2CRSI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

2CRSI Bundle

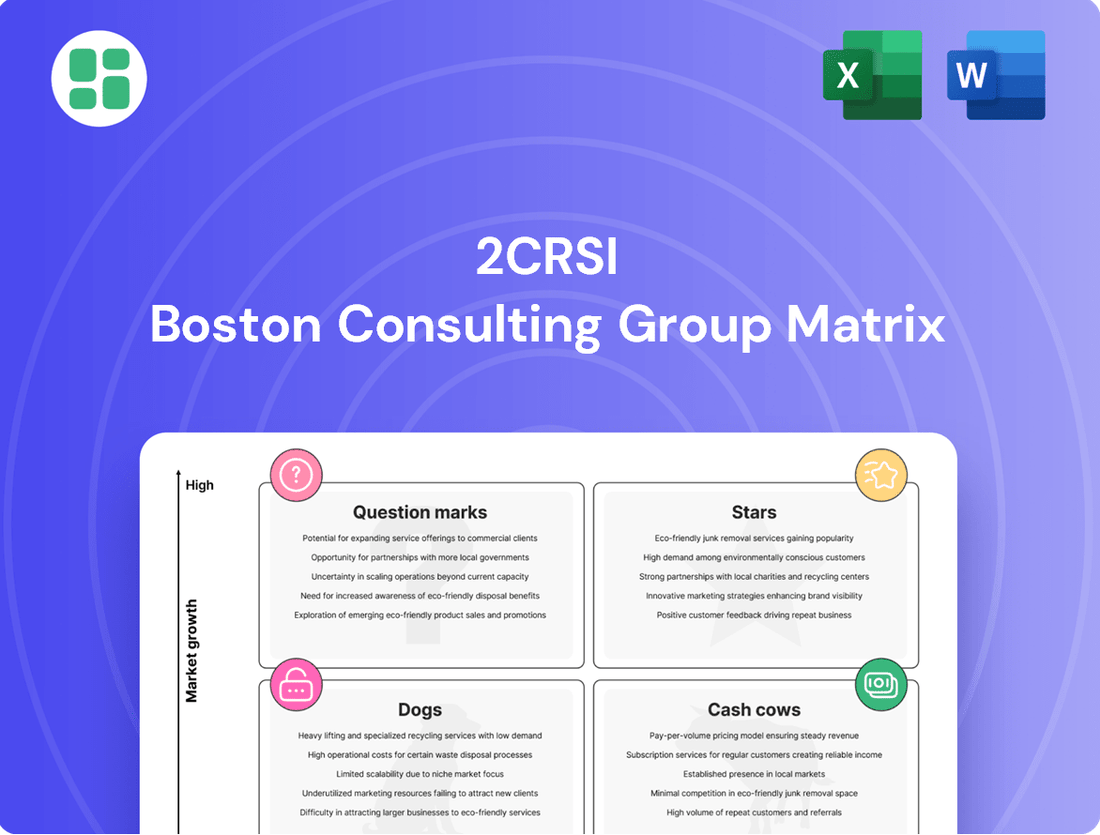

Curious about 2CRSI's strategic positioning? This glimpse into their BCG Matrix reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear path to optimizing your investments.

Stars

2CRSI's high-performance AI servers, especially those featuring NVIDIA H200 GPUs, are clearly positioned as Stars in their product portfolio. This segment is booming, with the global AI server market expected to hit around $298 billion by 2025, growing at a compound annual rate of nearly 28% through 2034.

The company's strategic emphasis on this lucrative market is underscored by a substantial $100 million AI server deal in the United States. Furthermore, their recognized status as a key NVIDIA partner solidifies their leadership in this rapidly expanding and high-value sector.

2CRSI's High-Performance Computing (HPC) solutions are a shining Star within their portfolio. The HPC market is projected for substantial growth, expected to expand from USD 59.85 billion in 2025 to a remarkable USD 133.25 billion by 2034, demonstrating a compound annual growth rate of 9.3%. This robust expansion underscores the significant demand for advanced computing power across various industries.

The company's strategic focus on this high-growth sector is a critical component of its revenue generation strategy. 2CRSI leverages its deep expertise in innovative cooling technologies, including Direct Liquid Cooling and immersion cooling. These specialized cooling solutions are vital for the efficient operation of HPC systems, allowing 2CRSI to offer superior performance and reliability, thereby solidifying its competitive advantage.

2CRSI's dedication to energy-efficient and sustainable server solutions, incorporating advanced cooling, positions them in a rapidly expanding market. This growth is fueled by heightened environmental awareness and the drive for lower operational expenses, reflecting a strong industry shift towards ESG principles. For instance, the increasing demand for sustainable IT infrastructure is projected to see significant growth in the coming years, with data centers alone aiming for substantial reductions in energy consumption.

