AAR Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AAR Bundle

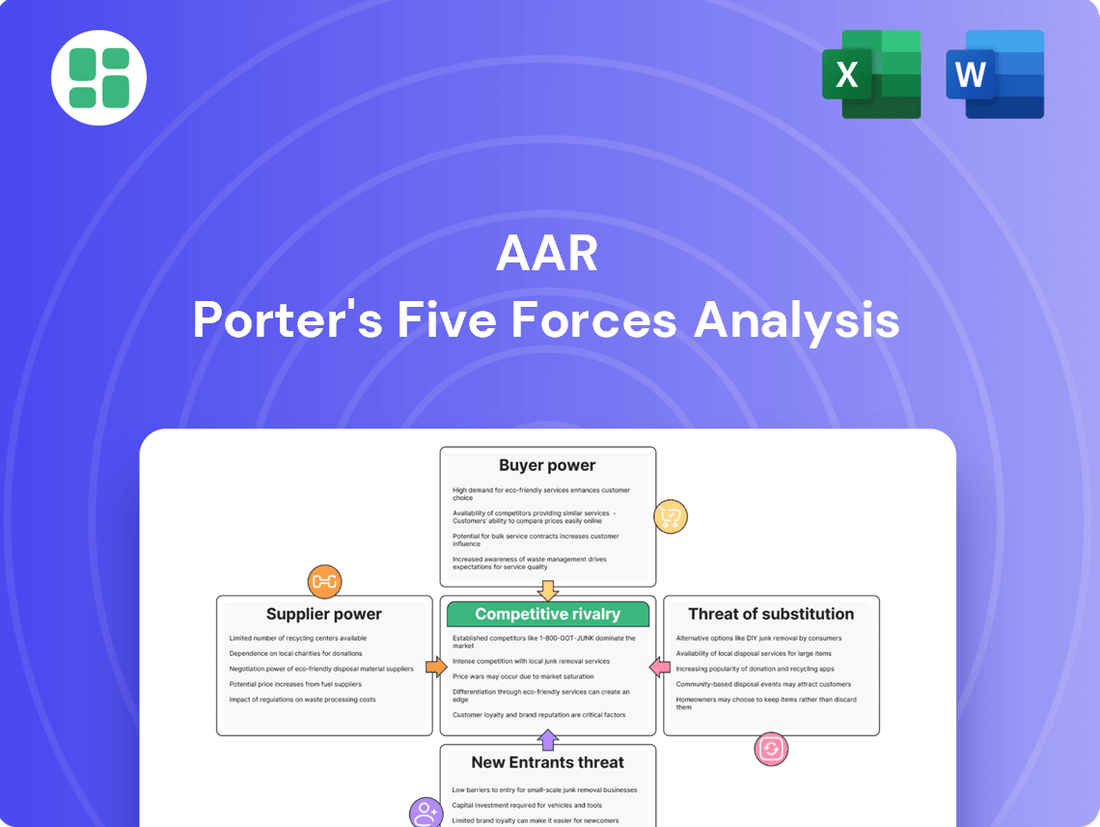

Porter's Five Forces Analysis helps dissect the competitive landscape, revealing the underlying forces that shape AAR's industry. Understanding these pressures—rivalry, new entrants, substitutes, buyer power, and supplier power—is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AAR’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized aircraft components, particularly those with unique, proprietary technology or few viable alternatives, hold considerable sway. AAR relies on these manufacturers for essential parts in its Maintenance, Repair, and Overhaul (MRO) and distribution operations. The specialized nature of these components often translates into AAR facing higher prices or less favorable contract terms.

The aerospace sector's rigorous certification processes further restrict the number of qualified suppliers. This limited supplier base amplifies their negotiating leverage. For instance, as of early 2024, global aerospace MRO market revenue was projected to reach over $100 billion, with a significant portion attributed to the cost of specialized parts, highlighting the critical role of these suppliers.

Raw material providers for the aerospace industry, such as those supplying aerospace-grade aluminum, titanium, and advanced composites, wield significant bargaining power. This is amplified when the supply of these critical materials is concentrated among a few global producers or when their prices are volatile due to global commodity market dynamics. For instance, fluctuations in aluminum prices, which saw significant volatility in 2024 driven by geopolitical events and production levels, directly influence the cost structure for manufacturers of aircraft components.

