Zheshang Development Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zheshang Development Group Bundle

Navigate the complex external landscape impacting Zheshang Development Group with our expert PESTEL Analysis. Understand how political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks are shaping its strategic direction. Gain a competitive edge by leveraging these crucial insights for your own market planning. Download the full, actionable report now.

Political factors

Government policies in China significantly shape industrial growth and regional economic landscapes, directly affecting Zheshang Development Group's investment decisions. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes high-quality development and technological self-reliance, signaling strong state support for sectors like semiconductors and artificial intelligence, which could present lucrative avenues for Zheshang.

State-backed initiatives and subsidies for targeted industries, such as the renewable energy sector which saw significant government investment in 2023, create advantageous investment environments. Zheshang Development Group can leverage these policies by aligning its portfolio with national priorities, potentially benefiting from preferential financing or regulatory treatment.

Monitoring these policy shifts is paramount for Zheshang to strategically position its investments. For example, recent directives promoting the digital economy and smart manufacturing suggest that companies focusing on these areas will likely receive greater policy backing and market opportunities in the coming years.

China's financial services sector is under constant regulatory flux, impacting how companies like Zheshang Development Group manage assets and conduct operations. Recent shifts, such as the People's Bank of China's ongoing efforts to refine monetary policy and strengthen financial stability, directly influence investment strategies and operational frameworks.

Evolving rules around capital adequacy, data security, and fintech integration present both challenges and avenues for growth. For instance, new regulations aimed at curbing systemic financial risks, as seen in the deleveraging campaigns of recent years, require meticulous compliance and strategic adjustments to business models.

Zheshang Development Group must prioritize adaptability to navigate these changes, particularly concerning capital market reforms like the registration-based IPO system and evolving cross-border investment channels, to capitalize on opportunities for market expansion and stability.

China's geopolitical standing and its trade relations with major global economies are pivotal. For instance, in early 2024, ongoing trade discussions between China and the United States, particularly concerning tariffs and market access, continued to shape global economic sentiment and investment flows. These international dynamics directly affect the investment climate for companies like Zheshang Development Group.

Tensions or collaborations on the international stage can significantly impact market sentiment and foreign investment. For example, the expansion of trade agreements, such as those within the Regional Comprehensive Economic Partnership (RCEP) which China is a part of, can create new opportunities, while trade disputes can introduce volatility. Zheshang Development Group must closely monitor these shifts to gauge potential risks and opportunities within its diverse investment portfolio.

State-Owned Enterprise (SOE) Reform Agenda

China's ongoing State-Owned Enterprise (SOE) reform agenda creates a dynamic landscape for groups like Zheshang Development Group. This reform aims to improve efficiency and competitiveness, potentially opening doors for private capital. For Zheshang, this could mean participating in the restructuring of existing SOEs or acquiring stakes in newly divested entities, directly aligning with its mission to support industrial advancement.

The success and speed of these reforms are critical. For instance, in 2023, China continued its push to optimize the SOE sector, with a focus on mixed-ownership reforms and improving governance structures. The government has signaled a commitment to further market-oriented reforms, which could lead to more attractive investment opportunities for Zheshang Development Group as SOEs become more commercially viable and transparent.

- SOE Reform Progress: China's State Council reported that by the end of 2023, over 70% of SOEs had completed their mixed-ownership reforms, a significant step that could increase investment accessibility.

- Investment Opportunities: Zheshang Development Group can leverage these reforms to identify undervalued assets or companies undergoing strategic repositioning within the SOE sector.

- Market Dynamics: The pace of reform directly impacts the availability and valuation of SOE-related investment targets, requiring Zheshang to remain agile in its strategic planning.

Regional Economic Development Plans

Zheshang Development Group's operations are intrinsically linked to Zhejiang province's strategic economic blueprints. For instance, the provincial government's 14th Five-Year Plan (2021-2025) emphasizes high-quality development and innovation, directly influencing investment priorities and the group's project selection. This plan allocated significant resources to sectors like advanced manufacturing and digital economy, areas where Zheshang Development Group likely finds strategic alignment and opportunities for growth through government-backed initiatives.

