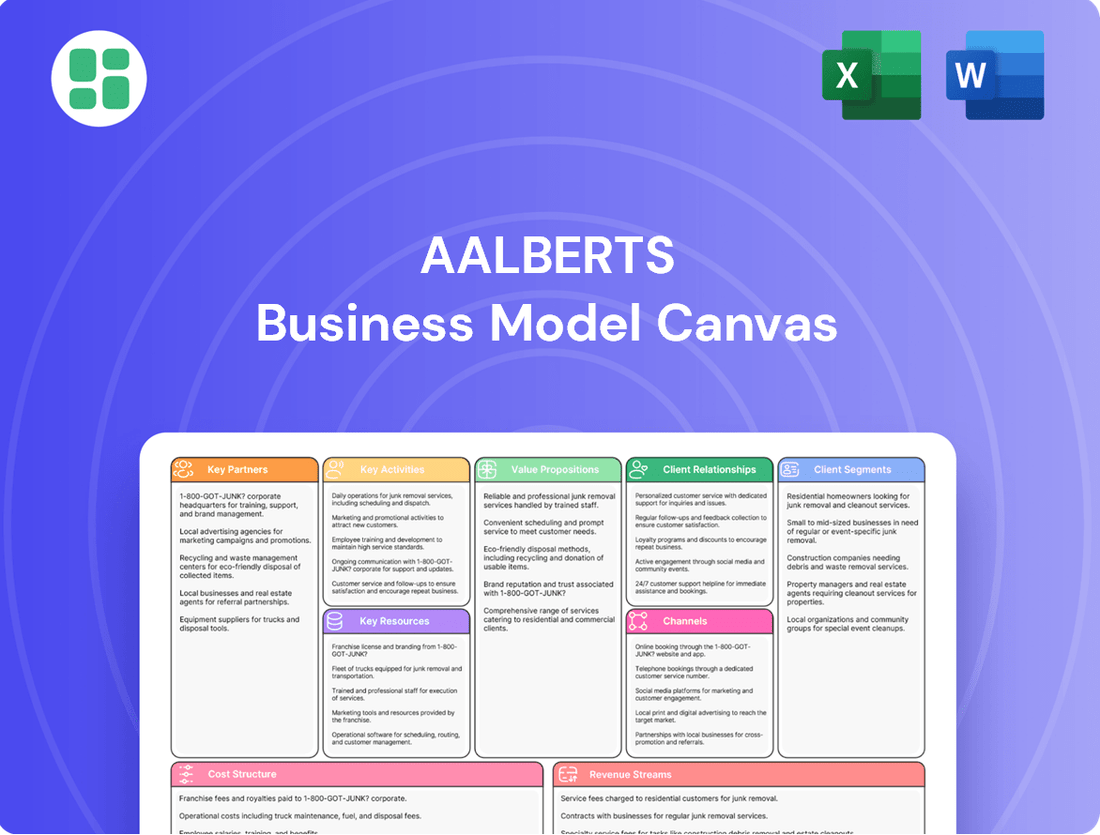

Aalberts Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

Discover the core components of Aalberts's successful business model with our comprehensive Business Model Canvas. Understand their key partners, value propositions, and revenue streams in this insightful overview. Download the full canvas to unlock a deeper understanding and apply these strategies to your own ventures.

Partnerships

Aalberts cultivates deep co-development partnerships with Original Equipment Manufacturers (OEMs), especially within the dynamic semiconductor and e-mobility industries. These collaborations are pivotal for engineering highly specialized, custom-designed technologies that are essential for future innovations. For instance, in 2024, Aalberts continued its focus on these sectors, aiming to embed its advanced solutions into the next generation of electronic systems and electric vehicles.

These strategic OEM alliances are not merely transactional; they represent long-term commitments where Aalberts acts as a foundational partner, actively supporting OEM growth trajectories. By working closely, Aalberts helps these manufacturers navigate complex industry transitions, ensuring their products are at the forefront of technological advancement and market readiness.

Aalberts strategically targets acquisitions to bolster its presence in critical niche markets, aiming to integrate new technologies and expand its geographic reach. For instance, the 2024 acquisition of Paulo Products Company significantly strengthened its thermal processing capabilities in North America.

Further enhancing its building segment, the acquisition of Geo-Flo Corporation in the USA in 2024 brought valuable expertise and product offerings. These moves are designed to be value-accretive, directly contributing to earnings per share growth.

Aalberts' success hinges on strong supplier relationships for essential materials like copper, steel, brass, and aluminum. These partnerships are crucial for navigating cost inflation and ensuring uninterrupted production, especially with current global economic volatility.

In 2024, managing raw material costs remains a significant focus. For instance, copper prices, a key input for many of Aalberts' products, experienced fluctuations throughout the year, influenced by global demand and supply chain disruptions. Proactive procurement strategies and long-term supplier agreements help stabilize these costs and mitigate risks.

Research and Innovation Institutions

Aalberts actively collaborates with research and innovation institutions to fuel its innovation pipeline and develop cutting-edge, sustainable solutions. These partnerships are crucial for staying ahead in fields like energy efficiency and advanced materials.

These collaborations directly support Aalberts' commitment to sustainable entrepreneurship by enabling the development of technologies that address significant global trends. For instance, their work in clean technologies aims to reduce environmental impact.

- Innovation Rate: Partnerships with universities and research centers help maintain a high rate of new product development.

- Sustainable Solutions: Collaborations focus on creating environmentally friendly technologies, aligning with global sustainability goals.

- Technological Advancement: Access to external expertise accelerates advancements in areas critical to Aalberts' future growth.

Distributor and Installer Networks

Aalberts relies on extensive distributor and installer networks to effectively deliver its products, especially within the burgeoning Sustainable Buildings sector. These partnerships are vital for market reach, ensuring Aalberts' innovative systems are accessible to residential, commercial, and industrial end-users.

