American Axle & Manufacturing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Axle & Manufacturing Bundle

American Axle & Manufacturing operates within a dynamic global automotive landscape, influenced by shifting political regulations, economic fluctuations, and evolving technological advancements. Understanding these external forces is crucial for strategic planning and identifying future opportunities. Our comprehensive PESTLE analysis dives deep into these factors, providing actionable intelligence. Download the full version now and gain the clarity you need to navigate the complexities of the automotive supply chain.

Political factors

Government policies, especially those encouraging electric vehicle (EV) adoption through incentives, significantly shape the demand for American Axle & Manufacturing's (AAM) EV driveline parts. These policies are crucial as they directly impact consumer purchasing decisions and, by extension, the volume of EV production. For instance, the US Inflation Reduction Act (IRA) provides tax credits for EV purchases, influencing market dynamics.

Despite some regional slowdowns in EV sales growth, ambitious government targets continue to propel the market forward. China, a major automotive market, has set a goal for electric vehicles to represent 50% of new car sales by 2025, a target that directly benefits suppliers like AAM. This commitment underscores the ongoing global shift towards electrification, creating sustained demand for specialized components.

However, policy uncertainty, such as potential alterations to EV tax credits or emissions standards, can introduce volatility. Fluctuations in government support can affect consumer adoption rates, leading to unpredictable shifts in demand for AAM's products and potentially impacting the company's strategic focus on EV components.

Uncertainty surrounding potential tariffs, particularly from a new U.S. administration on imported vehicles and auto parts, presents a considerable risk to the automotive supply chain. These proposed tariffs could directly increase production costs for companies like American Axle & Manufacturing (AAM) by raising the price of imported components and raw materials. For instance, if tariffs were implemented at a rate of 10-25% on key automotive parts, it could significantly impact AAM's cost of goods sold, especially given its global sourcing strategies.

Stricter global emissions regulations are pushing the automotive industry towards electrification. For instance, the European Union aims for a significant CO2 reduction by 2025 and plans to ban new internal combustion engine (ICE) vehicles by 2035. This regulatory landscape directly impacts American Axle & Manufacturing (AAM) by demanding continuous investment and innovation in electric and hybrid driveline technologies to ensure compliance and avoid potential penalties.

Geopolitical Stability and Supply Chain Resilience

Geopolitical instability and the ongoing fallout from supply chain disruptions, such as the persistent semiconductor shortage, continue to present significant hurdles for the automotive sector. These global events directly impact the availability and cost of essential components, affecting production schedules and delivery timelines for companies like American Axle & Manufacturing (AAM).

As a major Tier 1 automotive supplier, AAM's ability to maintain consistent production and meet customer demand hinges on its strategic approach to navigating these complex geopolitical landscapes. Diversifying its supplier base and actively working to build more robust and resilient supply chains are critical for mitigating risks and ensuring operational continuity.

- Supplier Diversification: AAM is actively pursuing strategies to reduce reliance on single-source suppliers, particularly for critical components like semiconductors and specialized materials. This involves identifying and onboarding new suppliers in different geographic regions.

- Inventory Management: The company is re-evaluating its inventory strategies, potentially increasing buffer stock for key components to cushion against unexpected disruptions. This balancing act aims to avoid excessive carrying costs while enhancing preparedness.

- Regional Sourcing: AAM is exploring opportunities for more regionalized sourcing of materials and components to shorten lead times and reduce exposure to distant geopolitical risks. This aligns with a broader industry trend towards nearshoring.

- Technology Investment: Investing in advanced manufacturing technologies and automation can also contribute to supply chain resilience by increasing production flexibility and reducing dependence on labor availability, which can be affected by geopolitical factors.

Government Investment in Infrastructure

Government investment in infrastructure, particularly in areas like electric vehicle (EV) charging networks and smart city technologies, directly benefits companies like American Axle & Manufacturing (AAM). These initiatives are projected to stimulate demand across the automotive and commercial vehicle sectors. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, allocated billions towards transportation infrastructure, including the build-out of a national EV charging network. This spending is expected to accelerate EV adoption, creating new opportunities for AAM's driveline and powertrain components.

The expansion of EV charging infrastructure is a key driver for the growth of the electric vehicle market. As more charging stations become available, consumer confidence in EVs increases, leading to higher sales. This, in turn, translates to greater demand for the specialized components AAM produces for electric and hybrid vehicles. The company's ability to adapt its product portfolio to meet the evolving needs of the automotive industry, driven by these government investments, is crucial for its future success.

Furthermore, smart city initiatives often incorporate advanced transportation systems, including autonomous vehicles and connected infrastructure. These developments require sophisticated driveline and chassis components, areas where AAM has significant expertise. The U.S. Department of Transportation's Smart City Challenge, though concluded, highlighted the ongoing commitment to integrating technology into urban mobility, signaling continued future investment in related areas. Such trends support AAM's strategy to diversify its offerings and capitalize on emerging market demands.