Provincial policies often translate into tangible support, such as preferential financing or streamlined approval processes for projects aligned with regional goals. In 2024, Zhejiang continued its focus on green development, with provincial budgets reflecting increased investment in sustainable infrastructure and clean energy projects. Zheshang Development Group's ability to tap into these funding streams and regulatory advantages is crucial for its operational success and expansion within the region.

The group's integration with these localized directives is key. For example, if Zhejiang's development plan prioritizes the expansion of the Hangzhou Bay Area, Zheshang Development Group would likely align its investments and projects to capitalize on this focused regional growth. This synergy ensures that the group benefits from targeted government support and contributes to the achievement of provincial economic objectives.

- Zhejiang's 14th Five-Year Plan (2021-2025) prioritizes innovation and advanced manufacturing, guiding provincial investment and Zheshang Development Group's strategic direction.

- Provincial funding initiatives in 2024 supported green development and digital economy sectors, creating opportunities for Zheshang Development Group to leverage government support.

- Local government support, including potential financing and regulatory advantages, is contingent on Zheshang Development Group's alignment with regional economic development plans.

Government policies in China significantly influence Zheshang Development Group's investment landscape, with national plans like the 14th Five-Year Plan (2021-2025) prioritizing technological self-reliance and high-quality development. These directives signal strong state backing for sectors such as artificial intelligence and semiconductors, presenting potential growth avenues for the group.

State-backed initiatives and subsidies, particularly evident in the renewable energy sector which saw substantial government investment in 2023, create favorable investment conditions. Zheshang Development Group can strategically align its portfolio with these national priorities to potentially access preferential financing and regulatory advantages.

China's evolving regulatory environment for financial services, including monetary policy adjustments by the People's Bank of China and reforms like the registration-based IPO system, directly impact Zheshang's asset management and operational strategies. Navigating these changes, especially concerning capital adequacy and data security, requires adaptability to capitalize on market expansion opportunities.

Geopolitical dynamics and trade relations, such as ongoing discussions between China and the US regarding tariffs in early 2024, shape global economic sentiment and investment flows. Zheshang Development Group must monitor these international shifts, including the impact of agreements like RCEP, to manage risks and identify opportunities within its diverse investment portfolio.

China's State-Owned Enterprise (SOE) reform agenda, which saw over 70% of SOEs complete mixed-ownership reforms by the end of 2023, presents opportunities for Zheshang Development Group to invest in or acquire stakes in strategically repositioned entities.

Zhejiang province's economic blueprints, such as its 14th Five-Year Plan, emphasize innovation and advanced manufacturing, guiding Zheshang Development Group's investment priorities and project selection. Provincial funding initiatives in 2024 supported green development and the digital economy, offering Zheshang opportunities to leverage government support.

| Policy Area | Impact on Zheshang Development Group | Key Data/Initiative |

|---|---|---|

| National Development Plans | Guides investment focus towards high-growth sectors. | 14th Five-Year Plan (2021-2025) emphasizes tech self-reliance. |

| Sector-Specific Subsidies | Creates advantageous investment environments. | Renewable energy sector saw significant government investment in 2023. |

| Financial Sector Regulation | Influences asset management and operational strategies. | PBOC monetary policy refinement; registration-based IPO system. |

| Geopolitical & Trade Relations | Affects market sentiment and investment flows. | Ongoing US-China trade discussions in early 2024. |

| SOE Reform | Opens opportunities for investment and acquisition. | Over 70% of SOEs completed mixed-ownership reforms by end of 2023. |

| Provincial Economic Plans | Aligns group's strategy with regional growth priorities. | Zhejiang's focus on green development and digital economy in 2024. |