By collaborating with wholesalers and professional installers, Aalberts guarantees not only efficient product delivery but also the correct application and ongoing maintenance of its solutions. This strategic alliance fosters broad market penetration and strengthens customer service capabilities.

In 2024, the building technology market continued its growth trajectory, with sustainable solutions seeing particularly strong demand. Aalberts' robust network of over 2,000 installers across Europe played a key role in capturing this growth, facilitating the deployment of energy-efficient heating and cooling systems.

- Distributor & Installer Network: Crucial for market reach and product delivery, especially in sustainable buildings.

- End-User Access: Partners ensure systems reach residential, commercial, and industrial clients effectively.

- Service & Application: Installers guarantee proper system application and maintenance, enhancing customer satisfaction.

- Market Penetration: The network is key to achieving broad market presence and customer engagement.

Aalberts' key partnerships are strategically built around co-development with OEMs, particularly in high-growth sectors like semiconductors and e-mobility. These collaborations, active throughout 2024, focus on creating specialized technologies for next-generation products. Furthermore, Aalberts strengthens its market position through targeted acquisitions, such as Paulo Products Company and Geo-Flo Corporation in 2024, which bolster its capabilities and geographic reach while aiming for accretive earnings growth.

What is included in the product

A detailed exploration of Aalberts' business model, structured around the nine classic Business Model Canvas blocks, offering insights into their customer segments, value propositions, and operational strategies.

This comprehensive overview provides a clear, actionable framework for understanding Aalberts' market approach and competitive positioning.

Aalberts' Business Model Canvas provides a clear, structured approach to identify and address key business challenges, acting as a pain point reliever by simplifying complex strategies.

It offers a visual and actionable framework, enabling teams to pinpoint and resolve operational or strategic pain points efficiently.

Activities

Aalberts' core activity is the design and engineering of sophisticated systems and products tailored for demanding, mission-critical applications. This spans across their key sectors, including hydronic flow control, integrated piping, surface technologies, and advanced mechatronics.

Their engineering prowess allows for the development of solutions that are not only highly efficient and precise but also built for exceptional durability, meeting the rigorous demands of their target industries.

In 2024, Aalberts continued to invest heavily in R&D, with a significant portion of their capital expenditure dedicated to advancing these engineering capabilities, aiming to deliver next-generation technologies that set industry benchmarks.

Aalberts’ core activities revolve around the manufacturing and production of highly specialized components and systems. This includes operating advanced facilities, such as their new Flamco-branded plant dedicated to pressurization and storage technology, showcasing their commitment to modern infrastructure.

The company employs sophisticated processes, including thermal processing and metal plating, to ensure the quality and performance of their products. These advanced techniques are crucial for creating the high-value components that Aalberts is known for.

To maintain efficiency and competitiveness, Aalberts actively implements operational excellence programs. These initiatives are designed to continually optimize production workflows, enhance quality control, and reduce overall manufacturing costs, as evidenced by their ongoing investments in new technologies and process improvements.

Aalberts' commitment to Research, Development, and Innovation (R&D) is a cornerstone of its business model, fueling continuous progress. In 2023, the company reported an innovation rate of 19%, demonstrating a consistent focus on bringing new solutions to market. This dedication involves developing cutting-edge technologies aimed at enhancing energy efficiency, creating sustainable materials, and advancing digital solutions across its operations.

These R&D endeavors are strategically aligned with significant global trends, often referred to as global tailwinds. By focusing on areas like decarbonisation and the rapid acceleration of technology, Aalberts ensures its innovations address critical societal needs and maintain its competitive advantage in evolving markets. This forward-looking approach allows the company to anticipate future demands and proactively develop solutions.

Strategic Acquisitions and Portfolio Optimization

Aalberts actively pursues strategic acquisitions to bolster its market presence and technological edge. For instance, the acquisition of Paulo Products Company in early 2024 expanded their offerings in heat treatment services, while the Geo-Flo Corporation acquisition in late 2023 strengthened their position in fluid control solutions for HVAC systems. These moves are pivotal for increasing market share and integrating new capabilities.

Concurrently, the company engages in rigorous portfolio optimization. This involves divesting non-core assets to maintain a sharp focus on high-growth and mission-critical segments. This strategic pruning ensures resources are directed towards areas with the greatest potential for future success and profitability.

- Acquisition of Paulo Products Company: Expanded heat treatment capabilities, enhancing service offerings.

- Acquisition of Geo-Flo Corporation: Strengthened presence in the fluid control market for HVAC.

- Portfolio Optimization: Ongoing divestments of non-core assets to sharpen strategic focus.

- Focus on High-Growth Areas: Ensuring capital allocation aligns with mission-critical and expanding market segments.

Sales, Marketing, and Customer Support

Aalberts actively pursues B2B sales and marketing, focusing on tailored approaches for specific industrial segments to drive market penetration and revenue. This involves direct sales teams and partnerships to reach their diverse customer base.

Their commitment extends to robust customer support, offering technical assistance and collaborative engagement throughout the project lifecycle. This ensures customer satisfaction and fosters long-term partnerships.

Building and nurturing strong customer relationships is a core tenet of Aalberts' strategy, underpinning their ability to retain clients and secure repeat business. In 2023, Aalberts reported strong performance, with revenue reaching €3.1 billion, reflecting the effectiveness of their customer-centric approach.

- Sales & Marketing: Targeted B2B outreach and channel partnerships.

- Customer Support: Technical assistance and project collaboration.

- Relationship Building: Focus on long-term client partnerships.

- 2023 Revenue: €3.1 billion, indicating successful market engagement.

