84 Lumber SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

84 Lumber Bundle

84 Lumber's market position is shaped by its strong brand recognition and extensive store network, yet it faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the building materials industry.

Want the full story behind 84 Lumber's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

84 Lumber boasts an extensive national footprint, operating over 320 facilities, including stores and manufacturing plants, strategically positioned across 34 states. This vast network enables them to cater to diverse markets and project types, from residential builds to significant commercial and multifamily developments.

The company's commitment to growth is evident in its ongoing expansion, with recent openings of new component plants and stores in high-demand areas such as South Carolina and Colorado, reinforcing their substantial national reach.

84 Lumber boasts a diverse product catalog, encompassing essential building materials such as lumber, windows, doors, roofing, and siding. This wide selection caters to a broad spectrum of construction needs, making them a one-stop shop for many projects.

Beyond raw materials, the company also excels in offering manufactured components, including custom-designed doors and pre-fabricated trusses. This capability streamlines the building process for contractors by providing ready-to-install elements.

Furthermore, 84 Lumber differentiates itself by providing turnkey installation services for many of its products. This integrated approach significantly enhances their value proposition, simplifying procurement and project execution for their professional builder and contractor clientele.

84 Lumber boasts a formidable reputation, consistently earning accolades that solidify its trustworthy brand image. The company was recognized as one of Newsweek's Most Trustworthy Companies in America for both 2024 and 2025, highlighting its sustained commitment to integrity and customer confidence. Furthermore, its designation as a USA Today Top Retailer in 2024 and frequent appearances on Forbes' lists of America's Best Large Employers and Top Private Companies underscore its industry leadership and operational excellence.

Privately Held and Flexible Operations

As the largest privately held supplier in its industry, 84 Lumber enjoys significant operational flexibility. This structure shields the company from the quarterly pressures often faced by publicly traded entities, allowing for a more patient, long-term strategic vision. For instance, in 2024, the company continued to invest in its store network and associate training without immediate shareholder return demands.

This private ownership fosters a distinct customer-centric approach. Freed from the need to constantly appease public shareholders, 84 Lumber can prioritize building enduring relationships with both its associates and its clientele. This focus on people, rather than just profit margins, is a key differentiator.

Owner and CEO Maggie Hardy's direct involvement further amplifies this agility. Her philosophy centers on adapting to the unique needs of local markets, a strategy that is more readily implemented in a privately held company. This allows for quicker decision-making and a more responsive business model, a crucial advantage in the dynamic building supply sector.

Key advantages stemming from this private ownership include:

- Operational Freedom: Unburdened by public market scrutiny, allowing for strategic flexibility.

- Long-Term Focus: Capacity to make investments that may not yield immediate returns but build sustainable growth.

- Customer-Centricity: Ability to prioritize client relationships and service over short-term financial performance.

- Agile Decision-Making: Direct leadership allows for rapid adaptation to market changes and local demands.

Investment in Manufacturing and Innovation

84 Lumber's significant investment in manufacturing, especially in component plants for engineered wood products and custom door shops, strengthens its market position. This strategic move enhances quality control and supply chain efficiency, allowing them to offer specialized, value-added products. For instance, their expansion into manufactured components directly addresses the growing demand for pre-fabricated building materials, a trend projected to continue through 2025.

The company's commitment to innovation is evident in its adoption of digital tools and advanced technologies. This focus on modernization aims to boost operational efficiency and elevate the customer experience, keeping them competitive in a rapidly evolving market. By embracing technology, 84 Lumber is better positioned to meet the increasing demand for integrated building solutions.

- Expanded Manufacturing Footprint: Investment in component plants and door shops provides greater control over production and product quality.

- Supply Chain Optimization: Direct manufacturing capabilities streamline the supply of key building materials, reducing lead times and costs.

- Value-Added Services: The ability to produce custom components and engineered wood products offers differentiated, higher-margin offerings.

- Technological Integration: Adoption of digital tools and advanced manufacturing technologies drives efficiency and improves customer service.

84 Lumber's extensive national presence, with over 320 facilities across 34 states, allows them to serve a broad customer base and diverse construction needs. Their commitment to growth is demonstrated by recent expansions into key markets like South Carolina and Colorado, reinforcing their market reach.

