AAR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

Unlock the critical external factors shaping AAR's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play to anticipate challenges and capitalize on opportunities. Invest in clarity and strategic foresight—download the full analysis now to gain a decisive advantage.

Political factors

AAR Corp's reliance on government and defense clients makes its financial performance highly susceptible to changes in defense spending. For instance, the US Department of Defense's budget for fiscal year 2024 was set at $886 billion, a significant sum that directly impacts companies like AAR. Fluctuations in these budgets, driven by evolving national security needs or political shifts, can directly affect AAR's expeditionary services and parts supply business segments.

Conversely, periods of heightened geopolitical instability or a strategic push to upgrade aging military hardware often translate into increased demand for AAR's services. The ongoing modernization efforts within various global air forces, for example, present a substantial opportunity for AAR to expand its MRO (Maintenance, Repair, and Overhaul) and parts distribution operations, contributing to revenue growth.

The aviation industry operates under a stringent regulatory framework, with organizations like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) dictating rigorous safety and maintenance standards. These regulations directly impact AAR's maintenance, repair, and overhaul (MRO) services and the demand for its spare parts.

Evolving regulatory landscapes, such as the introduction of new airworthiness directives or enhanced environmental standards for aircraft emissions, can necessitate significant investments in compliance and operational adjustments for AAR. For instance, the FAA's proposed changes to Part 145 repair station regulations in 2024 aim to further streamline oversight while maintaining safety, potentially affecting how MRO providers like AAR operate and document their processes.

The cost of adhering to these ever-changing international and national aviation regulations presents a continuous challenge and opportunity for AAR. Adapting to new certification requirements or implementing more demanding maintenance protocols directly influences operational expenses and the competitive positioning of AAR's service offerings in the global market.

AAR Corp, as a global player in aviation support, faces significant exposure to evolving international trade policies and tariffs. For instance, a 2024 report indicated that ongoing trade disputes could impose higher tariffs on critical aerospace components, directly impacting AAR's procurement costs and potentially increasing prices for maintenance, repair, and overhaul (MRO) services. These trade shifts can disrupt established supply chains, making it more challenging and expensive to source necessary parts and materials for its worldwide clientele.

Geopolitical Stability

Global geopolitical instability, including regional conflicts and escalating tensions, directly impacts the aviation sector. For AAR, this translates to fluctuating demand from commercial airlines facing route disruptions or economic uncertainty. Conversely, heightened geopolitical risk can spur unpredictable surges in demand for government and defense sector support, such as rapid deployment and logistical assistance in affected areas. Navigating these complex international operating environments is a core competency for AAR, as evidenced by their significant presence in supporting military operations globally.

AAR's financial performance is intrinsically linked to global stability. For instance, in 2023, the defense and government segment represented a substantial portion of AAR's revenue, highlighting the direct correlation between geopolitical events and business opportunities. The company's ability to adapt its service offerings and supply chain management to rapidly changing international landscapes is paramount. This adaptability is crucial for capitalizing on opportunities arising from global events while mitigating risks associated with supply chain disruptions or decreased commercial air travel.

- Geopolitical Influence: Global political instability and regional conflicts directly affect AAR's commercial airline clientele, leading to variable demand for MRO services.

- Defense Sector Demand: Heightened geopolitical tensions can trigger increased, albeit unpredictable, demand for AAR's support from government and defense entities for rapid response operations.

- Supply Chain Vulnerability: International tensions can disrupt global supply chains, impacting AAR's ability to source parts and materials efficiently, a critical factor given its extensive parts distribution network.

- Operational Resilience: AAR's capacity to operate effectively in diverse and potentially unstable international markets is a key determinant of its success in navigating geopolitical shifts.

Government Support for Aviation Industry

Government support plays a crucial role in shaping the aviation landscape, which in turn impacts companies like AAR. Initiatives such as infrastructure investments, like the Federal Aviation Administration’s (FAA) Airport Improvement Program, which allocated $3.15 billion in 2023, can stimulate air travel and, consequently, the demand for maintenance, repair, and overhaul (MRO) services. Subsidies for sustainable aviation fuels (SAFs) or new aircraft technologies, as seen with various international government grants, also encourage fleet modernization, creating opportunities for AAR’s parts and services.

These government programs directly influence market dynamics. For instance, stimulus packages for airlines, such as those seen during the COVID-19 pandemic, can prevent bankruptcies and maintain operational capacity, thus preserving the customer base for MRO providers. Conversely, a reduction in government support or the implementation of restrictive policies could hinder market recovery and slow the adoption of new technologies, potentially impacting AAR’s growth trajectory.

Key government actions and their potential impact on AAR include:

- Infrastructure Investment: Government funding for airport upgrades and expansions increases air traffic, boosting demand for MRO services and parts.

- Sustainable Aviation Initiatives: Subsidies and incentives for SAFs and greener aircraft encourage fleet renewal, creating opportunities for AAR in newer aircraft MRO.

- Airline Stimulus Packages: Financial aid to airlines helps maintain fleet operations and airline solvency, ensuring a stable customer base for AAR.

- Regulatory Environment: Favorable regulations for aviation operations and MRO activities can reduce compliance costs and facilitate business growth for AAR.

Government budgets directly influence AAR's revenue, with the US Department of Defense's $886 billion budget for FY2024 highlighting the scale of potential business. Geopolitical events can spur demand for AAR's defense support services, as seen in their significant role in global military operations. Government incentives for sustainable aviation fuels and fleet modernization also present growth avenues for AAR.