Key impacts of government infrastructure investment on AAM include:

- Increased demand for EV components: Government funding for EV charging networks directly supports the growth of the EV market, boosting sales of electric and hybrid vehicles and, consequently, AAM's specialized driveline systems.

- Opportunities in commercial vehicles: Investments in infrastructure also drive demand for commercial vehicles, a sector where AAM supplies critical components for both traditional and electrified powertrains.

- Support for technological innovation: Smart city initiatives and the push for connected mobility encourage the development and adoption of advanced vehicle technologies, aligning with AAM's focus on innovation and future-proofing its product lines.

- Economic stimulus for the automotive sector: Broader infrastructure spending creates a more robust economic environment, leading to increased consumer and business spending on vehicles, benefiting AAM's overall sales performance.

Government policies, particularly those supporting electric vehicle (EV) adoption, directly influence demand for American Axle & Manufacturing's (AAM) driveline components. For instance, the U.S. Inflation Reduction Act's EV tax credits are a significant factor. Furthermore, international targets, such as China's aim for 50% of new car sales to be electric by 2025, create sustained demand for AAM's specialized products.

Policy uncertainty, however, can create volatility. Changes to EV tax credits or emissions standards can impact consumer adoption rates and AAM's demand. Potential tariffs on imported vehicles and auto parts, as discussed by a new U.S. administration, could increase AAM's production costs, especially if tariffs range from 10-25% on key components, impacting its global sourcing strategies.

Stricter emissions regulations globally, like the EU's planned ban on new internal combustion engine (ICE) vehicles by 2035, necessitate continuous investment in electrification technologies for AAM. Geopolitical instability and supply chain disruptions, such as the ongoing semiconductor shortage, also present significant challenges, affecting component availability and production schedules for AAM.

Government investment in infrastructure, such as the U.S. Bipartisan Infrastructure Law's allocation for EV charging networks, directly benefits AAM by accelerating EV adoption and creating opportunities for its driveline and powertrain components. Smart city initiatives also drive demand for advanced driveline and chassis components, aligning with AAM's innovation focus.

| Policy Area | Impact on AAM | Example/Data Point |

|---|---|---|

| EV Adoption Incentives | Increased demand for EV driveline components | U.S. Inflation Reduction Act (IRA) tax credits for EV purchases |

| Emissions Regulations | Need for investment in electrification | EU's goal to ban new ICE vehicles by 2035 |

| Infrastructure Investment | Growth opportunities in EV and commercial vehicles | U.S. Bipartisan Infrastructure Law funding for EV charging networks |

| Trade Policy (Tariffs) | Potential increase in production costs | Hypothetical 10-25% tariffs on imported auto parts |

