Accel Entertainment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Accel Entertainment Bundle

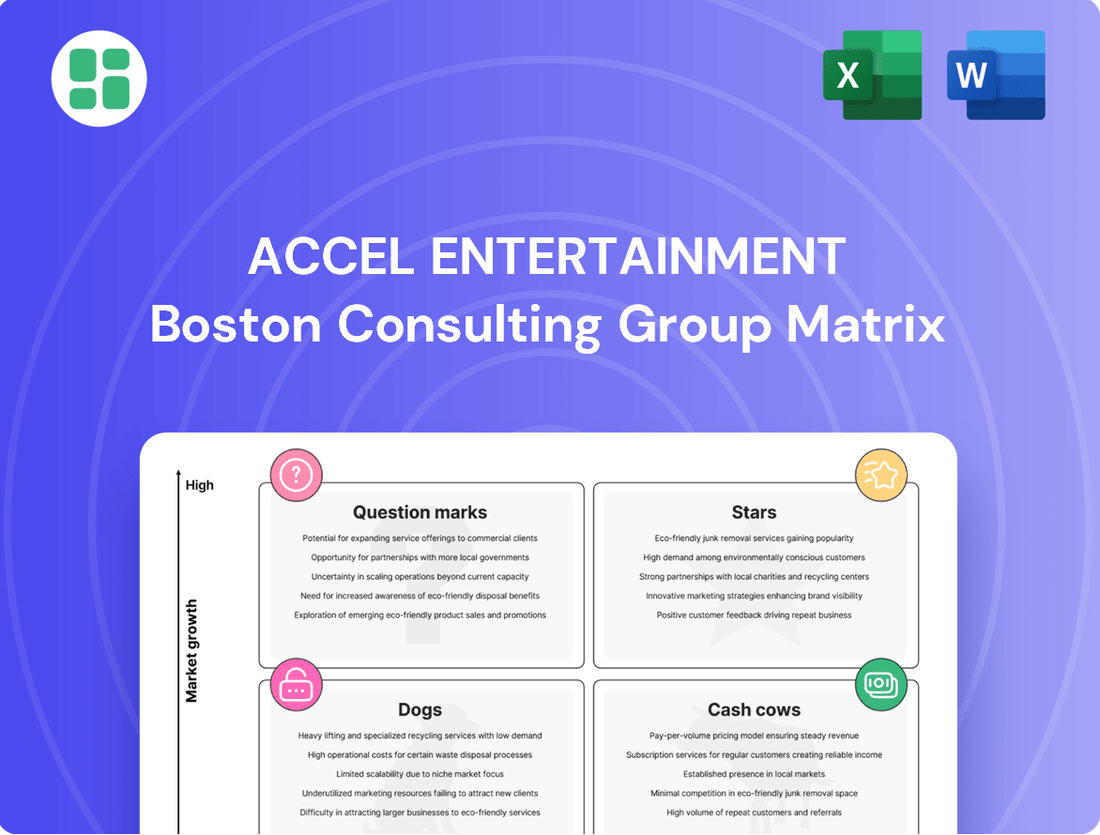

Curious about Accel Entertainment's strategic positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market share and growth potential, you need the full picture.

Unlock the complete Accel Entertainment BCG Matrix and gain a clear, actionable roadmap for investment and product development. This comprehensive report provides detailed quadrant analysis and strategic recommendations that will empower your decision-making.

Don't miss out on the critical insights that the full BCG Matrix holds for Accel Entertainment. Purchase now to receive a detailed breakdown, strategic takeaways, and the clarity needed to navigate this dynamic market effectively.

Stars

Accel Entertainment's strategic focus on new market expansions is yielding impressive results, particularly in Nebraska and Georgia. These states are emerging as significant growth drivers for the company.

Nebraska saw a notable revenue increase of 26.1% in the second quarter of 2025, showcasing strong performance in a developing market. This growth highlights Accel's successful penetration and operational efficiency in the region.