While AAR's primary business focuses on aftermarket services and parts distribution rather than direct raw material sourcing, the cost of these foundational materials impacts its suppliers. Consequently, any increases in raw material prices can translate into higher procurement costs for AAR, affecting its overall margins. Furthermore, disruptions in the supply chain for these essential aerospace materials, as seen with certain rare earth elements crucial for advanced alloys in 2024, can lead to extended lead times and increased pricing for finished parts, ultimately impacting AAR's operational efficiency and inventory management.

Suppliers of highly skilled and certified labor, such as licensed aircraft mechanics and specialized engineers, wield significant bargaining power due to the inherent scarcity of such expertise. AAR Porter's analysis highlights that for MRO services, a limited supply of these professionals directly impacts labor costs and can disrupt service timelines. For instance, in 2024, the demand for certified aerospace technicians continued to outstrip supply, leading to increased wage pressures across the industry.

Software and Technology Providers

Software and technology providers, particularly those offering specialized aviation software, MRO management systems, and advanced diagnostic tools, can wield substantial bargaining power. This is especially true when their products are considered industry standards or possess unique, indispensable capabilities. For instance, a robust MRO management system that streamlines operations and enhances efficiency can be critical for companies like AAR. The high switching costs associated with integrating and migrating data from such complex systems further solidify supplier leverage, enabling them to influence pricing, service terms, and update schedules. In 2024, the increasing reliance on data analytics and AI-driven diagnostics in aviation maintenance means that providers of these cutting-edge solutions are in a strong position. AAR's investment in digital transformation, as reported in their fiscal year 2024 earnings, highlights their dependence on these technology partners.

- Industry Standard Software: Suppliers whose software is widely adopted as the de facto standard in aviation MRO gain significant leverage due to the network effects and familiarity across the industry.

- Unique Capabilities: Providers offering proprietary diagnostic tools or advanced predictive maintenance software that cannot be easily replicated or substituted possess strong bargaining power.

- High Switching Costs: The expense and operational disruption involved in replacing deeply integrated software systems, including data migration and retraining, create substantial barriers to switching suppliers.

- Dependence on Innovation: AAR's operational efficiency and competitive edge are closely tied to the technological advancements offered by these software providers, increasing their reliance and the suppliers' power.

Logistics and Freight Carriers

The bargaining power of logistics and freight carriers, particularly those specializing in global aerospace component transport, presents a significant factor for AAR. These specialized carriers, capable of handling oversized or sensitive aerospace parts, can exert considerable influence on AAR's supply chain costs and operational efficiency. For a company like AAR, heavily involved in supply chain management and parts distribution, securing reliable and cost-effective transportation is paramount. The limited availability of such specialized aerospace logistics providers can translate into leverage for them, impacting pricing and service agreements.

- Specialized Aerospace Logistics: Carriers adept at global, oversized, and sensitive aerospace component transport hold significant power.

- Cost and Efficiency Impact: Their pricing and service levels directly affect AAR's supply chain expenses and operational flow.

- Limited Alternatives: A scarcity of qualified aerospace logistics partners amplifies their bargaining position.

Suppliers of specialized aircraft components and raw materials possess significant bargaining power due to limited alternatives and rigorous industry certification processes. This leverage can lead to higher prices and less favorable contract terms for AAR, impacting its procurement costs and overall margins. For instance, the global aerospace MRO market, projected to exceed $100 billion in early 2024, underscores the critical role and influence of these suppliers in the industry's cost structure.

The scarcity of highly skilled labor, such as certified aircraft mechanics and specialized engineers, also grants suppliers considerable negotiating power. This is evident in 2024, where the demand for these professionals continued to outpace supply, driving up labor costs for companies like AAR. Furthermore, providers of essential software and technology, particularly those with unique capabilities or high switching costs, can dictate terms, influencing AAR's operational efficiency and digital transformation efforts.

