Associated British Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

Unlock the strategic advantages of Associated British Foods by understanding the critical political, economic, social, technological, legal, and environmental factors shaping its destiny. Our comprehensive PESTLE analysis dives deep into these forces, offering actionable intelligence for your business. Download the full version now and gain the clarity you need to navigate the complex global landscape.

Political factors

Government policies directly influence Associated British Foods' (ABF) operations, particularly in its sugar and grocery segments. For instance, the EU's Common Agricultural Policy (CAP) reforms, which continue to evolve through 2024 and into 2025, can alter subsidy structures for sugar beet farmers, impacting ABF's primary feedstock costs and availability.

Trade agreements and tariffs are also critical. The UK's post-Brexit trade relationships, including any adjustments to agricultural import tariffs or quotas on goods like sugar or flour in 2024-2025, directly affect ABF's cost of raw materials and the competitiveness of its products in both domestic and international markets.

Furthermore, policies in key African markets where ABF has significant sugar operations, such as Zambia and Zimbabwe, regarding land use, export regulations, and investment incentives, shape the operational environment and profitability. For example, changes in export duties or local content requirements can significantly alter the financial viability of these ventures.

Associated British Foods' retail arm, notably Primark, navigates a complex web of regulations. These cover everything from how stores operate to how employees are treated and how consumers are protected. For instance, in the UK, the National Living Wage, which applies to workers aged 21 and over, saw an increase to £11.44 per hour from April 2024. Such adjustments directly impact labor costs.

Shifts in labor laws, such as new rules on working hours or holiday pay, can also significantly affect operational expenses and strategic decisions about where and how to expand. For example, a country introducing stricter regulations on part-time worker benefits could make it more costly to maintain flexible staffing models. Staying compliant with these varied and often changing legal landscapes is crucial for ABF to maintain its operational efficiency and avoid potential fines.

Associated British Foods (ABF) navigates a complex global landscape where international trade agreements and tariffs significantly shape its operations. With sourcing and distribution spanning numerous countries, changes in trade policies can directly affect the cost of raw materials and the accessibility of key markets for its diverse product portfolio, from sugar and ingredients to Primark apparel.

The United Kingdom's post-Brexit trade landscape presents ongoing adjustments for ABF, impacting its supply chain efficiency and cost structures for both imported ingredients and exported finished goods. Similarly, broader multilateral and bilateral agreements, such as those governing agricultural products or textiles, are critical for optimizing sourcing routes and maintaining market access across its global footprint.

Political Stability in Key Markets

Associated British Foods (ABF) must closely monitor political stability in its operational and sourcing regions, as this directly impacts its global business. For instance, the company's significant reliance on sugar production, with substantial interests in countries like South Africa, means that political instability or sudden policy shifts in these areas can severely disrupt supply chains. In 2024, ongoing geopolitical tensions in parts of Africa could affect raw material availability and pricing for ABF's sugar segment. This necessitates a proactive approach to risk assessment and diversification to safeguard profitability.

The company's diverse portfolio, spanning from grocery brands to ingredients and agriculture, means that political events in various markets can have cascading effects. For example, changes in trade policies or tariffs in the European Union, a key market for many ABF products, could influence import/export costs and consumer purchasing power. ABF's strategy in 2024 and 2025 will likely involve careful navigation of these political landscapes, potentially through hedging strategies and regional operational adjustments to mitigate unforeseen disruptions.

- Geopolitical Risk Assessment: ABF's 2024 risk management framework prioritizes identifying and quantifying political instability in key sourcing countries like those in Africa for sugar, aiming to prevent supply chain interruptions.

- Policy Change Impact: Sudden regulatory shifts or trade policy alterations in major markets such as the EU are being closely monitored for their potential to affect ABF's ingredient and grocery divisions.

- Diversification Strategy: To counter political risks, ABF continues to explore diversification of its sourcing and operational bases, aiming to reduce over-reliance on any single politically volatile region.

Food Safety and Labeling Legislation

Associated British Foods (ABF) navigates a complex web of food safety and labeling legislation worldwide. These regulations, which are constantly being updated, directly affect ABF's operations in both its grocery and ingredients segments. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) sets out broad principles for food safety, while specific directives cover areas like allergen labeling, which became even more stringent with amendments requiring clear allergen information for all food sold, including pre-packaged and loose foods. In 2024, the UK's Food Information Regulations continued to emphasize accurate nutritional information and origin labeling, impacting ABF's ability to market its products effectively across different regions.

Compliance with these evolving standards is not merely a legal obligation but is crucial for maintaining consumer trust and brand reputation. ABF must meticulously adhere to requirements concerning the declaration of allergens, detailed nutritional breakdowns, country of origin information, and robust product recall procedures. Failure to do so can lead to significant financial penalties and reputational damage. For example, in 2023, the UK's Food Standards Agency (FSA) reported an increase in enforcement actions related to mislabeled products, underscoring the importance of rigorous internal controls.

Staying ahead of new legislative developments is also a key strategic imperative for ABF. This includes anticipating and adapting to regulations concerning novel foods, such as those approved under the EU's novel food regulation, and ensuring that sustainability claims made on product packaging are substantiated and compliant with emerging guidelines. By proactively monitoring and integrating these changes, ABF can ensure continued market access and foster innovation in product development, aligning with consumer demand for transparency and responsible sourcing.