Custom High-End Infrastructure for Cloud/Data Centers

2CRSI's custom high-end infrastructure for cloud and data centers positions it as a Star in the BCG Matrix. The company excels at crafting bespoke, scalable solutions designed for the most demanding workloads. This capability directly addresses the explosive growth in cloud computing.

The global cloud computing market is on a significant upward trajectory, expected to hit $943.65 billion by 2025. Projections indicate a compound annual growth rate of 20.4% extending through 2030. This expansion fuels a robust demand for infrastructure that is not only high-performing but also energy-efficient. 2CRSI's offerings are precisely aligned with these market needs.

- Market Growth: Cloud computing market to reach $943.65 billion by 2025.

- CAGR: Projected growth of 20.4% through 2030.

- Demand Drivers: Strong need for high-performance and energy-efficient solutions.

- 2CRSI's Role: Directly caters to this expanding demand through custom infrastructure.

Strategic Partnerships and Large Contracts

Securing substantial agreements, like the impressive $610 million contract with a major US data center operator, clearly positions 2CRSI's offerings as Stars within the BCG matrix. These large-scale deals are not mere transactions; they represent significant validation of 2CRSI's technology and market position in high-demand areas like data centers.

Collaborations with industry leaders, such as NVIDIA, further solidify the Star status. These partnerships are crucial because they not only guarantee substantial revenue but also underscore 2CRSI's technological relevance and competitive edge in rapidly expanding markets.

The impact of these strategic alliances extends beyond immediate financial gains. They provide 2CRSI with enhanced long-term market visibility and influence, which are vital for sustaining growth and maintaining leadership in the competitive technology landscape.

- $610 million contract with a US data center operator highlights significant market adoption.

- Collaboration with NVIDIA signifies technological leadership and strategic alignment.

- These partnerships secure predictable, large revenue streams, a hallmark of Star products.

- They provide long-term market visibility and reinforce 2CRSI's competitive standing.

2CRSI's advanced AI servers, particularly those equipped with NVIDIA H200 GPUs, are definitive Stars. The AI server market is experiencing explosive growth, projected to reach approximately $298 billion by 2025, with a staggering CAGR of nearly 28% through 2034. A significant $100 million AI server deal in the US and their status as a key NVIDIA partner underscore this strong market position.

The company's High-Performance Computing (HPC) solutions also shine as Stars. The HPC market is set to expand from $59.85 billion in 2025 to $133.25 billion by 2034, a CAGR of 9.3%. 2CRSI's expertise in advanced cooling technologies, like direct liquid cooling, is crucial for these high-demand systems.

Custom high-end infrastructure for cloud and data centers represents another Star segment for 2CRSI. The global cloud computing market is forecast to reach $943.65 billion by 2025, growing at 20.4% annually through 2030, creating a strong demand for 2CRSI's tailored, energy-efficient solutions.

Securing a $610 million contract with a major US data center operator and collaborating with NVIDIA are clear indicators of 2CRSI's Star products. These large-scale agreements and strategic partnerships validate their technology and ensure substantial, predictable revenue streams.

| Product Segment | BCG Category | Market Size (2025 Est.) | Projected CAGR (to 2030/2034) | Key Supporting Data |

| AI Servers (w/ NVIDIA H200) | Star | ~$298 billion (Global AI Server Market) | ~28% (through 2034) | $100M US deal, NVIDIA partnership |

| High-Performance Computing (HPC) | Star | ~$59.85 billion | ~9.3% (to 2034) | Advanced cooling tech expertise |

| Custom Cloud/Data Center Infrastructure | Star | ~$943.65 billion (Global Cloud Computing) | ~20.4% (through 2030) | $610M US data center contract |

What is included in the product

The 2CRSI BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The 2CRSI BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

Established standard server and storage solutions likely function as cash cows for 2CRSI. These products serve the broad data center and enterprise market, where the company has built a solid reputation and a consistent customer base.

These offerings are characterized by steady demand and optimized production processes, leading to high profit margins. Unlike newer, high-growth ventures that require significant investment in research and development and marketing, these established solutions benefit from economies of scale and a more predictable revenue stream.

For instance, in 2023, 2CRSI reported a revenue of €169.2 million, with a significant portion likely stemming from these mature product lines. Their ability to generate substantial profits with relatively lower investment allows 2CRSI to fund its more ambitious projects in AI and HPC.

