First Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Bank Bundle

First Bank faces a dynamic competitive landscape, with moderate bargaining power from buyers and suppliers influencing its profitability. The threat of substitutes is a key consideration, potentially impacting market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore First Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Technology providers offering core banking software, cybersecurity, and digital infrastructure possess significant bargaining power over First Bank. These essential systems are critical for First BanCorp's operations, and the expense and complexity of switching vendors, including data migration, create high switching costs. The ongoing need for advanced fintech solutions further strengthens the position of specialized technology suppliers, allowing them to negotiate favorable pricing and terms.

The suppliers of capital, such as depositors, interbank lenders, and institutional investors, hold considerable sway over First BanCorp. The bank's success in attracting and keeping deposits at competitive rates is a direct determinant of its funding costs and overall profitability. For instance, in 2023, First BanCorp reported total deposits of $60.5 billion, highlighting the crucial role of these capital sources.

Highly skilled employees in crucial areas such as risk management, compliance, data analytics, and digital banking are essential suppliers of talent for First BanCorp. The increasing demand for this specialized expertise, especially with the rapid pace of digital transformation, significantly enhances the bargaining power of these professionals.

The competition for top talent in markets like Florida and Puerto Rico is intense, forcing First BanCorp to offer competitive compensation and benefits packages. In 2024, the average salary for a data scientist in the financial services sector saw an increase of approximately 10-15% year-over-year, directly impacting the bank's operational costs and profitability due to higher labor expenses.

Regulatory Bodies and Compliance Services

Regulatory bodies, such as the FDIC and the Federal Reserve, exert significant influence over First BanCorp. These entities dictate capital requirements, lending practices, and consumer protection standards, effectively acting as powerful suppliers of operational rules. For instance, in 2024, the banking industry continued to navigate evolving capital adequacy ratios and liquidity coverage requirements, directly impacting how First BanCorp manages its balance sheet and profitability.

First BanCorp's need to comply with these regulations necessitates substantial investment in technology, personnel, and reporting systems. These compliance costs represent a direct financial burden, akin to the cost of raw materials for other industries. Failure to adhere to these mandates can result in substantial fines and reputational damage, underscoring the high bargaining power of these regulatory entities.

- Regulatory Costs: Banks like First BanCorp must allocate significant resources to ensure adherence to complex and ever-changing financial regulations.

- Impact on Operations: Changes in rules, such as those related to loan loss provisioning or anti-money laundering efforts, directly alter a bank's operational framework.

- Profitability Constraints: Stricter capital requirements or increased compliance burdens can limit a bank's ability to lend and, consequently, its potential profitability.

- Market Stability: While imposing costs, these regulations also contribute to overall financial market stability, a benefit that indirectly supports First BanCorp's long-term viability.

Payment Network Providers

Payment network providers such as Visa and Mastercard hold significant sway over First BanCorp's operations, particularly in its transaction services. Their essential role in facilitating card payments means banks have limited alternatives when it comes to processing these transactions, even with the existence of other networks. This concentration of power allows these providers to dictate terms and fees, directly impacting First BanCorp's profitability from its credit and debit card offerings.

For instance, in 2023, Visa reported processing over 200 billion transactions globally, highlighting its immense network effect and the reliance of financial institutions. These networks charge interchange fees and assessment fees, which are a critical component of a bank's non-interest income. The ability of these providers to adjust these fees can significantly alter a bank's revenue forecasts.

- Network Dominance: A few major payment networks control the vast majority of card transactions, reducing banks' negotiation leverage.

- Fee Structures: Interchange and assessment fees set by networks directly impact bank revenue from card services.

- Limited Alternatives: The ubiquity and infrastructure of dominant networks make it difficult for banks to switch or bypass them.

- Impact on Profitability: Changes in network fees can lead to substantial shifts in a bank's net interest margin and fee income.

Technology providers for core banking, cybersecurity, and digital infrastructure wield considerable power over First BanCorp due to high switching costs and the critical nature of these services. Specialized fintech suppliers also benefit from the ongoing demand for advanced solutions, enabling them to negotiate favorable terms.

