84 Lumber Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

84 Lumber Bundle

84 Lumber navigates a competitive landscape shaped by intense rivalry among existing players and significant buyer power due to the commoditized nature of building materials. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping 84 Lumber’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration can significantly impact bargaining power. For 84 Lumber, a key supplier like West Fraser, a major provider of Spruce-Pine-Fir and Southern Yellow Pine in 2024, holds considerable sway. If 84 Lumber has few comparable alternatives for these essential materials, West Fraser's ability to dictate terms strengthens.

The lumber market's dynamics in 2024, while showing some price stabilization compared to pandemic peaks, still reflect elevated costs. This suggests that suppliers, even with settling prices, retain a degree of leverage over buyers like 84 Lumber, as the cost of key inputs remains a significant factor.

While basic lumber often acts as a commodity, 84 Lumber's reliance on specialized building materials, manufactured components, or proprietary products significantly influences supplier bargaining power. For instance, if a supplier provides unique, custom-fabricated roof trusses or advanced insulation systems, their leverage increases.

High switching costs further bolster supplier power. If 84 Lumber needs to re-engineer its installation processes or obtain new certifications to adopt alternative materials, the expense and time involved make switching difficult. This is particularly true for integrated supply chains where a disruption in one specialized component can halt production, as seen in the automotive industry's struggles with semiconductor shortages in recent years, impacting the broader construction supply chain.

The threat of suppliers integrating forward into distribution or retail is a consideration for 84 Lumber. However, for major lumber producers, establishing a nationwide network of over 320 facilities, as 84 Lumber operates, demands immense capital investment and specialized logistical know-how, making direct competition through forward integration a substantial hurdle.

Importance of Supplier's Product to 84 Lumber

The bargaining power of suppliers is a critical factor for 84 Lumber, particularly concerning core building materials. Lumber, windows, doors, and roofing are not just components; they are the very foundation of 84 Lumber's business model. Without a consistent and reliable supply of these items, their ability to fulfill customer orders and maintain operational efficiency is severely compromised.

This dependence highlights the significant leverage suppliers can wield. For instance, in 2024, the construction industry continued to grapple with extended lead times for various equipment and specialized materials. This trend directly impacts 84 Lumber, as it can lead to delays in project completion for their customers, potentially damaging relationships and revenue streams. The cost of these essential materials also plays a crucial role; fluctuations can directly affect 84 Lumber's profit margins.

- Criticality of Materials: Lumber, windows, doors, and roofing are indispensable to 84 Lumber's product offering and operational continuity.

- Supply Chain Vulnerability: Disruptions or price increases for these core materials directly impact 84 Lumber's ability to serve its customer base effectively.

- Supplier Leverage: Suppliers of these essential building products hold considerable power due to 84 Lumber's reliance on their consistent availability and pricing.

- Market Conditions: Broader industry trends, such as extended lead times observed in 2024 for construction-related items, amplify supplier bargaining power.

Availability of Substitute Inputs

The availability of substitute inputs plays a crucial role in determining the bargaining power of suppliers for a company like 84 Lumber. While traditional building materials such as lumber, concrete, and steel are currently dominant, the market is seeing a gradual increase in the adoption of alternative and sustainable materials. These could include engineered wood products, recycled materials, or advanced composites.

However, for the immediate future and the core of 84 Lumber's business, the substitutability of primary raw materials from suppliers remains limited. This means that suppliers of conventional construction inputs still hold significant leverage. For instance, the U.S. Census Bureau reported that in 2023, residential construction spending remained robust, indicating continued demand for traditional materials.

- Dominance of Traditional Materials: Lumber, concrete, and steel are still the primary inputs for most construction projects, giving their suppliers considerable power.

- Emergence of Alternatives: Sustainable and engineered materials are gaining traction, which could dilute supplier power in the long term.

- Limited Immediate Substitutability: For conventional construction, direct substitutes for key raw materials are not readily available, reinforcing current supplier leverage.

- Market Demand Influence: High demand in sectors like residential construction (as seen in 2023) further strengthens the position of established material suppliers.

