2CRSI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2CRSI Bundle

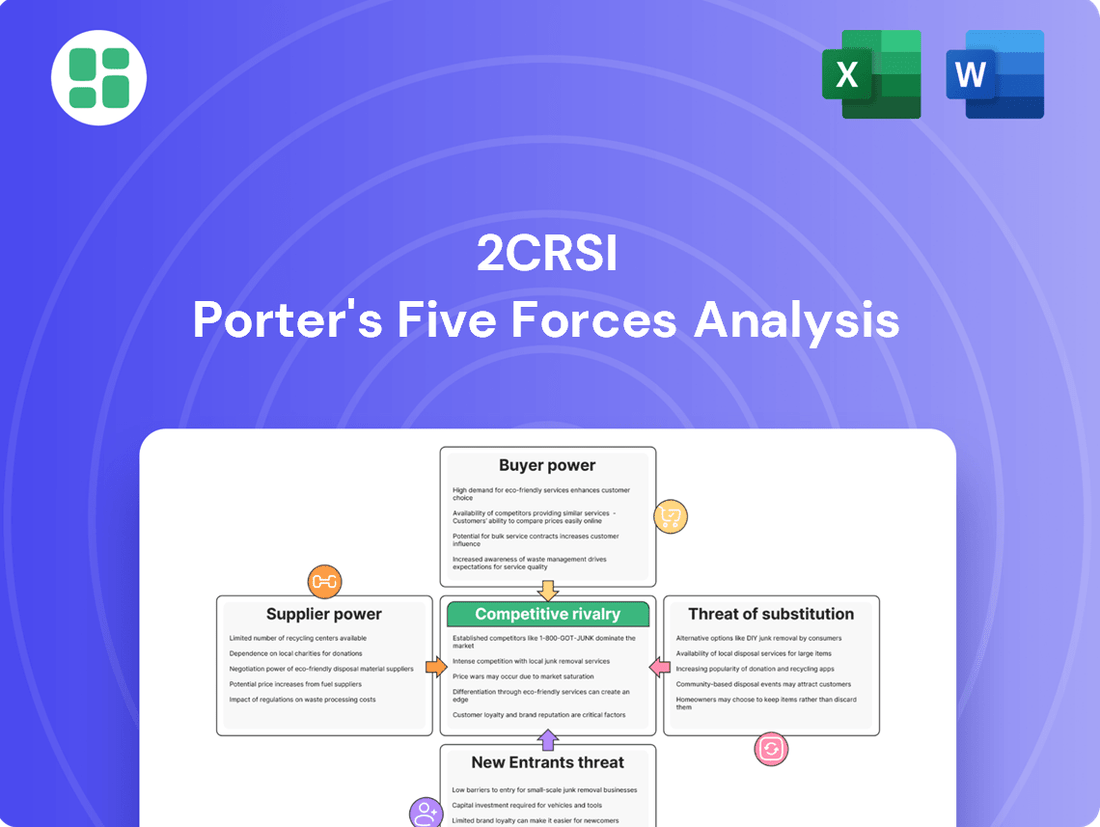

Understanding the competitive landscape for 2CRSI requires a deep dive into the forces shaping its industry. From the bargaining power of buyers to the threat of new entrants, each element plays a crucial role in defining the company's strategic position.

The complete report reveals the real forces shaping 2CRSI’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key component suppliers, particularly for CPUs, GPUs, and memory, grants them considerable bargaining power over 2CRSI. Major manufacturers such as NVIDIA, Intel, and AMD hold sway over critical technologies vital for high-performance computing and AI servers. This limited pool of high-tech producers restricts 2CRSI's options for sourcing these specialized components.

The bargaining power of suppliers for 2CRSI is significant, largely due to high switching costs for critical components. For instance, custom server designs are often intricately linked to specific chip architectures, meaning a change in supplier necessitates costly and time-consuming re-engineering of products. This deep integration fosters a dependency that limits 2CRSI's ability to negotiate favorable terms or readily switch to alternative providers.