Suppliers of capital, including depositors and institutional investors, significantly influence First BanCorp by dictating funding costs and impacting profitability. In 2023, First BanCorp's substantial deposit base of $60.5 billion underscores the critical role these suppliers play in the bank's financial health.

Highly skilled employees in areas like risk management and digital banking are crucial suppliers of talent, with their bargaining power amplified by the increasing demand for specialized expertise. The competitive talent market in regions like Florida and Puerto Rico further necessitates attractive compensation packages.

Payment network providers, such as Visa and Mastercard, exert significant influence over First BanCorp's transaction services. Their dominant market position and network effects allow them to dictate fees, directly affecting the bank's revenue from card offerings.

| Supplier Type | Impact on First BanCorp | Key Factors | 2023/2024 Data Point |

|---|---|---|---|

| Technology Providers | High switching costs, critical infrastructure | Data migration complexity, need for advanced fintech | Not directly quantifiable in public reports, but essential for operations |

| Capital Suppliers (Depositors) | Determines funding costs and profitability | Attracting and retaining deposits at competitive rates | Total Deposits: $60.5 billion (2023) |

| Skilled Employees | Increases operational costs, impacts service quality | Demand for specialized skills (risk, digital), competitive talent market | 10-15% YoY salary increase for data scientists (2024) |

| Payment Networks (Visa, Mastercard) | Affects revenue from card services | Network dominance, interchange and assessment fees | Visa processed over 200 billion transactions globally (2023) |

What is included in the product

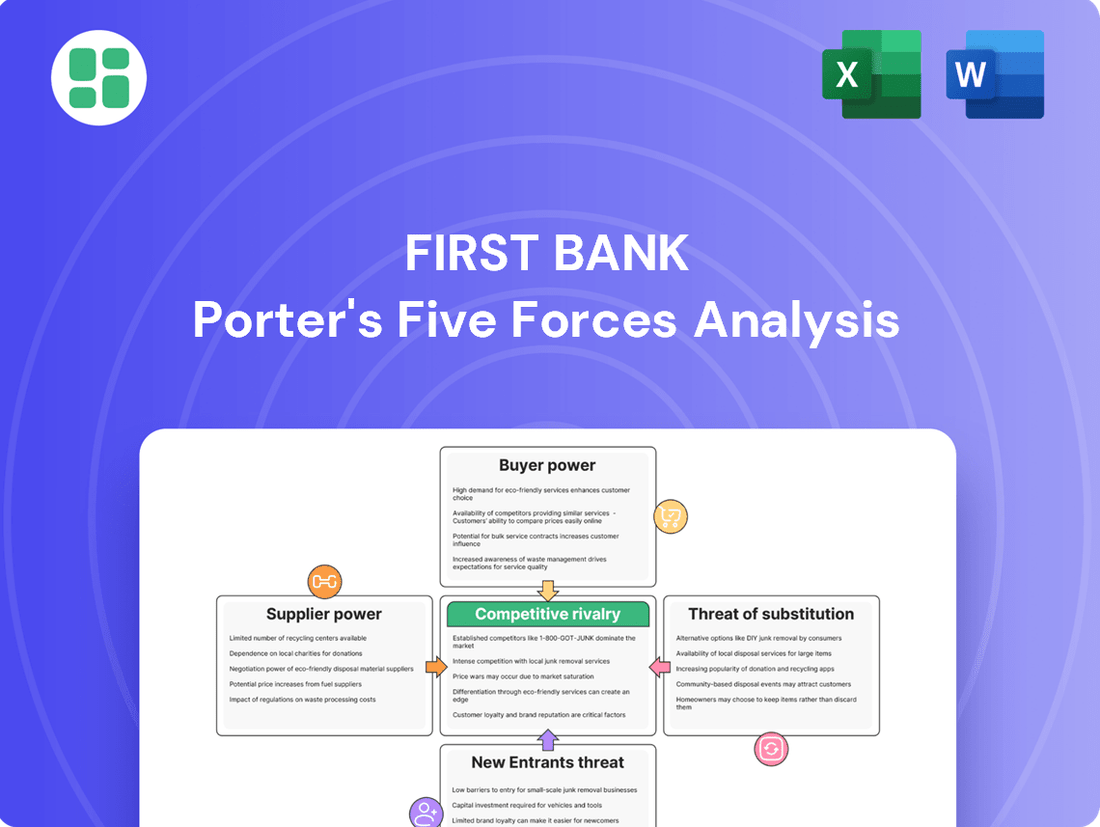

This analysis delves into the five competitive forces impacting First Bank, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the presence of substitutes.