The bargaining power of suppliers for 84 Lumber is substantial, particularly for core materials like lumber, windows, and doors. In 2024, the construction industry continued to face supply chain pressures, with extended lead times for critical components. This reliance on a limited number of key suppliers, such as West Fraser for lumber, means these entities can dictate terms, impacting 84 Lumber's costs and operational efficiency.

The criticality of these materials to 84 Lumber's business model, combined with limited immediate substitutes for traditional construction inputs, further amplifies supplier leverage. While the market is exploring sustainable alternatives, the current demand, as evidenced by robust residential construction spending in 2023, reinforces the power of established material providers.

| Factor | Impact on 84 Lumber | 2024/2023 Data/Trend |

|---|---|---|

| Supplier Concentration | High leverage for few key suppliers | West Fraser significant lumber provider |

| Criticality of Inputs | High dependence on lumber, windows, doors | Essential for core business operations |

| Substitutability of Inputs | Limited for traditional materials | Growing interest in sustainable alternatives, but not yet mainstream replacements |

| Market Demand | Strong demand amplifies supplier power | Robust residential construction spending in 2023 |

What is included in the product

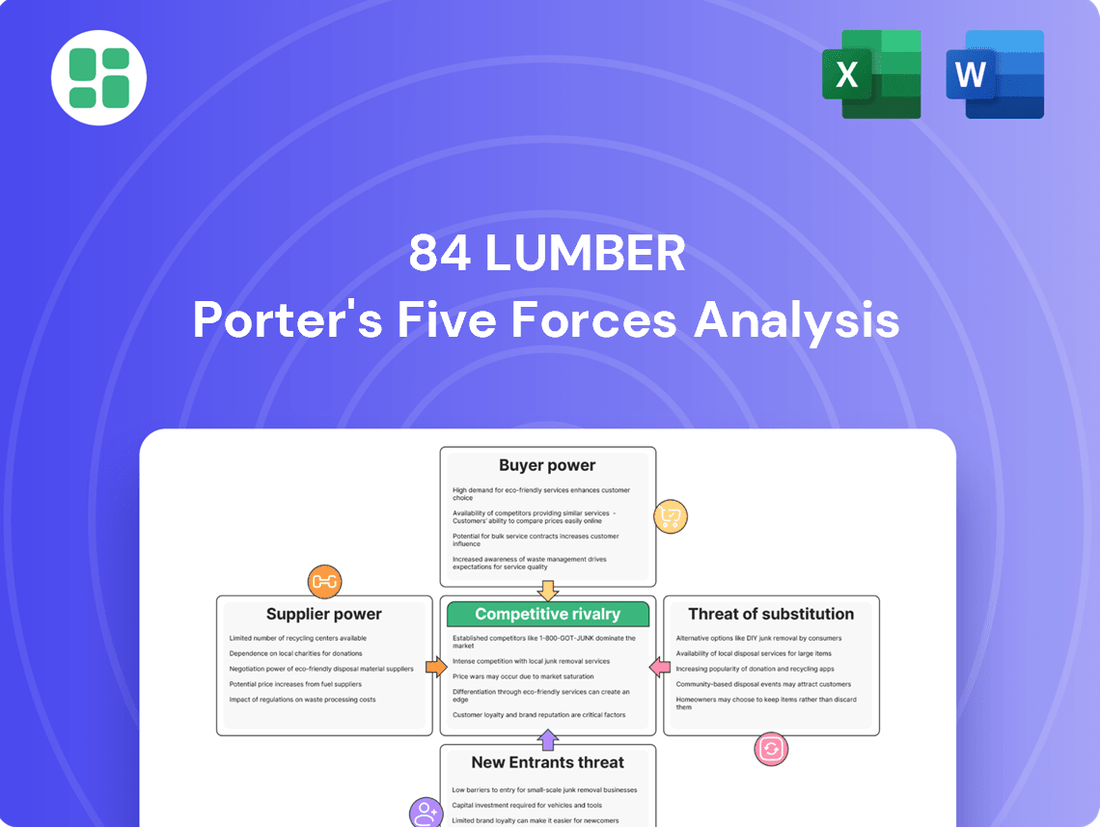

Tailored exclusively for 84 Lumber, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the building materials industry.

