2CRSI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2CRSI Bundle

2CRSI leverages its strong technological expertise and growing European market presence as key strengths, but faces challenges from intense competition and the need for continuous innovation. Understanding these dynamics is crucial for any stakeholder looking to capitalize on their trajectory.

Want the full story behind 2CRSI's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

2CRSI's strength lies in its innovative approach to creating energy-efficient IT servers and storage. This focus directly addresses the increasing market demand for sustainable computing, allowing clients to lower operational expenses and their environmental impact. For instance, their high-density servers are designed to maximize performance per watt, a crucial factor as data centers globally aim to reduce their significant energy consumption, which in 2023 accounted for roughly 1-1.5% of global electricity use.

2CRSI's core strength lies in its deep expertise in customization and scalability, allowing them to craft infrastructure solutions precisely matched to individual client needs. This bespoke approach ensures optimal performance and a distinct competitive advantage over generic offerings.

By tailoring machines to specific application use cases, 2CRSI guarantees the highest performance levels for its clients. This focus on bespoke engineering, for instance, was evident in their work with a major European cloud provider in 2024, where they delivered highly optimized server configurations that boosted application processing speeds by an average of 15%.

2CRSI's focus on high-growth sectors like cloud computing, data centers, HPC, and AI is a significant strength. These markets are booming, with global cloud infrastructure spending projected to reach $340 billion in 2024, according to Synergy Research Group. This positions 2CRSI to benefit from substantial demand for its specialized IT infrastructure solutions.

The company's strategic emphasis on advanced fields such as AI and HPC is already yielding positive results. For instance, 2CRSI reported a substantial increase in its revenue, with a 33% year-on-year growth in the first half of 2024, reaching €120.1 million. This growth is directly linked to its ability to serve these high-value, demanding applications.

Commitment to Sustainability

2CRSI's commitment to sustainability is a cornerstone of its strategy, focusing on optimizing energy consumption and minimizing environmental footprints. This 'Green IT' approach resonates strongly with clients prioritizing eco-friendly solutions and aligns with increasing global environmental regulations and corporate social responsibility expectations, bolstering 2CRSI's brand image.

The company actively pursues a vision of energy autonomy for its projects, aiming for a negative carbon impact. This forward-thinking strategy not only addresses environmental concerns but also positions 2CRSI as a leader in sustainable technological development.

- Energy Efficiency: 2CRSI's solutions are designed to reduce energy usage in data centers and IT infrastructure.

- Environmental Impact Reduction: The company targets a negative carbon footprint for its projects, reflecting a deep commitment to ecological balance.

- Regulatory Alignment: This focus on sustainability helps 2CRSI meet and exceed evolving environmental standards and client ESG (Environmental, Social, and Governance) requirements.

- Brand Reputation: A strong sustainability ethos enhances 2CRSI's appeal to a growing segment of environmentally conscious customers and investors.

Strong Commercial Momentum and Revenue Growth

2CRSI is experiencing a significant upswing in its commercial performance, marked by impressive revenue growth. For the fiscal year 2024/2025, the company reported a substantial 31% increase in revenue, reaching €220.8 million. This strong financial showing is a direct result of 2CRSI's strategic focus on lucrative market segments and the high demand for its energy-efficient server solutions, underscoring its successful market penetration and operational effectiveness.

The company's ability to capitalize on market trends, particularly the increasing need for sustainable and high-performance computing infrastructure, has fueled this robust commercial momentum. This growth trajectory highlights 2CRSI's competitive advantage and its capacity to meet evolving customer requirements in a dynamic technological landscape.

Key factors contributing to this strength include:

- Significant Revenue Increase: Achieved €220.8 million in revenue for FY24/25, a 31% year-over-year growth.

- Strategic Market Positioning: Successfully targeting high-value market segments with growing demand.

- Product Demand: Strong market acceptance driven by the appeal of energy-efficient server technology.

- Effective Execution: Demonstrates strong business execution and ability to translate market opportunities into financial gains.