Visualize competitive intensity with a dynamic heat map, instantly highlighting areas of greatest pressure.

Customers Bargaining Power

Retail clients, such as individual consumers, typically wield significant bargaining power. This is largely due to the low costs associated with switching between financial institutions for basic services like checking or savings accounts. With a multitude of options available, from traditional banks and credit unions to increasingly popular digital-only banks, customers can readily shop around for the best deposit rates and loan terms. In 2024, the average interest rate on savings accounts across major US banks hovered around 0.5%, while some online banks offered upwards of 4.5%, illustrating the competitive pressure on institutions like First BanCorp to remain attractive.

Commercial clients, encompassing everything from small businesses to major corporations, hold a significant level of bargaining power with First BanCorp. This power is directly tied to the scale of their dealings with the bank and the ease with which they can access competing financial services. For instance, a large corporation that places substantial deposits and takes out significant loans can leverage its volume to negotiate more favorable rates and terms on services like treasury management.

Government clients, especially those in Puerto Rico and the U.S. Virgin Islands, are crucial for First BanCorp, offering substantial deposit and lending avenues. This makes them powerful bargainers. For instance, in 2024, government deposits constituted a significant portion of the bank's funding base, allowing these entities to negotiate terms that align with their specific needs and financial objectives.

These relationships often involve competitive bidding, where government entities can dictate service requirements, interest rates, and reporting standards. This competitive environment underscores the leverage government clients hold, pushing banks like First BanCorp to offer highly customized solutions and favorable pricing to secure and maintain these valuable accounts.

Digital Natives and Tech-Savvy Customers

Digital natives and tech-savvy customers wield significant influence, demanding seamless online experiences and competitive pricing. In 2024, the rapid adoption of fintech solutions means customers can easily compare offerings and switch providers, putting pressure on traditional banks like First BanCorp to innovate. This segment expects personalized services and readily available information, making transparency and digital accessibility crucial for retention.

- Digital Adoption: By the end of 2023, over 70% of banking customers in the U.S. reported using mobile banking apps regularly, a trend that continued to grow into 2024.

- Fintech Competition: The global fintech market was projected to reach over $332 billion in 2024, indicating a strong competitive landscape for traditional financial institutions.

- Customer Expectations: Surveys from early 2024 showed that over 60% of consumers prioritize ease of use and digital functionality when choosing a bank.

- Switching Behavior: Customers are increasingly willing to switch banks for better digital services, with some reports indicating that up to 30% of customers have switched providers in the past two years due to dissatisfaction with digital offerings.

Information Availability and Transparency

The widespread availability of financial information, including interest rates, fees, and product comparisons, through online platforms and financial aggregators significantly boosts customer bargaining power. Customers can readily research and compare offerings from numerous banks, empowering them to demand better terms and make more informed choices.

This transparency compels First BanCorp to consistently offer competitive pricing and high-quality services to retain its customer base. For instance, in 2024, the number of financial comparison websites and apps accessible to consumers continued to grow, providing easy access to data on savings accounts, loans, and other banking products.

- Increased Customer Choice: Over 70% of banking customers in the US used online channels for at least one banking task in 2024, highlighting the ease of switching providers.

- Price Sensitivity: Customers actively compare interest rates on savings accounts and loan products, with minor differences often influencing their decisions.

- Demand for Value: Transparency allows customers to easily identify and switch to institutions offering superior value, putting pressure on First BanCorp to innovate and optimize its offerings.

