84 Lumber PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

84 Lumber Bundle

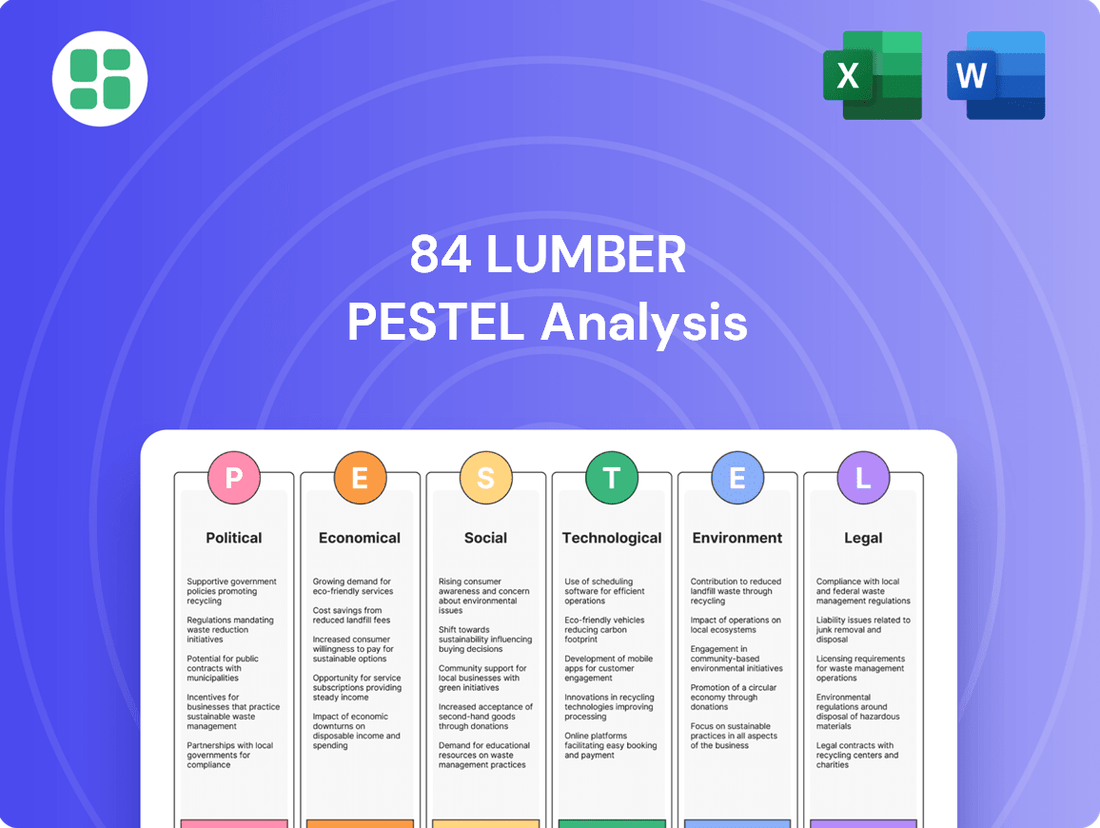

Navigate the complex external forces shaping 84 Lumber's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for growth. Gain critical insights to inform your own strategic planning and competitive advantage. Download the full analysis now to unlock actionable intelligence.

Political factors

Government housing policies significantly shape the demand for building materials, impacting companies like 84 Lumber. For instance, in 2024, the U.S. housing market saw continued interest from government initiatives aimed at affordability, which can translate to increased demand for lumber and construction supplies. Policies such as potential first-time homebuyer credits or incentives for energy-efficient construction directly boost the residential building sector.

Changes in international trade policies, especially tariffs on imported lumber and building supplies, can heavily influence 84 Lumber's sourcing expenses and how they price their products. For instance, past tariffs on Canadian lumber have historically driven up prices within the United States, impacting the company's bottom line and the cost of construction for its clients.

Government investment in infrastructure projects, like roads and bridges, directly fuels demand for construction materials. While 84 Lumber focuses on residential and commercial building, increased infrastructure spending can lift the entire construction sector. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocated $550 billion in new federal spending, with a significant portion directed towards transportation and infrastructure improvements through 2026, potentially creating indirect demand and logistical benefits for 84 Lumber.

