Associated British Foods Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

Associated British Foods operates within a dynamic food and retail landscape, facing significant pressures from powerful buyers and intense rivalry among established players. Understanding the threat of new entrants and the bargaining power of suppliers is crucial for navigating this complex market.

The complete report reveals the real forces shaping Associated British Foods’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Associated British Foods' reliance on agricultural commodities such as sugar, wheat, and oilseeds for its diverse food and ingredients segments means the concentration of raw material suppliers is a key factor. If a few major producers dominate the supply of these essential inputs, or if global crop yields are poor, these suppliers can wield considerable bargaining power. For instance, in 2024, global sugar prices saw significant fluctuations due to weather patterns impacting key producing regions, directly affecting the cost of goods for ABF's sugar division.

Associated British Foods' ingredients segment, particularly in areas like yeast and bakery, can face significant supplier power from providers of highly specialized or proprietary ingredients. If these suppliers hold unique intellectual property or operate in a market with few alternatives, they can command higher prices or dictate less favorable terms to ABF.

For example, in the competitive yeast market, a supplier with a patented strain or a highly efficient production process could wield considerable influence. ABF's 2023 annual report highlights the importance of securing reliable supply chains for its diverse ingredient portfolio, suggesting that managing these specialized supplier relationships is a key operational focus. This often necessitates forging strategic partnerships and entering into long-term agreements to guarantee consistent access to critical components.

Suppliers of energy, such as electricity and natural gas, and logistics providers play a crucial role in Associated British Foods' (ABF) cost structure. In 2024, global energy markets continued to experience volatility, directly impacting ABF's operational expenses. For instance, disruptions in natural gas supply chains could lead to significant price increases, forcing ABF to either absorb these higher costs or pass them on to consumers.

The bargaining power of these suppliers is amplified by their essential nature to ABF's widespread operations, from food manufacturing to retail. When energy prices surge, as they did in early 2024 following geopolitical events, suppliers of these commodities gain leverage. Similarly, a concentrated logistics market or port congestion can empower transportation companies, increasing warehousing and shipping fees for ABF’s diverse product lines.

Labor Market Dynamics for Primark

Primark's extensive retail network and manufacturing partnerships mean it depends on a large labor force. This includes staff in its stores, distribution centers, and the factories that produce its clothing. The availability and cost of this labor are significant factors.

The bargaining power of these suppliers, particularly labor, can influence Primark's costs. Factors such as minimum wage legislation, the presence of labor unions, and regional labor shortages play a role. For instance, in 2024, many countries saw discussions and adjustments to minimum wage rates, directly impacting retail labor costs.

- Labor Availability: In 2024, certain regions experienced tighter labor markets, especially for entry-level retail positions, potentially increasing recruitment costs and wage pressures for Primark.

- Wage Pressures: Inflationary trends in 2024 continued to put upward pressure on wages across the retail sector, impacting Primark's operational expenses.

- Unionization: While Primark's direct employee unionization rates vary by region, the broader trend of increasing union activity in retail can indirectly influence labor cost expectations.

- Skills Shortages: Specific roles within logistics and manufacturing might face localized skills shortages, giving those with in-demand expertise greater bargaining power.

Packaging Material Suppliers

The bargaining power of packaging material suppliers for Associated British Foods (ABF) is significant, given the sheer volume and variety of products requiring packaging. For specialized packaging, especially those with advanced sustainability features or unique designs, suppliers can exert considerable influence if ABF faces limited alternatives or substantial costs to switch providers. This is particularly relevant as ABF continues to prioritize eco-friendly packaging solutions.

In 2024, the demand for sustainable packaging materials, such as recycled plastics and biodegradable options, saw continued growth, potentially strengthening the position of suppliers offering these innovations. ABF's commitment to reducing its environmental footprint means that securing reliable and cost-effective access to such materials is paramount. For instance, the global flexible packaging market alone was valued at over $250 billion in 2023 and is projected to grow, indicating a robust supplier base but also highlighting the criticality of these inputs.

- Specialized Packaging Power: Suppliers of innovative or sustainable packaging materials hold sway due to limited alternatives.

- Switching Costs: High costs associated with changing packaging suppliers can increase their bargaining leverage.

- ABF's Strategy: ABF focuses on long-term agreements and investing in packaging efficiency to mitigate supplier power.

- Market Trends: The growing demand for sustainable packaging in 2024 strengthens the negotiating position of suppliers offering these solutions.

