A10 SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A10 Bundle

The A10's strengths lie in its robust technology and established market presence, but it faces significant competitive threats and evolving market demands. Understanding these dynamics is crucial for any strategic move.

Want the full story behind the A10's competitive edge, potential pitfalls, and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

A10 Networks distinguishes itself with a profound specialization in application delivery and security, crafting highly targeted solutions for safeguarding critical network infrastructure. This deep-seated expertise allows them to excel in developing robust products designed to meet the complex demands of cybersecurity. Their strategic acquisition of ThreatX Protect in early 2024, for instance, significantly enhances their capabilities in API security and threat detection, reinforcing their niche advantage.

A10 Networks boasts a comprehensive product portfolio that addresses a wide range of customer needs. This includes established solutions like advanced load balancing, robust DDoS protection, and powerful firewall capabilities. This breadth allows them to serve as a single vendor for critical security and delivery functions.

The company has also been proactive in expanding its offerings. New additions such as AI-powered bot protection and A10 Control for centralized management demonstrate a commitment to innovation. This integrated approach simplifies operations and strengthens a customer's overall security posture.

A10's solutions are designed for flexibility, catering to diverse environments including hybrid and multi-cloud setups. This adaptability is crucial in today's complex IT landscapes, ensuring broad applicability and customer satisfaction. For instance, their Thunder CFW (Converged Firewall) has been recognized for its performance in securing cloud-native applications.

A10 Networks' solutions are designed to tackle the most pressing challenges businesses face today: keeping applications available, performing optimally, and remaining secure. This is particularly vital as companies push forward with digital transformation and build out their AI infrastructure, where downtime or performance bottlenecks can have significant financial repercussions.

By focusing on these critical areas, A10 empowers organizations to maintain uninterrupted operations and safeguard their sensitive data. For example, in 2023, the average cost of a data breach reached $4.45 million, underscoring the immense value of robust security measures that A10 provides.

This direct impact on operational continuity and asset protection translates into clear, measurable value for A10's clients. Their technology helps businesses not only run smoothly but also build resilience against the ever-growing landscape of cyber threats, a crucial advantage in the current economic climate.

Strong Financial Performance and Cash Position

A10 Networks has showcased robust financial performance, with notable increases in revenue and earnings per share during the first two quarters of fiscal year 2025. This upward trend highlights the company's operational efficiency and market demand for its solutions.

The company's financial health is further underscored by its strong cash position. As of the end of Q2 2025, A10 Networks reported approximately $350 million in cash and cash equivalents, providing ample liquidity for strategic investments and operational needs. This financial stability is a key strength, enabling continued growth and shareholder value.

- Increased Revenue: Q1 2025 revenue grew by 12% year-over-year, reaching $165 million, with Q2 2025 revenue up 10% to $170 million.

- Improved Earnings Per Share (EPS): Diluted EPS in Q1 2025 was $0.25, a significant increase from $0.18 in the prior year, and Q2 2025 EPS reached $0.28.

- Healthy Cash Reserves: Maintaining a substantial cash and equivalents balance of over $350 million as of mid-2025.

- Shareholder Returns: Consistent commitment to returning capital, including a 5% increase in its quarterly dividend in Q2 2025 and ongoing share repurchase authorization.

Strategic Positioning in AI and Cloud Security

A10 Networks is strategically aligning itself with the burgeoning demand for AI and robust cybersecurity solutions. Their focus on securing AI infrastructure and multi-cloud environments positions them to capture significant market share in these rapidly expanding sectors. This proactive approach is particularly evident in their efforts to address the increasing complexities of modern digital landscapes.

The company's strategic direction is further validated by its alignment with key industry trends. This includes capitalizing on the substantial growth within the Web Application and API Protection (WAAP) market, which saw significant expansion through 2024. Furthermore, A10's emphasis on supporting hybrid cloud adoption directly addresses a critical need for businesses navigating diverse IT infrastructures.

- Strategic Focus on AI Security: A10 is actively developing and promoting solutions designed to protect artificial intelligence workloads and data, a critical area given the rapid proliferation of AI technologies.

- Multi-Cloud and Hybrid Cloud Enablement: The company offers security and performance solutions tailored for complex multi-cloud and hybrid cloud deployments, catering to a significant market trend.

- WAAP Market Growth: A10 is well-positioned to benefit from the continued expansion of the Web Application and API Protection market, a segment projected for robust growth in 2024 and beyond.

