Associated British Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Associated British Foods Bundle

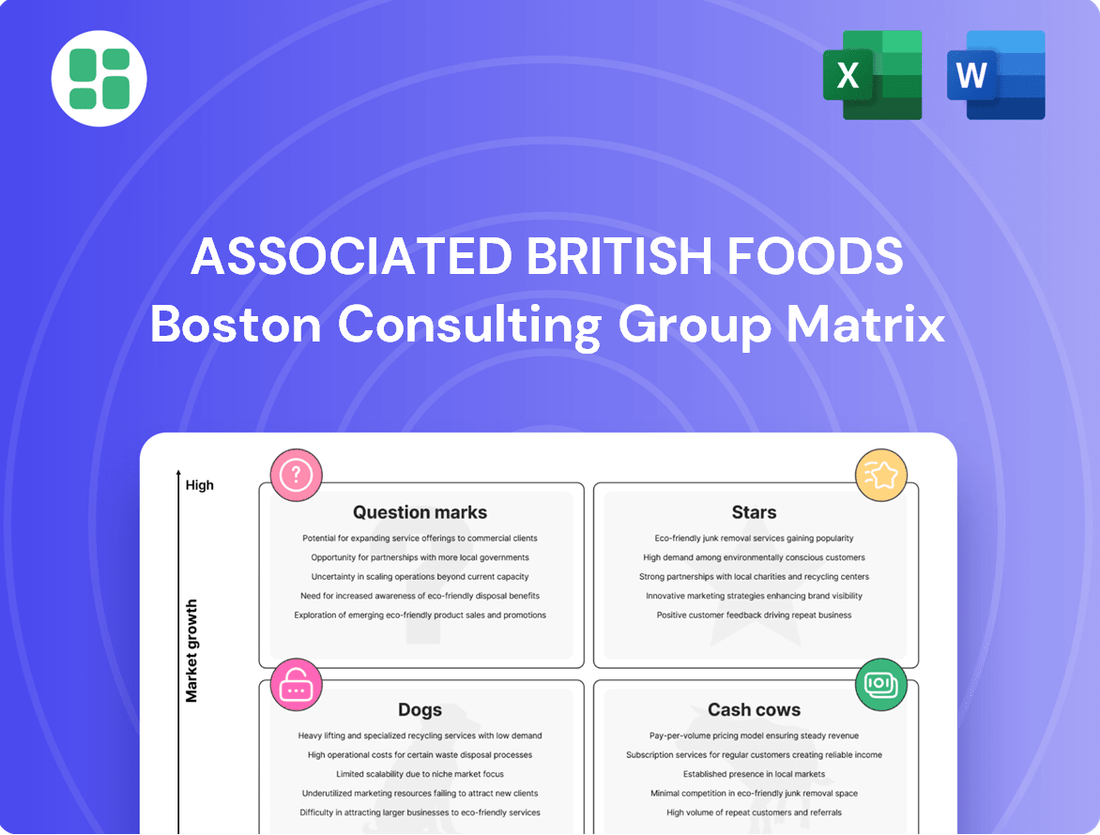

Associated British Foods' diverse portfolio spans from iconic grocery brands to profitable sugar and ingredients businesses. Understanding where each segment sits within the BCG Matrix—whether a high-growth Star or a stable Cash Cow—is crucial for strategic resource allocation. This preview offers a glimpse into their market positioning, but for a complete strategic roadmap, the full BCG Matrix report is essential.

Uncover the hidden potential and challenges within Associated British Foods' product lines with our comprehensive BCG Matrix analysis. This report provides the detailed quadrant placements, data-backed insights, and actionable recommendations you need to navigate their complex business landscape effectively. Purchase the full version to gain a competitive edge and make informed investment decisions.

Stars

Primark's aggressive expansion into the United States market firmly places it as a Star within Associated British Foods' portfolio. The company is rapidly increasing its store count, with a target of 60 stores by the end of 2026, signaling substantial investment and confidence in this high-growth region. This strategic push is fueled by strong sales performance, with the US market demonstrating significant potential for Primark's value fashion model.

Primark is seeing robust expansion in several key European countries beyond its initial strongholds. Spain, Portugal, France, and Italy are all demonstrating significant growth, alongside emerging opportunities in Central and Eastern Europe.