Associated British Foods (ABF) faces significant bargaining power from suppliers of agricultural commodities like sugar and wheat. Factors such as weather impacting yields in 2024, as seen with global sugar prices, can concentrate supply and increase supplier leverage. Similarly, specialized ingredients with proprietary technology give suppliers an edge.

Energy and logistics providers also hold considerable power, especially given the volatility in energy markets throughout 2024. Disruptions can lead to price hikes, impacting ABF's operational costs. For Primark, labor availability and wage pressures, influenced by minimum wage adjustments in 2024 and broader inflation, directly affect its cost structure.

Suppliers of sustainable packaging materials are gaining influence due to increasing demand in 2024. ABF's strategy to mitigate this involves long-term agreements and efficiency investments, recognizing the critical nature of these inputs.

| Factor | Impact on ABF | 2024 Trend/Data |

| Commodity Prices (Sugar, Wheat) | Increased cost of goods sold, potential margin pressure | Global sugar prices fluctuated significantly due to weather events affecting key producing regions. |

| Specialized Ingredients | Higher input costs if few alternatives exist | Continued reliance on proprietary yeast strains and other specialized ingredients. |

| Energy Costs (Natural Gas, Electricity) | Elevated operational expenses, potential for price pass-through | Continued volatility in global energy markets impacting operational expenditures. |

| Labor Costs (Retail, Logistics) | Increased wage bills and recruitment expenses | Upward pressure on wages due to inflation and regional labor market tightening. |

| Sustainable Packaging | Potential for higher material costs, supply chain dependency | Growing demand for eco-friendly options strengthens supplier negotiating power. |

What is included in the product

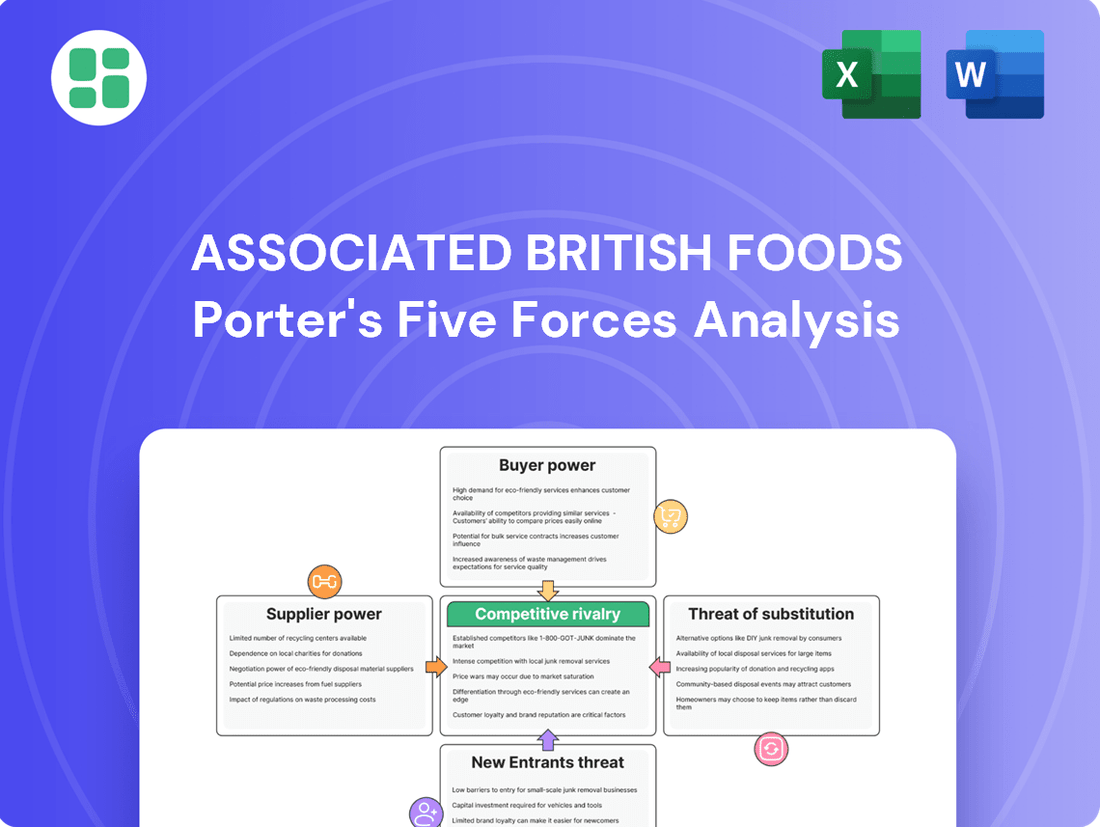

Explores market dynamics that deter new entrants and protect incumbents like Associated British Foods, while also assessing the bargaining power of suppliers and buyers and the threat of substitutes.

