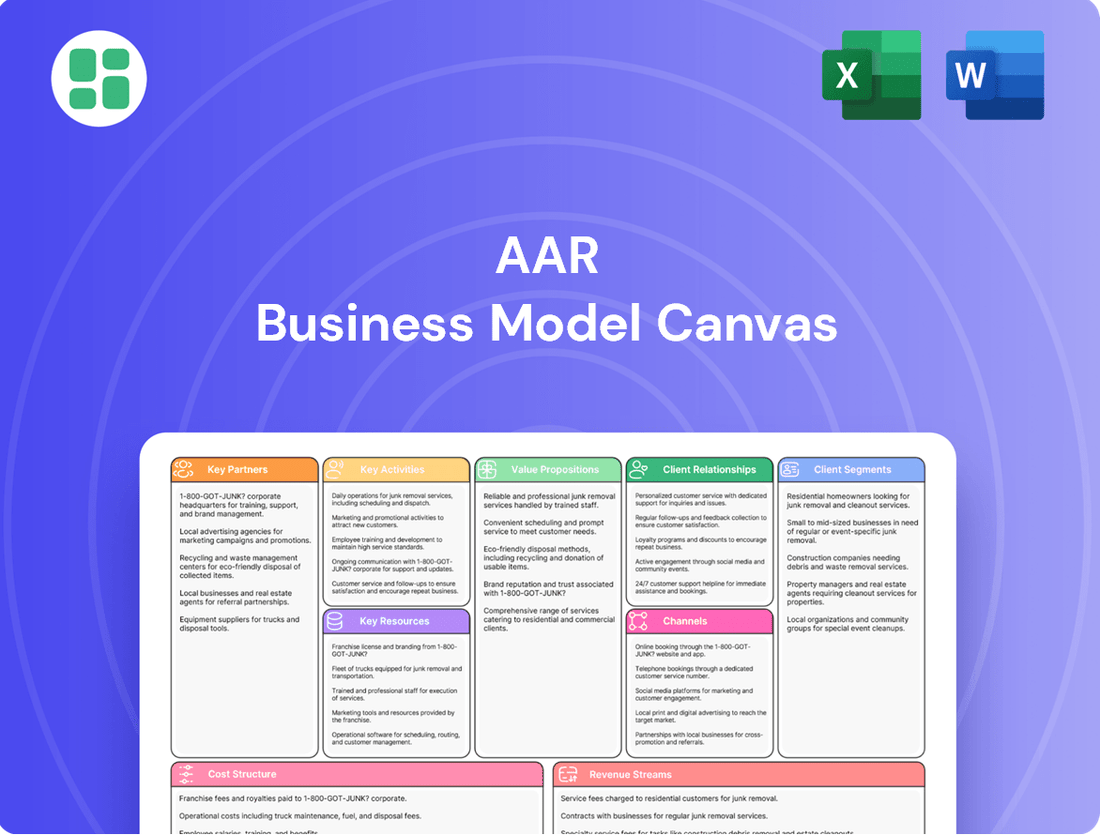

AAR Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

Unlock the core components of AAR's operational success with our Business Model Canvas. This snapshot reveals their key partners, customer segments, and value propositions, offering a glimpse into their strategic framework. Ready to dive deeper into how AAR generates revenue and manages costs?

Partnerships

AAR collaborates with Original Equipment Manufacturers (OEMs) to distribute their parts and potentially offer Maintenance, Repair, and Overhaul (MRO) services, utilizing the OEMs’ proprietary components and technical data. These relationships are vital for securing genuine parts and specialized repair instructions, ensuring aircraft airworthiness and optimal performance.

AAR cultivates enduring partnerships with commercial airlines, securing long-term contracts for essential Maintenance, Repair, and Overhaul (MRO) services, sophisticated supply chain management, and critical parts distribution. These collaborations are the bedrock of AAR's financial stability, ensuring a predictable and substantial revenue flow from ongoing aftermarket support needs.

For instance, in fiscal year 2023, AAR reported significant revenue growth driven by its strong airline customer base, underscoring the vital role these relationships play. These airlines rely on AAR to uphold their operational efficiency and minimize costly aircraft downtime, making AAR an indispensable partner in their day-to-day success.

AAR's relationships with government entities and defense contractors are foundational to its operations, encompassing critical Maintenance, Repair, and Overhaul (MRO), supply chain, logistics, and expeditionary services. These collaborations frequently materialize as long-term contracts and strategic alliances, exemplified by its ongoing work with the U.S. Defense Logistics Agency (DLA). In fiscal year 2024, AAR reported significant revenue streams from its government segment, underscoring the importance of these partnerships.

MRO Providers and Service Partners

AAR strategically partners with other Maintenance, Repair, and Overhaul (MRO) providers and service partners to extend its operational footprint and access specialized skills. These collaborations, often structured as joint ventures or sub-contracting arrangements, enable AAR to present a more comprehensive service portfolio to its clients.

By leveraging complementary expertise through these alliances, AAR can offer a wider range of solutions, from component repair to complex airframe maintenance, thereby enhancing its overall value proposition. This approach also allows for greater flexibility and efficiency in service delivery.

- Expanded Global Reach: Partnerships allow AAR to serve customers in regions where it may not have a direct physical presence, increasing market penetration.

- Specialized Capabilities: Access to niche MRO skills or certifications through partners broadens AAR's service offerings without significant internal investment.

- Cost Efficiencies: Sub-contracting or joint ventures can distribute costs and risks, particularly for large or specialized projects, improving profitability.

- Market Adaptability: These relationships enable AAR to quickly adapt to evolving market demands and technological advancements by integrating partner capabilities.

Technology and Software Providers

AAR actively collaborates with technology and software providers, a crucial aspect of its business model. A prime example is their partnership involving the Trax software solution, which is designed to deliver sophisticated Maintenance, Repair, and Overhaul (MRO) and supply chain management capabilities.