The bargaining power of suppliers for 2CRSI is significant due to the critical nature of their components. For 2CRSI's high-performance, energy-efficient solutions, especially those targeting AI and HPC, the quality and reliability of supplier inputs directly influence product differentiation and customer satisfaction. In 2023, 2CRSI reported that its cost of goods sold represented approximately 70% of its revenue, highlighting the substantial impact of supplier pricing on its profitability.

Supplier Power 4

The bargaining power of suppliers for 2CRSI is significantly influenced by ongoing global supply chain disruptions and geopolitical tensions, especially concerning electronic components. These factors can directly affect the reliability and pricing of essential materials, giving suppliers more leverage. For instance, the semiconductor shortage that persisted through 2023 and into early 2024 led to extended lead times and increased costs for many technology firms, a trend that likely continued to impact companies like 2CRSI.

Raw material scarcity and evolving trade policies further amplify supplier leverage. When critical inputs become harder to source or subject to new tariffs, 2CRSI may face longer production cycles and higher expenses. This situation strengthens the position of suppliers who can offer consistent access to these materials, allowing them to dictate terms and prices more effectively.

- Increased Lead Times: Global shortages of key electronic components, such as advanced processors and memory chips, have historically led to lead times extending from weeks to many months.

- Price Volatility: The cost of raw materials like rare earth metals, essential for certain electronic components, has seen significant fluctuations due to geopolitical instability and mining output.

- Limited Supplier Options: For highly specialized or custom-designed components, the number of qualified suppliers can be very limited, concentrating power in the hands of those few providers.

- Supply Chain Dependencies: Companies heavily reliant on a few key suppliers for critical parts are inherently more vulnerable to price increases or supply disruptions.

Supplier Power 5

While 2CRSI's specialization in custom servers and advanced cooling solutions, such as immersion cooling, provides some unique value, it doesn't completely neutralize the significant influence of key component suppliers. These suppliers, often large global manufacturers of CPUs, GPUs, and memory, hold considerable sway due to the critical nature of their products for 2CRSI's high-performance computing offerings.

The company's innovation pipeline is intrinsically linked to the technological advancements rolled out by these dominant component providers, ensuring their leverage remains substantial. For instance, Intel and AMD, major CPU suppliers, frequently introduce new architectures that dictate the performance benchmarks for servers, compelling companies like 2CRSI to adopt them.

- Component Dependency: 2CRSI relies on a limited number of high-volume suppliers for essential components like processors and memory modules, increasing supplier bargaining power.

- Technological Innovation: The pace of innovation in computing hardware, driven by suppliers like NVIDIA for GPUs, means 2CRSI must often adhere to supplier roadmaps and pricing for cutting-edge technology.

- Limited Switching Costs: While 2CRSI designs custom solutions, the core components themselves have relatively low switching costs for the supplier, as they can easily sell to other server manufacturers.

The bargaining power of suppliers for 2CRSI is substantial due to the critical nature of components like CPUs and GPUs, often sourced from a limited number of dominant manufacturers. This concentration means suppliers like NVIDIA, Intel, and AMD can exert significant influence over pricing and availability, impacting 2CRSI's cost structure and product development timelines.

High switching costs associated with integrating specialized chip architectures into custom server designs further solidify supplier leverage. The need for extensive re-engineering when changing component providers makes 2CRSI dependent on existing suppliers, limiting its negotiation flexibility.

Global supply chain disruptions and geopolitical factors, particularly affecting semiconductors, continued to bolster supplier power through 2023 and into 2024. These external pressures often translate into extended lead times and increased component costs for 2CRSI, directly affecting its profitability and operational efficiency.

| Factor | Impact on 2CRSI | Supplier Leverage |

| Component Concentration | Reliance on few high-tech producers (e.g., Intel, AMD, NVIDIA) | High |

| Switching Costs | Custom server integration with specific chip architectures | High |

| Supply Chain Volatility | Impact of shortages and geopolitical tensions on component availability and price | High |

| Innovation Dependency | Need to adopt supplier roadmaps for cutting-edge technology | High |

What is included in the product

This analysis unpacks the competitive intensity within the high-performance computing and server market for 2CRSI, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly visualize competitive pressures with a dynamic, interactive dashboard for 2CRSI's Porter's Five Forces analysis.