Effortlessly identify and address competitive threats by visually mapping the intensity of each of Porter's Five Forces for Associated British Foods.

Customers Bargaining Power

For Associated British Foods' grocery and ingredients divisions, major supermarket chains and large industrial food manufacturers are key customers. These consolidated buyers wield considerable influence due to their immense purchasing volumes and their capacity to shift between suppliers. This dynamic directly impacts ABF by exerting pressure on pricing and profit margins, as evidenced by the intense competition in the grocery sector where major players like Tesco and Sainsbury's, holding significant market share, can negotiate favorable terms.

Primark’s core strategy is offering value fashion, meaning its customers are very sensitive to price. This makes them a powerful force, even if each individual customer's impact is small.

The sheer volume of shoppers looking for low prices means Primark must keep its prices down. For example, in 2024, the fast fashion market continued to see intense competition, with consumers actively seeking deals. If Primark were to raise prices significantly, customers would quickly switch to other affordable brands, highlighting the critical need for its efficient, low-cost operations.

Associated British Foods' ingredients division faces a significant bargaining power from its industrial customers, who are typically large, sophisticated food and beverage manufacturers. These clients possess deep knowledge of market pricing, precise product specifications, and readily available alternative suppliers, allowing them to exert considerable pressure on ABF for more favorable terms.

The sheer scale of these industrial buyers means their purchasing decisions can significantly impact ABF's revenue streams. For instance, a major bakery client switching suppliers could represent a substantial loss, forcing ABF to be highly competitive. In 2024, the global food ingredients market saw intense price competition, with some commodity ingredient prices fluctuating by over 15% due to supply chain shifts and demand volatility, directly impacting negotiation leverage.

To counter this, ABF must consistently deliver exceptional product quality, ensure unwavering supply chain reliability, and develop customized solutions that go beyond mere price. Demonstrating tangible value through innovation and technical support is crucial for retaining these high-volume, discerning customers and mitigating the downward pressure on margins.

Impact of Private Label Brands

Associated British Foods (ABF) faces significant bargaining power from customers, particularly due to the rise of private label brands in the grocery sector. Retailers increasingly offer their own brands, which directly compete with ABF's established products, especially in staple food categories. This trend allows retailers to exert greater pressure on ABF for favorable pricing and terms, as they can easily substitute ABF's offerings with their own, often at a lower cost to the consumer.

The increasing quality and market penetration of these private label brands directly enhance the bargaining power of retailers. For instance, by 2024, many major UK supermarkets have significantly expanded their premium private label ranges, narrowing the quality gap with national brands. This forces ABF to continually invest in brand building, product innovation, and differentiation to maintain customer loyalty and justify its pricing strategies.

- Increased Competition: Retailer-owned brands provide a direct alternative, intensifying competition for ABF.

- Price Pressure: The lower price points of private labels compel ABF to manage costs and pricing carefully.

- Brand Differentiation: ABF must invest in marketing and product development to stand out against private labels.

- Retailer Leverage: Retailers can leverage their private label offerings to negotiate better terms with suppliers like ABF.

Global Distribution Network Demands

Global distribution network demands significantly influence the bargaining power of customers for Associated British Foods (ABF). Large multinational food companies, operating across numerous international markets, require sophisticated and efficient logistics. If ABF's distribution capabilities fall short of these complex demands, or if they are not cost-competitive, these major clients can easily shift their business to competitors offering superior supply chain solutions.

This dynamic forces ABF to continually invest in and refine its global supply chain infrastructure. For instance, ABF's 2023 annual report highlights ongoing investments in logistics and warehousing to enhance its international reach and responsiveness. The ability to manage diverse and demanding distribution requirements across continents is a key factor in retaining and attracting these high-volume customers.

- Global Reach Necessity: Major food manufacturers expect seamless product availability across all their operating regions, putting pressure on ABF's logistical prowess.

- Cost Efficiency Mandate: Customers demand that ABF's global distribution network operates cost-effectively to maintain their own profit margins.