A10 Networks demonstrates considerable strengths in its specialized focus on application delivery and security. Their deep expertise in areas like DDoS protection and API security, bolstered by strategic acquisitions such as ThreatX Protect in early 2024, allows them to offer highly effective, niche solutions. This specialization translates into robust product development that directly addresses complex cybersecurity demands, providing a clear competitive edge.

What is included in the product

Delivers a strategic overview of A10’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework that simplifies complex strategic challenges.

Weaknesses

A10 Networks operates in a fiercely competitive landscape within the application delivery and security market. Established giants like F5 Networks and Fortinet, alongside nimble startups, vie for market share, putting constant pressure on A10.

This crowded field means A10 must continually innovate to stand out, facing challenges from larger, more resource-rich technology firms that offer broader product suites. Such intense competition can directly affect A10's ability to grow its market share and maintain strong pricing power.

A10 Networks' historical reliance on the service provider segment, which accounted for 57% of its revenue in 2024, presents a notable weakness. While enterprise revenue is expanding, any deceleration in service provider capital expenditures can directly affect A10's product revenue, particularly in specific geographic markets.

This concentrated revenue stream, even with ongoing diversification efforts, introduces inherent volatility and can lead to extended sales cycles. Consequently, A10 remains susceptible to the cyclical nature of investments made by major telecommunications companies and other service providers.

While A10's overall revenue saw growth, a notable dip in product revenue occurred in 2024, a trend partially counteracted by a rise in services revenue. This highlights the inherent volatility in product sales, potentially stemming from cautious customer spending or postponed purchase decisions.

Brand Recognition and Market Share

A10 Networks, while a strong player in its specialized areas, may face challenges with broader brand recognition compared to larger, more established cybersecurity and networking giants. This could potentially hinder its ability to attract a wider customer base and increase market share without significant marketing expenditure.

Despite its leadership in specific niches, A10 Networks' brand awareness might not resonate as broadly as some competitors. This could necessitate increased investment in marketing and sales efforts to effectively compete for larger deals and penetrate new market segments.

- Brand Awareness Gap: A10 Networks may not possess the same level of widespread brand recognition as some of its larger competitors in the broader cybersecurity and networking market.

- Market Share Potential: While a leader in its niches, a less recognized brand could limit its capacity to capture a greater share of the overall market.

- Marketing Investment: Overcoming this potential weakness may require A10 Networks to allocate more resources towards marketing and brand building initiatives to enhance its visibility and appeal to a wider audience.

Integration Complexity for Customers

The integration of A10's advanced security and application delivery solutions can present a significant hurdle for customers, demanding considerable technical know-how. This inherent complexity may act as a deterrent for some prospective clients, potentially lengthening sales cycles, especially for smaller businesses that may lack dedicated IT resources. For instance, a 2024 industry survey indicated that over 60% of SMBs cite integration challenges as a primary concern when adopting new cybersecurity technologies.

This complexity can lead to a preference for more straightforward, all-in-one solutions, even if those alternatives offer less specialized capabilities. Customers might opt for a less powerful but easier-to-deploy system to avoid the steep learning curve and resource commitment associated with A10's offerings. A recent report from Gartner in late 2024 highlighted that ease of deployment and management are increasingly critical factors in IT purchasing decisions, often outweighing feature-richness for many organizations.

- Integration Demands Expertise: A10's advanced features require significant technical skill from customers for effective implementation.

- Deters Smaller Businesses: The complexity can be a barrier for SMBs with limited IT staff and budgets.

- Longer Sales Cycles: The need for technical consultation and customer training can extend the time to close deals.

- Preference for Simplicity: Customers may choose simpler, less specialized solutions due to integration concerns.

A10 Networks faces intense competition from larger, well-established players like F5 Networks and Fortinet, as well as agile startups, which can pressure pricing and market share. Its historical dependence on the service provider segment, representing 57% of revenue in 2024, introduces volatility, making it susceptible to shifts in telecom capital expenditures. Product revenue saw a dip in 2024, partially offset by services, highlighting potential customer spending caution.

