3M Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

3M faces moderate bargaining power from buyers, as its diverse product portfolio means customers have alternatives, but switching costs can be significant for specialized applications. The threat of new entrants is moderate, balanced by high capital requirements and established brand loyalty. The intensity of rivalry is high, with numerous competitors vying for market share across various industries.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore 3M’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for 3M is influenced by supplier concentration and the uniqueness of their offerings. If 3M relies on a limited number of suppliers for critical raw materials or specialized components, these suppliers gain significant leverage. For instance, if a particular chemical essential for 3M's adhesives is produced by only one or two companies globally, those suppliers can dictate terms.

The uniqueness of specialized inputs plays a crucial role. When suppliers provide proprietary technologies, patented materials, or rare earth minerals that are difficult for 3M to substitute, their bargaining power increases. This uniqueness can stem from intellectual property protection or the scarcity of the resource itself, making it challenging for 3M to find alternative sources or negotiate lower prices.

The bargaining power of suppliers for 3M is significantly influenced by switching costs. If 3M needs to change suppliers, it might incur substantial expenses related to retooling manufacturing processes, validating new materials, or integrating different supply chain systems. For instance, if a key component requires highly specialized manufacturing equipment that only a particular supplier possesses, 3M's ability to switch is limited, thereby increasing the supplier's leverage.

In 2023, 3M reported significant investments in its supply chain and manufacturing capabilities, highlighting the deep integration of its suppliers into its operational framework. The complexity of 3M's diverse product portfolio, ranging from adhesives to healthcare products, means that many raw materials and components are custom-formulated or require specific quality certifications. This specificity makes finding and qualifying alternative suppliers a time-consuming and costly endeavor, thus strengthening the bargaining position of incumbent suppliers.

The threat of forward integration by 3M's suppliers could significantly increase their bargaining power. If suppliers possess the capital and expertise to manufacture 3M's finished goods or establish their own distribution channels, they could directly compete, forcing 3M into less favorable terms. For instance, a key raw material supplier might leverage its existing manufacturing capabilities to produce adhesives or films, directly challenging 3M's market share in those segments.

Importance of 3M to Suppliers

3M's substantial size and global reach mean that many of its suppliers rely heavily on the company for a significant portion of their revenue. For instance, if a specialized adhesive supplier generates 40% of its annual sales from 3M, its bargaining power is considerably weakened. This dependence makes suppliers less likely to demand higher prices or more favorable terms.

Examining the market share of 3M relative to its suppliers highlights this dynamic. In many raw material and component markets, 3M commands a significant buyer position. For example, in the market for specific types of fluoropolymers used in advanced electronics, 3M might be one of the largest customers for a particular manufacturer, giving 3M considerable leverage.

- Supplier Dependence: Many suppliers to 3M are significantly reliant on the company for a substantial percentage of their overall revenue, reducing their ability to dictate terms.

- Market Share Disparity: 3M's large market share in various industries often translates to it being a dominant buyer for its raw material and component suppliers.

- Reduced Supplier Leverage: This imbalance means suppliers have less bargaining power, making them more amenable to 3M's pricing and contract conditions.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences 3M's bargaining power with its suppliers. If 3M can readily source alternative raw materials or components, the power of its current suppliers diminishes. For instance, if a key supplier of specialty adhesives raises prices, 3M's ability to switch to a comparable alternative from another vendor, without a substantial drop in product performance or an increase in overall cost, would limit that supplier's leverage.

3M's diverse product portfolio, spanning areas from healthcare to consumer goods and electronics, means it utilizes a vast array of materials. This breadth allows for greater flexibility in sourcing. For example, in its automotive division, if a supplier of specific coatings becomes too demanding, 3M might leverage its relationships with chemical manufacturers serving other sectors, potentially finding suitable alternatives or even developing in-house solutions. This reduces reliance on any single supplier for critical inputs.

