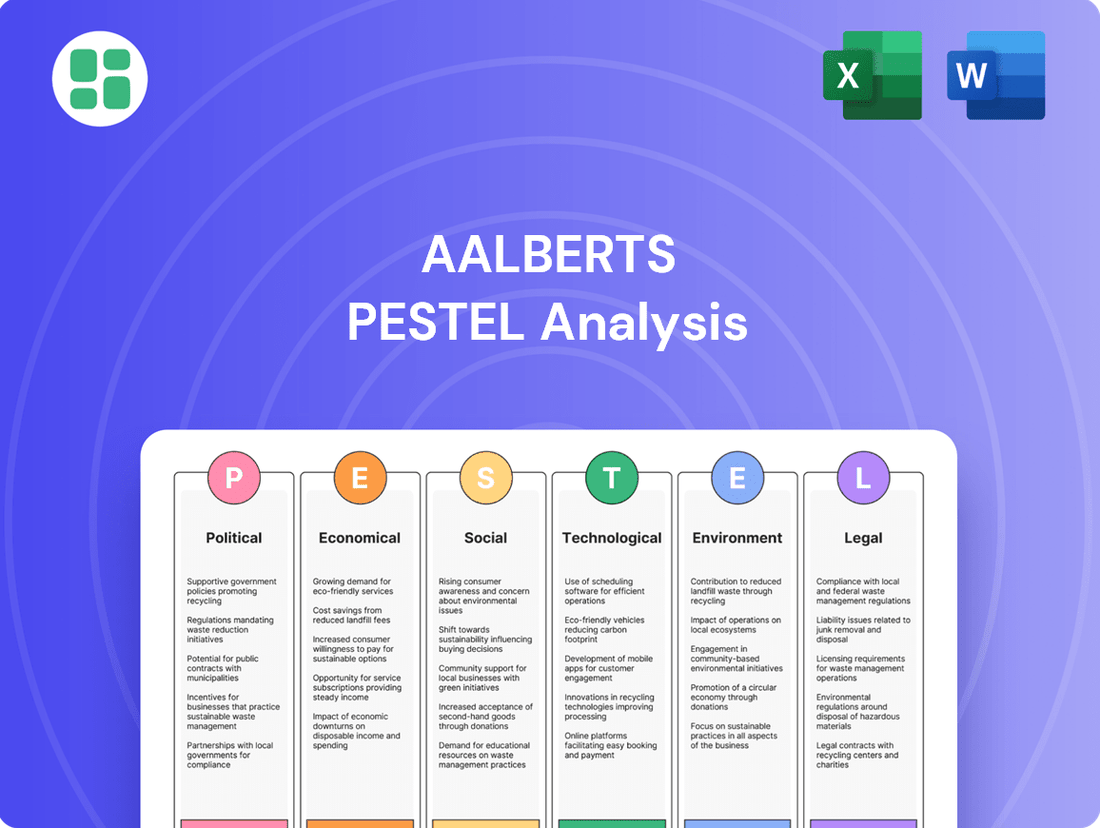

Aalberts PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

Navigate the complex external forces shaping Aalberts's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and socio-cultural trends are impacting their operations and market position. Gain a strategic advantage by leveraging these crucial insights to inform your own business decisions and investment strategies. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Aalberts' global footprint means it's directly exposed to geopolitical volatility. For instance, the ongoing tensions surrounding semiconductor supply chains, a critical component for many of Aalberts' end markets, create significant operational uncertainties. The company must navigate these complex international relations to ensure stability.

Changes in international trade policies, including tariffs and export controls, pose a direct threat to Aalberts' supply chains and market access. In 2024, the US and China continued to implement various trade restrictions, impacting global manufacturing and component sourcing, which could affect Aalberts' procurement costs and sales opportunities.

Aalberts actively monitors these evolving geopolitical and trade dynamics to proactively manage potential disruptions. This includes assessing how shifts in trade agreements or the imposition of new tariffs might influence its operational costs and the demand for its products in key regions, aiming to mitigate any adverse effects.

Governments globally are stepping up support for sustainability, which is a major plus for Aalberts. For instance, the European Union's Green Deal, with significant funding allocated through 2027, aims to boost energy efficiency and renewable energy adoption. This directly fuels demand for Aalberts' solutions in sustainable buildings and the e-mobility transition.

