A10 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A10 Bundle

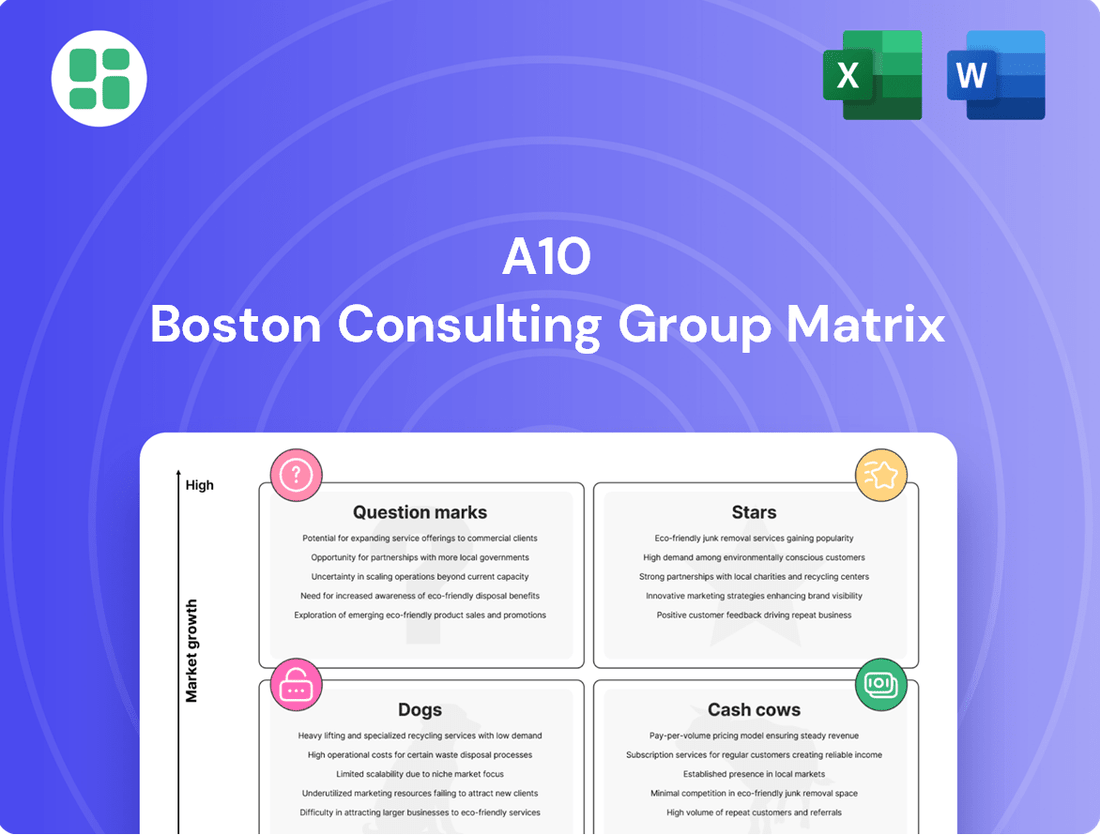

Understand the core of the BCG Matrix: how a company's products fit into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This foundational knowledge is crucial for strategic decision-making.

Ready to move beyond the basics? Purchase the full BCG Matrix to unlock detailed quadrant analysis, actionable insights for each product category, and a clear path to optimizing your portfolio.

Stars

A10 Networks' advanced DDoS protection solutions are considered Stars within the BCG Matrix. This classification is driven by the robust growth of the DDoS protection and mitigation market, which is anticipated to reach USD 13.90 billion by 2034, expanding at a compound annual growth rate of 13.81% from 2025.

The increasing volume and sophistication of DDoS attacks, as detailed in A10's 2025 Global DDoS Threat Report, make their offerings particularly relevant and in high demand. This strategic positioning highlights A10's strength in a critical and expanding security sector.

A10 Networks is capitalizing on the AI boom by investing in its AI-ready security solutions, particularly its AI firewalls. This strategic move positions the company to capture growth in a market that's just starting to take off.

The company is enhancing its ACOS with an integrated AI stack, specifically designed to protect large language models and AI inference environments. This development is crucial as the demand for securing AI infrastructure escalates.

A10's innovative approach to AI security is already being recognized, with the company receiving awards for its advancements in this nascent but rapidly expanding sector.