- Supplier Competition: Failure to meet these distribution demands can lead customers to switch to suppliers with more established or agile global supply chains.

Associated British Foods' customers, particularly in its grocery and ingredients segments, possess significant bargaining power. This stems from their large purchasing volumes, ability to switch suppliers, and the increasing prevalence of private label brands. For instance, major supermarket chains can leverage their market share to negotiate favorable pricing, while industrial food manufacturers demand stringent product specifications and competitive terms.

The fast fashion market, where Primark operates, is intensely price-sensitive. In 2024, consumers actively sought deals, meaning any significant price increase by Primark would likely lead customers to competitors. This necessitates a continuous focus on cost efficiency and value proposition to maintain market share.

ABF's ingredients division faces powerful industrial customers who are well-informed about market pricing and have access to alternative suppliers. The sheer scale of these buyers means their decisions can substantially impact ABF's revenue. In 2024, fluctuations in commodity ingredient prices, sometimes exceeding 15%, directly influenced customer negotiation leverage.

| Customer Type | Key Bargaining Factors | Impact on ABF |

| Major Supermarkets (Grocery) | High purchase volume, private label brands, ability to switch suppliers | Price pressure, margin erosion |

| Industrial Food Manufacturers (Ingredients) | Sophisticated market knowledge, precise specifications, alternative suppliers | Negotiation for favorable terms, demand for quality and reliability |

| Primark Shoppers (Retail) | Extreme price sensitivity, availability of alternatives | Need for low-cost operations, constant price monitoring |

Preview the Actual Deliverable

Associated British Foods Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis of Associated British Foods delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Understanding these forces is crucial for strategizing within the food manufacturing and retail sectors.

Rivalry Among Competitors

Associated British Foods (ABF) navigates a fiercely competitive landscape within the global food and beverage sector. Rivalry is particularly intense from industry titans such as Nestlé, Unilever, and Mondelez, impacting ABF's performance in key areas like tea with its Twinings brand and its cereal offerings. These large conglomerates leverage substantial financial resources, diverse product portfolios, and deeply entrenched distribution channels, creating a challenging environment for market share gains and brand visibility.

The sheer scale and established market presence of these global competitors mean ABF must constantly innovate and leverage its specific brand strengths to carve out and defend its market niches. For instance, in 2024, the global food and beverage market continued to see significant M&A activity, with major players acquiring smaller brands to expand their reach, underscoring the pressure on companies like ABF to maintain differentiation and agility.

Primark operates in a highly competitive fast fashion arena, facing intense pressure from both legacy brands like Zara and H&M, and agile online disruptors such as Shein and Boohoo. This market thrives on quick trend adoption, aggressive pricing strategies, and continuous advancements in supply chain efficiency and digital customer interaction.

The company differentiates itself through its strong value proposition, a distinctive in-store shopping experience, and the ongoing development of its click-and-collect offerings. For instance, in its fiscal year 2023, Associated British Foods reported that Primark’s revenue grew by 7.7% to £9.0 billion, demonstrating its ability to navigate this competitive landscape.

The ingredients division faces intense rivalry, battling both large, diversified ingredient suppliers and a vast array of smaller, niche global competitors. This fragmentation means competition often hinges on factors beyond just price, including groundbreaking product innovation, deep technical know-how, and the ability to craft highly customized solutions for industrial customers, particularly in sectors like yeast and bakery ingredients.

Price pressure is a constant, especially for more standardized, commodity-type ingredients. To navigate this, Associated British Foods must maintain a sharp focus on operational efficiency and rigorous quality control to remain competitive and profitable in these segments.

Price Wars in Commodity Markets

Associated British Foods (ABF) faces significant competitive rivalry in its commodity-driven segments, particularly in sugar. This market is characterized by intense price wars among large global producers, where cost efficiency and scale are paramount. For instance, in 2023, global sugar prices experienced volatility, impacting profit margins for major players like ABF.

The competition in sugar often boils down to securing access to prime growing regions and optimizing production costs. ABF's ability to leverage its integrated supply chain and operational scale provides a competitive edge, but the inherent cyclicality of commodity prices remains a persistent challenge. The company's diversified business model, however, helps to cushion the impact of downturns in any single commodity market.

- Global Sugar Production: In the 2023-2024 season, global sugar production was estimated to be around 180 million metric tons, with major producing countries like Brazil, India, and the European Union being key competitors.