These markets are particularly attractive due to the strong demand for value fashion. Primark's strategy of opening new stores and emphasizing its customer-friendly pricing is successfully capturing market share. For instance, in the fiscal year 2023, Primark reported a 7% increase in like-for-like sales in its European markets, excluding the UK, highlighting the effectiveness of its expansion.

Primark's strategic investment in digital engagement, notably its Click & Collect service expansion across the UK, positions it as a potential Star. This move is designed to bolster customer experience and draw shoppers into physical stores, tapping into the growing online retail market.

In 2024, Primark reported that its Click & Collect service was available in 25 stores across the UK, with plans for further rollout. This initiative is a key component of their omni-channel strategy, aiming to capture a larger share of the online apparel market.

Sustainability-Driven Product Lines

Primark's ambitious goal to have all its clothing made from recycled or more sustainably sourced materials by 2030 positions its sustainability-driven product lines as potential Stars within the Associated British Foods BCG Matrix. This commitment directly addresses the escalating consumer demand for ethical and environmentally responsible fashion choices.

These sustainable lines are well-positioned to capture a growing market share in a high-growth segment, attracting a new demographic of conscious consumers who prioritize brand values alongside style and affordability. For instance, in fiscal year 2023, Primark reported a 7% increase in like-for-like sales, demonstrating strong consumer engagement.

The brand appeal and market differentiation stemming from this sustainability focus could translate into significant competitive advantages.

- Market Growth: The global sustainable fashion market is projected to reach $15.1 billion by 2030, indicating a substantial growth opportunity.

- Consumer Preference: A 2024 survey revealed that 68% of consumers consider sustainability when making fashion purchases.

- Brand Differentiation: Primark's commitment sets it apart in a crowded retail landscape, fostering brand loyalty among ethically-minded shoppers.

Brand Collaborations and Licensed Products

Primark's brand collaborations are a significant driver of engagement and sales. Collections featuring celebrities like Rita Ora and Paula Echevarría, alongside popular licensed products, have proven highly successful. These partnerships tap into current fashion trends and consumer desires, bolstering Primark's market share in the fast-fashion sector.

These collaborations are not just about buzz; they translate into tangible results. For instance, the Rita Ora collection in early 2024 saw significant social media traction and immediate sell-through rates, demonstrating the power of celebrity endorsement in the fashion retail landscape. Similarly, licensed products, such as those featuring popular movie franchises, consistently perform well, attracting a broad customer base.

- Primark's celebrity collaborations, including those with Rita Ora and Paula Echevarría, have generated substantial sales growth.

- Licensed products, often tied to popular culture, also contribute significantly to Primark's revenue streams.

- These initiatives effectively capture current fashion trends, enhancing customer engagement and driving market share gains.

- The success of these collaborations highlights Primark's ability to leverage partnerships for commercial advantage in the competitive fast-fashion market.

Primark's aggressive expansion into the United States, with plans for 60 stores by the end of 2026, and its strong performance in key European markets, including Spain and France, solidify its position as a Star. The brand's successful Click & Collect service rollout across 25 UK stores in 2024 and its commitment to sustainable materials by 2030 further enhance its high-growth potential. These strategic moves, coupled with popular celebrity and licensed product collaborations, are driving significant sales increases and market share gains.

| Category | Key Initiatives | Market Performance | Growth Potential |

|---|---|---|---|

| Geographic Expansion | US market entry (60 stores by 2026), Central/Eastern Europe | Strong demand for value fashion | High |

| Digital Strategy | Click & Collect (25 UK stores in 2024) | Enhanced customer experience, omni-channel | High |

| Sustainability | 100% recycled/sustainable materials by 2030 | Growing consumer preference (68% in 2024 survey) | High |

| Brand Collaborations | Celebrity (Rita Ora), Licensed Products | Significant sales growth, social media traction | High |

What is included in the product

The Associated British Foods BCG Matrix provides a strategic overview of its diverse portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visual for ABF's portfolio offers relief by simplifying complex business unit performance, enabling strategic focus.

Cash Cows

Primark's established UK and Ireland operations are firmly positioned as Cash Cows within Associated British Foods' portfolio. Despite minor fluctuations in like-for-like sales, these markets are characterized by a substantial market share and a vast store footprint, ensuring consistent revenue generation.

These mature regions are critical for ABF, delivering robust profitability and a stable, significant cash flow. For instance, in the fiscal year ending September 2023, ABF reported that its total revenue reached £19.8 billion, with the retail segment, heavily influenced by Primark's UK and Ireland presence, playing a pivotal role in this performance.