What is included in the product

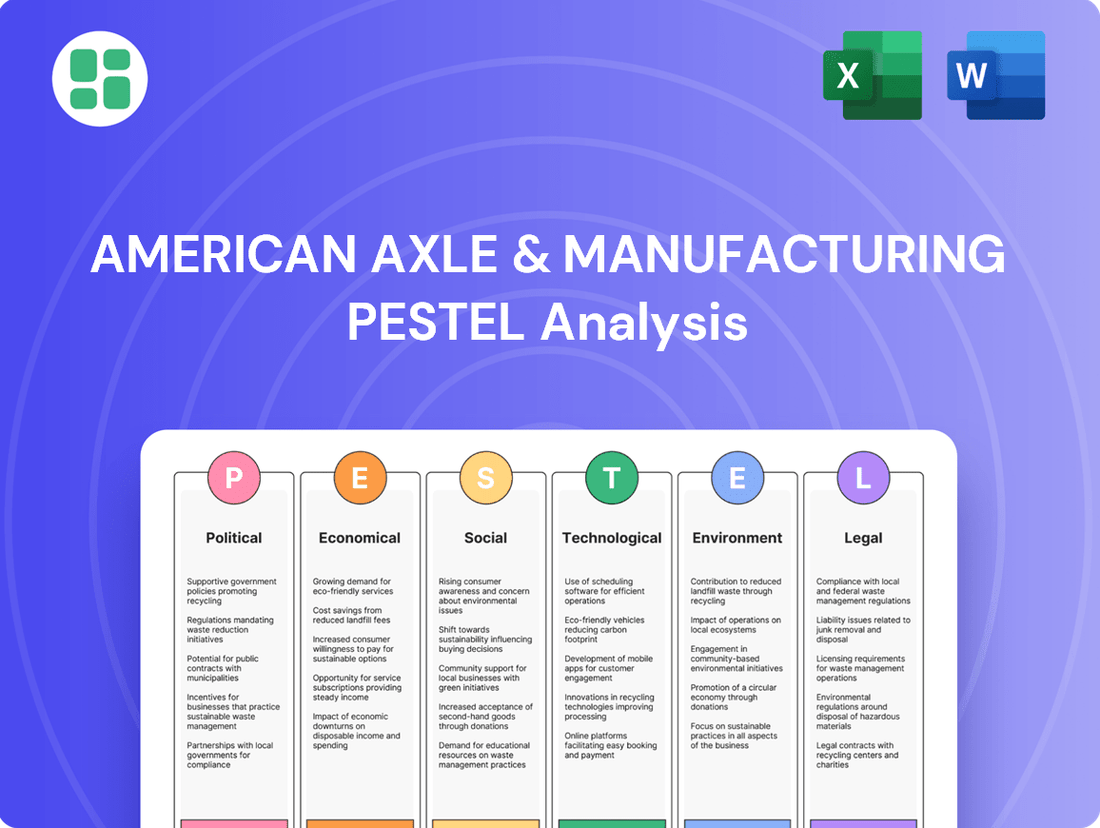

This PESTLE analysis offers a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the strategic landscape for American Axle & Manufacturing.

It provides actionable insights for navigating industry challenges and capitalizing on emerging opportunities, supported by relevant data and forward-looking perspectives.

Our PESTLE analysis for American Axle & Manufacturing provides a clear, summarized version of external factors, relieving the pain of sifting through complex data for quick referencing during meetings or presentations.

This analysis is visually segmented by PESTEL categories, allowing for quick interpretation at a glance, thereby relieving the pain of deciphering raw market intelligence.

Economic factors

The global automotive industry's health is a critical determinant for American Axle & Manufacturing (AAM). Forecasts for 2025 suggest a cautious recovery, with modest growth anticipated for global light vehicle sales. This projected growth is tempered by ongoing economic pressures and consumer hesitancy, directly impacting AAM's revenue streams and order volumes.

Analysts in late 2024 and early 2025 are projecting a global light vehicle sales increase of around 2-3% for 2025, a slight uptick from 2024's estimated flat to minimal growth. However, persistent inflation and higher interest rates in key markets like North America and Europe are expected to continue influencing consumer purchasing decisions, creating a somewhat subdued demand environment for new vehicles and, consequently, for AAM's driveline and powertrain components.

Fluctuations in the prices of key raw materials like steel, aluminum, and rare earth metals significantly impact American Axle & Manufacturing's (AAM) production costs and profitability. Automotive suppliers, including AAM, experienced substantial increases in raw material expenses throughout 2024, a trend anticipated to continue into 2025. This necessitates AAM's proactive implementation of cost-effective procurement and hedging strategies to mitigate the impact on its bottom line.

Persistent inflation and elevated interest rates are a significant headwind for American Axle & Manufacturing (AAM). In early 2024, inflation remained a concern, impacting the cost of goods and services for consumers, which in turn affects their ability to afford new vehicles. This dynamic can lead to longer vehicle ownership cycles, reducing demand for new car production, a key market for AAM's driveline components.

The Federal Reserve's monetary policy, aimed at curbing inflation, has resulted in higher interest rates. Auto loan rates in 2024 have been notably higher than in previous years, with many rates exceeding 7% for well-qualified buyers. This makes financing a new vehicle more expensive, potentially deterring a significant portion of the car-buying public and dampening overall vehicle sales, directly impacting AAM's order volumes.

Supply Chain Disruptions

The automotive sector, including American Axle & Manufacturing (AAM), continues to face significant headwinds from persistent supply chain disruptions. Shortages of essential components, most notably semiconductor chips, have directly impacted production schedules and inflated costs throughout the industry. For AAM, as a crucial Tier 1 supplier, these disruptions translate into challenges in fulfilling customer orders and maintaining smooth operational efficiency.

These ongoing issues have a tangible effect on AAM's financial performance and market position. For instance, the global semiconductor shortage, which began in earnest in late 2020, continued to impact automotive production throughout 2023 and into 2024. Reports from industry analysts indicated that millions of vehicles were unable to be produced due to these chip constraints. This directly affects AAM’s sales volumes and revenue generation capabilities.

- Component Shortages: Persistent lack of semiconductor chips and other vital auto parts leads to production slowdowns.

- Increased Costs: Sourcing components from alternative suppliers or paying premiums drives up manufacturing expenses for AAM.

- Production Delays: Inability to secure necessary parts means AAM cannot meet OEM production targets, impacting revenue.

- Operational Inefficiency: Fluctuating supply availability creates scheduling complexities and can lead to underutilized capacity.