- Price Volatility: Sugar prices on the ICE Futures U.S. exchange saw significant fluctuations throughout 2023, influenced by weather patterns, government policies, and demand from the biofuel sector.

- ABF's Sugar Segment Performance: While specific 2024 figures are still emerging, ABF's sugar division historically contributes a substantial portion of its revenue, highlighting the importance of managing competitive pressures in this area.

Brand Loyalty and Product Differentiation

Associated British Foods (ABF) benefits from established consumer brands such as Twinings, Ovaltine, and Jordans, fostering a degree of brand loyalty. However, the food and beverage sector is highly competitive, with rivals frequently launching new products and aggressive marketing initiatives. This necessitates continuous innovation and significant investment in brand equity to retain customers.

Maintaining and growing this loyalty in a crowded marketplace presents a persistent challenge for ABF. Competitors are actively vying for consumer attention, making it crucial for ABF to consistently deliver on product quality and differentiation. For instance, in 2023, the global tea market, where Twinings operates, was valued at approximately $65 billion and is projected to grow, indicating intense competition and the need for sustained brand appeal.

- Brand Strength: ABF possesses well-recognized brands like Twinings and Jordans, which have built consumer trust over time.

- Market Saturation: The food and beverage industry is characterized by a high number of players, making it difficult to capture and retain market share.

- Competitive Intensity: Rivals frequently introduce new products and employ robust marketing strategies, demanding constant adaptation from ABF.

- Innovation Imperative: To counter competitive pressures, ABF must continually invest in product development and brand building to maintain its edge.

Competitive rivalry is a defining characteristic across all of Associated British Foods' (ABF) diverse business segments. In the grocery sector, established giants and agile newcomers alike vie for consumer attention through aggressive pricing and product innovation. The fashion retail segment, particularly at Primark, faces relentless competition from both traditional high-street brands and rapidly evolving online retailers, demanding constant adaptation to fast-changing trends and consumer preferences. Even in the ingredients and sugar markets, where scale and efficiency are crucial, competition remains fierce, driven by global players and price volatility.

| Segment | Key Competitors | Competitive Dynamics |

| Grocery (e.g., Twinings, Jordans) | Nestlé, Unilever, Mondelez, private labels | Brand loyalty, product innovation, marketing spend, price sensitivity |

| Fashion Retail (Primark) | Zara, H&M, Shein, Boohoo | Trend adoption speed, pricing, supply chain efficiency, online presence |

| Ingredients | Large diversified suppliers, niche specialists | Technical expertise, customization, product innovation, price |

| Sugar | Global sugar producers (e.g., Brazil, India) | Cost efficiency, scale, access to raw materials, price volatility |

SSubstitutes Threaten

The rise of alternative sweeteners like stevia and erythritol presents a significant threat to Associated British Foods' (ABF) sugar division. Consumer demand is shifting towards these options due to perceived health benefits and a growing awareness of sugar's impact on diet. This trend directly challenges the market share of traditional sugar.

Health-conscious consumers are actively seeking sugar alternatives, which can directly reduce the volume of sugar ABF sells. This evolving dietary landscape means ABF must consider how to integrate or compete with these substitutes to maintain its position in the sweetener market.

The growing popularity of plant-based food alternatives poses a significant substitution threat to Associated British Foods (ABF). Consumers are increasingly opting for these products due to perceived health and sustainability benefits, potentially diverting demand away from ABF's traditional offerings in its grocery and ingredients segments. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to reach USD 162.5 billion by 2030, indicating a substantial shift in consumer preferences that ABF must address.

Primark faces significant substitution threats from online fashion retailers. These platforms, like ASOS and Boohoo, offer unparalleled convenience, a vast product selection, and direct-to-consumer pricing, directly challenging Primark's physical store model. In 2024, the global online fashion market is projected to reach over $1.2 trillion, demonstrating the scale of this digital alternative.

The burgeoning second-hand and rental fashion market also presents a potent substitute. For consumers prioritizing affordability and sustainability, platforms like Depop and Vinted offer compelling alternatives to new purchases. This segment is rapidly expanding, with the resale market alone expected to double in value by 2027, reaching an estimated $77 billion, indicating a growing consumer preference for pre-owned goods.

Home Cooking and DIY Food Trends

The rising popularity of home cooking and DIY food preparation presents a significant threat of substitution for Associated British Foods' (ABF) processed food and ingredient segments. As consumers increasingly engage in preparing meals from scratch, they may opt out of pre-made sauces, mixes, and convenience ingredients that ABF offers. This trend is driven by a desire for greater control over nutritional content and ingredient sourcing, potentially impacting ABF's market share in these areas.

