Aalberts Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aalberts Bundle

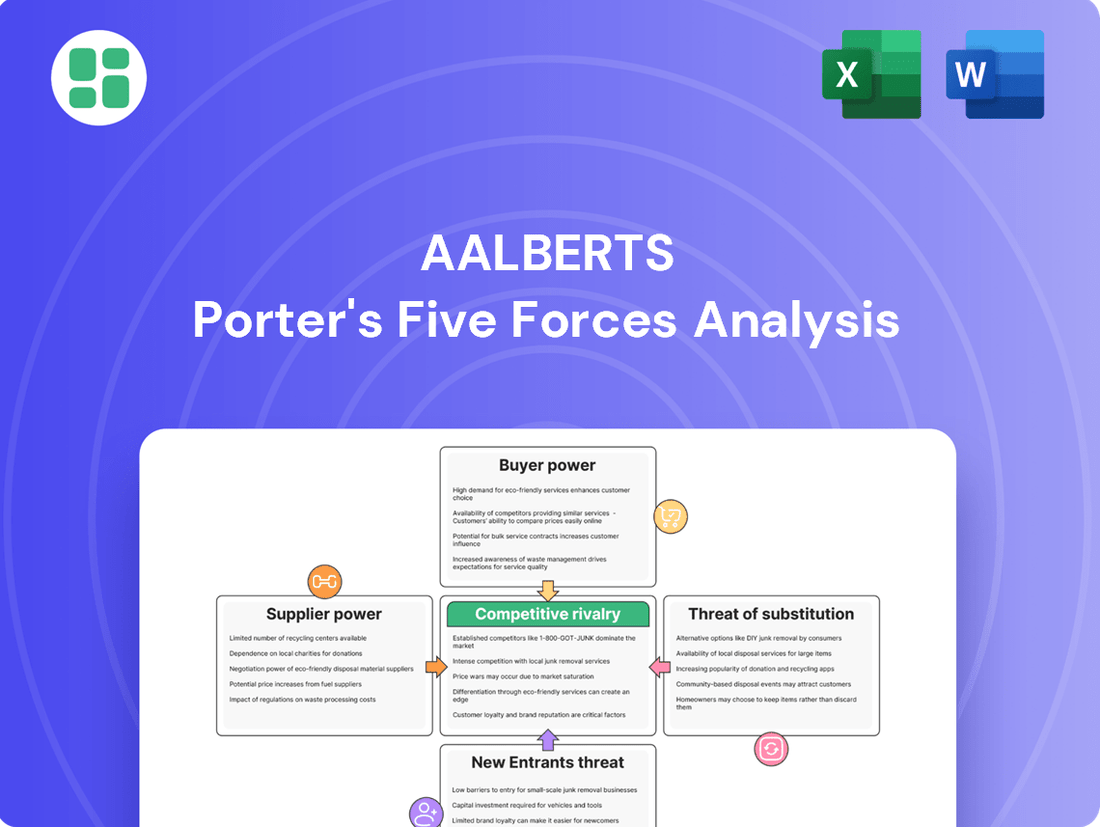

Aalberts operates in a dynamic market shaped by intense competition and evolving customer demands. Understanding the forces of buyer power, supplier bargaining, and the threat of new entrants is crucial for navigating its landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aalberts’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Aalberts' reliance on highly specialized components and raw materials for its mission-critical technologies significantly amplifies supplier bargaining power. When suppliers are the sole or dominant providers of these unique inputs, their leverage increases substantially.

The inherent complexity and proprietary nature of these specialized components translate into considerable switching costs for Aalberts. If the company needs to change suppliers, the investment in retooling, qualification, and potential production disruptions can be substantial, further entrenching the power of existing suppliers.

Supplier concentration significantly impacts bargaining power. In specialized sectors, like advanced semiconductor manufacturing equipment, a small number of highly capable suppliers can dictate terms. For instance, in 2024, the market for extreme ultraviolet (EUV) lithography machines, crucial for producing the most advanced chips, is dominated by ASML, which holds nearly a monopoly. This concentration allows ASML to command premium pricing and influence delivery schedules, directly affecting chip manufacturers' production capabilities and costs.