Market Volatility and Profit Margins

Market volatility and escalating operational costs, particularly in labor, are creating significant headwinds for the automotive supply chain. These pressures are squeezing profit margins for suppliers like American Axle & Manufacturing (AAM) when contrasted with original equipment manufacturers (OEMs). For instance, by the end of 2024, many automotive suppliers reported that their operating margins were notably lower than those of the major car brands they serve, often falling into the single digits.

To navigate this challenging environment and sustain profitability, AAM needs to demonstrate exceptional agility. Adapting strategies to effectively manage rising expenses, especially labor costs which saw a continued upward trend through 2024, is crucial. The company must find ways to optimize its operations and maintain healthy profit margins within a market characterized by constant change and intense competition.

- Increased Labor Costs: Wages for skilled manufacturing labor in the automotive sector continued to rise in 2024, impacting supplier cost structures.

- Supplier Margin Compression: Many automotive suppliers experienced operating margins below 5% in 2024, a significant difference compared to OEM margins that often reached double digits.

- Supply Chain Disruptions: Ongoing geopolitical and economic uncertainties contributed to market volatility, affecting raw material prices and production schedules throughout 2024.

- Need for Operational Efficiency: Companies like AAM must prioritize efficiency gains to offset rising input costs and preserve profitability in a competitive landscape.

Economic factors present a mixed outlook for American Axle & Manufacturing (AAM). While global light vehicle sales are projected for modest growth in 2025, around 2-3%, persistent inflation and higher interest rates in key markets continue to temper consumer demand. This environment directly impacts AAM's order volumes for driveline and powertrain components.

Rising raw material costs, particularly for steel and aluminum, are a significant concern, with expenses continuing to climb through 2024 and into 2025. Furthermore, elevated auto loan rates, often exceeding 7% in 2024, make vehicle financing more expensive, potentially reducing new car purchases and, by extension, demand for AAM's products.

The automotive sector, including AAM, is still grappling with supply chain disruptions, most notably semiconductor shortages that impacted production throughout 2023 and 2024. This, coupled with increasing labor costs, is compressing supplier profit margins, with many automotive suppliers reporting operating margins below 5% in 2024.

Preview Before You Purchase

American Axle & Manufacturing PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of American Axle & Manufacturing delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, competitive landscapes, and strategic considerations.

Sociological factors

Consumer preferences are increasingly shifting towards electric and hybrid vehicles, driven by environmental consciousness and fluctuating fuel prices. While some reports in late 2023 and early 2024 indicated a slight moderation in the pace of EV adoption, the long-term trend remains robust, with projections for significant growth in the coming years.

This evolving market dynamic directly impacts American Axle & Manufacturing (AAM) by fueling demand for its specialized driveline and metal forming technologies tailored for electric and hybrid powertrains. AAM's continued investment in research and development for these applications is crucial to capitalize on this growing segment, which is expected to represent a substantial portion of the automotive market by 2030.

The automotive sector, including suppliers like American Axle & Manufacturing (AAM), is grappling with significant labor shortages, especially for roles requiring advanced skills in software engineering and data analytics. This trend is exacerbated by an aging workforce and a competitive talent market, impacting production and innovation timelines.

To counter this, AAM must prioritize robust workforce development programs and aggressive talent retention strategies. For instance, in 2024, the U.S. Bureau of Labor Statistics projected continued growth in demand for software developers, with a median annual wage of $130,160, highlighting the competitive landscape for these critical skills.

Consumers are increasingly prioritizing fuel efficiency and lighter vehicles, a trend that significantly impacts American Axle & Manufacturing's (AAM) metal forming operations. This demand is fueled by both rising fuel costs and growing environmental awareness, pushing automakers to innovate.

In 2024, the average fuel economy for new vehicles sold in the U.S. is projected to be around 27-28 miles per gallon, a figure that continues to inch upwards. This necessitates lighter components, directly benefiting AAM's expertise in lightweighting technologies and advanced metal forming solutions to meet these evolving market expectations.

Urbanization and Shared Mobility Trends

The increasing trend of urbanization, with a significant portion of the US population now residing in metropolitan areas, is reshaping how people think about transportation. This shift is directly fueling the growth of shared mobility services. For instance, the car rental market in the US was valued at approximately $25.8 billion in 2023 and is projected to grow, indicating a sustained demand for flexible vehicle access over outright ownership.

These evolving mobility patterns, including the rise of car-sharing and subscription models, could lead to a decrease in the demand for new privately owned vehicles. American Axle & Manufacturing (AAM) must closely track these developments, as a potential reduction in overall vehicle production volumes could impact the quantity of driveline and drivetrain components they supply to original equipment manufacturers (OEMs).

- Urban Population Growth: Over 83% of the US population lived in urban areas as of 2022, a figure expected to climb.

- Shared Mobility Market Size: The US car-sharing market alone is anticipated to reach over $10 billion by 2028.