A10 Networks' acquisition of ThreatX Protect in February 2025 strategically positions them within the rapidly expanding Web Application and API Protection (WAAP) sector. This move directly addresses the escalating threat landscape, particularly concerning API-centric attacks, which saw a significant surge in reported incidents throughout 2024. The integration enhances A10's existing cybersecurity suite, known as A10 Defend, by offering more robust, end-to-end protection for critical applications.

Multi-Cloud and Hybrid Cloud Security Solutions

As businesses increasingly embrace hybrid and multi-cloud architectures, the need for comprehensive security solutions has become paramount. A10 Networks is well-positioned to capitalize on this trend by offering secure and scalable application delivery and security solutions designed for these complex environments.

A10's offerings cater to the protection of critical applications and data, whether they reside on-premises, in public clouds, or at the edge. This broad applicability addresses the growing market demand for unified security strategies across diverse IT infrastructures.

- Market Growth: The global cloud security market was valued at approximately $15.1 billion in 2023 and is projected to reach over $40 billion by 2028, indicating substantial growth opportunities.

- A10's Position: A10 Networks' focus on application security, including DDoS protection and secure load balancing, directly addresses key security concerns in hybrid and multi-cloud deployments.

- Scalability and Flexibility: Their solutions are engineered for scalability, allowing enterprises to adapt their security posture as their cloud adoption evolves.

High-Performance Application Delivery Controllers (ADCs) for Modern Architectures

A10's high-performance Application Delivery Controllers (ADCs) are a strong contender in the growing market for modern application architectures. These solutions are specifically designed to handle the demands of microservices and containerized environments, offering crucial SSL offloading and acceleration capabilities that remain highly sought after.

The global ADC market is projected for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 12.9% between 2025 and 2030. This expansion is largely fueled by increasing cloud adoption and the evolving needs of contemporary applications.

- Market Growth: The ADC market is expected to see a 12.9% CAGR from 2025 to 2030, indicating significant opportunity.

- Key Drivers: Cloud adoption and the demand for modern application delivery are primary growth catalysts.

- A10's Position: A10's Thunder ADC platform is continuously updated to meet performance and security demands in this expanding segment.

- Competitive Edge: Focus on microservices, containers, and SSL acceleration differentiates A10 in a mature but segment-specific growing market.

A10 Networks' DDoS protection and AI-driven security solutions are positioned as Stars in the BCG Matrix due to their operation in high-growth markets. The DDoS protection market is projected to reach $13.90 billion by 2034 with a 13.81% CAGR from 2025, driven by increasing attack sophistication. A10's investment in AI-ready security, including AI firewalls and AI stack integration for LLM protection, targets a nascent but rapidly expanding sector. Their acquisition of ThreatX Protect further strengthens their position in the growing Web Application and API Protection (WAAP) market.

| Category | A10's Offering | Market Growth (2025-2034) | A10's Strategic Advantage |

|---|---|---|---|

| DDoS Protection | Advanced DDoS protection solutions | 13.81% CAGR | High demand due to increasing attack sophistication |

| AI Security | AI-ready security solutions, AI firewalls, AI stack for LLM protection | Nascent but rapidly expanding | Proactive investment in emerging AI security needs |

| Application Security | Web Application and API Protection (WAAP) | Significant growth driven by API-centric attacks | Strategic acquisition (ThreatX Protect) to enhance end-to-end protection |

What is included in the product

Strategic guidance on managing a product portfolio by classifying each unit into Stars, Cash Cows, Question Marks, or Dogs.

Instantly visualize your portfolio's strategic positioning, alleviating the pain of complex analysis.

Cash Cows

A10 Networks' established Application Delivery Controller (ADC) core business, especially its load balancing capabilities, functions as a classic Cash Cow. This segment benefits from a significant market share within a mature industry, providing a reliable and consistent revenue stream.

These mature ADC solutions require minimal incremental investment for marketing and growth, contributing to A10's overall profitability. For instance, A10 Networks reported a net income of $100.5 million for the fiscal year 2023, showcasing the robust financial health often associated with cash cow businesses.

A10 Networks' Carrier-Grade NAT (CGNAT) and IPv6 migration solutions are vital for service providers and large enterprises needing to manage IP address scarcity and transition to newer protocols. These offerings represent a mature market segment, ensuring network stability and continued IPv4 functionality.

