A10 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A10 Bundle

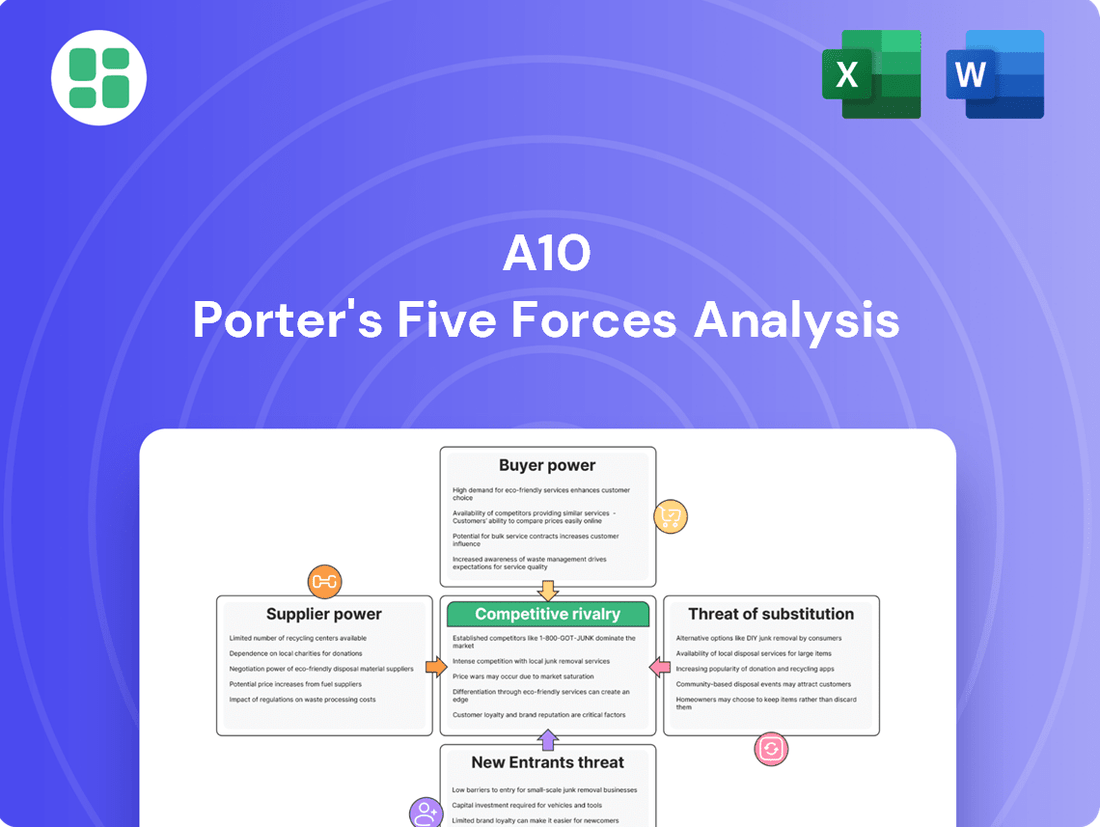

A10's competitive landscape is shaped by the interplay of five key forces. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore A10’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts A10 Networks' bargaining power. When a limited number of vendors supply critical, specialized hardware like network processors or proprietary software licenses, these suppliers gain leverage. A10's dependence on high-performance components for its application delivery and security solutions means these few suppliers can dictate pricing and terms, potentially increasing A10's costs.

Suppliers gain leverage when their offerings are unique or proprietary, leaving buyers with limited alternatives. For A10 Networks, this translates to greater bargaining power for suppliers of highly specialized hardware or critical intellectual property that A10 cannot easily substitute.

If A10 Networks relies on a single supplier for a unique component essential for its product development, that supplier can command higher prices. This is particularly relevant in the fast-evolving cybersecurity sector, where specialized technology is a key differentiator.

The February 2025 acquisition of ThreatX Protect by A10 Networks, aimed at bolstering its Web Application and API Protection (WAAP) capabilities, suggests a strategic focus on integrating unique security technologies. This move could potentially alter A10's supplier dynamics for other components, as it brings more functionalities in-house or consolidates relationships.