Customers Bargaining Power

2CRSI's main clients, such as major cloud service providers and large data center operators, wield considerable bargaining power. Their substantial order volumes and critical role in the technology ecosystem allow them to negotiate aggressively on price and contract conditions, impacting 2CRSI's profit margins.

The bargaining power of customers for 2CRSI is influenced by the specialized nature of its high-performance computing solutions. When clients require deeply integrated, custom-built servers for critical operations, such as AI-driven analytics, their ability to switch to a competitor diminishes significantly. This is because the cost and complexity of reconfiguring or replacing these bespoke systems can be substantial, effectively raising switching costs. For example, in 2024, the demand for customized AI infrastructure solutions meant that clients deeply invested in 2CRSI's tailored offerings faced considerable hurdles in migrating to alternative providers, thereby limiting their leverage.

Customers, particularly large hyperscalers, possess significant bargaining power due to the availability of alternative server Original Equipment Manufacturers (OEMs) and the potential to develop in-house solutions. This means they can readily switch if 2CRSI's pricing or performance doesn't align with their needs. For instance, in 2024, the global server market saw intense competition, with major players like Dell EMC and HPE offering a wide range of customizable solutions, putting pressure on smaller vendors like 2CRSI to remain competitive on both price and innovation.

Buyer Power 4

The increasing demand for AI and High-Performance Computing (HPC) infrastructure, a sector projected to grow significantly, does lend some leverage to suppliers like 2CRSI. For instance, the global AI market was valued at approximately USD 136.6 billion in 2022 and is expected to reach USD 1,345.7 billion by 2030, reflecting a compound annual growth rate of 33.2% during this period. This surge means customers are keen to secure advanced solutions.

Despite this, customers, particularly large enterprises and research institutions, remain highly informed and possess substantial purchasing power. They often have the technical expertise to compare offerings and negotiate favorable terms. This sophistication helps to balance the scales, preventing suppliers from dictating prices or conditions unilaterally.

- Growing AI/HPC Demand: The AI market's rapid expansion, with projections reaching over a trillion dollars by 2030, increases customer urgency for advanced infrastructure.

- Customer Sophistication: Buyers are typically well-versed in technology and market pricing, enabling them to negotiate effectively.

- Supplier Dependence: While demand is high, customers often require specialized, high-value solutions that limit the number of suitable suppliers.

- Negotiating Stance: The combination of informed buyers and specialized needs results in a strong, albeit balanced, negotiating position for customers.

Buyer Power 5

2CRSI's focus on energy efficiency and sustainability resonates with growing customer demands, particularly in the data center and high-performance computing sectors. This alignment can translate into a reduced willingness among these clients to switch based solely on price, as the long-term operational cost savings and environmental benefits become key differentiators. For instance, in 2024, the global demand for sustainable IT solutions saw a significant uptick, with many enterprises actively seeking vendors who demonstrate a commitment to reducing their carbon footprint.

The bargaining power of customers for 2CRSI is influenced by several factors:

- Customer Concentration: While 2CRSI serves a diverse client base, a few large clients could exert significant price pressure.

- Switching Costs: The integration of specialized hardware and software can create moderate switching costs for customers, providing 2CRSI with some leverage.

- Product Differentiation: 2CRSI's emphasis on high-performance, energy-efficient computing solutions differentiates it from generic providers, potentially lowering customer price sensitivity.

- Availability of Substitutes: The market for high-performance computing and server solutions includes several competitors, which can empower customers to negotiate better terms.

Customers, particularly large cloud providers and data center operators, possess significant bargaining power due to their substantial order volumes and the availability of alternative server manufacturers. This allows them to negotiate aggressively on pricing and contract terms, impacting 2CRSI's profit margins.

