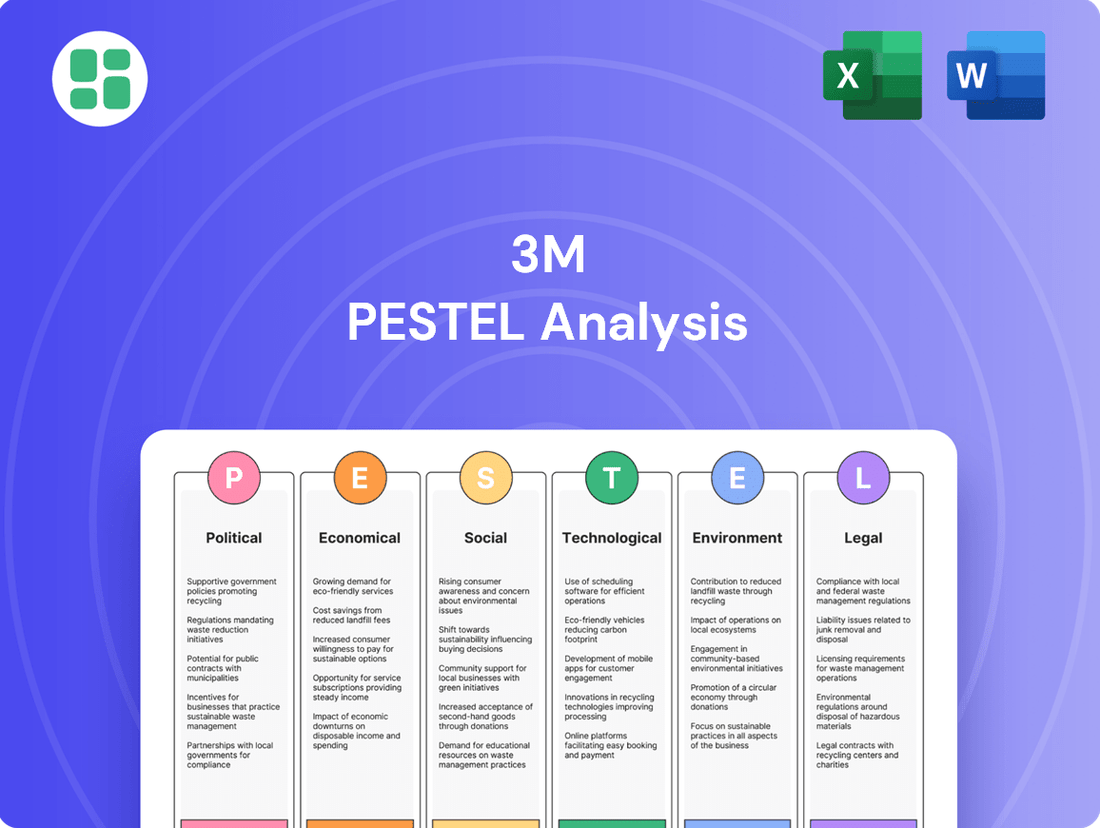

3M PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

3M Bundle

Unlock the secrets to 3M's strategic positioning with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its future. Gain the competitive edge you need to navigate market complexities and make informed decisions. Download the full analysis now for actionable intelligence.

Political factors

Global trade policies and tariffs present a significant political variable for 3M. As a multinational corporation, the company navigates a complex web of international trade agreements and potential tariff impositions, which directly influence its operational costs and market access. For instance, shifts in trade relations, such as those experienced between major economic blocs, can alter the cost of sourcing raw materials and components essential for 3M's vast product lines, impacting everything from adhesives to healthcare supplies.

The imposition of tariffs can lead to increased expenses for imported goods and components, potentially raising the cost of production for 3M. Conversely, tariffs on exported goods can reduce demand in foreign markets. This dynamic necessitates constant strategic adjustments in sourcing, manufacturing locations, and pricing to mitigate negative impacts and capitalize on any favorable trade conditions. The company's financial planning reflects this sensitivity, with forecasts often incorporating the potential effects of evolving trade landscapes.

For example, in anticipation of ongoing trade uncertainties, 3M has previously factored potential tariff impacts into its financial outlooks, adjusting its 2025 profit forecasts to reflect these evolving political and economic conditions. This proactive approach underscores the substantial influence that governmental trade decisions have on 3M's profitability and its ability to compete effectively on a global scale.

Geopolitical instability and regional conflicts pose significant risks to 3M's global operations, potentially disrupting its intricate supply chains and dampening demand in volatile regions. The company has explicitly cited ongoing conflicts, like the war in Ukraine, as contributing factors to its supply chain challenges, alongside pandemic-related disruptions.

These ongoing geopolitical tensions underscore the critical need for 3M to maintain robust risk management strategies and a highly diversified operational footprint. This diversification is key to building resilience and mitigating the impact of unforeseen global events on its business continuity and financial performance.