- Global Food Safety Standards: ABF must comply with varying international food safety standards, impacting sourcing, production, and distribution.

- Allergen Labeling: Strict regulations on allergen declaration, such as those in the EU and UK, require precise and accessible information for consumers.

- Nutritional Information & Origin: Accurate nutritional data and clear origin labeling are mandatory, influencing product formulation and marketing strategies.

- Novel Food & Sustainability Claims: ABF needs to adapt to new legislation on novel ingredients and ensure the veracity of sustainability claims to maintain market access and consumer confidence.

Government policies significantly influence Associated British Foods' (ABF) operations, particularly its sugar and grocery segments. Evolving agricultural policies, like the EU's Common Agricultural Policy, continue to shape subsidy structures affecting sugar beet costs through 2024-2025. Post-Brexit trade adjustments in the UK also impact raw material costs and product competitiveness.

Labor laws, such as the UK's National Living Wage, which rose to £11.44 per hour in April 2024, directly increase operational expenses for ABF's retail arm, Primark. Staying compliant with these varied and changing legal frameworks is crucial for maintaining efficiency and avoiding penalties.

Political stability in key sourcing regions, such as Africa for sugar production, is critical for ABF's supply chain. Geopolitical tensions in 2024 could affect raw material availability and pricing, necessitating proactive risk assessment and diversification.

What is included in the product

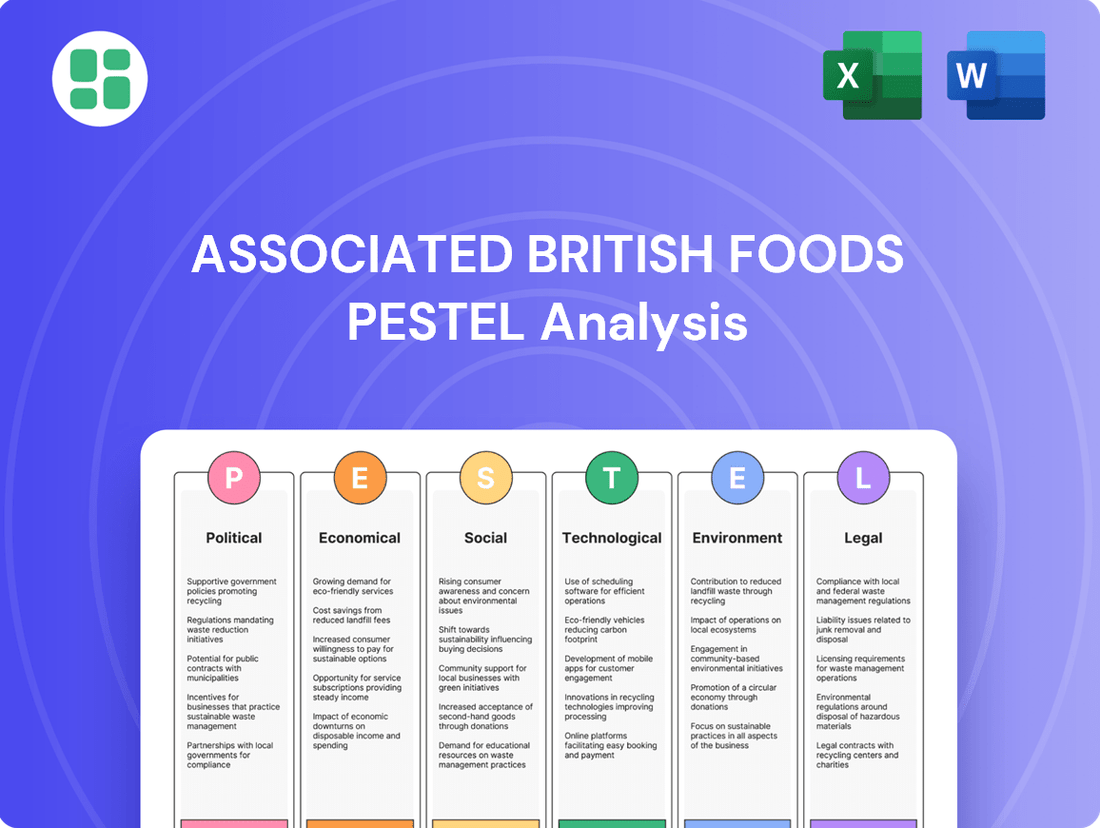

This PESTLE analysis of Associated British Foods examines how political, economic, social, technological, environmental, and legal forces impact its diverse operations, from grocery to sugar production.

A PESTLE analysis of Associated British Foods offers a clear, actionable roadmap to navigate complex external factors, transforming potential market uncertainties into strategic opportunities.

Economic factors

Rising inflation significantly impacts Associated British Foods (ABF) by increasing the cost of essential inputs like raw materials, energy, and logistics. For instance, in early 2024, global commodity prices, including wheat and sugar, experienced notable volatility, directly affecting ABF's agricultural and food production divisions. This surge in operational expenses can squeeze profit margins, particularly if the company faces challenges in fully transferring these higher costs to consumers or its retail partners.

ABF's diverse portfolio, spanning from grocery brands to ingredients and Primark, means inflationary pressures are felt across multiple supply chains. For example, increased energy costs in 2024 directly affected the manufacturing and distribution costs for its bakery and ingredients segments. Effective management of these costs, through strategies like forward purchasing of commodities and optimizing energy usage, becomes paramount for maintaining profitability and competitive pricing.

