American Axle & Manufacturing SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Axle & Manufacturing Bundle

American Axle & Manufacturing (AXL) possesses significant strengths in its established market presence and diverse product portfolio, particularly in driveline systems. However, its reliance on the automotive industry, a sector prone to cyclical downturns and technological shifts, presents notable threats. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind AXL's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

American Axle & Manufacturing (AAM) is a premier Global Tier 1 automotive and mobility supplier, a position built on deep-rooted relationships with major original equipment manufacturers (OEMs). This esteemed status grants AAM significant market access and a stable operational base, crucial in the dynamic automotive sector. As of early 2024, AAM's extensive network spans over 75 facilities strategically located across 16 countries, a testament to its robust global manufacturing footprint and supply chain resilience.

American Axle & Manufacturing (AAM) boasts a diverse product portfolio that includes driveline and metal forming technologies. This range covers essential components like axles, driveshafts, and chassis modules, alongside various metal-formed parts. This breadth of offerings is a key strength, as it spreads risk across different product lines and markets.

The company's ability to cater to a wide spectrum of vehicle types, from traditional internal combustion engines to newer electric and hybrid models, is particularly noteworthy. This adaptability ensures AAM remains relevant as the automotive industry shifts towards electrification. For instance, in 2023, AAM continued to secure new business for its electric drive units (EDUs), signaling strong demand for its EV-focused driveline solutions.

American Axle & Manufacturing (AAM) is making significant strides in electrification by investing heavily in advanced electric drive systems. This includes the development of sophisticated 3-in-1 electric drive units (eDUs) and e-Beam axles, which are fundamental components for the growing electric and hybrid vehicle market. These innovations strategically position AAM as a crucial supplier for the future of automotive powertrains.

AAM's commitment to the EV sector is evidenced by recent business wins. In 2024, the company secured deals to supply Xpeng with 3-in-1 electric drive units and is providing e-Beam axles to Skywell. These partnerships underscore AAM's growing influence and capability in the rapidly expanding electric vehicle landscape.

Strong Operational Performance and Cost Control

American Axle & Manufacturing (AAM) has showcased impressive operational resilience, even when facing a tough market. The company's commitment to managing expenses effectively is a significant advantage, allowing it to maintain financial health amidst industry fluctuations.

A key indicator of this strength is AAM's positive year-over-year operating cash flow in the first quarter of 2025. This achievement was directly fueled by successful cost management strategies and enhanced productivity efforts across its operations.

- Robust Operational Performance: AAM consistently delivers strong results despite market headwinds.

- Effective Cost Control: Disciplined expense management bolsters financial stability.

- Positive Q1 2025 Operating Cash Flow: Demonstrates the success of cost and productivity initiatives.

- Navigating Volatility: This operational discipline is vital for enduring industry uncertainties.

Commitment to Sustainability

American Axle & Manufacturing (AAM) demonstrates a strong commitment to sustainability, evidenced by its ambitious climate goals. The company aims to achieve net-zero greenhouse gas emissions across its entire value chain by 2040.

AAM is also making significant strides in renewable energy adoption. Notably, they achieved their target of sourcing 100% renewable and carbon-free energy for their U.S. operations in 2024, one year ahead of their initial schedule.

This proactive stance on reducing carbon emissions and embracing renewable energy sources not only underscores AAM's dedication to environmental responsibility but also serves to enhance its brand reputation. Such commitments are increasingly important for attracting and retaining environmentally conscious investors, customers, and employees.

Key sustainability achievements and commitments include:

- Net-zero emissions target by 2040 across the value chain.

- Achieved 100% renewable and carbon-free energy in U.S. operations in 2024.

- Proactive carbon emission reduction strategies.

- Enhanced appeal to environmentally conscious stakeholders.