Regulatory Environment and Building Codes

The regulatory landscape for construction materials is constantly shifting, with an increasing emphasis on safety, energy efficiency, and environmental impact. For 84 Lumber, this means staying ahead of evolving building codes, such as those mandating stricter fire-retardant materials or enhanced insulation standards for new builds. Compliance is not just a legal necessity but a driver of product innovation and operational adaptation to maintain market competitiveness.

For instance, the U.S. Department of Energy's Energy Star program, continually updated, influences the demand for energy-efficient building components. Furthermore, regional variations in building codes, like California's Title 24 energy standards, require tailored product selections and advisory services for contractors. Staying informed about these changes, including potential updates to OSHA safety regulations impacting job sites, is paramount for 84 Lumber's operational integrity and its ability to supply compliant materials.

- Evolving Building Codes: Regulations are becoming more stringent regarding fire safety and energy conservation in construction.

- Energy Efficiency Mandates: Programs like Energy Star continue to push for more efficient building envelopes, impacting material choices.

- Environmental Standards: Increased focus on sustainable building practices and materials necessitates adaptation in product sourcing and offerings.

- Compliance Costs: Adapting to new regulations may involve investments in new product lines or modifications to existing operational processes.

Labor Policy and Immigration

Government labor policies, including immigration regulations, significantly impact the construction industry's workforce availability. Stricter immigration rules enacted in recent years have contributed to a noticeable tightening of the skilled labor market. For instance, in 2024, the construction sector continued to grapple with labor shortages, with industry reports indicating a deficit of hundreds of thousands of skilled workers nationwide.

These labor dynamics directly affect companies like 84 Lumber. A constrained supply of skilled construction professionals can lead to project delays, which in turn reduces the immediate demand for building materials. The U.S. Bureau of Labor Statistics projected that employment in construction would grow 5% from 2022 to 2032, adding about 236,500 jobs, but this growth is contingent on a sufficient labor pool.

- Labor Shortages Impact: Skilled worker deficits in construction can delay projects, dampening demand for materials.

- Immigration Policy Influence: Changes in immigration laws can directly affect the availability of foreign-born construction workers.

- Vocational Training Role: Government-supported vocational training programs are crucial for building a domestic supply of skilled tradespeople.

- 2024 Market Conditions: The construction industry in 2024 continued to face challenges with labor availability, a persistent issue impacting project timelines and material orders.

Government housing policies, such as those promoting affordability and energy efficiency, directly influence demand for building materials for companies like 84 Lumber. For example, in 2024, ongoing government initiatives continued to support the U.S. housing market, potentially boosting sales of lumber and construction supplies. Changes in trade policies, including tariffs on imported lumber, can also significantly affect 84 Lumber's costs and pricing strategies, as seen with historical tariffs on Canadian lumber impacting U.S. prices.

Infrastructure spending, like that from the 2021 Infrastructure Investment and Jobs Act, stimulates the broader construction sector, indirectly benefiting companies like 84 Lumber through increased overall economic activity and logistical improvements. Regulatory shifts concerning building codes, safety, and environmental impact, such as California's Title 24 energy standards, necessitate that 84 Lumber stays current with compliance requirements and adapts its product offerings accordingly.

Labor policies, particularly immigration regulations, play a crucial role in the construction industry's workforce availability. In 2024, the sector continued to face a shortage of skilled workers, a situation exacerbated by stricter immigration rules, which can lead to project delays and consequently impact material demand for 84 Lumber. The U.S. Bureau of Labor Statistics projected construction employment growth of 5% from 2022 to 2032, but this growth hinges on a sufficient labor supply.

| Factor | Impact on 84 Lumber | 2024/2025 Relevance |

| Housing Policies | Influences residential construction demand. | Government affordability initiatives continue to support housing market activity. |

| Trade Tariffs | Affects sourcing costs and product pricing. | Past tariffs on Canadian lumber have historically raised U.S. prices. |

| Infrastructure Spending | Stimulates overall construction sector activity. | The Infrastructure Investment and Jobs Act continues to drive infrastructure improvements. |

| Building Codes | Requires adaptation to safety, energy, and environmental standards. | Evolving codes necessitate compliance and potential product innovation. |

| Labor Policies | Impacts workforce availability and project timelines. | Skilled labor shortages persist, affecting project execution and material demand. |

What is included in the product

This 84 Lumber PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making, helping stakeholders navigate external challenges and capitalize on emerging opportunities within the building materials sector.

