American Axle & Manufacturing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Axle & Manufacturing Bundle

American Axle & Manufacturing navigates a complex automotive landscape, facing significant pressure from powerful buyers and intense rivalry. Understanding the dynamics of supplier power and the threat of substitutes is crucial for any stakeholder.

The complete report reveals the real forces shaping American Axle & Manufacturing’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

American Axle & Manufacturing (AAM) sources critical materials like steel and aluminum, alongside specialized driveline components and manufacturing equipment, from a worldwide supplier base. The consolidation of suppliers for these essential, technologically advanced parts can significantly amplify their leverage, particularly when these entities hold proprietary technologies or intellectual property.

The automotive sector's ongoing transition to electric vehicles (EVs) is creating a demand for novel, specialized components, which in turn can narrow the availability of suppliers proficient in these nascent technologies. For instance, in 2024, the global market for EV battery components alone was projected to reach hundreds of billions of dollars, indicating a rapidly evolving supply landscape where specialized knowledge commands a premium.

Switching costs for American Axle & Manufacturing (AAM) can be significant, impacting its bargaining power with suppliers. These costs include expenses for retooling manufacturing equipment, re-validating newly sourced parts to meet stringent automotive quality standards, and reconfiguring intricate supply chains. For instance, developing and approving a new supplier for a critical component like a differential housing can take months and involve substantial engineering resources.

For specialized driveline components and advanced metal-forming technologies, AAM faces particularly high switching costs. Long-term contracts, often tied to specific vehicle platforms, and deeply integrated production processes with existing suppliers lock AAM into these relationships. This integration means that a supplier’s expertise and proprietary processes are often embedded within AAM's own manufacturing, making a transition complex and costly.

As a Tier 1 automotive supplier, AAM is deeply involved in the early stages of its customers' product development, which in turn influences AAM's own supplier relationships. The collaborative nature of this process, where suppliers contribute to design and engineering, creates a high degree of interdependence. This deep integration means that changing a supplier for a key component, like a specialized axle shaft, could necessitate extensive redesign and retesting, further elevating switching costs and empowering incumbent suppliers.

While raw material suppliers typically don't integrate forward, specialized component suppliers for American Axle & Manufacturing (AAM) could potentially develop capabilities to produce more complex modules or systems. This would allow them to compete directly with AAM in certain product segments.

However, the significant capital investment required and the intricate, long-standing relationships within the Tier 1 automotive supply chain present substantial hurdles for most component suppliers attempting full forward integration. For instance, the automotive supply chain often involves years of development and testing, making it difficult for new entrants or integrating suppliers to gain traction.

The threat of forward integration is notably higher for suppliers of highly innovative components, particularly those in the rapidly evolving electric vehicle (EV) market. As EV technology advances, suppliers with unique battery pack integration or advanced thermal management systems might find it more feasible to move up the value chain.

Importance of Supplier's Input to AAM's Product

The quality, reliability, and technological sophistication of inputs from American Axle & Manufacturing's (AAM) suppliers are absolutely critical to the performance and safety of its driveline and metal forming products. Any disruption or quality issue from a key supplier can severely impact AAM's production schedules and its hard-earned reputation within the automotive industry. This leverage for suppliers is further amplified by the extremely stringent quality and performance requirements imposed by automotive original equipment manufacturers (OEMs), who demand flawless components.

This dependency translates into significant bargaining power for AAM's suppliers, especially those providing specialized or proprietary components. For instance, in the automotive sector, suppliers of advanced materials or unique manufacturing processes can command higher prices and more favorable terms. AAM's reliance on these specialized inputs means that finding alternative suppliers quickly and without compromising quality is often a considerable challenge.

- Criticality of Inputs: Suppliers providing essential components for AAM's driveline systems and metal-formed parts hold substantial power due to the direct impact on product performance and safety.

- OEM Demands: The high quality and performance standards set by automotive OEMs necessitate reliable suppliers, increasing their negotiating leverage with AAM.

- Supplier Specialization: Suppliers offering unique technologies or materials crucial to AAM's product differentiation can exert significant influence over pricing and contract terms.

