3M SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

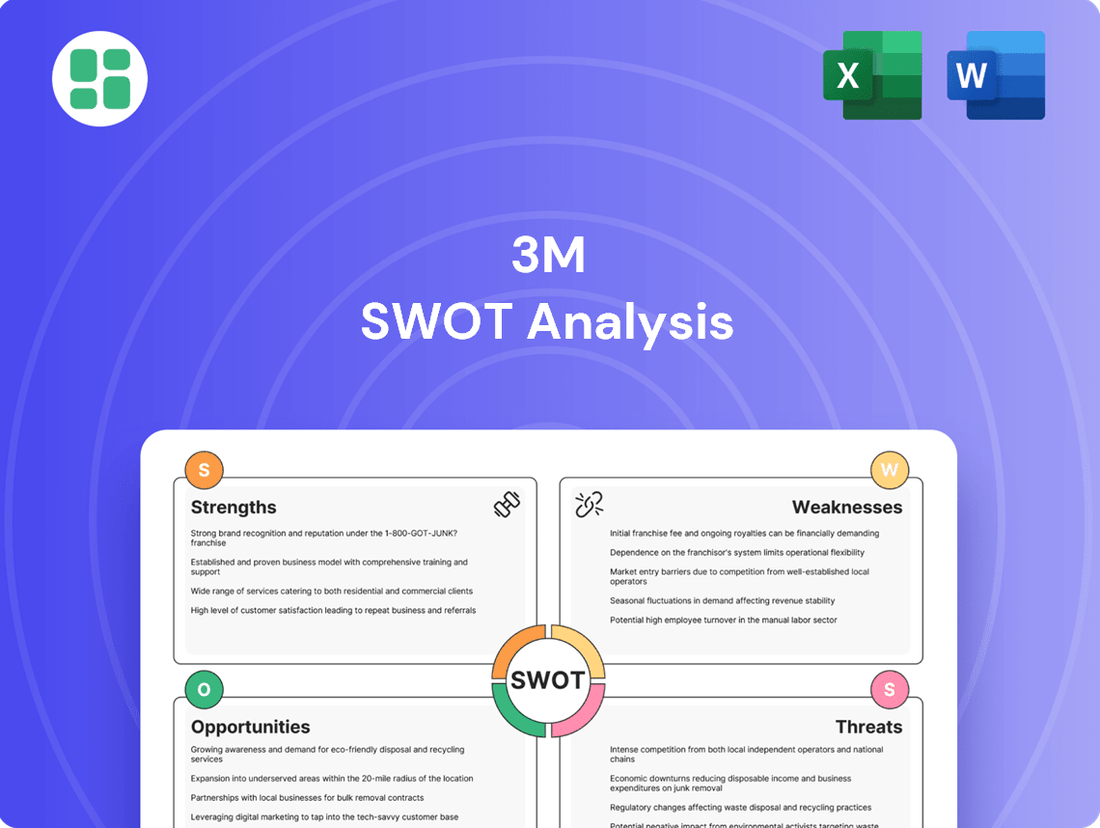

3M's diverse product portfolio and strong brand recognition are significant strengths, but the company faces challenges from increasing competition and potential litigation risks. Want to understand how these factors shape 3M's future?

Discover the complete picture behind 3M's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to leverage 3M's opportunities and mitigate its threats.

Strengths

3M's strength lies in its incredibly diverse global product portfolio, spanning critical sectors like Safety & Industrial, Transportation & Electronics, Health Care, and Consumer. This broad reach significantly mitigates risk by preventing over-reliance on any single market, thereby fostering robust financial stability. For instance, in 2023, the company generated approximately $32.7 billion in revenue, showcasing the breadth of its operations.

With a legacy stretching over a century, 3M has cultivated exceptional brand recognition and a reputation for quality and innovation among its vast array of nearly 60,000 products. This established trust allows 3M to maintain strong customer loyalty worldwide and often command premium pricing for its solutions, a testament to its enduring market presence.

3M's robust research and development capabilities are a cornerstone of its strength. The company plans to invest $3.5 billion in R&D between 2025 and 2027, aiming to launch 1,000 new products during this period. This substantial investment underscores 3M's dedication to driving innovation and maintaining its competitive edge.