What is included in the product

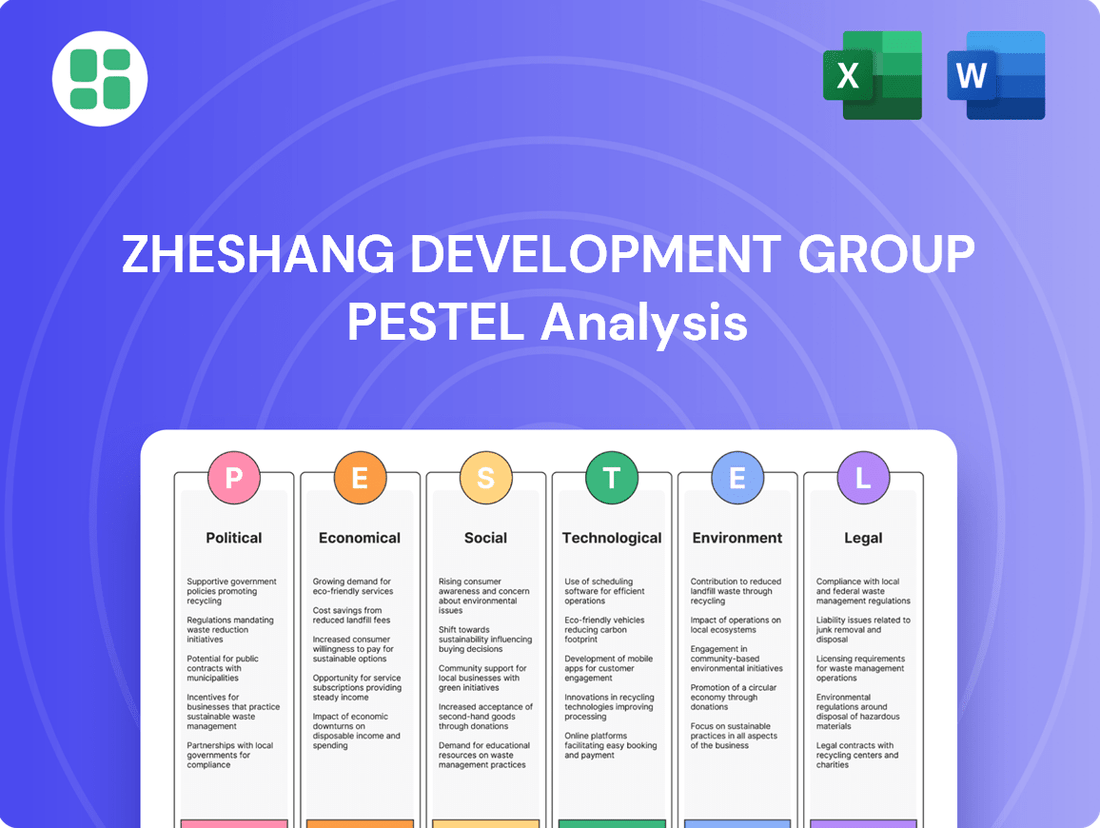

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Zheshang Development Group, offering a comprehensive view of its external operating landscape.

It provides actionable insights into how these macro-environmental factors present both challenges and strategic opportunities for the Zheshang Development Group's growth and sustainability.

A PESTLE analysis of Zheshang Development Group offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during meetings and strategic planning.

This analysis, segmented by PESTEL categories, allows for quick interpretation, relieving the pain of sifting through dense information and supporting discussions on external risks and market positioning.

Economic factors

China's economic growth rate is a critical factor for Zheshang Development Group, as it directly impacts the investment and asset management landscape. For instance, in 2023, China's GDP grew by 5.2%, demonstrating a healthy expansion that supports increased investment activity.

A strong GDP growth rate like this fosters an environment conducive to new investments, potentially leading to higher corporate profits and bolstered investor confidence. This positive economic momentum can translate into greater opportunities and improved performance for Zheshang Development Group's operations.

Conversely, any economic slowdown or deceleration in China's growth rate could dampen investment, reduce asset valuations, and consequently pressure Zheshang Development Group's financial results. For example, if growth were to dip significantly below the 2023 figure, the group might face challenges in asset management and new project funding.