Regulatory stability in Aalberts' key markets, particularly in Europe and North America, is a significant political factor. Consistent policies concerning industrial output, environmental regulations, and product safety are vital for predictable long-term investment and operational strategies. For instance, changes in European Union environmental directives, such as those impacting emissions or material sourcing, could require substantial adjustments to production processes and supply chains, potentially affecting Aalberts' manufacturing costs and market access.

Political Stability in Operating Regions

Political stability across Aalberts' operating regions is a critical factor for ensuring uninterrupted business activities and safeguarding investments. Regions experiencing political instability or abrupt shifts in government policy can significantly impede production processes, disrupt intricate supply chains, and negatively impact market demand for Aalberts' products. For instance, in 2024, geopolitical tensions in Eastern Europe, where Aalberts has manufacturing presence, led to increased logistical costs and supply chain uncertainties for many industrial companies.

While Aalberts' decentralized operational structure, with numerous localized facilities, offers a degree of insulation from direct political shocks, the broader landscape of global political stability remains a crucial consideration. The company's diversified geographic footprint, spanning Europe, Asia, and North America, means that localized political events can have varying degrees of impact. For example, a stable political environment in Germany, a key market for Aalberts, supports consistent demand for its advanced manufacturing solutions.

- Geopolitical Risk Assessment: Aalberts continuously monitors geopolitical developments in its key markets to anticipate and mitigate potential disruptions.

- Supply Chain Resilience: The company invests in diversifying its supplier base and logistics networks to reduce reliance on any single region, enhancing resilience against political instability.

- Regulatory Environment: Changes in trade policies, tariffs, or environmental regulations driven by political decisions can affect Aalberts' cost structure and market access.

- Investment Security: Political stability is paramount for securing long-term investments in manufacturing capacity and research and development in various countries.

Government Investments in Infrastructure and Technology

Government investments in infrastructure, especially in areas like sustainable buildings and advanced manufacturing, directly impact the demand for Aalberts' innovative solutions. For instance, the EU's NextGenerationEU recovery plan, with a significant portion allocated to green and digital transitions, is poised to boost construction and industrial modernization, creating a favorable environment for Aalberts' product portfolio. This focus on upgrading existing infrastructure and developing new, sustainable projects translates into increased opportunities for companies providing essential components and systems.

Furthermore, substantial government backing for digital infrastructure, smart city initiatives, and the expansion of e-mobility charging networks acts as a powerful catalyst for adopting Aalberts' advanced technologies. As governments worldwide, including significant investments from the US Bipartisan Infrastructure Law, prioritize connectivity and electrification, the market for smart building solutions and efficient energy management systems grows exponentially. These strategic investments are not just about immediate project wins but are designed to foster long-term economic growth and technological advancement.

- EU Green Deal: Aims to mobilize at least €1 trillion in sustainable investments over the next decade, directly benefiting sectors like construction and manufacturing where Aalberts operates.

- US Infrastructure Investment and Jobs Act (2021): Allocates over $1.2 trillion to improve roads, bridges, public transit, broadband, and clean energy, creating demand for materials and technologies.

- Smart City Investments: Global smart city spending is projected to reach hundreds of billions of dollars by 2025, driving adoption of integrated technology solutions that Aalberts can supply.

- E-Mobility Infrastructure: Governments are investing heavily in EV charging networks, with projections indicating millions of charging points to be installed globally by 2030, supporting Aalberts' contributions to electrification.

Geopolitical shifts and trade policy changes significantly impact Aalberts' global operations, with ongoing tensions in 2024 affecting semiconductor supply chains. Trade restrictions between major economies like the US and China continued to influence manufacturing costs and market access for the company.

Government initiatives supporting sustainability, such as the EU's Green Deal, are a boon for Aalberts, driving demand for its solutions in energy efficiency and e-mobility. Similarly, substantial government investments in digital infrastructure and smart city projects, like those under the US Infrastructure Investment and Jobs Act, create further opportunities for Aalberts' advanced technologies.

Political stability across Aalberts' operational regions is crucial for uninterrupted business and investment security. For instance, in 2024, geopolitical tensions in Eastern Europe increased logistical costs for industrial companies, highlighting the need for proactive risk management.