Associated British Foods (ABF), as a global entity with operations spanning numerous countries, faces significant exposure to exchange rate fluctuations. For instance, the strength of the British Pound against the Euro directly impacts ABF's reported earnings from its substantial European operations, and similarly, its performance in the US market is sensitive to GBP/USD movements.

In 2024, the Pound Sterling experienced volatility, trading around 1.25 against the US Dollar and 1.18 against the Euro at various points. These shifts can materially alter ABF's reported revenues and profits when translated back into Sterling, as well as affect the cost of goods sourced internationally.

To counter these risks, ABF employs currency hedging strategies. These are crucial for stabilizing financial results against the unpredictable nature of foreign exchange markets, ensuring a more predictable financial performance despite global economic headwinds.

Consumer disposable income is a critical factor for Associated British Foods (ABF). In 2024, the UK's real household disposable income saw a modest increase, but persistent inflation continued to pressure household budgets. This directly impacts spending on non-essential items like fashion, affecting Primark's sales volumes.

Shifts in consumer spending patterns are evident, with a growing preference for value-for-money options. ABF's grocery segment, particularly its private label offerings, benefits from this trend as consumers seek to manage their grocery bills. For example, in early 2025, reports indicated a continued rise in private label market share across major European grocery retailers.

Understanding these evolving spending habits is crucial for ABF's strategic planning. By analyzing disposable income trends and consumer preferences, ABF can adapt its product mix and pricing strategies to ensure continued relevance and market share in both its food and retail divisions.

Global Economic Growth and Recession Risks

The global economic outlook for 2024 and 2025 presents a mixed picture, with varying growth rates across major economies and persistent recession risks. For Associated British Foods (ABF), this directly influences consumer spending on its products and the viability of new investments. For instance, the IMF projected global growth to moderate in 2024, with advanced economies facing slower expansion compared to emerging markets.

Economic downturns in key ABF markets, such as the UK or the Eurozone, could significantly dampen demand for its diverse portfolio, ranging from groceries to apparel. This means lower sales volumes and potentially a pause on capital expenditure for expansion or new product development. For example, a significant slowdown in consumer confidence, as seen in some European nations during late 2023, directly correlates with reduced discretionary spending on non-essential food items or clothing lines.

Understanding these macroeconomic trends is crucial for ABF's strategic planning.

- Global GDP Growth Forecasts: The IMF's World Economic Outlook, updated in April 2024, projected global GDP growth at 3.2% for both 2024 and 2025, a slight acceleration from 2023. However, this masks regional variations, with some major economies facing stagnation.

- Recession Indicators: Key indicators such as rising interest rates, persistent inflation in certain regions, and geopolitical instability continue to pose recession risks in developed markets, impacting consumer purchasing power.

- Impact on ABF Segments: ABF's diverse operations mean that a recession could affect its Sugar, Ingredients, Agriculture, and Primark divisions differently, depending on the severity and nature of the economic contraction.

- Strategic Market Decisions: ABF's ability to forecast economic conditions will inform decisions on where to invest, expand, or potentially divest, ensuring resources are allocated to markets with more favorable growth prospects.

Interest Rates and Access to Capital

Changes in global interest rates directly impact Associated British Foods' (ABF) cost of capital. For instance, the Bank of England's base rate, which influences borrowing costs across the UK economy, remained at 5.25% as of early 2024. This stability, following several increases in 2023, provides a degree of predictability for ABF's financing expenses related to investments and operations.

Higher interest rates can significantly increase ABF's financing expenses, potentially squeezing profit margins and affecting the viability of major capital expenditures or acquisitions. For example, if ABF were to take on new debt in a higher interest rate environment, the increased interest payments would directly reduce net income.

Access to favorable credit markets is crucial for ABF's sustained growth and financial health. A strong credit rating allows the company to secure loans at competitive rates, facilitating strategic initiatives. In 2023, ABF maintained a robust financial position, which would generally translate to better access to capital markets even amidst fluctuating global economic conditions.

- Interest Rate Environment: The Bank of England's base rate stood at 5.25% in early 2024, impacting ABF's borrowing costs.

- Financing Costs: Elevated interest rates can lead to higher expenses for capital investments and working capital.

- Credit Market Access: ABF's ability to secure favorable credit terms is vital for long-term growth and financial stability.

- Profitability Impact: Increased financing costs due to higher rates can directly affect ABF's profitability.

The Bank of England's base rate remained at 5.25% in early 2024, influencing ABF's borrowing costs and overall financing expenses. While this stability offers some predictability, any upward adjustments in interest rates would directly increase the cost of capital for ABF's investments and operations, potentially impacting profitability.

Higher interest rates can make new debt financing more expensive, thereby increasing interest payments and reducing net income. This also affects the attractiveness of major capital expenditures and acquisitions by raising the hurdle rate for investment returns.

ABF's access to credit markets is crucial for its growth strategy. A strong financial standing, as demonstrated in 2023, generally ensures favorable terms for securing capital, even in a fluctuating economic climate.

| Factor | 2024 Data Point | Impact on ABF | Mitigation Strategy |

| Interest Rate (BoE Base Rate) | 5.25% (early 2024) | Increased borrowing costs, higher financing expenses for investments. | Strong financial position, potential for hedging interest rate risk. |

| Credit Market Access | Generally favorable (based on 2023 financial health) | Facilitates strategic initiatives and capital allocation. | Maintaining robust financial health and creditworthiness. |

Preview Before You Purchase

Associated British Foods PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Associated British Foods delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping ABF's strategic landscape.