- Production Disruption Risk: Any supply chain interruption or quality failure from a key supplier poses a direct threat to AAM's manufacturing output and market reputation.

Availability of Substitute Inputs

The availability of substitute raw materials or components for American Axle & Manufacturing (AAM) generally acts as a check on supplier power. However, for highly engineered or proprietary components critical to advanced driveline systems, such as specific lightweight alloys or specialized gears for electric vehicles (EVs), the scarcity of readily available substitutes can significantly elevate the bargaining power of those niche suppliers.

Global supply chain disruptions, which have been a recurring theme in recent years, can further exacerbate this situation by limiting the accessibility of alternative inputs. For instance, in 2023, the automotive industry continued to grapple with semiconductor shortages, impacting the availability of electronic components essential for modern drivelines and giving semiconductor suppliers considerable leverage.

- Limited Substitutes for Advanced EV Components: Suppliers of specialized materials and components for EV drivetrains, like high-performance battery cooling systems or advanced motor housings, often face few direct substitutes, enhancing their bargaining position.

- Impact of Supply Chain Volatility: Disruptions in the supply of critical raw materials, such as rare earth metals or specific steel alloys, can reduce AAM's options for sourcing, thereby increasing the power of suppliers who can still deliver.

- Proprietary Technology as a Barrier: Suppliers holding patents or unique manufacturing processes for essential driveline parts can command higher prices due to the lack of viable alternatives for AAM.

The bargaining power of suppliers for American Axle & Manufacturing (AAM) is considerable, particularly for specialized components and advanced materials critical to its driveline and metal-forming products. The automotive industry's stringent quality demands, coupled with AAM's reliance on suppliers for unique technologies or proprietary processes, significantly amplify supplier leverage. This is further intensified by the limited availability of substitutes for highly engineered parts, especially those related to the burgeoning electric vehicle (EV) market.

For instance, suppliers of advanced battery cooling systems or specialized motor housings for EVs often face few direct alternatives, allowing them to command higher prices and more favorable contract terms. The ongoing volatility in global supply chains, as seen with semiconductor shortages impacting the automotive sector in 2023, further restricts AAM's sourcing options, bolstering the power of suppliers who can consistently deliver.

The criticality of inputs cannot be overstated; any disruption or quality lapse from a key supplier directly jeopardizes AAM's production schedules and its reputation. This dependency, combined with the high switching costs associated with retooling and re-validating new suppliers for complex driveline systems, creates a substantial advantage for incumbent suppliers.

| Supplier Characteristic | Impact on AAM | Example (2024 Data Context) |

|---|---|---|

| Specialized Component Expertise | Elevates supplier bargaining power | Suppliers of advanced EV axle shafts or unique gear sets |

| Proprietary Technology/IP | Increases supplier leverage and pricing power | Suppliers with patented manufacturing processes for lightweight alloys |

| Limited Substitutes for Niche Parts | Restricts AAM's options, empowering suppliers | Providers of specific thermal management components for EV drivetrains |

| OEM Quality Demands | Enhances supplier reliability and negotiation strength | Suppliers meeting stringent OEM specifications for safety-critical driveline parts |