The bargaining power of suppliers for A10 Networks is significantly influenced by switching costs. If A10 Networks faces high expenses and considerable time in transitioning from one supplier to another, it grants suppliers more leverage. This situation is heightened when specialized, deeply integrated components, such as custom hardware or proprietary software, are involved, making a change disruptive and costly.

Threat of Forward Integration by Suppliers

Suppliers can increase their leverage by threatening to integrate forward into A10 Networks' business, essentially becoming a direct competitor. This would allow them to capture more of the value chain. While this is less of a concern for suppliers of physical components, companies providing critical software or intellectual property (IP) with a strong market standing could realistically consider this move.

For instance, a key software provider to A10 Networks might develop its own hardware solutions or partner with other hardware manufacturers, directly competing with A10’s offerings. This potential threat underscores the importance of A10 cultivating robust supplier relationships and exploring avenues for supply chain diversification to mitigate such risks. In 2023, the global market for network security hardware, a segment A10 operates in, saw significant growth, making the stakes for critical component suppliers even higher.

- Forward Integration Threat: Suppliers entering A10's market enhances their bargaining power.

- Software/IP Providers: These are more likely candidates for forward integration compared to hardware component suppliers.

- Risk Mitigation: A10 must foster strong supplier relationships and diversify its supply chain.

- Market Context: The growing network security hardware market in 2023 increases the strategic importance of supplier relationships.

Importance of A10 Networks to Suppliers

The significance of A10 Networks as a client to its suppliers directly influences their bargaining power. Should A10 constitute a substantial portion of a supplier's income, that supplier might be more amenable to offering competitive pricing or more flexible contract terms. This is a common dynamic in business-to-business relationships where customer volume dictates leverage.

Conversely, if A10 is a minor client for a large, diversified supplier, its ability to negotiate favorable terms diminishes. In such scenarios, the supplier has less incentive to accommodate A10's requests, as A10's business is not critical to their overall financial health. This asymmetry in customer-supplier importance is a key factor in determining bargaining power.

- Customer Dependence: A10's revenue contribution to its suppliers is a critical determinant of supplier willingness to negotiate.

- Supplier Diversification: Suppliers with a broad customer base are less influenced by any single client like A10.

- Market Share Impact: If A10 represents a significant percentage of a supplier's market share in a specific component, its leverage increases.

- Supplier Relationship Management: A10's ability to foster strong, long-term relationships can enhance its bargaining position, even with larger suppliers.

The bargaining power of suppliers is a crucial element in understanding the competitive landscape for companies like A10 Networks. When suppliers have significant leverage, they can command higher prices or impose less favorable terms on their customers, impacting profitability and strategic flexibility. This power is amplified when there are few suppliers for essential inputs, or when those inputs are highly specialized and difficult to substitute.

In 2024, the semiconductor industry, a key supplier base for networking hardware, continued to experience supply chain pressures, albeit easing from previous years. Companies like A10, reliant on advanced processors and specialized chips, would have navigated these dynamics. For instance, the demand for high-performance computing components remained robust, giving dominant chip manufacturers considerable sway in pricing and allocation.

A10 Networks' reliance on specific, high-performance components, such as network processors and specialized security ASICs, positions certain suppliers with substantial bargaining power. If these components are proprietary or manufactured by only a handful of firms, A10 has limited alternatives, allowing these suppliers to influence pricing and terms. This is particularly true given the critical nature of these components for A10's application delivery controllers and security solutions.

| Factor | Impact on A10 Networks | Example for A10 |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | Limited vendors for specialized network processors |

| Uniqueness of Offering | Increased supplier power | Proprietary security software or hardware IP |

| Switching Costs | Supplier leverage due to integration | High costs to transition to new hardware/software vendors |

| Forward Integration Threat | Potential for supplier competition | Software providers developing competing hardware solutions |

| A10's Importance to Supplier | Reduced supplier leverage if A10 is a major client | A10 representing a significant portion of a supplier's revenue |

What is included in the product

A10 Porter's Five Forces Analysis provides a comprehensive framework for understanding the competitive intensity and attractiveness of the market in which A10 operates.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

A10 Networks' customer base, heavily weighted towards large enterprises and service providers, significantly influences its bargaining power. In the second quarter of 2025, service providers alone represented a substantial 60% of A10's total revenue, with large enterprises contributing another 40%. This concentration means these major clients, due to their sheer purchasing volume, can effectively negotiate pricing and terms, thereby increasing their leverage.

