First Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Bank Bundle

Unlock the critical external factors influencing First Bank's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental concerns, and legal frameworks are shaping opportunities and challenges. Gain a strategic advantage by leveraging these expert insights to inform your decisions. Download the full PESTLE analysis now for actionable intelligence to navigate the complex landscape.

Political factors

The political landscape in Puerto Rico and the U.S. Virgin Islands is a key consideration for First BanCorp. Government stability directly impacts investor sentiment and the pace of economic growth in these territories. For instance, a stable political environment fosters greater confidence for both local and international investors, which can translate into increased lending and investment opportunities for the bank.

Changes in banking regulations, such as the Dodd-Frank Act's ongoing implementation and potential future amendments, directly influence First BanCorp's compliance burdens and strategic options. For instance, evolving capital adequacy ratios set by the Federal Reserve can affect lending capacity and profitability.

New legislation impacting consumer protection, like updated fair lending rules or data privacy requirements, may necessitate costly system upgrades and policy revisions for First BanCorp. Keeping abreast of directives from bodies like the FDIC is crucial for avoiding penalties and maintaining operational agility.

In 2024, the banking sector continued to navigate a complex regulatory landscape, with a particular focus on cybersecurity and consumer data protection. First BanCorp, like its peers, faces ongoing scrutiny regarding anti-money laundering (AML) and know-your-customer (KYC) regulations, which require significant investment in compliance technology and personnel.

The fiscal health of Puerto Rico and the U.S. Virgin Islands is a critical political factor for First BanCorp. In 2023, Puerto Rico's central government debt stood at approximately $72 billion, with ongoing negotiations to restructure obligations impacting investor confidence and public spending. The stability of these finances directly affects the economic capacity of First BanCorp's primary client base.

Government budgetary stability influences public sector deposits and lending opportunities for First BanCorp. For instance, any significant shifts in the islands' ability to meet pension obligations, which represent a substantial long-term liability, can create uncertainty in the financial markets where the bank operates.

Furthermore, the reliance on federal aid remains a key consideration. While federal funding, such as disaster relief and economic development grants, can bolster regional economies, any changes in the allocation or continuity of this aid, particularly in light of evolving U.S. fiscal policies, could impact economic growth and, consequently, First BanCorp's business environment.

Political Risk in Territories

The political standing of Puerto Rico and the U.S. Virgin Islands as U.S. territories presents distinct political risks, particularly concerning potential shifts in their relationship with the federal government. For instance, ongoing debates regarding statehood for Puerto Rico, as seen in recent plebiscites where a majority favored statehood, introduce significant uncertainty for long-term economic strategies and investment decisions. First BanCorp needs to closely monitor how these evolving political dialogues might impact local economic stability and investor confidence.

Discussions surrounding potential changes in governance, whether through statehood, enhanced autonomy, or other political statuses, create an environment of uncertainty. This uncertainty can directly affect economic planning and the attractiveness of the territories for sustained investment. For example, the U.S. Congress's role in determining the future political status of Puerto Rico means that legislative actions or inactions can have immediate financial implications.

- Federal Funding Dependence: The territories' reliance on federal funding, which can fluctuate based on political priorities, poses a risk to economic development and public services.

- Regulatory Environment Shifts: Changes in U.S. federal legislation or regulatory policies can disproportionately affect the territories' economies and business operations.

- Political Stability and Governance: Local political stability and the effectiveness of territorial governance are crucial for creating a predictable business environment.

- U.S. Economic Policy Impact: The economic policies enacted by the U.S. federal government, such as changes in tax laws or trade agreements, directly influence the economic conditions within these territories.

Geopolitical Relations and Trade

While First BanCorp's operations are primarily concentrated in Puerto Rico and Florida, the United States' broader geopolitical relationships and trade policies can have ripple effects. For instance, shifts in global trade agreements or rising international trade tensions could impact key sectors in these regions, such as manufacturing or tourism, indirectly influencing economic growth and consumer spending habits. This could affect loan demand and deposit levels for the bank.

Consider the impact of trade dynamics on industries vital to Puerto Rico and Florida. For example, if the U.S. imposes tariffs on goods that are significant imports or exports for these areas, it could lead to higher costs for businesses and consumers. This can dampen economic activity, potentially affecting First BanCorp's loan portfolio performance and overall profitability. The U.S. trade deficit with China, for example, has been a persistent factor in global economic discussions throughout 2024 and into 2025, highlighting ongoing trade relationship complexities.

Geopolitical instability in other regions can also influence investor sentiment and capital flows, indirectly affecting the economic climate in the U.S. territories and states where First BanCorp operates. Increased global uncertainty might lead to a more cautious economic outlook, potentially impacting investment, business expansion, and, consequently, the banking sector. For example, ongoing geopolitical events in Eastern Europe and the Middle East continue to create volatility in global energy markets, which can influence inflation and economic stability across various economies, including those linked to U.S. trade partners.