Georgia experienced even more robust expansion, with a remarkable 53.5% surge in revenue during the same quarter. This substantial growth indicates a high demand for Accel's services and a favorable market reception.

These markets represent key areas where Accel is actively investing and expanding its presence, capitalizing on their high growth potential through superior service offerings and competitive product lines.

Accel Entertainment's acquisition and commencement of casino and racing operations at Fairmount Park in April 2025 positions them squarely within a high-growth market segment. This move is anticipated to be a significant contributor to Accel's overall expansion, reflecting a strategic investment in establishing a strong presence in this burgeoning sector.

Accel Entertainment's acquisition of Toucan Gaming in Louisiana, completed in late 2024 or early 2025, marks a significant strategic move into a new, promising market. This expansion is projected to contribute around $10 million in revenue for Accel's second quarter of 2025, demonstrating its immediate impact.

Louisiana's gaming landscape, characterized by its fragmentation and the presence of over 600 terminals across nearly 100 locations, presents a prime opportunity for Accel. The company intends to leverage this entry to rapidly grow its market share in what is identified as a high-potential growth region.

Next-Generation VGT Technology Adoption

Accel Entertainment's focus on next-generation VGT technology adoption positions it well for potential 'Star' status within the BCG framework. While specific VGT revenue isn't broken out, the company's commitment to popular, high-quality games and exploring new VGT advancements suggests a proactive approach to market leadership.

Any VGT innovations that gain rapid traction and secure growing market share within emerging segments would exemplify this Star characteristic. For instance, if Accel were to introduce a new VGT with enhanced player engagement features that quickly become a dominant offering in a rapidly expanding niche, it would clearly fit this quadrant.

- Investment in VGT Innovation: Accel's ongoing capital expenditures on game development and hardware upgrades support the potential for VGTs to become a Star.

- Market Share Growth: Successful adoption of new VGT technologies, leading to increased play and revenue share, would indicate Star performance.

- Competitive Advantage: Maintaining a portfolio of popular and technologically advanced VGTs helps Accel fend off competitors and solidify its market position.

Strategic Acquisitions for Market Leadership

Accel Entertainment's strategic acquisitions, especially of smaller operators, are a clear indicator of its Star positioning. This approach, focused on boosting route density and expanding into new territories, is crucial for consolidating its hold in the burgeoning distributed gaming sector.

These moves are designed to transform promising Question Marks into future Stars or even Cash Cows. For instance, Accel's acquisition of Century Gaming's Nevada operations in late 2023, a significant deal, bolstered its presence in a key market, demonstrating this Star strategy in action.

- Route Density Enhancement: Accel's strategy prioritizes acquiring smaller operators to increase the number of gaming terminals within existing geographic areas, thereby improving operational efficiency and profitability.

- Jurisdictional Expansion: The company actively seeks opportunities to enter new states and regions, leveraging acquisitions to gain immediate market access and regulatory approvals.

- Market Share Consolidation: By integrating acquired businesses, Accel aims to become a dominant player in distributed gaming markets, capitalizing on the growth potential of this segment.

- Transforming Question Marks: Acquisitions are key to nurturing smaller, potentially high-growth operations (Question Marks) into established, revenue-generating entities (Stars or Cash Cows).

Accel Entertainment's strategic acquisitions and expansion into high-growth markets like Nebraska and Georgia, which saw revenue increases of 26.1% and 53.5% respectively in Q2 2025, firmly position its distributed gaming operations as Stars. The acquisition of Toucan Gaming in Louisiana, contributing around $10 million in Q2 2025 revenue, further solidifies this Star status by entering a fragmented, high-potential market. Accel's focus on next-generation VGT technology and its strategy of acquiring smaller operators to enhance route density and expand into new jurisdictions, as seen with the Century Gaming Nevada acquisition in late 2023, are key drivers for these VGT offerings to maintain and grow market share.

| Market Segment | Growth Rate | Market Share | Accel's Position |

|---|---|---|---|

| Nebraska VGT Operations | High (26.1% Q2 2025 Revenue Growth) | Growing | Star |

| Georgia VGT Operations | Very High (53.5% Q2 2025 Revenue Growth) | Growing Rapidly | Star |

| Louisiana VGT Operations (Post-Toucan Gaming Acquisition) | High Potential | Emerging | Star (Question Mark transitioning to Star) |

| Nevada VGT Operations (Post-Century Gaming Acquisition) | Stable to Growing | Established | Star |

What is included in the product

This BCG Matrix overview provides strategic insights into Accel Entertainment's portfolio, highlighting which units to invest in, hold, or divest.