This continuous focus on innovation allows 3M to develop differentiated products efficiently, ensuring it remains at the forefront of technological advancements. The company's impressive portfolio of over 135,000 patents is a testament to its strong innovation engine and its proven ability to consistently bring novel solutions to market.

3M's commitment to operational efficiency is evident in its lean manufacturing, optimized supply chains, and rigorous cost controls, which have consistently translated into significant cost savings and enhanced profitability. These efforts are crucial for maintaining a competitive edge.

The company's financial resilience is underscored by its performance in the first half of 2025, with reported strong adjusted earnings per share and healthy operating margins, demonstrating an improved financial standing even amidst market fluctuations.

Furthermore, 3M successfully completed strategic restructuring initiatives in 2024. This move has sharpened its focus on core growth areas and bolstered its overall financial health, setting a more stable foundation for future operations.

Global Reach and Established Market Positions

3M's global reach is a significant strength, with approximately 47% of its total revenue in 2023 derived from operations outside the Americas. This widespread presence allows the company to tap into diverse international markets, reducing reliance on any single region and providing a buffer against localized economic downturns. Its established market positions across numerous industries worldwide further solidify this advantage.

This extensive global footprint translates into tangible benefits:

- Diversified Revenue Streams: Nearly half of 3M's revenue comes from international markets, mitigating regional economic risks.

- Market Leadership: The company holds leading positions in multiple sectors globally, leveraging its brand recognition and product portfolio.

- Access to Growth Opportunities: A broad geographic presence enables 3M to capitalize on emerging market growth and diverse consumer needs.

- Resilience: Its established market presence and global operations contribute to a more resilient business model, capable of weathering varied economic conditions.

Commitment to Sustainability and Strategic Focus Areas

3M's commitment to sustainability is a significant strength, notably with its plan to exit PFAS manufacturing by the end of 2025. This proactive approach addresses increasing regulatory scrutiny and evolving consumer demand for safer products.

The company is strategically directing its innovation and resources towards high-growth sectors. These include climate technology, industrial automation, and the burgeoning automotive electrification market.

- Phasing out PFAS: 3M aims to cease production of all PFAS by the end of 2025, a move that will impact its chemical portfolio but align with global environmental standards.

- Focus on Climate Tech: Investments in climate technology are expected to capitalize on the growing demand for sustainable solutions in energy and environmental management.

- Automotive Electrification: The company's efforts in automotive electrification, including advanced materials for batteries and lightweighting, position it to benefit from the accelerating shift towards EVs.

3M's diversified product portfolio, spanning essential sectors, provides significant resilience. Its global presence, with nearly half of its 2023 revenue from outside the Americas, further dilutes regional risks and taps into varied growth opportunities.

The company's innovation engine is a core strength, backed by a substantial patent portfolio and a commitment to R&D. Plans to invest $3.5 billion in R&D between 2025 and 2027, aiming for 1,000 new product launches, highlight this focus.

Operational efficiency, including lean manufacturing and supply chain optimization, contributes to cost savings and profitability. Financial performance in early 2025 showed improved earnings and margins, reflecting this efficiency and strategic restructuring completed in 2024.

3M's proactive approach to sustainability, including the planned exit from PFAS manufacturing by the end of 2025, positions it favorably amidst evolving regulations and consumer preferences.

| Strength Category | Key Aspect | 2023 Data/2025 Projections |

|---|---|---|

| Product Diversification | Global Product Portfolio | Revenue of $32.7 billion (2023) |

| Brand & Reputation | Innovation and Quality | Nearly 60,000 products |

| Research & Development | Investment in Innovation | $3.5 billion R&D investment planned (2025-2027) |

| Global Reach | International Revenue Contribution | ~47% of revenue from outside Americas (2023) |

| Sustainability Focus | PFAS Manufacturing Exit | Planned by end of 2025 |

What is included in the product

Analyzes 3M’s competitive position through key internal and external factors, highlighting its innovation strengths and market opportunities while acknowledging potential threats and operational weaknesses.

Offers a clear, actionable framework to identify and address 3M's strategic challenges and leverage its strengths for growth.