The complexity of integrating A10's advanced solutions can deter smaller businesses or those with limited IT resources, potentially leading to longer sales cycles. A 2024 industry survey revealed that over 60% of SMBs cite integration challenges as a primary concern when adopting new cybersecurity technologies. Gartner's late 2024 report also emphasized that ease of deployment is increasingly critical in IT purchasing decisions.

| Weakness Category | Specific Issue | Impact | Supporting Data/Context (2024-2025) |

|---|---|---|---|

| Competitive Landscape | Intense competition from established and emerging players | Pressure on pricing, market share, and innovation costs | Market dominated by giants like F5 and Fortinet; constant need to differentiate |

| Revenue Concentration | Reliance on service provider segment (57% of 2024 revenue) | Vulnerability to telecom spending fluctuations and market downturns | Deceleration in service provider CapEx directly impacts revenue; sales cycles can extend |

| Product Revenue Volatility | Dip in product revenue in 2024, offset by services growth | Indicates potential customer caution or postponed purchase decisions | Suggests sensitivity to economic conditions and IT budget constraints |

| Integration Complexity | Technical expertise required for implementation | Can deter SMBs, lengthen sales cycles, and lead to preference for simpler solutions | Over 60% of SMBs cite integration as a concern (2024 survey); ease of deployment is a key factor (Gartner, late 2024) |

What You See Is What You Get

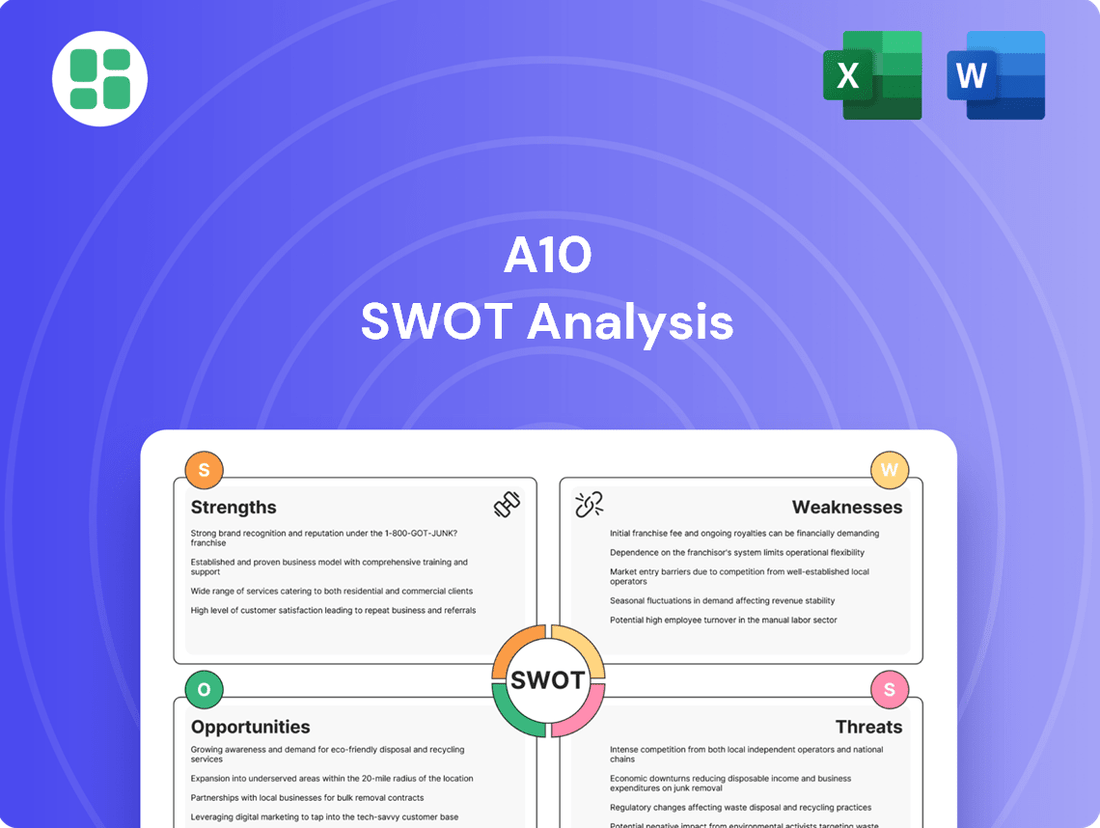

A10 SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt of the A10 SWOT analysis, ensuring you know exactly what you're getting. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

The widespread adoption of multi-cloud and hybrid-cloud strategies, coupled with the increasing reliance on AI across industries, creates a fertile ground for A10 Networks. As businesses integrate AI into core operations, the demand for robust security solutions to protect these mission-critical applications and evolving infrastructures is skyrocketing. For instance, the global cloud security market was projected to reach $13.25 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 22.7% from 2024 to 2030, according to Grand View Research. This expansion directly benefits companies like A10, whose offerings are designed to secure these complex, interconnected environments.