For instance, the market for home baking ingredients, a key area for ABF through brands like Kingsmill, saw a surge during periods of increased at-home activity. In 2024, consumer surveys indicated that over 60% of households reported increased home cooking frequency compared to pre-pandemic levels, highlighting the sustained consumer shift. This indicates a direct substitution for ready-to-eat or easily prepared food items.

- Growing Home Cooking Trend: Data suggests a persistent increase in home cooking, with consumers citing health and cost as primary drivers.

- DIY Food Preparation: The do-it-yourself aspect extends to making items like bread, pasta, and sauces from basic ingredients, directly competing with ABF's offerings.

- Consumer Preference Shift: A segment of consumers is actively seeking transparency in ingredients, favoring fresh produce and basic pantry staples over processed alternatives.

- ABF's Strategic Response: ABF could leverage this trend by expanding its portfolio of basic ingredients, offering recipe kits, or emphasizing the quality and provenance of its existing ingredient lines to appeal to home cooks.

Generic Brands and Private Labels

Generic brands and private labels represent a significant threat to Associated British Foods (ABF) across its diverse grocery portfolio. These lower-priced alternatives are increasingly capturing market share, particularly as consumer price sensitivity remains elevated. For instance, in the UK, private label penetration in the grocery market has consistently hovered around 50% in recent years, demonstrating a strong consumer preference for value.

This competitive pressure forces ABF to continually reinforce the value proposition of its established brands. The company must invest in product innovation, maintain high quality standards, and execute robust marketing campaigns to justify any price premium. Failure to do so risks customers migrating to cheaper substitutes, impacting ABF's sales volume and profitability.

The growing sophistication of private label offerings, with many supermarkets developing premium own-brand ranges, further intensifies this threat. Consumers now perceive less of a quality gap, making the price differential a more dominant factor in purchasing decisions. This dynamic necessitates ongoing strategic evaluation of ABF's brand positioning and pricing architecture.

- Private label market share in UK groceries often exceeds 50%, directly competing with ABF brands.

- Consumers increasingly view private label quality as comparable to national brands, driving substitution.

- ABF must invest in brand equity, innovation, and marketing to counter the price advantage of substitutes.

- The rise of premium private label ranges intensifies the threat by narrowing the perceived quality gap.

The threat of substitutes for Associated British Foods (ABF) is multifaceted, impacting its diverse business segments from sugar to fashion. In the food sector, alternative sweeteners and the increasing trend of home cooking pose direct challenges to ABF's sugar and ingredients divisions. For its retail arm, Primark, the rise of online fashion retailers and the burgeoning second-hand market represent significant substitution threats.

The market for sugar substitutes is expanding rapidly, driven by health consciousness. Similarly, the global online fashion market is projected to exceed $1.2 trillion in 2024, showcasing the scale of digital alternatives to brick-and-mortar retail like Primark. The second-hand fashion market is also a growing concern, expected to reach $77 billion by 2027.

| ABF Segment | Substitute Threat | Key Data Point |

|---|---|---|

| Sugar | Alternative Sweeteners (Stevia, Erythritol) | Growing consumer demand due to perceived health benefits. |

| Grocery & Ingredients | Home Cooking & DIY Food Preparation | Over 60% of households reported increased home cooking frequency in 2024. |

| Fashion (Primark) | Online Fashion Retailers (ASOS, Boohoo) | Global online fashion market projected to exceed $1.2 trillion in 2024. |

| Fashion (Primark) | Second-hand & Rental Fashion Market | Resale market expected to reach $77 billion by 2027. |

| Grocery | Generic Brands & Private Labels | Private label penetration in UK groceries often exceeds 50%. |

Entrants Threaten

Entering sectors where Associated British Foods (ABF) operates, such as food processing, sugar production, or large-scale retail like Primark, demands significant upfront capital. Building modern food manufacturing plants, establishing robust supply chains, and setting up extensive retail networks can easily run into hundreds of millions of dollars. For instance, constructing a new, state-of-the-art sugar refinery can cost upwards of $200 million, a sum prohibitive for many new entrants.

Newcomers face a steep challenge in matching the cost efficiencies that established giants like ABF achieve through economies of scale. ABF’s vast production volumes and integrated operations allow them to negotiate better raw material prices and spread fixed costs over a larger output. This cost advantage makes it incredibly difficult for smaller, less-established businesses to compete on price, effectively acting as a formidable barrier to entry.