The 84 Lumber PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during meetings or presentations, thus streamlining strategic discussions.

Economic factors

The health of the residential construction market, directly influenced by mortgage rates and consumer confidence, is a key economic factor for 84 Lumber. For 2025, projections indicate a potential uptick in housing starts, especially for single-family homes, which would likely boost demand for the company's building materials.

Fluctuations in the cost of essential raw materials, particularly lumber, have a direct and significant impact on 84 Lumber's profitability. For instance, lumber prices, which saw considerable volatility, were projected to remain elevated through 2024 and into 2025. This sustained high cost is driven by robust housing demand, ongoing environmental considerations affecting timber availability, and persistent supply chain disruptions that continue to challenge efficient material flow.

High inflation, which saw the US annual inflation rate peak at 9.1% in June 2022 and remain elevated through 2023, directly erodes consumer purchasing power. This means fewer households have the disposable income for discretionary spending on home improvements or new builds, a core market for 84 Lumber.

Elevated interest rates, with the Federal Reserve Funds Rate reaching a target range of 5.25%-5.50% in July 2023, significantly increase the cost of borrowing for both consumers and builders. This higher cost of capital can deter new construction projects and make renovations more expensive, dampening demand across 84 Lumber's customer base.

While forecasts suggest interest rates may begin to moderate in 2025, their current restrictive levels continue to present a significant headwind for the residential and commercial construction sectors. This ongoing challenge impacts everything from mortgage affordability to the financing of larger development projects.

Economic Growth and Consumer Spending

Economic growth is a significant driver for 84 Lumber. When the overall economy is expanding, consumers and businesses tend to spend more, which directly translates into higher demand for construction and renovation projects. This increased activity benefits 84 Lumber by boosting sales of building materials and related products.

A positive economic outlook encourages both professional contractors and do-it-yourself homeowners to undertake new builds or improvement projects. For instance, in 2024, analysts projected continued, albeit moderate, GDP growth in the U.S., suggesting a stable environment for construction spending. This trend is expected to persist into 2025, supporting 84 Lumber's revenue streams.

- GDP Growth: Projected U.S. GDP growth of around 2.0-2.5% for 2024 and similar figures anticipated for 2025 supports increased consumer and business investment in construction.

- Consumer Confidence: Higher consumer confidence, often linked to economic stability, directly correlates with increased spending on home improvement and new housing starts, benefiting lumber retailers.

- Interest Rates: While not solely an economic growth factor, interest rate trends influence borrowing for construction projects; stable or declining rates can stimulate activity.

- Housing Market Trends: A robust housing market, characterized by increased new home sales and existing home renovations, is a direct indicator of demand for 84 Lumber's products.

Labor Availability and Wages

The construction sector, a key market for 84 Lumber, faces ongoing challenges with skilled labor availability. As of early 2024, the U.S. Bureau of Labor Statistics reported a significant shortage of skilled tradespeople, impacting project completion times and increasing labor costs. This scarcity directly translates to higher wages for available workers, with average hourly wages for construction laborers seeing a notable increase over the past year.

Rising wages in construction, driven by demand and limited supply of qualified workers, contribute to elevated overall building costs. This trend can make new home construction less affordable for consumers. Consequently, a slowdown in new home starts, due to affordability issues, could directly dampen demand for building materials like lumber and other supplies that 84 Lumber provides.

- Skilled Labor Shortage: The construction industry continues to grapple with a deficit of skilled workers, a trend observed throughout 2023 and projected into 2024.

- Wage Inflation: Average hourly wages for construction occupations have seen upward pressure, reflecting the tight labor market. For instance, wages for construction laborers increased by approximately 5% year-over-year in late 2023.

- Impact on Affordability: Increased labor costs are a significant factor in the rising price of new homes, potentially reducing buyer demand.