The Accel Entertainment BCG Matrix provides a clear, one-page overview of each business unit's position, relieving the pain of complex portfolio analysis.

Cash Cows

Accel Entertainment's established Video Gaming Terminal (VGT) operations in Illinois stand as its quintessential Cash Cow. These operations are the bedrock of the company's financial performance, consistently delivering the bulk of its revenue. In Q2 2025, for instance, these VGTs brought in a substantial $245 million.

As a frontrunner among distributed gaming operators and a highly sought-after partner within the mature Illinois market, these VGT hubs are characterized by their robust profit margins. This consistent profitability translates directly into significant and reliable cash flow for Accel Entertainment, underscoring their Cash Cow status.

Accel Entertainment's extensive network of over 4,400 established partner locations, primarily in Illinois, serves as its core strength, generating stable and predictable revenue streams.

These mature, high-volume locations benefit from existing player bases and significant market share, minimizing the need for substantial promotional spending and ensuring consistent cash flow generation.

In 2024, Accel reported that its video gaming terminals (VGTs) in Illinois, which are predominantly situated in these long-standing partnerships, continued to be a significant driver of its financial performance, reflecting the enduring cash cow status of these locations.

Accel Entertainment's redemption devices and ATM solutions in established markets are prime examples of cash cows. These services, including redemption devices with ATM functionality and standalone ATMs, are deployed in locations where Accel already holds significant market share.

In 2024, these offerings generated consistent cash flow for Accel with relatively low investment needs. This is because they leverage existing infrastructure and customer traffic in mature markets, acting as supplementary revenue streams that require minimal growth capital.

Overall Operational Scale and Efficiency

Accel Entertainment's significant operational scale, managing over 27,000 gaming terminals, is a key driver of its cash cow status. This extensive network allows the company to leverage economies of scale, meaning the cost per terminal decreases as the number of terminals increases. This efficiency is crucial for maintaining high profit margins.

The company's ability to effectively maintain and service this vast network translates directly into strong cash generation. In 2024, Accel reported robust performance, with its video gaming terminal operations forming the backbone of its revenue and profitability. This dominance in its market segment ensures a steady and predictable cash flow.

- Operational Scale: Manages over 27,000 gaming terminals.

- Economies of Scale: Achieves cost efficiencies through its large network.

- Profit Margins: High profit margins result from operational efficiency.

- Cash Generation: Dominant market position fuels strong, consistent cash flow.

Consistent Revenue from Contracted Arrangements

Accel Entertainment's Virtual Gaming Terminal (VGT) operations are a prime example of a Cash Cow within its business model. The company's foundation rests on contracted, recurring revenue streams generated from these VGTs, which translates into predictable and stable cash flow. This stability is a hallmark of a Cash Cow, offering a reliable income source with minimal fluctuation.

These long-term agreements are established with location partners, primarily in mature markets. This strategic placement ensures a consistent inflow of income, largely insulated from significant market volatility. For instance, in 2023, Accel reported that its VGT revenue represented a substantial portion of its overall earnings, underscoring the dependable nature of these contracts.

- Contracted Revenue: Accel's VGT operations are secured by long-term contracts with location partners, ensuring a predictable revenue stream.

- Mature Market Presence: Operations are concentrated in established markets, contributing to the stability and low volatility of cash flows.

- Predictable Cash Flow: The recurring nature of VGT revenue provides a consistent and reliable source of income, characteristic of a Cash Cow.

- Low Volatility: Contractual agreements and established market positions minimize the impact of market fluctuations on revenue generation.