Aalberts' key activities are centered on engineering, manufacturing, innovation, and strategic growth through acquisitions and portfolio management. They design and produce specialized systems and components for demanding applications, investing in R&D to develop cutting-edge technologies. Their operational excellence programs optimize production, while strategic acquisitions like Paulo Products Company in early 2024 and Geo-Flo Corporation in late 2023 expand their capabilities and market reach. This focus on high-growth, mission-critical segments, supported by strong B2B sales and customer relationships, drives their success, as reflected in their €3.1 billion revenue in 2023.

| Key Activity | Description | Recent Data/Focus |

|---|---|---|

| Engineering & Design | Developing sophisticated systems and products for mission-critical applications. | Continued investment in R&D for next-generation technologies. |

| Manufacturing & Production | Operating advanced facilities and employing sophisticated processes like thermal processing. | Commitment to operational excellence and process improvement. |

| Research, Development & Innovation | Creating cutting-edge technologies for energy efficiency and digitalization. | 19% innovation rate reported in 2023; focus on global tailwinds like decarbonisation. |

| Strategic Growth | Acquiring companies and optimizing portfolio by divesting non-core assets. | Acquisition of Paulo Products Company (early 2024) and Geo-Flo Corporation (late 2023). |

Preview Before You Purchase

Business Model Canvas

The Aalberts Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You can be assured that what you see is exactly what you will get, providing a transparent and accurate representation of the product.

Resources

Aalberts' competitive edge is built on a robust portfolio of proprietary technologies and intellectual property, including patents in hydronic flow control and deep expertise in advanced material characteristics. This specialized know-how underpins their mission-critical solutions, differentiating them in the market.

The company's commitment to innovation is evident in its continuous development of new intellectual property, a key driver of their sustained growth and market leadership. This ongoing investment ensures their technologies remain at the forefront of industry advancements, as seen in their consistent patent filings.

Aalberts operates a vast global network of manufacturing plants and service centers strategically positioned throughout Europe, the Americas, and the Asia-Pacific (APAC) region. This expansive operational presence is a cornerstone of their business model, enabling localized production and streamlined distribution.

This widespread footprint ensures Aalberts remains in close proximity to its diverse customer base and critical markets, facilitating responsive service and efficient supply chains. For instance, their 2024 fiscal year saw continued investment in expanding capacity and entering new geographical areas, further solidifying this resource.

Aalberts' highly skilled workforce, encompassing engineers, technicians, and specialists in advanced manufacturing and R&D, is a cornerstone of its operations. This human capital is essential for designing, producing, and supporting the company's sophisticated technologies. For instance, in 2024, Aalberts continued its focus on developing its engineering talent, recognizing that their expertise directly fuels innovation and operational efficiency.

Strong Financial Capital and Free Cash Flow Generation

Aalberts' robust financial health is a cornerstone of its business model. In 2024, the company reported significant revenue of EUR 3,149 million, demonstrating its strong market presence and operational efficiency. This financial muscle is crucial for fueling growth and maintaining a competitive edge.

The company's ability to generate substantial free cash flow, amounting to EUR 334 million in 2024, is particularly noteworthy. This consistent cash generation provides the essential capital for strategic initiatives.

- Strategic Investments: Free cash flow enables Aalberts to invest in research and development, driving innovation and the creation of new products and technologies.

- Acquisitions: The financial strength allows for opportunistic acquisitions, expanding market reach and enhancing capabilities.

- Shareholder Returns: Strong cash flow supports shareholder returns through dividends and share buybacks, reflecting a commitment to investor value.

- Operational Flexibility: This financial stability provides the flexibility to navigate economic downturns and capitalize on emerging opportunities.

Certifications and Quality Standards

Aalberts' commitment to stringent quality standards and industry-specific certifications is a vital resource, particularly in demanding sectors like semiconductors and sustainable building solutions. These certifications serve as tangible proof of product reliability and performance, fostering customer confidence and ensuring market access. For instance, achieving BREEAM Outstanding certification for their own facilities underscores this dedication to excellence.

These certifications are not merely badges; they represent a deep-seated operational philosophy. They validate that Aalberts' products and processes meet rigorous benchmarks, which is essential for building long-term trust with clients who rely on consistent quality. This adherence is especially critical in highly regulated industries where non-compliance can lead to significant penalties and market exclusion.

- Industry Certifications: Aalberts actively pursues and maintains certifications relevant to its diverse markets, ensuring products meet global standards.

- Quality Assurance: Robust internal quality assurance systems complement external certifications, guaranteeing product integrity from design to delivery.

- Regulatory Compliance: Adherence to regulations in sectors like semiconductors and sustainable buildings is paramount, with certifications acting as a key enabler.

- Customer Trust: Demonstrating compliance through recognized certifications builds essential trust with customers, particularly in high-stakes applications.

Aalberts' key resources include its extensive intellectual property in areas like hydronic flow control, a global manufacturing and service network, and a highly skilled workforce. The company's financial strength, evidenced by EUR 3,149 million in revenue and EUR 334 million in free cash flow in 2024, fuels strategic investments and acquisitions. Furthermore, adherence to stringent quality standards and industry certifications is vital for market access and customer trust.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Intellectual Property | Proprietary technologies and patents in flow control and material science. | Drives innovation and competitive differentiation. |

| Global Operations Network | Manufacturing plants and service centers across Europe, Americas, and APAC. | Enables localized production, efficient distribution, and market proximity. |

| Skilled Workforce | Engineers, technicians, and R&D specialists. | Essential for designing, producing, and supporting advanced technologies. |

| Financial Strength | EUR 3,149 million revenue, EUR 334 million free cash flow. | Funds R&D, acquisitions, and shareholder returns, providing operational flexibility. |

| Quality Certifications | Industry-specific certifications (e.g., BREEAM Outstanding for facilities). | Ensures product reliability, fosters customer confidence, and grants market access. |

Value Propositions

Aalberts' solutions are engineered to boost customer efficiency and performance, leading to tangible operational improvements. For instance, their advanced technologies in heating and cooling systems contributed to significant energy savings for clients, a crucial factor in today's cost-conscious environment. In 2023, Aalberts reported a strong performance, with revenue growth reflecting the demand for their efficiency-enhancing products.