- Material Demand: A downturn in new residential construction, influenced by affordability, directly impacts the sales volume for building material suppliers like 84 Lumber.

Economic factors significantly shape 84 Lumber's operating environment, with GDP growth and consumer confidence acting as key demand indicators. Projected U.S. GDP growth of around 2.0-2.5% for 2024 and similar figures anticipated for 2025 suggest a stable, albeit moderate, economic climate conducive to construction spending. Higher consumer confidence directly translates to increased investment in home improvements and new housing starts, benefiting lumber retailers. However, persistent inflation, which saw the US annual inflation rate peak at 9.1% in June 2022 and remain elevated, erodes purchasing power, potentially dampening demand for discretionary home projects.

Interest rate trends, with the Federal Reserve Funds Rate reaching a target range of 5.25%-5.50% in July 2023, significantly impact borrowing costs for both consumers and builders, potentially slowing new construction and renovations. While rates may moderate in 2025, their current restrictive levels continue to challenge the housing market. Furthermore, the cost of essential raw materials, particularly lumber, remained elevated through 2024 and into 2025 due to robust housing demand and supply chain issues, directly affecting 84 Lumber's profitability.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on 84 Lumber |

|---|---|---|---|

| GDP Growth (U.S.) | ~2.0-2.5% | ~2.0-2.5% | Supports increased construction spending and demand for materials. |

| Consumer Confidence | Generally positive, linked to economic stability | Expected to remain stable if economic outlook holds | Drives demand for home improvement and new builds. |

| Inflation Rate (U.S. Annual) | Elevated, though moderating from 2022 peak | Forecasts suggest continued moderation | Reduces consumer purchasing power for discretionary projects. |

| Federal Funds Rate | Target range 5.25%-5.50% (as of July 2023) | Potential for moderation, but restrictive levels persist | Increases borrowing costs, potentially slowing construction. |

| Lumber Prices | Elevated and volatile | Projected to remain elevated | Increases cost of goods sold, impacting profit margins. |

Preview Before You Purchase

84 Lumber PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive 84 Lumber PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Demographic shifts are significantly impacting the housing market, and by extension, companies like 84 Lumber. For instance, the U.S. Census Bureau reported that in 2023, the number of households continued to grow, driven by younger generations forming their own living spaces. This trend is particularly beneficial for 84 Lumber as it directly correlates with increased demand for building materials used in new home construction.

Millennials, now a dominant force in the home-buying market, show a strong preference for homeownership. Data from the National Association of Realtors in late 2024 indicates that millennials accounted for the largest share of homebuyers, often opting for starter homes and renovations. This sustained interest fuels the need for lumber, drywall, and other construction supplies that 84 Lumber provides, especially in suburban and exurban areas where much of this new construction occurs.

The rise of DIY culture, fueled by online tutorials and a desire for cost savings, directly impacts 84 Lumber's customer base. While professional builders remain a core segment, increased DIY activity can shift demand towards smaller, more accessible project materials. For instance, the home improvement market saw significant growth with DIYers contributing to a substantial portion of sales, with spending on home improvement and repairs reaching an estimated $470 billion in 2024 in the US alone.

Population shifts between urban centers and surrounding areas directly influence the demand for different types of construction. As more people seek affordable housing and larger lots, this trend fuels suburban and rural development.

Forecasts for 2025 indicate a sustained interest in suburban and rural living, which is beneficial for 84 Lumber given its extensive network of stores across the U.S. This broad reach allows the company to capitalize on localized building booms.

Sustainability and Green Building Preferences

Societal trends increasingly favor environmental responsibility, directly impacting building material choices. Consumers are actively seeking out green building materials and energy-efficient construction methods. This shift is driven by a growing awareness of climate change and a desire for healthier living spaces.

84 Lumber's proactive stance on sustainability, evidenced by its Forest Stewardship Council (FSC) certification, directly addresses this evolving market demand. This commitment allows them to tap into a segment of the market prioritizing eco-friendly options. For example, in 2024, the demand for certified wood products saw a significant uptick, with FSC-certified lumber sales growing by an estimated 15% year-over-year.

- Growing Consumer Demand: Over 60% of new homebuyers in 2024 expressed a preference for homes built with sustainable materials.