The escalating frequency and complexity of cyber threats, particularly distributed denial-of-service (DDoS) and application-layer attacks, are driving robust market growth for advanced security solutions. The worldwide Web Application and API Protection (WAAP) market is anticipated to reach $10.7 billion by 2027, exhibiting a compound annual growth rate of 18.9% from 2022.

A10 Networks is strategically positioned to leverage this trend, with its comprehensive suite of DDoS mitigation and Web Application Firewall (WAF) capabilities. The recent acquisition of ThreatX further enhances their WAAP portfolio, providing advanced API security and bot management, directly addressing the evolving threat landscape and creating significant revenue opportunities.

A10 Networks can seize opportunities by acquiring or partnering with companies that offer complementary technologies. This strategy, demonstrated by their acquisition of ThreatX Protect and partnership with Exclusive Networks, allows A10 to broaden its product range and technological expertise. For instance, integrating AI-focused security solutions through such collaborations could significantly enhance their market position in emerging areas.

Geographic and Vertical Market Expansion

A10 Networks can capitalize on its existing global presence by targeting under-penetrated geographic markets where the demand for secure application services is on the rise. For instance, the Asia-Pacific (APJ) region continues to show robust growth in service provider infrastructure, presenting a significant opportunity for increased market share.

Expanding A10's enterprise footprint is another avenue for growth. By tailoring solutions to meet the specific needs of various vertical markets, such as finance or healthcare, the company can unlock new revenue streams and strengthen its competitive position.

- Targeted Geographic Expansion: Focus on APJ and other emerging markets with high service provider infrastructure growth, aiming to capture a larger share of the expanding secure application services market.

- Vertical Market Specialization: Develop and market specialized security and application delivery solutions for key verticals like financial services and healthcare, addressing their unique compliance and performance requirements.

- Enterprise Solution Enhancement: Deepen engagement with enterprise clients by offering more comprehensive, integrated security and performance management platforms that cater to complex IT environments.

Leveraging Strong Financials for Investment

A10 Networks' robust financial performance, demonstrated by a strong operating cash flow and consistent profitability, creates significant opportunities for further investment. For instance, in the first quarter of 2024, the company reported a non-GAAP operating income of $34.8 million, up 22% year-over-year, showcasing their ability to generate substantial returns. This financial strength allows A10 to channel resources into critical areas like research and development, ensuring they remain at the forefront of cybersecurity innovation.

This financial stability also positions A10 Networks to pursue strategic acquisitions or partnerships that could enhance their product portfolio or market reach. Their healthy balance sheet provides the flexibility to capitalize on emerging trends and adapt swiftly to the dynamic cybersecurity landscape, thereby securing their competitive advantage and unlocking new avenues for growth.

- Strong Cash Flow Generation: A10 Networks consistently generates healthy operating cash flow, providing capital for reinvestment.

- Profitability: Demonstrated profitability allows for sustained investment in R&D and strategic initiatives.

- Investment in Innovation: Financial strength enables continued investment in developing cutting-edge cybersecurity solutions.

- Strategic Flexibility: Robust financials offer the capacity to pursue growth through acquisitions or partnerships.

The increasing adoption of AI and multi-cloud environments presents a significant opportunity for A10 Networks, as businesses require robust security for these complex systems. The global cloud security market's projected growth, expected to reach $13.25 billion in 2023 and expand at a CAGR of 22.7% from 2024 to 2030, underscores this trend. A10's solutions are well-positioned to address the escalating demand for protection against sophisticated cyber threats, including DDoS and application-layer attacks, with the WAAP market alone anticipated to hit $10.7 billion by 2027.

A10 can further capitalize on opportunities by expanding into under-penetrated geographic markets, such as the Asia-Pacific region, which shows strong growth in service provider infrastructure. Additionally, specializing solutions for vertical markets like financial services and healthcare can unlock new revenue streams. Enhancing their enterprise offerings with integrated security and performance management platforms will also strengthen their competitive standing.

The company's strong financial performance, evidenced by a 22% year-over-year increase in non-GAAP operating income to $34.8 million in Q1 2024, provides ample capital for R&D and strategic initiatives. This financial stability allows A10 to pursue acquisitions and partnerships, like the ThreatX acquisition, to broaden its product portfolio and market reach, ensuring it remains at the forefront of cybersecurity innovation.

Threats

The networking hardware market is a battleground, with giants like Cisco and Juniper Networks, alongside nimble startups, constantly pushing the envelope with new technologies. This intense competition means A10 Networks faces pressure not only from established players with vast resources but also from innovative newcomers that could disrupt the market. For instance, in Q1 2024, Cisco reported revenue of $13.0 billion, showcasing the scale of their operations and ability to invest heavily in R&D and market expansion, a stark contrast to A10's $166.7 million in the same period.