Instantly visualize the competitive landscape for 84 Lumber, highlighting key threats and opportunities to inform strategic planning.

Customers Bargaining Power

84 Lumber's customer base is varied, encompassing individual DIY enthusiasts and large-scale professional builders. While individual DIYers typically exert minimal bargaining power, substantial clients, particularly those involved in large residential or commercial developments, can leverage their significant purchase volumes to negotiate more favorable terms. For instance, a major contractor undertaking a multi-unit housing project might represent a substantial portion of a local 84 Lumber's sales, giving them considerable leverage.

Customers possess significant bargaining power due to the readily available substitute products and services for building materials. Major competitors like Home Depot and Lowe's, along with other national and regional suppliers such as Builders FirstSource and US LBM Holdings, offer a broad selection, intensifying competition and empowering buyers.

For professional builders and contractors, the costs associated with switching lumber suppliers are generally manageable. While there might be initial logistical hurdles, these are typically not significant enough to deter a change, especially when better pricing or availability is on offer. For instance, in 2024, the average price of framing lumber saw fluctuations, making cost a primary driver for many purchasing decisions.

Price Sensitivity of Customers

Professional builders and contractors, especially those in residential construction, exhibit significant price sensitivity. This is directly linked to their own constrained profit margins, often hovering in the single digits. Consequently, they actively seek out the most competitive pricing and explore value-engineered alternatives, directly impacting 84 Lumber's pricing strategies.

The demand for cost-effective materials means that customers will readily switch suppliers for even minor price advantages. For instance, a 2023 report highlighted that over 60% of small to medium-sized construction firms consider price the primary factor when selecting a lumber supplier, underscoring the intense pressure on 84 Lumber to remain competitive.

- Price Sensitivity: Residential builders face slim profit margins, making them highly responsive to lumber price fluctuations.

- Competitive Sourcing: Customers actively compare prices and seek out suppliers offering better value.

- Value Engineering: Builders often opt for alternative, more cost-effective materials or designs to manage project costs.

- Supplier Loyalty: Price is a major determinant, potentially leading to lower customer loyalty if competitors offer significantly lower prices.

Threat of Backward Integration by Customers

Large construction firms, especially those undertaking massive projects, might consider backward integration to control costs and supply chains. This involves them developing their own capabilities for procuring or even manufacturing building materials. For instance, a major developer in 2024 working on a multi-billion dollar housing project could analyze the economics of producing their own lumber or concrete if procurement costs exceed a certain threshold.

The threat of backward integration by customers is a significant factor influencing suppliers like 84 Lumber. If customers, such as large homebuilders or commercial developers, perceive that they can achieve cost savings or greater control by producing materials in-house, they may pursue this strategy. This is particularly relevant for high-volume, commoditized building materials where economies of scale in production can be achieved.

Consider the implications for 84 Lumber: If a top customer, representing a substantial portion of their sales, initiates a backward integration strategy, it could directly impact 84 Lumber's revenue and market share. For example, a national homebuilder that previously sourced 15% of its lumber from 84 Lumber might decide to invest in its own sawmills if lumber prices remain volatile, as seen in some regional markets during 2024.

- Cost Savings: Customers may integrate backward if they believe they can produce materials more cheaply than purchasing them.

- Supply Chain Control: Backward integration offers customers greater certainty and control over the availability and quality of essential materials.

- Market Dynamics: The feasibility of backward integration increases with the scale and standardization of the materials required.

Customers, particularly large professional builders, hold considerable sway over 84 Lumber due to their substantial purchasing power and the availability of alternatives. This leverage is amplified by the relatively low switching costs for these buyers, making them highly sensitive to price. The pressure to remain competitive is significant, as customers will readily shift suppliers for even minor cost advantages.

In 2024, the average price of framing lumber experienced fluctuations, directly impacting the cost-consciousness of builders. For instance, a report indicated that over 60% of small to medium-sized construction firms prioritize price when selecting a lumber supplier. This price sensitivity, coupled with the option of value engineering, forces 84 Lumber to maintain competitive pricing strategies.