These strategic alliances are instrumental in bolstering AAR's digital service portfolio and driving greater operational efficiencies for its clientele. The Trax software, in particular, represents a significant advancement in modernizing the complex maintenance and engineering systems that airlines rely upon.

- Trax Software: AAR's partnership with technology providers centers on solutions like Trax, enhancing MRO and supply chain management.

- Digital Enhancement: These collaborations bolster AAR's digital offerings, directly improving customer operational efficiencies.

- Modernization Focus: Trax is a key component in updating and modernizing airline maintenance and engineering systems.

AAR's key partnerships are critical for its operational success and market reach. These include collaborations with Original Equipment Manufacturers (OEMs) for genuine parts and technical data, commercial airlines for long-term MRO and supply chain contracts, and government entities like the U.S. Defense Logistics Agency for specialized services. AAR also partners with other MRO providers to expand its service offerings and with technology firms, such as those providing the Trax software, to enhance its digital capabilities and operational efficiency.

| Partner Type | Key Collaboration Area | Impact on AAR | Example/Data Point |

|---|---|---|---|

| OEMs | Parts Distribution, MRO Services | Secures genuine parts and technical data | Enables distribution of proprietary components |

| Commercial Airlines | MRO, Supply Chain Management, Parts Distribution | Drives predictable revenue and financial stability | Significant revenue growth in FY23 driven by airline customers |

| Government & Defense | MRO, Supply Chain, Logistics | Foundation for operations, long-term contracts | Substantial revenue streams from government segment in FY24 |

| MRO Service Partners | Extended Operational Footprint, Specialized Skills | Broader service portfolio, enhanced value proposition | Joint ventures and sub-contracting arrangements |

| Technology Providers | MRO & Supply Chain Software Solutions | Bolsters digital portfolio, drives operational efficiencies | Partnership for Trax software to modernize airline systems |

What is included in the product

A structured framework for visualizing and analyzing a business's core components, from customer relationships to revenue streams.

Provides a holistic view of a business's strategy, enabling clear communication and informed decision-making.

The AAR Business Model Canvas provides a structured framework to pinpoint and address specific operational inefficiencies, acting as a powerful pain point reliever by clarifying complex relationships within a business.

Activities

AAR’s core activities revolve around providing extensive Maintenance, Repair, and Overhaul (MRO) services for a wide array of aircraft and their components. This includes everything from routine inspections to complex structural repairs and modifications, all designed to keep aircraft airworthy and mission-ready for their clients.

These MRO services are critical for both commercial airlines and government entities, ensuring their fleets can operate safely and efficiently. AAR’s commitment to this area is underscored by its operation of numerous certified hangars strategically located throughout North America, facilitating robust service delivery.

In fiscal year 2024, AAR reported significant growth in its MRO segment, with revenues reaching $2.2 billion, a testament to the strong demand for these essential aviation services. This segment accounted for approximately 59% of AAR's total revenue for the year.

AAR's key activities heavily involve managing intricate aviation supply chains. This encompasses the distribution of aircraft parts, meticulous inventory management, and comprehensive logistics support to ensure aircraft are operational.

These operations are vital for guaranteeing the timely availability of necessary components and facilitating the efficient global movement of these parts, directly impacting customer readiness.

In 2023, AAR reported approximately $2.1 billion in revenue, with a significant portion driven by these supply chain and logistics services, underscoring their critical role in the aviation ecosystem.

By optimizing these processes, AAR helps its customers drastically reduce aircraft downtime and achieve significant savings on their operational expenditures.

AAR actively distributes and sells both new and used aircraft parts and components. This core activity relies on an extensive inventory network, serving airlines, maintenance, repair, and overhaul (MRO) providers, and original equipment manufacturers (OEMs) globally. For fiscal year 2023, AAR reported strong performance in its aftermarket services segment, which includes parts distribution, highlighting the segment's contribution to overall revenue.

Manufacturing and Engineering Solutions

AAR's manufacturing and engineering solutions are central to its business, focusing on specialized operational needs within the aerospace and defense industries. This includes the design and production of unique equipment and providing essential engineering support to tackle complex aerospace challenges.

These capabilities are vital for addressing niche requirements, thereby broadening AAR's service portfolio and reinforcing its position as a comprehensive solutions provider. For instance, AAR's engineering services have been instrumental in developing advanced components and systems for military aircraft, ensuring operational readiness and performance enhancement.

- Expeditionary Services: Designing and producing specialized equipment for deployment in diverse operational environments.

- Engineering Support: Offering expert engineering solutions for aircraft modifications, repairs, and upgrades.

- Component Manufacturing: Producing critical aerospace components, often to exact specifications for demanding applications.

- Specialized Solutions: Catering to unique and often complex technical requirements within the aerospace and defense sectors.

Integrated Software Solutions (Trax)

AAR actively develops and provides integrated software solutions designed to manage aircraft maintenance and fleet operations. A prime example is their Trax eMRO platform, which offers digital tools to streamline maintenance processes and enhance data management for their clientele.

This software development is a key activity because it directly supports AAR's value proposition by offering efficiency gains and improved operational visibility to airlines. The Trax solution is a significant growth driver for AAR, evidenced by its success in securing contracts with major airlines.

For instance, in fiscal year 2024, AAR continued to expand its software offerings, with Trax being a central component in securing new customer agreements. These agreements represent a growing revenue stream and solidify AAR's position as a technology provider in the aviation aftermarket.

- Development of Trax eMRO: Continuous enhancement of the platform to meet evolving airline needs.

- Customer Acquisition: Securing new contracts with airlines for software solutions.

- Data Management: Providing tools for efficient and accurate tracking of aircraft maintenance data.

- Workflow Streamlining: Implementing digital solutions to optimize maintenance operations.