The company offers a comprehensive product range, from lumber and windows to custom-manufactured components like trusses and doors, positioning them as a convenient, one-stop shop for builders. Furthermore, their provision of turnkey installation services adds significant value, simplifying project execution for contractors.

84 Lumber's strong reputation is bolstered by consistent industry recognition, including being named one of Newsweek's Most Trustworthy Companies in America for 2024 and 2025, and a USA Today Top Retailer in 2024. These accolades highlight their commitment to integrity and customer trust.

As the largest privately held supplier in the building materials sector, 84 Lumber benefits from operational flexibility and a long-term strategic vision, unhindered by public market pressures. This private ownership structure, coupled with the direct involvement of CEO Maggie Hardy, enables a customer-centric approach and agile decision-making tailored to local market needs.

What is included in the product

Offers a full breakdown of 84 Lumber’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Identifies critical market gaps and competitive advantages to inform strategic resource allocation.

Highlights operational inefficiencies and potential threats to guide risk mitigation efforts.

Weaknesses

84 Lumber's deep connection to the construction sector means its fortunes are closely tied to the ups and downs of building activity. When the housing market or commercial development slows, demand for lumber and building materials naturally dips. This cyclical dependency can lead to unpredictable revenue streams for the company, making consistent financial performance a challenge.

The building materials sector is a battlefield, with 84 Lumber facing a crowd of competitors. National powerhouses like Menards and Builders FirstSource, alongside regional and local players, vie for customer attention. This intense rivalry often translates into price wars, making it tough for 84 Lumber to hold onto its market share and maintain healthy profit margins.

The construction sector, including 84 Lumber's market, grapples with persistent supply chain issues. In 2024, the Producer Price Index for construction materials saw fluctuations, with some categories experiencing double-digit increases year-over-year, impacting project timelines and costs. Geopolitical instability further exacerbates these challenges, creating uncertainty around material availability and transportation.

While 84 Lumber benefits from its manufacturing integration, it remains susceptible to external shocks. For instance, a major shipping port closure or a sudden imposition of tariffs on key building components, as seen in past trade disputes, could significantly disrupt inbound material flow and affect delivery schedules for its customers, even with robust internal processes.

Labor Shortages and Workforce Challenges

Persistent labor shortages and skill gaps continue to plague the construction industry, directly affecting suppliers like 84 Lumber. This scarcity of qualified workers, a trend amplified by an aging workforce and insufficient new talent entering the trades, can hinder 84 Lumber's operational efficiency.

These workforce challenges can manifest in difficulties staffing retail locations, managing complex logistics, and ensuring timely delivery of materials and services. The impact is often felt in increased labor costs and significant operational constraints, potentially affecting project timelines for customers.

- Aging Workforce: The average age of construction workers is rising, with fewer young people entering the field, creating a critical bottleneck for future labor supply.

- Skill Gaps: A mismatch exists between the skills required for modern construction and the skills possessed by available workers, impacting productivity and quality.

- Impact on Operations: Shortages can lead to longer wait times for customers, increased overtime for existing staff, and a potential inability to scale operations with demand.

- Rising Labor Costs: To attract and retain talent, companies may face pressure to increase wages and benefits, impacting overall profitability.

Limited Public Financial Transparency

As a privately held entity, 84 Lumber's lack of public financial disclosures presents a notable weakness. This limits external parties, like analysts and potential investors, from thoroughly evaluating its financial standing and performance trends, especially when contrasted with publicly traded rivals. For instance, while publicly traded competitors might report quarterly earnings, 84 Lumber's private status means such detailed insights are not readily available, impacting comparative analysis.

84 Lumber's reliance on the cyclical construction industry exposes it to significant demand fluctuations. For example, the U.S. Census Bureau reported a 15.6% decrease in housing starts in April 2024 compared to the previous year, directly impacting material sales. This volatility makes consistent revenue generation a considerable challenge.

Intense competition within the building materials sector, featuring large national players and numerous regional businesses, pressures 84 Lumber's pricing power and market share. Profitability can be squeezed by aggressive discounting strategies employed by rivals, particularly during economic downturns.

The company faces ongoing labor shortages and skill gaps within the construction trades. This scarcity, a persistent issue in 2024, drives up labor costs and can impede operational efficiency and the ability to meet customer demand promptly.