The specialized nature of 2CRSI's high-performance computing solutions, often custom-built for critical AI and analytics operations, creates high switching costs for clients. In 2024, this meant clients deeply invested in 2CRSI's tailored offerings faced considerable hurdles in migrating, limiting their leverage.

The global server market in 2024 was highly competitive, with major players like Dell EMC and HPE offering extensive customization. This competitive landscape empowers customers to demand favorable terms from vendors like 2CRSI, balancing the supplier's specialized offerings.

| Factor | Impact on 2CRSI | 2024 Relevance |

| Customer Concentration | Potential for price pressure from large clients. | Key hyperscalers represent a significant portion of demand. |

| Switching Costs | Moderate, due to specialized hardware integration. | Custom AI infrastructure in 2024 made switching complex. |

| Product Differentiation | Energy efficiency and performance can reduce price sensitivity. | Growing demand for sustainable IT solutions in 2024. |

| Availability of Substitutes | Customers can switch to competitors or in-house solutions. | Intense competition from established server OEMs. |

Preview the Actual Deliverable

2CRSI Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for 2CRSI, detailing the competitive landscape within the server and high-performance computing market. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing valuable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Rivalry Among Competitors

The high-performance computing and data center server market is a battleground, with giants like Dell EMC, HPE, and Lenovo holding significant sway. These established players boast vast resources, comprehensive product lines, and deep-rooted customer relationships, making it challenging for smaller firms like 2CRSI to gain substantial market share. For instance, Dell Technologies reported revenue of $102.3 billion for fiscal year 2024, highlighting the scale of its operations compared to niche players.

2CRSI's strategy of focusing on high-performance, energy-efficient, and customized server solutions for specialized sectors like Artificial Intelligence (AI) and High-Performance Computing (HPC) carves out a distinct space. This specialization, while sidestepping direct competition with broad-market server providers, intensifies rivalry within these lucrative, rapidly expanding niches. For instance, the global AI hardware market was valued at approximately $25.7 billion in 2023 and is projected to reach $200 billion by 2030, indicating a highly competitive landscape for specialized providers.

The competitive rivalry within the server and high-performance computing sector is intense, driven by rapid technological advancements. Companies like 2CRSI must continuously invest in research and development, especially in areas like AI and advanced processor technologies, such as NVIDIA's latest GPU offerings, to stay ahead. This constant need for innovation fuels a dynamic and fast-paced market where staying current is paramount for survival and growth.

Competitive Rivalry 4

The intense competition within the server and IT infrastructure sector, particularly for companies like 2CRSI, is amplified by robust industry growth, especially in areas like AI infrastructure and High-Performance Computing (HPC). This expansion presents significant opportunities for all participants, but it concurrently draws in new investments and intensifies the battle for market dominance.

The global AI infrastructure market, a key driver of this competition, is anticipated to surpass $200 billion by 2028. This substantial market size fuels vigorous competition as established players and emerging companies vie for a larger slice of this rapidly expanding pie. Companies are investing heavily in R&D and expanding production capabilities to meet the surging demand.

- Market Growth: The AI infrastructure market is projected to exceed $200 billion by 2028, creating a highly attractive but competitive landscape.

- Intensified Competition: Opportunities in AI and HPC attract new entrants and drive existing players to innovate and expand, increasing rivalry.

- Player Strategies: Companies are focusing on specialized solutions, strategic partnerships, and technological advancements to differentiate themselves.

Competitive Rivalry 5

Competitive rivalry in the server manufacturing sector, including companies like 2CRSI, is notably intense. High exit barriers, stemming from substantial capital investments in research and development and specialized manufacturing facilities, compel existing players to remain active and compete fiercely. This sustained competition keeps the pressure on pricing and innovation.

The server market, while consolidating, still features a number of significant players. For instance, in 2023, the global server market was valued at approximately $114.1 billion, with projections indicating continued growth. This large market size attracts and retains numerous competitors, all vying for market share.

- High Capital Investment: Significant upfront costs for R&D and manufacturing facilities create high exit barriers.