AAR's key activities are multifaceted, encompassing the vital Maintenance, Repair, and Overhaul (MRO) of aircraft, which generated $2.2 billion in revenue in fiscal year 2024, representing 59% of total revenue. Complementing this is their robust aviation supply chain management, including parts distribution and logistics, which contributed significantly to their $2.1 billion revenue in 2023. Furthermore, AAR engages in specialized manufacturing and engineering solutions for aerospace and defense, alongside the development and provision of integrated software like the Trax eMRO platform, enhancing operational efficiency for clients.

| Key Activity | Description | Fiscal Year 2024 Data (where applicable) | Fiscal Year 2023 Data (where applicable) |

|---|---|---|---|

| Maintenance, Repair, and Overhaul (MRO) | Comprehensive services for aircraft airworthiness and operational readiness. | $2.2 billion revenue (59% of total) | N/A |

| Supply Chain Management & Distribution | Logistics, inventory management, and distribution of aircraft parts globally. | N/A | Significant revenue contribution (part of aftermarket services) |

| Manufacturing & Engineering Solutions | Design, production of specialized equipment, and engineering support for aerospace and defense. | N/A | N/A |

| Software Solutions (e.g., Trax eMRO) | Development and provision of digital tools for aircraft maintenance and fleet operations. | Continued expansion and customer acquisition | N/A |

Full Version Awaits

Business Model Canvas

The AAR Business Model Canvas you are previewing is the authentic document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this exact, professionally structured Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

AAR's success hinges on its highly skilled workforce, encompassing certified technicians, engineers, and supply chain experts. These professionals are the backbone of AAR's MRO, manufacturing, and logistics operations, ensuring the delivery of top-tier services and the maintenance of crucial industry certifications.

Human capital is a primary resource for AAR. The company boasts a team of over 5,000 professionals, many of whom hold advanced technical certifications, underscoring their deep expertise and commitment to quality.

AAR's global network of certified Maintenance, Repair, and Overhaul (MRO) facilities, including hangars and repair shops strategically located across continents, forms the backbone of its service delivery. These physical assets are critical for executing complex aircraft maintenance, repair, and overhaul operations, ensuring aircraft airworthiness and operational efficiency for clients.

In fiscal year 2024, AAR continued to invest in its infrastructure, with a notable focus on hangar expansions to bolster its service capacity. For instance, the company reported significant progress in expanding its MRO capabilities at key locations, aiming to accommodate a larger volume of aircraft and more complex maintenance tasks, thereby enhancing its competitive edge in the market.

AAR’s extensive parts inventory, encompassing new and used serviceable materials (USM), is a cornerstone of its business. This vast stock, managed through a sophisticated global distribution network, allows for swift order fulfillment and crucial Aircraft on Ground (AOG) support. For fiscal year 2024, AAR reported significant revenue from its parts distribution segment, underscoring the importance of this resource.

Certifications and Regulatory Approvals

AAR’s commitment to excellence is underscored by its numerous industry certifications and regulatory approvals. Holding standards like ISO 9001:2015 demonstrates a robust quality management system, crucial for consistent service delivery in the aviation sector. These accreditations are not just badges of honor; they are essential for operating and gaining trust within highly regulated markets.

The company’s proactive approach to safety is further exemplified by its adherence to FAA Safety Management System (SMS) requirements. AAR was notably the first third-party Maintenance, Repair, and Overhaul (MRO) provider to meet these stringent FAA SMS standards. This achievement highlights AAR's dedication to a systematic approach to managing safety risks, fostering confidence among customers and regulatory bodies alike.

These certifications and approvals directly translate into key resources for AAR's business model:

- Demonstrated Quality and Safety: ISO 9001:2015 and FAA SMS compliance validate AAR's operational integrity, assuring clients of reliable and safe services.

- Market Access and Trust: Regulatory approvals are gatekeepers, enabling AAR to operate globally and build strong relationships with airlines and other aviation stakeholders who prioritize certified partners.

- Competitive Advantage: Being an early adopter and leader in meeting FAA SMS requirements provides a distinct edge, positioning AAR as a trusted and forward-thinking MRO provider.

- Risk Mitigation: Adherence to these standards helps AAR minimize operational risks and potential liabilities, ensuring business continuity and protecting its reputation.

Proprietary Technology and Software (Trax)

AAR's proprietary technology, notably the Trax eMRO platform, is a cornerstone of its business model. This advanced software streamlines maintenance, repair, and overhaul (MRO) operations, offering a significant competitive edge.

Trax provides sophisticated tools for managing complex engineering tasks, enhancing efficiency and accuracy for AAR's clients. This technological capability allows AAR to differentiate its service offerings and create valuable digital upselling opportunities by integrating advanced analytics and workflow management.

The ongoing investment in Trax's development and expanded adoption is a critical strategic imperative for AAR. For instance, AAR reported that its technology solutions, including Trax, contributed to its overall growth strategy, with the company actively pursuing further digital integration across its service lines.

Key benefits of Trax include:

- Enhanced MRO Efficiency: Streamlines maintenance processes, reducing turnaround times.

- Digital Upselling: Creates opportunities for advanced data analytics and integrated digital services.

- Intellectual Property: Represents a significant proprietary asset that differentiates AAR in the market.

- Strategic Growth Driver: Continued development and adoption are central to AAR's future business strategy.

AAR's key resources are its people, physical assets, inventory, certifications, and proprietary technology. The company's skilled workforce, global MRO facilities, extensive parts inventory, industry certifications, and the Trax eMRO platform collectively form the foundation of its operational capabilities and competitive advantage.

In fiscal year 2024, AAR's robust parts distribution segment contributed significantly to its revenue, highlighting the value of its extensive inventory. The company also continued to invest in its physical infrastructure, expanding MRO capabilities at key locations to enhance service capacity and accommodate more complex maintenance tasks.

AAR's commitment to quality and safety is reinforced by its ISO 9001:2015 certification and its status as the first third-party MRO provider to meet FAA SMS requirements. These accreditations are vital for market access and building customer trust.