- Trade Policy Impact: Changes in U.S. trade agreements, such as renegotiations of existing pacts or the imposition of new tariffs, can directly affect industries like manufacturing and agriculture in Florida and Puerto Rico, influencing their economic health.

- Global Economic Interdependence: The interconnectedness of global economies means that geopolitical events, like conflicts or political shifts in major trading blocs, can disrupt supply chains and affect consumer confidence, thereby impacting regional economic performance.

- Investment Climate: International trade relations and geopolitical stability influence foreign direct investment and overall capital flows into the U.S. and its territories, which can support business growth and employment opportunities.

Government stability in Puerto Rico and the U.S. Virgin Islands is paramount, directly influencing investor confidence and economic growth. For example, Puerto Rico's central government debt was approximately $72 billion in 2023, with ongoing restructuring efforts impacting the financial landscape for First BanCorp.

Regulatory changes from bodies like the Federal Reserve and FDIC significantly shape First BanCorp's operations, affecting compliance costs and lending capacity. Evolving capital adequacy ratios and consumer protection laws, such as those concerning data privacy, require continuous adaptation and investment in compliance technology.

The territories' political status, including ongoing debates about Puerto Rico's statehood, introduces long-term uncertainty that can affect economic strategies and investment decisions. First BanCorp must monitor these political dialogues as they can impact local economic stability and investor sentiment.

First BanCorp's performance is also tied to U.S. federal policies, including trade agreements and fiscal priorities, which can influence regional economies. For instance, shifts in global trade dynamics, like U.S. tariffs, can impact key sectors in Puerto Rico and Florida, affecting loan demand and profitability.

What is included in the product

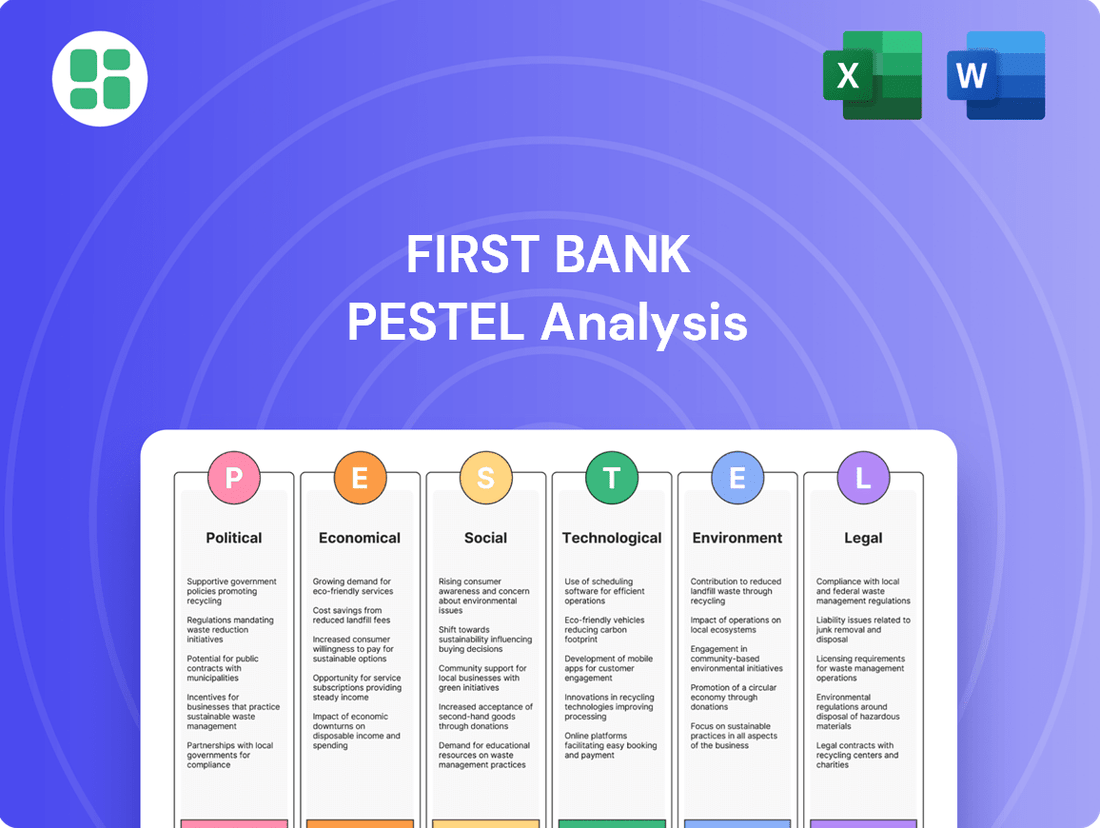

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the First Bank, offering a comprehensive view of its external operating environment.

A PESTLE analysis for First Bank provides a clear roadmap of external factors, acting as a pain point reliever by highlighting potential challenges and opportunities to proactively address market shifts and regulatory changes.