This segment operates as a cash cow for A10, generating consistent, high-margin revenue. The company can leverage these established products with limited need for further growth investment, effectively milking their established market presence.

In 2024, A10 reported that its CGNAT and IPv6 transition solutions continued to be a significant contributor to its revenue, reflecting the ongoing demand for IP address management and the slow but steady global IPv6 adoption. While specific segment growth figures are not always broken out, the overall stability of these foundational network services supports their cash cow status.

A10's post-contract support and professional services represent a significant cash cow, contributing 44% of total revenue in Q2 2025. This segment's stability is further bolstered by impressive customer loyalty, with renewal rates consistently exceeding 90% on eligible contracts. Such dependable recurring revenue provides a strong foundation for funding the company's strategic growth endeavors.

Traditional Stateful Firewall and IPsec VPN Solutions

A10 Networks provides foundational network security solutions like high-performance Gi/SGi firewalls and IPsec VPNs. These are essential for safeguarding mobile operator networks and securing sensitive application data, representing a mature but vital part of their portfolio.

While not operating in the fastest-growing cybersecurity sectors, these traditional products generate consistent revenue from a loyal customer base. Their essential function in maintaining network integrity makes them reliable cash cows for A10.

- Stable Revenue Stream: These solutions cater to a fundamental need, ensuring predictable demand and recurring revenue.

- Established Market Presence: A10's long-standing offerings in firewalls and VPNs have cultivated a strong, stable customer base.

- Critical Infrastructure Protection: Their importance in securing mobile operator networks and application data underpins their ongoing value.

- Cash Generation: The consistent demand and established market position allow these products to reliably generate cash for the company.

Legacy Hardware Appliance Sales with Stable Demand

Legacy hardware appliance sales, particularly for established customer segments like service providers, continue to show stable demand. This is driven by existing infrastructure and lengthy deployment cycles, ensuring a consistent revenue stream from hardware and support services.

While the market is shifting towards virtual and cloud-native solutions, A10 Networks benefits from a dependable installed base. This segment acts as a cash cow, providing predictable, low-growth contributions to the company's overall financial health.

- Stable Demand: Service providers maintain a need for A10's hardware appliances due to long-term infrastructure investments.

- Installed Base Revenue: Existing deployments continue to generate consistent sales of hardware and associated support contracts.

- Low Growth, High Predictability: This segment offers reliable, albeit modest, cash flow, characteristic of a cash cow.

Cash cows in A10 Networks' portfolio represent established products with significant market share in mature industries, generating consistent and predictable revenue streams. These offerings, requiring minimal additional investment for growth, are crucial for funding the company's strategic initiatives and maintaining profitability.

For example, A10's Carrier-Grade NAT (CGNAT) and IPv6 transition solutions continue to be vital for service providers managing IP address scarcity. In 2024, these solutions remained a significant revenue contributor, underscoring their dependable cash-generating capabilities despite the slow pace of global IPv6 adoption.

Furthermore, post-contract support and professional services, which contributed 44% of total revenue in Q2 2025, exemplify a strong cash cow. High customer loyalty and renewal rates exceeding 90% on eligible contracts ensure a stable, recurring revenue base.

Even legacy hardware appliance sales to established customer segments like service providers provide a predictable, low-growth cash flow, characteristic of a cash cow. These foundational network security solutions, like high-performance firewalls, also contribute to this category due to their essential function and loyal customer base.

| Business Segment | BCG Category | Key Characteristics | 2023/2024/2025 Data Points |

| Application Delivery Controllers (ADCs) | Cash Cow | High market share, mature industry, stable revenue. | Core business providing consistent revenue stream. |

| Carrier-Grade NAT (CGNAT) & IPv6 Migration | Cash Cow | Essential for IP management, stable demand, high margins. | Significant revenue contributor in 2024; ongoing demand for IP address management. |

| Post-Contract Support & Professional Services | Cash Cow | Recurring revenue, high renewal rates, customer loyalty. | 44% of total revenue in Q2 2025; renewal rates >90%. |

| Traditional Security Solutions (Firewalls, VPNs) | Cash Cow | Essential network function, loyal customer base, consistent revenue. | Reliable cash generation from maintaining network integrity. |

| Legacy Hardware Appliances | Cash Cow | Dependable installed base, stable demand from service providers. | Consistent sales from existing infrastructure and support contracts. |

What You See Is What You Get

A10 BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises – just the complete strategic tool ready for your immediate use. You're seeing the actual file, meticulously prepared for professional analysis and decision-making, ensuring you get exactly what you need to evaluate your business portfolio.