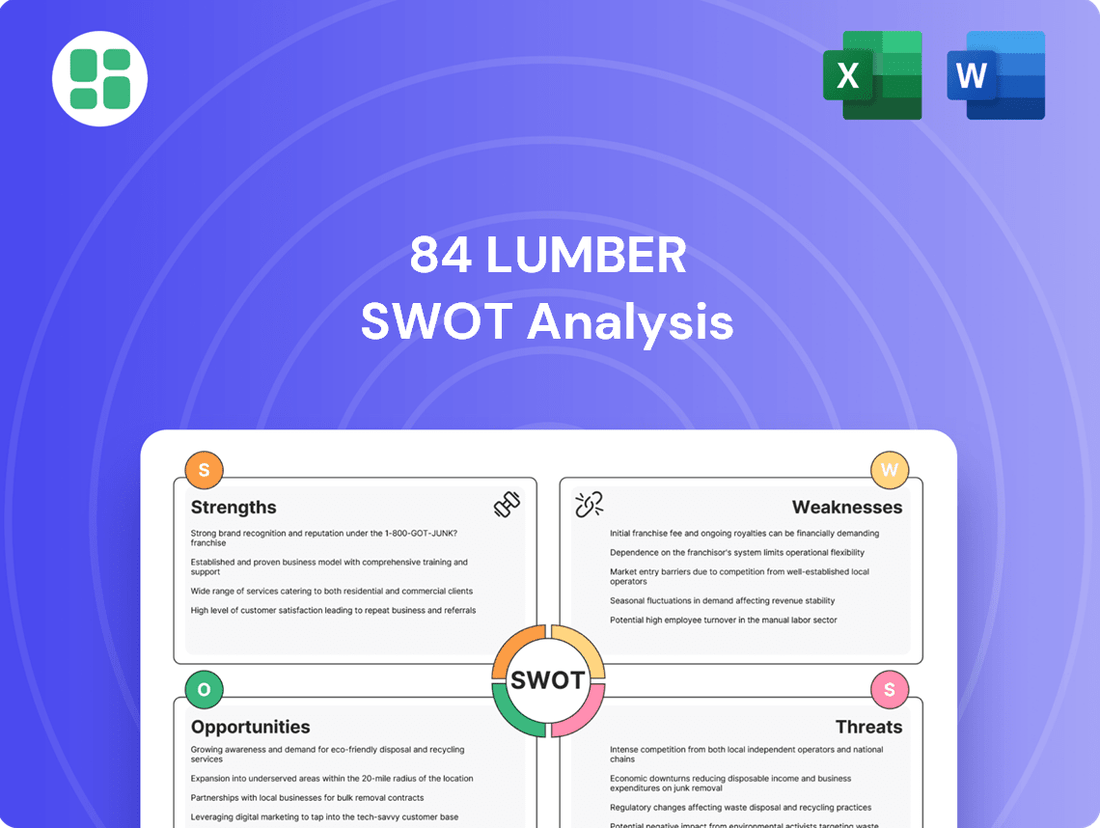

Preview Before You Purchase

84 Lumber SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights into 84 Lumber's strategic position.

This is a real excerpt from the complete 84 Lumber SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a complete picture of their internal strengths and weaknesses, and external opportunities and threats.

You’re viewing a live preview of the actual 84 Lumber SWOT analysis file. The complete version, detailing every aspect of their business strategy, becomes available after checkout.

Opportunities

84 Lumber's strategic expansion into multifamily and commercial construction, marked by 15 dedicated hubs, positions it to leverage strong market tailwinds. The multifamily sector alone saw a robust pipeline of projects in 2024, with new apartment construction starts projected to remain elevated, offering substantial revenue diversification opportunities.

This diversification allows 84 Lumber to tap into larger, more complex projects, such as hotels and commercial developments, which typically involve higher value contracts. The commercial construction market is also showing resilience, with significant investment anticipated in infrastructure and retail spaces through 2025, further bolstering this growth avenue.

The construction sector is increasingly prioritizing sustainability, driving a significant rise in demand for green building materials, eco-friendly construction methods, and energy-efficient designs. This shift is influenced by evolving environmental regulations and a growing consumer preference for certified green buildings.