What is included in the product

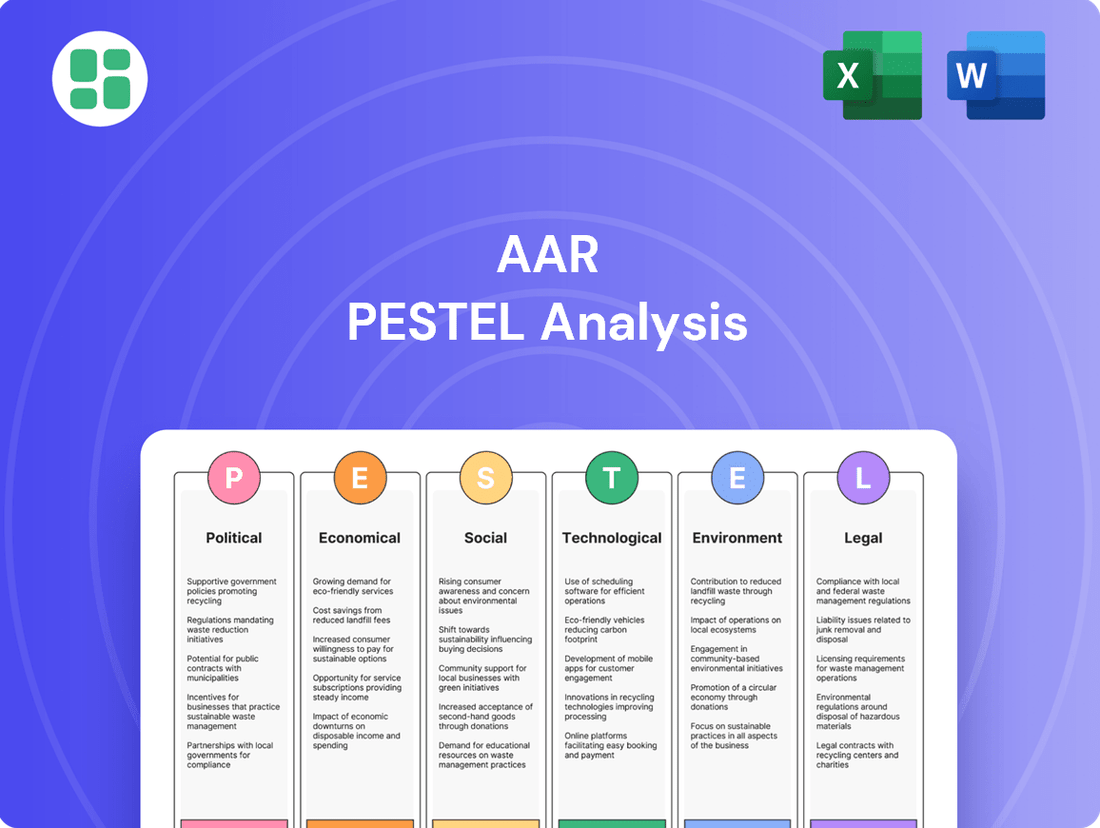

The AAR PESTLE Analysis provides a comprehensive examination of the external macro-environmental forces impacting the AAR, categorized into Political, Economic, Social, Technological, Environmental, and Legal factors.

This analysis is designed to equip stakeholders with the insights needed to navigate the complex external landscape and inform strategic decision-making.

A structured framework that helps identify and mitigate potential external threats and opportunities, thereby reducing uncertainty and strategic risk.

Economic factors

Global economic growth directly fuels air travel demand, which in turn drives the need for AAR's maintenance, repair, and overhaul (MRO) services and parts supply. A strong economy means more people flying for business and leisure, and more goods being shipped by air, leading to higher aircraft utilization. For instance, the International Air Transport Association (IATA) projected global air cargo traffic to grow by 4.5% in 2024, indicating a positive outlook for aircraft operations and subsequent MRO demand.

Conversely, economic downturns can significantly impact AAR's business. During periods of slow growth or recession, airlines often face reduced profitability, prompting them to potentially defer non-critical maintenance or reduce flight schedules. This directly translates to lower demand for MRO services and spare parts. The IMF's World Economic Outlook in April 2024 forecasted global growth to moderate to 3.2% in 2024, a slight slowdown from 2023, suggesting a potentially more cautious environment for airline investment in maintenance.

The financial health of commercial airlines is a crucial driver for AAR's MRO (Maintenance, Repair, and Overhaul) services. In 2024, many airlines are experiencing a rebound, with the International Air Transport Association (IATA) forecasting a global net profit of $25.7 billion for the industry. This improved profitability means airlines are more inclined to invest in essential maintenance, fleet modernization, and expansion, directly benefiting AAR's revenue streams.

Conversely, if airlines face financial headwinds, they might postpone maintenance or seek cheaper alternatives, impacting AAR's commercial MRO business. For instance, during economic downturns, airlines have historically reduced discretionary spending on MRO. The current economic climate, however, generally supports increased airline spending due to robust travel demand.

Higher aircraft utilization, a direct consequence of strong passenger demand, also fuels the need for more MRO services. As of early 2025, global air travel recovery continues, with passenger traffic nearing pre-pandemic levels. This increased flight activity leads to greater wear and tear on aircraft, necessitating more frequent and extensive maintenance, which translates into higher demand for AAR's specialized services.