Customers' ability to switch banks easily, especially for basic services, grants them significant leverage. The proliferation of online information and digital banking options in 2024 means consumers can quickly compare rates and terms, forcing institutions like First BanCorp to offer competitive pricing and superior service to retain business. This ease of comparison and switching is a primary driver of customer bargaining power.

| Customer Segment | Bargaining Power Driver | Impact on First BanCorp (2024 Outlook) |

|---|---|---|

| Retail Clients | Low switching costs for basic accounts; availability of online comparison tools. | Pressure on deposit rates; need for competitive digital offerings. |

| Commercial Clients | Volume of deposits and loans; access to alternative financing. | Negotiation leverage on loan pricing, treasury services, and fees. |

| Government Clients | Significant deposit bases; strategic importance in specific regions. | Ability to dictate terms for deposits, lending, and specialized financial services. |

Full Version Awaits

First Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the First Bank, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

First BanCorp faces significant competitive rivalry across its operating regions. In Puerto Rico, the banking landscape features a few dominant large banks alongside numerous smaller institutions, all competing for customer deposits and loans. This creates a dynamic environment where market share is constantly being contested.

Florida presents an even more fragmented competitive scenario. Major national banks, such as JPMorgan Chase and Bank of America, have a substantial presence, alongside a multitude of regional and community banks. For instance, as of Q1 2024, the U.S. banking sector comprised over 4,000 commercial banks, highlighting the sheer volume of potential competitors First BanCorp must navigate in this state.

The banking industry in First BanCorp's key markets, especially Puerto Rico, has seen a rebound in profitability. However, the pace of growth for traditional banking services is generally slower when contrasted with the dynamic expansion seen in fintech sectors. This disparity can lead to heightened competition among established players.

As core banking services experience more moderate growth, financial institutions often intensify their efforts to capture existing customers and market share. This dynamic can result in more aggressive strategies and a tighter competitive landscape as banks vie for a limited pool of expanding business.

Banking products and services are largely seen as commodities, making it tough for First BanCorp to stand out with basic offerings like checking accounts or typical loans. Competitors can easily copy these, pushing First BanCorp to compete on price, service, and digital tools, which ramps up the rivalry.

While areas like wealth management and specialized lending offer some differentiation, the inherent replicability of banking products means that First BanCorp must continuously innovate its customer experience and digital platforms to maintain a competitive edge. For instance, in 2023, the banking industry saw a significant increase in digital adoption, with mobile banking users growing by an estimated 15%, highlighting the importance of digital experience as a differentiator.

High Exit Barriers

The banking sector, including institutions like First Bank, faces intense competitive rivalry partly due to significant exit barriers. These include massive capital outlays in physical branches and digital infrastructure, stringent regulatory capital requirements, and the profound social and economic consequences of a bank failing. These factors make it incredibly difficult and costly for banks to cease operations.

Consequently, even when facing economic headwinds or profitability challenges, banks are compelled to remain in the market. This persistence prevents the natural consolidation that could otherwise reduce the number of competitors and ease competitive pressures. For instance, in 2023, the U.S. banking sector saw a net increase of 14 institutions, despite some failures, indicating the stickiness of market participants.

- High Capital Investments: Banks have substantial fixed assets, like data centers and branch networks, representing sunk costs that are hard to recover.

- Regulatory Hurdles: Strict regulations regarding capital adequacy, liquidity, and resolution planning make orderly exits complex and expensive.

- Social and Economic Impact: The systemic importance of banks means governments and regulators actively work to prevent failures, keeping even weak players operational.

- Limited Alternative Uses: Specialized banking assets have few alternative applications, further increasing exit costs.

Aggressive Digital Transformation

The financial sector is experiencing a fierce technology race, with institutions like First BanCorp pouring resources into digital advancements. This aggressive digital transformation intensifies competition as banks vie for customer loyalty through enhanced mobile banking, sophisticated online platforms, and AI-powered solutions. For instance, in 2024, the global digital banking market was projected to reach over $21 trillion, highlighting the massive investment and competitive pressure in this space.

This constant innovation cycle means competitors are continuously rolling out more user-friendly, tailored, and efficient digital services. Banks are investing heavily in areas like:

- Mobile Banking Apps: Enhancing features for seamless transactions and account management.

- Online Platforms: Streamlining onboarding processes and offering a wider range of services digitally.

- AI and Machine Learning: Personalizing customer experiences and automating customer service.

This technological arms race compels all players, including First BanCorp, to invest significantly to remain competitive and avoid losing market share to more digitally agile rivals.