Associated British Foods' Grocery division, featuring well-recognized international brands like Twinings and Ovaltine, is a prime example of a cash cow. These brands consistently generate substantial profits and robust cash flows, reflecting their strong market positions in mature global markets.

The division's financial strength is evident in its consistent delivery of high profit margins. With established brand loyalty and leading market shares, the Grocery segment requires minimal investment for growth, allowing it to serve as a significant internal funding source for other ABF businesses.

The ABF Ingredients business, encompassing yeast and bakery ingredients (AB Mauri) and specialty ingredients, is a clear cash cow for Associated British Foods. This division consistently delivers strong sales and profit growth, a testament to its stable market position.

In the fiscal year 2023, ABF Ingredients reported a revenue of £2.2 billion, showing its significant contribution to the group's overall performance. The adjusted operating profit for this segment reached £279 million, highlighting its robust profitability and reliable cash generation capabilities.

ABF Agriculture Division

The ABF Agriculture Division, encompassing specialty feeds and additives, has demonstrated consistent profitability. This segment is anticipated to see growth as market conditions improve. It serves as a stable contributor to Associated British Foods' overall cash flow, diversifying the company's revenue base.

While not a rapid expansion sector, the Agriculture division offers dependable cash generation for ABF. Its performance is a key element in the group's financial stability.

- Stable Profitability: The division consistently generates profits, contributing reliably to the group's earnings.

- Market Improvement: Future performance is expected to benefit from an improving market environment.

- Cash Generation: It acts as a steady source of cash for the broader Associated British Foods organization.

- Revenue Diversification: This segment helps to spread ABF's income sources, reducing reliance on any single market.

Core Value Proposition of Primark

Primark's core value proposition hinges on delivering trendy, affordable fashion through a high-volume, low-margin business model. This focus on value for money has proven exceptionally resilient, especially as consumers navigate economic uncertainties.

The company's extensive network of physical stores drives significant footfall, translating into consistent sales. In 2024, Primark continued to see robust performance, with sales growth reported across its key markets, demonstrating the enduring appeal of its accessible pricing strategy.

- Value Proposition: High-fashion at low prices.

- Sales Driver: Extensive physical store presence and high footfall.

- Market Position: Appeals to a broad, price-sensitive consumer base.

- 2024 Performance: Continued sales growth, underscoring model resilience.

Associated British Foods' Grocery division, featuring brands like Twinings and Ovaltine, functions as a classic cash cow. These established brands command strong market positions globally, generating consistent profits and reliable cash flows with minimal need for reinvestment.

The Grocery segment's financial strength is a significant asset, providing a stable internal funding source for other ABF ventures. This division's mature markets and brand loyalty ensure it remains a dependable contributor to the group's overall profitability.

ABF Ingredients, particularly its yeast and bakery ingredients, is another clear cash cow. The division's robust profitability, evidenced by a £279 million adjusted operating profit in fiscal year 2023, underscores its consistent sales and profit growth from a stable market position.

The Agriculture division, while not a high-growth area, also acts as a cash cow for ABF. It offers dependable cash generation and revenue diversification, contributing to the group's financial stability by spreading income sources.

| Segment | BCG Category | Key Characteristics | 2023 Contribution (Illustrative) |

|---|---|---|---|

| Primark (UK/Ireland) | Cash Cow | High market share, vast store footprint, consistent revenue | Significant contributor to £19.8bn group revenue |

| Grocery (Twinings, Ovaltine) | Cash Cow | Strong international brands, mature markets, high profit margins | Robust cash flow generation |

| Ingredients (AB Mauri) | Cash Cow | Stable market position, consistent sales and profit growth | £279m adjusted operating profit |

| Agriculture (Specialty Feeds) | Cash Cow | Consistent profitability, dependable cash generation | Stable contributor to overall cash flow |

Full Transparency, Always

Associated British Foods BCG Matrix

The preview you see is the exact Associated British Foods BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked analysis ready for immediate strategic application. This comprehensive document has been meticulously prepared, ensuring that the insights and visual representations of ABF's business units are precisely what you'll download and utilize. You can confidently proceed with your purchase, knowing that the quality and content of this BCG Matrix are exactly as presented, providing a robust foundation for your business planning and decision-making processes.