Weaknesses

3M is grappling with immense legal liabilities, primarily stemming from PFAS contamination and the Combat Arms Earplugs litigation. The company has agreed to settlements amounting to billions of dollars, with the PFAS settlement alone reaching $10.3 billion. These significant legal expenses have demonstrably impacted 3M's financial performance, notably straining operating cash flow and negatively affecting GAAP earnings per share in recent reporting periods.

While these substantial liabilities are structured for payment over an extended period, they continue to cast a shadow over 3M's brand reputation and overall financial stability. The ongoing legal battles and their financial repercussions present a considerable weakness for the company, requiring careful management of cash flow and strategic planning to mitigate long-term impacts.

The spin-off of 3M's healthcare business into Solventum Corporation in April 2024, while aimed at unlocking value and sharpening focus, means 3M no longer directly participates in the growth of this formerly significant segment. This strategic move, which saw 3M retain a stake in Solventum, introduces complexities in financial reporting and operational adjustments for the remaining business units.

While portfolio reshaping is generally a positive long-term strategy, the immediate aftermath of such significant divestitures can lead to temporary operational disruptions. These can include challenges in integrating remaining business lines and managing the financial implications of the separation, potentially impacting near-term performance metrics.

3M's reliance on traditional manufacturing and industrial sectors exposes it to the volatility of global economic cycles and potential downturns in industrial output. Economic slowdowns directly affect demand for its diverse product portfolio. For example, in the first quarter of 2024, 3M reported a 1.4% decrease in sales for its Transportation & Electronics segment, partly due to weaker demand in the automotive original equipment manufacturer (OEM) and consumer electronics markets.

Challenges in Innovation Output and Market Responsiveness

Despite significant investment in research and development, 3M has encountered difficulties in consistently out-innovating its leading rivals. This can lead to perceptions of the company as mature, prioritizing incremental updates to existing products rather than groundbreaking advancements. For instance, while 3M's R&D expenses were substantial, the conversion rate to successful new product introductions has faced scrutiny when compared to more nimble competitors in certain sectors.

Furthermore, 3M has demonstrated weaknesses in accurately forecasting product demand. This miscalculation has resulted in missed market opportunities and an accumulation of excess inventory. In 2023, for example, inventory levels were a point of focus, potentially impacting cash flow and leading to write-downs if demand projections proved overly optimistic.

- Innovation Lag: Difficulty in consistently generating breakthrough innovations compared to key competitors.

- Market Responsiveness: Perceived slowness in adapting to rapidly shifting market demands and consumer preferences.

- Forecasting Inaccuracies: Challenges in precise product demand forecasting, leading to inventory management issues and missed sales windows.

- Agility Concerns: Potential for a less agile operational structure compared to more specialized or digitally-native competitors.

High Operational Costs and Supply Chain Pressures

3M faces significant headwinds due to its high operational costs, particularly evident in its inventory management. In 2023, the company's days inventory outstanding was notably higher than many of its peers, necessitating substantial capital tied up in its supply chain, which can strain cash flow.

Persistent global supply chain disruptions and volatile raw material pricing continue to exert pressure on 3M's profit margins. These external factors, combined with the internal expenses related to ongoing restructuring efforts and the costs of ensuring legal and regulatory compliance, contribute to a higher overall operational expenditure structure.

- Elevated Inventory: 3M's days inventory outstanding often exceeds industry averages, demanding greater investment in supply chain infrastructure.

- Supply Chain Volatility: Global disruptions and fluctuating raw material costs directly impact production expenses and profitability.

- Restructuring and Compliance Costs: Significant outlays for organizational changes and legal adherence add to the company's operational burden.

3M's substantial legal liabilities, particularly the $10.3 billion PFAS settlement and ongoing earplug litigation, significantly impact its financial health and brand reputation. These settlements strain cash flow and negatively affect earnings per share, requiring careful financial management despite extended payment terms.

The spin-off of its healthcare business into Solventum in April 2024, while strategic, means 3M no longer directly benefits from this segment's growth. This divestiture introduces complexities in financial reporting and can cause temporary operational disruptions as the remaining business units adjust.

Reliance on traditional industrial sectors leaves 3M vulnerable to economic downturns, as seen in a 1.4% sales decrease in its Transportation & Electronics segment in Q1 2024 due to weaker demand. Furthermore, the company faces challenges in consistently out-innovating competitors, with a need to improve the conversion of R&D spending into groundbreaking new products.