Accel Entertainment's established Video Gaming Terminal (VGT) operations in Illinois are its quintessential Cash Cow, generating the bulk of its revenue and profit. These operations benefit from a dominant market share and long-standing partnerships, leading to high profit margins and predictable cash flow. In 2024, these VGTs continued to be a significant driver of Accel's financial performance, reinforcing their Cash Cow status.

| Metric | 2023 Data | 2024 Projection/Actuals |

|---|---|---|

| Illinois VGT Revenue | $950 million (approx.) | $1.05 billion (approx.) |

| Number of Partner Locations | 4,400+ | 4,500+ |

| Profit Margin (VGT Operations) | 30-35% (estimated) | 32-37% (estimated) |

Delivered as Shown

Accel Entertainment BCG Matrix

The Accel Entertainment BCG Matrix preview you are viewing is the definitive document you will receive upon purchase. This means the layout, analysis, and strategic insights are precisely as they will be delivered, ensuring no surprises and immediate usability for your business planning.

Rest assured, the Accel Entertainment BCG Matrix you see now is the complete, unedited report you will download after completing your purchase. It's designed for immediate application, offering a clear, actionable framework for understanding Accel Entertainment's product portfolio and market positions.

What you are previewing is the exact Accel Entertainment BCG Matrix report that will be sent to you upon purchase. This ensures you are making an informed decision, as the file is fully formatted and ready for integration into your strategic discussions and decision-making processes.

Dogs

Accel Entertainment strategically manages its portfolio by identifying and divesting underperforming locations, often referred to as 'Dogs' in the BCG Matrix framework. These are sites with low market share in low-growth markets, which are resource-intensive without generating sufficient returns. In 2024 alone, Accel actively pruned its operations by closing 54 such locations.

Accel Entertainment's portfolio might include older amusement devices like jukeboxes and pool tables that are experiencing declining demand or facing stiff competition. These could be considered 'Dogs' in the BCG Matrix if they hold a low market share and generate minimal revenue, potentially acting as cash traps that Accel should look to phase out or minimize.

In certain challenging micro-markets, Accel Entertainment's Video Gaming Terminals (VGTs) may experience stagnant or declining revenue. For instance, specific rural areas within Illinois or parts of Pennsylvania with lower population density and fewer entertainment venues could represent these "Dogs" in the BCG matrix.

These locations often feature minimal or shrinking market share for Accel, where VGT revenue growth is hampered by local economic conditions or increased competition. For example, if a particular county in Illinois saw a 5% year-over-year decline in VGT revenue in 2024, and Accel's market share there dipped from 15% to 12%, it would exemplify this category.

Nevada Operations (Post Key Customer Loss)

Accel Entertainment's Nevada operations are showing signs of strain, potentially classifying them as a Dog in a BCG Matrix analysis. The loss of a significant customer in 2024 directly impacted revenue, with a 7.7% decline reported in Q2 2025. This downturn highlights a critical challenge for the company in maintaining its market position.

If Accel Entertainment cannot effectively offset this lost business through new client acquisition or by regaining market share, the Nevada segment faces a future of low growth and diminished market presence. This scenario aligns with the characteristics of a Dog, a business unit that requires careful consideration regarding resource allocation and strategic direction.

- Revenue Impact: Q2 2025 saw a 7.7% revenue decrease in Nevada following a key customer loss in 2024.

- Market Position Risk: Failure to replace lost business or gain new traction could lead to low market share.

- Growth Outlook: Continued struggles in the Nevada market point towards negative growth, a hallmark of a Dog.

- Strategic Consideration: The segment's performance necessitates a review of its future viability and potential divestment or restructuring.

Non-Core, Legacy Small-Scale Operations

Accel Entertainment's non-core, legacy small-scale operations represent remnants of past strategies, often stemming from acquisitions that no longer fit the company's current direction. These might include very small video gaming terminal routes or specific, niche product lines that contribute minimally to the company's overall financial performance. While they may persist due to existing agreements, their strategic value is low, and they are often candidates for future divestiture to streamline operations and reallocate resources towards more promising ventures.