2CRSI's robust financial performance, highlighted by a 31% year-over-year revenue increase to €220.8 million for FY24/25, underscores its market strength. This growth is fueled by strategic positioning in high-demand sectors like AI and HPC, coupled with strong customer adoption of its energy-efficient server solutions.

The company's expertise in customization and scalability allows for tailored infrastructure solutions, ensuring optimal client performance and a competitive edge. This bespoke approach, demonstrated by a 15% average boost in application processing speeds for a major European cloud provider in 2024, directly translates into tangible client benefits.

2CRSI's commitment to sustainability, aiming for a negative carbon footprint, resonates with environmentally conscious clients and aligns with increasing global ESG expectations, enhancing its brand reputation and market appeal.

| Metric | Value (FY24/25) | Year-over-Year Growth |

| Revenue | €220.8 million | 31% |

| Key Market Focus | Cloud Computing, Data Centers, HPC, AI | High Growth Potential |

| Product Advantage | Energy-efficient, Customizable Servers | Increased Client Performance |

What is included in the product

Delivers a strategic overview of 2CRSI’s internal and external business factors, highlighting its strengths in high-performance computing and its opportunities in emerging markets, while also addressing weaknesses in brand recognition and threats from intense competition.

Offers a clear, actionable framework for identifying and mitigating potential threats and weaknesses, thereby relieving the pain of strategic uncertainty.

Weaknesses

As a hardware manufacturer, 2CRSI is susceptible to supply chain disruptions, particularly its reliance on specific component suppliers. The global supply chain for data center components has been tightening, with lead times for certain items extending. For instance, reports from late 2023 and early 2024 indicated extended lead times for high-performance processors and specialized memory modules, crucial for 2CRSI's server and storage solutions.

These vulnerabilities can directly impact production schedules and increase costs. Fluctuations in the availability or pricing of critical raw materials and components, such as semiconductors and specialized cooling systems, could force 2CRSI to absorb higher expenses or pass them on to customers, potentially affecting sales volume and profit margins. The company's ability to secure these components at competitive prices remains a key challenge.

The IT server and storage market is intensely competitive, with established global giants like Dell, HPE, and Lenovo holding significant market share. These larger players benefit from extensive resources for research and development, aggressive marketing campaigns, and strong brand recognition, making it challenging for smaller companies like 2CRSI to gain traction. For instance, in 2024, the global server market was projected to reach over $120 billion, a space where 2CRSI operates against these formidable competitors.

Despite a robust revenue trajectory, 2CRSI faces persistent hurdles in enhancing its profit margins. This is particularly true within the highly competitive landscape it operates in.

The company has articulated ambitious targets for its EBITDA margin, aiming for significant improvement. Achieving these goals necessitates stringent cost control measures and astute strategic pricing policies.

Capital Intensive Nature of Manufacturing and Expansion

Manufacturing high-performance IT hardware, especially for demanding sectors like AI, inherently requires substantial upfront capital. This includes investment in advanced research and development, state-of-the-art production facilities, and specialized machinery. For instance, establishing a new manufacturing line for AI-optimized servers could easily run into tens of millions of euros.

This capital-intensive nature can constrain 2CRSI's ability to quickly scale operations or diversify into new service areas, such as expanding cloud solutions, without external financial support. The need for significant investment means that rapid growth or entering new markets might be contingent on securing additional funding rounds.

2CRSI is actively pursuing new funding avenues to fuel its expansion plans, particularly within the rapidly growing AI sector. This strategic move aims to provide the necessary capital for increased production capacity and the development of new AI-focused hardware solutions. For example, securing a €50 million funding round in late 2024 would be crucial for these expansion efforts.

The company's commitment to innovation in areas like AI servers necessitates ongoing capital expenditure. This could present a weakness if market demand fluctuates or if the company struggles to secure the required financing for these ambitious growth initiatives.