The threat of backward integration by major customers also plays a role. A large national homebuilder, for example, might consider investing in its own sawmills if lumber prices remain volatile, as was observed in some regional markets during 2024. This potential for customers to control their own supply chain further intensifies the bargaining power they wield.

| Customer Segment | Bargaining Power Factors | Impact on 84 Lumber |

|---|---|---|

| Large Professional Builders | High purchase volume, low switching costs, price sensitivity | Forces competitive pricing, potential loss of volume if not met |

| Individual DIY Enthusiasts | Low purchase volume, minimal negotiation power | Less impact on overall pricing strategy, more reliant on retail experience |

| Potential for Backward Integration | Cost savings, supply chain control | Risk of losing significant customer accounts if integration occurs |

Preview the Actual Deliverable

84 Lumber Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis of 84 Lumber is meticulously detailed, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the building materials industry. You're looking at the actual document, providing actionable insights into 84 Lumber's competitive landscape.

Rivalry Among Competitors

The building materials supply industry is quite crowded, featuring a wide array of players. You've got big names like Home Depot and Lowe's, which are national giants, alongside other major companies such as US LBM Holdings and Builders FirstSource. This mix also includes countless smaller, regional, and local lumber yards, all vying for market share.

The construction industry anticipates modest growth in 2025, despite headwinds from elevated interest rates and persistent labor shortages. This environment, while not explosive, still fuels intense competition as established lumber suppliers vie for a larger slice of the market, particularly in the robust remodeling and repair sectors.

For many basic building materials, product differentiation is minimal, intensifying price competition among suppliers. However, 84 Lumber strives to stand out by offering an extensive product range exceeding 10,000 items, including manufactured components like trusses and wall panels. This comprehensive approach, coupled with turnkey installation services and a strong emphasis on customer relationships, aims to build customer loyalty and introduce switching costs.

Exit Barriers

High fixed costs are a major factor in the building materials sector, making it difficult for companies like 84 Lumber to exit. These costs are tied to extensive physical infrastructure, including numerous retail locations, manufacturing facilities, and complex distribution systems. For instance, the capital investment in a large lumber yard or a manufacturing plant for engineered wood products represents a substantial sunk cost that cannot be easily recouped.

These significant exit barriers mean that companies often continue to operate and compete even when market conditions are unfavorable. This persistence fuels intense rivalry, as firms are reluctant to shut down operations due to the financial penalties and asset write-downs involved. In 2024, the ongoing need for housing construction, despite economic fluctuations, keeps many players in the market, contributing to this competitive pressure.

The sheer volume of inventory and the specialized nature of distribution networks further solidify these exit barriers. Companies must maintain substantial stock to meet customer demand, and the logistics of moving bulky materials are costly to establish and dismantle. This creates a situation where firms are more likely to battle for market share rather than withdraw, intensifying competition.

- High Capital Investment: Building materials companies require substantial upfront investment in physical assets like stores, manufacturing plants, and distribution centers.

- Sunk Costs: Once these assets are in place, the costs are largely irrecoverable, discouraging companies from exiting the market.

- Inventory and Logistics: Maintaining large inventories and efficient distribution networks adds to fixed costs, further increasing the difficulty of exiting.

- Industry Persistence: These barriers lead to continued competition even during economic downturns, as firms are incentivized to stay operational.

Strategic Commitments and Market Expansion

84 Lumber's strategic expansion into the multifamily sector and continued growth in its facilities underscore a significant commitment to capturing greater market share. This aggressive expansion strategy, mirrored by its competitors, directly fuels the intensity of competitive rivalry within the industry.

Companies are actively vying for new construction projects and geographical regions, leading to heightened competition for resources and customers. For instance, in 2023, the multifamily construction sector saw substantial investment, with millions of new units planned or underway across the United States, indicating a robust demand but also a crowded competitive landscape.

- Aggressive Expansion: 84 Lumber's investment in new facilities and entry into the multifamily market signals a proactive approach to growth.

- Market Share Focus: This expansion is a clear strategy to increase its footprint and competitive standing.

- Competitor Response: Similar strategic moves by rivals intensify the battle for market dominance.