| Supplier Type | Key Factors Influencing Power | Impact on AAR | Relevant 2024 Data/Context |

|---|---|---|---|

| Specialized Component Manufacturers | Proprietary technology, limited alternatives, certification requirements | Higher prices, less favorable terms | Aerospace MRO market revenue projected over $100 billion (early 2024) |

| Raw Material Providers | Concentrated supply, commodity price volatility | Increased procurement costs for components | Aluminum price volatility in 2024 due to geopolitical events |

| Skilled Labor Providers | Scarcity of certified technicians and engineers | Increased labor costs, potential service disruptions | Continued demand exceeding supply for aerospace technicians in 2024 |

| Software & Technology Providers | Industry-standard solutions, unique capabilities, high switching costs | Influence on pricing, service terms, and operational efficiency | AAR's investment in digital transformation (FY2024) highlights dependence |

| Logistics & Freight Carriers | Specialization in aerospace transport, limited qualified providers | Impact on supply chain costs and operational flow | Securing reliable, cost-effective transport is paramount for AAR |

What is included in the product

This analysis dissects the five competitive forces impacting AAR, revealing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Major commercial airlines, as significant buyers of maintenance, repair, and overhaul (MRO) services, parts, and logistics, wield considerable influence. Their sheer volume of purchases allows them to negotiate favorable terms, discounts, and service level agreements. For instance, in 2024, the global aviation MRO market was valued at over $100 billion, with airlines representing a substantial portion of this spending, giving them leverage.

Government and defense entities, such as national air forces and defense departments, represent a significant customer segment for AAR. These clients are characterized by their substantial size, long-term commitment, and intricate procurement procedures, wielding considerable budgetary influence. For instance, in fiscal year 2023, AAR reported that its government and defense segment contributed approximately 35% of its total revenue, highlighting the importance of this customer base.

The nature of contracts with these entities often involves large-scale agreements with demanding performance specifications and strict price limitations. This allows them to exert considerable leverage. AAR's ability to meet these stringent requirements and offer competitive pricing is crucial for securing and retaining these valuable contracts.

Furthermore, the strategic criticality of the business provided to government and defense customers empowers them to negotiate for highly tailored solutions and favorable pricing. This bargaining power necessitates that AAR maintains agility and cost-efficiency to meet the unique and evolving needs of these key stakeholders.

Aircraft fleet operators and lessors wield significant bargaining power due to their ability to consolidate maintenance, repair, and overhaul (MRO) and supply chain requirements across vast portfolios of aircraft. Their primary objective is to ensure high asset utilization and minimize operational downtime, making them highly sensitive to service efficiency and cost. For instance, major lessors like AerCap, with a fleet of over 1,000 aircraft as of early 2024, can leverage this scale to negotiate favorable terms from MRO providers.

This aggregated demand allows fleet operators and lessors to negotiate for better pricing, service level agreements, and guaranteed turnaround times. Their substantial purchasing volume means they can often switch providers if their demands are not met, further strengthening their position. The sheer volume of business they represent makes them a crucial customer segment for MRO service providers.

Price Sensitivity and Cost Pressures

Many of AAR's customers, especially commercial airlines, operate in very competitive markets where every dollar counts. This means they are very careful about how much they spend on maintenance, repair, and overhaul (MRO) services and aircraft parts. For instance, in 2023, the global airline industry saw a net profit margin of just 2.2%, highlighting the constant pressure to reduce costs across the board.

Because of this intense focus on price, these customers have significant power to negotiate lower rates, particularly for standard maintenance tasks or common parts. They can easily switch providers if they find a better deal elsewhere, forcing AAR to be extremely competitive. This dynamic means AAR needs to consistently prove its value and efficiency to keep these price-aware clients happy.

- Price Sensitivity: Commercial airlines, a key customer segment for AAR, face significant economic pressures, leading to a strong demand for cost-effective MRO and parts solutions.

- Negotiating Power: The ability of airlines to source services and parts from multiple providers grants them considerable leverage to negotiate favorable pricing, especially for standardized offerings.

- Value Demonstration: AAR must clearly articulate and deliver superior value, including efficiency gains and quality assurance, to retain business from these cost-conscious customers.

Availability of Alternative Providers

The availability of alternative providers significantly impacts customer bargaining power in the aviation aftermarket. When numerous qualified companies can offer similar maintenance, repair, and overhaul (MRO), supply chain, and parts distribution services, customers gain considerable leverage. This is because they can easily solicit and compare bids from various suppliers.

For AAR, a prominent player in the industry, the presence of other established MRO providers and parts distributors means that customers are not locked into a single supplier. If a customer perceives AAR's pricing as too high or is unsatisfied with service quality, they have viable alternatives. This competitive landscape empowers customers to negotiate better terms or switch suppliers, thereby increasing their bargaining power.