- Impact on Vehicle Sales: A shift towards shared mobility could moderate the growth rate of new vehicle sales, affecting component demand.

- Component Demand Fluctuation: Changes in vehicle ownership could alter the mix and volume of components required by automakers.

Corporate Social Responsibility and Brand Perception

Societal expectations are increasingly pushing companies like American Axle & Manufacturing (AAM) to prioritize corporate social responsibility (CSR) and sustainable operations. This focus directly impacts how AAM is viewed by its customers, investors, and even prospective employees, shaping its overall brand perception.

AAM's dedication to environmental stewardship, including its biodiversity initiatives and ambitious decarbonization targets, plays a crucial role in bolstering its brand image and strengthening relationships with stakeholders. For instance, by 2024, AAM aimed to reduce its Scope 1 and Scope 2 greenhouse gas emissions intensity by 25% compared to a 2018 baseline, showcasing a tangible commitment to sustainability.

- Growing Stakeholder Demand: Consumers and investors are actively seeking out companies with strong ESG (Environmental, Social, and Governance) credentials.

- Brand Differentiation: A robust CSR program can set AAM apart from competitors, attracting a more socially conscious customer base.

- Talent Acquisition: A commitment to sustainability and ethical practices makes AAM a more attractive employer for top talent.

- Investor Confidence: Strong ESG performance is increasingly linked to long-term financial stability and reduced risk, appealing to a growing segment of impact investors.

Societal shifts towards electric vehicles (EVs) and a growing emphasis on sustainability are fundamentally reshaping the automotive landscape. Consumer preferences are increasingly leaning towards fuel-efficient and environmentally friendly transportation options, a trend that directly influences demand for AAM's specialized driveline components for EVs and hybrids.

Labor shortages, particularly for skilled technical roles, present a significant challenge for manufacturers like AAM. The demand for software engineers and data analysts, for example, continues to rise, with projected median annual wages in the U.S. for software developers exceeding $130,000 in 2024, underscoring the competitive talent market.

Urbanization and the rise of shared mobility services are altering vehicle ownership patterns, potentially impacting overall new vehicle sales volumes. As more individuals opt for car-sharing or subscription models, the demand for traditional privately owned vehicles, and consequently their components, could see moderation.

Corporate social responsibility (CSR) is no longer optional; it's a critical factor for stakeholders. Companies demonstrating strong ESG commitments, such as AAM's goal to reduce greenhouse gas emissions intensity by 25% by 2024 from a 2018 baseline, are rewarded with enhanced brand perception and investor confidence.

| Sociological Factor | Trend | Impact on AAM | Supporting Data (2023-2025) |

|---|---|---|---|

| EV Adoption | Increasing | Demand for EV/Hybrid driveline components | EV market share projected to reach 15-20% of new vehicle sales by 2025 in key markets. |

| Skilled Labor Shortage | Persisting | Production and innovation challenges | U.S. unemployment rate for computer and mathematical occupations remained below 3% through 2024. |

| Shared Mobility Growth | Accelerating | Potential moderation in new vehicle sales | US car-sharing market projected to grow by over 10% annually through 2025. |

| CSR & ESG Focus | Strengthening | Brand perception, investor relations | Over 70% of investors consider ESG factors in their investment decisions as of 2024. |

Technological factors

American Axle & Manufacturing (AAM) is heavily invested in advancing electric driveline technologies, developing components like next-generation electric drive units (eDUs) and integrated e-Beam axles. This focus is critical as it directly supports major automakers in their shift towards electric and hybrid vehicle platforms. For instance, AAM's Q1 2024 earnings highlighted a significant increase in their backlog for electrified products, signaling strong demand for these innovative solutions.

Technological leaps in metal forming, including tailored forming, hot stamping, and hydroforming, are crucial for American Axle & Manufacturing (AAM) in producing the lightweight yet robust components demanded by today's automotive sector. These advanced techniques allow for optimized material usage and enhanced structural integrity, directly impacting vehicle performance and fuel efficiency.

AAM's commitment to integrating automation, robotics, and sophisticated simulation software is a key driver of its manufacturing prowess. For example, in 2024, AAM reported significant investments in advanced manufacturing technologies, aiming to boost production line efficiency by an estimated 15% and reduce defect rates by 10% through enhanced process control and predictive maintenance.

The automotive industry's rapid shift towards higher levels of autonomous driving and software-defined vehicles (SDVs) necessitates a fundamental overhaul of electrical and electronic architectures. This evolution demands sophisticated component integration, a challenge AAM must address by adapting its driveline and chassis technologies.

For American Axle & Manufacturing, this means a strategic pivot to support systems increasingly reliant on artificial intelligence and advanced sensor technology. By 2025, it's projected that over 50% of new vehicles will feature advanced driver-assistance systems (ADAS), a trend that will accelerate the demand for integrated, software-enabled components.