What is included in the product

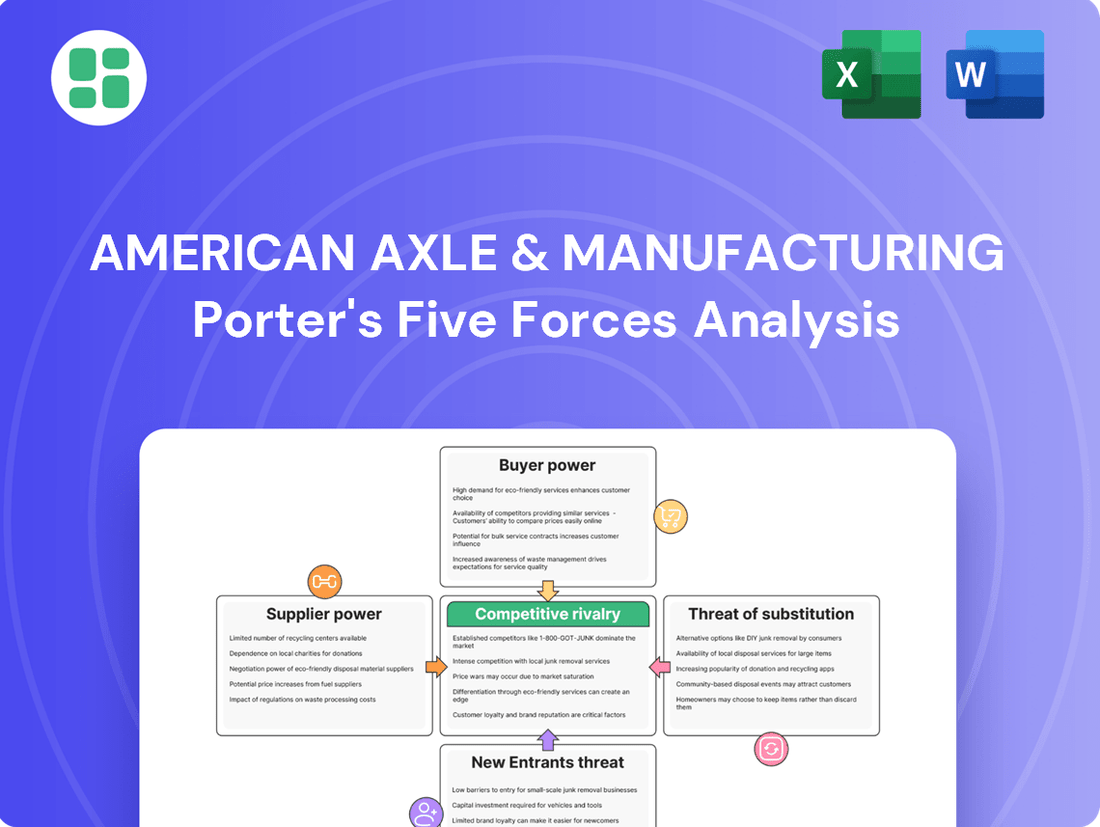

This analysis reveals the intense rivalry among existing players, the bargaining power of large automotive OEMs, and the threat of new entrants and substitutes impacting American Axle & Manufacturing's profitability.

Effortlessly navigate competitive pressures by isolating the impact of each of Porter's Five Forces on American Axle & Manufacturing, allowing for targeted strategic adjustments.

Customers Bargaining Power

American Axle & Manufacturing's (AAM) customer base is heavily concentrated among a few major global automotive and commercial vehicle original equipment manufacturers (OEMs). For example, in 2023, Ford and General Motors collectively represented a significant portion of AAM's net sales, underscoring the power these large buyers wield.

These OEMs purchase components in extremely high volumes, which naturally grants them considerable bargaining leverage. This volume purchasing allows them to negotiate favorable pricing and terms, putting pressure on suppliers like AAM to remain competitive.

The automotive sector is characterized by long-term supply agreements where price sensitivity is a constant factor. Consequently, customers can effectively demand competitive pricing and advantageous contract conditions, directly impacting AAM's profit margins.

For Original Equipment Manufacturers (OEMs), switching from a long-standing Tier 1 supplier like American Axle & Manufacturing (AAM) for essential driveline and metal-formed parts presents significant hurdles. These switching costs are substantial, encompassing the need for extensive re-engineering of vehicle platforms, rigorous re-testing of components, and a full re-validation process, which can easily run into millions of dollars and months of development time.

This deep integration with AAM’s established systems and product lines creates a considerable degree of customer stickiness. However, the automotive industry is dynamic, and OEMs are perpetually evaluating emerging technologies and alternative suppliers. This ongoing assessment is driven by a desire to optimize both cost structures and overall vehicle performance, a trend that has been amplified by the industry-wide transition towards electric vehicles (EVs).

Major automotive original equipment manufacturers (OEMs) often have the financial muscle and technical know-how to bring some driveline or metal forming component production in-house. This capability, even if not fully exercised, gives them significant negotiating leverage. For instance, in 2024, the automotive industry saw continued investment in advanced manufacturing technologies, making in-house production of certain components more feasible for large players.