- Increased Competition: The aviation aftermarket features several large MRO providers and a fragmented network of smaller specialized shops, giving customers choices.

- Price Sensitivity: Customers, particularly large airlines, are highly sensitive to MRO costs, which can represent a significant portion of their operating expenses, driving them to seek competitive pricing.

- Switching Costs: While switching MRO providers can involve some effort in qualifying new vendors and transferring technical data, the potential cost savings often outweigh these hurdles for many customers.

Customers, particularly large commercial airlines and government entities, possess substantial bargaining power due to their significant purchasing volume and the competitive nature of the aviation aftermarket. This leverage allows them to negotiate favorable pricing and service terms.

The global aviation MRO market, exceeding $100 billion in 2024, underscores the immense spending power of airlines. Furthermore, AAR's reliance on government and defense contracts, which accounted for about 35% of its revenue in fiscal year 2023, highlights the influence these large clients wield.

The presence of multiple MRO providers and parts distributors means customers can easily compare offers and switch suppliers, further enhancing their negotiating position and driving AAR to maintain competitive pricing and demonstrate clear value.

| Customer Segment | Key Leverage Factor | Impact on AAR |

|---|---|---|

| Commercial Airlines | High purchase volume, cost sensitivity (2.2% net profit margin in 2023) | Negotiate lower prices, demand efficient service |

| Government & Defense | Significant budget influence, long-term contracts (35% of AAR revenue FY23) | Dictate tailored solutions, strict pricing |

| Fleet Operators & Lessors | Consolidated demand (e.g., AerCap >1000 aircraft early 2024) | Secure better pricing, guaranteed turnaround times |

Full Version Awaits

AAR Porter's Five Forces Analysis

This preview showcases the complete AAR Porter's Five Forces Analysis, offering a thorough examination of the competitive forces within the airline industry. The document you see here is precisely the same professionally compiled analysis you will receive immediately upon purchase, ensuring you get a ready-to-use resource without any alterations or missing sections.

Rivalry Among Competitors

The aviation aftermarket services market is a complex landscape, characterized by its fragmentation and the presence of a wide array of players. This diversity includes large independent Maintenance, Repair, and Overhaul (MRO) providers, MRO divisions within airlines, Original Equipment Manufacturers (OEMs) extending their services into the aftermarket, and specialized distributors of aircraft parts.

This intricate mix of competitors means AAR faces rivalry from entities with varying strengths and strategies. For instance, in 2024, the global aviation MRO market was valued at approximately $80 billion, with independent MROs holding a significant share, directly competing with AAR's core business.

The competition intensifies as each segment, from OEM-provided support to specialized parts distribution, presents unique competitive pressures. This multifaceted rivalry demands AAR to constantly adapt its service offerings and pricing to maintain its market position amidst such a dynamic and diverse competitive environment.

Competitive rivalry at AAR is significantly shaped by cost-efficiency and pricing pressures. Customers in the aerospace aftermarket, particularly those focused on Maintenance, Repair, and Overhaul (MRO) and parts procurement, are acutely sensitive to costs. This means that AAR's competitors are constantly striving to streamline their operations, shorten service turnaround times, and offer more attractive pricing to secure and maintain business.

This intense competition compels AAR to relentlessly pursue operational improvements and supply chain optimization. For instance, in 2024, the global aerospace MRO market was valued at approximately $85 billion, with significant portions driven by cost-conscious airlines and defense entities. AAR's ability to manage its costs effectively and pass those savings onto customers through competitive pricing is therefore a critical determinant of its market share and profitability.

Competitive rivalry in the aviation aftermarket services sector is intense, with companies like AAR constantly seeking to stand out. Competitors differentiate through specialized skills, quicker service delivery, bundled offerings, or expanded geographic presence. For instance, some rivals might concentrate on repairing specific aircraft models or unique parts, or even develop their own advanced repair technologies.

AAR's strategy involves continuously strengthening its distinct advantages. Its integrated supply chain solutions and extensive global network are key differentiators. In 2024, the aviation MRO (Maintenance, Repair, and Overhaul) market continued its robust growth, with AAR reporting strong performance in its Parts & Maintenance segment, driven by demand for its integrated solutions. This segment saw significant revenue contributions, underscoring the value customers place on specialized and reliable service packages.