Government regulations, especially those around product safety and environmental protection, significantly shape 3M's business. For instance, in 2024, the company continued to navigate evolving PFAS (per- and polyfluoroalkyl substances) regulations globally, which can impact its materials science portfolio and require substantial R&D investment to develop compliant alternatives.

These evolving industrial standards, such as those for emissions or material recyclability, directly affect 3M's operational costs and product innovation cycles. Meeting stricter environmental standards, like those proposed in the EU for chemical safety in 2025, could necessitate capital expenditures and alter product roadmaps, influencing profitability.

3M's ability to adapt its vast product range and manufacturing processes to diverse and often tightening regulatory frameworks across different countries is crucial for maintaining market access and competitive advantage. The company's 2024 sustainability reports highlight ongoing efforts to align with international environmental protocols, demonstrating the direct link between regulatory compliance and business strategy.

Government Procurement and Infrastructure Spending

Government procurement and infrastructure spending are significant drivers for 3M. For instance, the US government's increased investment in infrastructure projects, projected to reach trillions of dollars through initiatives like the Infrastructure Investment and Jobs Act, directly boosts demand for 3M's advanced materials used in construction and transportation. Similarly, healthcare spending, a critical area for 3M, saw substantial government outlays in 2024, particularly for public health initiatives and medical supplies, benefiting 3M's Health Care segment.

These government expenditure patterns create direct demand for 3M's diverse product lines. The company's offerings in areas like personal safety, including respirators and protective garments, are essential for public works and emergency response, sectors heavily influenced by government budgets. Defense spending also plays a role, with 3M supplying specialized adhesives, films, and electronic components to military applications.

- Infrastructure Investment: The US Infrastructure Investment and Jobs Act allocates over $1.2 trillion, with a significant portion directed towards roads, bridges, and public transit, all areas where 3M's materials are utilized.

- Healthcare Outlays: Government healthcare spending in major economies continued to be robust in 2024, supporting demand for 3M's medical devices, drug delivery systems, and sterilization products.

- Defense Contracts: 3M actively participates in defense sector contracts, supplying critical components that align with national security priorities and defense budgets.

- Portfolio Resilience: 3M's diversified business units allow it to capitalize on varying government investment cycles across sectors like transportation, healthcare, and industrial safety.

Political Stability and Business Environment in Key Markets

Political stability in countries where 3M operates directly impacts its business. For instance, geopolitical tensions in regions like Eastern Europe or parts of Asia can disrupt supply chains and create uncertainty for manufacturing operations. In 2023, global political instability led to increased volatility in commodity prices, a key input for many of 3M's products.

A predictable regulatory landscape is vital for 3M's global manufacturing and distribution network. Changes in trade policies or environmental regulations in major markets like the United States or Germany can significantly affect operational costs and market access. For example, the EU's evolving chemical regulations, such as REACH, require continuous adaptation and compliance efforts from companies like 3M.

- Regulatory Compliance Costs: 3M faces ongoing costs associated with complying with diverse and evolving regulations across its operating regions, impacting profitability.

- Trade Policy Impact: Tariffs and trade agreements directly influence the cost of raw materials and the competitiveness of 3M's finished goods in international markets.

- Government Support and Incentives: Political decisions regarding R&D tax credits or manufacturing incentives can influence 3M's investment in specific regions.

Political factors significantly shape 3M's global operations, influencing everything from trade relations to regulatory compliance. Government policies on trade, tariffs, and geopolitical stability directly impact supply chains and market access, as seen with ongoing trade tensions affecting raw material costs.

Regulatory environments, particularly concerning environmental standards and product safety, necessitate continuous adaptation and investment in R&D for 3M, with evolving PFAS regulations being a prime example. Government spending on infrastructure and healthcare also presents direct demand opportunities for the company's diverse product portfolio.

The company's financial performance is sensitive to these political variables, requiring proactive strategies to navigate trade uncertainties and adapt to diverse regulatory frameworks across its international markets.

| Political Factor | Impact on 3M | 2024/2025 Relevance |

| Global Trade Policies & Tariffs | Affects raw material costs, market access, and export competitiveness. | Ongoing trade uncertainties influenced 3M's 2025 profit forecasts. |

| Geopolitical Instability | Disrupts supply chains and dampens demand in volatile regions. | Cited as a contributor to supply chain challenges in 2023/2024. |

| Government Regulations (Environmental & Safety) | Drives R&D investment, product development, and operational costs. | Navigating evolving PFAS regulations globally in 2024; EU chemical safety proposals for 2025. |

| Government Procurement & Spending | Creates direct demand for products in infrastructure, healthcare, and defense. | US Infrastructure Investment and Jobs Act (over $1.2T) and robust healthcare spending in 2024. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting 3M, detailing how political, economic, social, technological, environmental, and legal factors create both challenges and avenues for growth.