- Reduced Supplier Leverage: 3M's ability to switch inputs without significant quality or cost impact weakens supplier bargaining power.

- Portfolio Diversity: A wide product range means varied material needs, increasing sourcing options and reducing dependence on individual suppliers.

- Example: If 3M faces price hikes for a specific polymer used in its consumer products, its extensive research and development capabilities may allow it to identify or develop a suitable substitute from a different chemical supplier, thereby mitigating the supplier's power.

- Strategic Sourcing: 3M's proactive approach to identifying and qualifying alternative suppliers for its diverse material requirements is crucial in managing supplier power.

The bargaining power of suppliers for 3M is generally considered moderate to low, primarily due to 3M's significant scale and purchasing volume. Many of 3M's suppliers depend on the company for a substantial portion of their revenue, which inherently limits their ability to dictate terms. For instance, if a supplier's sales to 3M represent over 30% of their total business, 3M holds considerable sway in negotiations.

Furthermore, 3M's extensive product diversification means it sources a vast array of materials, reducing its reliance on any single supplier. This allows 3M to switch suppliers more readily if terms become unfavorable. In 2023, 3M's commitment to supply chain resilience and its ongoing investments in R&D for material innovation further bolster its position against suppliers, enabling it to explore and qualify alternative sources for critical inputs.

| Factor | Impact on 3M | Description |

|---|---|---|

| Supplier Concentration | Moderate | Limited number of suppliers for niche materials can increase their power. |

| Uniqueness of Inputs | Low to Moderate | Proprietary or patented materials give suppliers leverage, but 3M's R&D mitigates this. |

| Switching Costs | Moderate | High costs to change suppliers for specialized components can empower them. |

| Supplier Dependence on 3M | Low | Many suppliers rely heavily on 3M, weakening their bargaining power. |

| Availability of Substitutes | Low | 3M's ability to find alternative materials reduces supplier leverage. |

What is included in the product

This analysis examines the competitive landscape for 3M by evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

3M serves a vast array of customers across its diverse business segments, including Safety & Industrial, Transportation & Electronics, Health Care, and Consumer. The bargaining power of these customers is influenced by their concentration and the volume of their purchases. For instance, in 2023, 3M's sales were spread across numerous industries, but the concentration of large, key accounts within sectors like automotive and healthcare can give those specific customers greater leverage in negotiating pricing and terms.

Switching costs for customers significantly influence their bargaining power with 3M. For 3M's specialized industrial adhesives, for instance, a customer switching to a competitor might face substantial costs related to retooling production lines, retraining staff, and validating the new product's performance, potentially running into tens of thousands of dollars per line. These integration complexities and performance risks inherently limit a customer's ability to easily switch, thereby reducing their bargaining leverage.

Customer price sensitivity significantly impacts 3M's bargaining power. In segments where 3M's products are more commoditized, like certain adhesives or abrasives, customers tend to be highly sensitive to price changes. This sensitivity grants them greater leverage to negotiate lower prices, especially when alternative suppliers exist. For instance, in the automotive aftermarket for basic abrasives, a slight price increase could easily drive customers to competitors.

Conversely, in areas where 3M offers highly differentiated or mission-critical solutions, customer price sensitivity is considerably lower. For products like advanced medical tapes, specialized filtration systems for cleanrooms, or high-performance materials for aerospace, the emphasis is on performance, reliability, and innovation rather than just cost. In 2023, 3M's healthcare segment, which often features such differentiated products, continued to show resilience, indicating that customers in these sectors prioritize product efficacy and safety over minor price fluctuations.

Threat of Backward Integration by Customers

The threat of backward integration by 3M's customers can significantly impact its bargaining power. If major clients, particularly those in large-scale manufacturing or technology sectors, possess the capability and financial wherewithal to produce the components or materials they currently source from 3M, they gain considerable leverage. This could lead to demands for lower prices or more favorable terms from 3M.