Economic factors

The Federal Reserve's monetary policy significantly shapes the interest rate environment, directly influencing First BanCorp's profitability. For instance, the Federal Funds Rate, which influences broader market rates, stood at 5.25%-5.50% as of early 2024, a level that has increased from near zero in previous years. This tightening cycle can compress net interest margins if deposit costs rise faster than loan yields.

Higher interest rates, like those seen in 2023 and projected into 2024, can dampen loan demand as borrowing becomes more expensive for both individuals and businesses. This presents a challenge for First BanCorp in originating new loans. Furthermore, elevated rates can increase the likelihood of borrowers defaulting on existing loans, impacting asset quality.

Conversely, if rates were to fall significantly, First BanCorp's net interest margin could be squeezed, making it crucial to develop diverse income sources beyond traditional lending. Effective asset-liability management becomes paramount to navigate these fluctuations and maintain stable profitability.

The economic vitality of Puerto Rico, the U.S. Virgin Islands, and Florida significantly impacts First BanCorp's operational success. For instance, Puerto Rico's GDP growth, projected to be around 1.5% in 2024, and Florida's robust expansion, anticipated at over 2.5% for the same year, directly influence the bank's loan origination and deposit-gathering capabilities.

Job creation and consumer spending trends in these regions are key indicators for the demand for financial services. In the U.S. Virgin Islands, a rebound in tourism and construction, contributing to an estimated 2% GDP growth in 2024, supports increased banking activity.

First BanCorp's performance is intrinsically linked to the economic resilience and recovery patterns observed in its core markets. The ability of these regions to absorb economic shocks and maintain upward growth trajectories is crucial for the bank's sustained profitability and market share.

High inflation directly impacts First Bank by eroding consumer and business purchasing power, which can hinder loan repayment capabilities and diminish the real value of deposits. For instance, if inflation averages 4% in Puerto Rico, the real value of a $100 deposit after a year shrinks to $96.

Persistent inflationary pressures can also escalate First Bank's operational expenses, from employee salaries to technology investments, potentially contributing to a broader economic slowdown that affects loan demand and credit quality.

Therefore, closely tracking inflation rates across its key markets, such as Puerto Rico, the U.S. Virgin Islands, and British Virgin Islands, is crucial for First Bank to accurately assess credit risk and adapt its interest rate strategies to maintain profitability.

Unemployment Rates and Income Levels

Unemployment rates and average income levels are crucial indicators for First BanCorp, directly impacting loan demand and the quality of its loan portfolio. In the U.S. Virgin Islands and Puerto Rico, key markets for First BanCorp, unemployment rates have shown fluctuations. For instance, Puerto Rico's unemployment rate stood at 6.2% in April 2024, a notable decrease from previous periods, while the U.S. Virgin Islands reported a rate of 3.9% in the same month. These figures suggest a generally improving economic environment that can support stronger credit quality.

Rising average incomes generally translate into increased consumer spending and a greater capacity for individuals and businesses to take on new loans. This, in turn, boosts demand for First BanCorp's lending products. Conversely, periods of high unemployment and stagnant or declining incomes can lead to increased financial strain on borrowers, potentially resulting in higher non-performing assets and slower deposit growth for the bank.

- U.S. Virgin Islands Unemployment Rate (April 2024): 3.9%

- Puerto Rico Unemployment Rate (April 2024): 6.2%

- Impact on Credit Quality: Lower unemployment and higher incomes generally improve borrower repayment ability, reducing defaults.

- Impact on Spending: Rising income levels stimulate consumer and business spending, increasing demand for banking services.

Real Estate Market Dynamics

The real estate markets in Puerto Rico, the U.S. Virgin Islands, and Florida are critical economic indicators for First BanCorp due to its significant presence in mortgage and construction lending. Fluctuations in property values, the availability of housing, and the pace of new construction directly influence the bank's collateral, loan origination potential, and credit risk exposure.

In Puerto Rico, for instance, the housing market has shown resilience. As of early 2024, median home prices saw an increase, reflecting demand and limited inventory in desirable areas. This trend supports collateral values for First BanCorp's mortgage portfolio. Similarly, Florida's robust real estate market, characterized by strong population growth and continued development, offers a favorable environment for loan growth, although rising interest rates in 2024 have introduced some moderation in sales volume compared to the peak of 2023.

The U.S. Virgin Islands market presents a more nuanced picture, with recovery efforts post-hurricanes influencing construction activity and property values. While challenges remain, strategic investments in infrastructure and tourism are beginning to stimulate demand for residential and commercial properties, which can positively impact First BanCorp's loan book in the region.

Key real estate market indicators relevant to First BanCorp's performance include:

- Puerto Rico: Median home prices in key metropolitan areas like San Juan continued to trend upwards in late 2023 and early 2024, with year-over-year increases often exceeding 5%.