OEM Expansion into Aftermarket

Original Equipment Manufacturers (OEMs) are stepping up their game in the aftermarket, directly challenging independent service providers like AAR. This expansion means OEMs are now offering their own maintenance, repair, and overhaul (MRO) services, leveraging their unique access to aircraft designs and proprietary knowledge. For instance, in 2024, major OEMs continued to bolster their MRO capabilities, aiming to capture a larger share of the lucrative aftermarket business. This trend intensifies competitive rivalry, as these manufacturers can often bundle aftermarket services with new aircraft sales, creating a powerful incentive for airlines.

This OEM push into aftermarket services presents a significant challenge. OEMs possess an inherent advantage due to their intellectual property and direct understanding of aircraft systems. They can offer integrated solutions that independent providers might find difficult to match. For example, a significant portion of aftermarket revenue for OEMs is derived from their maintenance and parts divisions, a segment they are actively growing. This direct competition means AAR and similar companies must continually innovate and differentiate their offerings to remain competitive.

- OEMs leverage proprietary knowledge and direct access to aircraft designs for aftermarket services.

- This expansion intensifies rivalry by bringing manufacturers into direct competition with independent MRO providers.

- OEMs can offer bundled solutions with new aircraft sales, creating a competitive advantage.

- The aftermarket services sector is a growing revenue stream for OEMs, driving their expansion efforts.

Technological Advancements and Innovation

The aerospace aftermarket is experiencing intense competition driven by rapid technological advancements. Companies like AAR are actively investing in areas such as predictive maintenance, additive manufacturing (3D printing), and advanced data analytics. These innovations are crucial for gaining a competitive edge by improving operational efficiency, lowering costs, and delivering more advanced services to customers. For instance, in 2023, the global aerospace additive manufacturing market was valued at approximately $3.5 billion, with significant growth projected as more companies adopt these technologies.

AAR's ability to keep pace with or even lead in adopting these cutting-edge technologies is paramount to its sustained competitiveness. Customers are increasingly seeking partners who can offer sophisticated, digitally enabled solutions. Companies that fail to innovate risk falling behind, as rivals leverage new technologies to enhance their offerings and capture market share. The ongoing race to integrate AI and machine learning into MRO (Maintenance, Repair, and Overhaul) processes further intensifies this rivalry, with early adopters poised to reap substantial benefits in terms of predictive capabilities and cost savings.

- Predictive Maintenance Adoption: Airlines are increasingly adopting predictive maintenance solutions to reduce unscheduled downtime. A 2024 report indicated that 65% of major airlines are either implementing or evaluating predictive maintenance programs.

- Additive Manufacturing Investment: The aerospace industry's investment in additive manufacturing is growing, with a projected CAGR of over 20% through 2028, as companies seek lighter, more complex parts.

- Data Analytics in MRO: Advanced data analytics are transforming MRO operations, enabling better inventory management and more efficient repair processes. Companies leveraging these tools report up to a 15% reduction in operational costs.

- Customer Demand for Innovation: A significant driver of technological adoption is customer demand. A survey of airline procurement managers in 2023 revealed that 75% prioritize suppliers offering technologically advanced solutions.

Competitive rivalry within the aviation aftermarket services market is fierce, with numerous independent MRO providers, airline-owned MRO divisions, and Original Equipment Manufacturers (OEMs) vying for market share. This intense competition is further amplified by the constant pressure for cost-efficiency and competitive pricing, as airlines and defense entities are highly sensitive to operational expenses.

Companies like AAR must continuously differentiate themselves through specialized skills, rapid service delivery, bundled offerings, and expanding their global reach to stand out. The market's growth, with the global aviation MRO market valued at approximately $85 billion in 2024, fuels this competition, pushing players to innovate and optimize their operations.

Original Equipment Manufacturers (OEMs) are increasingly active in the aftermarket, leveraging their proprietary knowledge and direct access to aircraft designs to offer competitive MRO services, often bundling them with new aircraft sales. This strategic move by OEMs intensifies the rivalry for independent providers like AAR, forcing them to focus on unique value propositions and advanced technological integration.