First BanCorp operates in markets with substantial competitive rivalry, intensified by the commoditized nature of many banking products. Competitors can readily replicate core offerings like checking accounts and loans, forcing First Bank to compete primarily on price, customer service, and digital innovation. This dynamic is further fueled by high exit barriers in the banking sector, which keep even less profitable institutions in the market, thus sustaining competitive pressures.

The ongoing technology race significantly escalates this rivalry. Banks are making substantial investments in digital transformation, aiming to enhance mobile banking, online platforms, and AI-driven solutions to attract and retain customers. This continuous innovation cycle means that staying competitive requires constant upgrades to digital services to avoid losing ground to more agile competitors.

| Key Competitive Factors | First BanCorp's Position | Industry Trend (2024 Data) |

|---|---|---|

| Product Commoditization | High | Core banking products widely replicated. |

| Digital Innovation | Moderate to High | Significant investment in mobile, online, and AI services. |

| Market Fragmentation (Florida) | Moderate | Presence of national, regional, and community banks. |

| Exit Barriers | High | Capital, regulatory, and systemic factors limit bank exits. |

SSubstitutes Threaten

Fintech companies and digital-only banks present a substantial threat of substitution by delivering specialized, tech-focused financial services that circumvent traditional banking. These disruptors offer everything from mobile payment solutions and peer-to-peer lending to online mortgage origination and automated investment advice. Their appeal lies in lower operational costs, swift product development, and a superior user experience, particularly for younger, tech-savvy demographics, directly challenging First BanCorp's established services.

Credit unions and Community Development Financial Institutions (CDFIs) present a significant threat of substitutes for First BanCorp, particularly in its core retail and small business segments. These organizations, often non-profits, can offer more attractive interest rates on savings and loans due to their structure, directly competing with First Bank's offerings. For instance, credit unions in Puerto Rico, where First BanCorp has a strong presence, have seen steady growth in membership and assets, providing a viable alternative for local consumers and businesses seeking personalized service and potentially better terms.

Direct investment platforms and online brokerages offer a compelling alternative for individuals seeking to manage their wealth. These digital-first services empower users to bypass traditional bank intermediaries, directly accessing investment opportunities. For instance, by mid-2024, many leading robo-advisors and online brokerages reported significant increases in assets under management, with some seeing year-over-year growth exceeding 20% in their retail investor segments.

These platforms often boast considerably lower fee structures compared to traditional banking services, making them an attractive substitute for First BanCorp's wealth management and advisory offerings. The ability for individuals to take direct control of their investment portfolios, coupled with the cost savings, presents a strong threat. The trend towards self-directed investing, fueled by accessible technology and educational resources, further erodes the necessity for conventional bank-provided investment guidance.

Cryptocurrencies and Blockchain-Based Finance

The rise of cryptocurrencies and decentralized finance (DeFi) presents a developing threat of substitution for First Bank, especially in areas like payment processing and acting as a store of value. While these digital assets are still navigating volatility and regulatory landscapes, they offer alternative transaction methods and asset management possibilities that could lessen dependence on traditional banking systems.

For instance, the total market capitalization of cryptocurrencies, which had seen significant fluctuations, stood around $2.5 trillion in early 2024, indicating a substantial, albeit volatile, alternative financial ecosystem. DeFi protocols, meanwhile, saw a total value locked (TVL) exceeding $100 billion in early 2024, demonstrating growing user adoption for services like lending and borrowing outside traditional banks.

- Payment Processing: Cryptocurrencies offer peer-to-peer transactions that can bypass traditional banking fees and settlement times, potentially impacting revenue streams from wire transfers and card processing.

- Store of Value: Digital assets like Bitcoin are increasingly viewed by some as a hedge against inflation or a digital gold, challenging traditional savings and investment products offered by banks.

- Lending and Borrowing: DeFi platforms allow users to lend and borrow assets directly, bypassing banks and potentially reducing demand for traditional loan products.

In-House Corporate Finance and Alternative Lending

Large commercial and government clients are increasingly looking beyond traditional bank loans. In 2024, the private credit market continued its robust expansion, with estimates suggesting it could reach $2.7 trillion globally by 2027, presenting a significant alternative to bank financing.