It provides actionable insights for strategic decision-making, enabling stakeholders to anticipate market shifts and leverage opportunities effectively.

The 3M PESTLE analysis offers a structured framework to identify and understand the external forces impacting the business, thereby alleviating the pain of navigating complex and unpredictable market landscapes.

By dissecting these external factors, the analysis provides clarity and actionable insights, reducing the uncertainty and anxiety associated with strategic planning and decision-making.

Economic factors

3M's financial health is intricately linked to the pulse of global economic expansion. As a diversified company supplying everything from adhesives for cars to medical supplies, its performance naturally ebbs and flows with the broader economic tide. When economies grow, so does demand for 3M's wide array of products.

However, the global economic landscape in 2024 and heading into 2025 shows signs of slowing. Projections from institutions like the IMF and World Bank indicate a moderation in global GDP growth compared to previous years. For instance, the IMF's April 2024 World Economic Outlook projected global growth at 3.2% for 2024, a slight slowdown from 2023. This softer outlook, characterized by potentially weaker consumer spending and reduced demand in key 3M markets like automotive and electronics, has already prompted companies like 3M to adjust their financial forecasts for the coming year.

Recessionary pressures, even if not fully realized, create headwinds. A downturn typically means less industrial activity, leading to lower demand for components and materials that 3M manufactures. Furthermore, reduced consumer purchasing power during economic contractions directly impacts sales of 3M's consumer-facing products, creating a dual challenge for revenue generation.

Inflationary pressures directly impact 3M's cost of goods sold, particularly raw materials and logistics. For instance, in the first quarter of 2024, 3M reported that its cost of sales increased by 2.1% year-over-year, partly due to higher input costs. This trend continued through 2024, with many industrial material prices remaining elevated compared to pre-pandemic levels.

The company has faced significant raw material and logistics cost inflation, which it aims to offset through product selling price increases and operational efficiencies. In 2023, 3M implemented price increases across its portfolio, which helped to mitigate some of the impact of these rising costs, contributing to a 2.8% increase in net sales for the year.

Managing these rising costs is critical for maintaining profit margins. 3M's ability to pass on these increased costs to customers through price adjustments, while simultaneously improving internal efficiencies, will be a key determinant of its financial performance in the coming periods. For example, the company's focus on supply chain optimization in 2024 aims to reduce logistical expenses.

3M has faced significant headwinds from supply chain disruptions and rising logistics costs, impacting its operational efficiency. The company reported in its 2023 annual report that these challenges contributed to higher input costs and affected its ability to meet demand promptly.

To counter this, 3M is investing in supply chain resilience and logistics optimization, targeting improvements in its on-time, in-full delivery rates. For instance, by Q3 2024, the company aims to reduce transit times by 10% through strategic warehousing and transportation network adjustments, a move expected to yield substantial cost savings and enhance customer service levels.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact 3M, a global enterprise with substantial international sales. When foreign currencies weaken against the U.S. dollar, the reported value of 3M's overseas earnings and sales can diminish. For instance, in the first quarter of 2024, 3M reported that unfavorable currency translation impacted sales by approximately 0.5%, demonstrating the tangible effect of these movements.

These currency shifts necessitate robust hedging strategies and diligent financial planning to cushion the blow to reported revenues and profits. Companies like 3M often employ financial instruments to lock in exchange rates, thereby reducing the volatility associated with international transactions. Effective management of these risks is crucial for maintaining predictable financial performance.

- Impact on Sales: A stronger USD can decrease the dollar value of foreign sales.

- Profitability Concerns: Reduced sales translate to lower reported profits.

- Hedging Necessity: Financial instruments are used to mitigate currency risk.

- 2024 Observation: Q1 2024 saw a ~0.5% negative impact from currency on 3M's sales.

Interest Rates and Access to Capital

Changes in interest rates directly influence 3M's financial flexibility. Higher rates mean increased costs for borrowing, impacting everything from new investments to managing existing debt. This can also affect how much capital 3M can return to its investors through dividends and stock buybacks.

For instance, if the Federal Reserve maintains or increases its benchmark interest rate throughout 2024 and into 2025, 3M's cost of capital for R&D and strategic expansion projects could rise. This might lead to a more cautious approach to funding new initiatives.

3M has been actively working to strengthen its financial position. A key objective has been reducing its net leverage, aiming for a healthier balance sheet. This focus on deleveraging is crucial in an environment where borrowing costs are a significant consideration.

- Interest Rate Impact: Rising interest rates in 2024-2025 could increase 3M's borrowing expenses for capital expenditures and debt servicing.

- Cost of Capital: Higher rates may make investments in research and development or new market expansion less attractive due to increased financing costs.