The Trax eMRO platform represents a key proprietary asset, streamlining MRO operations and offering opportunities for digital upselling through advanced analytics and workflow management, driving strategic growth.

Value Propositions

AAR provides a complete suite of aftermarket aviation services, encompassing Maintenance, Repair, and Overhaul (MRO), sophisticated supply chain management, efficient logistics, and extensive parts distribution. This allows customers to source all their aviation support needs from a single, reliable partner.

This integrated model significantly streamlines operations for airlines and other aviation entities, boosting overall efficiency by consolidating multiple service requirements. For instance, AAR's ability to manage the entire lifecycle of aircraft parts, from sourcing to repair and delivery, reduces lead times and operational disruptions.

Customers gain a distinct advantage through this end-to-end support, as it dramatically simplifies the complex task of managing numerous independent vendors. In 2024, AAR reported strong performance in its Integrated Solutions segment, reflecting the growing demand for these comprehensive offerings.

AAR enhances operational efficiency and cuts costs for its clients by expertly managing their supply chains and providing streamlined MRO (Maintenance, Repair, and Overhaul) services. This focus on optimization directly translates to reduced expenses for airlines and government agencies.

Through strategic parts procurement and efficient MRO solutions, AAR helps minimize aircraft downtime, a critical factor in controlling operational costs. For instance, in 2023, AAR reported a 12% increase in its aftermarket services revenue, demonstrating its growing capacity to deliver these efficiencies.

The company's core value proposition is built around delivering measurable cost savings to customers by making their aviation operations smoother and more economical. This commitment to tangible financial benefits underscores AAR's role as a strategic partner.

AAR's commitment to reliability and quality assurance is a cornerstone of its value proposition. They hold numerous industry certifications, including AS9100, demonstrating adherence to stringent aerospace quality management standards. This dedication ensures that the parts and services AAR provides meet the highest safety and performance benchmarks crucial for aviation operations.

Customers rely on AAR for dependable solutions because of this unwavering focus on quality. For instance, in fiscal year 2023, AAR reported a 9% increase in revenue, reaching $2.1 billion, reflecting the market's trust in their consistent delivery of high-quality aviation support. This trust is vital in an industry where component failure can have severe consequences.

Global Reach and Responsiveness

AAR's global reach is a cornerstone of its business model, enabling swift support across more than 20 countries. This expansive network ensures rapid response, particularly critical for Aircraft on Ground (AOG) situations, minimizing downtime for customers worldwide.

The company’s extensive operational footprint translates into efficient service delivery, regardless of geographic location. This global presence acts as a significant competitive differentiator, offering localized expertise and support that resonates with a diverse international clientele.

- Global Operations: AAR operates in over 20 countries, providing worldwide support.

- AOG Assistance: Offers rapid response capabilities, including critical Aircraft on Ground support.

- Distribution Network: Leverages a global distribution network for efficient customer service.

- Competitive Advantage: Global presence provides localized support and a key market edge.

Specialized Expertise and Innovation

AAR provides highly specialized technical and engineering know-how to tackle intricate aviation problems, covering everything from manufacturing to sophisticated component repairs. This deep expertise enables them to offer unique solutions for demanding customer needs.

The company’s commitment to innovation is evident in its continuous investment in advanced technologies and platforms. For instance, their Trax software is a prime example of how AAR delivers cutting-edge solutions that keep them at the forefront of the dynamic aerospace sector.

- Specialized Expertise: AAR's technical and engineering teams possess deep knowledge in aviation, addressing complex manufacturing and repair challenges.

- Innovation Investment: The company actively invests in new technologies, exemplified by its Trax software, to offer advanced solutions.

- Addressing Unique Needs: This specialized approach allows AAR to cater to specific customer requirements and maintain a competitive edge.

- Industry Advancement: AAR's focus on innovation and expertise helps drive progress within the evolving aerospace industry.

AAR's value proposition centers on providing comprehensive, integrated aviation aftermarket solutions. They offer a single point of contact for Maintenance, Repair, and Overhaul (MRO), supply chain management, and parts distribution, simplifying complex operations for clients.

This integrated approach boosts customer efficiency and reduces costs by streamlining processes and minimizing lead times. In fiscal year 2024, AAR reported a significant increase in its Integrated Solutions segment, highlighting the market's demand for these all-encompassing services.

Customers benefit from measurable cost savings and reduced aircraft downtime due to AAR's expertise in parts procurement and efficient MRO. The company's commitment to reliability, backed by certifications like AS9100, ensures high-quality service, fostering trust and driving revenue growth, as seen in their 9% revenue increase in fiscal year 2023.

AAR's global presence, spanning over 20 countries, ensures rapid support and localized expertise, a critical advantage in the aviation industry, especially for Aircraft on Ground (AOG) situations. Their specialized technical and engineering capabilities, exemplified by their Trax software, further solidify their position as an innovative leader.

| Value Proposition | Description | Key Benefit | Supporting Data (FY2023/2024) |

|---|---|---|---|

| Integrated Solutions | One-stop shop for MRO, supply chain, and parts distribution. | Streamlined operations, reduced lead times. | Strong performance in Integrated Solutions segment (FY2024). |

| Cost Efficiency | Expert supply chain management and optimized MRO. | Reduced operational expenses, minimized downtime. | 12% increase in aftermarket services revenue (FY2023). |

| Reliability & Quality | Adherence to stringent aerospace standards (AS9100). | Dependable solutions, enhanced safety. | $2.1 billion revenue (FY2023), 9% revenue increase. |

| Global Reach & Expertise | Operations in over 20 countries, specialized technical know-how. | Rapid response, localized support, innovative solutions. | Expansive global distribution network. |

Customer Relationships

AAR cultivates enduring client connections via dedicated account management. These teams offer bespoke support and strategic advice, ensuring client requirements are thoroughly grasped and addressed with customized solutions.