The cost and complexity for A10's customers to switch to a competitor's solution directly influence their bargaining power. Significant migration efforts, potential downtime, and the need for retraining can make switching a substantial undertaking, thereby diminishing a customer's leverage.

For instance, a customer relying on A10's secure application delivery controllers for mission-critical operations would face considerable disruption and expense if they were to transition to a new vendor. This inherent stickiness in their infrastructure limits their ability to demand lower prices or more favorable terms.

Customer price sensitivity directly influences their bargaining power. In highly competitive sectors, such as secure application services, customers often exhibit significant price sensitivity, particularly when dealing with standardized offerings. For instance, in 2023, the average customer acquisition cost for SaaS companies increased by 15%, suggesting a growing pressure on pricing.

A10 Networks can effectively counter this by highlighting its unique value proposition. Differentiating through superior performance, unwavering reliability, and cutting-edge security features, such as its AI-driven threat detection capabilities, allows A10 to command a premium and reduce customer reliance solely on price. This strategy is crucial as the cybersecurity market continues to evolve, with spending projected to reach $269.3 billion in 2024, underscoring the demand for advanced solutions.

Availability of Substitutes and Alternatives

The availability of numerous alternative vendors and substitute solutions significantly amplifies customer bargaining power. If customers can readily find equally effective or more cost-efficient options, their ability to negotiate better terms with A10 increases. For instance, the cybersecurity market in 2024 features a wide array of cloud-native security services and open-source tools that can serve as alternatives to traditional appliance vendors.

A10 Networks' strategic moves, such as expanding its cybersecurity portfolio and acquiring companies like ThreatX Protect, are designed to counter this by strengthening its value proposition. This expansion aims to offer a more comprehensive suite of solutions, making it harder for customers to switch to competitors without sacrificing functionality or incurring higher integration costs. The company's focus on integrated security platforms in 2024 reflects this strategy to reduce the perceived substitutability of its offerings.

- Increased customer leverage: Numerous alternatives empower customers to demand lower prices or better service from A10.

- Market dynamics: The cybersecurity landscape in 2024 is characterized by rapid innovation and a proliferation of specialized security solutions.

- A10's strategic response: Portfolio expansion and acquisitions are key tactics to differentiate and retain customers in a competitive market.

- Customer switching costs: By offering integrated solutions, A10 aims to raise the costs and complexity associated with switching to a competitor.

Customer Information and Transparency

Customers armed with detailed information about pricing, product capabilities, and what competitors offer hold significant sway. This transparency empowers them to negotiate more effectively and seek better value.

The technology sector, in particular, has seen a surge in information accessibility. Analyst reports and industry benchmarks are readily available, enabling A10's potential clients to make well-informed choices about their purchases.

- In 2024, the global IT spending was projected to reach $5 trillion, indicating a highly competitive market where customer information is key.

- A significant portion of IT purchasing decisions are influenced by third-party reviews and comparative analyses, highlighting the impact of transparency.

- For a company like A10, understanding customer access to competitive intelligence is crucial for pricing strategies and product differentiation.

Customers' ability to negotiate with A10 Networks is significantly influenced by the availability of alternative solutions. In 2024, the cybersecurity market saw a rise in cloud-native services and open-source tools, providing viable substitutes for traditional vendors. This increased competition allows customers to demand better pricing and terms.

A10's strategy to mitigate this involves expanding its cybersecurity offerings and making strategic acquisitions, like ThreatX Protect. By providing a more integrated and comprehensive suite of solutions, A10 aims to increase customer switching costs and reduce the perceived substitutability of its products, a crucial move in a market where IT spending was projected to hit $5 trillion in 2024.

| Factor | Impact on Customer Bargaining Power | A10's Strategic Response |

|---|---|---|

| Availability of Alternatives | High (numerous cloud-native and open-source options in 2024) | Portfolio expansion, acquisitions (e.g., ThreatX Protect) to enhance integrated offerings. |

| Customer Information Access | High (readily available analyst reports and benchmarks) | Focus on differentiating through superior performance, reliability, and AI-driven security. |

| Switching Costs | Moderate to High (due to integration complexity and potential downtime) | Developing integrated security platforms to increase stickiness and deter switching. |

Full Version Awaits

A10 Porter's Five Forces Analysis

This preview showcases the complete A10 Porter's Five Forces analysis, offering a deep dive into the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. Our commitment is to provide you with a ready-to-use, comprehensive strategic tool for your business needs.