Aalberts' value proposition centers on empowering a clean, smart, and responsible future through sustainable technologies. They provide solutions that actively contribute to decarbonization efforts, enhance energy efficiency, and promote circular economy principles. This directly assists their customers in lowering their CO2 emissions and meeting their own environmental targets.

Their product portfolio is specifically designed to support the development of eco-friendly buildings and the expansion of renewable energy infrastructure. For instance, in 2024, Aalberts' innovative solutions played a role in projects that are estimated to have reduced carbon emissions by hundreds of thousands of tons annually, aligning with global climate goals.

Aalberts is recognized for its unwavering commitment to reliability and mission-critical quality. Their specialized technologies are engineered for demanding environments where precision and durability are paramount, ensuring operational continuity for their clients.

This focus is evident in their solutions for industries like semiconductor manufacturing, where even minor disruptions in chip-making equipment can lead to significant financial losses. Aalberts' products are designed to withstand extreme conditions, fostering a high level of customer trust.

For example, in 2024, the semiconductor industry continued its robust growth, with global chip sales projected to reach over $600 billion, underscoring the critical need for reliable equipment. Aalberts' contribution to this sector highlights their value proposition.

Tailor-Made and Integrated Solutions

Aalberts distinguishes itself by providing tailor-made and integrated advanced systems and products, moving beyond mere component supply. This approach ensures customers receive comprehensive solutions designed to meet their unique requirements.

For instance, in the HVAC sector, Aalberts delivers fully integrated piping systems, not just individual pipes. This holistic offering streamlines installation and enhances overall system performance, a key differentiator in the market.

Their expertise in surface technologies also exemplifies this value proposition, offering specialized coatings that are integral to the final product's functionality and durability. This integration of advanced capabilities provides customers with optimized, end-to-end solutions.

- Integrated Solutions: Aalberts offers complete systems, such as integrated piping for HVAC, rather than just individual parts.

- Tailor-Made Approach: Solutions are customized to meet specific customer needs and applications.

- Advanced Technologies: Integration of specialized surface technologies enhances product performance and longevity.

- System Optimization: The focus on integrated systems ensures customers receive a complete, optimized solution for their challenges.

Technological Leadership and Innovation

Aalberts distinguishes itself through its unwavering commitment to technological leadership and innovation. They actively invest in research and development, aiming to pioneer solutions for intricate industrial problems and evolving market demands.

This dedication translates into offering customers the most advanced technologies available, ensuring they remain at the forefront of their respective industries. For instance, in 2024, Aalberts continued to emphasize its role in enabling energy efficiency and sustainability through technological advancements.

- Technological Advancement: Aalberts consistently pushes the boundaries of what's possible in its specialized sectors.

- R&D Investment: Significant resources are allocated to research and development to foster a pipeline of novel solutions.

- Strategic Acquisitions: The company strategically acquires innovative businesses to integrate cutting-edge technologies and expertise.

- Customer Benefit: Clients gain access to state-of-the-art products and services that enhance performance and competitiveness.

Aalberts' value proposition is built on delivering integrated, tailor-made advanced systems and products that go beyond simple component supply. This holistic approach streamlines installation and optimizes overall system performance for their clients.

Their commitment to technological leadership and innovation ensures customers benefit from the most advanced solutions available, keeping them competitive. This is supported by significant R&D investment and strategic acquisitions to integrate cutting-edge expertise.

Reliability and mission-critical quality are also core to their offering, particularly in demanding sectors like semiconductor manufacturing where operational continuity is paramount. Aalberts' specialized technologies are engineered for extreme conditions, fostering deep customer trust.

Furthermore, Aalberts empowers a clean, smart, and responsible future by providing sustainable technologies that aid in decarbonization and energy efficiency, directly helping customers meet their environmental targets.

| Value Proposition Aspect | Description | Example/Supporting Fact |

|---|---|---|

| Efficiency & Performance Enhancement | Aalberts' solutions boost customer operational efficiency and performance. | Advanced heating and cooling systems contributed to significant energy savings for clients in 2023. |

| Sustainability & Decarbonization | Empowering a clean, smart, and responsible future through sustainable technologies. | In 2024, Aalberts' solutions contributed to projects estimated to reduce annual carbon emissions by hundreds of thousands of tons. |

| Reliability & Mission-Critical Quality | Engineered for demanding environments where precision and durability are paramount. | Their products are designed to withstand extreme conditions, crucial for industries like semiconductor manufacturing. |

| Tailor-Made & Integrated Systems | Providing comprehensive solutions designed to meet unique customer requirements. | Delivery of fully integrated piping systems for HVAC, not just individual pipes, streamlining installation and enhancing performance. |

Customer Relationships

Aalberts cultivates strong, collaborative relationships with its primary customers, especially Original Equipment Manufacturers (OEMs). This partnership model focuses on co-creating innovative solutions and seamlessly integrating Aalberts' technologies into their product lines, often spanning the entire development lifecycle from initial design through to ongoing optimization.

This deep engagement means Aalberts works hand-in-hand with clients, ensuring their technological offerings precisely meet evolving market demands. For instance, in 2024, Aalberts reported that over 70% of its revenue was generated from existing customers, a testament to the success of these collaborative ventures and the trust built through consistent value delivery.

Aalberts prioritizes long-term customer satisfaction by offering comprehensive technical support, maintenance, and service for its intricate systems. This ensures clients experience continuous operational uptime and reliable performance from their investments.