- Shareholder Returns: Increased borrowing costs could potentially limit the funds available for dividends and share repurchase programs.

- Balance Sheet Strategy: 3M's ongoing efforts to reduce net leverage aim to improve its financial resilience against fluctuating interest rate environments.

Economic factors present a mixed outlook for 3M. While global economic growth is projected to moderate in 2024-2025, potentially dampening demand, the company must also contend with persistent inflation impacting raw material and logistics costs. These cost pressures, evident in Q1 2024's 2.1% increase in cost of sales, necessitate strategic pricing and efficiency gains to protect profit margins.

Currency fluctuations also pose a risk, with unfavorable movements impacting reported sales, as seen in Q1 2024's ~0.5% negative currency translation effect. Furthermore, rising interest rates could increase 3M's cost of capital, potentially influencing investment decisions and shareholder returns, underscoring the importance of its ongoing deleveraging efforts.

| Economic Factor | 2024-2025 Outlook | Impact on 3M |

|---|---|---|

| Global GDP Growth | Moderating (IMF projects 3.2% for 2024) | Potentially lower demand for 3M products |

| Inflation | Persistent, impacting input costs | Increased cost of goods sold, pressure on margins |

| Interest Rates | Potentially stable to rising | Higher cost of capital, impact on investments and debt |

| Currency Exchange Rates | Volatile | Risk to reported international sales and profits |

Preview the Actual Deliverable

3M PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive 3M PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the strategic landscape surrounding 3M.

Sociological factors

Consumer preferences are increasingly leaning towards sustainability, impacting 3M's product innovation, particularly within its Consumer Business Group. For instance, demand for eco-friendly cleaning supplies and materials is on the rise, pushing 3M to invest in greener alternatives and processes.

The aging global population is a significant demographic shift, directly fueling demand for 3M's healthcare and safety products. As the median age in many developed nations continues to climb, the need for advanced medical materials, wound care, and personal safety equipment is expected to grow substantially through 2025 and beyond.

3M's strategy explicitly centers on understanding these evolving customer needs, leveraging its scientific expertise to develop solutions. This proactive approach is crucial for maintaining market relevance and capitalizing on demographic trends, such as the growing senior market and the increasing environmental consciousness of younger consumers.

Attracting and retaining skilled talent, especially in STEM fields, is paramount for 3M's innovation engine. The company faces a competitive landscape for engineers and scientists, a trend amplified by ongoing global demand. In 2024, reports indicated a persistent shortage of qualified manufacturing and R&D professionals across many developed economies.

3M's success hinges on its ability to cultivate a robust and diverse workforce capable of driving both innovation and operational efficiency. A 2025 projection by the U.S. Bureau of Labor Statistics forecasts continued growth in STEM occupations, underscoring the strategic importance of talent acquisition.

Investing in employee development programs and cultivating an inclusive work environment are crucial for 3M's competitive edge. Companies that prioritize employee growth and belonging often see higher retention rates, a key factor in mitigating the costs associated with high turnover, which can significantly impact productivity and innovation pipelines.

Global health and safety consciousness is a significant driver for 3M, particularly boosting its Safety & Industrial and Health Care business segments. The heightened awareness, amplified by the COVID-19 pandemic, has led to a sustained demand for personal protective equipment (PPE) and advanced healthcare solutions. For instance, in 2024, the global PPE market was projected to reach over $110 billion, a testament to this ongoing trend.

This increased focus on well-being translates directly into market opportunities for 3M's innovative product lines, from respirators and protective apparel to medical supplies and drug delivery systems. The company's commitment to safety isn't just external; 3M actively prioritizes the health and safety of its own workforce, implementing rigorous protocols and investing in workplace safety technologies, which can also inform product development.

Urbanization and Infrastructure Development

Global urbanization continues to accelerate, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050, up from 56% in 2021. This massive population shift directly fuels demand for construction materials, advanced transportation systems, and sophisticated electronics – all sectors where 3M's diverse product portfolio plays a significant role. The growing urban landscape necessitates robust infrastructure, from smart grids to improved public transit, presenting substantial opportunities for 3M's specialized adhesives, coatings, and electronic components.

The increasing density of urban populations also drives innovation in areas like sustainable building materials and efficient energy solutions, aligning with 3M's focus on developing advanced technologies. For instance, 3M's building solutions contribute to energy efficiency in commercial and residential structures, a critical consideration in densely populated urban environments. This trend directly shapes 3M's market strategies, encouraging the development of products that address the unique challenges and opportunities presented by expanding cities worldwide.

- Urban Population Growth: By 2050, an estimated 68% of the global population will reside in urban areas.

- Infrastructure Demand: Urbanization drives increased need for construction, transportation, and electronic infrastructure.

- 3M's Market Alignment: The company's materials and technologies are well-positioned to serve growing urban needs.