Several industries demonstrate this potential. For instance, automotive manufacturers, who are significant buyers of adhesives, films, and specialty materials from 3M, often have extensive R&D and manufacturing capabilities. Similarly, large electronics firms might explore in-house production of certain specialized coatings or substrates if the cost and complexity align with their strategic goals.

- Automotive Sector: Major car manufacturers have the scale and technical expertise to potentially develop and produce their own advanced adhesives and sealants, reducing reliance on external suppliers like 3M.

- Electronics Industry: Large technology companies could vertically integrate to produce specialized films or substrates used in their devices if it offers cost savings or greater control over critical components.

- Aerospace: While highly specialized, some very large aerospace companies might consider in-house production of certain high-performance materials if the volume justifies the investment and risk.

- Medical Device Manufacturers: In specific instances, large medical device companies might develop proprietary materials or components internally to ensure absolute quality control and intellectual property protection.

Availability of Substitute Products for Customers

The availability of substitute products significantly impacts 3M's customer bargaining power. When customers can easily find comparable alternatives, their ability to negotiate prices and terms increases. This is particularly true for 3M's more commoditized product lines where differentiation is less pronounced.

For instance, in the adhesives market, while 3M offers specialized solutions, numerous competitors provide standard tapes and glues. This broad availability of alternatives means customers can readily switch if 3M's pricing or product features are not competitive. In 2024, the global adhesives and sealants market was valued at approximately $60 billion, with a significant portion representing standard offerings.

- High availability of substitutes: Customers can easily find alternative products for many of 3M's offerings, especially in less specialized segments.

- Impact on pricing power: This ease of substitution empowers customers to demand lower prices or better terms from 3M.

- Competitive landscape: The broad market for products like adhesives and abrasives means many rivals offer similar functionality.

- 3M's innovation response: 3M counters this by focusing on innovation to create unique, high-performance products that are harder to substitute.

The bargaining power of 3M's customers is a significant factor, particularly for those purchasing in high volumes or in segments where 3M's products are less differentiated. Customer price sensitivity is a key driver, especially in markets with readily available substitutes, allowing buyers to exert pressure on pricing. While 3M's innovation in specialized areas can mitigate this, the overall threat remains, influencing negotiation dynamics and potentially impacting profit margins.

| Factor | Impact on 3M | Example/Data |

|---|---|---|

| Customer Concentration & Volume | High concentration of large buyers can increase leverage. | Key accounts in automotive and healthcare can negotiate terms based on purchase volume. |

| Switching Costs | High switching costs reduce customer power. | Retooling and validation for specialized adhesives can cost tens of thousands per production line. |

| Price Sensitivity | High sensitivity in commoditized segments grants customers leverage. | In 2024, the global adhesives market, with many standard offerings, was valued around $60 billion, indicating competitive pricing pressures. |

| Threat of Backward Integration | Potential for large customers to produce in-house. | Automotive and electronics manufacturers possess capabilities that could lead to vertical integration. |

| Availability of Substitutes | Increases customer power, especially for non-specialized products. | Numerous competitors offer standard adhesives and abrasives, allowing customers to switch easily if pricing is uncompetitive. |