Rivalry Among Competitors

The secure application services market is a crowded space, with a mix of large, established technology giants and nimble, specialized security firms vying for market share. This intense competition means companies like A10 Networks are constantly pressured to innovate and often engage in price wars to attract and retain customers.

In 2024, the cybersecurity market, which encompasses secure application services, continued its robust growth, with global spending projected to reach over $200 billion. This expansion fuels the entry of new players and intensifies existing rivalries, forcing established vendors to differentiate through advanced features and competitive pricing strategies.

The application security market is experiencing robust expansion, with projections indicating it will reach USD 30.41 billion by 2030, growing at a compound annual growth rate of 17.39% from its 2025 valuation of USD 13.64 billion. This substantial growth generally tempers aggressive price wars as companies focus on capturing market share.

However, within this expanding landscape, specific segments where A10 Networks is particularly active, such as advanced DDoS protection and sophisticated load balancing solutions, are likely to maintain high levels of competitive intensity. Even with overall market growth, the specialized nature of these offerings means companies will still vie fiercely for customers.

The degree to which products and services are unique significantly impacts how intensely companies compete. A10 Networks, for instance, carves out its niche by concentrating on delivering high-performance, secure application delivery solutions, increasingly enhanced by artificial intelligence. This focus on specialized, advanced features helps differentiate its offerings in a crowded market.

High switching costs can also act as a barrier to intense rivalry. For complex infrastructure solutions like those A10 Networks provides, customers often invest heavily in integration and training, making it costly and time-consuming to switch vendors. However, this advantage requires constant vigilance; continuous innovation is crucial to ensure customers remain locked in and to maintain a competitive edge.

Exit Barriers

High exit barriers can significantly influence competitive rivalry. When it's difficult or costly for companies to leave a market, they often remain and continue to compete, even when profitability is low. This can lead to prolonged periods of intense competition and price wars.

For established technology companies like A10 Networks, exit barriers are often substantial. These can include specialized, hard-to-repurpose physical assets, ongoing commitments through long-term customer contracts, and significant investments in research and development that create high fixed costs. These factors compel companies to stay in the game, maintaining pressure on rivals.

Consider the implications for A10 Networks. If the company has invested heavily in proprietary hardware and software development, or if it's bound by multi-year service agreements with major clients, exiting the market would involve substantial write-offs and contractual penalties. This makes continued operation, even in a challenging environment, the more pragmatic choice, thereby sustaining rivalry.

- Specialized Assets: A10 Networks' reliance on custom hardware for its cybersecurity and application delivery solutions represents a significant exit barrier. These assets have limited resale value outside of their intended purpose.

- Long-Term Contracts: Many enterprise clients enter into multi-year support and service agreements, creating revenue streams that are difficult to terminate prematurely without incurring penalties, thus locking companies into the market.

- High Fixed Costs: Ongoing investments in R&D to stay competitive in the rapidly evolving tech landscape, coupled with operational overhead, contribute to high fixed costs that must be covered, discouraging market exit.

- Brand and Reputation: The established brand reputation and customer relationships built over years are valuable assets that companies are reluctant to abandon, further increasing the disincentive to exit.

Strategic Stakes

The strategic importance of application security and delivery within the broader cybersecurity and networking landscape fuels intense competition. For many major players, these segments are not just add-ons but core pillars of their offerings, prompting substantial investment and aggressive market strategies. This high strategic stake means competitors are deeply invested in gaining and maintaining market share.

The cybersecurity sector's ongoing consolidation, particularly the push towards platformization and AI integration, underscores these elevated strategic stakes. Firms are actively acquiring capabilities to create more comprehensive solutions, making application security a key battleground. For instance, in 2024, major cybersecurity firms continued to announce significant M&A activity, with a notable focus on bolstering their application security portfolios. This trend indicates that the strategic value of controlling application security is driving substantial financial and operational commitments.