The aerospace aftermarket and MRO sector, including AAR, depend critically on robust supply chains for parts. Rising costs of raw materials like titanium and aluminum, coupled with persistent labor shortages in manufacturing and logistics, directly inflate operational expenses. For instance, the International Air Transport Association (IATA) has noted that supply chain bottlenecks contributed to a significant increase in MRO costs in 2023, impacting turnaround times for aircraft.

Disruptions, whether from geopolitical events or manufacturing delays, can severely hamper AAR's ability to provide timely services. Securing new engine parts remains a particular challenge, pushing the industry towards greater utilization of used serviceable materials (USM). However, even the availability of USM is facing constraints, as demonstrated by increased lead times for certain engine components reported by industry analysts in early 2024.

Interest Rates and Access to Capital

While interest rates may not directly sway the day-to-day demand for Maintenance, Repair, and Overhaul (MRO) services, their influence on the broader aviation ecosystem is significant. Higher borrowing costs can make it more challenging for airlines to finance the acquisition of new, more fuel-efficient aircraft. This could result in airlines extending the operational life of their existing fleets, potentially increasing the demand for maintenance on older, more complex aircraft. For AAR, this dynamic could shift the nature of services required, favoring more extensive repair work over routine checks for newer planes.

The ability of airlines to secure capital for major projects, including significant MRO investments or fleet modernization, is directly tied to prevailing interest rates. As of mid-2024, many major central banks, including the Federal Reserve, have maintained elevated interest rates to combat inflation. For instance, the Federal Funds Rate has remained in the 5.25%-5.50% range. This environment makes financing more expensive, potentially impacting airlines' capital expenditure budgets. Consequently, AAR might see a greater proportion of its business come from airlines deferring new aircraft purchases and opting for extended maintenance on their current assets.

- Increased reliance on older fleets: Higher interest rates make new aircraft financing costlier, encouraging airlines to keep older, maintenance-intensive planes flying longer.

- Shift in MRO service demand: This trend could lead to a greater demand for complex repairs and overhauls on aging aircraft rather than standard maintenance on new models.

- Impact on airline financial health: Elevated borrowing costs can strain airline finances, potentially affecting their ability to invest in MRO and impacting AAR's customer base.

- 2024/2025 economic outlook: Continued high interest rate environments projected for much of 2024 and into 2025 will likely sustain these pressures on airline capital planning.

Competition and Market Pricing

The aviation aftermarket is a fiercely competitive arena, featuring Original Equipment Manufacturers (OEMs), independent Maintenance, Repair, and Overhaul (MRO) providers, and specialized parts suppliers. This intense rivalry places significant pressure on pricing for services and components, directly impacting AAR's profitability. For instance, in the fiscal year ending May 31, 2024, AAR reported a 10% increase in revenue to $2.2 billion, driven by strong performance in its Aviation Services segment, yet navigating competitive pressures remains a constant.

To sustain and grow its market share, AAR must consistently differentiate its value proposition. This involves focusing on operational efficiency, maintaining high-quality standards, and offering integrated, comprehensive solutions that go beyond basic repair and parts supply. The ability to innovate and adapt to evolving customer needs in this dynamic market is crucial for AAR's continued success.

- Competitive landscape: AAR operates within a market with established OEMs and numerous independent MROs.

- Pricing pressure: Intense competition can lead to reduced margins on AAR's service and parts offerings.

- Differentiation strategy: AAR's success hinges on its ability to stand out through efficiency, quality, and end-to-end solutions.

- Market share maintenance: Continuous innovation and customer-centric approaches are vital for retaining and expanding AAR's position.

Global economic growth directly fuels air travel demand, which in turn drives the need for AAR's maintenance, repair, and overhaul (MRO) services and parts supply. A strong economy means more people flying for business and leisure, and more goods being shipped by air, leading to higher aircraft utilization. For instance, the International Air Transport Association (IATA) projected global air cargo traffic to grow by 4.5% in 2024, indicating a positive outlook for aircraft operations and subsequent MRO demand.

Conversely, economic downturns can significantly impact AAR's business. During periods of slow growth or recession, airlines often face reduced profitability, prompting them to potentially defer non-critical maintenance or reduce flight schedules. This directly translates to lower demand for MRO services and spare parts. The IMF's World Economic Outlook in April 2024 forecasted global growth to moderate to 3.2% in 2024, a slight slowdown from 2023, suggesting a potentially more cautious environment for airline investment in maintenance.

The financial health of commercial airlines is a crucial driver for AAR's MRO services. In 2024, many airlines are experiencing a rebound, with IATA forecasting a global net profit of $25.7 billion for the industry. This improved profitability means airlines are more inclined to invest in essential maintenance, fleet modernization, and expansion, directly benefiting AAR's revenue streams. Conversely, if airlines face financial headwinds, they might postpone maintenance or seek cheaper alternatives, impacting AAR's commercial MRO business.

Higher aircraft utilization, a direct consequence of strong passenger demand, also fuels the need for more MRO services. As of early 2025, global air travel recovery continues, with passenger traffic nearing pre-pandemic levels. This increased flight activity leads to greater wear and tear on aircraft, necessitating more frequent and extensive maintenance, which translates into higher demand for AAR's specialized services.

The aerospace aftermarket and MRO sector, including AAR, depend critically on robust supply chains for parts. Rising costs of raw materials like titanium and aluminum, coupled with persistent labor shortages in manufacturing and logistics, directly inflate operational expenses. For instance, IATA has noted that supply chain bottlenecks contributed to a significant increase in MRO costs in 2023, impacting turnaround times for aircraft. Disruptions, whether from geopolitical events or manufacturing delays, can severely hamper AAR's ability to provide timely services.