Preview the Actual Deliverable

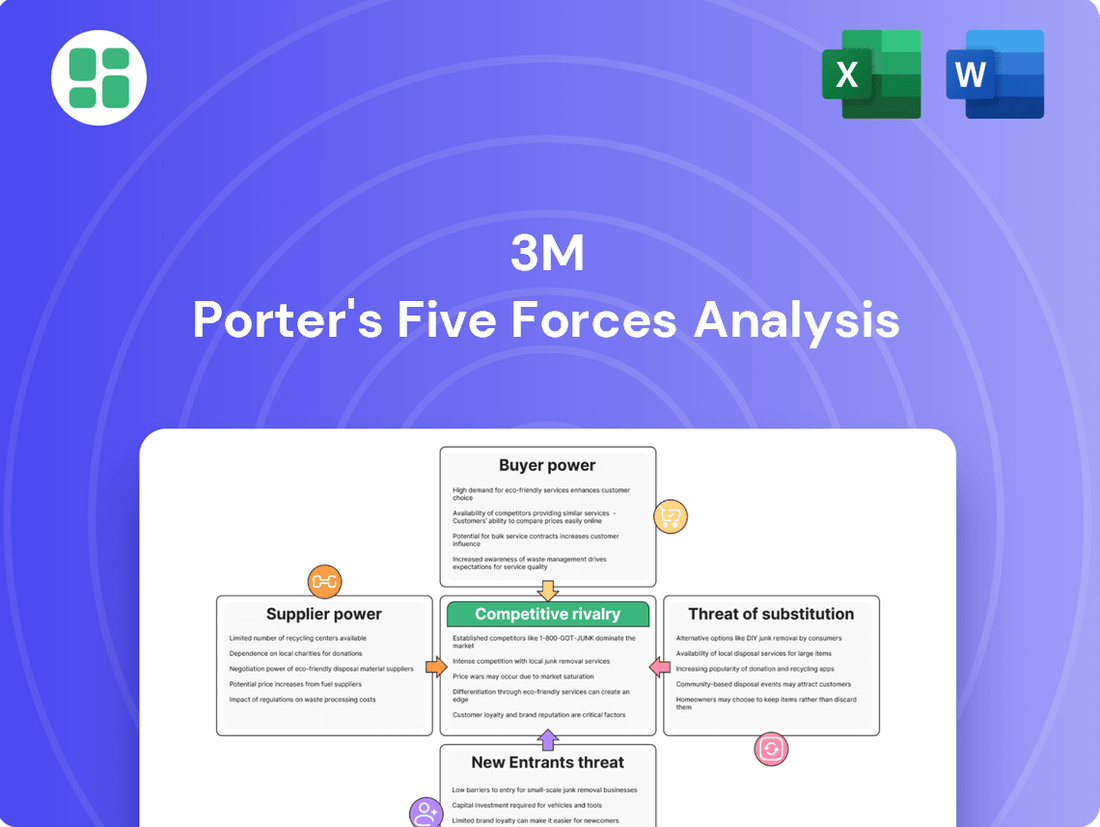

3M Porter's Five Forces Analysis

This preview showcases the complete 3M Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises and full immediate access to valuable strategic insights for 3M.

Rivalry Among Competitors

3M operates in a highly competitive landscape, facing a vast number of rivals across its diverse business segments. This includes large, diversified conglomerates that can leverage economies of scale and broad market reach, as well as smaller, specialized niche players who often possess deep expertise in specific product categories. For instance, in its Health Care segment, 3M competes with companies like Johnson & Johnson and Medtronic, while in Safety & Industrial, it encounters giants such as DuPont and Honeywell, alongside numerous smaller, focused manufacturers.

The sheer volume and varied strategic orientations of these competitors significantly amplify the intensity of competition. These rivals often employ different pricing strategies, innovation approaches, and distribution channels, forcing 3M to constantly adapt and refine its own market strategies. The global nature of 3M's operations means it contends with both established Western players and increasingly capable competitors emerging from Asia, further complicating the competitive dynamic.

The industry growth rate significantly impacts competitive rivalry for 3M. In mature markets, such as certain segments of adhesives or abrasives, competition is naturally more intense as companies vie for existing market share. For instance, the global adhesives and sealants market, a key area for 3M, was projected to grow at a compound annual growth rate (CAGR) of around 4.5% to 5.5% through 2024, indicating a relatively steady but not explosive growth phase where market share battles are common.

Conversely, 3M also operates in high-growth sectors, like healthcare technology or advanced materials for electronics, which can dilute direct competitive confrontation as companies focus on expanding capacity and innovation. The global medical devices market, for example, was expected to see robust growth, with some estimates placing its CAGR in the 6% to 7% range leading up to 2024. This faster expansion allows for easier organic growth, potentially reducing the pressure to aggressively steal market share from incumbents.