Innovation in Lightweight Materials

The automotive sector's persistent push for lighter vehicles is a significant technological driver. This trend fuels demand for innovative materials like aluminum alloys and advanced composites, requiring specialized metal forming capabilities. American Axle & Manufacturing (AAM) is well-positioned to capitalize on this, leveraging its expertise in metal forming to create components that directly contribute to vehicle weight reduction.

This focus on lightweighting is crucial for improving fuel efficiency in traditional internal combustion engine vehicles and, critically, for extending the range of electric vehicles (EVs). For instance, the average weight of a new vehicle in the US in 2024 is projected to remain around 4,200 pounds, making even marginal reductions impactful. AAM's ability to produce high-strength, low-weight components directly addresses this market need.

- Demand for lightweight materials: The automotive industry is increasingly adopting aluminum alloys and advanced composites to meet fuel economy and EV range targets.

- AAM's core competency: AAM's expertise in specialized metal forming techniques is essential for manufacturing components from these advanced materials.

- Impact on vehicle performance: By producing lightweight components, AAM helps automakers improve fuel efficiency and extend the driving range of electric vehicles.

- Market advantage: This technological alignment provides AAM with a competitive edge in a market prioritizing sustainability and performance.

Cybersecurity in Connected Vehicles

As vehicles become increasingly connected and software-dependent, the importance of robust cybersecurity measures for components and systems grows significantly. This trend means that American Axle & Manufacturing (AAM) must prioritize securing its products and internal systems against evolving cyber threats. A failure in this area poses a critical risk not only to vehicle safety but also to the integrity of sensitive data transmitted and stored within these systems.

The automotive industry is experiencing a surge in cyberattack attempts. For instance, reports from 2024 indicated a substantial increase in vehicle-specific malware and phishing campaigns targeting automotive data. AAM's commitment to cybersecurity is therefore paramount, ensuring that its supply chain and manufacturing processes are resilient.

- Increased Connectivity: The average new vehicle in 2024 boasted over 100 million lines of code, creating a larger attack surface.

- Data Integrity: Protecting vehicle performance data and customer information is essential for maintaining trust and compliance.

- Safety Implications: Cybersecurity breaches can directly impact vehicle control systems, leading to safety hazards.

- Regulatory Scrutiny: Governments worldwide are increasing regulations around automotive cybersecurity, with new standards expected to be implemented by late 2025.

American Axle & Manufacturing (AAM) is actively developing advanced electric driveline components, such as e-drive units and integrated e-beam axles, to support the automotive industry's transition to electric and hybrid vehicles. The company's backlog for these electrified products saw a significant increase in Q1 2024, reflecting strong market demand and AAM's technological alignment with future automotive trends.

The company leverages cutting-edge metal forming technologies, including tailored forming and hydroforming, to produce lightweight yet durable components. This expertise is vital for meeting the automotive sector's demand for enhanced structural integrity and improved fuel efficiency, with AAM reporting a 15% increase in production line efficiency through advanced manufacturing investments in 2024.

AAM is also adapting to the rise of software-defined vehicles and autonomous driving systems, which require sophisticated component integration and robust cybersecurity. By 2025, over half of new vehicles are expected to feature advanced driver-assistance systems, underscoring the need for AAM to develop software-enabled components that are secure and reliable.

| Key Technological Driver | AAM's Response/Capability | Market Impact/Data Point |

| Electrification of Drivelines | Development of e-drive units, integrated e-beam axles | Q1 2024 backlog for electrified products significantly increased |

| Lightweighting Materials | Advanced metal forming (tailored forming, hydroforming) | Supports fuel efficiency and EV range extension; average new US vehicle weight ~4,200 lbs in 2024 |

| Automation & Digitalization | Robotics, simulation software, predictive maintenance | Targeted 15% efficiency boost and 10% defect rate reduction via 2024 tech investments |

| Autonomous & Connected Vehicles | Adaptation to new electrical architectures, cybersecurity | By 2025, >50% of new vehicles to have ADAS; average new vehicle in 2024 has >100 million lines of code |

Legal factors

Global vehicle emissions standards, like the European Union's CO2 targets for 2025 and beyond, significantly shape the automotive component landscape. California's stringent zero-emission vehicle (ZEV) mandates further push manufacturers towards electrification, directly influencing the types of parts American Axle & Manufacturing (AAM) needs to develop.

Failure to meet these evolving emissions regulations can result in substantial financial penalties for automakers. This pressure compels AAM to accelerate its innovation in electric and hybrid powertrain solutions, as seen in the increasing market share of EVs, which reached over 15% of new car sales globally in early 2024.