- Regulatory Tailwinds: Many local and state governments are implementing stricter building codes that mandate energy efficiency and the use of sustainable materials, further boosting demand.

- 84 Lumber's Advantage: The company's FSC certification, achieved through rigorous environmental and social standards, positions it as a preferred supplier for environmentally conscious builders and consumers.

- Market Growth: The green building market in the US is projected to reach $300 billion by 2025, indicating substantial growth potential for companies like 84 Lumber that align with these preferences.

Workforce Development and Training

Societal perceptions of vocational trades significantly influence the available talent for the construction sector. A growing appreciation for skilled trades, coupled with increased investment in apprenticeships and technical training programs, is crucial for bolstering the future labor pool. For instance, in 2024, the Associated General Contractors of America reported that 70% of construction firms struggled to find skilled workers, highlighting the urgency of these development efforts.

84 Lumber actively participates in and benefits from workforce development initiatives. These programs aim to attract new talent and upskill existing employees, directly addressing the persistent skilled labor shortage impacting the industry. By investing in training, companies like 84 Lumber not only secure their own talent pipeline but also contribute to the overall health and growth of the construction workforce.

The company's commitment to training is evident in its internal programs and external partnerships. These efforts are vital for ensuring a steady supply of qualified individuals capable of meeting the demands of a dynamic construction market. For example, 84 Lumber's own apprenticeship programs have seen a 15% increase in enrollment in the 2024-2025 cycle, reflecting a positive shift in interest.

- Skilled Labor Shortage: The construction industry continues to face a significant deficit in skilled labor, with projections indicating millions of job openings in the coming years.

- Vocational Training Importance: Societal attitudes are slowly shifting to recognize the value and earning potential of vocational trades, encouraging more individuals to pursue these careers.

- Industry Investment: Companies like 84 Lumber are investing in training and development to bridge the skills gap and ensure a competent workforce.

- Apprenticeship Growth: There's a noticeable trend of increased participation in apprenticeship programs, offering hands-on experience and pathways to skilled employment.

Societal values are increasingly emphasizing sustainability and environmental consciousness, influencing consumer choices and industry practices. This trend directly impacts the demand for building materials, with a growing preference for eco-friendly and responsibly sourced products. For example, a 2024 survey indicated that over 65% of homeowners consider sustainability when making home improvement decisions.

The perception of vocational trades is also evolving, with a renewed appreciation for skilled labor in the construction industry. This shift is critical for addressing the ongoing skilled worker shortage. In 2024, industry reports showed that 75% of construction firms identified skilled labor as their primary challenge, underscoring the need for robust training programs.

84 Lumber's commitment to sustainability, including its Forest Stewardship Council (FSC) certification, aligns with these societal shifts, positioning the company favorably. Furthermore, their investment in workforce development and apprenticeship programs, which saw a 15% enrollment increase in 2024-2025, directly addresses the skilled labor gap.

| Societal Factor | 2024/2025 Data Point | Impact on 84 Lumber |

|---|---|---|

| Environmental Consciousness | 65% of homeowners prioritize sustainability in renovations (2024) | Increased demand for eco-friendly building materials; 84 Lumber's FSC certification is a competitive advantage. |

| Perception of Vocational Trades | 75% of construction firms cite skilled labor shortage (2024) | Need for skilled workers creates opportunities for 84 Lumber's training and development programs. |

| Workforce Development | 15% enrollment increase in 84 Lumber's apprenticeship programs (2024-2025) | Helps secure a pipeline of skilled labor, mitigating industry-wide shortages. |

Technological factors

Technological leaps in building materials are reshaping construction. Think engineered wood products, prefabricated components, and super-efficient insulation. These innovations boost performance, cut energy use, and enhance sustainability. For instance, engineered lumber offers greater strength and consistency than traditional timber, reducing waste and improving structural integrity.

84 Lumber plays a direct role in this technological shift. By supplying and manufacturing items like advanced roof trusses and engineered wood products, the company actively integrates these modern construction technologies into its offerings. This allows builders to access materials that streamline the construction process and deliver higher-quality, more energy-efficient homes.