Dogs

ABF Sugar's European Operations are currently positioned as a Dog in the BCG Matrix. This segment faced significant headwinds in the first half of fiscal year 2025, reporting an adjusted operating loss.

The outlook for the full financial year also anticipates a loss, driven by persistent challenges such as lower European sugar prices.

Operating within a low-growth market, the business is struggling to achieve profitability, suggesting a need for strategic reassessment, which could include divestment.

Vivergo, Associated British Foods' UK bioethanol venture, is currently experiencing an operating loss. This downturn is primarily attributed to the sustained low prices of bioethanol in the market.

This struggling unit is negatively impacting the overall profitability of ABF's Sugar division. Furthermore, Vivergo holds a low market share within an industry characterized by challenging conditions and minimal growth prospects.

Allied Bakeries, a segment within Associated British Foods' Grocery division, is navigating a highly competitive and slow-growing market. The business unit is anticipated to report an operating loss, reflecting its ongoing struggles to achieve profitability. This situation suggests a low market share in its sector, placing it in a position that could warrant consideration for divestment.

Less Profitable Legacy Brands (within Grocery)

Associated British Foods' Grocery division includes certain US oils and other regionally-focused brands that have seen reduced sales, consequently dampening overall segment growth. These brands, characterized by low market share and limited growth potential, demand careful oversight to prevent them from becoming substantial drains on cash flow.

For instance, in fiscal year 2024, the Grocery segment, while reporting overall revenue growth, faced headwinds from these specific legacy brands. While the company does not break out individual brand performance extensively, the broader segment’s performance indicates that these less profitable areas are a drag on the division's otherwise positive trajectory.

- US Oils and Regional Brands Impact: These legacy brands within the Grocery segment have experienced a decline in sales, negatively affecting overall growth.

- Low Growth, Low Share: They represent products with limited market appeal and slow sales expansion, fitting the profile of potential cash traps.

- Management Focus: Careful strategic management is necessary to mitigate their impact and prevent them from consuming significant resources without commensurate returns.

- Fiscal Year 2024 Context: While the broader Grocery segment showed resilience in 2024, these specific brands contributed to slower growth within the division.

Mothballed or Divested Sugar Assets

Associated British Foods' mothballed or divested sugar assets, such as those in Mozambique and North China, represent business units that have been strategically exited. These moves typically stem from poor performance, characterized by low market share and operations within declining or intensely competitive markets. For example, ABF’s decision to close its sugar business in North China and mothball operations in Mozambique aligns with the characteristics of ‘Dogs’ in the BCG matrix.

These divested sugar assets fit the 'Dog' quadrant due to their low market share and low growth potential. The financial implications of such segments often involve significant capital expenditure with little return, prompting divestment to reallocate resources to more promising areas of the business.

- Mozambique Sugar Operations: Mothballed, indicating a cessation of active operations and a potential future sale or disposal.

- North China Sugar Business: Divested, signifying a complete exit from this market segment.

- Market Conditions: These actions reflect challenging market dynamics within the sugar industry, potentially due to oversupply, regulatory changes, or evolving consumer preferences.

- Strategic Rationale: Exiting these 'Dog' assets allows ABF to focus capital and management attention on its higher-performing segments, such as Grocery or Ingredients, which offer better growth prospects and returns.

Associated British Foods' ABF Sugar's European operations, including Vivergo, and Allied Bakeries are considered Dogs in the BCG Matrix. These segments operate in low-growth markets with low market share, and are experiencing operating losses.

The company has strategically exited certain sugar assets, such as those in Mozambique and North China, which also fit the Dog profile due to poor performance and challenging market conditions. These divestments reflect a strategy to reallocate resources to more promising business areas.

For fiscal year 2024, while the overall Grocery segment showed resilience, specific legacy brands within it, like certain US oils, experienced reduced sales and are characterized by low market share and limited growth potential, acting as cash traps.

These 'Dog' assets require careful strategic management, with potential consideration for divestment to improve overall profitability and focus capital on higher-performing segments.

Question Marks

Primark's expansion into new territories like Hungary and additional US states such as Texas, South Carolina, and Georgia signifies a strategic move into potential high-growth markets. These entries are characteristic of a 'question mark' in the BCG matrix, demanding substantial investment to establish brand recognition and capture market share.