- Industry Growth: The multifamily sector's continued expansion provides opportunities but also attracts significant competitive attention, with industry reports in late 2023 and early 2024 highlighting ongoing development pipelines.

The building materials sector is intensely competitive, characterized by numerous players ranging from national giants like Home Depot to smaller regional suppliers. This rivalry is further amplified by the industry's high fixed costs and significant exit barriers, which keep companies like 84 Lumber competing even in challenging economic periods. In 2024, the ongoing demand for construction, particularly in remodeling and repair, fuels this competition, as companies fight for market share.

84 Lumber's strategic expansion, including its focus on the multifamily sector, directly intensifies this rivalry. Competitors are also pursuing growth, as evidenced by the substantial investment in new housing units seen in 2023, creating a crowded landscape where companies actively seek to capture more business.

The lack of significant product differentiation for many basic materials forces a strong reliance on price, making competitive pressure particularly acute. However, 84 Lumber attempts to mitigate this by offering a broad product selection and value-added services, aiming to build customer loyalty and create switching costs.

| Key Competitors | Market Position | 2023 Estimated Revenue (USD billions) | Key Strategies |

|---|---|---|---|

| Home Depot | National Retailer | 152.7 | Omnichannel, Pro services, Private label |

| Lowe's | National Retailer | 97.1 | Pro sales focus, Online improvements |

| US LBM Holdings | Building Products Distributor | 7.0 (est.) | Acquisitions, Regional strength |

| Builders FirstSource | Building Products Distributor | 17.0 | Integration, Value-added services |

SSubstitutes Threaten

The threat of substitutes for traditional lumber and building components is a significant factor for 84 Lumber. These substitutes are materials or methods that can perform the same function, potentially impacting demand for 84 Lumber's core products. For instance, the construction industry is increasingly exploring alternatives like engineered wood products, steel framing, and advanced composite materials, which can offer advantages in durability, fire resistance, or faster installation times.

Emerging sustainable and eco-friendly materials also represent a growing substitute threat. Recycled and reclaimed materials, such as salvaged wood or recycled plastics, are gaining traction due to environmental concerns and potential cost savings. Furthermore, innovative bio-based materials like bamboo, cross-laminated timber (CLT), and hempcrete are being developed and adopted, offering unique properties and a reduced carbon footprint compared to conventional lumber. For example, the global market for engineered wood products is projected to reach over $100 billion by 2027, indicating a substantial shift towards these alternatives.

The appeal of substitute materials for lumber hinges on their price-performance ratio. For instance, engineered wood products, while often more expensive upfront, can offer greater strength and consistency, potentially reducing waste and labor costs in construction projects. In 2023, the average price of dimensional lumber saw significant fluctuations, creating opportunities for materials like steel framing or advanced composites to gain traction if their long-term value proposition is compelling.

Emerging construction technologies like 3D printing and modular building present a significant threat of substitution for traditional building materials. These innovations can drastically cut build times and material waste, potentially displacing demand for lumber and other conventional products. For instance, the global 3D construction printing market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating a shift in how structures are built.

Changing Regulatory and Environmental Standards

The increasing global focus on sustainability, particularly concerning embodied carbon and circular economy principles, presents a significant threat from substitutes for traditional building materials. New regulations mandating low-carbon and ethically sourced materials are already influencing construction choices, pushing developers towards alternatives that meet these evolving standards. For instance, by 2024, several jurisdictions have implemented stricter building codes requiring a percentage of recycled content or specific lifecycle assessments for materials.

This regulatory push directly impacts the demand for conventional materials by making them less competitive when compared to emerging sustainable options. Builders and developers are actively seeking out greener alternatives to comply with these new rules and to appeal to environmentally conscious consumers. This shift can lead to a reduction in market share for companies that do not adapt their product offerings or supply chains to incorporate more sustainable materials.

- Growing demand for low-carbon materials: Initiatives like the EU's Green Deal are accelerating the adoption of materials with lower embodied carbon.

- Circular economy mandates: Regulations promoting material reuse and recycling encourage the use of salvaged or recycled building components as substitutes.

- Ethical sourcing requirements: Increased scrutiny on supply chains means materials with transparent and ethical sourcing are favored over those with questionable origins.