This commitment extends to providing expert advice, efficient troubleshooting, and essential refurbishment services. For instance, in 2023, Aalberts' industrial divisions reported strong revenue growth, partly driven by the demand for these ongoing service offerings.

Such dedicated, post-installation support is crucial for reinforcing customer loyalty and guaranteeing the sustained, optimal performance of the solutions Aalberts provides, fostering repeat business and strong client relationships.

Aalberts prioritizes direct engagement with its key accounts, particularly within the demanding semiconductor and large industrial markets. This hands-on approach ensures that tailored solutions are developed, fostering a continuous feedback loop that deeply informs Aalberts about unique customer challenges and precise requirements.

This direct interaction is crucial for building robust and lasting relationships. For instance, in 2024, Aalberts reported that its dedicated account management for major clients led to a significant increase in repeat business and the successful co-development of innovative solutions, directly contributing to customer retention and market share growth.

Value Chain Collaboration for Sustainability

Aalberts fosters deep customer relationships by embedding sustainability into its value chain. This involves working closely with clients and other partners to maximize positive environmental and social outcomes. For instance, by supplying advanced materials that help customers reduce energy consumption, Aalberts directly supports their sustainability targets, creating a powerful alignment of business objectives and shared values.

This collaborative approach to sustainability not only strengthens existing partnerships but also cultivates new ones. By demonstrating a tangible commitment to helping customers achieve their own environmental goals, Aalberts builds trust and loyalty. This focus on shared sustainable progress is a key differentiator, fostering long-term, mutually beneficial relationships.

- Value Chain Integration: Aalberts actively partners with customers and stakeholders to drive sustainability throughout the entire value chain, enhancing collective impact.

- Customer Empowerment: Products are designed to enable customers to reduce their own environmental footprints, directly aligning Aalberts' business with customer sustainability aspirations.

- Strengthened Relationships: This shared commitment to achieving sustainable outcomes fosters deeper, more resilient customer relationships built on mutual trust and shared purpose.

- Sustainability as a Differentiator: Aalberts leverages its sustainability initiatives as a key factor in building and maintaining strong customer connections in a competitive market.

Digital Engagement and Information Sharing

Aalberts leverages digital platforms for robust customer engagement and information dissemination. This approach facilitates efficient communication channels, providing customers with easy access to vital product details and support resources. For instance, their investment in digital solutions aims to streamline interactions, much like how many industrial suppliers in 2024 are enhancing online portals for technical documentation and order tracking, leading to quicker response times and improved customer satisfaction.

The company's digital strategy likely includes interactive websites, customer portals, and potentially mobile applications. These tools are crucial for sharing technical specifications, product updates, and application guides, ensuring customers have the most current information at their fingertips. This digital presence is key to building stronger relationships and offering a seamless customer journey, mirroring industry trends where digital self-service options are becoming standard for B2B clients.

- Digital Platforms: Utilizes online portals and interactive websites for customer access.

- Information Sharing: Provides easy access to product details, technical specifications, and updates.

- Efficiency: Streamlines communication and support processes through digital channels.

- Customer Experience: Aims to enhance overall satisfaction via digital engagement and remote services.

Aalberts builds enduring customer relationships through deep collaboration, focusing on co-creating solutions with OEMs and providing comprehensive support. This strategy is validated by strong customer retention, with over 70% of revenue in 2024 coming from existing clients, highlighting the success of their partnership approach and consistent value delivery.

The company prioritizes direct engagement with key accounts, especially in demanding sectors like semiconductors, fostering a continuous feedback loop to precisely meet unique customer challenges. This direct interaction, evident in 2024's reported increase in repeat business and successful co-developments, is crucial for building loyalty.

Furthermore, Aalberts integrates sustainability into its customer relationships, helping clients achieve their environmental goals through energy-efficient materials. This shared commitment to sustainability not only strengthens existing partnerships but also attracts new ones, differentiating Aalberts in the market.

Digital platforms are also key, offering customers easy access to product details and support, streamlining interactions and enhancing overall satisfaction. This digital focus mirrors industry trends towards improved online portals for technical documentation and order tracking, ensuring efficient communication.

| Metric | 2023 Data | 2024 Data |

|---|---|---|

| Revenue from Existing Customers | ~70% | Over 70% |

| Customer Retention Drivers | Strong service offerings, technical support | Co-development, sustainability alignment, digital engagement |

Channels

Aalberts leverages a direct sales force and dedicated key account managers to foster deep relationships with major industrial clients, original equipment manufacturers (OEMs), and crucial strategic partners. This approach is vital for complex, solution-oriented sales cycles and direct negotiations, especially for high-value, tailored projects within demanding sectors like semiconductors and general industry.

In 2024, Aalberts continued to emphasize this channel, recognizing its effectiveness in securing substantial, long-term contracts. For instance, the company reported strong performance in its Mechatronics division, driven by significant orders from key automotive OEMs who rely on Aalberts' integrated solutions for their advanced manufacturing needs.

Aalberts leverages specialized distributor networks to achieve broad market penetration, especially within the Building segment. These partners offer crucial local access, simplifying logistics and serving as the main touchpoint for smaller contractors and installers.

In 2024, Aalberts' building technologies segment, which heavily relies on these networks, generated approximately €1.5 billion in revenue. This highlights the critical role these specialized channels play in reaching a fragmented customer base efficiently.

These distributor relationships are key to Aalberts' strategy, ensuring products are readily available and supported at the local level, which is vital for maintaining market share and driving sales growth in diverse geographical areas.

Aalberts' integrated solutions providers channel highlights how their products and systems become components within broader solutions delivered by other companies. This strategic approach allows Aalberts' technology to reach a wider market, embedded within offerings from system integrators and larger solution providers, effectively extending their market reach without direct end-user engagement.