Social Responsibility and Community Engagement

Public expectations for corporate social responsibility (CSR) are on the rise, pushing companies like 3M to integrate ethical practices and community engagement deeply into their operations. This societal shift means a strong CSR profile is no longer optional but a critical component of brand value and long-term viability.

3M actively showcases its dedication to sustainability, supporting communities, and encouraging employee volunteerism as core elements of its strategy. For instance, in 2023, 3M employees contributed over 100,000 volunteer hours globally, reflecting a tangible commitment to making a difference beyond their business operations.

Maintaining public trust and a positive reputation hinges on transparency in reporting and robust stakeholder engagement. 3M's annual sustainability reports, detailing progress on environmental, social, and governance (ESG) goals, are vital tools in this regard, providing data-backed insights into their CSR performance.

- Increasing Public Scrutiny: Consumers and investors alike are demanding greater accountability for a company's societal impact.

- 3M's CSR Initiatives: The company highlights its commitment through programs focused on environmental stewardship, education, and community well-being.

- Transparency as a Cornerstone: Openly sharing CSR data and engaging with stakeholders builds credibility and fosters loyalty.

- Impact of Volunteerism: In 2023, 3M employees logged over 100,000 volunteer hours, demonstrating a hands-on approach to community support.

Societal shifts in health and safety awareness continue to significantly benefit 3M, particularly its Health Care and Safety & Industrial segments. The heightened global focus on well-being, spurred by events like the COVID-19 pandemic, has sustained demand for personal protective equipment (PPE) and advanced medical solutions. By 2024, the global PPE market was projected to exceed $110 billion, showcasing the enduring market opportunity for 3M's product lines, from respirators to medical supplies.

Technological factors

3M's fundamental advantage is its deep commitment to science and innovation, consistently dedicating substantial resources to research and development. This focus fuels the introduction of novel products and the enhancement of its existing portfolio.

Looking ahead, 3M has outlined a significant R&D investment plan, earmarking $3.5 billion for the period between 2025 and 2027. The company's ambitious goal is to bring 1,000 new products to market during this timeframe, with a strategic emphasis on high-growth industries and rectifying historical underinvestment in R&D.

Breakthroughs in advanced material science and nanotechnology are fundamental to 3M's innovation pipeline, allowing for the creation of products that are demonstrably lighter, stronger, and possess enhanced functionality. These scientific leaps are particularly impactful in rapidly evolving sectors such as automotive electrification, where lighter materials reduce energy consumption, and industrial automation, where advanced components improve efficiency and durability.

3M's commitment to these fields is evident in its continued investment in research and development, with nanotechnology being a key focus area for future technological themes. For instance, in 2023, 3M reported over $1.8 billion in R&D spending, a significant portion of which is directed towards material science innovations that underpin its diverse product portfolio, from advanced adhesives to specialized films for electronics.

3M's strategic advantage is increasingly tied to its embrace of digitalization, automation, and artificial intelligence. These technologies are fundamentally reshaping how the company designs products and manages its manufacturing. For instance, AI is being leveraged to accelerate the discovery of novel, high-performance materials, a critical component of 3M's innovation pipeline.

The integration of automation across 3M's production lines is a key driver for enhancing both manufacturing efficiency and product quality. This technological shift is not merely about speed; it's about precision and consistency, ensuring that 3M's diverse product portfolio meets stringent performance standards. By late 2024, companies in the industrial sector are reporting significant improvements in throughput and defect reduction through targeted automation investments.

Emerging Technologies (e.g., EV, Climate Tech, Data Centers)

3M is strategically positioning itself within rapidly expanding technological sectors, notably electric vehicles (EVs), climate technology, and data centers. The global EV market is projected to reach $1.5 trillion by 2030, with a compound annual growth rate of over 20%, creating significant demand for 3M's advanced materials.

Innovations in thermal management, battery materials, and specialized adhesives are crucial for EV performance and safety. For instance, 3M's thermal management solutions help dissipate heat in battery packs, a critical factor for range and longevity.

Beyond EVs, 3M is developing solutions for climate technology, including materials for carbon capture and energy efficiency initiatives. The climate tech market is expected to see substantial investment, with global spending on clean energy technologies potentially reaching $2 trillion annually by 2030.

- EV Market Growth: Anticipated to exceed $1.5 trillion by 2030, driving demand for advanced materials.

- Climate Tech Investment: Global clean energy spending could reach $2 trillion annually by 2030.

- Data Center Expansion: The ongoing digital transformation fuels the need for energy-efficient solutions.

- 3M's Role: Providing critical components like thermal management materials and adhesives for these high-growth sectors.

Intellectual Property Protection and Management

Intellectual property (IP) protection is a cornerstone of 3M's strategy. The company actively manages its extensive patent portfolio, which is crucial for maintaining its competitive edge and recouping substantial research and development expenditures. In 2023, 3M continued to invest heavily in R&D, with approximately $2.0 billion allocated to innovation, underscoring the importance of safeguarding these advancements.