3M's operational costs are elevated, partly due to higher-than-average days inventory outstanding in 2023, tying up significant capital. Global supply chain disruptions and volatile raw material prices continue to pressure profit margins, compounded by restructuring and compliance expenses.

| Weakness | Description | Impact/Data Point |

| Legal Liabilities | PFAS and Combat Arms Earplugs litigation | $10.3 billion PFAS settlement; significant strain on cash flow and EPS. |

| Healthcare Spin-off | Separation of healthcare business into Solventum (April 2024) | Loss of direct participation in a high-growth segment; reporting complexities. |

| Economic Sensitivity | Dependence on traditional industrial sectors | 1.4% sales decrease in Transportation & Electronics (Q1 2024) due to weaker demand. |

| Innovation Challenges | Difficulty in consistent breakthrough innovation | Need to improve conversion of R&D into successful new product introductions. |

| Operational Costs | High inventory and supply chain issues | Elevated days inventory outstanding in 2023; pressure on profit margins from supply chain volatility. |

Full Version Awaits

3M SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual 3M SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

3M has a substantial opportunity to grow in emerging markets, where demand for its wide range of products is on the rise. The company can utilize its existing global infrastructure to meet unique regional demands and create new uses for its technologies.

Growth in sectors like electronics, renewable energy, and healthcare, even with its divested businesses, offers pathways for increased revenue. For instance, the global renewable energy market is projected to reach $1.97 trillion by 2030, according to Precedence Research, a significant area for 3M’s advanced materials.

3M is well-positioned to leverage emerging technologies like artificial intelligence to boost innovation and streamline its operations. For instance, AI can be instrumental in accelerating materials science research, a core strength for 3M, potentially leading to faster development cycles for new products.

The company can unlock substantial growth by focusing on new product development in high-demand sectors such as advanced materials, climate technology solutions, and infrastructure for data centers. This aligns with global trends and increasing market needs, offering a clear path for revenue expansion.

Embracing digital transformation across its business can significantly enhance commercial effectiveness. This includes optimizing sales force productivity, refining pricing strategies, and improving customer engagement, all of which are critical for driving top-line growth in the competitive 2024-2025 landscape.

3M's history shows a consistent ability to successfully integrate acquired companies, which can lead to more efficient operations and more robust supply chains. For instance, its acquisition of Polyply in 2023 for $1 billion aimed to strengthen its advanced materials portfolio, showcasing a strategic move to enhance its offerings in high-growth sectors.

By actively seeking out strategic acquisitions and partnerships, 3M can significantly strengthen its current product lines, upgrade its technological capabilities, and broaden its reach into new customer segments within crucial growth markets. This approach is vital for staying competitive and expanding market share.

Engaging in close collaborations with customers is a powerful engine for innovation, directly fueling the development of new products that meet evolving market demands. This customer-centric approach ensures 3M's offerings remain relevant and cutting-edge.

Focus on Sustainability and ESG Initiatives

The escalating global emphasis on sustainability presents a key opportunity for 3M. The company's proactive stance on phasing out per- and polyfluoroalkyl substances (PFAS) and its strategic investments in climate technology, sustainable packaging, and automotive electrification are well-aligned with market trends. These efforts are poised to bolster 3M's brand reputation, catering to increasing regulatory and consumer preferences for eco-friendly products and services, thereby unlocking new avenues for growth in green markets.

3M's commitment to ESG initiatives is not just about compliance; it's a strategic move to capture value. For instance, in 2023, 3M reported a 2.5% increase in sales for its Health Care business, partly driven by demand for sustainable solutions. The company also announced plans to invest $1 billion in sustainability-related capital projects and R&D through 2025.

- Enhanced Brand Reputation: Demonstrating a strong commitment to environmental responsibility can significantly improve public perception and customer loyalty.

- Meeting Evolving Demands: Aligning with increasing consumer and regulatory pressure for sustainable products opens up new market segments.

- Innovation in Green Technologies: Investment in areas like climate tech and sustainable packaging can lead to the development of proprietary, high-demand solutions.

- Attracting Investment: Strong ESG performance is increasingly a factor for institutional investors, potentially leading to better access to capital.