- Government incentives for green building: Tax credits and subsidies for projects utilizing sustainable materials further drive the adoption of substitutes.

Customer Acceptance and Industry Inertia

Customer acceptance and industry inertia significantly influence the threat of substitutes for 84 Lumber. The construction sector, deeply rooted in tradition, often resists new materials and methods due to established building codes, contractor familiarity, and the perceived learning curve associated with alternatives. For instance, while engineered wood products offer advantages, the widespread use and established supply chains for traditional lumber create a significant barrier to rapid adoption.

However, this inertia is being challenged by growing demands for sustainability. As environmental concerns become more prominent, customers and regulators are increasingly open to innovative materials that offer better performance or reduced environmental impact. This shift is gradually accelerating the acceptance of substitutes, even within a traditionally slow-moving industry.

The adoption rate of substitutes is often tied to their cost-effectiveness and proven performance. For example, the increasing cost of traditional lumber, exacerbated by supply chain disruptions and tariffs, can make engineered wood or alternative building systems more attractive. In 2023, lumber prices experienced volatility, with futures contracts for framing lumber fluctuating significantly, making the total cost of construction a key driver for material choice.

- Industry Inertia: Established practices and building codes favor traditional materials, slowing the adoption of substitutes.

- Customer Acceptance: A learning curve and familiarity with existing options can hinder the uptake of new materials.

- Sustainability Drivers: Growing environmental awareness is increasing customer and regulatory openness to sustainable substitutes.

- Cost and Performance: Fluctuations in the price of traditional materials, like lumber, can make substitutes more economically viable.

The threat of substitutes for 84 Lumber is amplified by advancements in construction technology, such as 3D printing and modular building. These methods can significantly reduce build times and material waste, potentially decreasing reliance on traditional lumber. The global 3D construction printing market, valued at approximately $1.5 billion in 2023, illustrates this growing trend.

Furthermore, a strong global push towards sustainability is driving demand for low-carbon and ethically sourced materials. Regulations and consumer preferences are increasingly favoring alternatives that meet stricter environmental standards, making traditional lumber less competitive in certain markets. By 2024, many regions have implemented building codes requiring recycled content or specific lifecycle assessments.

Customer acceptance and industry inertia also play a role, though this is shifting. While established practices favor traditional lumber, growing environmental awareness and the economic advantages of substitutes, like engineered wood products, are accelerating their adoption. For instance, the fluctuating price of lumber in 2023 made alternatives more economically appealing.

| Substitute Material | Key Advantages | Market Trend/Data Point |

|---|---|---|

| Engineered Wood Products | Strength, consistency, reduced waste | Global market projected over $100 billion by 2027 |

| Steel Framing | Durability, fire resistance, faster installation | Gained traction during lumber price volatility in 2023 |

| Advanced Composites | Lightweight, weather-resistant | Increasing use in specialized construction applications |

| 3D Printed Materials | Speed, reduced waste, design flexibility | Global market valued at ~$1.5 billion in 2023 |

| Sustainable/Recycled Materials | Environmental benefits, potential cost savings | Driven by green building initiatives and regulations |

Entrants Threaten

Launching a building materials supply business on the scale of 84 Lumber demands immense upfront capital. Think about the cost of acquiring prime real estate for numerous retail locations and extensive distribution centers, not to mention the significant investment in manufacturing facilities if you're vertically integrated. For instance, in 2024, the average cost of commercial land suitable for a large retail footprint in a growing suburban area can easily run into millions of dollars per parcel. This sheer financial hurdle makes it incredibly difficult for smaller players to even consider entering the market at a competitive level.

Established players like 84 Lumber leverage significant economies of scale in purchasing, logistics, and manufacturing. This allows them to negotiate better prices with suppliers and operate more efficiently. For instance, in 2023, the building materials industry saw substantial price fluctuations, where larger companies could absorb these better than smaller, newer ones.

New entrants face a substantial hurdle in replicating these cost advantages. Without the same purchasing volume or established distribution networks, they would likely incur higher per-unit costs. This makes it challenging to compete on price against established giants like 84 Lumber, who can pass on savings to customers.