For instance, Primark's 2023 fiscal year saw continued international expansion, with new stores opening across various European countries and the US. While specific profitability figures for these new market entries are not yet fully realized, the company's overall revenue growth, which reached £9.0 billion for the fiscal year ended September 16, 2023, demonstrates the potential of such strategic investments.

Primark's digital expansion, beyond its current Click & Collect service, represents a significant Question Mark within the ABF portfolio. While the overall online retail market is experiencing robust growth, Primark's market share in this broader digital space remains relatively modest.

This strategic area demands substantial and ongoing investment to build brand presence and capture a larger share of the digitally-savvy consumer. For instance, in 2024, the global online fashion market continued its upward trajectory, with projections indicating continued double-digit growth for the foreseeable future, presenting a clear opportunity that Primark is still developing its strategy for.

Primark's expansion into beauty, homeware, and food categories represents a strategic move to diversify beyond its core apparel business. These new ventures are in growing markets, but Primark's current market share in these segments is still nascent, placing them in the question mark quadrant of the BCG matrix. This means they require significant investment to grow and capture market share.

For example, Primark's beauty range, which includes makeup and skincare, competes in a dynamic market. Similarly, their foray into household items and vegan snacks taps into evolving consumer trends. While these categories offer potential for future growth, their current low market share necessitates careful resource allocation to transform them into stars.

Innovation in Ingredients and Agriculture

Associated British Foods' (ABF) Ingredients and Agriculture divisions are positioned as question marks within its BCG Matrix. The company's ongoing investment in novel technologies, such as advanced food processing and the development of new crop varieties, fuels potential growth in these segments. For instance, ABF Ingredients' focus on specialty starches and proteins addresses evolving consumer demands for healthier and more sustainable food options.

These innovative efforts aim to capture emerging market opportunities and possess significant growth potential. However, the ultimate market share and profitability of these ventures remain uncertain, necessitating careful monitoring and strategic resource allocation. In 2023, ABF's Ingredients segment reported revenue growth, reflecting the positive impact of innovation, though specific figures for R&D investment in these particular areas are not publicly itemized separately.

- Focus on Specialty Ingredients: ABF Ingredients is investing in areas like functional proteins and novel sweeteners, targeting high-growth food and beverage markets.

- Agricultural Technology Adoption: Within Agriculture, ABF is exploring precision farming techniques and sustainable sourcing to enhance efficiency and yield.

- Market Uncertainty: While these innovations show promise, their ability to achieve significant market share and profitability is still developing.

- R&D Investment: ABF consistently allocates capital to research and development across its businesses, supporting the innovation pipeline in Ingredients and Agriculture.

Sustainability Initiatives requiring Upfront Investment

Associated British Foods' sustainability initiatives, particularly those aiming for significant carbon emission reductions or implementing novel sustainable sourcing methods across its diverse operations, represent substantial upfront investments. These projects, while vital for enhancing long-term brand reputation and ensuring regulatory compliance, often involve considerable capital expenditure with returns that are not immediately quantifiable in terms of market share gains. For example, investing in renewable energy sources for its food manufacturing plants or developing more efficient, lower-emission logistics networks requires significant initial outlay.

These types of investments are characteristic of a question mark in the BCG matrix, indicating high growth potential in responsible business practices but demanding substantial resources without guaranteed immediate returns. Associated British Foods' commitment to these areas, such as its targets for reducing Scope 1 and 2 emissions, reflects a strategic positioning for future market demands and stakeholder expectations. The company reported a 15% reduction in absolute Scope 1 and 2 GHG emissions in FY23 compared to its 2019 baseline, a testament to ongoing investment in more sustainable operations.

- Investing in renewable energy: Transitioning to solar or wind power for its factories and distribution centers.

- Sustainable sourcing programs: Developing and implementing new methods for sourcing raw materials like palm oil or sugar that minimize environmental impact.

- Water stewardship: Implementing advanced water management and recycling technologies in water-intensive operations.

- Packaging innovation: Research and development into more sustainable and recyclable packaging materials.

Question Marks within Associated British Foods' portfolio represent areas with high growth potential but currently low market share. These ventures require significant investment to establish a stronger market position. For example, Primark's expansion into new territories and digital channels, alongside ABF's ventures into specialty ingredients and sustainable agriculture, all fall into this category. These strategic bets are crucial for future growth, but their success is not yet guaranteed, demanding careful resource allocation and ongoing evaluation.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.