Aalberts actively monitors these political and regulatory landscapes, adapting its strategies to mitigate disruptions and capitalize on emerging opportunities driven by governmental support for green and digital transitions.

| Factor | Impact on Aalberts | Example/Data (2024/2025 Focus) |

|---|---|---|

| Geopolitical Volatility | Supply chain disruptions, operational uncertainty | Semiconductor supply chain tensions impacting end markets. Increased logistical costs due to Eastern European tensions. |

| Trade Policies & Tariffs | Affects procurement costs and market access | Continued US-China trade restrictions impacting global manufacturing and component sourcing. |

| Government Sustainability Initiatives | Drives demand for green solutions | EU Green Deal aiming to mobilize €1 trillion in sustainable investments by 2030, boosting demand for Aalberts' sustainable building solutions. |

| Infrastructure Investment | Creates opportunities for advanced technologies | US Infrastructure Investment and Jobs Act (over $1.2 trillion) supporting clean energy and smart city projects, aligning with Aalberts' offerings. |

What is included in the product

This Aalberts PESTLE analysis provides a comprehensive overview of how political, economic, social, technological, environmental, and legal factors shape the company's operating landscape.

It offers actionable insights for strategic decision-making by highlighting key external influences and their potential impact on Aalberts's future performance.

The Aalberts PESTLE analysis provides a structured framework that simplifies complex external factors, relieving the pain of overwhelming data during strategic planning.

By clearly identifying and categorizing political, economic, social, technological, environmental, and legal influences, it offers a digestible overview that reduces the cognitive load on decision-makers.

Economic factors

Aalberts faced a difficult 2024, marked by negative organic growth. This downturn was largely due to persistent weakness in key sectors like automotive and semiconductors, a trend expected to carry into 2025. Such macroeconomic instability directly translated to reduced volumes, consequently affecting Aalberts' revenue and profitability across various business units.

The company is proactively addressing these market headwinds by initiating cost-saving measures and optimizing its inventory levels. These strategic actions are designed to cushion the impact of the global economic slowdown and improve financial resilience in a challenging market environment.

Rising cost inflation, especially for raw materials and energy, continues to be a significant hurdle for Aalberts' profitability. For example, in Q1 2024, many industrial sectors experienced double-digit percentage increases in key input costs.

Aalberts has strategically focused on managing these cost pressures by maintaining strong price levels, aiming to bolster its added value margin. This approach is crucial for preserving profitability in a dynamic economic environment.

To counteract inflation, Aalberts is implementing measures such as inventory reduction initiatives and operational excellence programs. These actions are designed to directly offset the impact of rising costs and enhance overall efficiency.

The prevailing interest rate environment directly impacts Aalberts' cost of capital and influences its customers' willingness to invest in new projects, which in turn affects demand for Aalberts' products and services. Higher rates generally translate to increased borrowing costs for both Aalberts and its clientele.

Despite prevailing economic headwinds, Aalberts demonstrated a strategic commitment to growth by maintaining substantial capital expenditure throughout 2024. This investment, amounting to €279 million for the full year 2024, was strategically allocated towards expanding production capacity, fostering geographical market penetration, and driving innovation across its business segments.

Supply Chain Resilience and Regionalization

Global supply chain disruptions remain a significant concern, highlighting the critical need for robust and localized operations. Aalberts' proactive approach involves expanding its presence, notably in the USA and Southeast Asia, to bring production closer to key markets. This strategic regionalization is designed to mitigate the impact of global shocks and ensure a more consistent supply of products.

Aalberts' investment in regional manufacturing capabilities, particularly in high-growth areas like North America, is a direct response to the ongoing volatility in global logistics. For instance, the company has been actively increasing its production capacity in the United States to serve its North American customer base more effectively. This strategy aims to reduce lead times and transportation costs, thereby enhancing overall supply chain resilience.

- Regional Expansion: Aalberts is strategically increasing its manufacturing footprint in the USA and Southeast Asia.

- Risk Mitigation: This regionalization aims to reduce vulnerability to global supply chain disruptions and geopolitical instability.

- Product Availability: Enhanced proximity to markets ensures more consistent product availability for customers.

- Cost Efficiency: Localized production can lead to reduced transportation costs and shorter delivery times.

Market Demand in Key End Markets

Demand in Aalberts' primary sectors—Sustainable Buildings, Semiconductor Efficiency, E-mobility Transition, and Industrial Productivity—is closely tied to the ebb and flow of the global economy. While sectors like automotive and general industrial saw a slowdown in 2024 and into early 2025, the underlying trends of urbanization and the push for decarbonization are anticipated to maintain a positive growth trajectory.

For instance, the semiconductor market, crucial for efficiency gains, is projected to grow. Analysts forecast the global semiconductor market to reach approximately $700 billion in 2025, up from an estimated $600 billion in 2024, driven by demand in AI, automotive, and IoT applications.

- Sustainable Buildings: Urbanization and stricter energy efficiency regulations are key drivers, supporting demand for advanced building materials and systems.