When Aalberts' products rely on highly integrated or customized components from suppliers, switching becomes a costly and time-consuming endeavor. This deep integration creates a significant dependency on existing suppliers, thereby amplifying their bargaining power.

For instance, if a supplier provides a unique, patented component that is essential to Aalberts' core product offering, and developing an alternative would require extensive re-engineering and significant capital investment, that supplier holds considerable leverage. This situation is common in specialized manufacturing sectors where proprietary technology or intricate design specifications are involved.

Input Importance and Differentiation

The bargaining power of suppliers for Aalberts is significantly influenced by the importance and differentiation of the inputs they provide. For critical, high-performance materials essential to Aalberts' specialized products, such as those used in semiconductor manufacturing or the burgeoning e-mobility sector, suppliers can wield considerable influence. When these inputs are integral to the unique selling propositions and performance capabilities of Aalberts' offerings, their suppliers are often in a strong position to negotiate higher prices.

This dynamic is particularly relevant as Aalberts continues to focus on advanced solutions. For instance, in the semiconductor industry, the availability and cost of specialized silicon wafers or advanced lithography materials directly impact Aalberts' ability to deliver cutting-edge products. Similarly, in e-mobility, suppliers of high-purity copper for advanced wiring or specialized thermal management materials can command premium pricing if their products are critical differentiators for Aalberts' components.

- Critical Input Dependence: Suppliers of unique or highly specialized components that are fundamental to Aalberts' product performance and innovation hold significant leverage.

- Differentiation Impact: When a supplier's input directly contributes to the unique selling proposition or superior performance of an Aalberts product, that supplier gains pricing power.

- Supplier Concentration: In niche markets where only a few suppliers can provide the necessary high-performance inputs, their bargaining power is amplified.

Forward Integration Threat

While component suppliers typically don't integrate forward, the possibility exists for them to enter low-barrier segments and directly challenge Aalberts. This could theoretically bolster their bargaining power.

However, Aalberts' intricate system integration capabilities significantly diminish this threat. For instance, in 2024, Aalberts' diverse product portfolio and custom solutions create high switching costs for many of its clients, making it difficult for a component supplier to replicate the full value proposition.

- Forward Integration Threat: Suppliers might enter Aalberts' markets, especially in simpler segments.

- Mitigation through Complexity: Aalberts' sophisticated system integration acts as a strong defense.

- Real-world Impact: High switching costs for Aalberts' customers in 2024 limit the feasibility of supplier forward integration.

Aalberts faces considerable supplier bargaining power due to its reliance on specialized, high-performance components. Suppliers of critical inputs, such as those for advanced semiconductor manufacturing or e-mobility, can command higher prices when their products are key differentiators for Aalberts. This leverage is amplified in concentrated markets, like the EUV lithography machine sector dominated by ASML in 2024, where a few suppliers dictate terms.

The complexity and proprietary nature of these inputs create substantial switching costs for Aalberts, further entrenching supplier power. For instance, integrating a unique, patented component requires significant re-engineering and capital investment, making it difficult for Aalberts to change suppliers. While forward integration by suppliers is a theoretical threat, Aalberts' intricate system integration and the high switching costs for its clients in 2024 significantly mitigate this risk.

| Factor | Impact on Aalberts | Example/Data Point (2024) |

|---|---|---|

| Supplier Concentration | High | ASML's near-monopoly in EUV lithography machines |

| Switching Costs | High | Re-tooling, qualification, and production disruption risks |

| Input Differentiation | High | Specialized materials for semiconductor and e-mobility sectors |

What is included in the product

Analyzes the competitive intensity within Aalberts' markets, examining supplier and buyer power, new entrant barriers, and the threat of substitutes.

Instantly diagnose competitive pressures with a visual breakdown of each force, enabling faster identification of strategic vulnerabilities.

Customers Bargaining Power

Aalberts' focus on niche markets for mission-critical technologies often means its customer base is comprised of a limited number of large, highly specialized industrial clients or original equipment manufacturers (OEMs). This concentration can empower these customers, giving them significant leverage in negotiations.