Technological advancements, including predictive maintenance, additive manufacturing, and data analytics, are critical battlegrounds for competitive advantage. AAR's investment in these areas, such as its strong performance in its Parts & Maintenance segment in 2024, highlights the industry's shift towards digitally enabled solutions and the need for continuous innovation to maintain market leadership.

| Competitor Type | Key Competitive Actions | Market Share Impact (Illustrative) | 2024 Market Context |

|---|---|---|---|

| Independent MROs | Cost leadership, specialized repair capabilities, faster turnaround times | Significant, direct competition on core services | Held substantial share of the ~$85 billion global MRO market |

| Airline MRO Divisions | Leveraging in-house expertise, integrated fleet support, potential cost advantages | Can offer bundled services to own fleet, impacting external MRO demand | Focus on fleet efficiency and cost control |

| OEMs | Proprietary knowledge, direct access to designs, bundled aftermarket packages | Increasingly capturing aftermarket revenue, posing direct challenge | Actively expanding MRO capabilities, aiming for larger aftermarket share |

| Specialized Parts Distributors | Supply chain efficiency, inventory management, niche part availability | Crucial for parts procurement, impacting overall MRO cost structure | Integral to the aftermarket supply chain, facing competition on price and availability |

SSubstitutes Threaten

Large commercial airlines and government entities often possess their own in-house maintenance, repair, and overhaul (MRO) facilities and supply chains. This internal capability serves as a direct substitute for AAR's offerings, allowing these organizations to manage maintenance operations themselves. For instance, many major carriers have invested heavily in their own technical operations centers, aiming for greater control over quality and turnaround times.

These entities may opt for in-house maintenance to retain direct control over critical processes, potentially manage costs more effectively by utilizing existing infrastructure and personnel, or to leverage specialized skills already within their organization. This presents a challenge for AAR, as it must clearly articulate its value proposition in terms of cost-efficiency or unique technical expertise to compete with these established internal capabilities.

The emergence of newer aircraft models, such as the Boeing 787 Dreamliner and Airbus A350, presents a significant threat of substitution for traditional Maintenance, Repair, and Overhaul (MRO) services. These advanced aircraft are engineered with composite materials and sophisticated systems that inherently require less frequent and less labor-intensive maintenance compared to older, metal-based airframes. For instance, the 787's design emphasizes reliability and modularity, aiming for extended intervals between heavy checks.

This shift means that while maintenance is still necessary, the nature of the work changes. Instead of extensive, time-consuming overhauls, there's a growing demand for more specialized, component-level repairs and advanced diagnostics. This can directly substitute the need for the broader, more traditional MRO services that companies like AAR have historically relied upon, potentially impacting revenue streams from heavy maintenance.

Component exchange programs pose a significant threat by offering a faster alternative to traditional repair services. Instead of waiting for a faulty part to be fixed, customers can swap it for a readily available, serviceable unit, drastically reducing aircraft downtime. This is particularly appealing for high-value or frequently failing components.

For instance, the global aerospace MRO market, which includes repair services, was valued at approximately $80 billion in 2023 and is projected to grow. Within this, component repair is a substantial segment. Exchange programs directly compete by offering immediate availability, potentially diverting revenue from repair shops.

AAR, while a parts distributor that can participate in these programs, also offers repair services. The growth of exchange programs means customers might bypass AAR’s repair capabilities altogether, choosing the speed and convenience of an immediate swap instead of a potentially longer repair turnaround. This substitution directly impacts the demand for AAR's core repair offerings.

Digital Solutions and Predictive Analytics

Advanced digital solutions and predictive maintenance platforms are emerging as significant substitutes for traditional, reactive repair models in the aviation MRO sector. These technologies, leveraging AI and machine learning, can anticipate equipment failures and optimize maintenance schedules, thereby reducing the need for unscheduled repairs and ad-hoc part replacements. For instance, by 2024, the global predictive maintenance market was projected to reach over $11 billion, indicating a substantial shift towards proactive solutions.

These digital substitutes directly challenge the volume of traditional MRO work by minimizing downtime and extending component life. Companies that can effectively integrate these predictive analytics into their service offerings will likely gain a competitive edge. AAR, like other MRO providers, faces the imperative to adopt and offer these sophisticated digital tools to maintain its market relevance and cater to an evolving industry demand for efficiency and cost reduction.

- Digitalization Threat: Predictive maintenance technologies offer a substitute for reactive repair, aiming to reduce unscheduled downtime and optimize part usage.

- Market Growth: The predictive maintenance market is expanding rapidly, with significant growth expected through 2024 and beyond, signaling a strong customer appetite for these solutions.