Associated British Foods (ABF) benefits significantly from deeply ingrained brand loyalty across its grocery segments, including household names like Twinings and Ovaltine. This loyalty, cultivated over decades, makes it incredibly difficult for newcomers to capture market share. For instance, Twinings reported strong sales growth in 2024, demonstrating continued consumer preference.

Furthermore, ABF possesses a robust and extensive distribution network, particularly evident in its Primark retail operations, which reach millions of consumers globally. New entrants would struggle to replicate this reach, facing significant hurdles in securing shelf space and efficient logistics. Primark's continued expansion in 2024, opening new stores across Europe and North America, underscores the strength of its established distribution channels.

The food and ingredients sectors are subject to rigorous regulations concerning food safety, quality, and accurate labeling, varying significantly by country. New companies must meticulously navigate these complex compliance demands, secure essential certifications, and implement robust quality assurance protocols, all of which demand substantial time and financial investment. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) sets a high bar for traceability and safety, requiring extensive documentation and adherence to HACCP principles.

Access to Raw Material Supply Chains

New companies entering the sugar and ingredients market face significant hurdles in securing raw material supply chains. For instance, Associated British Foods (ABF), a major player, leverages its extensive, long-term relationships with agricultural producers. These established connections, often built over decades, provide ABF with preferential access and pricing for key commodities like sugar beet and grains.

For newcomers, replicating this level of supply chain integration is difficult and costly. They must invest heavily in building trust and securing contracts with farmers, often at less favorable terms initially. This can lead to higher input costs and less reliable supply compared to established entities.

- Supply Chain Integration: ABF's established networks give it an advantage in sourcing agricultural inputs.

- Cost Disadvantage: New entrants may face higher raw material costs due to a lack of established supplier relationships.

- Sourcing Consistency: Securing consistent volumes and quality of raw materials is a challenge for new competitors.

Intense Competition and Retaliation

Associated British Foods (ABF) operates in industries characterized by significant maturity and intense competition. Incumbent firms, including ABF itself, often deploy aggressive tactics such as price reductions, enhanced marketing campaigns, and rapid product innovation to defend their market share against newcomers. This potent threat of retaliation can effectively discourage potential entrants who may not possess the financial resilience or established market presence to endure such a competitive onslaught, thereby rendering market entry a high-risk proposition.

The sheer scale and established brand loyalty of existing players in sectors like grocery retail and sugar production present formidable barriers. For instance, in the UK grocery market, the top four retailers (Tesco, Sainsbury's, Asda, and Morrisons) held approximately 73% of the market share in early 2024, illustrating the dominance of established entities. New entrants would need substantial capital investment not only to establish operations but also to compete on price and attract consumers away from trusted brands and convenient store networks.

- Market Maturity: ABF's core markets, such as baking and sugar, are largely mature, meaning growth is often incremental rather than explosive, making it harder for new players to carve out significant market share.

- Incumbent Retaliation: Existing large players are well-equipped to respond aggressively to new entrants through price wars or increased promotional activity, as seen in the competitive dynamics of the European sugar market.

- Capital Intensity: Industries ABF operates in, like food manufacturing and retail, often require significant upfront capital investment in production facilities, distribution networks, and marketing, creating a high barrier to entry.

- Brand Loyalty and Scale: Established brands benefit from consumer trust and economies of scale, which new entrants struggle to replicate quickly, further deterring market entry.

The threat of new entrants for Associated British Foods (ABF) is generally low due to significant capital requirements, established economies of scale, and strong brand loyalty in its key sectors like food manufacturing and retail. For example, building a new sugar refinery can cost over $200 million, a substantial hurdle for potential competitors.

ABF's scale allows for cost efficiencies that new entrants struggle to match, impacting their ability to compete on price. Furthermore, established brands like Twinings, which saw strong sales growth in 2024, benefit from decades of cultivated consumer trust.

The company's extensive distribution network, exemplified by Primark's global reach and continued expansion in 2024, also presents a significant barrier. Navigating complex food safety regulations and securing consistent raw material supply chains, where ABF has long-standing relationships, further deters new market participants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Associated British Foods is built upon a foundation of diverse data. We leverage official company filings, including annual reports and investor presentations, alongside industry-specific market research from reputable firms like Mintel and Euromonitor International.