While interest rates may not directly sway the day-to-day demand for MRO services, their influence on the broader aviation ecosystem is significant. Higher borrowing costs can make it more challenging for airlines to finance the acquisition of new, more fuel-efficient aircraft. This could result in airlines extending the operational life of their existing fleets, potentially increasing the demand for maintenance on older, more complex aircraft. For AAR, this dynamic could shift the nature of services required, favoring more extensive repair work over routine checks for newer planes.

The ability of airlines to secure capital for major projects, including significant MRO investments or fleet modernization, is directly tied to prevailing interest rates. As of mid-2024, many major central banks, including the Federal Reserve, have maintained elevated interest rates to combat inflation. For instance, the Federal Funds Rate has remained in the 5.25%-5.50% range. This environment makes financing more expensive, potentially impacting airlines' capital expenditure budgets.

The aviation aftermarket is a fiercely competitive arena, featuring Original Equipment Manufacturers (OEMs), independent MRO providers, and specialized parts suppliers. This intense rivalry places significant pressure on pricing for services and components, directly impacting AAR's profitability. For instance, in the fiscal year ending May 31, 2024, AAR reported a 10% increase in revenue to $2.2 billion, driven by strong performance in its Aviation Services segment, yet navigating competitive pressures remains a constant.

To sustain and grow its market share, AAR must consistently differentiate its value proposition. This involves focusing on operational efficiency, maintaining high-quality standards, and offering integrated, comprehensive solutions that go beyond basic repair and parts supply. The ability to innovate and adapt to evolving customer needs in this dynamic market is crucial for AAR's continued success.

| Economic Factor | Impact on AAR | Supporting Data/Outlook (2024/2025) |

| Global Economic Growth | Drives demand for air travel and MRO services. | Projected 4.5% growth in global air cargo traffic (IATA, 2024). Global growth forecasted at 3.2% (IMF, April 2024). |

| Airline Profitability | Higher profits lead to increased MRO investment. | Industry net profit forecast of $25.7 billion (IATA, 2024). |

| Supply Chain Costs & Disruptions | Increases operational expenses and affects service timeliness. | Supply chain bottlenecks increased MRO costs in 2023 (IATA). Increased lead times for certain engine components reported (Industry Analysts, early 2024). |

| Interest Rates | Affects airline financing for new aircraft, potentially extending fleet life and MRO demand for older aircraft. | Federal Funds Rate maintained at 5.25%-5.50% (mid-2024). |

| Competition | Puts pressure on pricing and profitability. | AAR reported 10% revenue increase to $2.2 billion (FY ending May 31, 2024), indicating competitive market navigation. |

Preview the Actual Deliverable

AAR PESTLE Analysis

The preview you see here is the exact AAR PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real glimpse of the product you’re buying, delivered exactly as shown, ensuring no surprises.

The content and structure of this AAR PESTLE Analysis preview are the same document you’ll download after payment.

Sociological factors

The aviation Maintenance, Repair, and Overhaul (MRO) sector, including companies like AAR, grapples with a pronounced shortage of skilled technicians and engineers. This deficit directly impacts operational capacity and the ability to meet growing demand for aircraft maintenance services.

AAR's reliance on a highly trained workforce is critical for its success, yet the industry faces an aging demographic of experienced professionals. Projections indicate that a substantial portion of the current aviation maintenance workforce will retire in the coming years, exacerbating the skills gap.

Furthermore, a perceived lack of new talent entering aviation MRO careers presents a significant long-term risk. For instance, reports from industry bodies in 2024 highlight that the pipeline of new technicians is not keeping pace with the projected needs, potentially hindering AAR's growth and service delivery capabilities.

Public confidence in air travel safety is a cornerstone for the aviation sector's expansion. Any significant accidents or perceived issues with maintenance directly affect passenger willingness to fly, impacting airline revenues and the demand for maintenance, repair, and overhaul (MRO) services. For instance, while air travel remains statistically very safe, public perception can be swayed by high-profile events, influencing booking trends.

AAR's strong emphasis on quality and adherence to rigorous safety standards is therefore vital for sustaining trust among its airline partners and the flying public. This commitment is essential for AAR to maintain its competitive edge and secure long-term contracts in an industry where safety is non-negotiable.

The global travel landscape is transforming, with a notable surge in middle-class populations across emerging economies like India and Southeast Asia. This demographic shift is fueling increased demand for both leisure and business air travel, directly impacting aircraft utilization and the need for maintenance, repair, and overhaul (MRO) services. For AAR, this means adapting to potentially higher volumes and evolving service requirements as these new travelers take to the skies.

Furthermore, the preference for experiential travel and the growing "bleisure" trend, where business trips are extended for leisure, are reshaping travel habits. This can lead to longer aircraft utilization periods between maintenance checks, potentially affecting the cadence of MRO demand. In 2024, global air passenger traffic is projected to reach 90% of pre-pandemic levels, with continued growth expected in 2025, underscoring the dynamic nature of these evolving demographics.

Corporate Social Responsibility and Ethical Sourcing

Societal expectations for corporate social responsibility (CSR) are significantly impacting businesses like AAR. Consumers and investors are increasingly scrutinizing companies for their ethical conduct and supply chain integrity. For AAR, this translates to a need for robust policies on fair labor, responsible material sourcing, and transparent operations. Failure to meet these evolving standards can directly affect partnerships and brand reputation. For instance, a 2024 survey by Edelman found that 59% of consumers globally are more likely to buy from companies they trust to do the right thing, highlighting the financial implications of ethical lapses.