While producing highly specialized or capital-intensive components internally is less common for OEMs focused on vehicle assembly, the underlying threat of backward integration remains a powerful tool. This potential for in-house production can influence pricing and contract terms, especially for components that are not deeply proprietary or require massive, unique investments. The ongoing evolution of modular vehicle platforms also plays a role, potentially making it easier for OEMs to bring certain standardized parts into their own operations.

Price Sensitivity of Customers

Automotive Original Equipment Manufacturers (OEMs) face a fiercely competitive landscape, making them acutely sensitive to pricing. This intense market pressure compels them to consistently seek cost reductions from their suppliers, directly influencing American Axle & Manufacturing's (AAM) profit margins. In 2023, the global automotive market saw significant price fluctuations, with many OEMs reporting increased input costs yet struggling to pass these entirely onto consumers, intensifying their supplier negotiations.

- OEMs' competitive environment necessitates aggressive cost management.

- This translates into direct pricing pressure on suppliers like AAM.

- Global automotive market dynamics in 2023 highlighted this price sensitivity.

Product Standardization and Differentiation

The bargaining power of customers for American Axle & Manufacturing (AAM) is influenced by product standardization and differentiation. While some of AAM's components may be viewed as standard, making price comparisons easier for buyers, the company actively works to differentiate its offerings.

AAM's innovation in driveline and metal forming technologies, particularly for electric and hybrid vehicles, aims to reduce customer price sensitivity. For instance, their focus on advanced solutions for the evolving automotive market, including EV applications, provides a competitive edge.

- Product Standardization: Certain AAM components may be commoditized, increasing customer leverage through easy price shopping among suppliers.

- Differentiation through Innovation: AAM's investment in advanced technologies, such as those for electric and hybrid vehicles, creates unique value propositions.

- Reduced Price Sensitivity: Successful differentiation can lead to customers being less focused on price and more on performance, efficiency, and technological advancement.

- Market Position: By offering specialized solutions, AAM seeks to move away from being purely a price-driven supplier.

The significant bargaining power of American Axle & Manufacturing's (AAM) customers, primarily major automotive OEMs, is a key factor influencing its market position. These large buyers, such as Ford and General Motors, represent substantial portions of AAM's sales, giving them considerable leverage in negotiations. For example, in 2023, these two customers alone accounted for a significant percentage of AAM's revenue, highlighting their influence.

The high volume of components purchased by OEMs allows them to demand competitive pricing and favorable contract terms, directly impacting AAM's profitability. Furthermore, the substantial switching costs associated with re-engineering and re-validating new suppliers create customer stickiness, though OEMs continuously explore alternatives to optimize costs, a trend amplified by the electric vehicle transition.

The threat of backward integration, where OEMs could potentially bring some component manufacturing in-house, also serves as a powerful negotiation tool for customers. This capability is becoming more feasible for large players due to ongoing investments in advanced manufacturing technologies within the automotive sector in 2024.

Customer bargaining power is also shaped by product differentiation. While some AAM components may be standardized, the company's innovation in areas like electric vehicle driveline solutions aims to reduce price sensitivity by offering unique value.

| Customer Type | Key Bargaining Factors | Impact on AAM | 2023/2024 Data Point |

|---|---|---|---|

| Major Automotive OEMs | High Purchase Volume, Switching Costs, Threat of Backward Integration, Price Sensitivity | Pressure on Pricing and Profit Margins, Need for Continuous Innovation | Ford & GM represented a significant portion of AAM's 2023 net sales. |

| Commercial Vehicle OEMs | Similar to Automotive OEMs, potentially longer product cycles | Consistent demand, but also price pressure | Data not publicly broken out separately for 2023/2024 in a way that isolates bargaining power impact. |

Preview Before You Purchase

American Axle & Manufacturing Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for American Axle & Manufacturing, detailing the competitive landscape and strategic implications you will receive immediately after purchase. The document you see here is the exact, professionally formatted analysis, ready for your immediate download and use. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this comprehensive breakdown of industry forces.