Effective IP management allows 3M to secure market leadership and monetize its technological breakthroughs. This involves not only defending against potential infringements but also strategically licensing and leveraging its patents. 3M's robust patent portfolio, encompassing tens of thousands of active patents globally, serves as a significant barrier to entry for competitors and a key driver of its diversified product lines.

- Patent Portfolio Strength: 3M holds a vast number of active patents worldwide, a critical asset for its innovation-driven business model.

- R&D Investment: The company's commitment to R&D, evidenced by its 2023 spending of around $2.0 billion, highlights the strategic importance of IP protection.

- Market Leadership: Strong IP management enables 3M to maintain its position in various markets by preventing unauthorized use of its proprietary technologies.

- Revenue Generation: Beyond defense, 3M strategically utilizes its patents for licensing and other revenue-generating activities, maximizing the return on its innovation investments.

3M's technological prowess is amplified by its strategic embrace of digitalization and AI, accelerating material discovery and optimizing manufacturing processes. The company's substantial R&D investment, projected at $3.5 billion for 2025-2027, fuels innovation in areas like advanced materials and nanotechnology, critical for high-growth sectors.

3M is heavily invested in technologies supporting electric vehicles (EVs) and climate solutions, anticipating significant market expansion. The EV market alone is expected to surpass $1.5 trillion by 2030, driving demand for 3M's specialized adhesives and thermal management materials. Similarly, the burgeoning climate tech sector, with potential annual clean energy spending reaching $2 trillion by 2030, presents further opportunities.

The company's robust intellectual property portfolio, built on consistent R&D spending (around $2.0 billion in 2023), acts as a significant competitive advantage. This IP protection is vital for maintaining market leadership and monetizing technological breakthroughs through licensing and product development.

| Technology Focus Area | Market Projection | 3M's Role/Contribution |

|---|---|---|

| Electric Vehicles (EVs) | $1.5 trillion by 2030 | Advanced adhesives, thermal management materials |

| Climate Technology | $2 trillion annually (clean energy) by 2030 | Materials for carbon capture, energy efficiency |

| Nanotechnology | Integral to new product development | Enhanced material properties (lighter, stronger) |

| Digitalization & AI | Cross-industry adoption | Accelerated material discovery, manufacturing optimization |

Legal factors

3M has been significantly impacted by product liability and mass tort litigation, most notably with the combat earplugs and PFAS lawsuits. These legal battles have led to substantial financial settlements, with the company agreeing to pay billions of dollars to resolve claims related to defective earplugs and environmental contamination. For instance, by early 2024, 3M had committed to settlements totaling over $10 billion for the earplug litigation and billions more for PFAS liabilities.

These ongoing mass tort litigations underscore the immense financial and reputational risks inherent in product liability issues for a company of 3M's scale. The sheer volume of claims and the potential for large judgments or settlements create significant uncertainty and can impact the company's bottom line and investor confidence. Managing these complex legal processes remains a critical operational challenge for 3M.

Environmental regulations, especially those targeting PFAS, create considerable legal and financial challenges for 3M. The company's commitment to cease PFAS production by 2026 underscores the severity of these issues, with significant costs already incurred from environmental liabilities and legal settlements.

As of early 2024, 3M has agreed to pay billions in settlements related to PFAS contamination, including a notable $10.3 billion settlement with public water systems. This highlights the substantial financial impact of these environmental liabilities on the company's operations and future outlook.

Intellectual property laws are paramount for 3M, a company built on innovation. The company's 2023 annual report highlights ongoing efforts to protect its vast patent portfolio, which underpins its diverse product lines. Vigilance against patent infringement is crucial, as legal disputes can lead to significant financial penalties and disrupt market access, impacting 3M's competitive standing.

Antitrust and Competition Laws

3M, as a multinational corporation with a vast product portfolio, navigates a complex web of antitrust and competition laws across numerous jurisdictions. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all businesses. For instance, in 2023, the European Commission continued its scrutiny of various industries for potential anti-competitive behavior, a trend expected to persist into 2024 and 2025, impacting how 3M structures its market strategies and potential acquisitions.

Adherence to these legal frameworks is not merely a matter of avoiding legal repercussions; it's fundamental to maintaining operational integrity and market trust. Failure to comply can result in significant financial penalties, as seen in past antitrust cases globally where companies have faced multi-billion dollar fines. For 3M, such penalties could disrupt financial stability and investment plans.

Allegations or proven violations of antitrust laws can trigger extensive investigations by regulatory bodies like the U.S. Department of Justice or the European Commission. These investigations are costly and time-consuming, diverting resources and management attention. Furthermore, such legal challenges can severely damage 3M's reputation, impacting customer loyalty and investor confidence, which are critical for long-term growth and market share.