Operational Margin Expansion and Cost Optimization

3M is actively pursuing operational margin expansion through a multi-pronged approach. This includes optimizing its global supply chain, a critical area for efficiency gains. The company is also implementing targeted cost reduction strategies across its operations to boost profitability.

These initiatives are designed to drive significant earnings growth. For instance, in the first quarter of 2024, 3M reported adjusted earnings per share of $2.25, reflecting progress in these operational improvements. A key focus is also on disciplined capital expenditures, ensuring investments are strategically aligned with long-term growth and efficiency goals.

Furthermore, 3M is prioritizing improvements in on-time delivery from its manufacturing facilities. This operational enhancement directly impacts customer satisfaction and reduces logistical costs. The combined effect of these efforts is expected to lead to improved free cash flow conversion, providing greater financial flexibility.

- Supply Chain Optimization: Streamlining logistics and inventory management to reduce costs and improve efficiency.

- Cost Reduction Strategies: Implementing measures across various business units to lower operating expenses.

- Disciplined Capital Expenditures: Focusing investments on high-return projects and operational upgrades.

- Improved On-Time Delivery: Enhancing manufacturing and logistics to meet customer commitments reliably.

3M has a significant opportunity to capitalize on the growing demand for sustainable solutions, aligning with global environmental trends. Its strategic investments in climate technology, sustainable packaging, and automotive electrification position it well to capture market share in green sectors.

The company can also leverage emerging technologies like AI to accelerate materials science research, leading to faster product development and innovation. Furthermore, expanding into high-growth sectors such as electronics and healthcare, even with divested businesses, offers substantial revenue potential.

Digital transformation across its operations, from sales force productivity to customer engagement, presents another avenue for enhanced commercial effectiveness and revenue growth in the 2024-2025 period.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Emerging Markets Growth | Expand product reach in developing economies. | Rising demand for diverse product portfolios. |

| High-Growth Sectors | Capitalize on demand in electronics, renewables, healthcare. | Global renewable energy market projected to reach $1.97 trillion by 2030. |

| AI Integration | Enhance R&D and operational efficiency. | AI can accelerate materials science research. |

| Sustainability Focus | Develop and market eco-friendly products. | 3M plans to invest $1 billion in sustainability projects through 2025. |

| Digital Transformation | Improve commercial effectiveness and customer engagement. | Optimizing sales and pricing strategies for 2024-2025. |

Threats

3M navigates intensely competitive landscapes across its diverse business segments, contending with formidable rivals such as General Electric, Emerson, Honeywell, and Corning. This robust competition directly impacts market share, pricing power, and overall profitability, demanding constant strategic adaptation.

The imperative to maintain a competitive edge necessitates significant and ongoing investment in research and development. For instance, in 2023, 3M's R&D expenditure was approximately $1.9 billion, underscoring the substantial resources required to foster innovation and stay ahead in these demanding markets.

Despite settling major lawsuits, 3M still faces ongoing legal and regulatory challenges, particularly concerning PFAS environmental liabilities. The company agreed to pay up to $12.5 billion in September 2023 to resolve claims related to "forever chemicals" in public water systems, but this does not eliminate future risks.

Stricter environmental and healthcare regulations, especially those emerging in 2024 and 2025, could significantly increase 3M's compliance costs and potentially restrict its business operations. These evolving legal landscapes pose a continuous threat to profitability and market access.

The long-term financial impact of the PFAS settlement, spanning many years, represents a substantial and persistent obligation for 3M, impacting its cash flow and financial flexibility moving forward.

Global economic instability, marked by persistent inflation and the threat of recession, directly impacts 3M’s diverse product portfolio. For instance, rising interest rates in 2024 could dampen demand for consumer electronics and automotive components, key markets for 3M. Geopolitical tensions, including ongoing trade disputes and regional conflicts, further exacerbate these risks, potentially disrupting supply chains and increasing operational costs.

Trade protectionism, exemplified by tariffs imposed by various nations, presents a direct challenge to 3M's international sales and manufacturing strategies. Softening demand in major economies, such as a projected slowdown in China's manufacturing sector for 2024, could significantly affect revenue streams across 3M's Safety & Industrial and Transportation & Electronics segments. These headwinds necessitate agile strategic adjustments to mitigate financial impacts.