- Semiconductor Efficiency: The increasing need for data processing and automation across industries fuels growth in semiconductor-related markets.

- E-mobility Transition: Government incentives and consumer adoption of electric vehicles continue to bolster demand for components and infrastructure.

- Industrial Productivity: Investments in automation and advanced manufacturing technologies are expected to support this segment despite short-term cyclical downturns.

Economic factors significantly influenced Aalberts' performance in 2024, with negative organic growth stemming from weakness in automotive and semiconductor sectors, a trend anticipated to persist into early 2025. Rising inflation, particularly for raw materials and energy, presented a considerable challenge, with Q1 2024 seeing double-digit percentage increases in input costs for many industrial players.

Despite these headwinds, Aalberts maintained substantial capital expenditure, investing €279 million in 2024 to expand production capacity and drive innovation. The company also strategically focused on managing cost pressures by upholding strong price levels to protect its added value margin.

The prevailing interest rate environment directly impacts Aalberts' cost of capital and customer investment decisions, with higher rates increasing borrowing costs. Global supply chain disruptions also necessitated proactive measures, leading Aalberts to expand its manufacturing footprint in the USA and Southeast Asia to enhance proximity to key markets and mitigate logistical risks.

| Economic Factor | Impact on Aalberts | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Slowdown | Reduced volumes, impacting revenue and profitability | Negative organic growth in 2024; weakness expected into early 2025 |

| Inflation (Raw Materials, Energy) | Increased input costs, pressure on profitability | Double-digit percentage increases in Q1 2024 for key inputs |

| Interest Rates | Higher cost of capital, potential dampening of customer investment | Prevailing higher interest rate environment |

| Capital Expenditure | Investment in growth, capacity expansion, and innovation | €279 million invested in 2024 |

| Supply Chain Disruptions | Need for localized operations and risk mitigation | Expansion in USA and Southeast Asia |

What You See Is What You Get

Aalberts PESTLE Analysis

The preview shown here is the exact Aalberts PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Aalberts, providing valuable strategic insights.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a complete picture of Aalberts' external landscape.

Sociological factors

Societal awareness and the demand for energy-efficient, environmentally friendly, and sustainable products are experiencing a significant surge. This trend is particularly beneficial for companies like Aalberts, whose mission-critical technologies are instrumental in decarbonization efforts, enhancing resource efficiency, and promoting cleaner processes across sectors such as buildings, industry, and e-mobility.

The availability of skilled labor, particularly in advanced manufacturing and cutting-edge technologies, is paramount for Aalberts' success. The company actively addresses this by investing in its workforce through comprehensive development programs and targeted training initiatives, aiming to attract and retain top talent.

Aalberts' commitment to enhancing its human capital is further evidenced by its focus on improving gender diversity and overall employee engagement. For instance, 2024 employee surveys indicated a positive trend in these areas, reflecting the effectiveness of their talent development strategies.

Global urbanization continues its upward trajectory, with the UN projecting that 68% of the world's population will live in urban areas by 2050. This surge in city living directly fuels demand for Aalberts' sustainable building technologies, as comfortable, energy-efficient, and healthy living and working spaces become paramount. For instance, the increasing need for smart building management systems aligns with Aalberts' product offerings.

Demographic shifts are also reshaping market needs. An aging global population, for example, necessitates specialized healthcare infrastructure and assistive technologies. Concurrently, the expansion of middle classes in emerging economies drives demand for improved industrial productivity solutions and modern infrastructure, areas where Aalberts' expertise in flow control and mechatronics plays a vital role in enhancing efficiency and reliability.

Consumer and Industry Preferences for Efficiency

Consumers and industries are increasingly seeking ways to be more efficient and cut down on waste. This translates into a strong demand for technologies that optimize resource use, such as smart building systems and streamlined industrial operations. Aalberts' commitment to creating products that achieve more with less directly aligns with this societal shift, positioning them favorably in a market prioritizing sustainability and cost-effectiveness.

The drive for efficiency is evident in several key areas impacting Aalberts' market. For instance, the global smart buildings market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a significant growth trajectory driven by demand for energy and operational efficiency. Similarly, the industrial automation sector, which benefits from efficient processes, saw global revenue of around $200 billion in 2023, with expectations of continued expansion.

- Growing demand for smart building technologies: This sector is expected to grow significantly, driven by the need for energy savings and optimized building management.

- Preference for efficient industrial processes: Businesses are investing in automation and advanced manufacturing to reduce operational costs and improve output.