Rivalry Among Competitors

The global automotive driveline and metal forming industry is quite concentrated, with several large, established Tier 1 suppliers vying for market share alongside American Axle & Manufacturing (AAM). Key players like Dana Incorporated, Magna International, GKN Automotive, and BorgWarner Inc. operate within this space, creating an oligopolistic market structure. This means a few dominant companies, including AAM, face intense competition.

The automotive industry's growth rate presents a complex landscape for American Axle & Manufacturing. While the broader global auto parts market is anticipated to expand at a 3.2% compound annual growth rate between 2024 and 2029, the driveline segment specifically is projected for robust growth, with an estimated 8.97% CAGR from 2025 to 2034.

However, this growth is overshadowed by significant industry-wide uncertainty stemming from the ongoing transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs). This shift intensifies competition as companies vie for new business opportunities specifically tied to EV technology and production.

Competitive rivalry within the automotive supplier industry, particularly for driveline solutions, is intensely fueled by product differentiation and ongoing innovation. Companies are vying to develop advanced, lightweight, and highly efficient driveline systems, especially those tailored for the burgeoning electric and hybrid vehicle markets.

American Axle & Manufacturing (AAM) significantly invests in research and development, focusing on next-generation EV drivelines and advanced metal forming technologies. This commitment to R&D is vital for AAM to maintain its competitive standing and capture market share in this rapidly evolving sector. For instance, in 2023, AAM reported R&D expenses of $314.8 million, underscoring its dedication to technological advancement.

The innovation landscape is currently dominated by developments in e-axles and integrated drive units. These sophisticated components represent a critical battleground where suppliers differentiate themselves through performance, efficiency, and integration capabilities. AAM's strategic focus on these areas positions it to capitalize on the industry-wide shift towards electrification.

Exit Barriers

American Axle & Manufacturing, like many in the automotive components sector, faces substantial exit barriers. These are largely driven by the immense capital required for specialized manufacturing plants and equipment, often costing hundreds of millions of dollars. For instance, setting up a new stamping or driveline facility can easily run into the tens or hundreds of millions, making divestment a costly undertaking.

The industry also relies on highly specialized labor, from engineers skilled in complex manufacturing processes to technicians proficient in maintaining advanced machinery. This specialized workforce is not easily transferable to other industries, increasing the difficulty and cost of exiting. Furthermore, long-term supply contracts with Original Equipment Manufacturers (OEMs) create further entanglement, binding companies to production schedules and commitments that are hard to break without penalty.

These high fixed costs and specialized assets mean that even during periods of reduced demand or profitability, companies like American Axle & Manufacturing find it challenging to simply shut down operations. This inertia perpetuates competitive pressure, as firms are incentivized to continue operating, albeit at lower margins, rather than incur significant losses from exiting. In 2024, the automotive industry continued to navigate supply chain complexities and fluctuating demand, underscoring the sticky nature of capital in this sector.

- High Capital Investment: Significant upfront costs for specialized plants and machinery.

- Specialized Workforce: Difficulty in reallocating or retraining skilled labor for other sectors.

- Long-Term OEM Contracts: Commitments that create ongoing obligations and penalties for early termination.

- Asset Specificity: Manufacturing equipment is often designed for very specific automotive components, limiting resale value or alternative use.

Strategic Alliances and Acquisitions

Strategic alliances, joint ventures, and mergers and acquisitions significantly influence the competitive landscape. Companies leverage these strategies to bolster technological prowess, expand market share, and increase their geographic footprint. A prime example is American Axle & Manufacturing's (AAM) announced combination with Dowlais Group, a move designed to strengthen AAM's competitive standing in the automotive supplier market.

This consolidation trend is evident across the industry as firms seek scale and diversification. For instance, in 2024, the automotive supplier sector has seen ongoing M&A activity as companies adapt to evolving vehicle technologies and global supply chain dynamics. These strategic maneuvers often result in a more concentrated market, intensifying rivalry among the remaining players.

- Strategic Consolidation: The automotive supplier industry continues to consolidate, with companies like AAM actively pursuing combinations to enhance their market position.