- Sustained Competition: Companies are incentivized to stay and compete aggressively due to these barriers.

- Market Size: The global server market's substantial value, estimated at over $100 billion in 2023, supports multiple competitors.

The server market, particularly in high-performance computing and AI, is characterized by fierce competition. Established giants like Dell EMC and HPE possess significant advantages in scale and resources, making it challenging for smaller players like 2CRSI to compete directly. For example, Dell Technologies reported revenues of $102.3 billion in fiscal year 2024, dwarfing niche players.

Despite the dominance of larger firms, 2CRSI carves out a space by focusing on specialized, high-performance, and energy-efficient solutions for AI and HPC. This strategy intensifies rivalry within these rapidly growing segments, with the global AI hardware market valued at approximately $25.7 billion in 2023 and projected to reach $200 billion by 2030.

Continuous investment in research and development, particularly in areas like AI and advanced processors, is crucial for survival. Companies must stay abreast of technological advancements, such as NVIDIA's latest GPU offerings, to remain competitive in this dynamic market.

| Company | FY2024 Revenue (Approx.) | Key Focus Areas |

|---|---|---|

| Dell Technologies | $102.3 billion | Broad IT solutions, servers, storage, networking |

| HPE | $31.4 billion (FY2023) | Edge-to-cloud platforms, HPC, AI solutions |

| Lenovo | $62.3 billion (FY2023/24) | PCs, mobile, servers, smart devices |

| 2CRSI | Niche player (specific figures not publicly disclosed at this scale) | High-performance, energy-efficient servers for AI/HPC |

SSubstitutes Threaten

The primary threat of substitutes for 2CRSI's custom-built IT infrastructure comes from public cloud computing services, specifically Infrastructure as a Service (IaaS) and Platform as a Service (PaaS). Hyperscale providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud offer highly scalable, flexible, and often more cost-efficient alternatives for a wide range of IT workloads.

While general cloud services can be seen as substitutes, 2CRSI's specialization in high-performance computing (HPC) and artificial intelligence (AI) creates a unique market position. These demanding workloads often necessitate custom hardware configurations and specialized infrastructure that public cloud providers may not always offer with the same level of optimization or cost-effectiveness for very specific, large-scale applications. This niche focus helps to lessen the direct threat from broader cloud computing alternatives.

Software-defined infrastructure (SDI) and hyper-converged infrastructure (HCI) offer a significant, albeit conceptual, threat by abstracting hardware. This allows for greater flexibility and can reduce dependence on traditional, purpose-built servers, potentially leading to vendor-agnostic solutions. For instance, the HCI market was valued at approximately $10.4 billion in 2023 and is projected to reach $31.7 billion by 2028, indicating a strong shift towards these more adaptable infrastructure models.

Threat of Substitutes 4

Large enterprises and hyperscalers, like Amazon Web Services or Microsoft Azure, possess the resources to develop their own IT infrastructure. This in-house capability acts as a significant substitute for purchasing hardware from companies like 2CRSI. By designing and building their own solutions, these giants gain ultimate control and can optimize hardware specifically for their unique needs, bypassing external vendors entirely.

The trend towards custom silicon and specialized hardware by major cloud providers further intensifies this threat. For instance, Google's Tensor Processing Units (TPUs) and Amazon's Inferentia chips demonstrate a commitment to in-house development, aiming for superior performance and cost efficiency. This strategic move directly reduces reliance on third-party hardware manufacturers, impacting the market for standard server components.

- In-house IT infrastructure development by hyperscalers poses a direct threat.

- Custom silicon and specialized hardware initiatives by tech giants reduce reliance on external vendors.

- Companies like Google with TPUs and Amazon with Inferentia chips exemplify this substitution trend.

- This strategy allows for ultimate control and optimization, bypassing traditional hardware purchasers.

Threat of Substitutes 5

While 2CRSI operates in the server and high-performance computing space, alternative computing paradigms could emerge as long-term threats. Quantum computing, though still in its early stages, offers a fundamentally different approach to problem-solving that could eventually displace traditional computing for certain applications. For instance, advancements in quantum algorithms could revolutionize fields like drug discovery and financial modeling, areas where high-performance computing is currently crucial.