- Competitive Imperative: AAR must integrate these advanced digital solutions into its service portfolio to remain competitive and address the industry's drive for efficiency and cost savings.

Alternative Part Sourcing Channels

Customers can increasingly source aircraft parts through alternative channels, including direct purchases from specialized smaller vendors or online marketplaces, potentially bypassing traditional distributors like AAR. This shift is driven by growing market transparency and accessibility, allowing customers to seek more cost-effective options for individual components.

For instance, the global aerospace MRO (Maintenance, Repair, and Overhaul) market, which includes parts sourcing, was valued at approximately $86.7 billion in 2023 and is projected to reach $115.8 billion by 2030, indicating a competitive landscape where alternative sourcing becomes more viable. AAR's extensive supply chain solutions are challenged by this trend, as customers may opt for direct sourcing for specific, less complex parts.

- Direct Procurement: Airlines and MRO providers can build relationships with smaller, specialized manufacturers or repair shops, potentially securing parts at lower prices.

- Online Marketplaces: Digital platforms are emerging that connect buyers and sellers of aircraft parts directly, increasing price competition and offering a wider selection.

- Component Consolidation: Customers might choose to consolidate their parts purchasing strategy, focusing on core, high-value components through established channels like AAR while sourcing more commoditized parts elsewhere.

- Increased Transparency: Greater availability of pricing data and part specifications online empowers buyers to identify and pursue lower-cost alternatives more readily.

The threat of substitutes for AAR's services comes from entities performing MRO in-house, newer aircraft designs requiring less maintenance, component exchange programs, advanced digital predictive maintenance, and alternative parts sourcing channels. These substitutes directly challenge AAR's traditional revenue streams by offering faster, cheaper, or more efficient alternatives.

For instance, the global aerospace MRO market was valued at approximately $86.7 billion in 2023. Within this, the growth of digital predictive maintenance, projected to exceed $11 billion by 2024, highlights a significant shift towards proactive solutions that can reduce the need for traditional repair services.

| Substitute Category | Description | Impact on AAR | Example/Data Point |

|---|---|---|---|

| In-house MRO | Airlines performing maintenance internally | Reduces demand for outsourced services | Major carriers invest in their own technical operations centers |

| Newer Aircraft | Advanced designs requiring less frequent maintenance | Shifts demand from heavy overhauls to specialized repairs | Boeing 787 and Airbus A350 engineered for reduced maintenance |

| Component Exchange | Swapping faulty parts for serviceable units | Bypasses traditional repair services, impacting repair revenue | High-value component exchange offers immediate availability |

| Digital Predictive Maintenance | AI/ML for anticipating failures | Minimizes unscheduled repairs and ad-hoc part needs | Predictive maintenance market projected over $11 billion by 2024 |

| Alternative Sourcing | Direct purchases from smaller vendors/online marketplaces | Challenges AAR's supply chain solutions for commoditized parts | Aerospace MRO market valued at $86.7 billion in 2023 |

Entrants Threaten

Entering the aviation aftermarket services sector, particularly in Maintenance, Repair, and Overhaul (MRO) and parts distribution, demands significant capital. New players must invest heavily in specialized facilities like hangars and repair stations, along with cutting-edge tools and technology.

The need to maintain extensive and diverse inventories of aircraft parts further escalates these initial costs. For instance, a typical MRO provider might need to stock thousands of different part numbers, each with associated warehousing and management expenses. This substantial upfront financial commitment acts as a formidable barrier, deterring many potential competitors from entering the market.

The aviation industry's stringent regulatory environment acts as a significant deterrent to new entrants. Obtaining certifications from bodies like the FAA or EASA for maintenance, repair, and overhaul (MRO) facilities, personnel, and even individual parts is a complex, time-consuming, and costly endeavor. This rigorous process, designed to ensure safety and quality, creates a substantial barrier, making it incredibly difficult for new players to enter the market.

The aerospace aftermarket, particularly for complex maintenance, repair, and overhaul (MRO) services, demands a highly specialized and experienced workforce. This includes certified airframe and powerplant mechanics, aerospace engineers, and skilled logistics professionals with deep industry knowledge. For instance, a recent report indicated a global shortage of aviation technicians, with projections suggesting a need for over 620,000 new technicians between 2023 and 2042 to maintain the existing and growing global fleet. This scarcity makes it incredibly difficult for new entrants to quickly build a competent team.