3M's competitive rivalry is significantly shaped by its robust product differentiation and a relentless focus on innovation. The company boasts a strong brand reputation built over decades, which helps customers perceive value beyond mere price. This is further bolstered by proprietary technologies and a consistent stream of new product introductions, effectively mitigating direct price wars with rivals.

For instance, 3M's investment in research and development (R&D) serves as a crucial competitive differentiator. In 2023, 3M reported spending approximately $1.9 billion on R&D, a testament to its commitment to developing unique solutions across its diverse business segments. This ongoing innovation allows 3M to command premium pricing and maintain market share even in highly competitive sectors.

Exit Barriers

3M faces significant exit barriers due to its substantial investment in specialized manufacturing facilities and proprietary technologies across diverse product lines. These highly specific assets, often tailored for particular production processes, would be difficult and costly to repurpose or sell if the company were to exit certain market segments. This immobility of capital can trap resources, compelling firms to remain operational even in less profitable areas, thereby contributing to sustained competitive rivalry.

The company's extensive global manufacturing footprint, built over decades, represents another layer of high exit barriers. Redeploying or divesting these fixed assets, which include specialized plants for adhesives, abrasives, and advanced materials, involves considerable transaction costs and potential write-downs. For instance, closing a facility might incur substantial severance packages for a workforce with specialized skills, further increasing the cost of exiting a market. In 2023, 3M announced plans to close its plant in Aberdeen, South Dakota, which produced medical supplies, highlighting the operational complexities and associated costs of such decisions.

Furthermore, 3M's long-term supply and customer contracts, particularly in sectors like automotive and healthcare, can create sticky situations for exiting. Breaking these agreements often incurs penalties or reputational damage, making a clean exit from these markets challenging. The intricate nature of its supply chains and the integration of its products into customers' value chains mean that exiting a segment can disrupt more than just the direct operations.

- Specialized Assets: 3M's manufacturing equipment is often highly specific to its product categories, making it difficult and expensive to redeploy or sell.

- High Fixed Costs: The company's extensive global plant network represents a significant fixed cost base that is hard to exit without substantial losses.

- Long-Term Contracts: Existing supply and customer agreements can impose penalties or reputational risks for early termination, complicating market exits.

- Employee Severance: The cost of laying off a specialized workforce can be a considerable financial burden when considering exiting a market segment.

Switching Costs for Buyers

Switching costs for buyers in 3M's markets can vary significantly. For instance, in the adhesives and tapes sector, while some products might have low switching costs, specialized industrial tapes or those integrated into complex manufacturing processes can present higher barriers. If a customer has heavily invested in training their workforce on a specific 3M product or if the product is a critical component in their production line, switching to a competitor becomes more costly and time-consuming.

High switching costs can indeed dampen competitive rivalry. When customers face significant expenses or disruptions in changing suppliers, they tend to stick with their current provider, even if a competitor offers a slightly lower price. This stability allows companies like 3M to maintain customer loyalty and focus on innovation rather than engaging in price wars. For example, in the healthcare sector, where 3M offers a wide range of medical tapes and wound care products, the need for consistent performance and regulatory compliance can lead to higher switching costs for hospitals and clinics.

- Industrial Adhesives: Switching can involve re-qualification of materials and potential redesign of assembly processes, creating moderate to high switching costs.

- Automotive Components: Integration into vehicle platforms means that changing a supplier for critical components like films or sealants can be very costly due to re-tooling and testing.

- Healthcare Products: For items like medical tapes and wound dressings, switching can involve new training for medical staff and ensuring compatibility with existing protocols, leading to higher switching costs.

- Electronics Materials: Specialized films and adhesives used in electronic device manufacturing often require extensive testing and validation, making switching a complex and expensive undertaking.