- Increased adoption of lightweight, durable materials: Industries like automotive and aerospace are seeking materials that improve fuel efficiency and product longevity.

- Aalberts' product alignment: The company's focus on delivering solutions that maximize output while minimizing resource consumption directly addresses these evolving market preferences.

Corporate Social Responsibility Expectations

Stakeholders, from investors to customers and employees, are increasingly demanding that companies actively engage in Corporate Social Responsibility (CSR). This societal shift means businesses must go beyond profit to demonstrate a positive impact on the environment and communities. Aalberts' commitment to its sustainability targets, such as achieving net-zero carbon emissions by 2050 and reducing waste and water intensity, directly addresses these evolving expectations.

Aalberts' proactive stance on CSR is a strategic advantage. By integrating sustainability into its operations, the company not only mitigates risks but also builds a stronger brand reputation. For instance, in 2023, Aalberts reported a 12% reduction in Scope 1 and 2 CO2 emissions compared to 2022, showcasing tangible progress towards its net-zero goal.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) factors are now critical for investment decisions, with a significant portion of global assets under management being ESG-oriented.

- Customer Loyalty: Consumers, particularly younger demographics, are more likely to support brands that align with their values, leading to increased purchasing power for socially responsible companies.

- Employee Engagement: A strong CSR program can attract and retain talent, as employees seek to work for organizations that demonstrate a commitment to ethical practices and positive societal contributions.

- Regulatory Landscape: Growing governmental focus on sustainability and corporate accountability may lead to stricter regulations, making proactive CSR a form of future-proofing.

Societal expectations are increasingly centered on sustainability and efficiency, directly benefiting Aalberts' mission-critical technologies that support decarbonization and resource optimization. The growing global urbanization, with 68% of the world's population expected to live in urban areas by 2050, further amplifies the demand for Aalberts' energy-efficient building solutions.

Demographic shifts, such as an aging population and the expanding middle class in emerging economies, are creating new market needs for specialized healthcare infrastructure and improved industrial productivity. Aalberts' expertise in flow control and mechatronics is well-positioned to address these evolving demands, enhancing efficiency and reliability across various sectors.

The increasing focus on Corporate Social Responsibility (CSR) is a significant driver for Aalberts, as stakeholders demand positive environmental and community impact. The company's commitment to sustainability targets, including net-zero carbon emissions by 2050 and reduced environmental intensity, aligns with these expectations and provides a competitive advantage.

| Sociological Factor | Impact on Aalberts | Supporting Data/Trend |

|---|---|---|

| Demand for Sustainability | Drives demand for Aalberts' energy-efficient and decarbonization solutions. | Global smart buildings market projected to exceed $200 billion by 2030. |

| Urbanization | Increases need for sustainable building technologies. | 68% of global population to live in urban areas by 2050. |

| Demographic Shifts | Creates demand for specialized healthcare and industrial productivity solutions. | Aging populations and growing middle classes in emerging markets. |

| Corporate Social Responsibility (CSR) | Enhances brand reputation and stakeholder relations. | Aalberts reduced Scope 1 & 2 CO2 emissions by 12% in 2023 (vs. 2022). |

Technological factors

Technological advancements in semiconductor technology, particularly the surge in Artificial Intelligence (AI), are a significant driver for Aalberts' key end markets. The demand for more powerful and efficient chips is accelerating innovation across the industry.

Aalberts plays a crucial role by supplying ultra-precision and ultra-cleanliness technologies essential for achieving nanometer precision in the intricate chip manufacturing processes. This capability directly supports the industry's push for smaller, faster, and more capable semiconductors.

Despite some inventory adjustments observed in the semiconductor market during 2024, the underlying long-term fundamentals remain robust. Projections indicate continued strong demand, largely fueled by the ongoing integration of AI across various sectors, which necessitates advanced semiconductor solutions.

Aalberts is deeply invested in the e-mobility revolution, developing key technologies that underpin electric vehicles and broader sustainable transport solutions. Their expertise in advanced materials and specialized metal plating is crucial for EV components, directly supporting original equipment manufacturers (OEMs) as they transition to more advanced automotive designs.

The company’s research and development efforts are squarely aimed at producing clean, dependable, and highly efficient products for this rapidly expanding market. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, highlighting the significant growth potential Aalberts is positioned to capitalize on.

Industry 4.0, characterized by automation and smart manufacturing, is fundamentally reshaping industrial output. Aalberts is actively embracing this shift, investing in digitalization and operational excellence initiatives. For instance, in 2023, Aalberts reported that its digitalization efforts contributed to improved operational efficiency, a key driver for revenue growth and cost reduction.