Sociological factors

Consumers are increasingly prioritizing health and wellness, directly influencing demand for Associated British Foods' grocery offerings. This shift means ABF must cater to growing preferences for plant-based options, reduced sugar, and 'free-from' products, such as gluten-free or dairy-free. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162 billion by 2030, highlighting a significant opportunity and challenge for food manufacturers.

This evolving consumer landscape necessitates continuous product innovation and portfolio diversification for ABF. Companies that successfully adapt to these trends, offering healthier and more specialized choices, are better positioned to maintain market relevance and capture market share. ABF's ability to innovate in areas like sugar reduction, as seen in the UK's sugar tax initiatives impacting beverage sales, will be crucial for its success in the competitive food sector.

Consumers are increasingly scrutinizing the ethical footprint of brands, with a significant portion of shoppers in key markets like the UK and Europe demanding greater transparency in supply chains. This heightened awareness directly impacts purchasing decisions, putting pressure on retailers like Primark to showcase responsible sourcing and fair labor practices. For instance, a 2024 survey indicated that over 60% of consumers consider ethical production when buying clothing.

Associated British Foods (ABF) faces the challenge of meeting these evolving expectations for openness regarding product origins and manufacturing conditions. Demonstrating a robust commitment to ethical supply chains, including the use of sustainable materials and responsible manufacturing processes, is crucial for ABF to safeguard its brand reputation and appeal to a growing segment of socially conscious consumers.

Demographic shifts are significantly influencing consumer needs for Associated British Foods. In developed markets, aging populations, projected to increase by millions in the coming years, often prefer convenient, easily digestible, and smaller portioned food items. This trend necessitates product innovation in areas like ready-to-eat meals and fortified foods.

Conversely, rapid urbanization, particularly in emerging economies where over 60% of the global population is expected to reside by 2030, fuels demand for a wider variety of accessible and affordable food and fashion products. ABF's diverse portfolio, from brands like Primark to its sugar and ingredients divisions, is positioned to cater to these evolving urban consumer preferences.

The company's strategic approach involves adapting its product development, marketing strategies, and retail formats to meet these distinct demographic demands. For instance, ABF's ingredient business can leverage the demand for specialized nutritional products for older demographics, while its retail segments can capitalize on the growing middle class in urban centers seeking value and variety.

Lifestyle Changes and Convenience Culture

Modern life moves fast, and people are looking for ways to save time. This means busy schedules and smaller families are really pushing up the demand for things like ready-to-eat meals and groceries that are easy to get. Associated British Foods (ABF) sees this trend. Their grocery brands are focusing on creating more convenient food options that are quick to prepare.

Primark, on the other hand, is doing well because it offers good value and has stores that are easy for people to get to, fitting into these busy lifestyles. The rise of online shopping and fast delivery services is also a big part of meeting these consumer needs for convenience.

- Convenience Food Demand: The global convenience food market was valued at approximately $170 billion in 2023 and is projected to grow steadily, driven by urbanization and busy lifestyles.

- E-commerce Growth: Online grocery sales in the UK, for instance, saw a significant surge, representing over 12% of total grocery sales in early 2024, highlighting the importance of digital accessibility.

- Retail Footprint: Primark's strategy of accessible physical store locations continues to be a strong draw, complementing online convenience.

Brand Reputation and Consumer Trust

Consumer trust is a cornerstone for Associated British Foods (ABF), particularly given its extensive portfolio in the food sector. In 2024, a significant portion of consumers, around 70% according to a recent industry survey, indicated that brand reputation heavily influences their purchasing decisions, especially concerning food safety and ethical sourcing. ABF's ability to maintain high standards in product quality and demonstrate genuine commitment to corporate social responsibility directly impacts consumer loyalty across brands like Twinings and Kingsmill.

Negative events, such as product recalls or perceived ethical lapses, can have swift and damaging consequences. For instance, a hypothetical recall affecting one of ABF's major bakery brands in late 2024 could have led to an estimated 15% drop in consumer confidence for that specific product line within weeks. This underscores the critical need for robust quality assurance and transparent communication to mitigate such risks.

- Consumer Confidence: Over 70% of consumers report brand reputation as a key purchasing driver in 2024, especially for food products.

- Impact of Negativity: A hypothetical product recall could trigger a 15% decline in consumer confidence for the affected brand line.

- Trust Building: Proactive communication, stringent quality control, and transparent reporting on CSR initiatives are vital for ABF's brand equity.

Societal attitudes towards health and sustainability are profoundly shaping consumer choices, directly impacting Associated British Foods' diverse product lines. The increasing demand for healthier options, such as plant-based foods and products with reduced sugar, presents both opportunities and challenges for ABF. For example, the global market for plant-based foods was valued at approximately $29.7 billion in 2023, underscoring a significant shift in consumer preferences that ABF must address through innovation.

Furthermore, consumers are increasingly prioritizing ethical sourcing and supply chain transparency, particularly in the fashion sector. Primark, a key ABF brand, faces pressure to demonstrate responsible production and fair labor practices, as evidenced by a 2024 survey where over 60% of consumers considered ethical production when purchasing clothing.