For instance, a key client in a specialized sector might represent a substantial portion of Aalberts' revenue in that particular market segment. Such a customer, with significant purchasing power and potentially few alternative suppliers for highly specific components, can indeed exert considerable pressure on pricing, favorable payment terms, and demanding service level agreements, impacting Aalberts' profitability and operational flexibility.

Aalberts' focus on integrated, mission-critical systems significantly raises switching costs for its customers. These systems are designed to boost efficiency and sustainability, meaning that once a customer's operations are deeply embedded with Aalberts' solutions, the effort and expense to transition elsewhere become substantial.

The integration process itself, which includes specialized training for personnel and potential retooling of existing infrastructure, creates a significant barrier to entry for competitors. This deep entanglement makes it difficult for customers to simply switch to another provider without considerable disruption and investment, thereby diminishing their bargaining power.

Aalberts' strategic emphasis on advanced, efficiency-boosting, and sustainable solutions cultivates a compelling value proposition for its clientele. This differentiation directly counters customer bargaining power. For instance, if Aalberts' innovations in energy-efficient building technology lead to significant operational cost reductions for their clients, customers become less inclined to switch to competitors offering less advanced, less efficient alternatives.

Customer Information and Price Sensitivity

Sophisticated industrial buyers, particularly those in large-scale manufacturing, often have access to detailed market intelligence. This allows them to meticulously compare prices for standardized components, making them highly price-sensitive. For instance, in the semiconductor industry, where components are largely commoditized, buyers can exert significant pressure on pricing.

However, the dynamic changes when Aalberts offers highly customized or proprietary solutions. In these scenarios, customers are more inclined to evaluate the total cost of ownership and the performance advantages these solutions provide. For example, a custom-engineered fluid control system that significantly reduces energy consumption or downtime in a chemical processing plant will likely be judged on its long-term operational benefits rather than its initial purchase price.

- Price Sensitivity for Standardized Components: Industrial customers with access to ample market data can exert considerable pricing pressure on standardized parts.

- Shifting Focus for Custom Solutions: For bespoke or patented offerings, customer evaluation prioritizes total cost of ownership and performance gains over mere price.

- Example of Price Sensitivity: The semiconductor supply chain often sees intense price competition for identical chips.

- Example of Value-Based Pricing: Advanced automation solutions that boost manufacturing output are valued for their contribution to efficiency, not just their upfront cost.

Backward Integration Threat

The threat of backward integration by customers, while theoretically present for large, technologically sophisticated buyers, is generally low for Aalberts. The significant investment in research and development, along with the specialized manufacturing processes required to produce Aalberts' advanced components, creates a substantial barrier to entry for most customers.

For example, customers in industries like semiconductor manufacturing or advanced industrial equipment often lack the specific expertise and capital to replicate Aalberts' proprietary technologies. Aalberts invested €384 million in R&D in 2023, highlighting the ongoing commitment needed to maintain its technological edge, a level of expenditure most customers would find prohibitive to match for their own in-house production.

- High R&D Investment: Aalberts' substantial R&D spending creates a technological moat that is difficult for customers to breach.

- Specialized Manufacturing: The intricate and precise manufacturing techniques employed by Aalberts are not easily replicated.

- Scale Economies: Aalberts benefits from economies of scale in production, making it difficult for individual customers to achieve comparable cost efficiencies.

- Limited Customer Capability: Most customers lack the internal resources and expertise to successfully undertake backward integration.

Aalberts' customers, especially large industrial buyers, can wield significant bargaining power due to their purchasing volume and access to market information, particularly for standardized components. This can lead to price pressures and demands for favorable terms, impacting Aalberts' profitability.

However, Aalberts mitigates this by offering highly customized, mission-critical solutions where switching costs are high and value is based on performance rather than just price. Their substantial investment in R&D, such as €384 million in 2023, further solidifies their technological advantage, making backward integration by customers unlikely.

| Factor | Impact on Aalberts' Customer Bargaining Power | Mitigation Strategies |

|---|---|---|

| Customer Concentration | High for niche, specialized markets | Focus on value-added solutions, high switching costs |

| Price Sensitivity | High for standardized components | Differentiation through custom solutions, total cost of ownership focus |

| Switching Costs | Low for customers embedded in Aalberts' systems | Integration complexity, specialized training |

| Threat of Backward Integration | Low due to high R&D and manufacturing barriers | Substantial R&D investment (€384M in 2023), proprietary technology |

Same Document Delivered

Aalberts Porter's Five Forces Analysis

This preview shows the exact, professionally written Aalberts Porter's Five Forces Analysis you'll receive immediately after purchase, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. No surprises, no placeholders—just a comprehensive document ready for your strategic planning needs.