- Strategic Importance: Application security and delivery are critical components of many large cybersecurity and networking firms' broader portfolios.

- Investment & Positioning: This criticality drives significant investment and aggressive market positioning by competitors.

- Industry Consolidation: Ongoing consolidation, driven by platformization and AI integration, highlights the high strategic stakes involved.

- 2024 Trends: Major cybersecurity firms in 2024 continued to prioritize acquisitions in application security to enhance their comprehensive offerings.

Competitive rivalry in the secure application services market is characterized by a dynamic interplay of established giants and specialized firms. This intense competition, fueled by a projected global cybersecurity spending exceeding $200 billion in 2024, compels companies like A10 Networks to continuously innovate and often engage in competitive pricing to capture market share.

While the overall application security market is expanding, with a projected valuation of USD 30.41 billion by 2030, specific segments like advanced DDoS protection and load balancing remain highly competitive. Companies differentiate through advanced features and AI integration, as seen in A10 Networks' focus on high-performance solutions.

High switching costs and substantial exit barriers, including specialized assets and long-term contracts, generally temper extreme price wars. However, these factors also mean companies are compelled to remain in the market, sustaining ongoing rivalry and the need for continuous innovation to retain customers.

The strategic importance of application security within broader cybersecurity portfolios further intensifies rivalry, driving significant investment and aggressive market positioning. This is evident in the 2024 trend of cybersecurity firms actively acquiring capabilities to bolster their application security offerings, highlighting the high stakes involved.

| Metric | 2024 Data/Projection | Impact on Rivalry |

| Global Cybersecurity Spending | >$200 billion | Fuels market entry and intensifies competition. |

| Application Security Market Growth (CAGR) | 17.39% (2025-2030) | Generally tempers aggressive price wars, but specialized segments remain intense. |

| A10 Networks' Focus | AI-enhanced application delivery & security | Differentiates offerings, reducing direct price competition in niche areas. |

| Switching Costs | High (integration, training) | Acts as a barrier to intense rivalry, encouraging customer retention. |

| Exit Barriers | High (specialized assets, contracts) | Compels companies to stay in the market, sustaining rivalry. |

SSubstitutes Threaten

The threat of substitutes for A10 Networks is significant, primarily stemming from alternative technologies that can address similar networking and security needs. Native security and load balancing services provided by major public cloud providers like AWS, Azure, and Google Cloud represent a key substitute. These integrated solutions are attractive due to their seamless fit within cloud-native environments.

The increasing adoption of cloud platforms directly impacts A10's market. In 2024, cloud deployment commanded a substantial 65.9% share of the application security market, highlighting the growing preference for provider-native solutions over specialized third-party offerings.

Very large enterprises with significant engineering capabilities might consider building their own application delivery and security solutions. This approach, though resource-intensive, can cater to highly specific and unique needs that off-the-shelf products may not fully address. For instance, a major financial institution might develop proprietary systems to manage its high-frequency trading platforms, ensuring maximum control and performance.

However, the escalating sophistication of cyber threats and the continuous need for specialized, up-to-date expertise often tip the scales in favor of third-party providers. The sheer cost and ongoing maintenance of developing and maintaining cutting-edge security infrastructure in-house can be prohibitive. In 2024, the average cost for companies to develop custom software solutions can range from tens of thousands to millions of dollars, depending on complexity, making specialized third-party offerings a more cost-effective and efficient alternative for many.

Open-source software presents a significant threat of substitutes for A10 Networks. Solutions like Nginx, widely adopted for load balancing and basic security, offer a compelling lower-cost alternative, particularly for smaller businesses or those with in-house technical expertise. In 2024, the adoption of open-source solutions continued to grow, with many organizations leveraging their flexibility and cost-effectiveness for core network functions.

While these open-source options may not match the advanced features, peak performance, or dedicated enterprise support found in A10's premium products, their affordability can be a deciding factor. The total cost of ownership for open-source, when factoring in internal management, can still undercut proprietary solutions, making them a viable substitute for budget-conscious customers.