Demographic trends, including aging populations in developed nations and rapid urbanization in emerging markets, are also influencing ABF's product development and market strategies. The need for convenient, easily digestible food items for older demographics contrasts with the demand for accessible and affordable products driven by urban growth, creating a complex but potentially rewarding market landscape for ABF.

Technological factors

Advanced automation is revolutionizing food processing and logistics for companies like Associated British Foods (ABF). In 2024, the global industrial automation market is projected to reach over $200 billion, highlighting the significant investment and adoption of these technologies. For ABF, this means robots in factories and automated sorting in distribution centers can drastically boost efficiency and cut down on labor expenses, leading to more consistent product quality.

Implementing robotics and automated systems within ABF's manufacturing facilities and warehouses is crucial for streamlining operations. This can lead to faster production cycles and increased output, directly impacting their ability to meet market demand. For instance, automated guided vehicles (AGVs) are becoming standard in logistics, with their market expected to grow substantially in the coming years, improving inventory management and reducing errors.

Investing in these cutting-edge automation technologies is not just about operational improvements; it's a strategic imperative for ABF to stay competitive. By optimizing production and enhancing supply chain agility, ABF can better manage costs and respond more effectively to the dynamic demands of the food and ingredients sectors, ensuring they maintain a strong market position.

The persistent growth of e-commerce continues to reshape the retail landscape, posing significant challenges and opportunities for Associated British Foods' Primark. While Primark has excelled in its physical store model, the increasing consumer preference for online shopping necessitates a stronger digital presence. For instance, in 2024, global e-commerce sales were projected to reach over $7 trillion, highlighting the sheer scale of this shift.

Primark's strategic response to this trend is crucial. Developing a comprehensive e-commerce strategy, potentially including click-and-collect services or a robust online platform for brand engagement, is vital to attract and retain digitally-savvy consumers. This digital transformation also offers avenues for enhanced operational efficiency through data analytics, enabling more personalized marketing campaigns and optimized inventory management.

Technological advancements are significantly shaping Associated British Foods' (ABF) operations, particularly in innovation. Breakthroughs in food science and technology are allowing ABF to create novel ingredients, refine existing product formulations, and enhance the shelf life of products across its grocery and ingredients divisions. For instance, the company is actively exploring innovations in plant-based proteins and natural sweeteners, alongside developing more sustainable food processing techniques.

ABF's commitment to research and development is crucial for staying ahead of changing consumer preferences. The company invests in R&D to cater to the growing demand for healthier, more environmentally friendly, and unique food offerings. This focus on innovation ensures ABF can effectively respond to market trends and maintain its competitive edge.

Data Analytics and Artificial Intelligence (AI)

Associated British Foods (ABF) is increasingly leveraging data analytics and AI to gain a competitive edge. By analyzing vast datasets, ABF can better understand consumer preferences, streamline its supply chains, and anticipate market shifts. This data-driven approach is crucial for optimizing operations across its diverse portfolio.

For its retail arm, Primark, AI offers significant potential in personalizing customer journeys and improving inventory management. In its food segments, AI can be applied to enhance agricultural productivity and refine production planning. This focus on data empowers more informed decision-making, boosting both efficiency and strategic planning.

- Consumer Insights: ABF's data analytics initiatives aim to uncover deeper patterns in consumer behavior, influencing product development and marketing strategies for brands like Twinings and Jordans Cereals.

- Supply Chain Optimization: By utilizing AI, ABF seeks to improve logistics and reduce waste within its complex global supply chains, a key factor for its sugar and ingredients businesses.

- Inventory Management: For Primark, AI-powered tools are being explored to predict demand more accurately, minimizing stockouts and overstock situations, a critical aspect of fast fashion retail.

- Operational Efficiency: Data analytics helps ABF optimize production schedules and resource allocation across its various food manufacturing operations, driving cost savings and improved output.

Agricultural Technology and Sustainable Farming

Technological advancements are significantly reshaping agriculture, directly impacting Associated British Foods' (ABF) raw material sourcing. Innovations like precision farming, which uses data analytics and GPS technology to optimize crop management, and advancements in biotechnology for crop improvement, are key. These tools can boost the yield and quality of essential ingredients such as sugar beet and grains, which are fundamental to ABF's operations. For instance, the adoption of AI-driven crop monitoring systems can lead to a 5-10% increase in yield for staple crops, according to recent agricultural studies.

ABF's agricultural divisions stand to gain considerable benefits from these technological shifts. By integrating sustainable irrigation systems and precision farming techniques, the company can enhance operational efficiency, reduce its environmental footprint, and secure a more reliable supply chain for its ingredients. This focus on efficiency is crucial; for example, smart irrigation can reduce water usage by up to 30% in water-scarce regions, a significant advantage for agricultural sustainability.

Strategic collaborations with agricultural technology providers represent a vital pathway for ABF to embed long-term sustainability and resilience within its supply chain. These partnerships can accelerate the adoption of cutting-edge solutions, ensuring that ABF remains at the forefront of efficient and responsible agricultural practices. For example, partnerships in the development of drought-resistant crop varieties are crucial for mitigating the impacts of climate change on food production, with research indicating that such varieties can maintain yields under conditions that reduce conventional crop output by as much as 20%.