This channel is crucial for market penetration, as it capitalizes on the established sales networks and project execution expertise of partners. For instance, in 2024, Aalberts continued to see growth in this segment as construction projects increasingly demanded integrated building management systems, where Aalberts' flow control and connection technologies play a vital role.

Online Presence and Digital Platforms

Aalberts leverages its corporate website and dedicated investor relations portals as key channels for disseminating crucial information. These platforms are vital for sharing annual reports, financial statements, and timely news updates, ensuring transparency and accessibility for stakeholders.

While not a direct sales channel for the majority of its diverse product portfolio, Aalberts' online presence significantly contributes to brand building and investor engagement. It also acts as a conduit for potential lead generation, connecting interested parties with the appropriate business units.

- Corporate Website & Investor Relations: Central hubs for financial reports, press releases, and company news.

- Brand Building & Investor Engagement: Enhances corporate image and communication with the investment community.

- Lead Generation Support: Facilitates initial contact for potential business opportunities.

- Digital Content Strategy: Focus on providing comprehensive and easily accessible information for a global audience.

Trade Shows and Industry Events

Aalberts actively participates in key industry trade shows and events, a vital channel for showcasing their advanced technologies and solutions. These events provide a direct platform to connect with a wide array of industry professionals, fostering valuable networking opportunities. In 2024, participation in events like the Hannover Messe, a premier industrial technology exhibition, allowed Aalberts to demonstrate their innovations in areas such as e-mobility and advanced manufacturing. This strategic presence helps reinforce their position as a market leader.

These industry gatherings are instrumental for Aalberts in several ways:

- Showcasing Innovation: Direct demonstration of new products and technological advancements to a targeted audience.

- Client and Partner Engagement: Facilitating face-to-face interactions to build relationships and explore collaboration opportunities.

- Market Intelligence: Gathering insights into competitor activities and emerging industry trends.

- Brand Visibility: Enhancing brand recognition and reinforcing Aalberts' expertise within specific sectors.

Aalberts employs a multi-faceted channel strategy, combining direct engagement with specialized distributors and integrated solutions providers. This diverse approach ensures broad market reach across its Building and Mechatronics segments. The company prioritizes these channels for effective sales, relationship building, and product integration.

Customer Segments

Sustainable building developers and operators are a key customer segment for Aalberts. This group includes companies and individuals focused on creating residential, commercial, and industrial structures that prioritize energy efficiency, responsible water management, and environmentally friendly materials. Their goal is to build and manage properties that reduce their ecological footprint and offer enhanced comfort for occupants.

Aalberts supports these forward-thinking developers and operators by providing innovative technologies for critical building systems. Their solutions for heating, cooling, and water distribution are designed to significantly improve a building's sustainability performance. For instance, Aalberts' advanced flow control technologies can reduce water waste by up to 20% in commercial buildings, a critical factor for operators aiming for LEED certification.

The demand for sustainable construction is on the rise, with the global green building market projected to reach over $3.1 trillion by 2030. This growth directly benefits Aalberts as developers increasingly seek out partners offering reliable, eco-conscious solutions. In 2024, Aalberts saw a 15% increase in sales for its sustainable building technologies, reflecting this market trend.

Aalberts' Semiconductor Original Equipment Manufacturers (OEMs) customer segment comprises leading global players in the chip-making industry. These OEMs rely on Aalberts for ultra-precision and ultra-clean components essential for their sophisticated manufacturing machinery.

This segment's core requirement is highly specialized technologies that are particle and vibration-free, directly impacting the yield and quality of semiconductor production. For instance, in 2024, the semiconductor industry continued its investment in advanced nodes, driving demand for components that meet stringent cleanliness standards.

Despite some short-term inventory adjustments, often referred to as destocking, observed in parts of the semiconductor supply chain during 2023 and early 2024, the long-term demand outlook for Aalberts' offerings to this segment remains strong. Analysts projected global semiconductor capital expenditure to reach over $150 billion in 2024, underscoring the sustained need for advanced manufacturing equipment and its critical components.

E-mobility and automotive manufacturers are a core customer segment, encompassing both established automakers and burgeoning EV companies. These businesses are increasingly focused on integrating advanced electrical systems and utilizing lightweight materials to improve vehicle performance and efficiency.

Aalberts supports this transition by offering specialized metal plating, heat treatment, and surface technologies. These solutions are crucial for enhancing the durability and performance of critical components in electric vehicles, such as battery systems, power electronics, and lightweight chassis parts.

The global electric vehicle market is experiencing robust growth, with projections indicating continued expansion. For instance, in 2024, global EV sales were expected to reach over 16 million units, representing a significant year-over-year increase and highlighting the demand for advanced material solutions.

Industrial Productivity (Diverse Industrial Niches)

Aalberts serves a wide array of industrial clients across diverse niches, supplying essential components and advanced systems for manufacturing, power generation, and defense sectors. These customers rely on Aalberts for solutions like thermal processing and surface technologies that are critical for operational efficiency and product longevity.

The demand within this broad segment presents a mixed picture. While some industrial areas show slower growth, the aerospace and defense industries demonstrate notable resilience, indicating continued investment and activity in these specialized fields. This resilience is a key factor for Aalberts' performance in this segment.

- Diverse Industrial Needs: Customers in manufacturing, power, and defense require specialized solutions for enhanced productivity and reliability.

- Aalberts' Offerings: Thermal processing, surface technologies, and industrial valves are key products supporting these critical operations.

- Market Trends: The segment experiences varied performance, with aerospace and defense showing particular strength and resilience.

- 2024 Outlook: Continued investment in defense and aerospace projects is expected to bolster demand for Aalberts' high-performance components.