Managed Security Services

The threat of substitutes for A10 Networks' products comes from large managed security service providers (MSSPs) and system integrators. These entities offer comprehensive security solutions that can bundle various technologies, potentially diminishing the need for A10's standalone offerings. Their approach aims to provide an all-encompassing security posture, acting as a substitute for managing individual security components.

For instance, in 2024, the global managed security services market was valued at approximately $31.4 billion, with projections indicating continued growth. This expansion signifies a strong customer preference for outsourcing security management, which can be seen as a direct substitute for A10's hardware and software solutions.

- Comprehensive Security Suites: MSSPs often provide integrated platforms covering threat detection, prevention, and response, which can replace the need for separate A10 products.

- Outsourcing Trend: Businesses increasingly opt for managed services to reduce internal IT burdens and leverage specialized expertise, a trend that grew significantly through 2024.

- Bundled Offerings: System integrators can bundle security services with other IT infrastructure, making it more convenient and cost-effective for clients than acquiring individual components.

Evolution of Network Architectures

The evolution of network architectures presents a significant threat of substitution for traditional solutions. The move towards microservices, serverless computing, and API-centric designs fundamentally alters how applications are deployed and secured. This shift can reduce reliance on legacy application delivery controllers (ADCs) and firewalls, as newer, more distributed security models emerge.

While A10 Networks is proactively addressing this by expanding into areas like Web Application and API Protection (WAAP), the underlying architectural changes themselves create new avenues for substitution. For instance, cloud-native security solutions and integrated API gateways can offer functionalities previously handled by dedicated hardware, potentially diminishing demand for A10's traditional product lines.

Consider the growing adoption of API gateways, which can manage traffic, enforce security policies, and provide observability for microservices. Gartner predicted in 2023 that API security would become a critical focus, with many organizations prioritizing API-centric security platforms. This trend directly impacts the market share of traditional ADCs if they cannot adequately integrate or compete with these newer, specialized solutions.

- Shift to Microservices: Applications are increasingly broken down into smaller, independent services, changing traffic patterns and security needs.

- Serverless Computing: Event-driven architectures and Function-as-a-Service (FaaS) reduce the need for always-on infrastructure, impacting traditional ADC models.

- API-Centric Security: The rise of APIs as primary communication interfaces necessitates specialized security solutions that may bypass or replace traditional network security devices.

- Cloud-Native Alternatives: Cloud providers offer integrated security services and managed solutions that can substitute for on-premises or traditional ADC hardware and software.

The threat of substitutes for A10 Networks is multifaceted, encompassing cloud-native security, in-house development, open-source alternatives, and managed security services. These substitutes leverage cost-effectiveness, integration, and specialized expertise to address similar networking and security needs.

In 2024, the application security market saw cloud deployment capture 65.9% of the share, underscoring the strong preference for integrated cloud solutions. Furthermore, the global managed security services market reached approximately $31.4 billion in 2024, indicating a significant trend towards outsourcing security functions.

| Substitute Category | Key Examples | Impact on A10 | 2024 Market Context |

|---|---|---|---|

| Cloud-Native Security | AWS Security Hub, Azure Security Center, Google Cloud Security Command Center | Offers integrated, seamless security within cloud environments, reducing reliance on third-party solutions. | 65.9% share of application security market for cloud deployments. |

| In-House Development | Custom-built security solutions by large enterprises | Allows for highly specific needs but is resource-intensive, with custom software development costs ranging from tens of thousands to millions of dollars in 2024. | Prohibitive ongoing maintenance and expertise costs favor third-party providers for most. |

| Open-Source Software | Nginx, HAProxy | Provides cost-effective load balancing and basic security, appealing to budget-conscious organizations. | Continued growth in adoption due to flexibility and cost-effectiveness. |

| Managed Security Services (MSSPs) | Broad range of outsourced security solutions | Bundles various technologies, offering comprehensive security management and reducing the need for individual component purchases. | Global MSS market valued at ~$31.4 billion in 2024, with strong growth. |

Entrants Threaten

The secure application services and cybersecurity market is a capital-intensive arena. New players need substantial funding to cover extensive research and development, build out comprehensive sales networks, and establish the global support infrastructure essential for competing effectively. This significant upfront investment acts as a formidable barrier, deterring many potential entrants.