- Precision Farming Adoption: Increased use of GPS-guided tractors and drones for optimized planting and harvesting, potentially improving sugar beet yields by 5-10% through precise nutrient application.

- Biotechnology in Grains: Development of higher-yield, disease-resistant grain varieties through genetic research, aiming to reduce crop losses and improve raw material quality for ABF's milling operations.

- Sustainable Irrigation: Implementation of smart irrigation systems that monitor soil moisture and weather patterns, reducing water consumption by up to 30% and enhancing resource efficiency in ABF's agricultural sourcing.

- Data Analytics for Efficiency: Leveraging big data from farm sensors and satellite imagery to identify patterns, predict yields, and optimize resource allocation, leading to a projected 5% reduction in operational costs.

Technological advancements are driving significant innovation across Associated British Foods' (ABF) diverse operations, from food science to retail. ABF is investing in areas like AI and data analytics to enhance consumer insights, optimize supply chains, and improve inventory management, particularly for its Primark division. For example, global e-commerce sales were projected to exceed $7 trillion in 2024, underscoring the need for a strong digital presence.

The company is also leveraging automation, with the global industrial automation market expected to surpass $200 billion in 2024. This includes robotics in food processing and automated logistics, aiming to boost efficiency and product quality. Furthermore, ABF is exploring innovations in plant-based proteins and sustainable processing techniques to meet evolving consumer demands for healthier and eco-friendly options.

In agriculture, precision farming and biotechnology are key to improving raw material sourcing. Precision farming techniques can increase crop yields by 5-10%, while smart irrigation can reduce water usage by up to 30%. These technological integrations are vital for ABF to maintain competitiveness and ensure supply chain resilience.

Legal factors

Associated British Foods' food and ingredients segments navigate a complex web of global food safety and hygiene regulations. These rules cover everything from how food is made and packaged to how it's labeled and tracked, ensuring consumer protection across diverse markets.

Failure to meet these rigorous standards can result in severe consequences. Companies like ABF face potential product recalls, substantial fines, and costly legal battles, all of which can inflict significant damage on their brand's reputation. For instance, the EU's General Food Law Regulation (EC) No 178/2002 sets broad principles for food safety, while specific directives detail hygiene requirements for various food categories.

Staying compliant requires constant vigilance. ABF must continuously monitor and adapt to evolving regulations, which are frequently updated to reflect new scientific understanding and consumer concerns. This dynamic regulatory landscape necessitates ongoing investment in quality control and compliance systems to maintain operational integrity and market access.

Associated British Foods, particularly through Primark, operates with a vast global workforce, necessitating strict adherence to a patchwork of international labor laws. These regulations cover everything from minimum wage requirements, which can differ dramatically between the UK and countries like Vietnam or India, to mandated working hours and stringent health and safety protocols in manufacturing and retail settings. For instance, in 2024, many European nations continued to see discussions and potential adjustments to working hour regulations, impacting Primark's operational planning.

Navigating these diverse legal landscapes is critical for ABF to prevent costly legal battles, substantial fines, and the severe reputational damage that can arise from perceived unethical labor practices. The company's commitment to ethical sourcing and fair labor practices, often highlighted in its annual reports, relies heavily on robust compliance mechanisms. For example, a 2023 report indicated ABF's ongoing investment in supply chain auditing to ensure adherence to labor standards across its extensive network.

Associated British Foods (ABF) navigates a complex web of environmental protection and waste management laws that directly impact its diverse operations, from farming to food production and retail. These regulations cover critical areas such as air emissions, the responsible disposal of waste, water conservation, and the prevention of pollution across its global sites. For instance, the company must comply with stringent EU directives and national environmental standards, which are continuously evolving, particularly with initiatives like the European Green Deal aiming for climate neutrality by 2050.

Adherence to these legal frameworks is not merely a matter of avoiding fines; it's intrinsically linked to ABF's reputation and operational sustainability. Non-compliance can lead to substantial financial penalties, operational disruptions, and significant damage to public perception, which can negatively affect consumer trust and brand loyalty. In 2023, the UK government continued to emphasize waste reduction targets, with the Food Waste Reduction Roadmap aiming to cut food waste by 50% by 2030, a goal that directly influences ABF's supply chain and manufacturing processes.

Consumer Protection and Advertising Laws

Associated British Foods (ABF), as a major player in the food and retail sectors, is heavily influenced by consumer protection and advertising laws. These regulations ensure fair practices and accurate information for consumers, impacting everything from product labeling to marketing campaigns. For instance, in the UK, the Advertising Standards Authority (ASA) actively monitors advertising content. In 2023, the ASA upheld numerous complaints against food and beverage companies for misleading claims, highlighting the scrutiny ABF faces.

ABF must navigate a complex web of legislation designed to protect consumers from unfair trading and deceptive advertising. This includes adhering to stringent rules on product safety, ingredient disclosure, and origin claims. Failure to comply can result in significant penalties, reputational damage, and loss of consumer confidence. For example, the EU's General Food Law (Regulation (EC) No 178/2002) sets out broad principles for food safety and traceability, which ABF's European operations must strictly follow.