Rivalry Among Competitors

Aalberts thrives in specialized, technology-driven niches. This means its direct competitors are other global firms possessing similar advanced expertise in areas such as material technology, fluid control, and surface treatment. For instance, in the realm of advanced semiconductor manufacturing equipment, companies like ASML and Applied Materials are key rivals.

The rivalry within these specific niches is often fierce, with competition centered on groundbreaking innovation, superior product performance, and unwavering reliability rather than solely on price. In 2024, the semiconductor equipment market alone was projected to reach over $100 billion, highlighting the significant investment and competitive pressure in technologically advanced sectors where Aalberts operates.

The competitive landscape for companies like Aalberts is marked by a relentless pursuit of innovation, demanding substantial investments in research and development. For instance, the global R&D spending in the industrial sector, which includes many of Aalberts' markets, reached an estimated $1.5 trillion in 2024, highlighting the intense focus on technological advancement.

Rivals actively compete by launching new products that boast improved efficiency, greater sustainability, and enhanced performance features. This constant drive to differentiate through technological superiority fuels a rapid pace of innovation and intensifies pressure among industry players to stay ahead.

Aalberts faces intense competitive rivalry, as many players boast a global footprint comparable to its own international operations. This means competition isn't confined to local markets; it's a worldwide contest for dominance.

The battle for market share intensifies in areas experiencing significant industrial shifts or a push towards sustainable building practices. Companies like Aalberts are leveraging their deep-rooted networks and established customer relationships to gain an edge in these dynamic regions.

For instance, in the European industrial valves market, which is a key area for Aalberts, competition is particularly strong. In 2024, the market size was estimated to be around $15 billion, with several large global players vying for contracts, especially in sectors like energy and water management that are prioritizing efficiency and sustainability.

Product Differentiation vs. Commoditization

Aalberts strives to differentiate its offerings by providing mission-critical, high-value solutions, thereby moving away from pure price competition. However, certain market segments may still experience pressure towards commoditization, where products become more standardized and price becomes the primary differentiator. In 2023, Aalberts reported revenue of €3.0 billion, with a significant portion attributed to its advanced technology solutions, underscoring its focus on value-added products.

To maintain a competitive edge, Aalberts must continually invest in research and development to foster proprietary technologies and secure patents. A strong brand reputation is also crucial in signaling quality and reliability, helping to insulate the company from direct price-based rivalry. For instance, their investments in sustainable technologies are designed to create unique selling propositions.

- Differentiation Strategy: Aalberts focuses on high-value, mission-critical solutions to avoid commoditization.

- Market Pressures: Some market segments may still face commoditization, leading to price-based competition.

- Investment Focus: Continuous investment in proprietary technologies and patents is key to sustaining advantage.

- Brand Reputation: A strong brand image reinforces value and reduces susceptibility to price wars.

Strategic Partnerships and Acquisitions

Competition isn't just about direct rivalry; it also plays out through strategic alliances and consolidation. Companies actively pursue partnerships, joint ventures, and mergers and acquisitions (M&A) to strengthen their market standing, acquire cutting-edge technologies, or enter new specialized markets. This M&A trend significantly reshapes the competitive environment.

The year 2024 saw continued robust activity in this area. For instance, the global M&A market, while experiencing some fluctuations, remained a key battleground for market share. Companies are leveraging these moves to build scale and integrate capabilities, directly impacting rivals who may not participate in such strategic maneuvers.

Consider these key aspects of strategic partnerships and acquisitions in competitive rivalry:

- Market Consolidation: M&A activity allows dominant players to absorb smaller competitors or merge with equals, increasing their market power and potentially raising barriers to entry for new entrants.