Competitive rivalry is a significant force for 3M, stemming from a broad array of competitors across its diverse business segments. These range from large, diversified corporations with substantial resources to specialized niche players offering focused expertise. For instance, in the healthcare sector, companies like Johnson & Johnson and Medtronic represent formidable rivals, while the Safety & Industrial segment sees competition from giants such as DuPont and Honeywell.

The intensity of this rivalry is further amplified by the varied strategies employed by competitors, including differing pricing models, innovation pipelines, and distribution networks. 3M's global presence means it contends with a wide spectrum of players, from established Western firms to increasingly capable Asian competitors, necessitating continuous adaptation of its own market approaches.

3M's commitment to innovation and product differentiation serves as a key defense against intense competition. The company's substantial investment in research and development, with approximately $1.9 billion allocated in 2023, underpins its ability to introduce unique solutions. This focus on R&D allows 3M to command premium pricing and maintain market standing, even when facing numerous rivals across its various product lines.

SSubstitutes Threaten

Customers often face a compelling price-performance trade-off when considering substitutes for 3M's diverse product portfolio. For instance, while 3M's adhesives are known for their advanced bonding capabilities, lower-cost alternatives from competitors might offer sufficient performance for less demanding applications, potentially capturing market share where cost is the primary driver. In 2024, the market for industrial adhesives saw significant growth, with many smaller players offering specialized, cost-effective solutions that directly compete with 3M's broader offerings.

The ease with which customers can switch to these alternatives is a key concern. If a substitute product can deliver 80% of the performance of a 3M product at 60% of the cost, many customers, particularly in price-sensitive segments, will likely make the switch. This dynamic is evident in the personal care sector, where generic brands of items like Scotch-Brite sponges can offer comparable functionality at a fraction of the price, impacting 3M's revenue in those segments.

3M's customers show a varied propensity to substitute, influenced by the specific product category. For many of its industrial and healthcare solutions, switching costs are often high due to integration with existing processes or regulatory requirements, making direct substitution less likely. However, in consumer-facing segments like adhesives or cleaning supplies, where convenience and perceived value are paramount, customers may more readily explore alternatives if price or performance benefits are significant.

Technological leaps in seemingly unrelated sectors can spawn potent substitutes for 3M's offerings. For instance, advancements in bio-materials or advanced digital platforms might disrupt traditional adhesive, abrasive, or protective film markets. 3M's substantial investment in R&D, which reached approximately $2.0 billion in 2023, is a critical defense, allowing them to preemptively develop next-generation solutions and integrate emerging technologies into their product lines.

Relative Price of Substitutes

The relative price of substitutes significantly impacts the threat to 3M. If alternative products offering similar functionality are priced considerably lower, customers are more likely to switch, eroding 3M's market share and pricing power. For instance, in the adhesives market, lower-cost generic brands can pose a challenge to 3M's premium products, especially for less critical applications.

Factors like raw material costs and manufacturing efficiencies directly influence the pricing of substitute goods. Companies with access to cheaper inputs or more streamlined production processes can offer alternatives at a lower price point. This was evident in 2024 as fluctuations in the cost of petrochemicals, a key component for many of 3M's materials, influenced the cost competitiveness of alternative products.

- Lower-priced alternatives in segments like consumer tapes and cleaning supplies directly compete with 3M's offerings, forcing price adjustments.

- In 2024, the average price of generic office supplies, a segment where 3M has a presence, was approximately 15-20% lower than comparable branded items.

- Manufacturing efficiencies for smaller competitors can allow them to undercut 3M's pricing on certain industrial components.

- The perceived value proposition versus price for substitutes is a critical determinant of customer choice.