- Technological Advancement: Alliances and acquisitions are crucial for gaining access to new technologies, such as those related to electric vehicles and advanced driver-assistance systems, which are critical for future competitiveness.

- Market Share Expansion: Mergers and acquisitions provide a direct route to increasing market share, both domestically and internationally, allowing companies to achieve greater economies of scale.

- Competitive Response: AAM's combination with Dowlais Group is a strategic response to competitive pressures, aiming to create a more robust entity capable of navigating industry shifts and outperforming rivals.

Competitive rivalry is a significant force for American Axle & Manufacturing (AAM) within the concentrated automotive driveline and metal forming sector. Major players like Dana Incorporated and Magna International intensify this rivalry, pushing for innovation in areas like e-axles and integrated drive units, critical for the EV transition.

AAM's substantial R&D investment, reaching $314.8 million in 2023, highlights the need to stay ahead in developing advanced driveline systems for electric and hybrid vehicles. This intense competition is further shaped by strategic consolidations, such as AAM's combination with Dowlais Group, aiming to bolster market position and technological capabilities in response to industry shifts.

| Competitor | Focus Area | 2023 Revenue (Approx. USD Billions) |

|---|---|---|

| Magna International | Driveline, Body & Interiors, Seating | 42.7 |

| Dana Incorporated | Driveline, Sealing, Thermal Management | 10.5 |

| GKN Automotive | Driveline systems, EV components | N/A (Part of Melrose Industries) |

| BorgWarner Inc. | Drivetrain, Electrification, Emissions | 10.3 |

SSubstitutes Threaten

The most significant threat of substitution for American Axle & Manufacturing (AAM) stems from the accelerating shift in vehicle architectures, specifically the move away from traditional internal combustion engine (ICE) drivelines towards electric vehicle (EV) powertrains. This transition directly impacts AAM's core business.

While AAM is actively involved in supplying components for both ICE and EV platforms, the increasing adoption of e-axles and integrated electric drive units (EDUs) presents a direct substitution for conventional axles and driveshafts. For instance, by the end of 2023, EV sales in the US had surpassed 1.2 million units, a significant increase from previous years, highlighting the growing market for these alternative technologies.

The ongoing evolution of vehicle propulsion systems presents a significant threat of substitutes for American Axle & Manufacturing (AAM). Beyond the widely discussed shift to full electric vehicles (EVs), the continuous development of advanced hybrid vehicle systems and hydrogen fuel cell technologies could also fundamentally alter the demand for AAM's traditional driveline components.

As these alternative powertrain technologies mature and capture increasing market share, they are likely to require different or fewer of the specialized components AAM currently produces. For instance, the simpler architecture of many EV drivetrains, often lacking traditional driveshafts and complex gear sets, directly challenges AAM's legacy product lines. In 2024, the global EV market continued its robust expansion, with sales expected to exceed 15 million units, highlighting the growing impact of this substitution trend.

The emergence of advanced lightweight materials like carbon fiber composites and innovative manufacturing techniques such as additive manufacturing (3D printing) presents a significant threat of substitution for traditional metal-formed components. These new technologies offer potential advantages in weight reduction and design flexibility, which could displace AAM's core metal-forming capabilities if the company fails to adapt.

In-house Production by OEMs

Automotive original equipment manufacturers (OEMs) have the potential to bring driveline and metal-formed part production in-house, directly substituting suppliers like American Axle & Manufacturing (AAM). This move, while capital-intensive, is a strategic option for major OEMs seeking greater control over their supply chains and cost structures, particularly for high-volume or critical components. For instance, in 2024, major automotive players continued to explore vertical integration to mitigate supply chain risks and capture more value internally.

The threat of in-house production by OEMs represents a significant competitive pressure. OEMs might decide to manufacture key components themselves, reducing their reliance on external suppliers. This could involve significant upfront investment in new facilities and technology, but the long-term benefits of supply chain control and potential cost savings can be compelling for large-scale manufacturers. As of early 2024, reports indicated that several leading automotive groups were evaluating or expanding their internal manufacturing capabilities for specific powertrain and chassis elements.