Stringent vehicle safety standards and product liability laws are paramount for automotive component manufacturers like American Axle & Manufacturing (AAM). These regulations mandate exhaustive testing and unwavering quality control for every part produced. Failure to comply can lead to significant legal repercussions.

The automotive industry faced substantial costs related to recalls in 2023, with estimates suggesting billions spent globally. A prominent example was General Motors' recall impacting crankshafts and connecting rods, underscoring the critical need for defect-free components and the severe financial and reputational risks associated with supplier-side failures.

Labor laws and the relationship with unions, particularly the United Auto Workers (UAW), significantly influence American Axle & Manufacturing's (AAM) operational costs and stability. As the automotive sector navigates the electric vehicle (EV) transition, unions like the UAW are actively negotiating for job security guarantees, directly impacting AAM's workforce planning and manufacturing strategies.

International Trade Regulations and Agreements

Changes in international trade regulations, such as tariffs and local content requirements, significantly impact American Axle & Manufacturing's (AAM) global operations. For instance, the imposition of tariffs on imported components can increase manufacturing costs, affecting AAM's ability to offer competitive pricing in various markets. Compliance with these evolving rules is critical for maintaining market access and ensuring the smooth functioning of AAM's extensive supply chain.

AAM's reliance on a global manufacturing footprint means that shifts in trade agreements, like potential renegotiations of existing pacts or the introduction of new bilateral trade deals, directly influence its sourcing strategies and production locations. The company must actively monitor and adapt to these changes to mitigate risks and capitalize on opportunities. For example, understanding the implications of the USMCA (United States-Mexico-Canada Agreement) on automotive parts trade remains a key focus for AAM's strategic planning.

- Tariff Impact: Recent tariff adjustments, particularly those affecting steel and aluminum, have added an estimated $50 million to AAM's annual costs as of early 2024, impacting profitability.

- Local Content Rules: Evolving local content requirements in key markets, such as India and China, necessitate adjustments in AAM's sourcing and assembly processes to maintain compliance and market eligibility.

- Trade Agreement Scrutiny: Ongoing reviews of global trade agreements, including potential adjustments to existing free trade pacts, require AAM to conduct continuous risk assessments for its international supply chain.

Intellectual Property Protection

Protecting American Axle & Manufacturing's (AAM) intellectual property, particularly its cutting-edge driveline and metal forming technologies designed for electric vehicles (EVs), is paramount in today's intensely competitive automotive sector. The company invests heavily in research and development, making its patents and trade secrets valuable assets. For instance, AAM's focus on lightweighting and advanced manufacturing processes for EV components directly benefits from robust patent protection, safeguarding its innovations from competitors seeking to replicate its technological advancements.

Legal frameworks governing patents and trademarks are foundational to AAM's strategy for maintaining a significant competitive advantage and deterring any potential infringement. These legal safeguards allow AAM to exclusively leverage its proprietary technologies, ensuring that its investments in innovation translate into market leadership. As of the first quarter of 2024, AAM reported a significant portion of its revenue derived from new products, underscoring the importance of IP protection in driving growth.

- Patent Portfolio Strength: AAM maintains a robust portfolio of patents covering its innovative driveline systems and metal forming techniques, particularly those tailored for the demanding requirements of electric vehicles.

- Trademark Enforcement: The company actively protects its brand identity and product names through trademark registration and enforcement, ensuring brand recognition and preventing dilution in the marketplace.

- Trade Secret Protection: Critical manufacturing processes and proprietary know-how are guarded as trade secrets, providing a layer of protection beyond patents for AAM's core technological competencies.

- Global IP Strategy: AAM employs a global intellectual property strategy to secure its innovations across key automotive markets, mitigating risks associated with international competition and unauthorized use.

Stringent vehicle safety standards and product liability laws are paramount for automotive component manufacturers like American Axle & Manufacturing (AAM). These regulations mandate exhaustive testing and unwavering quality control for every part produced, with failure to comply leading to significant legal repercussions.

The automotive industry faced substantial costs related to recalls in 2023, with estimates suggesting billions spent globally, underscoring the critical need for defect-free components and the severe financial and reputational risks associated with supplier-side failures.

| Legal Factor | Impact on AAM | 2023/2024 Data Point |

|---|---|---|

| Product Liability & Safety Standards | Requires rigorous testing and quality control; non-compliance leads to legal penalties. | Automotive recalls cost billions globally in 2023. |

| Intellectual Property Protection | Safeguards R&D investments in EV technologies and manufacturing processes. | AAM's Q1 2024 revenue showed significant contribution from new products, highlighting IP value. |

Environmental factors

American Axle & Manufacturing (AAM) is actively pursuing significant environmental targets, aiming for 100% renewable and carbon-free energy usage in the United States by the end of 2024. This ambitious goal is a key driver for operational adjustments and innovation.