Furthermore, the increasing sophistication of specialized Application-Specific Integrated Circuits (ASICs) developed by customers for their unique needs presents another potential substitute. Companies like Google with its Tensor Processing Units (TPUs) or Amazon with its Inferentia chips demonstrate a trend towards in-house silicon design. This allows them to optimize hardware for specific workloads, potentially reducing their reliance on general-purpose servers offered by companies like 2CRSI. For example, AI training workloads are increasingly being handled by specialized ASICs, bypassing traditional CPU-based server solutions.

- Quantum Computing: While nascent, quantum computing represents a paradigm shift with the potential to solve complex problems intractable for classical computers.

- Specialized ASICs: Customers designing their own custom chips for specific tasks, like AI or data analytics, can bypass standard server offerings.

- Customer-driven Innovation: Companies investing heavily in proprietary hardware solutions reduce their dependence on external server providers.

The threat of substitutes for 2CRSI's offerings is significant, primarily stemming from the rise of public cloud services and in-house hardware development by major tech players. While 2CRSI specializes in custom-built IT infrastructure, particularly for high-performance computing and AI, hyperscale cloud providers like AWS, Azure, and Google Cloud offer scalable and often cost-effective alternatives. This trend is further amplified by companies developing their own custom silicon, such as Google's TPUs and Amazon's Inferentia, to optimize specific workloads and reduce reliance on third-party hardware vendors.

The market for software-defined and hyper-converged infrastructure also presents a substitution threat, offering greater flexibility and potentially reducing the need for traditional, purpose-built servers. The HCI market, valued at approximately $10.4 billion in 2023, is projected to grow substantially, indicating a shift towards more adaptable infrastructure solutions. Furthermore, emerging paradigms like quantum computing, though still in early stages, represent a long-term potential displacement for certain high-performance computing applications.

| Substitute Category | Key Players/Examples | Impact on 2CRSI | Market Data/Trends |

|---|---|---|---|

| Public Cloud (IaaS/PaaS) | AWS, Microsoft Azure, Google Cloud | Offers scalable, flexible, and cost-efficient alternatives for general IT workloads. | Global cloud computing market expected to exceed $1 trillion by 2027. |

| In-house Hardware Development | Google (TPUs), Amazon (Inferentia) | Reduces reliance on external vendors for specialized, high-performance needs. | Companies invest heavily in custom silicon for AI and data processing. |

| Software-Defined/Hyper-Converged Infrastructure | VMware, Nutanix | Increases flexibility and reduces dependence on specific hardware configurations. | HCI market projected to reach $31.7 billion by 2028 (from $10.4 billion in 2023). |

| Emerging Computing Paradigms | Quantum Computing | Potential long-term displacement for specific complex computations. | Early-stage development, but with significant future implications for HPC. |

Entrants Threaten

The threat of new entrants in the high-performance server market is relatively low due to substantial barriers. The significant capital required for research and development, advanced manufacturing facilities, and building a reliable supply chain makes it difficult for newcomers to compete effectively. For instance, developing next-generation, energy-efficient server hardware demands considerable upfront investment, often in the tens or hundreds of millions of dollars, before any revenue is generated.

Securing access to cutting-edge components like the latest GPUs and CPUs presents a significant hurdle for newcomers. Established players often have preferential relationships with dominant chip manufacturers, giving them an advantage in supply chain access. This makes it challenging for new entrants to source the high-performance parts needed to compete effectively in the market.

The threat of new entrants into the high-performance server market, where 2CRSI operates, is significantly mitigated by the substantial need for deep technical expertise. Designing and manufacturing energy-efficient, high-performance IT servers and custom solutions demands a highly specialized workforce, creating a considerable knowledge barrier for aspiring competitors.