AAM's established relationships with major automakers provide a solid foundation for its business, ensuring consistent demand for its products. The company's diverse product range, spanning driveline and metal forming technologies, mitigates risk and allows it to serve various market segments. Furthermore, AAM's strategic investments in electric vehicle components, such as electric drive units and e-Beam axles, position it favorably for the industry's ongoing transition to electrification, as evidenced by recent supply agreements with companies like Xpeng and Skywell in 2024.

| Strength | Description | Supporting Data/Examples |

|---|---|---|

| Customer Relationships | Deep-rooted ties with major OEMs | Stable market access and operational base |

| Product Diversification | Driveline and metal forming technologies | Covers axles, driveshafts, chassis modules, and metal parts |

| Electrification Focus | Investment in EV components | Supply agreements for 3-in-1 EDUs with Xpeng (2024), e-Beam axles for Skywell (2024) |

| Global Footprint | Extensive manufacturing network | Over 75 facilities in 16 countries (early 2024) |

What is included in the product

Delivers a strategic overview of American Axle & Manufacturing’s internal and external business factors, highlighting its product diversification and market position against industry shifts.

Offers a clear, actionable SWOT analysis for American Axle & Manufacturing, pinpointing key areas to address competitive pressures and leverage market opportunities.

Weaknesses

American Axle & Manufacturing (AAM) faces a significant weakness due to its heavy reliance on the automotive industry's inherent cyclicality. Fluctuations in vehicle production, especially in key markets like North America, directly impact AAM's sales and profitability. For instance, the company experienced a notable decline in sales during the first quarter of 2025 compared to the previous year, largely attributed to reduced overall production volumes.

This dependence makes AAM particularly susceptible to economic downturns, shifts in consumer preferences for vehicles, and persistent supply chain disruptions that can throttle production. Such vulnerabilities can lead to unpredictable revenue streams and hinder long-term financial planning.

American Axle & Manufacturing (AAM) faces a significant weakness due to its heavy reliance on a small number of major customers. In 2024, General Motors accounted for approximately 42% of AAM's consolidated net sales, while Stellantis represented about 13%. This concentration creates a substantial risk.

Any disruption in business with these key original equipment manufacturers (OEMs), whether through reduced order volumes or shifts in their procurement strategies, could have a profound negative impact on AAM's financial performance. Such dependency makes the company particularly vulnerable to fluctuations in the automotive industry driven by these large clients.

American Axle & Manufacturing (AAM) has grappled with maintaining healthy profit margins. For instance, the company reported a decrease in net income and adjusted earnings per share in the first quarter of 2025 when compared to the same period in 2024, indicating pressure on profitability.

A significant concern for AAM is its substantial leverage, with a reported net debt of $2.1 billion as of the latest available data. This high level of debt can restrict the company's financial maneuverability and make it more vulnerable to changes in interest rates.

While AAM is actively working to reduce its debt through strategic initiatives like asset disposals and operational synergies, the existing debt burden remains a key weakness. High leverage can impede the company's ability to invest in new technologies or respond effectively to market downturns.

Impact of Geopolitical and Trade Policy Uncertainties

American Axle & Manufacturing (AXL) faces significant headwinds from an unpredictable geopolitical and trade policy landscape. The ongoing uncertainty surrounding trade agreements and potential tariffs, particularly impacting imports from Mexico and Canada, directly threatens AXL's cost structure and supply chain stability. For instance, in 2024, the automotive industry continued to grapple with the potential for tariffs, which could add millions in costs for components and finished goods, impacting profitability.

These external pressures introduce considerable volatility into AXL's operational planning and financial forecasting. The company's reliance on international sourcing and manufacturing means that shifts in trade policy can rapidly escalate operational expenses and disrupt the flow of essential materials. This necessitates a constant state of vigilance and strategic adaptation to mitigate the financial impact of these evolving trade dynamics.

- Trade Policy Volatility: Tariffs on key automotive components imported from Mexico and Canada could increase AXL's cost of goods sold, potentially by several percentage points in affected product lines.

- Supply Chain Disruptions: Geopolitical tensions can lead to unexpected delays or stoppages in the supply chain, impacting production schedules and increasing inventory holding costs.

- Increased Operational Costs: Navigating complex and changing trade regulations requires additional resources for compliance, legal counsel, and supply chain reconfigurations.

- Market Access Challenges: Unfavorable trade policies could limit AXL's access to critical international markets, impacting sales volumes and revenue growth opportunities.