84 Lumber is well-positioned to leverage this trend by broadening its portfolio to include a wider range of sustainable building products. For instance, the global green building materials market was valued at approximately $272.9 billion in 2023 and is projected to reach $587.6 billion by 2030, indicating substantial growth potential for companies that adapt.

The building materials sector is increasingly embracing digital tools, with B2B online sales and e-commerce platforms gaining traction. 84 Lumber can capitalize on this trend by enhancing its digital footprint, providing smooth online transactions, transparent inventory data, and smart AI tools to boost customer satisfaction and streamline operations.

Strategic Acquisitions and Partnerships

84 Lumber can leverage its robust market standing and financial stability to acquire smaller regional lumber suppliers or niche manufacturers. This strategy, exemplified by its 2023 asset purchase from West Coast Lumber, allows for swift expansion into new territories, diversification of its product offerings, and enhancement of its manufacturing capacity. Such moves can solidify its competitive edge and tap into new customer bases.

Strategic alliances and partnerships also present a significant avenue for growth. By collaborating with complementary businesses, 84 Lumber can gain access to new technologies, distribution channels, and customer segments without the full capital commitment of an acquisition. These partnerships can foster innovation and create synergistic opportunities, driving mutual benefit and market penetration.

- Acquisition of regional players: Expands geographic footprint and market share.

- Partnerships for technology: Access to advanced manufacturing or distribution solutions.

- Product portfolio expansion: Integration of specialized lumber products or services.

- Synergistic growth: Combining resources to achieve greater market impact.

Infrastructure Spending and Renovation Market

Significant government investment in infrastructure, projected to reach trillions globally in the coming years, creates a substantial opportunity. For instance, the U.S. Infrastructure Investment and Jobs Act of 2021 allocated over $1 trillion towards improving roads, bridges, and public transit, directly benefiting material suppliers like 84 Lumber. This increased public spending, coupled with a rising demand for energy-efficient building retrofits, offers a robust market for renovation materials.

84 Lumber can capitalize on this by:

- Targeting government contracts for infrastructure projects, supplying lumber and building materials for new bridges, highways, and public facilities.

- Developing specialized product lines for green renovations, focusing on sustainable and energy-saving materials that meet the growing demand for eco-friendly building practices.

- Expanding partnerships with contractors and developers specializing in both new infrastructure builds and large-scale building renovations.

- Leveraging its existing distribution network to efficiently serve diverse project locations across the country.

84 Lumber can capitalize on the growing demand for sustainable building materials, with the global green building market projected to reach $587.6 billion by 2030. Expanding its product lines to include eco-friendly options and targeting government infrastructure projects, which saw over $1 trillion allocated by the U.S. Infrastructure Investment and Jobs Act, presents significant revenue growth potential. Furthermore, strategic acquisitions, like the 2023 asset purchase from West Coast Lumber, and partnerships can accelerate market penetration and product diversification.

| Opportunity Area | Market Projection/Data | 84 Lumber's Actionable Step |

|---|---|---|

| Sustainable Building Materials | Global green building market to reach $587.6B by 2030 (from $272.9B in 2023) | Broaden product portfolio with eco-friendly and energy-efficient materials. |

| Infrastructure Development | U.S. Infrastructure Investment and Jobs Act allocated over $1T | Target government contracts for new infrastructure projects. |

| Strategic Expansion | 2023 asset purchase from West Coast Lumber | Pursue acquisitions of regional players and form technology partnerships. |

Threats

Broader economic instability poses a significant threat. For instance, a recessionary environment, coupled with rising interest rates as seen in late 2023 and early 2024, can drastically dampen consumer spending and business investment, directly impacting construction projects.

Fluctuations in the housing market are particularly concerning for building material suppliers. A downturn in housing starts, which saw a notable slowdown in new single-family home construction in 2023 compared to prior years, translates directly to reduced demand for lumber and other materials that 84 Lumber supplies.

This decreased demand can lead to lower sales volumes, increased inventory holding costs, and potentially force price reductions, squeezing profit margins for companies like 84 Lumber. Project cancellations or delays during economic uncertainty further exacerbate these sales challenges.