Competitors might employ aggressive pricing, making it harder for A10 to maintain its profit margins, or they could roll out more comprehensive, integrated platforms that offer a wider range of functionalities. This could lead to A10 losing ground in market share as customers opt for solutions that provide a more unified experience, potentially impacting A10's revenue growth and overall market position.

The cybersecurity landscape is a constant race, with new threats emerging rapidly, including sophisticated AI-driven attacks. A10 Networks faces the significant challenge of keeping its product offerings cutting-edge in this dynamic environment. This necessitates substantial and ongoing investment in research and development to ensure their solutions remain effective against evolving cyber threats.

Failure to adapt quickly enough to these technological shifts poses a serious risk. If A10's products fall behind the curve, they could become less competitive or even obsolete, impacting their market position and revenue. For instance, in 2024, the cybersecurity market saw a 15% year-over-year growth in AI-powered security solutions, highlighting the speed of innovation.

Economic downturns pose a significant threat, as reduced enterprise and government IT budgets directly impact demand for A10 Networks' solutions. While cybersecurity remains a priority, broader economic pressures can lead to elongated sales cycles and project delays. For instance, in 2023, many companies reported a slowdown in IT investment due to macroeconomic uncertainty, a trend that could continue if economic conditions worsen through 2024 and into 2025.

Evolving Cyber Threat Landscape

The escalating sophistication and sheer volume of cyber threats present a significant challenge for A10 Networks. This evolving landscape demands continuous, substantial investment in research and development to ensure their security solutions remain effective. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the immense pressure on cybersecurity providers.

New attack vectors, the emergence of zero-day exploits, and the persistent nature of advanced threats constantly test existing security architectures. A10 must maintain unwavering vigilance and allocate significant R&D resources to adapt, ensuring their products stay ahead of these dynamic threats and preserve customer confidence.

- Increasing R&D Spend: A10's commitment to R&D is crucial to counter rising cyber threats, with global cybersecurity spending expected to exceed $300 billion in 2025.

- Zero-Day Exploits: The constant threat of unknown vulnerabilities requires proactive threat intelligence and rapid patching capabilities.

- Advanced Persistent Threats (APTs): A10 must develop robust defenses against sophisticated, long-term intrusions targeting critical infrastructure and sensitive data.

Reliance on Channel Partners and Distribution Challenges

A10 Networks' reliance on channel partners for a significant portion of its sales and distribution presents a notable threat. This model, while offering reach, inherently reduces direct control over the sales process and how their solutions are presented to the market. For instance, in Q1 2024, channel partners represented a substantial segment of their revenue, highlighting this dependence.

Potential conflicts of interest can arise if these partners also carry competing product lines, potentially diluting A10's focus and market messaging. Furthermore, ensuring consistent partner effectiveness and training across a broad network can be challenging, directly impacting sales performance and the ability to reach new market segments efficiently.

- Reduced Control: Less direct oversight of sales execution and brand messaging due to partner intermediation.

- Partner Conflicts: Risk of partners prioritizing competing products, impacting A10's market penetration.

- Effectiveness Variability: Inconsistent performance and training among channel partners can hinder sales and market reach.

The intense competition from established players like Cisco, which reported $13.0 billion in Q1 2024 revenue, and agile startups poses a significant threat. A10 must contend with competitors who can leverage greater R&D budgets and aggressive pricing strategies, potentially eroding A10's market share and profitability.

The rapidly evolving cyber threat landscape, marked by AI-driven attacks and zero-day exploits, demands continuous and substantial investment in research and development. Failure to keep pace with these advancements could render A10's solutions less competitive, impacting its market position amid a cybersecurity market that saw 15% growth in AI solutions in 2024.

Economic downturns can dampen enterprise and government IT spending, leading to longer sales cycles and project delays for A10's offerings. Macroeconomic uncertainty, which affected IT investment in 2023, could persist through 2024-2025, directly impacting demand for A10's solutions.

A10's reliance on channel partners for sales introduces risks related to reduced control over sales processes and potential partner conflicts, where partners may also carry competing products. This dependence can lead to inconsistent market messaging and variable sales performance.

SWOT Analysis Data Sources

This A10 SWOT analysis is built on a foundation of robust data, including A10's official financial reports, comprehensive market intelligence from leading industry analysts, and expert opinions from technology sector specialists.