Developing cutting-edge application delivery and security solutions demands profound technical knowledge in areas like networking, cryptography, and artificial intelligence. This steep learning curve, coupled with the relentless pace of innovation, presents a significant hurdle for any new company attempting to enter this market.

In the cybersecurity sector, brand loyalty and reputation are incredibly important. Established companies like A10 Networks have spent years building trust and strong relationships with their customers. This makes it a significant hurdle for newcomers to break into the market, particularly when dealing with essential infrastructure that requires utmost reliability.

Access to Distribution Channels

Securing effective distribution channels, whether through direct sales, channel partners, or system integrators, is paramount for any company aiming to reach its customers. For new entrants, establishing these vital networks can be a significant hurdle, often requiring substantial time and investment to build trust and reach.

A10 Networks, on the other hand, leverages its existing relationships with a diverse array of channel partners and system integrators. This established infrastructure provides a distinct advantage, allowing for more immediate and widespread market penetration compared to a newcomer needing to forge these connections from scratch.

The difficulty new entrants face in accessing these channels can significantly impact their ability to compete. For instance, in the cybersecurity market, where A10 Networks operates, established relationships with value-added resellers (VARs) and managed security service providers (MSSPs) are critical for reaching enterprise clients. A report from Canalys in Q4 2023 indicated that channel partners accounted for approximately 70% of sales in the cybersecurity market, highlighting the importance of these networks.

- Established Distribution Networks: A10 Networks benefits from pre-existing relationships with channel partners and system integrators, facilitating market access.

- Barriers for New Entrants: New companies often struggle to build comparable distribution networks quickly, facing significant time and resource constraints.

- Market Penetration: The strength of a company's distribution channels directly impacts its ability to penetrate the market effectively and reach a broad customer base.

- Industry Dependence on Channels: In sectors like cybersecurity, where channel partners are crucial for sales, this barrier to entry is particularly pronounced.

Regulatory and Compliance Hurdles

The cybersecurity industry is facing a growing wave of strict regulations and compliance mandates, such as GDPR, HIPAA, and PCI DSS. These requirements demand substantial financial and time commitments from companies, creating a significant barrier for new entrants looking to establish a foothold.

For instance, achieving compliance with certain data protection regulations can cost millions, a figure that can be prohibitive for startups. This regulatory landscape effectively raises the cost of entry, making it more challenging for smaller, less-resourced companies to compete with established players who have already invested in meeting these standards.

- Increased Compliance Costs: New cybersecurity firms must allocate significant capital to meet evolving data privacy and security standards.

- Time-to-Market Delays: The process of achieving necessary certifications can extend product launch timelines, impacting competitive agility.

- Operational Complexity: Navigating and adhering to diverse international and industry-specific regulations adds layers of operational complexity for new businesses.

- Reputational Risk: Failure to comply can lead to severe penalties and damage a new company's credibility from the outset.

The threat of new entrants in the secure application services and cybersecurity market is moderate, largely due to substantial capital requirements for R&D and infrastructure, coupled with the need for deep technical expertise. Established brand loyalty and the critical importance of trust also present significant hurdles for newcomers. Furthermore, navigating complex regulatory landscapes and establishing robust distribution channels are key barriers that deter many potential competitors.

| Barrier | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Capital Requirements | High | Estimated R&D and infrastructure costs can exceed $50 million for a comprehensive cybersecurity solution. |

| Technical Expertise | High | Requires specialized knowledge in AI, cryptography, and networking, with a shortage of skilled professionals impacting new hires. |

| Brand Loyalty & Trust | High | Enterprise clients often prioritize established vendors with proven track records, leading to longer sales cycles for new entrants. |

| Regulatory Compliance | Moderate to High | Compliance costs for GDPR and similar regulations can add 10-15% to initial operational expenses. |

| Distribution Channels | Moderate to High | Channel partners accounted for roughly 70% of cybersecurity sales in late 2023, making access crucial. |

Porter's Five Forces Analysis Data Sources

Our A10 Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, industry-specific market research reports, and competitor disclosures. This blend ensures a comprehensive understanding of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.