Developing this essential talent pool from the ground up is both challenging and time-consuming. New companies face significant hurdles in attracting and retaining individuals with the requisite certifications and hands-on experience, as established players like AAR have long-standing relationships and robust training programs. Consequently, new entrants would struggle to rapidly acquire the necessary human capital and institutional knowledge required to compete effectively with incumbents who possess this critical advantage.

Established Customer Relationships and Reputation

Established customer relationships represent a significant barrier to entry for new players looking to compete with companies like AAR. Incumbents have cultivated deep, trust-based connections with key clients, including major airlines, government agencies, and defense contractors. These relationships are built on years of reliable service and proven performance, making it difficult for newcomers to gain a foothold.

New entrants must overcome the challenge of establishing credibility in an industry where customers are inherently risk-averse. They prioritize safety, operational continuity, and a solid track record, all of which take time and consistent delivery to build. For instance, AAR's long history and established reputation for quality maintenance and supply chain solutions provide a significant advantage.

The aerospace sector places a premium on reputation and a proven history of success. Potential new entrants would need to invest heavily in demonstrating their capabilities and building trust to even begin challenging established players. This is evident in the rigorous certification processes and supplier vetting that are standard practice across the industry, making it a high-stakes environment for any new competitor.

Key factors contributing to this barrier include:

- Long-standing partnerships: AAR's established relationships with major airlines and defense contractors are difficult to replicate.

- Trust and reliability: Decades of consistent performance build a level of trust that new entrants must earn.

- Risk aversion of customers: The critical nature of aerospace operations means clients are hesitant to switch to unproven suppliers.

- Industry reputation: A strong track record and positive reputation are paramount and take considerable time to develop.

Complex Supply Chain and Global Network

The threat of new entrants in the aircraft parts and MRO (Maintenance, Repair, and Overhaul) sector is significantly mitigated by the sheer complexity and established nature of global supply chains and logistics networks. Building an efficient, reliable, and far-reaching system for sourcing, stocking, and delivering aircraft components worldwide is a monumental undertaking that requires substantial time, capital, and expertise.

AAR, for instance, has cultivated an impressive global footprint, boasting an extensive network for parts distribution and MRO services. This deeply entrenched infrastructure, developed over decades, presents a formidable barrier for any newcomer. Replicating such a vast and intricate logistical capability, crucial for serving a diverse global clientele effectively, would be an immense challenge for potential entrants.

- AAR's Global Reach: Operates in over 30 countries, facilitating efficient parts distribution and MRO services.

- Logistical Expertise: Years of experience in managing complex international shipping, customs, and inventory for aviation-critical components.

- Network Effects: The established network provides AAR with economies of scale and preferred supplier relationships that are difficult for new players to match.

The threat of new entrants into the aviation aftermarket services sector, particularly in MRO and parts distribution, is substantially low due to the immense capital requirements. New companies need to invest heavily in specialized facilities, advanced technology, and extensive parts inventories, creating a significant financial hurdle. For example, establishing a certified MRO facility can cost tens of millions of dollars.

The stringent regulatory landscape, demanding certifications from authorities like the FAA and EASA, further elevates the barrier to entry. This complex and costly approval process, designed for safety, makes it exceedingly difficult for newcomers to gain market access. Furthermore, the need for a highly skilled and certified workforce, coupled with existing players' strong customer relationships built on trust and reliability, solidifies the position of incumbents.

| Barrier to Entry | Description | Example Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for facilities, technology, and inventory. | A new MRO facility can cost upwards of $50 million to build and equip. |

| Regulatory Hurdles | Complex and costly certifications from aviation authorities (FAA, EASA). | Obtaining necessary certifications can take years and millions in compliance costs. |

| Skilled Workforce | Demand for certified mechanics, engineers, and logistics specialists. | Global technician shortages mean attracting and retaining talent is difficult and expensive. |

| Customer Relationships | Established trust and long-term contracts with airlines and defense sectors. | New entrants must overcome customer risk aversion and prove reliability over time. |

| Supply Chain Complexity | Building efficient global logistics for parts distribution. | Replicating established networks like AAR's, operating in over 30 countries, is a massive undertaking. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company annual filings, and expert interviews. This multi-faceted approach ensures a comprehensive understanding of competitive dynamics.