Exposure to Rapid Technological Obsolescence

The technology sector is notoriously fast-paced, meaning 2CRSI's existing products could quickly become outdated as newer, more advanced solutions emerge. This necessitates substantial and ongoing investment in research and development to keep its product portfolio competitive and relevant in the market.

For instance, the rapid advancements in artificial intelligence (AI) hardware demand continuous innovation. Companies like 2CRSI must adapt their offerings to support the increasing computational power required for AI applications, a trend that is only expected to accelerate through 2025.

- Constant R&D Investment: 2CRSI faces the ongoing challenge of allocating significant resources to R&D to counter the risk of technological obsolescence.

- AI Hardware Demands: The accelerating development of AI technologies requires 2CRSI to continuously innovate its hardware solutions to meet growing performance needs.

- Market Competitiveness: Failure to keep pace with technological evolution could lead to a loss of market share and reduced competitiveness.

2CRSI's reliance on a limited number of component suppliers makes it vulnerable to supply chain disruptions, potentially impacting production and increasing costs. The intense competition from larger, well-resourced players like Dell and HPE poses a significant challenge to market share growth. Furthermore, the capital-intensive nature of high-performance hardware manufacturing requires substantial ongoing investment, which could constrain expansion and diversification efforts if financing is not secured.

Preview the Actual Deliverable

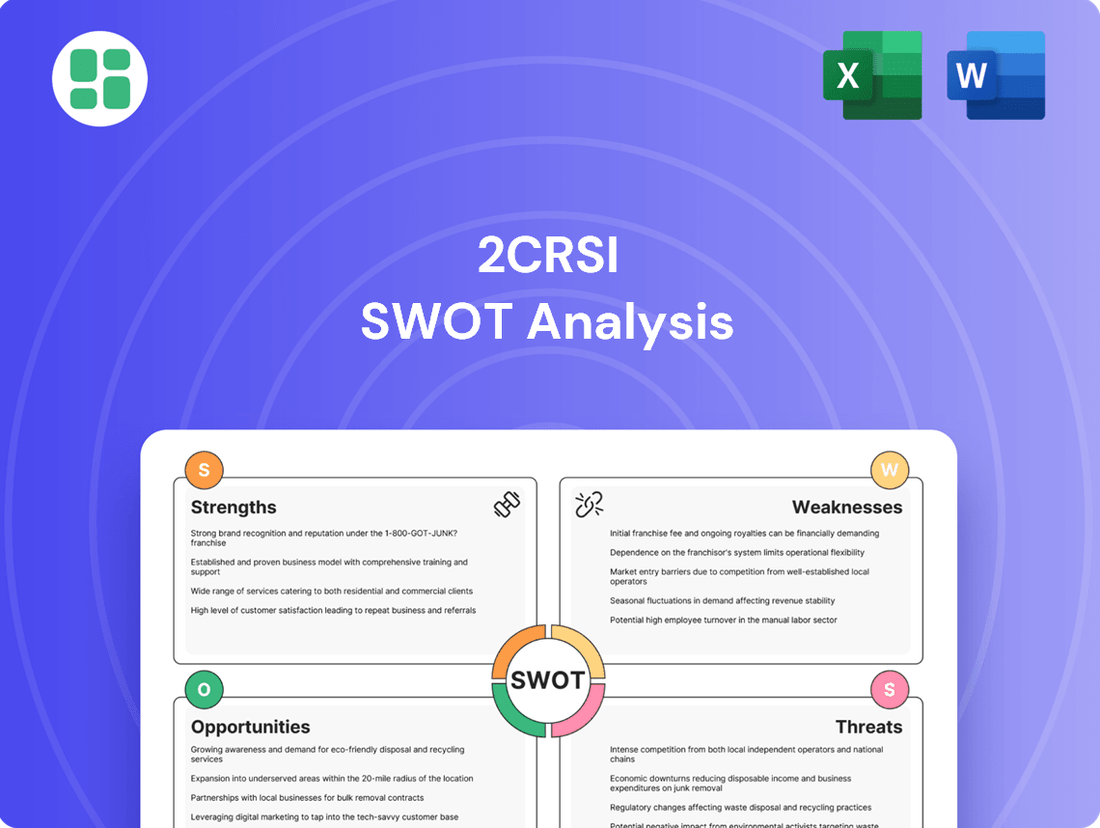

2CRSI SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of 2CRSI's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key internal and external factors impacting 2CRSI's market position and future growth potential.