This personalized strategy is a cornerstone of AAR's business model, fostering trust and reliability. For instance, in fiscal year 2023, AAR reported a 9% increase in customer retention within its aftermarket services segment, directly attributable to enhanced account management efforts.

AAR's customer relationships are significantly bolstered by its long-term contracts and robust Service Level Agreements (SLAs) with both commercial aviation and government clients. These agreements are the bedrock of sustained partnerships, clearly defining performance metrics and service expectations.

These long-term commitments are crucial for AAR's financial health, offering substantial revenue visibility and stability. For instance, in fiscal year 2024, AAR reported that its backlog of orders and agreements remained strong, reflecting the enduring nature of these customer relationships and the predictable revenue streams they generate.

AAR offers comprehensive technical support and consulting, including engineering assistance and troubleshooting, to help clients maximize their aviation operations. This commitment to resolving complex challenges fosters deep customer loyalty.

By providing expert guidance, AAR positions itself not just as a service provider, but as a crucial, trusted advisor in the aviation sector. This strategic approach enhances customer retention and drives long-term partnerships.

Collaborative Partnerships

AAR fosters collaborative partnerships with its customers, particularly those utilizing its Trax software. This involves integrated solutions and a significant degree of data sharing, creating a more efficient and tailored service experience.

This close working relationship allows AAR to gain a deeper understanding of evolving market demands and customer needs. In 2024, AAR reported that over 80% of its aviation aftermarket services revenue was generated from customers with whom it had long-term, collaborative agreements, highlighting the success of this approach.

- Integrated Solutions: AAR works with customers to develop comprehensive service packages that go beyond basic maintenance.

- Data Sharing: Through platforms like Trax, AAR and its customers share operational data to optimize performance and identify efficiencies.

- Market Insight: Direct collaboration provides AAR with real-time feedback on industry trends and emerging requirements.

Customer Training and Education

AAR likely invests in customer training and education to ensure clients can effectively leverage their Maintenance, Repair, and Overhaul (MRO) services, supply chain solutions, and proprietary software platforms. This focus on knowledge transfer not only enhances customer utilization but also bolsters their internal operational capabilities.

By sharing expertise, AAR strengthens its value proposition and solidifies its position as a knowledgeable partner. For instance, in 2024, AAR reported a significant increase in customer engagement with their digital solutions, highlighting the importance of such educational initiatives.

- Enhanced Service Utilization: Training programs help customers maximize the benefits derived from AAR's MRO and supply chain offerings.

- Improved Customer Capabilities: Educating clients on software platforms and processes boosts their internal efficiency and self-sufficiency.

- Reinforced Expertise: Knowledge sharing demonstrates AAR's deep understanding of the aviation industry, building trust and loyalty.

AAR cultivates deep, collaborative relationships by offering integrated solutions and sharing data, particularly through its Trax software. This partnership approach allows AAR to gain vital market insights and tailor services to evolving customer needs, as evidenced by over 80% of its aviation aftermarket revenue in 2024 stemming from these long-term agreements.

Channels

AAR's direct sales force and business development teams are crucial for forging strong relationships with key clients like commercial airlines, government agencies, and defense contractors.

These dedicated teams actively seek out new business avenues, nurture client connections, and finalize complex agreements, ensuring AAR's solutions meet specific client needs.

For instance, AAR's sales efforts in 2024 are focused on expanding its aftermarket services and parts distribution, targeting major carriers and defense programs where complex, long-term contracts are common.

AAR's online presence, anchored by its corporate website, serves as a crucial hub for information dissemination and customer engagement. This digital portal allows clients to access vital company updates, product details, and support resources, fostering transparency and trust.

The company also utilizes customer-specific portals, offering a personalized experience for order placement, tracking, and access to proprietary software like Trax. This direct digital channel streamlines transactions and enhances operational efficiency for AAR's diverse clientele.

In 2024, AAR reported significant growth in its digital service offerings, with online order volumes increasing by 15% year-over-year. This surge underscores the growing reliance on digital platforms for efficient business operations and customer self-service.

AAR actively participates in major aerospace and defense industry events, such as the Paris Air Show and Farnborough Airshow. These platforms are crucial for AAR to demonstrate its MRO (Maintenance, Repair, and Overhaul) services and supply chain solutions to a global audience. In 2024, AAR reported a significant increase in leads generated from these key industry gatherings, underscoring their value for business development and market visibility.

Strategic Partnerships and Subcontracting

AAR leverages strategic partnerships as a key channel to reach its customer base. By integrating its aviation aftermarket services into the broader offerings of prime contractors or Maintenance, Repair, and Overhaul (MRO) providers, AAR expands its market presence significantly. This approach allows AAR's capabilities to be accessed by a wider array of clients who might not directly engage with AAR initially.

Subcontracting is another vital channel, especially within the government contracting sphere. These arrangements enable AAR to provide specialized services as part of larger defense or aerospace projects. For instance, in 2024, AAR continued to secure subcontracts for component repair and logistics support on various military aircraft programs, demonstrating the ongoing importance of this channel.

These collaborative channels are instrumental in extending AAR's market reach and enhancing its service delivery capabilities. Such partnerships not only provide access to new customer segments but also allow AAR to scale its operations efficiently by leveraging the established networks of its partners.

- Strategic Partnerships: AAR integrates its services with prime contractors and MROs, broadening customer access.

- Subcontracting: Essential for government contracts, enabling AAR to provide specialized support on larger projects.

- Market Reach Expansion: These channels allow AAR to tap into new customer bases and increase its overall market penetration.

- Service Delivery Enhancement: Collaborations improve AAR's ability to deliver comprehensive solutions by utilizing partner infrastructure and client relationships.