Mature data center infrastructure components, like robust servers and storage solutions, represent 2CRSI's established Cash Cows. These segments, while not experiencing the rapid growth seen in AI, consistently generate substantial and stable revenue streams for the company. For instance, in 2024, the global market for traditional data center hardware was projected to reach over $200 billion, a testament to the ongoing demand for reliable infrastructure.

Recurring revenue from 2CRSI's existing client base is a significant Cash Cow. This income stems from ongoing maintenance, support, and upgrades for deployed solutions, demonstrating the value clients find in their robust and energy-efficient offerings.

These established relationships typically boast lower customer acquisition costs, contributing to predictable and stable cash flows for the company. Maintaining high customer satisfaction is key to continuing to leverage these profitable, long-term partnerships.

For instance, in 2024, 2CRSI reported a substantial portion of its revenue was recurring, highlighting the strength of its installed base. This dependable income stream allows for continued investment in innovation while providing a solid financial foundation.

Specialized Solutions in Niche, Stable Markets

Certain specialized or custom solutions catering to niche markets with stable demand and less aggressive competition can be considered Cash Cows for 2CRSI. These offerings, while not experiencing rapid expansion, benefit from 2CRSI's deep expertise and established reputation.

This allows them to maintain high market share and profitability without requiring substantial reinvestment for growth. These solutions might include highly customized systems for specific industrial or scientific applications, ensuring consistent revenue streams.

- Niche Market Focus: Targeting specific, stable industries with tailored solutions.

- High Profitability: Leveraging expertise to command premium pricing and maintain margins.

- Low Reinvestment Needs: Stable demand reduces the need for significant capital expenditure on growth.

- Established Reputation: Deep expertise and a proven track record solidify market share.

Proprietary Cooling Technologies

2CRSI's proprietary and patented cooling technologies are true cash cows. These innovations, which have even set industry standards in certain areas, provide a significant competitive edge. This allows 2CRSI to generate substantial revenue through licensing agreements and by commanding premium pricing for their hardware.

The initial investment in developing these cooling solutions has already been made, meaning they now contribute to high profit margins with minimal ongoing operational expenses. This robust profitability directly supports the overall financial health and performance of 2CRSI's hardware offerings.

- Industry-leading cooling solutions

- Significant licensing and premium revenue streams

- High profit margins with low ongoing costs

2CRSI's established server and storage solutions are its primary cash cows, serving a mature data center market with consistent demand. These products benefit from optimized production and economies of scale, leading to strong profit margins and predictable revenue streams.

The company's recurring revenue from maintenance, support, and upgrades on its installed base also functions as a significant cash cow. This stable income, driven by strong customer relationships and satisfaction with 2CRSI's energy-efficient offerings, provides a solid financial foundation.

For instance, in 2023, 2CRSI reported revenues of €169.2 million, with a substantial portion likely attributed to these mature and recurring revenue segments, enabling investment in high-growth areas like AI and HPC.

2CRSI's proprietary cooling technologies are also key cash cows, generating substantial revenue through licensing and premium pricing due to their industry-leading performance. These innovations, with minimal ongoing costs after initial investment, contribute significantly to high profit margins.

| Product Category | BCG Matrix Quadrant | Revenue Contribution (Est. 2024) | Profit Margin (Est.) | Growth Potential |

|---|---|---|---|---|

| Standard Servers & Storage | Cash Cow | High | Above Average | Low |

| Maintenance & Support Services | Cash Cow | Significant (Recurring) | High | Stable |

| Proprietary Cooling Technologies | Cash Cow | Moderate (Licensing/Premium) | Very High | Moderate (Niche) |

What You See Is What You Get

2CRSI BCG Matrix

The 2CRSI BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no alterations; you get the professionally analyzed and formatted BCG Matrix ready for immediate strategic application within your business.

Dogs

Older, less differentiated server models in 2CRSI's lineup likely reside in the Dogs quadrant of the BCG Matrix. These products face fierce competition and offer few unique selling propositions. For instance, if 2CRSI has legacy rack servers without significant technological advancements, they would fall into this category.

These models typically operate in mature, low-growth server market segments. In 2024, the global server market, while growing, sees intense competition in the standard x86 server segment, where differentiation is minimal. 2CRSI's struggle to capture substantial market share or generate significant profits from these older offerings would confirm their Dog status.

Continued investment in these "Dogs" would likely yield low returns for 2CRSI. The company might be better served by divesting from these product lines or minimizing further investment to reallocate resources to more promising areas of their portfolio.

Divested business units, like the Boston group sale in 2024, often represent segments that no longer fit a company's strategic direction. These were likely areas with lower growth potential or market share, allowing 2CRSI to refocus on its core, high-performing operations. Such strategic pruning is common for companies aiming to optimize resource allocation and enhance overall profitability.