AAR's commitment to CSR influences its strategic decisions and operational framework. This includes ensuring that its suppliers uphold ethical labor practices, which is a growing concern in global supply chains. AAR's proactive approach to ethical sourcing and transparent business conduct can foster stronger relationships with stakeholders and enhance customer loyalty. Reports from 2025 indicate a continued rise in consumer demand for ethically produced goods, with studies showing that brands with strong CSR initiatives saw an average revenue growth of 4% in the past year compared to those without.

- Ethical Sourcing Mandates: AAR must ensure its sourcing partners comply with international labor standards, avoiding child labor and ensuring safe working conditions, a trend reinforced by upcoming 2025 supply chain transparency regulations in key markets.

- Consumer Trust and Brand Image: A growing segment of consumers, estimated at over 60% in recent polls, actively seek out and prefer brands demonstrating strong ethical commitments, directly impacting AAR's market perception and sales.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are paramount for investors; AAR's adherence to CSR principles is crucial for attracting and retaining investment, with ESG funds projected to manage over $50 trillion globally by 2025.

- Partnership Viability: Many B2B partners now integrate CSR performance into their supplier selection criteria, meaning AAR's ethical standing can directly influence its ability to secure and maintain valuable business relationships.

Demand for Sustainable Aviation

Growing public concern over climate change is significantly boosting the demand for sustainable aviation solutions. This societal shift pressures aviation maintenance, repair, and overhaul (MRO) providers like AAR to adopt greener practices, from using eco-friendly materials to optimizing energy use in their operations. The industry is seeing increased investment in technologies aimed at reducing aviation's carbon footprint.

This trend is reflected in market projections and industry initiatives. For instance, the global sustainable aviation fuel (SAF) market is projected to grow substantially, with estimates suggesting it could reach over $15 billion by 2030, up from around $2 billion in 2022. AAR's strategic focus on sustainability aligns with these market forces, influencing their investment in areas like:

- Development of SAF-compatible maintenance procedures.

- Implementation of energy-efficient MRO processes.

- Research into sustainable aircraft materials and component lifecycle management.

- Offerings that help airlines reduce their environmental impact.

Societal expectations around corporate social responsibility are a significant driver for AAR. Consumers and investors alike are increasingly prioritizing ethical operations and supply chain integrity. Reports from 2025 indicate that brands with strong CSR initiatives experienced an average revenue growth of 4% in the past year, underscoring the financial impact of ethical conduct.

AAR's commitment to CSR influences its strategic decisions, particularly regarding fair labor and responsible sourcing. This focus is crucial for maintaining strong stakeholder relationships and brand reputation in an environment where over 60% of consumers actively seek out ethical brands.

Investor scrutiny on Environmental, Social, and Governance (ESG) factors is also paramount, with ESG funds projected to manage over $50 trillion globally by 2025. AAR's adherence to CSR principles is therefore vital for attracting and retaining investment.

Furthermore, public concern over climate change is fueling demand for sustainable aviation solutions, pushing MRO providers like AAR to adopt greener practices and invest in eco-friendly technologies.

| Factor | Impact on AAR | Supporting Data/Trends |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhances brand reputation, attracts investment, and secures partnerships. | 60%+ consumers prefer ethical brands; ESG funds to reach $50T+ by 2025. |

| Climate Change Concerns | Drives demand for sustainable aviation solutions and greener MRO practices. | Global SAF market projected to exceed $15B by 2030. |

| Skilled Labor Shortage | Impacts operational capacity and ability to meet demand. | Aging workforce and insufficient new talent pipeline reported in 2024. |

| Global Travel Trends | Influences aircraft utilization and MRO demand cadence. | Air passenger traffic projected to reach 90% of pre-pandemic levels in 2024. |

Technological factors

The Maintenance, Repair, and Overhaul (MRO) sector is rapidly digitizing, with significant investments in technologies like AI and predictive maintenance. For instance, by 2024, the global aviation MRO market is projected to reach $100.5 billion, driven partly by these technological shifts. These innovations allow for more efficient and proactive upkeep of aircraft, directly impacting operational costs and aircraft availability.

AAR's ability to integrate advanced solutions such as AI-powered diagnostics and digital twins is crucial for staying ahead. Predictive maintenance, which uses data to anticipate failures before they occur, can significantly reduce unscheduled downtime. Studies suggest that predictive maintenance can cut maintenance costs by up to 20% and improve asset lifespan by 10-15%.

Additive manufacturing, or 3D printing, is set to revolutionize Maintenance, Repair, and Overhaul (MRO) operations by facilitating the on-demand creation of aircraft parts, particularly for legacy or scarce components. This advancement promises to significantly shorten lead times and lower inventory expenses, thereby bolstering supply chain robustness.

The growing adoption of 3D printing in aerospace is evident, with projections indicating the market for 3D printed aircraft parts could reach $10 billion by 2030, according to some industry analyses. This technology presents a dual-edged sword for established parts distributors, offering opportunities for new service models while also posing a challenge to traditional distribution networks.

The ongoing digitalization and automation of Maintenance, Repair, and Overhaul (MRO) processes are fundamentally reshaping the aerospace industry. This shift from traditional paper-based systems to digital workflows and increased automation is a key technological factor impacting companies like AAR. These advancements directly translate to enhanced operational efficiency, improved accuracy in record-keeping and diagnostics, and significantly reduced turnaround times for aircraft maintenance.