The construction industry's digital transformation is accelerating, with e-commerce platforms becoming increasingly vital. 84 Lumber must invest in digital tools for sales, inventory, and customer engagement to keep pace. For instance, in 2024, the global construction technology market was projected to reach $3.7 billion, highlighting the significant shift towards digital solutions.

An improved online presence and streamlined digital ordering systems are no longer optional but essential for 84 Lumber's competitive edge. This allows for greater efficiency in managing stock and serving a wider customer base, a trend seen across many retail sectors where online sales continue to grow robustly.

The manufacturing sector, including areas relevant to 84 Lumber's operations like component production, is seeing a significant shift towards automation and robotics. This trend is driven by the potential to boost efficiency, enhance precision, and improve workplace safety, all while potentially lowering long-term labor expenses. In 2024, the global industrial robotics market was valued at approximately $50 billion, with projections indicating continued growth as more companies invest in these technologies to remain competitive.

84 Lumber's strategic investments in new facilities are actively incorporating advanced robotic technology. These advancements are designed to streamline production processes, particularly in areas like truss manufacturing, leading to faster turnaround times and more consistent product quality. By embracing these technological shifts, 84 Lumber aims to optimize its operational performance and better meet market demand.

Building Information Modeling (BIM) and Design Software

The construction sector's increasing adoption of Building Information Modeling (BIM) and sophisticated design software presents a significant technological shift. This means suppliers like 84 Lumber must ensure their product information is compatible with these digital platforms. For instance, a substantial majority of large construction projects in North America now utilize BIM, with estimates suggesting over 70% of firms involved in commercial construction employ BIM to some degree. This integration allows for more accurate material take-offs and streamlined project planning.

This digital integration enables more precise material estimation, reducing waste and improving cost-efficiency on job sites. Furthermore, it facilitates better collaboration between designers, contractors, and suppliers.

- BIM Adoption: Over 70% of commercial construction firms in North America utilize BIM.

- Data Integration: Suppliers need to provide product data in formats compatible with BIM software.

- Efficiency Gains: BIM improves material estimation accuracy and reduces project waste.

- Digital Workflows: Supporting these digital processes is becoming a competitive necessity.

Logistics and Supply Chain Technology

Technological advancements in logistics are significantly boosting efficiency. For instance, real-time tracking systems and AI-powered route optimization can slash delivery times and fuel costs. Warehouse automation, including robotic picking and sorting, further streamlines operations, ensuring materials reach 84 Lumber's numerous locations and customer sites reliably.

Considering 84 Lumber's vast operational footprint, embracing these technologies is crucial for maintaining a competitive advantage. In 2024, companies that invested in supply chain visibility saw an average reduction of 15% in inventory holding costs, according to industry reports. This translates directly to better service and cost control for a business like 84 Lumber.

- Advanced Tracking: Real-time GPS and RFID technology provide precise location data for all shipments, improving visibility and reducing loss.

- Route Optimization: AI algorithms analyze traffic, weather, and delivery schedules to create the most efficient routes, saving time and fuel.

- Warehouse Automation: Automated guided vehicles (AGVs) and robotic arms in distribution centers speed up the loading and unloading process, minimizing dwell times.

- Predictive Analytics: Utilizing data to forecast demand and potential disruptions allows for proactive adjustments in inventory and delivery, enhancing reliability.

The construction industry is rapidly adopting digital tools, with Building Information Modeling (BIM) becoming standard for many projects. 84 Lumber must ensure its product data is compatible with BIM software to facilitate accurate material take-offs and streamlined planning. This digital integration, with over 70% of North American commercial construction firms using BIM, enhances efficiency and reduces waste.

Legal factors

Building codes are a significant legal factor for 84 Lumber. The company must ensure all its products and operations comply with national and local building codes, which are constantly being updated. For instance, upcoming 2025 regulations are placing a greater emphasis on fire safety, energy efficiency, and structural resilience, directly impacting the materials and construction methods 84 Lumber supplies and supports.

Compliance with labor laws, such as minimum wage, overtime, and worker classification, is paramount for 84 Lumber. In 2024, the U.S. Department of Labor continued to enforce stringent wage and hour regulations, impacting payroll and operational costs. Adherence to Occupational Safety and Health Administration (OSHA) standards is also crucial, particularly in the construction supply sector, to prevent workplace accidents and associated legal liabilities.