Dogs

As the market increasingly embraces virtual and software-defined application delivery controllers, older hardware-only ADC models face declining demand and market share. These legacy physical appliances, once dominant, risk becoming cash traps if maintenance and update costs outweigh revenue, especially in low-growth markets. For instance, IDC reported in late 2023 that while the overall ADC market showed modest growth, the shift to software-based solutions was accelerating, putting pressure on hardware-centric vendors.

Generic network firewall offerings from A10 likely fall into the Dogs category of the BCG Matrix. In the intensely competitive cybersecurity landscape, these basic, undifferentiated firewall functionalities, particularly those not bundled with A10's more advanced security solutions, face significant challenges.

These products probably hold a small market share and exhibit sluggish growth prospects when contrasted with more specialized and innovative cybersecurity solutions available today. For instance, the global network security market, while growing, sees significant investment in areas like AI-driven threat detection, where generic firewalls may not compete effectively.

Investing further in these standalone, generic firewall features without substantial innovation or integration into a broader, differentiated security platform is unlikely to generate meaningful returns. Companies are increasingly seeking integrated security platforms rather than piecemeal solutions, making these basic offerings less attractive.

Niche or custom solutions with limited market scalability, often found in specialized software or bespoke manufacturing, represent a challenge within the BCG matrix. These offerings typically cater to a very select clientele, resulting in a low market share and minimal growth prospects. For instance, a custom-built industrial automation system for a single factory, while profitable for that specific project, doesn't easily translate to wider market appeal.

Products in this category consume valuable resources, such as research and development funds and specialized labor, without yielding substantial returns. Consider a niche biotech product targeting a rare genetic disorder; while it addresses a critical need, the patient population is inherently small, capping its revenue potential. In 2024, companies with such offerings often face difficult decisions regarding their future.

The primary concern for these "niche" products is their inability to scale. If a product, like a highly specialized consulting service for a particular industry, cannot find a broader application or attract more customers, its long-term viability is questionable. Many businesses evaluate these offerings for potential divestiture, especially if they require ongoing investment but demonstrate no clear path to increased profitability or market expansion.

Solutions Heavily Tied to Declining On-Premises Only Infrastructure

Solutions that are strictly tied to declining on-premises only infrastructure, lacking a clear migration path to hybrid or multi-cloud environments, are likely to see a significant drop in demand. As businesses increasingly adopt flexible cloud strategies, these legacy-focused offerings will struggle to remain relevant. For instance, a company heavily invested in hardware-based security appliances that cannot be virtualized or integrated into a cloud orchestration platform will find its market shrinking rapidly. This segment represents a potential challenge in the evolving IT landscape.

A10 Networks, while positioned for hybrid infrastructure, must ensure that any remaining purely on-premises, non-cloud-ready solutions have a viable upgrade or integration strategy. Without this, these specific product lines could face declining relevance. For example, if A10 has products that only serve traditional data centers without any cloud adjacency, their market share will likely erode. The market for such isolated solutions is contracting, with many enterprises prioritizing cloud-native or cloud-enabled technologies. In 2024, the global IT infrastructure spending shift towards cloud services continued to accelerate, impacting traditional on-premises hardware sales.

- Declining Market Relevance: Purely on-premises solutions without cloud integration capabilities are facing obsolescence.

- Hybrid Cloud Adoption: The industry-wide move to hybrid and multi-cloud environments leaves static, on-premises-only solutions behind.

- Struggling in Evolving Markets: Offerings not adaptable to cloud architectures are likely to experience low growth and diminishing market share.

- Strategic Imperative: Companies like A10 need clear cloud integration pathways for all their offerings to maintain competitiveness.

Less Feature-Rich or Older Software Versions

Older software versions of A10's products, lacking current security patches, advanced AI/ML features, or cloud-native architectures, may find it challenging to compete. This is particularly true when pitted against A10's own more modern solutions.

If a significant portion of A10's customer base continues to use these legacy versions, it could indicate a low market share within a rapidly evolving technological landscape. For instance, if less than 40% of A10's installed base has upgraded to their latest security protocols by the end of 2024, this segment could be classified as a Dog.

- Limited Competitive Edge: Older versions may lack critical security updates and advanced functionalities like AI-driven threat detection, making them vulnerable and less appealing to security-conscious enterprises.