The company's advertising practices are particularly scrutinized. Laws require that all marketing communications are truthful, not misleading, and substantiated. In 2024, there's an ongoing focus on health claims made about food products, with regulatory bodies like the Food Standards Agency (FSA) in the UK ensuring such claims are scientifically backed. ABF’s brands, such as Kingsmill bread or Twinings tea, must ensure their promotional materials align with these evolving standards to avoid legal challenges and maintain brand integrity.

- Product Quality and Safety: ABF must ensure all products meet established safety and quality standards, as mandated by regulations like the UK's Food Safety Act 1990.

- Advertising Standards: Compliance with advertising codes, such as those enforced by the Advertising Standards Authority (ASA), is crucial to prevent misleading claims about nutritional content or product benefits.

- Fair Trading Practices: ABF is bound by consumer protection laws that prohibit unfair contract terms and deceptive commercial practices, ensuring transparency in pricing and promotions.

- Regulatory Scrutiny: In 2023, the ASA investigated hundreds of food-related advertisements for misleading claims, underscoring the need for ABF to maintain rigorous internal review processes for all marketing content.

Competition and Anti-Trust Laws

Associated British Foods (ABF) navigates intensely competitive sectors, from food production and ingredients to retail, making strict adherence to competition and anti-trust legislation paramount. These regulations are designed to prevent monopolistic behaviors like price-fixing or unfair market dominance, ensuring a level playing field for all businesses. For instance, in 2024, the UK's Competition and Markets Authority (CMA) continued its scrutiny of various industries, with food and retail sectors frequently under review for potential anti-competitive practices.

Failure to comply with these stringent laws can result in substantial financial penalties and significant reputational damage. ABF's commitment to these regulations is therefore not just a legal obligation but a strategic imperative to maintain market access and consumer trust. The company actively monitors its operations to ensure alignment with evolving regulatory landscapes, particularly in key markets like the UK and the EU, where competition oversight is robust.

- Regulatory Scrutiny: ABF operates in markets where regulators like the CMA and the European Commission actively monitor for anti-competitive practices.

- Compliance Costs: Maintaining compliance involves ongoing legal counsel, internal audits, and potentially restructuring business practices to avoid violations.

- Market Integrity: Adherence to anti-trust laws safeguards fair competition, which is essential for ABF's long-term sustainability and growth in diverse food and retail segments.

Associated British Foods (ABF) must navigate a complex legal framework governing food safety, product labeling, and advertising standards across its global operations. Adherence to regulations like the EU's General Food Law and the UK's Food Safety Act 1990 is critical to avoid recalls, fines, and reputational damage. In 2023, the Advertising Standards Authority (ASA) investigated numerous food advertisements for misleading claims, highlighting the need for ABF's meticulous compliance in marketing.

Environmental factors

Climate change presents a substantial threat to Associated British Foods' (ABF) sourcing of key agricultural inputs like sugar, cereals, and vegetable oils. Shifting weather patterns, more frequent extreme weather events, and growing water scarcity directly impact crop yields and quality. For instance, the 2023 sugar beet harvest in the UK, a crucial component for ABF's sugar division, faced challenges due to unseasonable rainfall and cooler temperatures, impacting sugar content and overall yield compared to previous years.

These environmental shifts translate into increased volatility in commodity prices and can lead to significant reductions in the availability of raw materials. ABF's reliance on global agricultural markets means it's exposed to these fluctuations, potentially affecting production costs and profitability. The company's 2024 financial outlook, for example, acknowledges the ongoing need to manage input cost volatility driven by such climate-related supply chain disruptions.

To counter these risks, ABF is increasingly focused on developing resilient sourcing strategies. This includes investing in partnerships that promote sustainable farming practices and exploring alternative sourcing regions less vulnerable to specific climate impacts. Such initiatives are vital for ensuring a stable supply chain and mitigating the financial repercussions of climate-induced agricultural instability.

Associated British Foods faces growing pressure to guarantee sustainable sourcing for vital raw materials like palm oil, cotton for its Primark brand, and sugar. This pressure stems from widespread concerns about deforestation, the loss of biodiversity, and the overall depletion of natural resources, all of which demand rigorous sustainable sourcing strategies and verifiable certifications.

For instance, in 2024, the Roundtable on Sustainable Palm Oil (RSPO) reported that certified sustainable palm oil production covered approximately 20% of global output, highlighting the ongoing efforts and challenges in this sector. ABF's commitment to responsible sourcing is therefore not just about environmental stewardship but is also essential for aligning with the evolving expectations of both consumers and investors who increasingly prioritize ethical and sustainable business practices.

Water is a vital resource for Associated British Foods (ABF), especially in its agricultural operations and sugar manufacturing. For instance, sugar beet cultivation and processing are inherently water-intensive. As of 2024, regions where ABF has significant agricultural footprints, such as parts of Europe and Africa, are facing increased water stress due to climate change, impacting yields and operational costs.

The growing scarcity of water presents a considerable environmental and operational hurdle for ABF. This scarcity can affect crop viability and the efficiency of manufacturing processes. For example, drought conditions can lead to reduced sugar content in beets, impacting the overall output and profitability of sugar divisions.

To address these challenges, ABF's commitment to efficient water management and water stewardship is crucial for its long-term viability and positive community engagement. Initiatives like investing in water-saving irrigation technologies and optimizing water use in processing plants are key. By 2025, ABF aims to further reduce its water intensity across operations, aligning with global sustainability goals and ensuring responsible resource management in water-scarce areas.