- Technology Access: Acquiring companies with innovative technologies or forming partnerships to co-develop solutions provides a competitive edge, allowing firms to offer superior products or services.

- Geographic and Niche Expansion: Strategic moves enable companies to quickly enter new geographic regions or tap into underserved niche markets, thereby expanding their customer base and revenue streams at the expense of less agile competitors.

- Synergy Realization: Successful integration of acquired entities or effective collaboration in joint ventures can lead to cost savings and operational efficiencies, translating into a stronger competitive position and potentially better pricing power.

Aalberts faces intense rivalry from global competitors in specialized technology niches like material technology and fluid control. Competition hinges on innovation and product performance, not just price, especially in high-value sectors. For example, the global industrial valves market, a key area for Aalberts, was valued around $15 billion in 2024, with significant competition.

Companies like Aalberts differentiate through high-value, mission-critical solutions to avoid commoditization. Continuous investment in R&D and patents is vital for maintaining an edge, as is a strong brand reputation. In 2023, Aalberts reported €3.0 billion in revenue, underscoring its focus on advanced technology offerings.

Strategic alliances and mergers and acquisitions (M&A) are also key battlegrounds. The global M&A market in 2024 remained active, with companies using these strategies to gain market share, acquire technology, and expand geographically. This consolidation reshapes the competitive landscape significantly.

| Key Competitor Aspects | Description | 2024/2023 Data Point |

| Rivalry Focus | Innovation & Product Performance | Semiconductor equipment market projected >$100 billion (2024) |

| Differentiation | High-Value, Mission-Critical Solutions | Aalberts revenue €3.0 billion (2023) |

| Market Dynamics | Intense Global Competition, M&A Activity | Global industrial valves market ~ $15 billion (2024) |

SSubstitutes Threaten

The threat of substitutes for Aalberts is significant, stemming from technological advancements that offer alternative ways to meet customer needs for efficiency and sustainability. For instance, sophisticated software solutions could potentially reduce the demand for certain hardware components that Aalberts supplies, or entirely new materials might emerge that outperform current offerings, thereby diminishing the need for Aalberts' existing product lines.

Changes in industry standards and regulations present a significant threat of substitutes for Aalberts. For instance, evolving building codes mandating higher energy efficiency could drive demand for new materials or systems that Aalberts may not yet specialize in, potentially making their current offerings less competitive. As of early 2024, many regions are strengthening environmental regulations, pushing industries towards circular economy principles, which could favor substitute solutions designed for easier disassembly and recycling.

Customers often weigh the cost-benefit ratio when evaluating alternatives. If a substitute, even if less sophisticated, offers a significantly lower price point, it can attract certain market segments. For example, in 2024, while advanced industrial automation solutions are prevalent, some smaller businesses might opt for simpler, more affordable machinery if the perceived urgency of highly specialized features is low for their operations.

Emergence of Disruptive Innovations

The threat of substitutes for Aalberts' products, particularly in areas like energy efficiency and fluid control, is amplified by the potential emergence of unforeseen disruptive innovations. These could originate from agile startups or advanced research institutions developing entirely new technological paradigms that bypass existing solutions. For instance, advancements in advanced materials science or novel energy harvesting techniques could offer fundamentally different approaches to achieving performance levels currently met by Aalberts' offerings.

These disruptive innovations often leverage different value chains and business models, making them difficult to anticipate through traditional competitive analysis. Consider the rapid evolution in solid-state cooling or advanced thermoelectric materials, which could eventually replace conventional fluid-based thermal management systems in certain applications. Such shifts represent a significant threat, as they can rapidly commoditize or render obsolete established product categories.

While specific 2024 data on disruptive innovations directly impacting Aalberts is not yet widely published, the broader market trends indicate a heightened risk. For example, the global market for advanced materials, a key area for potential substitutes, was projected to reach over $100 billion in 2024, with significant growth driven by innovation in areas like nanomaterials and composites.

- Emergence of radical new technologies: Innovations like solid-state cooling or advanced thermoelectric devices could substitute traditional fluid control systems.