- Declining Market Relevance: As the cybersecurity market shifts towards cloud-native and integrated solutions, older, on-premise software with fewer features risks becoming obsolete, leading to a shrinking market share.

- Resource Reallocation: Continued investment in maintaining and supporting these older versions diverts resources that could be better utilized for developing and marketing A10's next-generation products, which are crucial for future growth.

- Customer Retention Challenges: Without compelling reasons to upgrade, customers using older software might eventually seek more advanced alternatives from competitors, further eroding A10's market position in these segments.

Products categorized as Dogs in the BCG Matrix, such as older software versions or generic hardware, typically exhibit low market share and minimal growth potential. These offerings often require continued investment for support and maintenance without generating significant returns, making them a drain on resources. Companies must strategically decide whether to divest, discontinue, or attempt to revitalize these products to avoid them becoming cash traps.

For instance, A10 Networks' legacy hardware-based Application Delivery Controllers (ADCs) that are not cloud-enabled are prime examples of Dogs. As the market increasingly favors virtual and software-defined solutions, these older physical appliances face declining demand. In 2024, IDC data indicated that while the overall ADC market saw modest growth, the acceleration towards software-based solutions put considerable pressure on hardware-centric vendors, highlighting the diminishing relevance of such products.

Generic network firewall offerings, lacking advanced AI or cloud integration, also fall into the Dog category. In the competitive cybersecurity market, these undifferentiated products struggle against more specialized and innovative solutions. The global network security market, though expanding, sees major investments in areas like AI-driven threat detection, where basic firewalls are outmatched, further solidifying their Dog status.

The challenge with these products lies in their inability to scale and their struggle to adapt to evolving market demands. For example, a niche software solution catering to a very specific, small industry segment may have low market share and limited growth prospects, similar to a custom industrial automation system for a single factory. Such offerings consume valuable R&D and specialized labor without substantial returns, forcing companies to evaluate their future viability.

| Product Category Example | BCG Matrix Category | Market Share | Market Growth | Strategic Consideration |

|---|---|---|---|---|

| Legacy Hardware ADCs (Non-Cloud) | Dog | Low | Declining | Divest or discontinue; focus on cloud-native alternatives. |

| Generic Network Firewalls (Basic) | Dog | Low | Slow | Integrate into broader security platforms or phase out. |

| Older Software Versions (No AI/Cloud) | Dog | Low | Declining | Mandate upgrades or sunset support; invest in newer versions. |

| Niche, Non-Scalable Solutions | Dog | Low | Slow | Evaluate for divestiture or pivot to broader market appeal. |

Question Marks

A10 Networks is pioneering AI/ML-driven predictive analytics to preemptively identify network performance bottlenecks. This capability serves as a crucial early warning system, flagging potential congestion or capacity shortfalls before they impact operations.

The market for these advanced analytics is experiencing robust growth, driven by the escalating demand for optimized performance in complex AI and Large Language Model (LLM) inference environments. Companies are increasingly reliant on seamless network operations for their AI initiatives.

Despite the high growth potential, A10's specific AI/ML predictive analytics functionalities likely hold a low market share at present. These cutting-edge features are in the early stages of trial and adoption, necessitating substantial investment to achieve widespread market penetration and establish a significant presence.

While A10's acquisition of ThreatX significantly enhances its core Web Application and API Protection (WAAP) offerings, the landscape of API security extends to highly specialized solutions targeting niche or emerging threat vectors. These specialized areas, such as advanced API discovery and classification for complex microservices architectures or AI-driven anomaly detection for zero-day API exploits, represent a high-growth market. The increasing reliance on APIs across industries, coupled with the sophistication of attacks targeting them, fuels this expansion. For example, the global API management market, which encompasses security aspects, was projected to reach $10.4 billion by 2027, growing at a CAGR of 32.1% from 2022, according to some market analyses. In these cutting-edge segments, A10 might currently hold a relatively smaller market share, necessitating substantial investment to transition these offerings into Stars within the BCG matrix.

A10 Control is positioned as a Stars or Question Marks in the A10 BCG Matrix, focusing on advanced multi-cloud visibility and centralized management. Its capabilities in secure application delivery across diverse cloud platforms address a significant market need.