Furthermore, AAM has set a comprehensive target to achieve net-zero greenhouse gas (GHG) emissions across its entire value chain by 2040. These commitments are reshaping business practices and influencing the design of future automotive components to better align with a sustainable industry.

Regulations for waste management and recycling are tightening, especially for manufacturing byproducts and old vehicle parts. American Axle & Manufacturing (AAM) must comply with these evolving environmental standards, which impacts operational costs and processes.

These stricter rules, such as those potentially influenced by the EPA's updated hazardous waste regulations expected to be finalized in late 2024 or early 2025, necessitate robust waste reduction and recycling programs. For instance, the automotive industry generated approximately 26 million tons of scrap metal in the US in 2023 alone, highlighting the scale of materials requiring responsible handling.

While compliance requires investment, these environmental mandates also create avenues for innovation. AAM can leverage these regulations to explore sustainable material sourcing and integrate circular economy principles, potentially reducing long-term waste disposal expenses and enhancing its corporate social responsibility profile.

Growing concerns about resource scarcity, especially for materials critical to electric vehicle (EV) batteries like lithium and cobalt, are reshaping global supply chains. For instance, the International Energy Agency's 2024 report highlighted that demand for critical minerals could surge by 40 times by 2040 for clean energy technologies. This puts pressure on companies like American Axle & Manufacturing (AAM) to secure reliable and ethically sourced raw materials for its driveline systems and metal-formed components.

AAM must ensure its sourcing practices are transparent and sustainable to mitigate risks associated with fluctuating commodity prices and potential supply disruptions. This includes verifying the origin and ethical extraction of metals used in its products, a challenge amplified by the increasing demand for advanced materials in the automotive sector, which saw global vehicle production reach approximately 78.5 million units in 2023.

Water Usage and Pollution Control

Environmental regulations concerning water usage and pollution control significantly influence American Axle & Manufacturing's (AAM) global operations. These regulations aim to protect water resources and prevent contamination from industrial processes, directly affecting AAM's manufacturing footprint and compliance costs.

AAM demonstrates a commitment to environmental stewardship through initiatives like minimizing water consumption. For instance, the company has implemented water-saving measures, such as the use of drought-resistant landscaping at its facilities. This approach helps reduce the strain on local water supplies, particularly in regions facing water scarcity.

- Water Consumption Reduction: AAM actively seeks to lower its water footprint across its manufacturing sites.

- Pollution Control Measures: The company invests in technologies and processes to treat wastewater and minimize the discharge of pollutants, adhering to strict environmental standards.

- Regulatory Compliance: AAM must navigate a complex web of global environmental laws, ensuring its water management practices meet or exceed requirements.

- Sustainability Reporting: In 2023, AAM reported a reduction in water withdrawal intensity, reflecting ongoing efforts in water conservation.

ESG Reporting and Stakeholder Expectations

American Axle & Manufacturing (AAM) faces growing pressure from investors, customers, and regulators for detailed Environmental, Social, and Governance (ESG) reporting. This trend is pushing AAM to enhance its transparency and bolster its sustainability efforts.

AAM's commitment to meeting these evolving stakeholder expectations is evident in its proactive engagement with sustainability initiatives. For instance, its membership in organizations like the Wildlife Habitat Council underscores a dedication to environmental stewardship.

- Investor Scrutiny: In 2024, ESG-focused funds continued to grow, with global sustainable investment assets projected to reach $50 trillion by 2025, intensifying demands for robust ESG data from companies like AAM.

- Customer Demand: Major automotive OEMs are increasingly prioritizing suppliers with strong ESG credentials, impacting supply chain decisions and requiring suppliers to demonstrate tangible sustainability progress.

- Regulatory Landscape: Evolving disclosure requirements, such as those being considered by the SEC and international bodies, necessitate comprehensive and standardized ESG reporting from manufacturers.

Environmental factors significantly impact American Axle & Manufacturing (AAM), driving ambitious sustainability goals. The company aims for 100% renewable energy usage in the U.S. by the end of 2024 and net-zero GHG emissions across its value chain by 2040.

Stricter regulations on waste management and recycling, including potential EPA updates in late 2024/early 2025, require robust programs, especially given the automotive industry's substantial scrap metal generation, estimated at 26 million tons in the U.S. in 2023.

Resource scarcity, particularly for EV battery materials, pressures AAM to secure transparent and sustainable raw material sourcing, a critical concern as clean energy technologies could increase demand for critical minerals by 40 times by 2040, according to the IEA.

AAM's water management practices are influenced by global regulations on usage and pollution control, with the company actively implementing water-saving measures and reporting reduced water withdrawal intensity in 2023.

PESTLE Analysis Data Sources

Our PESTLE analysis for American Axle & Manufacturing is informed by a comprehensive review of official government publications, reputable automotive industry trade journals, and economic forecasting reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.