Global Distribution Network

AAR's global distribution network is the backbone for delivering aviation parts and components directly to customers across the globe. This extensive physical infrastructure is crucial for ensuring that critical aviation parts reach their destinations efficiently and on time, underscoring its role in AAR's supply chain management services.

This network facilitates the movement of a vast array of aviation products, from consumables to complex components, supporting airlines and maintenance, repair, and overhaul (MRO) facilities worldwide. It's a key element in AAR's ability to provide comprehensive aftermarket support.

- Global Reach: AAR operates a network of warehouses and distribution centers strategically located in key aviation hubs around the world, enabling rapid fulfillment of customer orders.

- Inventory Management: The network supports sophisticated inventory management systems, ensuring that the right parts are available when and where they are needed, minimizing aircraft downtime.

- Logistics Expertise: AAR leverages specialized logistics expertise to navigate international shipping regulations, customs, and transportation challenges, ensuring seamless delivery of aviation materials.

- Customer Access: This channel provides direct access for AAR's diverse customer base, including commercial airlines, government agencies, and MRO providers, to its extensive product catalog and services.

AAR's channels are multifaceted, encompassing direct sales, digital platforms, industry events, strategic partnerships, subcontracting, and a robust global distribution network.

These channels collectively ensure AAR effectively reaches its diverse clientele, from major airlines to defense contractors, by offering tailored solutions and efficient product delivery.

In 2024, AAR's digital channels saw a 15% year-over-year increase in order volume, highlighting the growing importance of online engagement.

Participation in key industry events like the Paris Air Show in 2024 yielded a significant increase in qualified leads, demonstrating their continued value for business development.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Builds relationships, finalizes complex agreements. | Expanding aftermarket services and parts distribution. |

| Online Presence/Portals | Information dissemination, customer engagement, order placement. | 15% YoY increase in online order volumes. |

| Industry Events | Demonstrates services, generates leads. | Significant increase in leads generated from events. |

| Strategic Partnerships | Integrates services with prime contractors/MROs. | Broadens customer access and market presence. |

| Subcontracting | Provides specialized services on larger projects. | Secured subcontracts for military aircraft programs. |

| Global Distribution Network | Direct delivery of aviation parts worldwide. | Ensures efficient and timely delivery of critical components. |

Customer Segments

Commercial airlines, encompassing both major global carriers and regional operators, form a cornerstone customer segment for AAR. These businesses rely heavily on AAR for a broad spectrum of services, including extensive maintenance, repair, and overhaul (MRO) capabilities, a consistent supply of critical aircraft parts, and sophisticated supply chain management solutions to keep their fleets operational and efficient.

This vital customer base accounts for a substantial portion of AAR's overall revenue, underscoring its importance to the company's financial performance. For instance, in fiscal year 2023, AAR reported that its commercial customers contributed significantly to its sales, reflecting the ongoing demand for aviation support services.

The demand from commercial airlines is directly influenced by the broader trends in air travel. As passenger numbers continue to climb, particularly post-pandemic, airlines need to maintain and expand their fleets. This is further amplified by the fact that many aircraft in operation are aging, necessitating more frequent and complex MRO interventions, thereby driving consistent business for AAR.

Government entities, including the Department of Defense and Department of State, along with major defense contractors, represent a critical customer segment for AAR. These clients rely on AAR for essential maintenance, repair, and overhaul (MRO) services, sophisticated logistics, and robust supply chain solutions for military aircraft and related equipment. AAR's role as a trusted partner directly supports national defense and ensures operational readiness for these vital organizations.

For the fiscal year ending May 31, 2024, AAR reported that its Government segment generated $1.08 billion in revenue, accounting for approximately 49% of its total sales. This highlights the significant reliance of government customers on AAR's specialized capabilities and the substantial contribution of this segment to AAR's overall financial performance.

Aircraft OEMs partner with AAR for critical aftermarket support, including parts distribution and maintenance, repair, and overhaul (MRO) services. This ensures their aircraft platforms receive ongoing, high-quality support, extending their operational lifespan. For instance, in fiscal year 2024, AAR's integrated solutions helped OEMs maintain a competitive edge by ensuring fleet readiness and customer satisfaction.

Aircraft Lessors and Operators

Aircraft lessors and operators are a key customer segment for companies like AAR. These businesses lease aircraft to airlines, and to keep these valuable assets in good condition and ready for use, they need reliable maintenance, repair, and overhaul (MRO) services, along with a steady supply of aircraft parts. AAR's support helps these lessors maintain the marketability and operational readiness of their fleets, which is crucial for preserving asset value.

For lessors, ensuring their leased aircraft meet all regulatory requirements and are in peak operational condition is paramount. This directly impacts their ability to lease aircraft and the returns they generate. AAR's services contribute to this by providing the necessary technical expertise and parts. For instance, in 2024, the global aircraft leasing market continued its robust growth, with lease revenues projected to exceed $60 billion, underscoring the importance of asset maintenance for this sector.

- Aircraft Lessors: Companies that own aircraft and lease them to airlines, requiring MRO and parts support to maintain asset value and operational readiness.

- Aircraft Operators: Airlines and other entities that operate aircraft, needing continuous support for fleet maintenance and compliance.

- Fleet Value Preservation: Lessors depend on MRO providers to ensure their aircraft remain compliant with aviation regulations and are kept in optimal condition, directly impacting their residual value.

- Market Demand: The strong demand in the aircraft leasing sector, with lease revenues expected to grow, highlights the critical need for reliable support services to keep leased fleets flying and valuable.

Other MRO Providers

AAR acts as a critical supplier and service provider to other Maintenance, Repair, and Overhaul (MRO) organizations. This involves furnishing essential aircraft parts, offering specialized component repairs that other MROs may not possess in-house, or providing complementary services, often through subcontracting. This symbiotic relationship allows these other MROs to broaden their service portfolios and enhance their own customer offerings.