Capital Expenditure Requirements for Transformation

The shift towards electric vehicles and the integration of the Dowlais business demand considerable capital. These strategic moves, while crucial for future expansion, require significant upfront investment that can strain free cash flow in the immediate period.

American Axle & Manufacturing's (AAM) financial projections for 2025 anticipate capital expenditures to be around 5% of its total sales. This level of investment underscores the substantial financial commitment needed to navigate these industry-wide transformations.

- High Capital Outlay: Electrification and the Dowlais integration necessitate substantial capital investments.

- Short-Term Cash Flow Impact: Significant spending may temporarily reduce free cash flow.

- 2025 Capital Spending Target: AAM projects capital expenditures to be approximately 5% of sales for 2025.

AAM's substantial debt load, with net debt reported at $2.1 billion, limits financial flexibility and increases vulnerability to interest rate changes. This high leverage can hinder investments in new technologies and the ability to weather market downturns. While debt reduction efforts are underway, the existing burden remains a key concern.

The company's profitability has been under pressure, with a reported decrease in net income and adjusted earnings per share in Q1 2025 compared to Q1 2024. This indicates challenges in maintaining healthy profit margins amidst operational costs and market conditions.

AAM's heavy reliance on a few major customers, such as General Motors (42% of sales in 2024) and Stellantis (13%), presents a significant risk. Any disruption in business with these key OEMs could severely impact AAM's financial performance.

The ongoing shift towards electric vehicles and the integration of the Dowlais business require significant capital investment, potentially straining free cash flow in the short term. AAM projects capital expenditures to be around 5% of sales for 2025.