Opportunities

The rapid expansion of artificial intelligence and high-performance computing presents a substantial growth avenue for 2CRSI. The increasing complexity of AI models and the escalating demand for data processing directly fuel the need for specialized, energy-efficient hardware, a niche where 2CRSI excels. This is evidenced by their significant traction, including a notable $100 million contract secured in the US for AI servers, underscoring their capability to capitalize on this burgeoning market.

The increasing global demand for environmentally friendly IT solutions and energy-efficient data centers is a significant opportunity for 2CRSI. This trend aligns perfectly with the company's core mission of optimizing energy consumption in computing, allowing it to attract clients aiming to lower their carbon emissions and operational expenses.

2CRSI's commitment to sustainability is exemplified by projects such as its 'AI Gigafactory,' which boasts a negative carbon footprint. This focus on green IT positions the company to capture a larger share of a rapidly expanding market as more businesses prioritize eco-conscious operations.

2CRSI is strategically broadening its horizons by launching 2CRSI Cloud Solutions, a dedicated subsidiary focused on high-performance cloud services. This move taps into the growing demand for cloud infrastructure and specialized computing power, creating a significant new avenue for revenue generation.

Concurrently, the company is pursuing aggressive geographical expansion, targeting key markets in the US, Europe, and Asia. This dual approach of expanding service offerings and market presence is designed to diversify revenue streams and capture a larger share of the global IT solutions market.

Strategic Partnerships and Collaborative Projects

Forging strategic alliances with key technology players, such as NVIDIA, can significantly boost 2CRSI's capabilities and market presence. These partnerships are crucial for accessing cutting-edge components and co-developing advanced solutions, particularly in the rapidly evolving AI and high-performance computing sectors. For instance, collaborations can lead to optimized hardware designs tailored for specific AI workloads, giving 2CRSI a competitive edge.

Participation in significant European initiatives, like the PILOT and HIGHER projects, offers a platform for innovation and growth. These projects, focused on developing advanced European processors and AI solutions, not only provide substantial funding but also foster collaboration with leading research institutions and industry partners. Such involvement helps 2CRSI stay at the forefront of technological advancements and strengthens its position within the European tech ecosystem.

- Enhanced Innovation: Access to NVIDIA's AI technologies and expertise can accelerate 2CRSI's product development cycles.

- Market Expansion: Collaborations within European projects can open doors to new markets and customer segments.

- Technological Advancement: Involvement in PILOT and HIGHER projects positions 2CRSI to leverage and contribute to next-generation European processor and AI technologies.

- Competitive Positioning: Strategic partnerships and project participation solidify 2CRSI's standing against larger, established competitors.

Relocalization of Production and National Sovereignty Initiatives

2CRSI's participation in initiatives like France's 'Industrie 4.0' program is a significant opportunity. This focus on relocalizing electronics production directly supports national sovereignty goals by lessening dependence on potentially fragile global supply chains.

This strategic shift enhances operational resilience, a critical factor in today's volatile economic landscape. Furthermore, aligning with these national objectives positions 2CRSI favorably for securing government contracts and subsidies aimed at bolstering domestic manufacturing capabilities.

For instance, the French government's investment in industrial modernization, including significant funding for digital transformation in manufacturing sectors, provides a tangible tailwind. By demonstrating its commitment to these national priorities, 2CRSI can tap into a growing market driven by security and self-sufficiency concerns.

Key benefits include:

- Reduced supply chain risk: Lessening exposure to international disruptions.