This shift means that clients can bypass banks by tapping into their own in-house finance capabilities or by accessing capital directly through private equity, venture capital, or corporate bond markets. For instance, many large corporations now have sophisticated treasury departments capable of managing complex financing needs internally.

The availability of these alternative lending sources directly substitutes traditional commercial lending services offered by banks. This growing trend reduces client dependence on banks, as direct market access or specialized non-bank financing becomes a more viable and often more attractive option for capital acquisition.

- Private Credit Market Growth: Projected to reach $2.7 trillion globally by 2027, offering a substantial alternative to traditional bank loans.

- In-House Finance Capabilities: Large corporations increasingly leverage their internal treasury departments for financing needs.

- Direct Market Access: Clients can raise capital through private equity, venture capital, and corporate bonds, bypassing banks.

- Reduced Bank Dependence: The rise of these substitutes diminishes reliance on commercial banks for essential capital.

Fintech, credit unions, and direct investment platforms offer increasingly competitive alternatives to traditional banking services. These substitutes leverage technology and specialized models to provide lower costs and enhanced user experiences, directly challenging First BanCorp's market share. The growing adoption of digital assets and decentralized finance further expands the landscape of potential substitutes, particularly in payments and lending.

| Substitute Category | Key Offerings | Impact on First BanCorp | 2024 Data/Trend |

|---|---|---|---|

| Fintech & Digital Banks | Mobile payments, P2P lending, online mortgages | Circumvents traditional banking, lower costs, better UX | Continued growth in user adoption, especially among younger demographics. |

| Credit Unions & CDFIs | Attractive rates on savings and loans | Direct competition in retail and small business segments | Steady membership and asset growth noted in key markets like Puerto Rico. |

| Direct Investment Platforms | Online brokerage, robo-advisors | Bypasses bank intermediaries for wealth management | Significant increases in assets under management reported, with some platforms seeing >20% YoY growth in retail segments. |

| Cryptocurrencies & DeFi | Peer-to-peer transactions, alternative lending | Potential impact on payment processing and store of value | DeFi TVL exceeded $100 billion in early 2024; crypto market cap around $2.5 trillion. |

| Private Credit Markets | Non-bank lending, direct market access | Alternative to commercial bank loans for large clients | Market projected to reach $2.7 trillion globally by 2027. |

Entrants Threaten

The banking sector, particularly for established players like First BanCorp, faces a significant threat from new entrants due to extremely high capital requirements. Regulators mandate substantial initial capital for new banks to secure licenses, build essential infrastructure, and maintain financial soundness. For instance, in 2024, regulatory capital ratios, such as the Common Equity Tier 1 (CET1) ratio, remain stringent, often requiring new entrants to hold a considerable percentage of their risk-weighted assets in high-quality capital. This financial hurdle effectively deters many potential competitors from entering the market, thereby protecting existing institutions.

New entrants into the banking sector face significant challenges due to extensive regulatory hurdles and substantial compliance costs. Obtaining necessary licenses, adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations, and meeting consumer protection standards require considerable investment. For instance, in 2024, the average cost for a new fintech to achieve full regulatory compliance in a major market could easily run into millions of dollars, encompassing legal fees, technology infrastructure, and staffing.

Trust and brand reputation are massive hurdles for any new bank trying to enter the market. Think about it, people want to know their money is safe. Established players like First BanCorp have spent years, even decades, building that confidence. In 2023, for instance, major banks consistently reported high customer satisfaction scores, a testament to their long-standing relationships. This deep-seated trust is incredibly hard for newcomers to quickly replicate.

Consumers and businesses are naturally cautious when it comes to their finances. They're less likely to hand over their hard-earned cash to an unknown entity. This reluctance creates a significant barrier for new entrants, making it tough to gain market acceptance and scale their operations effectively. For example, the initial capital requirements and regulatory approvals alone are substantial, but overcoming the ingrained customer loyalty to existing institutions is arguably the greater challenge.