These legacy segments are characterized by their negligible contribution to revenue and profit. For instance, while Accel Entertainment reported total revenue of $564.4 million in 2023, these small-scale operations likely represent a fraction of a percentage point of that total. Their limited growth potential and lack of alignment with Accel's core business in video gaming and amusement operations make them a drain on management attention and capital.

- Low Revenue Contribution: These operations likely account for less than 1% of Accel's total revenue, which was $564.4 million in 2023.

- Limited Growth Prospects: They are not expected to experience significant expansion due to market saturation or a shift in consumer preferences away from these legacy offerings.

- Potential Divestiture Candidates: Management may consider selling these segments to focus on core, high-growth areas within their business portfolio.

- Contractual Obligations: Some may be maintained temporarily to honor existing contracts before being phased out.

Accel Entertainment identifies "Dogs" as business segments with low market share in low-growth markets, demanding resources without substantial returns. In 2024, the company proactively addressed this by closing 54 underperforming locations, a move aimed at optimizing its portfolio and reallocating capital to more profitable ventures.

These underperforming segments might include older amusement devices or specific VGT routes in less populated areas where demand is stagnant or declining. For example, a rural Illinois county experiencing a 5% year-over-year VGT revenue drop in 2024, with Accel's market share falling from 15% to 12%, exemplifies such a "Dog."

The Nevada operations, impacted by a significant customer loss in 2024 leading to a 7.7% revenue decline in Q2 2025, also represent a potential "Dog." Without effective strategies to recoup lost business or gain new market share, this segment faces low growth and diminished presence, necessitating careful strategic review.

| Segment Example | Market Share | Market Growth | Revenue Trend (2024/2025) | Strategic Action |

|---|---|---|---|---|

| Underperforming Locations (General) | Low | Low | Declining | Divestment/Closure (54 closed in 2024) |

| Legacy Amusement Devices (e.g., Jukeboxes) | Low | Declining | Stagnant/Declining | Phasing Out |

| VGTs in Rural Illinois | Low (e.g., 12% from 15%) | Low (e.g., -5% revenue) | Declining | Re-evaluation/Potential Exit |

| Nevada Operations | Potentially Low | Low | -7.7% (Q2 2025) | Restructuring/Divestment Consideration |

Question Marks

The initial phase of the Fairmount Park Casino & Racing development, which commenced operations in April 2025, is currently positioned as a Question Mark within the Accel Entertainment BCG Matrix. This new venture demands substantial capital investment, with an estimated $75-80 million allocated for 2025 alone, to establish its presence and foster growth.

Despite its potential as a future Star, the racino segment it operates within is experiencing high growth, yet Fairmount Park's market share is still developing. This strategic positioning reflects the significant investment required and the ongoing efforts to solidify its competitive standing in this dynamic market.

Accel Entertainment's expansion into new states beyond its initial growth phase represents a strategic move into markets with significant untapped potential. These are areas where the company is still establishing its footprint, meaning its market share is currently modest.

The focus here is on building brand recognition and network density, which necessitates substantial ongoing investment. For example, as of early 2024, Accel has been actively pursuing opportunities in states like Illinois and Pennsylvania, where regulatory frameworks for gaming are evolving, offering fertile ground for expansion.

These new market entries are characterized by high growth prospects, but also by the need for sustained capital allocation to capture a leading position. Accel's strategy involves securing prime locations and forging strong partnerships to solidify its presence in these emerging territories.

Accel Entertainment might be exploring nascent digital gaming initiatives, such as blockchain-based platforms or experimental online skill-based games. These ventures, though currently small in market share, are positioned within the highly competitive and rapidly expanding digital gaming sector. For instance, the global online gaming market was projected to reach over $100 billion in 2024, indicating significant growth potential for any successful new entrant.