- Unforeseen market entrants: Startups and research institutions may develop entirely new paradigms, bypassing existing competitive spheres.

- Rapid commoditization risk: Disruptive innovations can quickly make established product categories obsolete or less competitive.

- Impact on energy efficiency solutions: New methods for achieving energy efficiency, potentially outside traditional mechanical or fluid systems, pose a substitute threat.

Internal Customer Development

Large customers might bypass external suppliers like Aalberts by developing critical capabilities in-house. This internal customer development acts as a substitute, particularly when customers see a strategic benefit or cost advantage in producing components themselves. For instance, a major automotive manufacturer might decide to vertically integrate the production of a specialized electronic component if it offers a significant competitive edge or reduces their reliance on external supply chains.

This 'make-or-buy' decision directly impacts Aalberts' market position. If a significant portion of their customer base begins to insource, Aalberts could see a reduction in demand for those specific products or services. The increasing complexity and accessibility of advanced manufacturing technologies in 2024 further enable customers to consider in-house production, potentially impacting Aalberts' revenue streams in key segments.

- Customer Insourcing: Large clients may develop their own capabilities, reducing reliance on Aalberts.

- Strategic Advantage: Customers may pursue in-house development for competitive differentiation or cost savings.

- Technological Enablement: Advances in manufacturing technology in 2024 make internal production more feasible for customers.

The threat of substitutes for Aalberts is characterized by the potential for alternative technologies or methods to fulfill customer needs, particularly in areas like energy efficiency and fluid control. Disruptive innovations, such as solid-state cooling or advanced thermoelectric devices, could directly replace traditional fluid-based systems, posing a significant challenge. Furthermore, evolving industry standards and regulations, especially those promoting circular economy principles as seen in early 2024, can favor substitute solutions designed for easier disassembly and recycling, potentially impacting Aalberts' existing product lines.

Customers' cost-benefit analysis also plays a crucial role, where more affordable, albeit less sophisticated, substitutes can attract certain market segments. For instance, in 2024, smaller businesses might opt for simpler machinery if the need for highly specialized features is minimal. The increasing accessibility of advanced manufacturing technologies in 2024 also empowers larger customers to consider insourcing critical component production, acting as a direct substitute and potentially reducing Aalberts' demand in key segments.

| Area of Substitution | Potential Substitute | Impact on Aalberts | Example Trend (2024) |

|---|---|---|---|

| Thermal Management | Solid-state cooling, Thermoelectric devices | Reduced demand for fluid control systems | Growing research in advanced materials for cooling |

| Energy Efficiency | Novel energy harvesting techniques | Diminished need for traditional efficiency solutions | Increased investment in renewable energy integration |

| Component Manufacturing | Customer insourcing via advanced manufacturing | Lower sales volume for specific components | Greater availability of affordable 3D printing and automation for businesses |

Entrants Threaten

Entering Aalberts' core markets, particularly in semiconductor efficiency and advanced manufacturing, necessitates significant capital outlays for research and development, sophisticated machinery, and state-of-the-art production facilities. For instance, the semiconductor industry alone saw global capital expenditures exceeding $200 billion in 2023, a figure expected to grow as technology advances.

This substantial financial hurdle acts as a potent deterrent, effectively limiting the number of new players capable of mounting a serious challenge to established companies like Aalberts.

Aalberts' strategic emphasis on mission-critical technologies, as evidenced by their consistent investment in research and development, creates a significant barrier for potential new entrants. In 2023, Aalberts allocated €283 million to R&D, a 7% increase from 2022, underscoring their commitment to innovation and proprietary knowledge. This focus on advanced, often patented, solutions means newcomers would need substantial capital and specialized expertise to replicate Aalberts' technological capabilities, making entry economically prohibitive.

Aalberts operates in sectors like Sustainable Buildings and E-mobility, which are heavily regulated. New companies entering these markets must navigate complex approval processes and meet rigorous quality standards. For instance, in the building sector, certifications like BREEAM or LEED are often mandatory, requiring significant investment and time to achieve.

The cost and time associated with obtaining these certifications act as a substantial barrier. A new entrant might spend years and millions of euros just to gain the necessary accreditations, delaying market entry and revenue generation. This lengthy process deters many potential competitors who lack the resources or patience to comply.