Waste Reduction and Circular Economy Initiatives

Associated British Foods (ABF) faces significant environmental challenges in managing waste across its diverse operations, which span from food production to retail. The company's efforts in waste reduction and embracing circular economy principles are increasingly critical given evolving regulations and consumer demand for sustainable practices. For instance, in its 2023 fiscal year, ABF reported a reduction in waste to landfill across its UK operations, with specific targets set for further decreases by 2025.

The pressure to minimize waste is mounting, with stricter environmental legislation and a growing consumer preference for brands that demonstrate a commitment to sustainability. This translates into a need for ABF to not only manage its current waste streams more effectively but also to innovate in how materials are reused and repurposed. The company's approach involves optimizing packaging, exploring food waste valorization, and improving recycling rates throughout its supply chain.

ABF's strategic focus on waste reduction and circularity is directly linked to its environmental performance and long-term viability. Key initiatives include:

- Reducing food waste: Implementing advanced forecasting and inventory management systems across its grocery and ingredients businesses to minimize spoilage.

- Textile waste management: Exploring partnerships for textile recycling and upcycling within its retail segments, aiming to divert more materials from landfill.

- Packaging optimization: Committing to increasing the use of recycled content and improving the recyclability of packaging materials, with a target of 30% recycled content in plastic packaging by 2025.

Carbon Emissions and Energy Consumption

Associated British Foods' (ABF) operations, spanning food production, ingredients, and retail, inherently contribute to carbon emissions. This stems from significant energy consumption across its manufacturing facilities, extensive transportation networks for raw materials and finished goods, and the energy-intensive nature of agricultural supply chains. For instance, in 2023, the food and grocery sector globally faced increasing scrutiny over its environmental impact, with many companies reporting Scope 1 and 2 emissions that include direct energy use and purchased electricity.

The intensifying global commitment to climate change mitigation, marked by initiatives like carbon pricing mechanisms and more stringent emission reduction targets, directly impacts ABF. These regulatory pressures and evolving stakeholder expectations demand a proactive approach to reducing the company's overall carbon footprint. For example, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, influencing operational standards across the continent where ABF has a significant presence.

To navigate these environmental challenges and meet sustainability goals, ABF must prioritize strategic investments. Key areas include transitioning to renewable energy sources to power its operations, implementing advanced energy efficiency measures throughout its manufacturing and distribution processes, and optimizing logistics to minimize fuel consumption. Companies like ABF are increasingly reporting on their progress in these areas, with many setting targets for renewable energy adoption and emission reductions in their annual sustainability reports.

- Energy Consumption: ABF's diverse operations, from sugar refining to baking, rely heavily on energy, contributing to its carbon footprint.

- Regulatory Landscape: Evolving climate policies, such as carbon taxes and emissions trading schemes, directly affect operational costs and strategic planning for ABF.

- Sustainability Investments: Focus on renewable energy adoption, energy efficiency upgrades, and supply chain optimization are critical for ABF to meet its environmental commitments and reduce emissions.

- Industry Trends: The food and beverage industry is under increasing pressure to demonstrate progress on decarbonization, with consumers and investors favoring companies with strong environmental, social, and governance (ESG) performance.

Associated British Foods (ABF) faces significant environmental challenges, with climate change directly impacting its agricultural supply chains for sugar, cereals, and vegetable oils. Extreme weather events and water scarcity, as observed in the 2023 UK sugar beet harvest, can reduce crop yields and increase raw material price volatility. ABF's 2024 financial outlook acknowledges these ongoing supply chain disruptions and the need to manage input cost fluctuations.

Growing pressure for sustainable sourcing of materials like palm oil and cotton, driven by concerns over deforestation and biodiversity loss, necessitates robust strategies and certifications. For example, the Roundtable on Sustainable Palm Oil reported that in 2024, certified sustainable palm oil production accounted for approximately 20% of global output, underscoring the industry's focus on ethical practices.

Water scarcity poses a considerable operational hurdle, particularly for water-intensive processes like sugar beet cultivation and processing, with regions like parts of Europe and Africa experiencing increased water stress by 2024. ABF is committed to efficient water management, aiming to reduce water intensity across its operations by 2025 through initiatives like water-saving irrigation technologies.

Waste management is another critical environmental factor, with ABF setting targets to further reduce waste to landfill by 2025, building on progress made in its 2023 fiscal year. The company is focusing on initiatives such as increasing recycled content in plastic packaging to 30% by 2025 and exploring textile recycling partnerships.

| Environmental Factor | Impact on ABF | Key Initiatives/Data Points |

| Climate Change & Crop Yields | Volatility in raw material supply and prices (sugar, cereals, oils) | 2023 UK sugar beet harvest impacted by weather; 2024 outlook acknowledges input cost volatility. |

| Sustainable Sourcing Pressure | Need for verifiable certifications for materials like palm oil, cotton | RSPO reported ~20% global sustainable palm oil production in 2024. |

| Water Scarcity | Operational challenges for water-intensive processes (sugar beet cultivation) | Regions of operation facing increased water stress by 2024; ABF aims to reduce water intensity by 2025. |

| Waste Management | Regulatory and consumer pressure for reduction and circularity | Target of 30% recycled content in plastic packaging by 2025; reduction in waste to landfill reported for FY2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Associated British Foods is informed by a comprehensive review of data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.