What You See Is What You Get

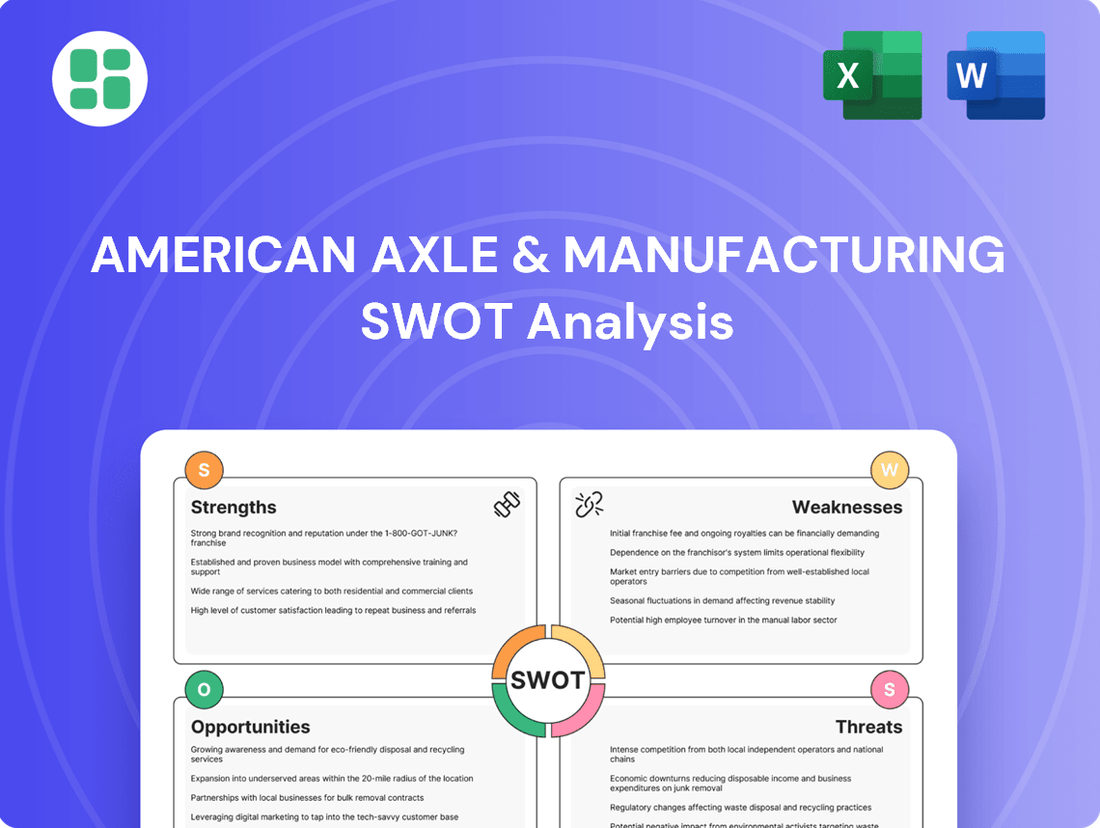

American Axle & Manufacturing SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual American Axle & Manufacturing SWOT analysis, providing a clear overview of its strategic positioning. Upon purchase, you'll gain access to the complete, in-depth report.

Opportunities

The accelerating global transition to electric and hybrid vehicles represents a substantial growth avenue for American Axle & Manufacturing (AAM). The company is strategically investing in and expanding its electrification capabilities, highlighting its advanced e-drive units and e-Beam axles. This focus directly addresses the surging consumer and regulatory demand for more sustainable and fuel-efficient automotive solutions.

AAM is well-positioned to benefit from this market shift, as evidenced by recent business awards for critical electric drive components. These include contracts for e-drive units and e-Beam axles slated for integration into new electric vehicle models launching in 2025. This demonstrates AAM's commitment to innovation and its ability to secure significant partnerships in the rapidly evolving EV landscape.

The planned combination with Dowlais Group, anticipated to finalize by the fourth quarter of 2025, represents a significant strategic shift for American Axle & Manufacturing (AAM). This merger is designed to integrate AAM's established driveline technologies with Dowlais's strengths in powder metallurgy and electric vehicle (EV) drivetrain components.

A key objective of this integration is to achieve considerable cost synergies, with an estimated $300 million targeted. This strategic move is poised to broaden AAM's product portfolio, particularly in the rapidly growing electrification sector, and strengthen its market presence.

Furthermore, the combination is projected to bolster AAM's financial health by facilitating deleveraging, thereby improving its overall capital structure and financial flexibility for future growth initiatives.

American Axle & Manufacturing (AAM) has significant opportunities to grow by entering new global markets. For instance, in 2024, AAM secured new business awards specifically within the Chinese market, signaling a successful initial penetration. This geographic expansion is a key avenue for increasing revenue and diversifying its customer base beyond traditional strongholds.

Looking ahead to 2025, AAM is poised to launch a series of new and replacement programs across a range of important automotive manufacturers. These include significant clients like Stellantis, Audi, and Skywell, indicating strong demand for AAM's driveline and metal forming technologies. This ongoing expansion of programs with established and emerging automakers is a direct driver for future revenue growth and solidifies AAM's market position.

Focus on High-Value Driveline and Metal Forming Technologies

By concentrating on its core strengths in driveline and metal forming technologies, American Axle & Manufacturing (AAM) is strategically positioning itself for future growth across internal combustion engine (ICE), hybrid, and electric vehicle (EV) platforms. This sharpened focus allows for better allocation of resources towards areas with higher potential returns.

A tangible step in this strategic direction is the planned divestiture of its commercial vehicle axle business in India, with a target completion date of July 1, 2025. This move is designed to streamline AAM's operational footprint and enable a deeper concentration on high-growth, high-margin segments within its portfolio.

- Portfolio Optimization: Streamlining operations by divesting non-core assets, such as the Indian commercial vehicle axle business, allows AAM to concentrate capital and expertise on its most promising technology areas.

- Focus on High-Margin Segments: By honing in on driveline and metal forming for all powertrain types, AAM aims to capture higher profit margins associated with advanced technologies and specialized manufacturing.

- Strategic Divestiture: The sale of the Indian commercial vehicle axle business, slated for completion by July 1, 2025, is a clear indicator of AAM's commitment to shedding less profitable or strategically misaligned operations.

- Adaptation to Market Trends: This strategic shift supports AAM's ability to adapt and thrive in the evolving automotive landscape, which increasingly favors electrification and advanced driveline solutions.