The fluctuating costs of key building supplies such as lumber, steel, and concrete present a significant challenge. Global supply and demand imbalances, geopolitical events, and trade policies can cause these prices to swing wildly. For instance, lumber prices saw significant volatility in 2021 and early 2022, with futures contracts trading at record highs before experiencing sharp declines, impacting project costs unpredictably.

These unpredictable price surges directly affect 84 Lumber's profitability by reducing profit margins. They also complicate the crucial tasks of accurate bidding and project budgeting for both the company and its clientele, creating financial uncertainty in an already complex industry.

The intensifying regulatory landscape presents significant threats. Stricter building codes and evolving environmental regulations, such as those related to energy efficiency and sustainable materials, can increase compliance costs for 84 Lumber. For instance, new federal initiatives promoting net-zero buildings could necessitate costly material upgrades or process changes. Furthermore, tariffs on imported lumber and building materials, like those seen in recent years impacting Canadian softwood lumber, directly raise the cost of goods sold and can disrupt supply chains, potentially squeezing profit margins if these costs cannot be fully passed on to consumers.

Disruptive Technologies and Business Models

Emerging technologies such as 3D printing in construction, advanced composite materials, and new digital marketplaces pose a significant threat by potentially disrupting 84 Lumber's traditional supply chains and established business models. For instance, the global 3D printed construction market was valued at approximately $1.8 billion in 2023 and is projected to grow substantially, potentially altering demand for conventional building materials.

While 84 Lumber has demonstrated a commitment to innovation, a failure to rapidly adopt and integrate truly revolutionary technologies could result in a diminished competitive advantage. The company's ability to pivot and embrace disruptive forces will be crucial in maintaining market relevance in the face of evolving industry standards and customer expectations.

Key areas of technological disruption include:

- 3D Printing in Construction: Offering faster build times and reduced material waste, potentially impacting demand for traditional lumber and building supplies.

- Advanced Materials: Innovations in composites and engineered wood products could offer superior performance characteristics, challenging existing product lines.

- Digital Marketplaces: Online platforms for material sourcing and project management could streamline procurement and bypass traditional distribution channels.

Geopolitical Instability and Trade Policies

Geopolitical instability and evolving trade policies pose significant threats to 84 Lumber. For instance, the ongoing global tensions, including the Russia-Ukraine conflict, continue to impact supply chain reliability and material costs. Tariffs or trade restrictions implemented by various nations can directly inflate the price of lumber and other building materials sourced internationally, directly affecting 84 Lumber's cost of goods sold.

These disruptions can manifest as:

- Increased Material Costs: Tariffs on imported lumber, for example, could raise expenses. In 2023, lumber prices experienced volatility, with futures contracts showing significant fluctuations due to supply-side concerns and demand shifts, impacting companies like 84 Lumber.

- Supply Chain Disruptions: Geopolitical events can lead to shipping delays and reduced availability of key materials, forcing 84 Lumber to seek alternative, potentially more expensive, suppliers.

- Unpredictable Operating Environment: Shifting trade agreements and international relations create uncertainty, making long-term inventory planning and cost management more challenging for a company with a national distribution network.

- Reduced Profitability: The combination of higher costs and potential material shortages can squeeze profit margins, especially for a business heavily reliant on the timely and cost-effective procurement of construction supplies.

Intensifying competition from both traditional lumber yards and emerging online retailers presents a significant threat. The ease of online purchasing and the potential for lower overheads among digital competitors could erode 84 Lumber's market share, especially as consumer preferences shift towards convenient, digitally-enabled shopping experiences. The competitive landscape is dynamic, with players constantly seeking to optimize their pricing and service offerings.

The company must also contend with potential labor shortages and rising labor costs within the construction industry, which can impact project timelines and overall demand for materials. For instance, the U.S. Bureau of Labor Statistics has consistently highlighted shortages in skilled trades, a trend that persisted through 2023 and into early 2024, driving up wages and potentially slowing construction activity.

Furthermore, shifts in consumer preferences towards smaller, more energy-efficient homes or increased demand for renovations over new builds could alter the product mix and volume required, necessitating strategic adjustments in inventory and sales focus.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including 84 Lumber's financial statements, comprehensive market research reports, and expert industry commentary, ensuring a thorough and accurate assessment.