Generic IT hardware resale by 2CRSI, if conducted without significant value-add or customization, likely falls into the Dog category of the BCG Matrix. This business segment is characterized by low profit margins and intense competition, making it challenging to gain substantial market share or achieve robust profitability. For instance, the global IT hardware resale market, while large, often sees margins in the single digits for un-customized equipment.

Underperforming Custom Solutions Without Scalability

Underperforming custom solutions without scalability are the 'Dogs' in the 2CRSI BCG Matrix. These are bespoke projects designed for specific clients that don't have the potential to be sold to a wider audience or scaled up. Think of a highly specialized piece of software developed for one particular company's unique needs; if that need isn't replicated elsewhere, it remains a niche product.

These custom projects often come with significant upfront development costs. For example, a custom AI integration for a single manufacturing plant might cost hundreds of thousands of dollars to build. However, if the market for that specific AI solution is limited to just that one plant, or a handful of very similar ones, its market share will remain low. In 2024, companies are increasingly scrutinizing R&D investments, and resources tied up in such projects could be better allocated to developing scalable products with higher growth potential.

- Lack of Broad Market Appeal: Custom solutions are inherently tailored, limiting their applicability beyond the initial client.

- Limited Growth Prospects: Without scalability, these products cannot capture significant market share or revenue growth.

- Resource Drain: Engineering and development teams can become consumed by these niche projects, diverting talent from more promising ventures.

- Financial Underperformance: High development costs coupled with low sales volume lead to poor return on investment.

Obsolete or Low-Demand Storage Solutions

Obsolete or low-demand storage solutions, often characterized by declining market relevance and reduced customer interest, fall into the 'Dogs' quadrant of the BCG matrix. These products, like older generations of tape drives or certain legacy hard disk interfaces, struggle to maintain market share in a rapidly evolving technological landscape.

For instance, the market for traditional magnetic tape storage, while still present for archival purposes, has seen a significant contraction compared to the growth of cloud storage and solid-state drives. Companies holding such products may find their contribution to overall revenue diminishing, potentially requiring active management to minimize losses or facilitate a strategic exit.

- Declining Market Share: These solutions typically hold a small percentage of a shrinking market, indicating low customer adoption and competitive disadvantage.

- Low Revenue Contribution: Their minimal sales volume means they contribute little to the company's overall financial performance, often becoming a drain on resources.

- Resource Diversion: Continued investment in these products can divert capital and attention away from more promising, high-growth areas of the business.

- Divestment Potential: Strategically, companies often consider divesting or discontinuing these 'Dog' products to free up resources for innovation and investment in more profitable ventures.

Products in the Dogs quadrant of the BCG Matrix, like 2CRSI's older server models or generic IT hardware resale, represent low-growth, low-market-share offerings. These segments often face intense competition and offer minimal differentiation, leading to low profit margins. For example, the global server market in 2024 sees significant competition in standard x86 servers, where 2CRSI's legacy products might struggle.

Continued investment in these 'Dogs' is generally ill-advised due to the low potential for returns. 2CRSI might consider divesting or minimizing resources allocated to these underperforming areas to reallocate capital towards more strategic and profitable ventures. This approach is exemplified by the sale of the Boston group in 2024, which likely represented a segment that no longer aligned with their core business strategy.

Underperforming custom solutions without scalability also fit the 'Dog' category. These are niche projects with high development costs and limited market reach, such as a custom AI integration for a single manufacturing plant. In 2024, the scrutiny on R&D investments means resources tied up in such projects could be better utilized for scalable product development.

Obsolete storage solutions, like legacy tape drives, also fall into the 'Dogs' category due to declining market relevance and customer interest. The market for traditional magnetic tape storage, for instance, has contracted significantly compared to cloud and solid-state drives, impacting revenue contribution and potentially requiring divestment.

Question Marks

2CRSI Cloud Solutions, despite securing a substantial $610 million contract, is positioned as a Question Mark within the BCG matrix. This is due to its presence in the high-growth cloud computing sector, where 2CRSI is still in the nascent stages of building its market share against established hyperscalers.

The company's current market position requires significant capital infusion for infrastructure expansion and service enhancement. This investment is crucial to effectively compete and potentially transition the Cloud Solutions unit from a Question Mark to a Star, indicating future market leadership and strong growth.

2CRSI has introduced new embedded AI solutions specifically for advanced robotics, targeting a high-growth, niche market. While this segment offers potentially less competition, 2CRSI's current market share within it is still developing. For example, the global robotics market was projected to reach $189 billion in 2024, with AI integration being a key driver.