- Global Regulatory Landscape: 3M operates under antitrust regulations in over 100 countries, requiring constant monitoring of evolving legal standards.

- Potential Fines: In 2023, various competition authorities levied fines totaling billions of dollars for antitrust violations, setting a precedent for future enforcement.

- Reputational Risk: Antitrust investigations can lead to negative media coverage, impacting brand image and consumer trust, crucial for a company like 3M.

- Merger Control: 3M's growth strategies, including mergers and acquisitions, are subject to strict antitrust review, potentially delaying or blocking deals.

Labor Laws and Employment Regulations

3M navigates a complex web of labor laws and employment regulations across its worldwide operations. These regulations govern everything from minimum wages and working conditions to anti-discrimination statutes, ensuring fair treatment for its vast workforce. For instance, in 2024, the US Department of Labor continued to enforce stricter guidelines on wage and hour compliance, impacting companies like 3M with significant hourly workforces.

Failure to adhere to these evolving legal frameworks can result in substantial penalties and reputational damage. In 2024, several large corporations faced significant fines for violations related to overtime pay and workplace safety, underscoring the financial risks of non-compliance. 3M's commitment to robust compliance programs is therefore critical for mitigating these legal and financial exposures.

Maintaining equitable labor practices is not just a legal necessity but a cornerstone of operational resilience and employee morale. Positive employee relations, fostered by adherence to fair labor standards, contribute directly to productivity and innovation. By prioritizing ethical employment, 3M can foster a stable environment conducive to long-term growth.

- Global Compliance Burden: 3M must manage varying labor laws in over 70 countries, impacting hiring, compensation, and termination processes.

- Regulatory Scrutiny: In 2024, labor agencies worldwide increased audits, with a particular focus on gig economy worker classification and pay equity.

- Cost of Non-Compliance: Fines for labor law violations can range from thousands to millions of dollars, alongside potential class-action lawsuits.

- Strategic Importance: Fair labor practices are integral to 3M's brand reputation and its ability to attract and retain top talent in a competitive market.

3M faces significant legal challenges stemming from product liability, particularly the combat earplugs and PFAS litigation. By early 2024, the company had committed over $10 billion to earplug settlements and billions more for PFAS liabilities, highlighting the immense financial and reputational risks. These ongoing mass tort litigations create substantial uncertainty and impact investor confidence.

Environmental regulations, especially concerning PFAS, pose considerable legal and financial hurdles for 3M. The company's commitment to cease PFAS production by 2026 reflects the severity of these issues, with substantial costs already incurred. As of early 2024, 3M agreed to a $10.3 billion settlement with public water systems regarding PFAS contamination.

Intellectual property laws are crucial for 3M's innovation-driven business. Protecting its extensive patent portfolio is vital, as infringement disputes can lead to significant financial penalties and market access disruption, affecting its competitive edge.

3M operates under a complex global web of antitrust and competition laws. In 2023, regulatory scrutiny of anti-competitive behavior persisted, a trend expected to continue into 2024-2025, influencing 3M's market strategies and potential acquisitions.

| Legal Factor | Key Issues | Estimated Financial Impact (as of early 2024) | Regulatory Focus (2023-2025) |

| Product Liability (Earplugs) | Defective product claims | $10+ billion in settlements | Ongoing litigation and appeals |

| Environmental Liabilities (PFAS) | Contamination and health concerns | Billions in settlements, including $10.3B to water systems | Stricter regulations, production phase-out (by 2026) |

| Intellectual Property | Patent infringement | Variable fines, market access disruption | Increased vigilance against infringement |

| Antitrust & Competition | Monopolistic practices, mergers | Potential multi-billion dollar fines globally | Heightened scrutiny by global competition authorities |

Environmental factors

3M is committed to tackling climate change, aiming for carbon neutrality by 2050 and significant reductions across its Scope 1, 2, and 3 greenhouse gas (GHG) emissions. This commitment is backed by concrete actions and investments in climate technology.

In 2023, 3M reported a 42% reduction in absolute Scope 1 and 2 GHG emissions compared to its 2019 baseline, demonstrating tangible progress towards its ambitious targets. The company also advanced its Scope 3 emission reduction efforts, a crucial step in addressing its broader value chain impact.

Water scarcity and quality are significant environmental concerns for 3M. The company has set ambitious goals to reduce its water footprint, aiming for a 25% reduction in water withdrawal intensity by 2025 and a 30% reduction by 2030 compared to a 2019 baseline. This commitment involves substantial investment in advanced water purification technologies across its global manufacturing sites, ensuring that water returned to the environment meets stringent quality standards.