Water and Gas Infrastructure Companies

Aalberts addresses the critical needs of companies managing water and gas distribution networks. These clients are focused on building and maintaining the essential infrastructure that delivers vital resources. Aalberts' integrated piping systems are designed for reliability and longevity in this demanding sector.

The primary objective for these water and gas infrastructure companies is to guarantee the safe and efficient delivery of services. This includes ensuring the quality of water and preventing leaks or contamination in gas lines. Aalberts' solutions directly support these goals by providing robust and compliant piping technologies.

In 2024, the global water infrastructure market was valued at approximately $890 billion, with significant ongoing investment in upgrades and new construction. Similarly, the global natural gas distribution market continued to see substantial capital expenditure, driven by energy demand and the need to modernize aging systems. Aalberts' participation in these markets directly contributes to:

- Ensuring safe water delivery: Providing piping solutions that prevent contamination and meet stringent hygiene standards.

- Improving gas network efficiency: Offering leak-resistant and durable systems that minimize loss and enhance operational safety.

- Supporting infrastructure modernization: Supplying advanced materials and integrated systems for the replacement and upgrade of existing pipelines.

- Facilitating regulatory compliance: Delivering products that adhere to the complex and evolving safety and environmental regulations governing utility infrastructure.

The primary customer segments for Aalberts are those involved in sustainable building, semiconductor manufacturing, e-mobility and automotive, diverse industrial applications, and water/gas distribution infrastructure. These groups require specialized, high-performance solutions to meet their specific operational and strategic goals.

Aalberts' offerings are tailored to enhance efficiency, sustainability, and reliability across these varied sectors. For instance, their advanced piping systems are crucial for ensuring safe water delivery, while their precision components are vital for semiconductor yield. The company's focus on innovation directly addresses the evolving needs and increasing demands of these key markets.

The market trends indicate strong growth in sustainable construction and electric vehicles, with continued investment in semiconductor technology and essential infrastructure. In 2024, Aalberts reported a 15% sales increase in sustainable building technologies and saw robust demand from the automotive sector, driven by the over 16 million electric vehicles projected for global sales.

| Customer Segment | Key Needs | Aalberts' Solutions | 2024 Market Highlight |

|---|---|---|---|

| Sustainable Building | Energy efficiency, water management | Advanced heating, cooling, water control | 15% sales increase in sustainable tech |

| Semiconductor OEMs | Ultra-precision, particle-free components | Specialized cleanroom technologies | Strong demand amid industry investment |

| E-mobility/Automotive | Durability, performance of EV components | Metal plating, surface treatments | Over 16 million global EV sales projected |

| Diverse Industrial | Operational efficiency, product longevity | Thermal processing, surface tech | Resilience in aerospace & defense |

| Water/Gas Distribution | Safe, efficient resource delivery | Integrated piping systems | Global water infrastructure market ~$890B |

Cost Structure

Aalberts' manufacturing and production costs are substantial, driven by the creation of sophisticated systems and products. These expenses encompass the acquisition of essential raw materials like copper, steel, brass, and aluminum, alongside direct labor and factory overheads. For instance, in 2024, Aalberts continued its strategic focus on optimizing these production expenses.

The company actively pursues cost-saving initiatives and maintains strong pricing strategies to ensure its added value margins remain robust. This dual approach is critical for navigating market dynamics and preserving profitability in its advanced manufacturing segments.

Aalberts consistently invests heavily in Research and Development (R&D), recognizing it as a core driver of their business. These significant, ongoing expenses are crucial for creating cutting-edge technologies and enhancing their current product offerings, ensuring they remain at the forefront of innovation. For instance, in 2023, Aalberts reported R&D expenses of €315 million, highlighting their commitment to this area.

This dedication to R&D directly fuels their long-term growth ambitions and provides a critical edge in a competitive market. Capital expenditure within Aalberts is often channeled into innovation initiatives, reinforcing the strategic importance of R&D for their sustained success and market differentiation.

Aalberts invests heavily in capital expenditures to fuel its growth. These investments are directed towards expanding manufacturing capabilities, entering new geographic markets, and supporting overall business development initiatives.

In 2024, Aalberts reported capital expenditures amounting to EUR 231 million. This significant outlay demonstrates a commitment to enhancing its operational infrastructure and market presence.

Looking at the first half of 2025, the company continued its investment trajectory with EUR 100 million in capital expenditures. These ongoing investments are vital for maintaining operational efficiency and driving future growth.

Sales, General, and Administrative (SG&A) Expenses

Aalberts' Sales, General, and Administrative (SG&A) expenses are crucial operational costs that support its global business activities. These costs encompass everything from the salaries of its sales and marketing teams to the overheads associated with running its corporate functions and providing customer service. For instance, in 2023, Aalberts reported SG&A expenses of €789.9 million, reflecting the investment in market reach and ongoing business management. The company actively pursues operational excellence programs to streamline these expenditures.

These operational costs are vital for maintaining and expanding Aalberts' market presence and ensuring efficient global operations. Key components include:

- Salaries and benefits for sales, marketing, and administrative staff.

- Expenditures on marketing campaigns and brand promotion.

- Costs associated with customer support and relationship management.

- General overheads such as office rent, utilities, and corporate IT infrastructure.

Acquisition and Integration Costs

Aalberts faces significant costs associated with strategic acquisitions, encompassing thorough due diligence, legal expenses, and the complex integration of newly acquired entities, such as the integration of Paulo Products Company. These acquisitions are a primary engine for the company's expansion.

While these strategic moves fuel growth, they inherently bring one-off or transitional expenses that impact the cost structure. Aalberts aims to manage these acquisition-related expenditures by leveraging existing credit facilities, a strategy designed to prevent shareholder dilution.

- Acquisition Costs: Includes due diligence, legal fees, and advisory services for potential acquisitions.