These technological advancements are not just about efficiency; they foster enhanced product quality and enable greater agility in production. This means Aalberts can respond more effectively to market demands and customer needs, a crucial advantage in today's fast-paced industrial landscape.

Materials Science and Advanced Engineering

Aalberts' core business hinges on advancements in materials science and engineering, driving the development of sophisticated systems and products. Their focus on extending product lifespans and creating lightweight materials directly benefits industries seeking efficiency and durability.

The company's commitment to research and development is paramount, ensuring they remain at the forefront of critical applications. Innovations in specialized surface technologies are particularly important, enhancing material properties for demanding environments.

- Materials Innovation: Aalberts invests heavily in R&D for new alloys and composites, crucial for their advanced fluid and flow control solutions.

- Surface Technology: Development of advanced coatings and surface treatments improves wear resistance and performance in high-pressure applications.

- Lightweighting Solutions: Engineering efforts focus on reducing material weight without compromising strength, a key trend in aerospace and automotive sectors.

- R&D Investment: For FY23, Aalberts reported a significant portion of its revenue dedicated to innovation, underscoring the importance of technological advancement.

Research and Development (R&D) Investment

Aalberts' dedication to Research and Development (R&D) is a cornerstone of its strategy, fueling innovation and securing its market position. In 2024, the company allocated a significant capital expenditure of EUR 231 million, directly supporting its innovation and business development initiatives.

This substantial investment allows Aalberts to pioneer advanced technologies and craft highly customized solutions for its discerning clientele. The focus on R&D ensures the company remains at the forefront of its industry, capable of meeting evolving customer demands.

- Consistent R&D Investment: Aalberts prioritizes R&D to maintain a competitive advantage.

- 2024 Capital Expenditure: EUR 231 million was invested in innovation and business development.

- Innovation Focus: This investment enables the development of breakthrough technologies.

- Customer-Centric Solutions: R&D efforts are geared towards creating tailored solutions for high-end customers.

Technological factors are paramount for Aalberts, particularly in the semiconductor industry where AI-driven demand for advanced chips necessitates ultra-precision manufacturing technologies. The company's expertise in nanometer precision directly supports the creation of smaller, faster semiconductors, a trend amplified by the projected growth of the electric vehicle market, which is expected to exceed $1.5 trillion by 2030. Furthermore, Aalberts' embrace of Industry 4.0 principles, evidenced by its 2023 operational efficiency gains through digitalization, positions it to capitalize on smart manufacturing trends.

| Area | Key Technology Focus | Market Impact/Data Point |

|---|---|---|

| Semiconductors | Ultra-precision, Ultra-cleanliness | Supports nanometer precision in chip manufacturing; AI driving demand. |

| E-Mobility | Advanced Materials, Specialized Plating | Key for EV components; Global EV market projected to reach over $1.5 trillion by 2030. |

| Industry 4.0 | Digitalization, Automation | Improved operational efficiency (reported in 2023); Enhanced product quality and agility. |

| Materials Science | New Alloys, Composites, Surface Treatments | Extending product lifespans, lightweighting; Crucial for high-pressure applications. |

Legal factors

Aalberts navigates a complex web of environmental regulations worldwide, impacting everything from emissions and waste disposal to water and energy consumption. Failure to comply can result in hefty fines and severe damage to its brand image. For instance, in 2023, the European Union's Emissions Trading System (EU ETS) continued to tighten caps, potentially increasing compliance costs for industrial emitters.

The company's commitment to sustainability, including its goal of achieving net-zero carbon emissions by 2050 and reducing waste by 20% by 2025 compared to 2022 levels, highlights a proactive approach to meeting these legal obligations. These targets are not just aspirational; they are increasingly tied to operational efficiency and investor expectations, with many financial institutions factoring environmental performance into their lending and investment decisions.

Aalberts' commitment to product safety and quality is underscored by rigorous adherence to international standards, crucial for their high-tech components. For instance, in 2024, the company continued to invest in advanced quality control systems, aiming to reduce defect rates by 5% year-over-year, a testament to their focus on reliability.

Compliance with regulations like REACH for chemical safety and ISO certifications for quality management systems is non-negotiable, especially when supplying the semiconductor industry. In 2025, Aalberts is projected to undergo several key audits, ensuring their processes meet the stringent requirements of global markets and maintain customer confidence.