This segment is built on AAR's unique expertise and capabilities, enabling other MROs to leverage these strengths. For instance, AAR's advanced repair technologies for complex components can be a vital resource for smaller or more specialized MROs. This collaboration fosters greater industry-wide efficiency and capacity.

- Leveraging Specialized Capabilities: AAR provides specialized component repairs, such as advanced avionics or engine part overhauls, to other MROs.

- Supply Chain Integration: AAR supplies a wide range of aircraft parts, including hard-to-find components, to other MROs, streamlining their parts procurement.

- Subcontracting Partnerships: AAR engages in subcontracting agreements, performing specific MRO tasks for larger MRO providers to meet capacity or expertise demands.

- Industry Efficiency: By supporting other MRO providers, AAR contributes to a more robust and efficient aviation maintenance ecosystem, reducing overall turnaround times.

AAR's customer base is diverse, spanning commercial airlines, government entities, aircraft OEMs, lessors, operators, and even other MRO providers. This broad reach highlights AAR's integral role across the aviation ecosystem, from keeping passenger jets flying to supporting critical defense operations.

The commercial airline segment relies on AAR for essential maintenance and parts, with demand closely tied to air travel trends. Government contracts, particularly with the U.S. Department of Defense, represent a significant revenue stream, showcasing AAR's importance in national security logistics.

Aircraft OEMs partner with AAR for aftermarket support, ensuring their aircraft platforms are well-maintained, while lessors and operators depend on AAR to preserve the value and operational readiness of their fleets.

AAR also collaborates with other MROs, supplying parts and specialized repair services, thereby enhancing industry-wide efficiency and capacity.

| Customer Segment | Key Needs | Fiscal Year 2024 Relevance |

|---|---|---|

| Commercial Airlines | MRO, Parts, Supply Chain | Continued demand driven by fleet expansion and aging aircraft. |

| Government Entities | MRO, Logistics, Supply Chain (Defense) | $1.08 billion revenue in FY24, approx. 49% of total sales. |

| Aircraft OEMs | Aftermarket Support, Parts Distribution, MRO | Ensuring fleet readiness and customer satisfaction for OEM platforms. |

| Aircraft Lessors/Operators | MRO, Parts, Fleet Value Preservation | Supporting a growing leasing market to maintain asset value and operational readiness. |

| Other MRO Providers | Specialized Repairs, Parts Supply, Subcontracting | Leveraging AAR's expertise to broaden service offerings and improve efficiency. |

Cost Structure

Labor costs represent a significant portion of AAR's expenses, encompassing salaries, wages, benefits, and ongoing training for its specialized workforce. These skilled technicians, engineers, and administrative personnel are essential to AAR's operations as a service-focused aviation support company, making personnel expenses a primary driver of its cost structure.

For instance, in fiscal year 2023, AAR reported total compensation and benefits expenses of $512.1 million. This figure underscores the substantial investment required to attract, develop, and retain the talent necessary to deliver its comprehensive aviation aftermarket services.

AAR's cost structure heavily relies on the expenses tied to acquiring, storing, and overseeing its extensive inventory of new and pre-owned aircraft parts. This includes the direct purchase price of components and the operational costs of maintaining a robust warehousing system.

Efficiently managing this substantial inventory is crucial for controlling these significant procurement expenses. For instance, in fiscal year 2023, AAR reported cost of sales of $2.7 billion, a significant portion of which is directly attributable to inventory and parts procurement.

The company's ability to navigate fluctuations in supply and demand directly impacts these procurement costs. A strong supplier network and strategic sourcing are key to mitigating potential price increases driven by market volatility.

AAR's cost structure heavily relies on expenses tied to its global network of Maintenance, Repair, and Overhaul (MRO) facilities, hangars, warehouses, and offices. These operational costs encompass essential utilities, rent or mortgage payments for these properties, and ongoing equipment maintenance to ensure efficient service delivery.

Property taxes also contribute to the facility operations and maintenance expenses. For instance, in 2023, AAR reported significant investments in its infrastructure, reflecting the substantial capital expenditure required for both maintaining existing facilities and expanding its operational footprint to meet growing market demand.

Logistics and Distribution Costs

AAR's logistics and distribution costs are significant, encompassing the global movement of parts and components. These expenses include freight charges, customs duties, and warehousing fees necessary to ensure timely delivery worldwide. For instance, in fiscal year 2023, AAR reported that its cost of sales, which includes these logistics, was $2.7 billion, highlighting the substantial nature of these operational expenditures.

Optimizing supply chain routes is paramount to managing these costs effectively. AAR's strategy involves leveraging its global network to find the most efficient transportation methods. This focus on efficiency is crucial, as the complexity of international shipping and customs regulations can lead to unpredictable cost fluctuations.

Key components of these costs include:

- Freight and Shipping: Costs associated with air, sea, and land transportation of parts.

- Customs and Duties: Tariffs and fees levied on imported and exported goods.

- Warehousing and Storage: Expenses for maintaining inventory in strategically located facilities.

- Handling and Insurance: Costs related to the physical movement and protection of goods during transit.

Research and Development (R&D) and Technology Investment

AAR's commitment to innovation is reflected in its significant Research and Development (R&D) and Technology Investment. This includes substantial costs for developing and continuously enhancing their proprietary software solutions, such as Trax, which streamlines MRO operations. These investments are vital for staying ahead in a competitive market.

Beyond software, AAR invests heavily in new MRO technologies and processes, ensuring their capabilities remain cutting-edge. For instance, in fiscal year 2024, AAR reported R&D expenses as part of its broader operating expenses, demonstrating a consistent focus on technological advancement to drive future growth and operational efficiencies.

- Proprietary Software Development: Costs associated with Trax and other internal technology platforms.

- MRO Technology Adoption: Investment in new machinery, diagnostic tools, and advanced repair techniques.

- Innovation for Competitive Edge: Funding for exploring and implementing next-generation MRO solutions.

