources and time to achieve.

- Brand Loyalty: Accel's established partnerships foster loyalty, making it difficult for new entrants to gain initial traction.

- Reputational Capital: Years of reliable service have built a strong reputation that new players must actively work to match.

- Market Penetration Costs: Acquiring new locations requires significant marketing and sales expenditure to overcome existing brand preference.

The threat of new entrants for Accel Entertainment is considerably low due to the substantial capital required to enter the distributed gaming sector. Establishing a widespread network of terminals and securing necessary licenses involves significant upfront investment, making it a high barrier for potential competitors. Accel's operational scale, evidenced by its extensive terminal network and long-term venue contracts, further solidifies this advantage.

| Factor | Barrier Strength | Impact on Accel Entertainment |

|---|---|---|

| Capital Requirements | High | Significant financial outlay needed for terminals, software, and operations. |

| Regulatory Hurdles | High | Complex licensing and compliance processes deter new entrants. |

| Network Effects | High | Accel's established network of thousands of partner locations creates a strong advantage. |

| Economies of Scale | High | Accel's large volume leads to lower per-unit costs, impacting pricing power. |

| Brand Reputation & Trust | High | Years of reliable service build trust, making it difficult for new entrants to gain traction. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Accel Entertainment is built upon a foundation of publicly available financial data, including SEC filings and annual reports. This is supplemented by insights from industry-specific market research reports and trade publications that track the amusement and entertainment sector.