Protecting its intellectual property, including patents and proprietary technologies, is crucial for Aalberts' competitive advantage. In 2024, the company continued to invest in R&D, a key driver for its innovation pipeline, with a significant portion of its budget allocated to developing new technologies that are then secured through patents.

Aalberts actively manages and strengthens its IP portfolio to prevent infringement and leverage its innovations. As of early 2025, the company holds thousands of active patents globally, safeguarding its advanced manufacturing processes and specialized product designs.

Legal frameworks for IP protection vary significantly by region, necessitating a robust global strategy for Aalberts. The company navigates diverse patent laws and enforcement mechanisms across its operational territories to ensure its innovations remain protected and commercially viable.

Labor Laws and Employment Regulations

Aalberts, operating across more than 50 countries, navigates a complex web of labor laws and employment regulations. These vary significantly, covering everything from minimum wage and working hours to employee rights, collective bargaining, and anti-discrimination statutes. For instance, in 2024, many European nations continued to strengthen worker protections, with some countries implementing new mandates on remote work rights and pay transparency, which Aalberts must integrate into its global HR policies.

Adhering to these diverse legal frameworks is crucial for maintaining a motivated and stable workforce. Non-compliance can lead to costly legal disputes, fines, and reputational damage. For example, a significant labor dispute in one of its key operating regions could disrupt production and impact overall financial performance. Aalberts' proactive approach to understanding and implementing these regulations supports fair labor practices and fosters a positive employer brand.

Key areas of compliance for Aalberts include:

- Working Conditions: Adherence to safety standards, maximum working hours, and rest periods as mandated by local laws.

- Employee Rights: Ensuring fair treatment, protection against unfair dismissal, and access to grievance procedures.

- Non-Discrimination: Implementing policies that prevent discrimination based on age, gender, race, religion, disability, and other protected characteristics.

- Collective Bargaining: Engaging with employee representatives and unions where legally required or customary.

Anti-Corruption and Trade Compliance Laws

Aalberts navigates a complex web of anti-corruption and trade compliance laws across its global operations. These regulations, including stringent anti-bribery statutes and export control frameworks, are critical for maintaining its legal standing and upholding ethical business practices. Failure to comply can result in significant penalties and reputational damage.

To mitigate these risks, Aalberts has established comprehensive internal controls and ongoing training programs for its employees. These measures are designed to ensure adherence to laws such as the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, among others relevant to its diverse markets. For instance, in 2023, the company's commitment to compliance was underscored by its ongoing internal audit processes, which identified no material instances of non-compliance requiring external reporting.

- Global Reach, Local Laws: Aalberts operates in numerous countries, each with its own specific anti-corruption and trade compliance legislation.

- Risk Mitigation Strategies: The company employs robust internal controls and regular employee training to ensure adherence to laws like the FCPA and UK Bribery Act.

- Ethical Imperative: Strict compliance is not just a legal requirement but a cornerstone of Aalberts' commitment to ethical business conduct and maintaining trust with stakeholders.

- Trade Compliance Focus: Adherence to export controls and sanctions is vital to prevent disruptions in its international supply chains and market access.

Aalberts' legal obligations extend to robust intellectual property protection, crucial for its innovation-driven business. As of early 2025, the company held thousands of active patents globally, safeguarding its advanced manufacturing processes and specialized product designs. Navigating diverse patent laws across its operational territories is key to maintaining commercial viability and competitive advantage.

Environmental factors

Growing concerns about climate change are accelerating global efforts towards decarbonization, directly influencing Aalberts' operational strategies and the innovation of its product portfolio. This environmental shift necessitates a proactive approach to sustainability.

Aalberts has set an ambitious goal to achieve net-zero carbon emissions by 2050. As a key interim step, the company aims to reduce its Scope 1, 2, and 3 CO2 intensity by 2030, demonstrating a concrete commitment to environmental stewardship and aligning with international climate targets.

Achieving these targets involves significant operational changes, including a strategic transition to renewable energy sources and the electrification of industrial processes across its global facilities. These initiatives are crucial for minimizing Aalberts' carbon footprint.

Global resource scarcity is driving a shift towards more efficient material use and the adoption of circular economy models. This trend directly impacts companies like Aalberts, which rely on raw materials for its manufacturing processes.

Aalberts is actively addressing this by setting ambitious targets to reduce its environmental footprint. Specifically, the company aims to decrease its scope 3 CO2 intensity related to raw materials and waste disposal intensity by 30% by 2030, using 2024 as the baseline year. This commitment underscores the growing importance of sustainability in supply chain management.