Quality and Performance of Substitutes

The threat of substitutes for 3M's diverse product portfolio hinges significantly on the quality and performance of alternative offerings. For many of 3M's highly engineered solutions, such as advanced adhesives, filtration systems, or electronic materials, potential substitutes must demonstrate equivalent or superior reliability and efficacy to be considered viable competitors. If a substitute product fails to meet these stringent standards, its threat is considerably diminished.

3M's long-standing reputation for innovation and consistent quality acts as a crucial defense against substitute threats. Customers often rely on 3M's brand assurance, particularly in critical applications where product failure could have severe consequences. For instance, in the healthcare sector, where 3M provides medical tapes and wound care products, the performance and biocompatibility of substitutes are paramount, and any perceived compromise in quality would limit their adoption.

In 2024, the competitive landscape continues to evolve, with emerging technologies and materials constantly challenging established players. While specific market share data for every 3M product line against direct substitutes is proprietary, industry reports highlight that in sectors like personal protective equipment (PPE), where 3M is a major player, the performance and certification of alternative respirators and masks are rigorously scrutinized by regulatory bodies. This scrutiny inherently raises the bar for substitutes to match 3M's established product performance.

- Performance Equivalence: Substitutes must match or surpass 3M's product efficacy, especially in demanding industrial and healthcare applications.

- Reliability Standards: For critical uses, alternatives need to demonstrate comparable long-term dependability and failure rates.

- Brand Trust: 3M's established reputation for quality and innovation serves as a significant barrier to substitutes lacking similar credibility.

- Regulatory Scrutiny: In regulated industries, substitutes face rigorous testing and certification, often mirroring or exceeding the standards met by 3M's products.

The threat of substitutes for 3M is amplified by the availability of lower-cost alternatives, particularly in consumer-facing segments. While 3M's innovation often commands a premium, price-sensitive customers may opt for generic brands if performance is deemed adequate. This dynamic was evident in 2024, where the average price for comparable generic office supplies was 15-20% lower than branded counterparts, impacting 3M's market share in those areas.

Manufacturing efficiencies of smaller competitors can also enable them to offer products at lower price points, directly challenging 3M's established pricing. The perceived value proposition versus price for these substitutes is a critical factor in customer purchasing decisions, especially for less demanding applications.

While 3M's robust R&D spending, around $2.0 billion in 2023, helps it stay ahead, emerging technologies can still create potent substitutes. For instance, advancements in bio-materials could disrupt traditional adhesive markets, requiring continuous innovation to maintain competitive advantage.

| Product Segment | 3M's Offering | Substitute Characteristics | Price Differential (Approx.) |

|---|---|---|---|

| Adhesives | High-performance, specialized bonding solutions | Standard industrial adhesives, DIY glues | 20-40% lower |

| Cleaning Supplies | Durable, specialized cleaning tools (e.g., Scotch-Brite) | Generic sponges, cloths | 30-50% lower |

| Office Supplies | Branded tapes, Post-it Notes | Generic tapes, sticky notes | 15-20% lower (2024 data) |

Entrants Threaten

Entering 3M's established markets demands substantial capital, particularly for manufacturing infrastructure and cutting-edge research and development. Building advanced production facilities and R&D labs alone can cost hundreds of millions, creating a significant financial hurdle for potential new competitors.

3M's formidable intellectual property, evidenced by its vast patent portfolio, acts as a significant barrier to new entrants. The company held over 120,000 patents globally as of early 2024, protecting its unique product designs and proprietary technologies.

These strong patents and the sheer complexity of replicating 3M's innovations necessitate substantial research and development investment or pose considerable legal risks for potential competitors, thereby deterring new market entrants.

3M's formidable economies of scale and scope present a significant barrier to new entrants. The company's massive production volumes lead to substantial cost advantages in manufacturing and procurement, making it incredibly difficult for newcomers to match 3M's per-unit costs. For instance, in 2023, 3M reported net sales of $32.67 billion, a testament to its vast operational capacity.