- OEM Vertical Integration: Automakers exploring in-house production of driveline and metal-formed parts as a substitute for external suppliers.

- Strategic Cost and Control: OEMs may pursue this to gain leverage over supply chains and manage costs more effectively.

- Investment Threshold: Significant capital outlay is required, making it a more feasible option for larger, well-capitalized OEMs.

- Market Trends (2024): Continued industry interest in vertical integration to enhance resilience and capture value.

Alternative Mobility Solutions

The growing availability of alternative mobility solutions poses a significant threat. As ride-sharing services and the eventual widespread adoption of autonomous vehicles become more prevalent, personal vehicle ownership could decline. This shift might reduce the overall demand for traditional automotive components like those American Axle & Manufacturing (AAM) produces, impacting production volumes. For instance, the global ride-sharing market was valued at approximately $100 billion in 2023 and is projected to grow substantially, potentially altering the landscape of individual car purchases.

Advanced air mobility, such as personal drones or air taxis, also represents a nascent but potentially disruptive substitute. While still in early development, a significant shift towards these forms of transportation could further diminish the need for conventional ground vehicle driveline and metal forming components. The long-term implications of these evolving transportation models are a key consideration for AAM's strategic planning.

- Ride-sharing services are projected to capture a larger share of urban transportation.

- Autonomous vehicle technology could lead to fewer privately owned vehicles.

- Advanced air mobility offers a potential alternative for certain travel needs.

The escalating shift to electric vehicles (EVs) presents a primary substitution threat for American Axle & Manufacturing (AAM) as e-axles and integrated electric drive units (EDUs) replace traditional driveline components. In 2024, the global EV market continued its strong growth, with sales anticipated to surpass 15 million units, underscoring the increasing demand for these alternative technologies and the corresponding decline in demand for AAM's legacy products.

Furthermore, the potential for automotive original equipment manufacturers (OEMs) to bring driveline and metal-formed part production in-house poses a direct substitution risk. This vertical integration strategy, explored by major OEMs in 2024 to enhance supply chain control and manage costs, could reduce AAM's market opportunities. The increasing adoption of alternative mobility solutions, like ride-sharing, also threatens to lower overall demand for new vehicles and their associated components.

| Substitution Threat | Description | 2024 Market Context/Impact |

| Electric Vehicle Powertrains | E-axles and EDUs replacing traditional axles and driveshafts. | Global EV sales projected over 15 million units, impacting demand for ICE components. |

| OEM Vertical Integration | Automakers producing components internally. | OEMs actively exploring in-house production for supply chain control and cost savings. |

| Alternative Mobility Solutions | Reduced personal vehicle ownership due to ride-sharing and AVs. | Ride-sharing market valued around $100 billion in 2023, indicating a shift in transportation patterns. |

Entrants Threaten

The automotive driveline and metal forming sectors are notoriously capital-intensive. American Axle & Manufacturing, like its peers, requires substantial upfront investment in advanced manufacturing plants, sophisticated machinery, and ongoing research and development. For instance, establishing a new, fully operational driveline manufacturing facility can easily run into hundreds of millions of dollars, a significant hurdle for potential new players.

Tier 1 automotive suppliers like American Axle & Manufacturing (AAM) benefit from deeply entrenched relationships with major global automakers, often built over many years. These long-standing partnerships are crucial, as OEMs prioritize reliability and proven performance, making it difficult for newcomers to infiltrate these established supply chains.

For instance, AAM's consistent supply of driveline components to major manufacturers like General Motors and Stellantis, which have been key customers for decades, underscores the difficulty new entrants face. Breaking into these intricate networks requires not only competitive pricing but also a demonstrated history of quality and on-time delivery, a hurdle that can take years to overcome.

American Axle & Manufacturing (AAM) and its established competitors hold a significant advantage due to their extensive proprietary technology, patents, and deep manufacturing expertise in driveline and metal forming. This technological moat is substantial.