Leveraging Advanced Manufacturing and Operational Excellence

American Axle & Manufacturing (AAM) is actively pursuing operational excellence, aiming for efficiency gains through its E4 standards. This focus on streamlined processes and quality control is crucial for maintaining competitiveness in the automotive supply chain.

Investments in advanced manufacturing technologies, including artificial intelligence (AI) and machine learning (ML), are central to AAM's strategy. These technologies are being deployed to optimize production lines, predict maintenance needs, and enhance overall operational efficiency, potentially leading to significant cost reductions.

The company's commitment to these advanced manufacturing and operational excellence initiatives offers several key opportunities:

- Cost Reduction: Implementing AI and ML can automate tasks and improve resource allocation, driving down manufacturing costs. For instance, predictive maintenance can prevent costly unplanned downtime.

- Enhanced Product Quality: Greater precision and control in manufacturing processes, facilitated by advanced technologies, can lead to fewer defects and higher-quality components, strengthening customer trust.

- Improved Customer Relationships: Consistently delivering high-quality products on time and at competitive prices fosters stronger, more reliable relationships with automotive OEMs.

- Competitive Advantage: AAM's dedication to operational excellence and technological adoption positions it favorably against competitors, particularly as the industry shifts towards more complex and technologically advanced vehicle systems.

The strategic combination with Dowlais Group, expected to close by Q4 2025, offers substantial opportunities for AAM. This merger is projected to generate approximately $300 million in cost synergies, enhancing profitability and operational efficiency. It will also broaden AAM's product portfolio, particularly in the high-growth electric vehicle (EV) component sector, and improve its financial flexibility through deleveraging.

Threats

A significant threat to American Axle & Manufacturing (AAM) is the persistent volatility and potential downturn in North American light vehicle production. This directly affects the volume of axles and driveline components AAM sells.

For instance, AAM's first quarter 2025 sales experienced a negative impact due to lower overall production volumes. The company's financial projections for 2025 are built on cautious assumptions regarding potential production reductions by key automakers such as General Motors, Ford, and Stellantis (Ram).

American Axle & Manufacturing (AAM) operates within a fiercely competitive automotive supplier sector, characterized by a multitude of global manufacturers actively seeking original equipment manufacturer (OEM) contracts. This crowded market forces AAM to contend with significant pricing pressures, which directly affect its profit margins and ability to grow its market share.

The need for constant innovation and rigorous cost management is paramount for AAM to not only survive but also to thrive amidst this intense rivalry. For instance, in 2023, the automotive industry saw continued consolidation and strategic partnerships, underscoring the pressure on suppliers to optimize operations and product offerings to remain attractive to major automakers.

American Axle & Manufacturing (AAM) faces significant threats from supply chain disruptions and volatile raw material prices. The automotive industry, and by extension AAM, relies heavily on a complex global network for components and raw materials like steel and aluminum. These disruptions, as seen in 2021 and 2022 with widespread semiconductor shortages, can severely impact production schedules.

Fluctuations in the cost of these essential materials directly squeeze AAM's profit margins. For instance, a sharp increase in steel prices, which are a primary input, can significantly elevate production expenses. This volatility makes it challenging for AAM to accurately forecast costs and maintain consistent profitability, especially when passing on these increases to customers can be difficult in a competitive market.

Rapid Technological Evolution and Obsolescence

The automotive industry's swift technological evolution, especially concerning electrification, presents a significant risk of obsolescence for American Axle & Manufacturing's (AAM) current product lines and manufacturing capabilities. The shift towards electric vehicles (EVs) demands new driveline components and manufacturing processes that differ substantially from traditional internal combustion engine (ICE) systems. For instance, by the end of 2024, it's projected that over 15% of new vehicle sales in the US could be electric, a figure expected to climb significantly by 2025, directly impacting demand for ICE-focused components.