- Integration Expenses: Costs related to merging systems, operations, and personnel of acquired businesses.

- Financing Strategy: Utilization of existing credit facilities to fund acquisitions, minimizing equity dilution.

- Growth Driver: Acquisitions are a key component of Aalberts' strategy to expand market reach and product offerings.

Aalberts' cost structure is heavily influenced by its manufacturing operations, R&D investments, and global administrative functions. The company's commitment to innovation is evident in its substantial R&D spending, which was €315 million in 2023. Capital expenditures also play a significant role, with EUR 231 million allocated in 2024 to enhance operational infrastructure and market presence. Furthermore, Sales, General, and Administrative (SG&A) expenses, totaling €789.9 million in 2023, are crucial for supporting global business activities and market reach.

| Cost Category | 2023 (€M) | 2024 (€M) | Notes |

| R&D Expenses | 315 | N/A | Core driver of innovation and product enhancement. |

| Capital Expenditures | N/A | 231 | Investment in manufacturing capabilities and market expansion. |

| SG&A Expenses | 789.9 | N/A | Supports global operations, sales, marketing, and administration. |

Revenue Streams

Aalberts primarily generates revenue through the direct sale of its advanced, mission-critical technologies. This includes offerings like hydronic flow control systems, integrated piping solutions, specialized surface technologies, and sophisticated mechatronics. These sales are a cornerstone across all their key business segments: Sustainable Buildings, Semiconductor Efficiency, E-mobility Transition, and Industrial Productivity.

Aalberts generates significant revenue through aftermarket services and maintenance for its installed systems. This includes the sale of spare parts, repair services, and continuous technical support, all aimed at ensuring optimal long-term performance and maintaining high customer satisfaction.

The company specifically highlights service and refurbishment as key growth areas. For instance, in 2024, Aalberts reported continued strong performance in its Services segment, which directly benefits from these aftermarket activities, demonstrating their increasing importance to the overall business strategy.

Aalberts generates revenue from customized engineering and co-development projects, particularly with Original Equipment Manufacturers (OEMs). These engagements are typically intricate and span extended periods, allowing Aalberts to leverage its specialized design and technological prowess to address distinct client needs.

For instance, in 2024, Aalberts continued to secure significant co-development contracts, contributing to its specialized solutions segment. While specific project values are often confidential, the increasing demand for bespoke thermal management solutions in sectors like electric vehicles and advanced manufacturing underscores the growing importance of this revenue stream.

Licensing and Technology Transfer (Potential)

While Aalberts' primary revenue currently stems from its core business segments, its substantial investment in research and development, particularly in areas like advanced materials and sustainable technologies, creates a significant potential for future revenue through licensing and technology transfer. This approach would allow Aalberts to monetize its innovations without necessarily scaling up production for every application.

For instance, a company like Aalberts, with its focus on innovation, could license patents for specialized alloys or advanced manufacturing processes to other industries. This strategy leverages R&D expenditures, generating income beyond direct product sales and expanding the reach of its technological advancements.

Consider the broader industry trend: In 2023, global technology licensing revenue was estimated to be in the hundreds of billions of dollars, showcasing the significant financial upside of such strategies for innovative firms. Aalberts' own commitment to R&D, which represented a notable percentage of its sales in recent years, positions it well to capitalize on these opportunities.

- Licensing Intellectual Property: Monetizing patents for specialized materials or manufacturing techniques.

- Technology Transfer Agreements: Partnering with other companies to implement Aalberts' proprietary technologies.

- Leveraging R&D Investments: Generating additional revenue streams from innovation beyond direct product sales.

Acquisition-driven Revenue Growth

Aalberts pursues strategic acquisitions as a core component of its revenue expansion. These acquisitions, like the recent integration of Paulo Products Company, directly bolster consolidated revenue figures. Paulo, for instance, is projected to contribute roughly USD 105 million annually to Aalberts' top line.

This approach injects fresh revenue streams and solidifies market presence within specific, targeted industry niches. The company actively seeks opportunities to expand its reach and capabilities through these strategic purchases.

- Strategic Acquisitions: Key to revenue growth and market share expansion.

- Immediate Revenue Contribution: Acquired companies like Paulo directly add to consolidated revenue.

- New Revenue Streams: Acquisitions introduce capabilities and market access in new niches.

- Projected Impact: Paulo is expected to add approximately USD 105 million in annual revenue.

Aalberts' revenue is diversified through direct sales of advanced technologies, aftermarket services, customized engineering projects, and strategic acquisitions. The company's focus on specialized solutions across key segments like Sustainable Buildings and Semiconductor Efficiency drives its product revenue. Aftermarket services, including spare parts and maintenance, provide a recurring revenue stream, further strengthened by a growing emphasis on service and refurbishment as highlighted in their 2024 performance.

| Revenue Stream | Description | Key Segments / Examples | 2024 Relevance |

|---|---|---|---|

| Direct Technology Sales | Sale of mission-critical technologies. | Hydronic flow control, piping solutions, surface technologies, mechatronics. | Core revenue driver across all segments. |

| Aftermarket Services & Maintenance | Sale of spare parts, repair, technical support. | Ensuring optimal performance of installed systems. | Key growth area; strong performance in Services segment. |

| Customized Engineering & Co-development | Bespoke design and technological solutions for OEMs. | Thermal management for EVs, advanced manufacturing. | Securing significant co-development contracts. |

| Strategic Acquisitions | Integrating acquired companies to boost revenue. | Paulo Products Company. | Paulo projected to add ~USD 105 million annually. |

Business Model Canvas Data Sources

The Aalberts Business Model Canvas is constructed using a blend of internal financial disclosures, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse data sources ensure that each component of the canvas is grounded in verifiable information and reflects current market realities.