AAR's strategic investments in digital tools, including mobile applications for technicians and sophisticated automated systems for inventory management and inspection, are crucial for maintaining a competitive edge. For instance, by mid-2024, many leading MRO providers reported seeing efficiency gains of up to 20% through the implementation of digital inventory tracking systems alone, reducing errors and stockouts.

The adoption of technologies like augmented reality (AR) for complex repair guidance and artificial intelligence (AI) for predictive maintenance analytics is also becoming increasingly important. These innovations not only streamline operations but also improve safety and compliance, critical aspects in the highly regulated aerospace sector. By early 2025, AAR's continued integration of these advanced digital solutions will be a significant driver of its operational excellence and ability to meet evolving customer demands.

New Aircraft Technologies and Complex Systems

The aerospace industry is constantly innovating, with new aircraft featuring advanced materials like composites and sophisticated integrated avionics. For instance, the Boeing 787 Dreamliner utilizes over 50% composite materials, significantly impacting maintenance requirements compared to traditional aluminum airframes. This technological shift necessitates that Maintenance, Repair, and Overhaul (MRO) providers, such as AAR, continuously invest in specialized training for their technicians and acquire advanced diagnostic tooling to service these complex systems. AAR's commitment to staying ahead in technical expertise and certifications is crucial for supporting the evolving global aircraft fleet.

AAR's strategic focus includes adapting to these technological advancements. The company's investment in training programs and state-of-the-art equipment directly addresses the need to service next-generation aircraft. For example, in fiscal year 2024, AAR reported significant investments in its capabilities to support newer platforms, reflecting the ongoing demand for MRO services on aircraft incorporating advanced technologies. This proactive approach ensures AAR maintains its competitive edge and capacity to handle the intricate maintenance needs of modern aviation.

The complexity of new aircraft systems presents both challenges and opportunities for MRO providers.

- Advanced Materials: Servicing composite structures requires specialized techniques and equipment, different from traditional metal repairs.

- Integrated Avionics: Modern aircraft feature highly integrated digital systems, demanding expertise in software, network diagnostics, and electronic systems.

- Complex Systems: The increasing number of sophisticated onboard systems, from fly-by-wire to advanced cabin management, requires continuous upskilling of technicians.

Cybersecurity in Aviation Systems

As MRO operations become increasingly digitized and connected, cybersecurity risks escalate significantly. The aviation sector, including companies like AAR, faces growing threats to its sensitive aircraft data, critical operational systems, and valuable intellectual property. A report from 2024 highlighted a substantial increase in cyberattacks targeting aviation infrastructure, underscoring the urgency of this issue.

Protecting this information is paramount for AAR's continued success and reputation. Robust cybersecurity measures are not just a technical necessity but are essential for maintaining operational integrity, securing customer trust, and ensuring ongoing regulatory compliance in an ever-evolving threat landscape.

- Escalating Threats: Digitization of MRO processes directly correlates with increased vulnerability to cyber threats.

- Data Protection Imperative: Safeguarding sensitive aircraft data, operational systems, and intellectual property is critical for aviation MROs.

- Maintaining Trust and Compliance: Strong cybersecurity is vital for operational continuity, customer confidence, and adherence to aviation regulations.

Technological advancements are fundamentally reshaping the aerospace MRO landscape, driving efficiency and innovation. AAR's strategic integration of AI for predictive maintenance, for instance, aims to reduce unscheduled downtime, with industry estimates suggesting potential cost savings of up to 20%. Furthermore, the rise of additive manufacturing (3D printing) is set to revolutionize parts production, with the market for 3D printed aerospace components projected to reach $10 billion by 2030, offering AAR opportunities to shorten lead times and manage inventory more effectively.

The increasing complexity of new aircraft, such as those utilizing over 50% composite materials like the Boeing 787, necessitates continuous investment in specialized technician training and advanced diagnostic tooling. AAR's commitment to upskilling its workforce and acquiring cutting-edge equipment is crucial for servicing these next-generation aircraft. By fiscal year 2024, AAR reported substantial investments in capabilities to support newer platforms, reflecting the growing demand for MRO services on technologically advanced aircraft.

The digital transformation of MRO processes also heightens cybersecurity risks, making data protection paramount. With a reported increase in cyberattacks targeting aviation infrastructure in 2024, AAR must maintain robust cybersecurity measures to safeguard sensitive data, operational systems, and intellectual property, ensuring operational continuity and customer trust.

| Technology Area | Impact on MRO | AAR's Strategic Focus/Example | Market Projection/Data Point |

|---|---|---|---|

| Artificial Intelligence (AI) & Predictive Maintenance | Reduced unscheduled downtime, proactive repairs, cost savings | AI-powered diagnostics and analytics for anticipating failures | Predictive maintenance can cut maintenance costs by up to 20% |

| Additive Manufacturing (3D Printing) | On-demand part creation, reduced lead times, lower inventory costs | Facilitating creation of legacy or scarce components | Aerospace 3D printing market projected to reach $10 billion by 2030 |

| Digitalization & Automation | Enhanced operational efficiency, improved accuracy, reduced turnaround times | Mobile apps for technicians, automated inventory management | Efficiency gains up to 20% from digital inventory tracking systems |

| Advanced Materials & Avionics | Need for specialized repair techniques, software diagnostics, and electronic system expertise | Investment in training for composite structures and integrated avionics servicing | Boeing 787 utilizes over 50% composite materials |

| Cybersecurity | Protection of sensitive data, operational systems, and intellectual property | Implementing robust cybersecurity measures | Increased cyberattacks targeting aviation infrastructure reported in 2024 |

Legal factors

AAR operates within a highly regulated aviation sector, demanding strict adherence to safety standards established by bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These regulations are paramount for AAR's Maintenance, Repair, and Overhaul (MRO) and parts supply businesses, influencing everything from operational procedures and employee training to meticulous record-keeping.