- Florida: Despite a slight cooling from 2023 highs due to interest rates, Florida's housing market in 2024 still reported strong demand, with inventory levels remaining below historical averages in many growth corridors.

- U.S. Virgin Islands: Construction starts, particularly for residential and hospitality projects, saw a notable uptick in 2023, driven by post-disaster rebuilding and new investment, a trend expected to continue into 2024.

- Overall Impact: Market stability and sustained growth across these territories are vital for maintaining asset quality and driving profitable lending activities for First BanCorp.

Economic factors significantly influence First BanCorp's operations. The Federal Reserve's monetary policy, with the Federal Funds Rate at 5.25%-5.50% in early 2024, impacts net interest margins and loan demand. Regional economic health, such as Puerto Rico's projected 1.5% GDP growth in 2024 and Florida's over 2.5% expansion, directly affects loan origination and deposit growth.

| Economic Factor | Key Data Point (Early 2024/2024 Projections) | Impact on First BanCorp |

| Interest Rates (Fed Funds Rate) | 5.25%-5.50% | Affects net interest margin, loan demand, and credit quality. |

| Puerto Rico GDP Growth | ~1.5% | Influences loan origination and deposit gathering. |

| Florida GDP Growth | >2.5% | Supports robust lending opportunities. |

| Puerto Rico Unemployment | 6.2% (April 2024) | Lower rates generally improve borrower repayment ability. |

| U.S. Virgin Islands Unemployment | 3.9% (April 2024) | Indicates improving economic conditions and credit quality. |

Same Document Delivered

First Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the First Bank offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understanding these external forces is crucial for strategic planning and risk management.

Sociological factors

Demographic shifts are significantly reshaping First BanCorp's operating environment. In Puerto Rico, the population is aging, with the median age reaching 41.5 years in 2023, a trend that often correlates with increased demand for financial advisory and retirement services. Conversely, Florida continues to experience robust population growth, adding approximately 300,000 new residents in 2023, many of whom are younger and seeking diverse banking solutions.

Migration patterns also play a crucial role. While Puerto Rico has seen a net out-migration of over 100,000 people between 2020 and 2023, contributing to a shrinking customer base in certain segments, the U.S. Virgin Islands faces its own demographic challenges with a declining birth rate and an aging populace, impacting future growth potential. These evolving demographics necessitate a strategic approach to product development and customer engagement for First BanCorp.

Consumer behavior is shifting, with a growing preference for digital banking channels over traditional branches. For instance, by the end of 2024, it's projected that over 80% of routine banking transactions will be conducted digitally, impacting how First BanCorp allocates resources to its branch network and digital platforms. This evolution also extends to payment methods, with a significant increase in contactless and mobile payments being observed throughout 2024.

Financial literacy levels play a crucial role in the adoption of more sophisticated financial products offered by institutions like First BanCorp. In 2024, surveys indicated that while general financial awareness is improving, a substantial portion of the population still struggles with understanding complex investment vehicles and credit management, directly influencing the credit risk profile of the customer base.

Income inequality significantly shapes demand for First Bank's offerings. In Puerto Rico, where First Bank primarily operates, while specific up-to-the-minute wealth distribution data is dynamic, general trends indicate a notable gap. This means basic banking services for lower-income segments and specialized wealth management for higher-net-worth individuals are both crucial.

For instance, if a significant portion of the population falls into lower income brackets, the demand for affordable credit and basic transaction accounts will be higher. Conversely, a smaller, affluent segment will drive demand for investment products and advisory services. This segmentation necessitates a nuanced approach to product development and marketing for First Bank to effectively serve all economic strata within its operational areas.

Cultural Attitudes Towards Finance

Cultural norms significantly shape financial engagement across First BanCorp's operating regions. In Puerto Rico and the U.S. Virgin Islands, there's a historical emphasis on community lending and a more conservative approach to investment, often favoring tangible assets. This contrasts with Florida, where a more diverse population exhibits a wider range of financial attitudes, from aggressive investment strategies to a strong preference for digital banking solutions.

Trust in financial institutions is a key differentiator. While established banks are generally trusted, the rise of fintech and alternative lending platforms is creating new dynamics. For instance, a 2023 survey indicated that while 75% of Floridians use traditional banking services, nearly 40% also engage with at least one fintech app for savings or investments, a trend less pronounced in the islands.

First BanCorp must adapt its service offerings and marketing to resonate with these varied cultural attitudes. This includes:

- Tailoring loan products: Offering flexible repayment options for mortgages that align with island traditions of longer-term, community-backed financing.

- Promoting savings vehicles: Developing accessible savings accounts and educational programs that emphasize long-term financial security, resonating with conservative cultural values.

- Embracing digital innovation: Investing in user-friendly digital platforms and mobile banking solutions to cater to the preferences of younger demographics and tech-savvy consumers in Florida.

- Cultivating trust through transparency: Clearly communicating fees, interest rates, and investment risks to build and maintain confidence across all customer segments.