- Government support: Access to funding and preferential treatment for national projects.

- Enhanced market position: Capitalizing on the trend towards localized production.

- Increased operational control: Greater oversight over manufacturing processes and quality.

The burgeoning field of artificial intelligence and high-performance computing presents a significant growth opportunity for 2CRSI, driven by the increasing demand for specialized, energy-efficient hardware. The company's strategic expansion into cloud solutions and its focus on green IT further position it to capitalize on evolving market needs and sustainability trends.

2CRSI's proactive engagement in European technological initiatives, such as PILOT and HIGHER, alongside strategic partnerships, notably with NVIDIA, are key drivers for innovation and market penetration. These collaborations are critical for staying ahead in the rapidly advancing AI and HPC sectors, ensuring access to cutting-edge components and co-development of advanced solutions.

The company's alignment with national sovereignty goals, particularly through participation in France's 'Industrie 4.0' program, offers a substantial advantage by reducing supply chain risks and fostering stronger relationships with government entities. This focus on relocalizing electronics production resonates with the growing global emphasis on secure and self-sufficient supply chains.

| Opportunity Area | Description | Key Benefit | Supporting Data/Example |

|---|---|---|---|

| AI & High-Performance Computing | Growing demand for specialized, energy-efficient hardware. | Directly addresses a core competency and market need. | $100 million US contract for AI servers. |

| Green IT & Energy Efficiency | Increasing global demand for sustainable IT solutions. | Attracts environmentally conscious clients and lowers operational costs. | 'AI Gigafactory' with a negative carbon footprint. |

| Cloud Solutions Expansion | Launch of 2CRSI Cloud Solutions subsidiary. | Taps into growing cloud infrastructure demand and creates new revenue streams. | Dedicated focus on high-performance cloud services. |

| Geographical Expansion | Targeting key markets in US, Europe, and Asia. | Diversifies revenue and captures a larger global market share. | Aggressive market presence strategy. |

| Strategic Partnerships | Alliances with technology leaders like NVIDIA. | Accelerates product development and market access. | Co-development of advanced AI solutions. |

| European Initiatives | Participation in PILOT and HIGHER projects. | Fosters innovation, secures funding, and strengthens European tech ecosystem position. | Development of advanced European processors and AI solutions. |

| National Sovereignty & Relocalization | Alignment with 'Industrie 4.0' and similar programs. | Reduces supply chain risk and enables access to government support. | Focus on relocalizing electronics production in France. |

Threats

The IT hardware sector, especially for high-performance computing and AI, is incredibly competitive. Established companies and emerging players are always bringing out new, cheaper, or better products. This means 2CRSI constantly faces the risk of rivals offering superior solutions, which could shrink its market share and ability to set prices.

In 2024, the global AI hardware market is projected to reach over $100 billion, a significant increase driven by demand for specialized processors and servers. Major players like NVIDIA and Intel, alongside a growing number of Chinese manufacturers, are aggressively competing on both innovation and cost. This intense environment puts pressure on companies like 2CRSI to maintain a competitive edge in both technology and pricing to avoid losing ground.

The computing, storage, and AI sectors are experiencing incredibly fast technological evolution. For 2CRSI, a significant innovation from a rival or a major change in industry benchmarks could swiftly diminish the competitiveness of their existing offerings, potentially making them outdated and requiring substantial, accelerated investment in adaptation.

Global economic volatility presents a significant threat to 2CRSI. Economic downturns, persistent inflation, and geopolitical instability directly impact corporate IT budgets. For instance, a slowdown in global GDP growth, such as the projected 2.6% for 2024 by the IMF, often leads businesses to cut discretionary spending, including investments in new server and storage infrastructure.

This reduction in demand can directly affect 2CRSI's sales volumes and overall profitability. Companies facing economic uncertainty tend to defer or cancel IT upgrade projects, making it harder for 2CRSI to secure new contracts and maintain its revenue streams. The sensitivity of IT spending to macroeconomic shifts means 2CRSI's financial performance is intrinsically linked to the broader economic climate.