Economies of Scale and Network Effects

Incumbent banks like First BanCorp enjoy substantial economies of scale. This allows them to spread the costs of operations, technology upgrades, and marketing across a larger customer base, resulting in lower per-unit service costs compared to new entrants. For instance, in 2024, major banks continued to invest billions in digital transformation, a cost barrier for smaller or newer players.

Network effects also present a significant hurdle. First BanCorp's extensive branch and ATM network provides convenience and accessibility, particularly in its core markets where some customers still value a physical banking presence. This established infrastructure creates a loyalty loop that new entrants struggle to replicate quickly, especially in regions where face-to-face interaction remains important for trust and service delivery.

- Economies of Scale: Lower operational costs per transaction due to high volume.

- Technology Investment: High capital expenditure on IT infrastructure and digital platforms by incumbents.

- Network Effects: Customer preference for banks with widespread physical and digital access points.

- Brand Recognition: Established trust and familiarity built over years of operation.

Customer Switching Costs

Customer switching costs can significantly deter new entrants, particularly for First BanCorp's more sophisticated financial services. While it's relatively easy for a consumer to switch banks for a basic checking account, moving complex commercial lending relationships or wealth management portfolios involves considerable effort and potential disruption.

These higher switching costs, including the administrative burden of transferring accounts, the time needed to build new relationships with a different institution, and the potential for service interruptions, create stickiness for First BanCorp's existing client base. For instance, a business relying on integrated treasury management services or an individual with a tailored wealth plan might hesitate to switch even if a competitor offers slightly better rates.

This inertia makes it challenging for new players to attract established customers away from First BanCorp. Data from 2024 indicates that while overall customer acquisition costs remain a factor, the retention of clients in specialized banking segments is notably higher due to these embedded switching barriers.

- High Switching Costs in Complex Services: Commercial lending, wealth management, and integrated financial solutions present significant hurdles for customers looking to switch banks.

- Administrative Burden and Disruption: Moving accounts, re-establishing payment systems, and building new relationships involve time and potential operational interruptions.

- Relationship Dependency: Established trust and tailored financial advice in areas like wealth management make clients less likely to move, even with competitive offers.

- Deterrent to New Entrants: These factors create a barrier for new banks aiming to capture First BanCorp's established, high-value customer segments.

The threat of new entrants for First BanCorp is moderate, primarily due to high capital requirements and stringent regulatory oversight. While fintech innovations offer potential disruption, the established trust and extensive compliance infrastructure of incumbent banks like First BanCorp create significant barriers.

New entrants face substantial upfront costs for licensing, technology, and compliance, estimated in the millions for major markets in 2024. Furthermore, the need to build brand recognition and customer trust, which First BanCorp has cultivated over years, presents a considerable challenge for newcomers aiming to capture market share.

Economies of scale enjoyed by First BanCorp, coupled with billions invested in digital transformation in 2024, further elevate the entry barrier. The established network effects and high switching costs associated with complex financial services also limit the immediate impact of new competitors.

| Barrier Type | Description | Impact on New Entrants | Example (2024 Data/Trends) |

|---|---|---|---|

| Capital Requirements | Substantial initial capital mandated by regulators. | High barrier, requiring significant funding. | CET1 ratios remain stringent, demanding considerable high-quality capital. |

| Regulatory Hurdles | Complex licensing, AML, KYC, and consumer protection compliance. | High barrier, involving extensive legal and operational investment. | Compliance costs for fintechs can reach millions in major markets. |

| Brand Reputation & Trust | Established customer confidence built over time. | High barrier, difficult and time-consuming to replicate. | Major banks consistently report high customer satisfaction, reflecting long-term relationships. |

| Economies of Scale | Lower per-unit costs due to high transaction volumes. | Significant advantage for incumbents, cost disadvantage for new entrants. | Incumbents invest billions in technology, creating a cost gap. |

| Customer Switching Costs | Effort and disruption involved in moving complex financial relationships. | High barrier for specialized services, fostering customer retention. | Clients with integrated treasury or wealth management services show high retention. |

Porter's Five Forces Analysis Data Sources

Our First Bank Porter's Five Forces analysis is built upon a robust foundation of data, including the bank's own annual reports and investor presentations, alongside industry-specific research from leading financial publications and market analysis firms.