Furthermore, 3M's diversified product portfolio allows it to leverage economies of scope, spreading research and development costs, marketing expenses, and overhead across numerous business segments. This broad reach, supported by a global footprint with operations in over 70 countries, enables 3M to achieve purchasing power and distribution efficiencies that are virtually unattainable for nascent competitors.

Brand Identity and Customer Loyalty

3M benefits from exceptionally strong brand recognition and deep customer loyalty, particularly with iconic brands like Post-it and Scotch. This established trust acts as a significant deterrent for new entrants, who would face substantial hurdles in marketing expenditure and time investment to cultivate similar brand equity and customer faith across both consumer and industrial markets.

The threat of new entrants is notably low due to 3M's formidable brand identity and the resulting customer loyalty. For instance, in 2024, 3M's consumer division, which heavily relies on brand strength, continued to be a major revenue driver. New companies entering the adhesive or office supply markets would need to overcome the deeply ingrained preference consumers and businesses have for 3M's trusted products, a feat requiring vast resources and a long-term commitment to building credibility.

- Brand Equity: 3M's portfolio includes household names, making it difficult for newcomers to gain immediate traction.

- Customer Loyalty: Repeat purchases are common, driven by consistent product performance and brand familiarity.

- Marketing Costs: New entrants must invest heavily in advertising to even approach 3M's level of brand awareness.

- Time to Market: Building a reputation comparable to 3M's decades-long presence takes significant time.

Access to Distribution Channels

Securing access to established distribution channels poses a significant hurdle for potential new entrants aiming to challenge 3M. The company has cultivated deep, long-standing relationships with a vast network of distributors, retailers, and industrial customers across its diverse product lines. This entrenched network provides 3M with a substantial competitive advantage, making it difficult for newcomers to gain comparable market penetration and reach.

For instance, in the consumer electronics sector, where 3M supplies components and films, new entrants would struggle to replicate 3M's established presence with major electronics manufacturers and their supply chains. Similarly, in the healthcare market, gaining shelf space and access to hospital procurement systems requires extensive effort and proven track records, areas where 3M already holds considerable sway.

- Established Relationships: 3M's decades-long partnerships with key distributors and retailers create significant barriers to entry.

- Global Reach: Newcomers face immense difficulty in replicating 3M's extensive global distribution infrastructure.

- Market Penetration: The cost and time required to build a comparable distribution network are prohibitive for most emerging competitors.

The threat of new entrants into 3M's diverse markets is significantly low, primarily due to the company's robust patent portfolio and substantial capital requirements. Building comparable manufacturing facilities and R&D capabilities demands hundreds of millions, a steep initial investment that deters many potential competitors. Furthermore, 3M's extensive patent protection, encompassing over 120,000 global patents as of early 2024, shields its innovations and creates legal hurdles for those seeking to enter its established product categories.

Economies of scale and scope also play a crucial role in mitigating the threat of new entrants. 3M's vast production volumes and diversified product lines, generating $32.67 billion in net sales in 2023, allow for significant cost advantages in manufacturing and procurement. This operational efficiency, coupled with a global presence in over 70 countries, makes it exceedingly difficult for smaller, emerging companies to compete on cost and breadth of offerings.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for manufacturing and R&D infrastructure. | Significant financial hurdle, limiting the number of potential entrants. |

| Intellectual Property | Extensive patent portfolio (over 120,000 globally in early 2024). | Legal risks and need for substantial R&D investment to circumvent existing patents. |

| Economies of Scale | Massive production volumes leading to cost advantages. | New entrants struggle to match 3M's per-unit costs. |

| Brand Equity & Loyalty | Strong recognition of brands like Post-it and Scotch. | Requires vast marketing investment and time to build comparable customer trust. |

| Distribution Channels | Established, long-standing relationships with distributors and retailers. | Difficult for newcomers to gain market penetration and reach. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from industry-specific market research reports, company annual filings, and expert interviews. This multi-faceted approach ensures a comprehensive understanding of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.