Supply Chain Geopolitical Risks and Trade Barriers

2CRSI's reliance on global supply chains for critical components makes it vulnerable to geopolitical tensions and trade disputes. For instance, the ongoing semiconductor shortage, exacerbated by trade restrictions between major economies in 2023-2024, significantly impacted the availability and cost of essential parts for server manufacturing.

These trade barriers, including tariffs and potential export controls, can directly disrupt 2CRSI's manufacturing processes and increase the cost of goods sold. A notable example is the imposition of tariffs on electronic components in late 2023, which added an estimated 5-10% to the cost of certain imported parts. This situation can lead to production delays and reduced profit margins.

Furthermore, evolving international relations can restrict market access for 2CRSI's products or create uncertainty around future sales. The company must navigate a complex landscape where political instability in key manufacturing regions or major consumer markets could swiftly alter its operational and strategic outlook.

- Geopolitical Instability: Increased risk of supply chain disruptions due to international conflicts or political unrest impacting component sourcing.

- Trade Tariffs: Potential for new or increased tariffs on imported electronic components, raising manufacturing costs.

- Export Controls: Risk of restrictions on the export of critical technologies or components from key supplier nations.

- Market Access Restrictions: Possibility of trade barriers limiting 2CRSI's ability to sell its products in certain international markets.

Dependency on Specific GPU Technologies and Vendors

2CRSI's reliance on NVIDIA GPUs for its high-performance AI servers, while a current strength, presents a significant threat. A concentrated dependency on a single vendor like NVIDIA exposes the company to potential disruptions. For instance, if NVIDIA were to implement substantial price increases in 2024 or 2025, or if supply chain issues impacted NVIDIA's production, 2CRSI's cost structure and product availability could be severely affected.

Furthermore, any shifts in NVIDIA's strategic focus or product roadmap could directly influence 2CRSI's competitive edge in the rapidly evolving AI hardware market. This vulnerability was highlighted in late 2023 and early 2024 as the demand for AI-specific chips surged, leading to price volatility and allocation challenges for many hardware providers.

- Vendor Lock-in: High dependency on NVIDIA limits flexibility and negotiation power.

- Price Volatility: Potential for increased costs due to NVIDIA's pricing strategies or market demand.

- Supply Chain Risk: Disruptions in NVIDIA's manufacturing or distribution can halt 2CRSI's production.

- Strategic Alignment: Future product development is tied to NVIDIA's technological advancements and priorities.

Intense competition in the high-performance computing and AI hardware sectors poses a significant threat, with rivals frequently introducing superior or more cost-effective solutions. This dynamic market, projected for global AI hardware to exceed $100 billion in 2024, pressures 2CRSI to continually innovate and maintain competitive pricing to avoid market share erosion.

Rapid technological advancements in computing, storage, and AI mean that a rival's breakthrough innovation could quickly render 2CRSI's current offerings obsolete, demanding substantial and accelerated investment in adaptation and potentially impacting profitability.

Global economic volatility, including potential GDP slowdowns like the IMF's 2.6% projection for 2024, directly threatens 2CRSI by impacting corporate IT budgets and leading to deferred or canceled infrastructure upgrade projects, thereby reducing sales volumes and revenue streams.

Geopolitical instability and trade disputes create supply chain vulnerabilities for 2CRSI, as seen with semiconductor shortages in 2023-2024, potentially increasing component costs by 5-10% due to tariffs and export controls, impacting production and profit margins.

2CRSI's significant reliance on NVIDIA for AI server GPUs presents a risk; price hikes or supply disruptions from NVIDIA could severely affect 2CRSI's costs and product availability, as evidenced by price volatility and allocation challenges in late 2023 and early 2024.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from 2CRSI's official financial reports, comprehensive market research, and expert industry analysis to ensure a well-rounded and insightful assessment.