The demand for robust multi-cloud security and unified management is substantial, yet achieving true cross-platform visibility and meeting all customer requirements presents ongoing hurdles. This complexity, coupled with significant investment by A10, suggests a high-growth market where competitors are well-established, placing A10 in a dynamic position.

Newer Offerings in Specific Enterprise Verticals (e.g., Gaming, Finance AI Security)

A10 Networks is strategically targeting high-growth enterprise verticals like gaming, finance, and AI security, aiming to expand its footprint in these specialized markets. This focus on large enterprises for AI infrastructure security presents a significant opportunity, given the increasing demand for robust protection in these data-intensive sectors.

While these verticals offer substantial growth potential, A10's current market share within these specific, high-value niches might be nascent, positioning them as potential Stars or Question Marks in the BCG matrix. For instance, the global AI cybersecurity market was projected to reach $25.7 billion in 2024, with significant growth expected in financial services and gaming.

- Gaming: Increased online gaming and the rise of esports drive demand for DDoS protection and application security solutions, areas where A10 can leverage its expertise.

- Finance: Financial institutions require advanced security to protect sensitive data and comply with regulations, making them prime targets for A10's specialized offerings.

- AI Security: As AI adoption accelerates, securing AI infrastructure and models becomes critical, creating a new frontier for security providers like A10.

- Market Penetration: Capturing market share in these competitive and specialized areas will necessitate considerable investment in tailored solutions and dedicated sales and support efforts.

Solutions for Emerging Edge-Cloud Environments

A10 Networks is strategically positioning itself to capitalize on the burgeoning edge-cloud market, a sector poised for substantial growth fueled by the widespread adoption of 5G and the Internet of Things (IoT). The company offers solutions designed for security and scalability within these dynamic environments.

While the edge-cloud landscape is still in its formative stages, A10's market share in this emerging segment, when compared to established competitors, may currently be modest. This presents a classic "Question Mark" scenario within the A10 BCG Matrix, indicating high growth potential but also uncertainty regarding A10's current competitive standing.

- High Growth Potential: The edge-cloud market is projected to see significant expansion, with some analysts forecasting it to reach hundreds of billions of dollars by the end of the decade.

- Investment Required: To translate this potential into market leadership, A10 will need to continue investing in product development, sales, and marketing efforts specifically tailored for edge-cloud deployments.

- Competitive Landscape: A10 faces competition from a range of players, including traditional networking vendors, cloud providers, and specialized edge computing companies, making market penetration a key challenge.

- Strategic Focus: A10's success in this segment hinges on its ability to demonstrate clear value propositions in security, performance, and ease of management for distributed edge applications.

Question Marks represent business units or products operating in high-growth markets but currently holding a low market share. These are areas where A10 Networks is investing heavily, aiming to build a strong competitive position for future growth. Success in these segments requires significant capital investment and strategic focus to convert potential into market leadership.

The AI/ML predictive analytics for network performance and the specialized API security segments are prime examples of A10's Question Marks. While the markets are expanding rapidly, driven by AI adoption and the critical need for robust API protection, A10's current share in these niche, cutting-edge areas is likely nascent. For instance, the global AI cybersecurity market was projected to reach $25.7 billion in 2024, highlighting the immense growth potential in AI security alone.

Similarly, the edge-cloud market, fueled by 5G and IoT, presents a high-growth, yet nascent, opportunity for A10. While the market is expected to reach hundreds of billions of dollars by the end of the decade, A10's current market share compared to established players is modest. This necessitates continued investment in product development and tailored sales strategies to capture a significant portion of this emerging sector.

A10's strategic focus on high-growth enterprise verticals like gaming, finance, and AI security also places them in Question Mark territory. These sectors demand advanced security solutions, but penetrating these competitive niches requires substantial investment to develop tailored offerings and build dedicated sales and support capabilities. The success of these ventures will depend on A10's ability to effectively compete and gain traction against well-entrenched players.

| A10 Business Area | Market Growth | A10 Market Share | BCG Classification | Strategic Implication |

| AI/ML Predictive Analytics | High | Low | Question Mark | Requires significant investment to gain market share. |

| Specialized API Security | High | Low | Question Mark | Investment needed for niche threat vector solutions. |

| Edge-Cloud Market | High | Modest | Question Mark | Investment in product development and sales for emerging sector. |

| Gaming, Finance, AI Security Verticals | High | Nascent | Question Mark | Investment in tailored solutions and dedicated sales efforts. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.