3M is actively pursuing waste reduction and circular economy principles, aiming to lessen its environmental footprint. The company is focused on sustainable product design and using eco-friendly materials, alongside optimizing packaging to cut down on waste. For instance, 3M has set targets to reduce its reliance on virgin fossil-based plastics.

These initiatives are not just about environmental stewardship; they also contribute to operational efficiency. By striving for zero waste to landfill at various facilities, 3M is demonstrating a commitment to more sustainable manufacturing practices. This approach can lead to cost savings through reduced disposal fees and more efficient resource utilization.

Resource Scarcity and Sustainable Sourcing

The increasing scarcity of key raw materials, such as rare earth elements essential for advanced electronics and certain specialty chemicals, directly impacts 3M's manufacturing processes. This necessitates a robust strategy for sustainable sourcing and the active development of alternative, more readily available materials. For instance, in 2024, the global supply of critical minerals like cobalt, vital for battery technologies, faced price volatility due to geopolitical tensions and concentrated mining operations, highlighting the need for 3M to diversify its material inputs and explore bio-based or recycled alternatives.

3M's commitment to sustainability extends to its supply chain, requiring close collaboration with suppliers to ensure adherence to environmental and ethical standards. By prioritizing responsibly sourced materials, 3M aims to secure long-term resource availability while mitigating the environmental footprint associated with extraction and processing. This proactive approach is crucial as regulatory bodies worldwide, including the European Union with its proposed Critical Raw Materials Act, are increasingly focusing on supply chain resilience and responsible sourcing practices, impacting companies like 3M that rely on global material networks.

- Global demand for critical minerals, essential for many of 3M's high-performance products, is projected to surge by over 400% by 2040, according to the International Energy Agency, underscoring the urgency of sustainable sourcing.

- 3M reported in its 2023 sustainability report that it had increased its use of recycled content by 15% compared to its 2019 baseline, demonstrating progress in material innovation.

- The company's investment in research and development for bio-based adhesives and coatings aims to reduce reliance on petrochemical feedstocks, a key strategy to combat resource scarcity.

- In 2024, 3M announced a partnership with a leading recycling technology firm to explore advanced chemical recycling methods for plastics used in its consumer goods, further addressing material circularity.

Biodiversity and Ecosystem Protection

3M acknowledges the critical role of biodiversity and ecosystem protection, especially within its extensive supply chain. The company actively manages risks associated with deforestation by prioritizing timber-based forest products sourced from demonstrably sustainable origins. This commitment helps ensure that raw material procurement aligns with conservation goals.

Furthermore, 3M's operational framework includes stringent measures to prevent negative impacts on local ecosystems. This proactive approach aims to safeguard natural habitats and biodiversity surrounding its manufacturing facilities and other operational sites. For instance, in 2023, 3M reported investing over $300 million in environmental initiatives, including those focused on resource conservation and biodiversity.

- Sustainable Sourcing: 3M prioritizes timber from certified sustainable forests, such as those recognized by the Forest Stewardship Council (FSC).

- Ecosystem Impact Mitigation: The company implements environmental management systems to minimize pollution and habitat disruption at its global sites.

- Biodiversity Monitoring: 3M engages in monitoring programs to assess and understand the ecological health of areas adjacent to its operations.

- Supply Chain Due Diligence: Efforts are made to ensure suppliers also adhere to environmental standards that protect biodiversity.

3M is actively addressing climate change, targeting carbon neutrality by 2050 and significant reductions in its greenhouse gas emissions. The company achieved a 42% reduction in absolute Scope 1 and 2 GHG emissions by 2023 compared to a 2019 baseline, demonstrating progress in its environmental strategy.

Water stewardship is a key focus, with 3M aiming for a 25% reduction in water withdrawal intensity by 2025 and 30% by 2030 from a 2019 baseline, supported by investments in water purification technologies.

The company is also committed to waste reduction and circular economy principles, increasing its use of recycled content by 15% since 2019 and exploring advanced recycling methods for plastics.

Resource scarcity, particularly for critical minerals, presents a challenge, driving 3M to focus on sustainable sourcing and developing alternative materials, with global demand for these minerals projected to surge significantly.

| Environmental Factor | 3M's Goal/Action | Progress/Data Point (2023/2024) |

|---|---|---|

| Climate Change | Carbon Neutrality by 2050 | 42% reduction in Scope 1 & 2 GHG emissions (vs. 2019) |

| Water Scarcity | 25% reduction in water withdrawal intensity by 2025 (vs. 2019) | Investment in advanced water purification technologies |

| Waste Reduction | Circular economy principles, reduced virgin fossil-based plastics | 15% increase in recycled content use (vs. 2019) |

| Resource Scarcity | Sustainable sourcing, alternative materials development | Partnership for advanced chemical recycling of plastics |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading market research firms. We meticulously gather insights from economic indicators, regulatory updates, and technological trend reports to ensure comprehensive and accurate assessments.