For new companies looking to enter the building materials supply market, securing access to effective distribution channels presents a significant barrier. 84 Lumber has established a substantial network, operating over 250 stores and numerous component manufacturing plants and custom shops spanning 34 states. This extensive infrastructure is not easily replicated by newcomers, giving 84 Lumber a considerable advantage in reaching customers efficiently.

Brand Loyalty and Established Relationships

84 Lumber has cultivated a robust brand identity and fostered enduring relationships with professional builders and contractors. This is reflected in its reputation as a reliable company and a preferred supplier for many in the construction industry. For instance, in 2024, 84 Lumber continued to be a prominent name in building materials, with industry reports highlighting its strong customer retention rates among professional clients.

New competitors face a considerable hurdle in replicating this level of trust and loyalty. Establishing a comparable reputation and network within the professional building community requires substantial time, investment, and consistent delivery of quality and service. Building this kind of ingrained customer preference is a significant barrier to entry, as it goes beyond just offering competitive pricing.

- Brand Recognition: 84 Lumber's established brand name provides immediate recognition and a baseline level of trust among its target audience.

- Customer Loyalty: Long-term relationships with professional builders translate into repeat business and a reduced likelihood of switching to new, unproven suppliers.

- Barriers to Entry: New entrants must invest heavily in marketing, sales, and operational excellence to even begin to challenge 84 Lumber's established market position and customer loyalty.

- Industry Reputation: 84 Lumber's consistent performance and service have built a strong reputation, making it difficult for newcomers to gain traction without a significant differentiator or a substantial track record.

Regulatory Hurdles and Industry Expertise

The construction and building materials sector presents significant barriers to entry due to a complex web of regulations and stringent building codes. New companies must navigate these requirements, which vary by region, adding substantial compliance costs and time delays. For instance, in 2024, the average time to obtain building permits in major US metropolitan areas could extend several months, impacting project timelines and initial capital outlay for new entrants.

Beyond regulatory compliance, the industry demands specialized expertise. This includes deep knowledge of product specifications, efficient supply chain management, and proficiency in installation techniques. Companies like 84 Lumber have cultivated decades of experience in these areas, creating a knowledge gap that new competitors would struggle to bridge quickly. This expertise is crucial for maintaining quality and customer satisfaction, further deterring potential new entrants.

- Regulatory Complexity: Navigating diverse building codes and permits across different jurisdictions requires significant legal and administrative resources.

- Industry Expertise: Mastering product knowledge, supply chain logistics, and installation best practices takes years of hands-on experience.

- Capital Investment: Meeting regulatory standards and acquiring necessary expertise often necessitates substantial upfront capital, creating a financial barrier.

The threat of new entrants in the building materials supply sector, particularly for a company like 84 Lumber, is considerably low. This is largely due to the immense capital required to establish a comparable operation, including real estate, distribution, and potentially manufacturing. For example, in 2024, securing suitable commercial land in high-growth areas could cost millions per parcel, a significant barrier for smaller entities. Furthermore, the established economies of scale enjoyed by incumbents like 84 Lumber, which allow for better pricing and operational efficiency, are difficult for newcomers to match. Without the purchasing power and established logistics, new entrants would face higher per-unit costs, hindering their ability to compete on price.

The existing infrastructure and market presence of companies like 84 Lumber also pose a substantial barrier. With over 250 stores and numerous manufacturing facilities across 34 states, replicating this extensive network is a monumental task for any new competitor. Building brand recognition and fostering the deep-seated loyalty 84 Lumber has with professional builders and contractors takes considerable time and investment. In 2024, industry reports continued to highlight 84 Lumber's strong customer retention, underscoring the difficulty for new players to gain traction. Navigating complex regulations and acquiring specialized industry expertise, from product knowledge to supply chain management, further solidifies these entry barriers, demanding significant upfront capital and years of experience.

Porter's Five Forces Analysis Data Sources

Our 84 Lumber Porter's Five Forces analysis is built upon a foundation of industry-specific data, including market research reports from firms like IBISWorld, financial disclosures from publicly traded competitors, and trade publications within the building materials sector.