Non-compliance with these critical aviation safety regulations can lead to severe penalties, including hefty fines and operational suspensions. For instance, the FAA can levy significant civil penalties; in 2023 alone, the FAA reported collecting over $20 million in aviation civil penalties, underscoring the financial risks associated with regulatory breaches.

AAR's global operations, spanning over 20 countries, necessitate strict adherence to a complex array of international trade laws, export controls, and economic sanctions. Failure to comply can result in significant penalties and disrupt vital supply chains, impacting the flow of aircraft parts and services. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce stringent export controls, particularly concerning dual-use technologies, which directly affect aerospace components.

As a global employer of over 4,500 individuals, AAR navigates a complex web of labor laws and employment regulations across its operating regions. These regulations dictate minimum wages, working conditions, and employee rights, directly influencing HR strategies and operational expenses.

Compliance with these diverse legal frameworks, encompassing areas like unionization and workplace safety, is crucial for AAR's workforce management and can impact its overall cost structure. For instance, in 2024, the US Bureau of Labor Statistics reported an average hourly wage for aircraft mechanics and service technicians, a key demographic for AAR, at $27.85, a figure subject to varying state-level minimum wage laws.

Intellectual Property Rights

Intellectual property (IP) rights are paramount in the aerospace aftermarket, covering everything from intricate aircraft component designs to precise repair procedures and innovative engineering solutions. AAR’s ability to thrive hinges on its careful navigation of these rights. This means not only safeguarding its own proprietary technologies and processes but also rigorously respecting the IP held by Original Equipment Manufacturers (OEMs).

Failure to adhere to IP laws can lead to costly legal battles, potentially halting operations or resulting in significant financial penalties. For instance, patent infringement lawsuits in the aerospace sector can involve millions of dollars in damages and injunctions that disrupt supply chains. In 2024, the global aerospace market continued to see robust activity, with aftermarket services representing a significant portion of the industry's revenue, estimated to be well over $100 billion annually. This makes IP protection a direct contributor to AAR's competitive edge in manufacturing and engineering services.

AAR's strategy must therefore include robust IP management, encompassing:

- Patent Protection: Securing patents for novel repair techniques and component designs developed by AAR.

- Licensing Agreements: Negotiating favorable licensing terms with OEMs for access to repair data and specifications.

- Trade Secret Safeguarding: Implementing stringent measures to protect confidential engineering processes and customer data.

- Freedom-to-Operate Analysis: Conducting thorough reviews to ensure AAR's offerings do not infringe on existing OEM IP.

Environmental Regulations and Compliance

AAR's aviation maintenance, repair, and overhaul (MRO) and manufacturing activities are heavily influenced by environmental regulations. These rules cover everything from how waste is handled and disposed of to controlling emissions into the air and managing hazardous substances used in aircraft maintenance. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards for volatile organic compounds (VOCs) in aerospace coatings, impacting the types of solvents and paints AAR can utilize.

Compliance with these evolving environmental laws, particularly those focusing on carbon emissions and promoting sustainable operations, is becoming a critical factor. AAR's adherence to regulations like the International Civil Aviation Organization's (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), which is being phased in, directly affects its operational costs and necessitates strategic investments in greener technologies and processes. Failure to comply can result in significant fines and reputational damage.

Key environmental considerations for AAR include:

- Waste Management: Proper disposal of hazardous waste, such as spent solvents and oils, is mandated by regulations like the Resource Conservation and Recovery Act (RCRA) in the U.S.

- Air Emissions: Controls on emissions from painting, cleaning, and manufacturing processes are critical, with ongoing scrutiny on VOCs and particulate matter.

- Sustainable Aviation Fuel (SAF): While not a direct regulation on AAR's core operations, the increasing push for SAF adoption by airlines creates demand for MRO services that can support SAF-compatible aircraft.

- Chemical Handling: Strict protocols govern the storage, use, and disposal of chemicals like degreasers and solvents, often requiring specialized training and containment measures.

AAR's legal landscape is dominated by aviation safety regulations, with bodies like the FAA and EASA setting stringent standards for MRO and parts supply. Non-compliance can result in substantial fines, as evidenced by the FAA's collection of over $20 million in civil penalties in 2023. Furthermore, AAR must navigate international trade laws and export controls, particularly concerning dual-use technologies, with agencies like the Bureau of Industry and Security actively enforcing these rules.

Environmental factors

The aviation sector faces intense scrutiny regarding its environmental impact, with a global commitment to achieve net-zero emissions by 2050. This significant target necessitates substantial shifts across the industry.

AAR's Maintenance, Repair, and Overhaul (MRO) operations and supply chain expertise can play a crucial role in achieving these ambitious climate goals. By implementing more efficient maintenance practices, fostering the adoption of sustainable aviation fuels and materials, and streamlining logistics to minimize carbon output, AAR can directly contribute to reducing the industry's environmental footprint.