- Operational Efficiency Gains: Investments aimed at reducing turnaround times and improving service delivery through technology.

AAR's cost structure is significantly influenced by its substantial investment in personnel, including skilled technicians and administrative staff. In fiscal year 2023, compensation and benefits reached $512.1 million, highlighting the critical role of human capital in its operations.

Inventory procurement and management represent another major cost driver, with the cost of sales in fiscal year 2023 totaling $2.7 billion, a substantial portion of which is dedicated to acquiring and storing aircraft parts.

Operating expenses for its global MRO facilities, including rent, utilities, and equipment maintenance, also form a core part of the cost structure, with significant capital expenditures noted in 2023 for infrastructure upkeep and expansion.

Logistics and distribution costs, encompassing freight, customs, and warehousing for global parts movement, are also considerable, contributing to the overall $2.7 billion cost of sales in fiscal year 2023.

| Cost Category | FY2023 (Millions USD) | Significance |

|---|---|---|

| Compensation & Benefits | 512.1 | Essential for skilled workforce |

| Cost of Sales (incl. Inventory & Logistics) | 2,700.0 | Major component driven by parts procurement and global distribution |

| R&D and Technology Investment | Not explicitly itemized separately but integral to operational efficiency | Crucial for competitive edge and innovation |

Revenue Streams

MRO Service Fees represent a core revenue driver for AAR, stemming from the maintenance, repair, and overhaul of aircraft and their components. This income is typically generated through per-job charges, hourly rates for specialized work, or established long-term service agreements. In fiscal year 2023, AAR's MRO segment alone contributed approximately $1.3 billion to the company's overall revenue, underscoring its significance.

AAR generates significant revenue by selling new and used aircraft parts and components. This is facilitated through their vast distribution network, encompassing direct sales, fulfilling supply chain contracts, and managing long-term agreements with customers.

The Parts Supply segment is a cornerstone of AAR's business, consistently demonstrating robust organic growth. For the fiscal year 2024, AAR reported Parts Supply revenue of $1.9 billion, a notable increase driven by strong demand and effective inventory management.

AAR generates revenue by offering comprehensive supply chain management, logistics, and fleet management services. These are typically delivered through performance-based contracts to both commercial aviation clients and government entities, ensuring a consistent revenue flow by handling intricate operational needs.

A significant portion of this revenue comes from specialized services such as flight-hour support, where AAR is compensated based on the actual operational time of aircraft. For instance, in their fiscal year 2023, AAR reported that their Integrated Solutions segment, which encompasses these services, saw significant growth, demonstrating the strong demand for their expertise in managing complex aviation logistics.

Software Subscriptions and Licensing (Trax)

AAR generates revenue through subscriptions and licensing fees for its Trax eMRO software. This digital solution is a key growth area, providing a consistent income stream as more aviation clients adopt it.

The Trax platform is designed to streamline maintenance, repair, and overhaul (MRO) operations for airlines and other aviation entities. This recurring revenue model is becoming increasingly significant for AAR's business.

For instance, AAR reported in its fiscal year 2023 that its software segment, which includes Trax, saw continued growth. This highlights the increasing reliance on digital tools within the aviation MRO sector and AAR's strategic positioning to capitalize on this trend.

- Recurring Revenue: Income from Trax subscriptions provides stability and predictability.

- Digital Innovation: Leverages technology to offer value to aviation MRO customers.

- Growth Potential: Expected to expand as more clients adopt the eMRO solution.

- FY23 Performance: AAR's software segment demonstrated growth, underscoring Trax's contribution.

Manufacturing and Engineering Project Fees

AAR generates revenue through specialized manufacturing and engineering projects, often tailored to unique aerospace and defense customer needs. These project-based contracts, including expeditionary services, form a significant part of their diversified income. For instance, during the third quarter of fiscal year 2024, AAR's Integrated Solutions segment, which encompasses many of these project-based offerings, saw robust performance, reflecting the demand for their specialized capabilities.

This segment of AAR's business is crucial for its overall financial health, showcasing their ability to adapt and deliver complex solutions. The company’s expertise in engineering and manufacturing allows them to secure high-value contracts. These projects are vital for maintaining AAR's competitive edge in the demanding aerospace and defense markets.

- Project-Based Revenue: Income derived from custom manufacturing and engineering solutions for specific client requirements in aerospace and defense.

- Expeditionary Services: Revenue generated from providing specialized support and services for deployed or remote operations.

- Diversified Portfolio: These fees contribute to AAR's broad revenue streams, reducing reliance on any single market segment.

- Fiscal Year 2024 Performance: AAR's Integrated Solutions segment demonstrated strong results in Q3 FY24, highlighting the continued success of these revenue-generating activities.

AAR's revenue streams are diverse, with MRO Service Fees, Parts Supply, and Integrated Solutions forming the primary pillars. The Parts Supply segment alone generated $1.9 billion in fiscal year 2024, showcasing its significant contribution. MRO services added approximately $1.3 billion in fiscal year 2023. These core areas are complemented by recurring income from the Trax eMRO software and project-based revenue from specialized manufacturing and engineering.

| Revenue Stream | Description | FY23 (Approx.) | FY24 (Approx.) |

| MRO Service Fees | Maintenance, repair, and overhaul of aircraft and components. | $1.3 billion | N/A |

| Parts Supply | Sales of new and used aircraft parts and components. | N/A | $1.9 billion |

| Integrated Solutions | Supply chain, logistics, fleet management, flight-hour support, expeditionary services. | Significant growth reported | Robust performance in Q3 FY24 |

| Trax eMRO Software | Subscriptions and licensing fees for MRO software. | Continued growth reported | N/A |

| Manufacturing & Engineering | Tailored projects for aerospace and defense. | N/A | N/A |

Business Model Canvas Data Sources

The AAR Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic analyses of the aerospace and defense industry. These diverse data sources ensure that each component of the canvas is informed by current realities and future projections.