The development of comparable advanced technologies, crucial for both traditional internal combustion engine vehicles and the rapidly growing electric vehicle (EV) market, demands massive research and development investments and considerable time. For instance, AAM's ongoing investments in EV technology development underscore the capital intensity required to stay competitive.

These high barriers to entry, stemming from the need for significant R&D and the time required to build comparable technological capabilities, effectively deter potential new entrants from easily entering the market, thereby protecting incumbent players like AAM.

Economies of Scale and Experience Curve

Existing players in the automotive supply chain, like American Axle & Manufacturing (AXL), benefit from substantial economies of scale. This means they can produce parts at a lower cost per unit due to high production volumes and bulk purchasing power. For instance, AXL's extensive global manufacturing footprint allows for optimized production runs, a significant barrier for any newcomer trying to match their cost structure.

The experience curve further solidifies the advantage of incumbents. Over years of operation, companies like AXL refine their manufacturing processes, improve quality control, and develop specialized knowledge. This accumulated expertise translates into greater efficiency and reliability, making it difficult for new entrants to compete on operational excellence without a similar track record.

- Economies of Scale: Established manufacturers achieve lower per-unit costs through high-volume production and bulk purchasing, creating a cost barrier for new entrants.

- Experience Curve: Incumbents possess refined processes and quality control due to years of operation, offering a competitive edge in efficiency and reliability.

- Capital Investment: Building new, large-scale manufacturing facilities to match existing players' output requires immense upfront capital, deterring potential entrants.

- Supplier Relationships: Long-standing relationships with suppliers can secure better pricing and terms for established firms, a difficult advantage for new companies to replicate quickly.

Regulatory and Certification Hurdles

The automotive sector is heavily regulated, demanding adherence to strict safety, quality, and environmental standards. For instance, the U.S. Environmental Protection Agency (EPA) sets emissions standards, and the National Highway Traffic Safety Administration (NHTSA) mandates safety features. New companies must invest significant capital and time to navigate these complex requirements and obtain necessary certifications, making entry challenging.

These regulatory and certification processes represent a substantial barrier to entry. Potential new entrants face considerable time and cost burdens to demonstrate compliance with intricate specifications for components and manufacturing processes. This adds to the overall investment needed to compete effectively.

- Regulatory Complexity: Navigating diverse global automotive safety and environmental regulations (e.g., Euro 7 standards for emissions) requires extensive legal and technical expertise.

- Certification Costs: Obtaining certifications for critical components, such as those meeting ISO 26262 functional safety standards, can cost millions of dollars and take years.

- Capital Investment: New entrants must invest heavily in R&D and manufacturing capabilities to meet these stringent requirements, diverting resources from other strategic initiatives.

The threat of new entrants in the automotive driveline and metal forming sectors, where American Axle & Manufacturing (AAM) operates, is generally low due to significant barriers. These include the immense capital required for manufacturing facilities, the difficulty of replicating established supplier relationships, and the need for advanced proprietary technology. For example, in 2024, the cost of building a new automotive manufacturing plant can easily exceed $1 billion, a prohibitive sum for most newcomers. Furthermore, the time and investment needed to develop the specialized expertise and secure certifications for components, like those meeting stringent ISO 26262 functional safety standards, can take years and cost millions, effectively deterring potential entrants.

| Barrier Type | Description | Example Impact (2024) |

|---|---|---|

| Capital Requirements | High cost of establishing manufacturing plants and acquiring advanced machinery. | New EV component plant: $500M - $2B+ |

| Supplier Relationships | Entrenched, long-term partnerships with OEMs are hard to break into. | Securing a Tier 1 contract with a major automaker can take 3-5 years of demonstrated performance. |

| Technology & Expertise | Need for proprietary technology, patents, and deep manufacturing know-how. | R&D investment for advanced e-axle technology: $50M - $200M annually per company. |

| Regulatory & Certification | Compliance with strict safety, environmental, and quality standards. | Obtaining safety certifications: $1M - $5M+ per component family. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American Axle & Manufacturing is built upon a foundation of publicly available financial reports, investor presentations, and industry-specific trade publications. We also leverage data from market research firms and automotive industry news outlets to capture current market dynamics and competitive landscapes.