The increasing focus on Sustainable Aviation Fuel (SAF) presents a nuanced environmental factor for AAR. While SAF directly impacts airlines, its widespread adoption necessitates a re-evaluation of Maintenance, Repair, and Overhaul (MRO) practices. Engines and aircraft components may require specific certifications or adaptations to ensure compatibility with SAF, potentially altering maintenance protocols.

AAR could see a future demand for specialized MRO services catering to SAF-compatible aircraft. This might involve investments in new tooling, training for technicians, and the development of expertise in handling SAF-related engine or system requirements. For instance, by 2025, the International Air Transport Association (IATA) projects SAF usage to reach 0.5% of global jet fuel consumption, a figure expected to climb significantly in the coming years, underscoring the growing importance of this transition.

AAR's extensive Maintenance, Repair, and Overhaul (MRO) operations, a core part of their business, naturally generate significant waste streams from aircraft component repairs and full overhauls. These materials can range from used oils and solvents to retired metal parts and composite materials.

To address this, AAR is increasingly focused on advanced waste management and recycling. This includes diverting materials from landfills through specialized recycling programs for metals, plastics, and composites. For instance, in 2023, the aviation industry as a whole saw a notable increase in the adoption of sustainable practices, with many MRO providers reporting a 10-15% improvement in waste diversion rates year-over-year.

Furthermore, AAR is actively exploring and implementing circular economy principles. This involves a strategic approach to reusing and repurposing aircraft components that are still serviceable or can be refurbished, thereby extending their lifecycle and minimizing the need for new raw materials. This not only reduces their environmental footprint but also aligns with growing global sustainability mandates and investor expectations for environmentally responsible operations.

Resource Scarcity and Material Sourcing

AAR's operations are inherently tied to the availability of aircraft parts and raw materials, many of which are finite resources. This dependence creates a long-term environmental and economic challenge, as the sourcing of these materials can have significant ecological footprints and be subject to price volatility. For instance, the aerospace industry relies on specialized alloys and composites, the extraction and processing of which can be energy-intensive and generate waste.

AAR's strategic focus on supply chain management and efficient parts distribution necessitates a keen awareness of the environmental impact and long-term availability of these critical materials. This challenge can act as a catalyst for innovation within AAR, encouraging the development of more sophisticated repair techniques that extend the life of existing components and the exploration of novel material alternatives that offer greater sustainability and reduced environmental impact. The company's commitment to these areas is crucial for maintaining operational resilience and competitive advantage in an increasingly resource-conscious global market.

Consider the following points regarding resource scarcity:

- Reliance on critical minerals: The aerospace sector's demand for high-performance alloys often includes materials like titanium and nickel, whose extraction can be environmentally disruptive and geographically concentrated.

- Circular economy initiatives: AAR's investment in parts repair and overhaul directly supports a more circular economy, reducing the need for virgin material production. For example, the company's MRO (Maintenance, Repair, and Overhaul) capabilities aim to maximize the lifespan of aircraft components.

- Material innovation drivers: Growing concerns over resource depletion and environmental regulations are pushing manufacturers to develop and adopt advanced composite materials and sustainable alternatives, which AAR will need to integrate into its distribution and repair services.

- Supply chain resilience: Ensuring a consistent and environmentally responsible supply of parts requires AAR to diversify its sourcing and potentially invest in technologies that enable greater material recovery and recycling within the aviation ecosystem.

Noise and Air Quality Regulations

Aviation operations, including those of AAR, are increasingly scrutinized for their environmental impact, particularly concerning noise and air quality. Regulations at local and regional levels, such as those governing emissions from aircraft and maintenance facilities, directly affect how AAR operates. For instance, stricter noise abatement procedures around airports can influence flight paths and operating hours, while air quality standards might dictate the types of solvents and materials used in maintenance, repair, and overhaul (MRO) processes. In 2024, the International Civil Aviation Organization (ICAO) continued to push for advancements in Sustainable Aviation Fuels (SAFs), with many regions setting ambitious targets for SAF adoption, which indirectly impacts MRO providers like AAR by influencing the types of aircraft and engines they service and the materials they use in repairs.

Compliance with these environmental standards can lead to significant operational adjustments and capital expenditures for AAR. These might include investing in quieter ground support equipment, upgrading MRO facilities to better control emissions, or adapting repair techniques to use more environmentally friendly materials. For example, the European Union's environmental regulations are among the strictest globally, requiring significant investment in cleaner technologies. Failure to comply can result in substantial fines and reputational damage, making proactive environmental management a critical aspect of AAR's business strategy.

- Noise regulations can impact airport operating hours and flight path approvals, affecting aircraft turnaround times and MRO scheduling.

- Air quality standards may necessitate changes in chemical usage and waste disposal practices within AAR's MRO facilities.

- The push for Sustainable Aviation Fuels (SAFs), gaining traction in 2024-2025, indirectly influences MRO by potentially altering engine maintenance requirements and material compatibility.

- Compliance costs, including investments in quieter equipment and emission control technologies, are a direct consequence of these environmental factors.

The aviation industry's commitment to net-zero emissions by 2050 is a defining environmental factor. AAR's MRO services can support this by promoting efficient maintenance and the use of sustainable aviation fuels (SAFs). The increasing adoption of SAFs, projected to reach 0.5% of global jet fuel consumption by 2025, necessitates adaptations in MRO practices and potential new service demands for SAF-compatible aircraft.

PESTLE Analysis Data Sources

Our AAR PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable financial news outlets, and comprehensive industry-specific research. We prioritize data that reflects current political landscapes, economic indicators, and emerging technological advancements.