Workforce Availability and Skills

First BanCorp's ability to tap into a skilled workforce is a key sociological consideration. The financial services industry, especially in areas like cybersecurity and data analytics, demands specialized expertise. For instance, in 2024, the demand for data scientists in the US financial sector saw a significant uptick, with reported salary increases of up to 15% for experienced professionals.

Demographic trends and the overall educational attainment within First BanCorp's operating regions directly influence the talent pool. A growing aging population might present challenges in finding younger talent for digital-focused roles, while varying educational outcomes can impact the readiness of new entrants. In Puerto Rico, a key market for First BanCorp, the unemployment rate for those with a bachelor's degree or higher was approximately 3.5% in late 2024, indicating a relatively tight labor market for skilled individuals.

- Cybersecurity Talent Gap: The global shortage of cybersecurity professionals continues to be a concern, with projections suggesting millions of unfilled roles by 2025.

- Data Analytics Demand: Financial institutions are increasingly reliant on data analytics for risk management and customer insights, driving demand for skilled analysts.

- Digital Banking Skills: The shift towards digital banking requires employees proficient in user experience design, mobile development, and digital marketing.

- Educational Alignment: Ensuring educational institutions are producing graduates with the relevant skills needed by the financial sector is crucial for a sustainable talent pipeline.

Sociological factors, including changing consumer behaviors and evolving cultural norms, directly impact First BanCorp's market strategy. The increasing preference for digital banking, with over 80% of routine transactions expected by the end of 2024, necessitates investment in user-friendly digital platforms. Cultural attitudes towards savings and investment vary significantly between Puerto Rico, the U.S. Virgin Islands, and Florida, requiring tailored product offerings and marketing approaches to resonate with diverse customer segments.

Technological factors

The banking sector is undergoing a rapid digital transformation, with First BanCorp needing to keep pace. This includes enhancing mobile banking capabilities, streamlining online account opening processes, and expanding digital payment options to better serve its customer base. For instance, as of Q1 2024, digital payment volumes continue to surge, with mobile payment transactions globally expected to reach $11.5 trillion by 2025, highlighting the critical need for robust digital infrastructure.

Investing in user-friendly and secure digital platforms is paramount for First BanCorp to meet evolving customer expectations and maintain its competitive edge. In 2023, customer satisfaction scores for banks with advanced digital offerings were significantly higher than those with lagging digital services, underscoring the direct link between digital investment and customer loyalty.

Failure to adapt to these technological shifts poses a substantial risk, potentially leading to customer attrition and a decline in market share. Banks that don't prioritize digital innovation may find themselves outmaneuvered by more agile competitors, impacting their long-term growth and profitability.

The evolving landscape of cyber threats presents a major technological hurdle for First BanCorp. As cyberattacks become more sophisticated, the bank must continuously adapt its defenses to safeguard sensitive customer information and financial operations.

Data privacy regulations, such as those enacted globally, add another layer of complexity. First BanCorp faces the challenge of ensuring strict compliance, which requires ongoing investment in secure data handling practices and technologies to avoid substantial fines and reputational damage.

In 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial imperative for robust cybersecurity. This highlights the critical need for First BanCorp to maintain cutting-edge security infrastructure and protocols to protect its assets and customer trust.

First BanCorp's adoption of AI and automation is a critical technological factor. By integrating AI for enhanced fraud detection and personalized financial advice, the bank can significantly boost operational efficiency and customer satisfaction. For instance, AI-powered chatbots are increasingly handling customer inquiries, freeing up human staff for more complex tasks.

Automation of routine processes, such as loan application processing and data entry, can lead to substantial cost savings and reduced error rates. This technological shift is not just about efficiency; it's about remaining competitive in a rapidly evolving financial landscape. The global AI in banking market was valued at approximately $10.8 billion in 2023 and is projected to grow significantly in the coming years.

Fintech Competition and Collaboration

The financial technology (Fintech) landscape is rapidly evolving, presenting a dual challenge and opportunity for First BanCorp. Fintechs are known for their agility and specialized offerings, often targeting niche areas within traditional banking, which can lead to disruption. For instance, by mid-2024, the global Fintech market was projected to reach over $2.5 trillion, highlighting the significant competitive pressure.

First BanCorp faces a strategic decision: either develop in-house innovative solutions to directly compete with these agile players or forge strategic partnerships. Collaboration can allow First BanCorp to integrate cutting-edge Fintech services, thereby enhancing its own product suite and expanding its reach to previously untapped customer demographics.

- Competitive Threat: Fintechs' specialized, often digital-first, offerings can chip away at traditional banking revenue streams.

- Opportunity for Integration: Partnering with Fintechs can allow First BanCorp to quickly adopt new technologies and improve customer experience.

- Market Growth: The continued growth of the Fintech sector, with significant investment flowing into digital banking solutions, underscores the need for adaptation.