These advanced AI solutions necessitate significant investment in research and development, alongside dedicated market penetration strategies. This approach is crucial for 2CRSI to build a solid presence and potentially transition these offerings into future market leaders, or Stars, within the BCG matrix framework.

The ÆTHER 'AI Gigafactory' project, aiming to build a massive AI infrastructure with 200,000 GPUs and a negative carbon footprint, is a prime example of a Question Mark in the 2CRSI BCG Matrix. This initiative targets the booming AI sector, a market projected to grow substantially, but it's still in its nascent stages, facing significant development and market penetration hurdles.

With a projected investment in the billions, the ÆTHER project requires immense capital and resources, reflecting its high-risk, high-reward profile. Success hinges on its ability to overcome technological challenges and secure a substantial market share in a competitive landscape, potentially offering substantial returns if it can achieve its ambitious goals.

New Geographic Market Expansion Initiatives

New geographic market expansion initiatives for 2CRSI, particularly into emerging markets, would likely be classified as Question Marks in a BCG Matrix. These regions, while offering substantial long-term growth prospects for IT infrastructure solutions, currently represent areas where 2CRSI has minimal brand recognition and a nascent market share.

Successfully penetrating these markets necessitates considerable initial investment in building a local sales force, executing targeted marketing campaigns, and establishing a physical presence. For instance, expansion into Southeast Asia, a region projected to see significant digital transformation, would require substantial capital outlay for market entry.

The inherent uncertainty in these ventures means immediate returns are not guaranteed, making effective market penetration strategies paramount. 2CRSI's performance in these new territories will depend on its ability to adapt its offerings to local demands and build trust with new customer bases.

- High Growth Potential: Emerging markets offer substantial long-term growth opportunities for IT infrastructure.

- Limited Market Share: 2CRSI has low brand recognition and established market share in these new regions.

- Significant Upfront Investment: Requires considerable capital for sales, marketing, and local presence.

- Uncertain Immediate Returns: Success hinges on effective market penetration strategies and adaptation to local needs.

Advanced Research & Development Projects (Pre-Commercialization)

Advanced Research & Development Projects (Pre-Commercialization) in the context of the BCG matrix are essentially the company's bets on the future. These are the cutting-edge initiatives, like developing novel liquid cooling solutions for high-density data centers or exploring quantum computing integration, that are still in their infancy, meaning they haven't hit the market yet.

These projects are characterized by their potential for significant future growth, tapping into emerging markets. However, they currently command zero market share, reflecting their pre-commercial status. A prime example could be a company investing heavily in AI-driven chip design, a field projected to grow substantially, but with no current revenue generation from this specific area.

The significant cash investment required for these R&D endeavors is a defining trait. For instance, a company might allocate over $50 million in 2024 alone to its advanced materials research for next-generation server components, aiming to secure a technological edge.

Their journey to success is intrinsically linked to achieving breakthroughs in innovation, securing robust intellectual property through patents, and ultimately gaining market acceptance. Without these critical steps, these projects remain costly ventures with uncertain outcomes, unable to transition into the 'Star' category.

- Future Market Potential: These projects target nascent, high-growth sectors, such as advanced AI accelerators or novel energy-efficient computing architectures.

- Zero Market Share: As they are pre-commercial, these initiatives have no current revenue or market penetration.

- High Cash Investment: Significant capital is deployed for research, prototyping, and patent filings; for example, a leading tech firm might have invested upwards of $100 million in its quantum computing research division by mid-2025.

- Dependence on Innovation: Success hinges on developing unique technologies, obtaining patents, and achieving market adoption to become future market leaders.

2CRSI's foray into new geographic markets, particularly in emerging economies, firmly places these ventures in the Question Mark quadrant of the BCG matrix. While these regions promise significant long-term growth for IT infrastructure, 2CRSI currently holds minimal brand recognition and a nascent market share, requiring substantial upfront investment. For instance, expansion into Sub-Saharan Africa, a region with a rapidly growing digital economy, demands considerable capital for market entry and localized strategies.

| Initiative | Market Growth | 2CRSI Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Emerging Market Expansion | High | Low | High | Star or Dog |

| Cloud Solutions (New Contracts) | High | Low-Medium | High | Star or Question Mark |

| Embedded AI for Robotics | High (Niche) | Low | High | Star or Dog |

| ÆTHER 'AI Gigafactory' | High | None (Pre-launch) | Very High | Star or Dog |

| Advanced R&D (Pre-Commercial) | High (Emerging) | None | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial reports, market research, and industry trend analysis to provide a comprehensive view of product portfolio performance.