While AAM is actively investing in new technologies, a failure to consistently match or exceed the pace of innovation seen from competitors could erode its market standing. Competitors are rapidly developing and scaling advanced EV driveline systems, battery enclosures, and related technologies. For example, major competitors have announced substantial capital expenditures, upwards of $10 billion through 2027, specifically targeting EV component development and production, highlighting the intense competitive landscape and the imperative for AAM to maintain a strong R&D and capital allocation strategy to avoid falling behind.

- Technological Obsolescence: The rapid shift to EVs threatens AAM's existing ICE-centric product portfolio.

- Pace of Innovation: Competitors' accelerated development of EV technologies poses a risk if AAM cannot match their speed.

- Evolving Industry Standards: Failure to adapt to new EV manufacturing processes and component designs could lead to market exclusion.

- Investment Lag: Insufficient investment in next-generation technologies compared to rivals could result in a competitive disadvantage by 2025.

Economic Downturns and Shifting Consumer Preferences

Economic downturns pose a significant threat to American Axle & Manufacturing (AAM). Factors like rising interest rates, which can dampen consumer spending on big-ticket items like vehicles, directly impact AAM's order volumes. For instance, in early 2024, persistent inflation and the Federal Reserve's cautious stance on interest rate cuts continued to create economic uncertainty, potentially affecting new vehicle sales.

Shifting consumer preferences represent another critical challenge. A notable trend observed through 2024 and projected into 2025 is a potential move away from larger vehicles like trucks and SUVs, which are historically strong revenue drivers for AAM. This shift, if it gains momentum, could lead to reduced demand for AAM's core driveline components. The automotive industry saw a slight softening in SUV and truck sales in certain segments during late 2023 and early 2024, underscoring this risk.

The direct consequence of these economic headwinds and preference changes is a tangible impact on AAM's sales and profitability. Reduced vehicle demand translates into fewer orders for AAM's products, creating a ripple effect throughout its supply chain and financial performance. For example, a 5% year-over-year decline in light truck production in North America during Q1 2024 would directly affect AAM's order book for related components.

- Economic Uncertainty: Rising interest rates and inflation in 2024 continue to create a cautious consumer spending environment, potentially impacting new vehicle purchases.

- Consumer Preference Shifts: A noticeable trend towards more fuel-efficient or smaller vehicles could reduce demand for components used in larger trucks and SUVs, key revenue sources for AAM.

- Reduced Demand: Economic slowdowns and changing consumer tastes directly correlate to lower overall vehicle production, leading to decreased orders for automotive suppliers like AAM.

- Profitability Impact: Lower order volumes resulting from these external factors directly translate into reduced sales and pressure on AAM's profit margins.

The increasing regulatory scrutiny and potential for stricter emissions standards globally pose a significant threat to American Axle & Manufacturing (AAM). Governments worldwide are pushing for cleaner transportation, which could necessitate substantial retooling and investment in new technologies for AAM's traditional driveline components.

For example, the European Union's proposed CO2 emission targets for 2030 and beyond are among the most ambitious, directly impacting the viability of internal combustion engine (ICE) vehicles and, consequently, the demand for AAM's core products. This regulatory pressure is not isolated; similar trends are emerging in North America and Asia, creating a complex and evolving compliance landscape.

Furthermore, the potential for trade disputes and tariffs on key raw materials or finished goods represents another threat. Such actions could disrupt AAM's global supply chain, increase costs, and impact its ability to compete effectively in international markets. For instance, past trade tensions have demonstrated the vulnerability of the automotive sector to sudden policy shifts.

| Threat Category | Specific Risk | Potential Impact on AAM | Industry Trend/Data Point (2024-2025) |

|---|---|---|---|

| Regulatory Environment | Stricter Emissions Standards | Reduced demand for ICE components, need for costly R&D for EV alternatives. | EU targets aim for significant CO2 reductions, impacting ICE vehicle sales. |

| Trade Policy | Tariffs and Trade Disputes | Increased raw material costs, supply chain disruptions, reduced export competitiveness. | Ongoing geopolitical tensions can lead to sudden imposition of trade barriers. |

SWOT Analysis Data Sources

This American Axle & Manufacturing SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and authoritative industry publications, ensuring a robust and data-driven assessment.