Persistent global supply chain vulnerabilities continue to pose a threat, impacting 3M's ability to ensure timely production and delivery of goods. Disruptions in the availability of raw materials or shipping logistics, as seen in late 2023, can lead to increased costs and delayed product launches, thereby affecting market share and profitability in its Health Care and Consumer divisions.

Raw Material Price Volatility and Supply Chain Disruptions

Raw material price volatility presents a significant challenge for 3M. Fluctuations in the cost of key inputs, such as petrochemicals and rare earth minerals, directly impact manufacturing expenses and, consequently, profit margins. For instance, the price of oil, a critical component for many of 3M's products, saw significant swings in 2023 and early 2024, affecting the cost of plastics and adhesives.

Supply chain disruptions further exacerbate these risks. Geopolitical tensions, trade disputes, and unexpected events like the COVID-19 pandemic have demonstrated the fragility of global supply networks. These disruptions can lead to material shortages, production slowdowns, and increased logistics costs, as seen in the semiconductor industry's impact on 3M's electronics segment in recent years.

The company's broad product portfolio, spanning adhesives, abrasives, and advanced materials, means it relies on a diverse array of raw materials, making it susceptible to a wide range of supply chain vulnerabilities. Effectively navigating these external pressures is paramount for maintaining operational stability and financial performance.

- Impact on Margins: Volatile raw material costs can directly squeeze 3M's gross profit margins, particularly for products with less pricing power.

- Production Delays: Supply chain disruptions can halt or slow production, leading to missed sales opportunities and increased inventory holding costs.

- Geopolitical Sensitivity: Events in regions supplying key materials, such as rare earth minerals from China or oil from the Middle East, pose a direct threat.

- Diversification Challenges: While 3M's diversification is a strength, it also means managing a complex web of suppliers and material dependencies.

Reputational Damage from Past and Ongoing Issues

3M faces significant reputational threats stemming from ongoing litigation, particularly concerning PFAS (per- and polyfluoroalkyl substances) and combat earplugs. This has generated considerable negative publicity, potentially eroding its historical image of innovation and dependability. For instance, by the end of 2023, 3M had agreed to settlements totaling billions of dollars related to these issues, impacting public and investor confidence.

Regaining trust is a protracted endeavor, even with the company’s mitigation efforts. This damage could influence how consumers view its products and affect its ability to secure and maintain crucial business partnerships. The financial implications of these settlements and the ongoing reputational repair are substantial, requiring significant investment and strategic communication.

- Litigation Impact: Billions in settlements for PFAS and earplug claims.

- Reputational Erosion: Damage to the long-standing image of innovation and reliability.

- Trust Rebuilding: A lengthy process requiring sustained positive action and communication.

- Business Relationships: Potential negative effects on consumer perception and partnerships.

3M faces considerable threats from evolving regulatory landscapes, particularly concerning environmental standards and healthcare. The company's substantial $12.5 billion settlement in September 2023 for PFAS-related claims highlights the ongoing financial and operational risks associated with these liabilities, with future compliance costs and potential restrictions on business activities remaining significant concerns throughout 2024 and into 2025.

Global economic volatility, including inflation and potential recessions, along with geopolitical tensions, directly impacts 3M's diverse markets. For example, rising interest rates in 2024 could depress demand for automotive and electronics components, while trade protectionism and slowing growth in key regions like China present headwinds for revenue. Persistent supply chain vulnerabilities and raw material price fluctuations, as seen with oil prices in late 2023 and early 2024, further threaten production, delivery, and profit margins.

| Threat Category | Specific Threat | Impact/Example | Timeline/Data Point |

| Regulatory & Legal | PFAS Liabilities | Ongoing compliance costs, potential operational restrictions. | $12.5 billion settlement (Sept 2023). |

| Economic & Geopolitical | Global Economic Instability | Reduced demand for key product segments (automotive, electronics). | Rising interest rates in 2024. |

| Supply Chain & Materials | Raw Material Price Volatility | Increased manufacturing costs, squeezed profit margins. | Oil price fluctuations (late 2023-early 2024). |

| Reputational | Litigation Fallout (PFAS, Earplugs) | Erosion of brand trust, potential impact on partnerships. | Billions in settlements by end of 2023. |

SWOT Analysis Data Sources

This 3M SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market intelligence reports, and expert industry forecasts to provide a data-driven and strategic perspective.