- Customer Demand: Consumers increasingly expect seamless, digital financial services, a demand that Fintechs are adept at meeting.

Technological Infrastructure and Connectivity

The reliability of technological infrastructure in Puerto Rico and the U.S. Virgin Islands directly impacts First BanCorp's digital services. In 2024, while internet penetration continues to grow, with over 70% of households having internet access, consistent and high-speed connectivity remains a challenge in some areas. Power grid stability is also a significant concern, as evidenced by the 2022 data showing an average of 2.5 power outages per customer in Puerto Rico, impacting the seamless operation of online banking platforms.

First BanCorp must prioritize robust backup systems and resilient infrastructure to ensure business continuity. This is particularly critical given the region's susceptibility to natural disasters, which can cause widespread disruptions. For instance, following Hurricane Fiona in September 2022, many businesses experienced prolonged outages, highlighting the need for advanced disaster recovery plans and redundant systems to maintain customer access to financial services.

- Internet Penetration: Over 70% of households in Puerto Rico and USVI had internet access in 2024, but consistent speed remains a factor.

- Power Grid Reliability: Puerto Rico averaged 2.5 power outages per customer in 2022, underscoring infrastructure vulnerabilities.

- Disaster Preparedness: Hurricane Fiona in 2022 demonstrated the critical need for resilient technological infrastructure and backup systems.

- Digital Operations Impact: Disruptions in connectivity and power directly affect First BanCorp's online services and customer accessibility.

First BanCorp's technological advancement hinges on embracing digital transformation, including enhancing mobile banking and online services. Global mobile payment transactions are projected to hit $11.5 trillion by 2025, emphasizing the need for robust digital infrastructure to meet customer expectations and maintain competitiveness, as banks with advanced digital offerings saw higher customer satisfaction in 2023.

The bank must also address the escalating sophistication of cyber threats and stringent data privacy regulations. The global average cost of a data breach in 2023 was $4.45 million, underscoring the financial imperative for First BanCorp to invest in advanced cybersecurity measures and secure data handling practices to avoid significant penalties and protect customer trust.

AI and automation offer significant opportunities for First BanCorp to boost efficiency and customer satisfaction through fraud detection and personalized advice. The global AI in banking market was valued at approximately $10.8 billion in 2023 and is expected to grow substantially, highlighting the competitive advantage gained by integrating these technologies.

The evolving Fintech landscape presents both challenges and opportunities, with the global Fintech market projected to exceed $2.5 trillion by mid-2024. First BanCorp can either develop in-house solutions or partner with Fintech firms to integrate cutting-edge services, thereby enhancing its product offerings and expanding its market reach to meet growing customer demand for seamless digital financial services.

| Technological Factor | Impact on First BanCorp | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Digital Transformation & Mobile Banking | Enhance customer experience, maintain competitiveness | Mobile payment transactions globally projected to reach $11.5 trillion by 2025. Higher customer satisfaction for banks with advanced digital offerings (2023). |

| Cybersecurity & Data Privacy | Mitigate financial and reputational risks | Global average cost of data breach: $4.45 million (2023). Need for compliance with evolving regulations. |

| AI & Automation | Improve operational efficiency, fraud detection, customer service | Global AI in banking market valued at $10.8 billion (2023), with significant projected growth. |

| Fintech Landscape | Drive innovation, potential disruption, partnership opportunities | Global Fintech market projected to exceed $2.5 trillion by mid-2024. |

Legal factors

First BanCorp is subject to stringent federal and local banking regulations, overseen by entities like the Federal Reserve, FDIC, and various state financial authorities. Failure to adhere to capital adequacy ratios, such as maintaining a Common Equity Tier 1 (CET1) ratio, which for large banks often needs to exceed 7% as per Basel III, can lead to significant penalties and operational restrictions.

Compliance with lending limits, consumer protection laws, and anti-money laundering (AML) statutes is paramount for maintaining its banking license and public trust. For instance, the Community Reinvestment Act (CRA) requires banks to meet the credit needs of the communities they serve, including low- and moderate-income neighborhoods, with performance regularly assessed.

Navigating the dynamic legal environment necessitates continuous adaptation and robust internal compliance frameworks. In 2024, regulatory focus often includes cybersecurity preparedness and data privacy, with institutions investing heavily to meet evolving standards and prevent breaches, which can result in substantial fines and reputational damage.

Consumer protection laws like the Truth in Lending Act and the Fair Credit Reporting Act significantly shape First BanCorp's operations. These regulations mandate transparency in lending, accurate credit reporting, and fair treatment of all customers, directly influencing how First Bancorp structures its loan products and manages customer data. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively enforcing these rules, with fines levied against financial institutions for violations, underscoring the importance of strict compliance.

First BanCorp's operations are heavily influenced by stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) legal requirements. These mandates are designed to combat financial crimes, including terrorism financing and money laundering, by requiring thorough customer identification and ongoing monitoring of transactions. Failure to comply can lead to significant penalties.