The persistent labor shortage across the construction and retail industries in 2024 and 2025 directly impacts 84 Lumber. Legal frameworks governing workforce development, such as apprenticeship programs and training initiatives, become vital for attracting and retaining skilled employees. Companies must navigate regulations related to employee benefits and retention strategies to mitigate the challenges posed by a tight labor market.

Environmental laws significantly shape 84 Lumber's business, dictating how they source raw materials like timber, manage construction waste, and control emissions from their operations and transportation fleet. For instance, the Forest Stewardship Council (FSC) certification, while voluntary, is increasingly sought after by consumers and businesses to ensure sustainable forestry practices, impacting lumber availability and cost. Failure to comply with regulations such as the Clean Air Act or state-specific waste disposal rules can lead to hefty fines, potentially millions of dollars, and operational shutdowns.

Obtaining permits for new retail locations or distribution centers is a critical legal hurdle. In 2024, the permitting process for commercial construction can take anywhere from a few months to over a year, depending on the location and environmental impact assessments required. For example, projects in areas prone to wetlands or endangered species habitat face more rigorous review, potentially delaying or even preventing development, and adding significant costs to capital expenditure plans.

Contract Law and Supplier Agreements

84 Lumber's operations are deeply intertwined with a vast network of contracts, from supplier agreements to customer sales. Navigating these agreements requires a strong understanding of contract law to mitigate risks, ensure the smooth flow of goods, and handle any disagreements that may arise. For instance, in 2024, the construction industry continued to see fluctuations in material costs, making clear and enforceable supplier contracts vital for price stability and delivery commitments.

Effective contract management is not just about avoiding disputes; it's a strategic tool. It helps 84 Lumber secure favorable terms, manage payment schedules, and define quality standards. This diligence is particularly important given the company's extensive supply chain, which relies on timely deliveries to maintain project momentum for its customers.

Key aspects of 84 Lumber's contract law considerations include:

- Supplier Agreements: Ensuring clear terms on pricing, delivery schedules, and quality specifications for building materials.

- Customer Contracts: Defining scope of work, payment terms, and delivery expectations for lumber and building supplies.

- Contractor Agreements: Outlining responsibilities, timelines, and payment for construction and installation services.

- Dispute Resolution: Establishing clear mechanisms for addressing and resolving any contractual disagreements efficiently.

Land Use and Zoning Laws

Local land use and zoning laws significantly influence 84 Lumber's ability to secure prime locations for new stores, manufacturing facilities, and distribution hubs. These regulations dictate what types of businesses can operate in specific areas, impacting site selection and development timelines.

For instance, a municipality might have strict zoning ordinances that classify certain areas as exclusively residential, preventing the establishment of a retail lumber yard or a production facility. This necessitates extensive research and compliance with local planning boards and permitting processes, which can be time-consuming and costly.

Navigating these legal frameworks is crucial for 84 Lumber's growth. The company must ensure all proposed sites meet zoning requirements, which could include setbacks, height restrictions, or environmental impact assessments. Failure to comply can lead to significant delays or the outright denial of expansion plans.

In 2024, several states continued to review and update their land use regulations. For example, efforts in states like California and New York focused on streamlining approval processes for commercial developments while also addressing environmental concerns, which could present both opportunities and challenges for companies like 84 Lumber seeking to expand.

Legal compliance is a cornerstone for 84 Lumber, impacting everything from product standards to employee relations. Adherence to evolving building codes, particularly those emphasizing energy efficiency and fire safety for 2025, is critical. Furthermore, strict enforcement of labor laws in 2024, including minimum wage and OSHA standards, directly influences operational costs and risk management.

Environmental factors

The availability and cost of sustainably sourced lumber remain critical environmental factors for 84 Lumber. The company's continued commitment to its Forest Stewardship Council (FSC) certification, a standard recognized globally for responsible forest management, directly impacts its supply chain resilience and material costs. This focus is particularly relevant as consumer and regulatory pressure for eco-friendly building materials intensifies, influencing purchasing decisions and potentially affecting market share.