To achieve these goals, Aalberts is focusing on innovative product design that prioritizes durability, reusability, and recyclability. Furthermore, responsible waste management practices are being implemented across its operations, ensuring that materials are handled in a way that minimizes environmental impact and maximizes resource recovery.

Water scarcity and quality are increasingly critical environmental issues, especially for manufacturing companies. Aalberts is actively working to reduce its water intensity, aiming for a decrease compared to its 2018 baseline. This commitment directly supports the provision of hygienic water distribution and enhances water efficiency within buildings.

This strategic focus on water management aligns with the United Nations’ Sustainable Development Goal 6, which champions access to water and sanitation for all. By prioritizing water efficiency, Aalberts not only mitigates operational risks but also contributes to broader environmental sustainability efforts.

Biodiversity and Ecosystem Impact

While Aalberts' core business in technology and manufacturing might not seem directly tied to biodiversity, its extensive supply chain and operational footprint can have indirect consequences. Responsible sourcing of materials, for instance, is crucial to avoid contributing to habitat destruction or the depletion of natural resources. Aalberts' commitment to sustainability, which includes efforts to reduce waste and emissions, also plays a role in mitigating its impact on ecosystems.

The company's 2024 sustainability report highlights a focus on supply chain transparency, aiming to ensure that raw materials are procured in ways that respect environmental regulations and minimize ecological disruption. This includes evaluating suppliers based on their environmental performance and adherence to standards that protect biodiversity. For example, initiatives to reduce water consumption across its facilities, which stood at 1,500,000 cubic meters in 2023, indirectly benefit aquatic ecosystems.

- Supply Chain Scrutiny: Aalberts is increasing its oversight of suppliers to ensure raw material sourcing does not negatively impact biodiversity.

- Land Use Efficiency: Efforts are underway to minimize the land footprint of its manufacturing and operational sites.

- Pollution Reduction: Continued investment in technologies to lower emissions and waste directly supports ecosystem health.

- Sustainability Reporting: The company's 2024 report details progress on environmental targets, including those related to resource management and pollution control.

Waste Reduction and Recycling Initiatives

Aalberts is deeply invested in minimizing waste throughout its operations, embracing circular economy principles. This involves innovative approaches like refurbishing and reusing components at the end of their lifecycle, thereby extending product life and reducing the need for new materials. The company also champions rigorous waste management and recycling protocols across all its facilities, aiming for a more sustainable manufacturing process.

These waste reduction initiatives directly translate to a reduced carbon footprint for Aalberts. For instance, by extending the life of modules through refurbishment, the company avoids the energy and emissions associated with manufacturing new parts. In 2023, Aalberts reported a significant increase in the proportion of waste recycled, with over 70% of operational waste being diverted from landfills, a testament to their commitment.

Key aspects of Aalberts' waste reduction and recycling strategy include:

- Circular Solutions: Implementing programs for refurbishing and reusing end-of-life modules, reducing raw material consumption.

- Operational Efficiency: Promoting best practices in waste handling and recycling at all manufacturing sites to minimize landfill contributions.

- Sustainability Metrics: Actively tracking and reporting on waste diversion rates and CO2 reductions linked to these initiatives, with a target to increase recycled material usage by 15% by the end of 2025.

Aalberts is actively working to reduce its environmental impact, with a strong focus on decarbonization and resource efficiency. The company has set a net-zero carbon emissions target for 2050 and aims to cut its CO2 intensity by 2030. This involves transitioning to renewable energy and improving water efficiency, aligning with global sustainability goals.

The company is also tackling resource scarcity by promoting circular economy principles and reducing waste. Aalberts aims to decrease its scope 3 CO2 intensity related to raw materials and waste disposal by 30% by 2030, using 2024 as a baseline. Initiatives like refurbishing modules and increasing recycling rates are key to achieving these objectives.

| Environmental Focus | Target | Baseline Year | Progress Indicator |

| Net-Zero Emissions | 2050 | N/A | Progress towards interim 2030 intensity reduction |

| Scope 1, 2, 3 CO2 Intensity | Reduce by 20% | 2024 | Tracking intensity reduction |

| Raw Material & Waste Disposal Intensity | Reduce by 30% | 2024 | Tracking intensity reduction |

| Water Intensity | Reduce | 2018 | Tracking water usage per unit |

| Waste Diversion from Landfill | Increase recycled material usage by 15% | 2025 | Tracking recycling rates |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aalberts is constructed using a blend of publicly available data from leading financial institutions, industry-specific market research reports, and official government publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting Aalberts' operations and strategic direction.