In 2023, global financial institutions faced substantial AML fines, with reports indicating billions of dollars in penalties levied worldwide. For First BanCorp, maintaining robust AML/KYC programs is not just a legal necessity but a crucial element in safeguarding its reputation and operational integrity. The regulatory landscape continues to evolve, demanding constant vigilance and investment in compliance technology.

Data Privacy and Cybersecurity Laws

First BanCorp must navigate a complex web of data privacy and cybersecurity laws, with increasing scrutiny on how customer information is handled. The Gramm-Leach-Bliley Act (GLBA) remains a cornerstone federal regulation for financial institutions, mandating safeguards for sensitive customer data. As of 2024, the landscape is further shaped by evolving state-level privacy laws, requiring diligent compliance to avoid penalties.

These regulations dictate the collection, usage, and protection of customer information, making robust data security measures and transparent privacy policies a legal imperative for First BanCorp. Failure to comply can lead to significant fines and reputational damage. For instance, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), have set a precedent for consumer data rights, influencing practices nationwide.

- GLBA Compliance: Strict adherence to federal data privacy standards for financial institutions.

- State-Specific Laws: Navigating varying privacy regulations across different US states, impacting data handling practices.

- Cybersecurity Mandates: Implementing robust security protocols to protect sensitive customer data from breaches.

- Consumer Rights: Ensuring transparency and providing consumers with control over their personal information.

Litigation and Regulatory Enforcement

First BanCorp, like many financial institutions, navigates a landscape fraught with potential litigation and regulatory scrutiny. This can manifest as customer-initiated lawsuits, including potentially costly class-action suits, or enforcement actions from bodies like the Consumer Financial Protection Bureau (CFPB) or the Office of the Comptroller of the Currency (OCC). These actions often stem from allegations of non-compliance with banking regulations, consumer protection statutes, or operational missteps. For instance, in 2023, the banking sector saw a significant increase in enforcement actions related to fair lending practices and data privacy. Managing these risks effectively requires a strong legal defense, proactive compliance frameworks, and robust internal controls to mitigate potential financial and reputational damage.

The financial impact of litigation and regulatory enforcement can be substantial. Fines, legal fees, and potential settlements can significantly erode profitability. For example, in 2024, several large banks faced multi-million dollar penalties for various compliance failures. First BanCorp's approach to managing these legal factors includes:

- Maintaining a dedicated legal and compliance team: Ensuring adherence to evolving banking laws and consumer protection regulations is paramount.

- Implementing robust internal controls: Proactive identification and remediation of operational risks can prevent many legal challenges.

- Engaging in effective dispute resolution: Seeking to resolve issues through negotiation or mediation can minimize the costs and disruptions associated with protracted litigation.

- Staying abreast of regulatory changes: Adapting business practices to comply with new or amended regulations, such as those concerning cybersecurity or anti-money laundering, is crucial.

Legal factors significantly shape First BanCorp's operational landscape, demanding strict adherence to a complex web of regulations. These include federal mandates like the Gramm-Leach-Bliley Act for data privacy and state-specific laws, all requiring robust cybersecurity measures. Compliance with consumer protection statutes, such as the Truth in Lending Act, is also critical for maintaining transparency and customer trust.

The bank faces ongoing scrutiny from regulatory bodies like the CFPB and OCC, with enforcement actions and potential litigation a constant consideration. For instance, in 2023, the financial sector saw a notable rise in enforcement actions related to fair lending and data privacy, highlighting the need for proactive compliance frameworks. First BanCorp's strategy involves a dedicated legal team, strong internal controls, and continuous adaptation to evolving legal requirements.

Navigating anti-money laundering (AML) and Know Your Customer (KYC) regulations is paramount to prevent financial crime and safeguard the bank's reputation. Global AML fines reached billions in 2023, underscoring the severe financial and reputational consequences of non-compliance. First BanCorp's commitment to these areas is essential for operational integrity and market standing.

Capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which for large banks often needs to exceed 7% under Basel III, are rigorously monitored. Failure to meet these benchmarks can result in penalties and operational limitations, emphasizing the importance of sound financial management and regulatory alignment.

Environmental factors

First BanCorp's core markets in Puerto Rico and the U.S. Virgin Islands are particularly vulnerable to climate change impacts, especially hurricanes. These events, like Hurricane Maria in 2017, can devastate infrastructure and economies, directly affecting the bank's loan portfolios and the value of its collateral.

The increasing frequency and intensity of such natural disasters pose a significant physical risk to First BanCorp's operations and financial stability. For instance, in 2023, Puerto Rico experienced several tropical storm systems, leading to power outages and localized flooding, which can hinder loan repayment and property valuations.

Proactive assessment and mitigation of these climate-related physical risks are essential for First BanCorp's long-term resilience. This includes strengthening collateral protection and developing robust business continuity plans to navigate the economic disruptions caused by severe weather events.