Climate change is a significant environmental factor impacting raw material supply chains, particularly for companies like 84 Lumber that rely heavily on timber. The increasing frequency of wildfires, such as those seen in Western Canada during 2023 which burned over 18 million hectares, directly threatens timber availability and quality. Similarly, pest infestations, exacerbated by warmer winters, can decimate forests, further constricting supply and driving up lumber prices. For instance, the mountain pine beetle has caused widespread damage in North American forests for years, impacting timber yields.

These environmental disruptions create substantial volatility in the availability and cost of key raw materials essential for 84 Lumber's operations. Extreme weather events, including prolonged droughts and severe storms, can hinder logging operations and transportation, leading to unpredictable supply fluctuations. This unpredictability forces the company to navigate a more challenging and potentially more expensive sourcing environment, directly affecting their cost of goods sold and pricing strategies.

The construction sector is under growing pressure to adopt greener practices, focusing on energy efficiency and reducing carbon emissions. 84 Lumber can play a key role by offering building materials that improve a home's energy performance, such as advanced insulation and low-E windows. Furthermore, optimizing their own supply chain and operational energy use, perhaps through more efficient logistics or renewable energy sources at their facilities, will be crucial.

Waste Management and Recycling in Construction

Growing environmental awareness is significantly shaping the construction industry, driving demand for sustainable building materials. This trend directly impacts companies like 84 Lumber, pushing for greater adoption of recyclable and recycled content in their product offerings. For instance, the U.S. Environmental Protection Agency (EPA) reported that in 2018, construction and demolition (C&D) debris accounted for approximately 600 million tons of waste generated in the United States, highlighting a substantial opportunity for waste reduction and material reuse.

Efficient waste management on construction sites is becoming a critical factor for compliance and cost-effectiveness. Builders are increasingly seeking suppliers who can provide materials that facilitate recycling and minimize landfill contributions. 84 Lumber can capitalize on this by offering a range of products designed for easy disassembly and recycling, alongside guidance on best practices for on-site waste segregation and diversion.

- Increased Demand for Recycled Content: Builders are actively seeking lumber, insulation, and other materials incorporating recycled components to meet green building standards and reduce their environmental footprint.

- Focus on Waste Reduction: Projects are prioritizing suppliers who can demonstrate strategies and offer products that minimize off-cuts and construction waste generation.

- Regulatory Pressures: Evolving environmental regulations, particularly concerning landfill diversion rates for C&D waste, are compelling the industry to adopt more sustainable material sourcing and disposal methods.

- Circular Economy Initiatives: The broader shift towards a circular economy encourages the use of materials that can be easily repurposed or recycled at the end of a building's lifecycle.

Water Conservation in Construction

Growing emphasis on water conservation is reshaping the construction industry. Regulations and consumer demand for water-efficient homes directly impact the types of building materials that are popular. This means 84 Lumber needs to stay ahead of these trends.

For instance, in 2024, many regions are seeing stricter building codes that mandate lower water usage in new homes. This can translate to increased demand for products like low-flow toilets, water-saving showerheads, and drought-resistant landscaping options. 84 Lumber's inventory strategy must reflect this shift to remain competitive.

- Regulatory Changes: Stricter water usage mandates in building codes are becoming more common.

- Consumer Preferences: Homebuyers are increasingly seeking homes with water-saving features.

- Product Demand Shift: Expect higher demand for water-efficient fixtures and permeable paving materials.

- Inventory Alignment: 84 Lumber must adapt its product offerings to meet these evolving environmental standards.

Environmental factors significantly influence 84 Lumber's operations, from raw material sourcing to product demand. The company's commitment to sustainable forestry, evidenced by its Forest Stewardship Council (FSC) certification, is crucial given increasing consumer and regulatory pressure for eco-friendly building materials. Climate change impacts, such as wildfires and pest infestations, create volatility in timber supply and pricing, as seen with the extensive 2023 Canadian wildfires. Furthermore, the industry's push for reduced carbon emissions and water conservation is driving demand for energy-efficient and water-saving building products, requiring 84 Lumber to align its inventory with these evolving trends.

PESTLE Analysis Data Sources

Our 84 Lumber PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable industry trade publications, and comprehensive market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable information.