Established Customer Relationships and Reputation

Aalberts has cultivated deep, long-standing relationships with its industrial clients, particularly in specialized, high-stakes markets. These partnerships are built on a foundation of trust, proven reliability, and the ability to deliver complex, integrated solutions. For instance, in the semiconductor equipment sector, where Aalberts is active, the switching costs for manufacturers to change suppliers of critical components can be prohibitively high due to rigorous qualification processes and the need for absolute precision.

New competitors face a significant hurdle in replicating these established connections and the reputation for consistent, high-performance delivery that Aalberts enjoys. Building the necessary credibility and track record to displace existing, trusted suppliers requires substantial time, investment, and demonstrable success in meeting stringent industry demands. This makes it difficult for new entrants to gain a foothold, especially in sectors where failure is not an option.

- Entrenched Client Loyalty: Aalberts' focus on niche industrial markets fosters strong, often multi-year, relationships with key customers.

- High Switching Costs: The technical complexity and regulatory requirements in many of Aalberts' operating segments create significant barriers for clients looking to change suppliers.

- Reputational Capital: Years of delivering reliable, high-performance solutions have built a strong reputation that new entrants find challenging to match quickly.

- Integrated Solutions Provider: Aalberts often provides not just components but also integrated systems and services, further deepening client dependencies.

Economies of Scale and Experience Curve

Existing players in Aalberts' markets, such as those in advanced manufacturing and building technologies, leverage significant economies of scale. This translates into lower per-unit costs for manufacturing, bulk purchasing power for raw materials, and more efficient R&D spending. For instance, in 2024, major industrial component manufacturers often reported operating margins that were several percentage points higher than smaller, niche players, directly attributable to their scale.

New entrants would face a steep climb to match this cost efficiency. They would need substantial initial investment to build production capacity and establish supply chains capable of competing on price. Until they can achieve a similar production volume and move down the experience curve, learning and optimizing processes over time, they will likely operate at a cost disadvantage, making it harder to attract customers from established, cost-effective suppliers.

The experience curve effect is particularly relevant. As companies like Aalberts produce more over time, they become more efficient, reducing costs further. This accumulated knowledge and process improvement creates a barrier. For example, in the semiconductor equipment sector, a market where Aalberts has a presence, companies with decades of experience often have proprietary manufacturing techniques that are difficult for newcomers to replicate quickly, leading to a persistent cost advantage.

- Economies of Scale: Aalberts benefits from cost reductions through increased production volume in manufacturing and procurement, a key advantage over smaller competitors.

- Experience Curve: Accumulated knowledge and process optimization over time allow established players to lower production costs, creating a barrier for new entrants.

- Cost Disadvantage for New Entrants: Newcomers would likely face higher initial costs until they achieve comparable scale and efficiency, impacting their competitiveness.

- R&D Investment: Larger companies can spread R&D costs over a greater output, making innovation more affordable per unit than for startups.

The threat of new entrants for Aalberts is generally low due to substantial capital requirements, particularly in R&D and advanced manufacturing, with global semiconductor CapEx exceeding $200 billion in 2023. Aalberts' significant R&D investment, €283 million in 2023, and focus on proprietary technologies create high barriers. Furthermore, stringent regulations and lengthy certification processes in sectors like Sustainable Buildings add to the entry challenge.

Established client relationships and high switching costs, driven by technical complexity and reliability needs in markets like semiconductor equipment, deter new competitors. Aalberts' reputation for consistent, high-performance delivery is difficult for newcomers to replicate. The company's integrated solutions also deepen customer dependencies, making it harder for new entrants to gain market share.

Economies of scale and the experience curve provide Aalberts with a significant cost advantage. In 2024, larger industrial manufacturers often reported higher operating margins due to their scale. New entrants struggle to match this cost efficiency without substantial initial investment and time to optimize processes, facing a cost disadvantage compared to established, efficient suppliers.

Porter's Five Forces Analysis Data Sources

Our Aalberts Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Aalberts' official annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports from leading firms and insights from reputable financial news outlets to capture the full competitive landscape.