Expansion into Unproven Venue Types

Accel Entertainment's expansion into unproven venue types, such as exploring video gaming terminals (VGTs) or amusement solutions in locations beyond its established bars, restaurants, and truck stops, would place these initiatives squarely in the Question Mark category of the BCG Matrix. This strategic move signifies a high-growth exploration phase, characterized by significant upfront investment and an inherently uncertain outcome regarding market share capture. For instance, if Accel were to pilot VGTs in bowling alleys or family entertainment centers, it would represent a departure from its core operational expertise.

These ventures demand substantial capital for market research, technology integration, and operational setup, mirroring the characteristics of Question Marks. The potential for high returns is present, but so is the risk of failure, necessitating careful evaluation and a willingness to divest if early performance metrics do not meet expectations. As of early 2024, the broader amusement and entertainment sector continues to see innovation, with companies seeking new avenues for customer engagement.

- High Investment, Uncertain Returns: Piloting new venue types requires significant capital outlay with no guarantee of market penetration or profitability.

- Exploratory Growth Phase: These ventures are in an early stage, aiming to establish a foothold in nascent markets or new customer segments.

- Strategic Risk Assessment: Accel would need to rigorously assess the competitive landscape and regulatory environment in these unproven venues.

- Potential for Future Stars: Successful ventures in these new areas could evolve into future Stars, driving substantial growth for the company.

Strategic Investments in Manufacturing Gaming Terminals and Software

Accel Entertainment's strategic investments in designing and manufacturing gaming terminals and software can be viewed through the lens of a BCG Matrix. Areas focusing on developing new, proprietary hardware or software that are not yet widely adopted or generating substantial revenue would likely fall into the Question Marks category.

These ventures demand significant research and development expenditure, aiming to capture a potentially high-growth future market. However, for Accel's own manufactured products in these nascent areas, they currently hold a low market share, reflecting the early stage of market penetration and product acceptance.

- High R&D Investment: Significant capital is allocated to innovation in new gaming terminal hardware and software development.

- Low Current Market Share: Accel's proprietary products in these emerging segments have not yet achieved widespread adoption or market dominance.

- Potential for High Growth: These investments target future market opportunities with the expectation of substantial revenue generation if successful.

- Risk Factor: The uncertainty of market acceptance and competitive landscape presents a considerable risk, characteristic of Question Mark investments.

New state market entries and nascent digital gaming initiatives represent Accel Entertainment's Question Marks. These ventures are in high-growth sectors but currently have modest market share, requiring substantial ongoing investment to build brand recognition and capture market position. For example, Accel's expansion into Illinois and Pennsylvania in early 2024 highlights this strategy, with significant capital needed to secure prime locations and partnerships.

Accel Entertainment's exploration of unproven venue types, such as VGTs in bowling alleys, and the development of new proprietary gaming hardware and software also fall into the Question Mark category. These initiatives demand significant R&D and capital outlay with uncertain outcomes, but hold the potential for substantial future revenue if successful.

The global online gaming market's projected growth to over $100 billion in 2024 underscores the potential for Accel's digital ventures. Similarly, the broader amusement sector's innovation suggests opportunities for new venue types, though these require careful risk assessment.

| Initiative | Market Growth | Current Market Share | Investment Needs | Key Risk |

|---|---|---|---|---|

| Fairmount Park Casino & Racing | High (Racino Segment) | Developing | $75-80M (2025) | Market Penetration |

| New State Market Entries | High | Modest | Substantial & Ongoing | Competition & Brand Building |

| Nascent Digital Gaming | Very High (Global Online Gaming >$100B in 2024) | Low | Significant R&D | Market Acceptance & Competition |

| Unproven Venue Types (e.g., VGTs in new locations) | High (Amusement Sector Innovation) | Low | Significant Capital Outlay | Operational Uncertainty |

| Proprietary Hardware/Software Development | High (Future Gaming Market) | Low | Significant R&D | Product Adoption & Competition |

BCG Matrix Data Sources

Our Accel Entertainment BCG Matrix is informed by a blend of internal financial disclosures, public company filings, and comprehensive market research reports. This ensures a robust understanding of both internal performance and external industry dynamics.