In 2024, the complexity of semiconductor design and advanced cooling technologies, crucial for 2CRSI's offerings, requires years of specialized training and experience. This technical know-how is not easily replicated, making it difficult for new companies to enter and compete effectively without significant investment in talent acquisition and development.

Threat of New Entrants 4

The threat of new entrants in the high-performance computing (HPC) and data center server market, where 2CRSI operates, is relatively low. Building a strong brand reputation, fostering trust, and cultivating established customer relationships with major players like large data centers, cloud providers, and HPC clients is a lengthy and resource-intensive process. Incumbents such as 2CRSI already possess this crucial advantage of existing trust and demonstrated performance in demanding, mission-critical environments.

New companies face significant hurdles in overcoming the established loyalty and proven track record of existing suppliers. For instance, securing initial contracts with hyperscale cloud providers often requires extensive validation and a history of reliability, which newcomers lack. The capital expenditure required to establish manufacturing capabilities and R&D for cutting-edge server technology also presents a substantial barrier.

Key barriers to entry include:

- High Capital Requirements: Significant investment is needed for advanced manufacturing facilities and research and development in server technology.

- Brand Loyalty and Trust: Established players like 2CRSI benefit from years of building trust and proven performance with major clients.

- Economies of Scale: Existing, larger competitors can often offer more competitive pricing due to their production volumes.

- Access to Distribution Channels: Penetrating established sales and distribution networks is challenging for new entrants.

Threat of New Entrants 5

The artificial intelligence (AI) and high-performance computing (HPC) infrastructure market, while experiencing robust growth, presents significant barriers to entry for newcomers. Companies like 2CRSI, operating in this space, benefit from established reputations and existing client relationships.

The substantial capital investment required for research and development, manufacturing facilities, and global supply chain establishment acts as a major deterrent. Furthermore, achieving the necessary scalability to meet the demands of large enterprises and navigating complex compliance landscapes, including industry-specific certifications and data privacy regulations, demands considerable expertise and resources.

- High Capital Requirements: Building out AI/HPC infrastructure necessitates significant upfront investment in specialized hardware, software development, and skilled personnel.

- Scalability and Distribution: New entrants must demonstrate the ability to scale operations rapidly and establish a global distribution network to serve a diverse customer base.

- Regulatory Compliance: Adhering to various industry standards, certifications, and data protection laws (e.g., GDPR, CCPA) adds complexity and cost for potential competitors.

- Technological Expertise: Deep technical knowledge in areas like chip design, advanced cooling systems, and software optimization is crucial, creating a steep learning curve for new players.

The threat of new entrants for 2CRSI remains low due to formidable barriers in the high-performance server market. These include immense capital needs for R&D and manufacturing, the necessity of deep technical expertise, and the challenge of building brand trust and customer loyalty. For instance, the global market for servers, including high-performance segments, saw significant growth, with shipments expected to rise. In 2024, the demand for AI-optimized servers alone represented a substantial market segment, requiring specialized design and component sourcing that favors established players.

| Barrier Type | Description | Impact on New Entrants | 2024 Market Context |

|---|---|---|---|

| Capital Requirements | High investment in R&D, advanced manufacturing, and supply chains. | Significant financial hurdle, limiting potential entrants. | AI server development alone can cost hundreds of millions. |

| Technical Expertise | Need for specialized knowledge in hardware design, cooling, and software. | Steep learning curve and talent acquisition challenges. | Complex chip integration and thermal management are critical. |

| Brand Reputation & Trust | Established relationships and proven reliability with major clients. | Difficult to displace incumbents with existing client loyalty. | Hyperscale providers require extensive validation periods. |

| Economies of Scale | Lower production costs for larger, established manufacturers. | New entrants may struggle with competitive pricing. | Larger players can leverage bulk purchasing for components. |

Porter's Five Forces Analysis Data Sources

Our 2CRSI Porter's Five Forces analysis is built upon a robust foundation of data, drawing from 2CRSI's official annual reports, investor presentations, and public filings. We supplement this with industry-specific market research reports and competitor analysis from reputable financial data providers to ensure a comprehensive view of the competitive landscape.