Environmental factors are increasingly shaping lending practices, with a significant push for integrating Environmental, Social, and Governance (ESG) criteria. This trend directly impacts how institutions like First BanCorp approach their lending and investment portfolios. For instance, a growing number of investors, including those focused on sustainable finance, are scrutinizing the environmental impact of companies they invest in, which in turn pressures banks to align their lending with these expectations.

There's a palpable expectation for financial institutions to actively finance projects that are environmentally sustainable and to thoroughly assess the environmental footprint of their borrowers. This isn't just about compliance; it's becoming a strategic imperative. By incorporating ESG metrics into credit assessments, banks can bolster their reputation, attract a widening pool of responsible investors, and proactively manage potential future environmental risks that could affect loan performance.

The availability and cost of key resources like water and energy directly influence the economic health of communities where First BanCorp operates, potentially impacting the quality of its loan portfolio. For instance, in Puerto Rico, a primary market for First BanCorp, water scarcity and energy grid reliability remain persistent challenges, affecting businesses across sectors from tourism to agriculture.

Infrastructure resilience, particularly concerning energy and water systems, is vital for economic stability. Areas facing environmental challenges require robust infrastructure to support business operations and community well-being. The ongoing efforts to modernize Puerto Rico's energy infrastructure, with significant federal investment, aim to mitigate these risks, though progress can be uneven.

First BanCorp's operations are indirectly influenced by these resource dynamics. Disruptions to local businesses due to resource scarcity or infrastructure failures can lead to increased credit risk, while investments in resilient infrastructure could foster economic growth and improve the bank's operating environment.

Environmental Regulations and Policy

Evolving environmental regulations, particularly those concerning carbon emissions and sustainable land use, are increasingly influencing the industries that First BanCorp serves. For instance, stricter emissions standards in manufacturing or new waste management requirements in the tourism sector can directly increase operational costs for borrowers.

These compliance burdens can affect a business's profitability and, consequently, their capacity to service debt obligations. Financial institutions like First BanCorp must actively monitor these regulatory shifts to accurately assess lending risks, especially within sectors like real estate development and heavy industry.

- Increased Compliance Costs: Businesses in sectors like manufacturing and real estate may face higher expenses to meet new environmental standards.

- Impact on Loan Repayment: Elevated operational costs due to regulations can strain a company's financial health, potentially affecting their ability to repay loans.

- Risk Assessment Focus: First BanCorp needs to integrate the monitoring of environmental policy changes into its credit risk assessment processes.

- Sectoral Vulnerability: Industries such as tourism and manufacturing are particularly susceptible to the financial impacts of environmental regulatory changes.

Green Finance and Sustainable Investing

The growing emphasis on green finance and sustainable investing offers significant avenues for First BanCorp. By developing innovative products like green bonds or specialized loans for renewable energy infrastructure, the bank can tap into a burgeoning market. This strategic alignment not only caters to environmentally aware investors but also reinforces First BanCorp's commitment to broader sustainability objectives, potentially attracting substantial capital flows.

For instance, the global sustainable investment market reached an estimated $35.3 trillion in assets under management by the end of 2022, according to the Global Sustainable Investment Alliance. This demonstrates a clear investor preference for companies and financial institutions prioritizing environmental, social, and governance (ESG) factors. First BanCorp can leverage this trend to:

- Develop and market green loan products for renewable energy and energy efficiency projects.

- Issue green bonds to finance environmentally beneficial initiatives.

- Attract a wider base of ESG-focused institutional and retail investors.

- Enhance its corporate reputation and social license to operate.

First BanCorp's core markets are susceptible to climate change, with hurricanes like Maria in 2017 causing significant economic damage and impacting loan portfolios. The increasing frequency of severe weather events in 2023, such as tropical storms leading to power outages in Puerto Rico, directly affects the bank's operational stability and collateral values.

Environmental regulations are evolving, requiring businesses to adapt to stricter standards, which can increase operational costs for borrowers and influence loan repayment capacity. First BanCorp must integrate the monitoring of environmental policy changes into its credit risk assessment processes to manage these evolving challenges effectively.

The global push for green finance and sustainable investing presents opportunities for First BanCorp to develop new products and attract ESG-focused investors, aligning with a market trend that saw sustainable investments reach $35.3 trillion by the end of 2022.

Resource availability, such as water and energy, remains a critical factor for economic health in Puerto Rico, directly influencing the loan portfolio quality for First BanCorp. Investments in resilient infrastructure, supported by federal funding, are crucial for mitigating these environmental risks and fostering economic stability.

PESTLE Analysis Data Sources

Our PESTLE analysis for First Bank is built upon a robust foundation of data from reputable financial institutions, government economic reports, and leading industry publications. We meticulously gather information on regulatory changes, market trends, and technological advancements to ensure a comprehensive understanding of the macro-environment.