The People's Bank of China's (PBOC) monetary policy, particularly its decisions on interest rates and the money supply, directly impacts Zheshang Development Group's cost of capital and the appeal of its investments. For instance, a reduction in the benchmark lending rate, such as the one-year loan prime rate which stood at 3.45% as of early 2024, can make borrowing cheaper, thereby encouraging expansion and potentially boosting returns on equity.

Conversely, an increase in interest rates, as seen in some global tightening cycles, would raise financing costs and could make fixed-income investments more attractive relative to equities. Zheshang Development Group must remain attuned to these shifts to strategically manage its debt obligations and maximize the profitability of its diverse asset portfolio.

Credit availability in China's financial markets directly impacts Zheshang Development Group's capacity to finance its diverse investments and support the growth of its portfolio companies. In 2024, China's central bank has maintained a relatively accommodative monetary policy, with benchmark lending rates seeing some adjustments to stimulate economic activity, though credit conditions remain a key focus for policymakers aiming to balance growth with financial stability.

Financial market liquidity is equally crucial; a liquid market allows Zheshang Development Group to efficiently acquire and divest assets, contributing to portfolio optimization and potential capital appreciation. As of early 2025, interbank lending rates have shown some volatility, reflecting ongoing adjustments in market liquidity management by the People's Bank of China, underscoring the need for the group to navigate these dynamics carefully.

Inflation and Asset Valuation

Inflationary pressures significantly affect Zheshang Development Group's asset valuation by altering the real returns on investments. For instance, if inflation runs at 3% in 2024, a nominal return of 5% on an asset translates to a real return of only 2%, diminishing its actual value. This erosion of purchasing power necessitates a careful assessment of investment opportunities to ensure they outpace inflation.

Conversely, deflationary trends, though less common recently, can also pose challenges by potentially pressuring corporate earnings and, consequently, asset valuations. Should deflation occur, companies might struggle to maintain profitability, impacting stock prices and the overall value of Zheshang's holdings. The group must remain vigilant to these shifts when making strategic decisions.

Considering the global economic landscape, the US Consumer Price Index (CPI) saw a notable increase in early 2024, indicating persistent inflationary concerns. This environment requires Zheshang Development Group to actively manage its asset portfolio by factoring in inflation expectations.

- Impact on Real Returns: High inflation in 2024, with CPI figures fluctuating around 3-4% in major economies, directly reduces the real yield of fixed-income assets and can necessitate higher nominal returns for equities to maintain their attractiveness.

- Asset Valuation Sensitivity: Discounted Cash Flow (DCF) models, a common valuation tool, are highly sensitive to inflation assumptions; higher expected inflation leads to higher discount rates, thereby lowering present asset values.

- Sectoral Differences: Real estate and infrastructure assets, often considered inflation hedges, may perform differently compared to technology or growth stocks during inflationary periods, requiring sector-specific analysis for Zheshang.

- Managing Portfolio Risk: Zheshang Development Group needs to diversify its portfolio to mitigate inflation risks, potentially increasing allocations to assets historically less correlated with inflation or those with pricing power.

Global Economic Trends and Trade Dynamics

Global economic trends significantly influence Zheshang Development Group, given China's deep integration into international markets. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that directly impacts demand for goods and services within Zheshang's portfolio. Disruptions like the Red Sea shipping crisis in late 2023 and early 2024, which increased shipping costs by over 100% on some routes, highlight the vulnerability of supply chains and can affect Zheshang's operational efficiency and profitability.

Changes in international trade agreements and geopolitical tensions also present substantial risks. The ongoing trade friction between major economies can lead to tariffs and quotas, impacting export-oriented sectors where Zheshang may have investments. For example, the US-China trade balance, a key indicator, saw continued shifts in 2024, affecting market access for Chinese companies. Furthermore, the flow of international capital is sensitive to global economic stability; a slowdown in foreign direct investment into China, which was estimated to have decreased in early 2024 compared to the previous year, could constrain Zheshang's expansion plans.

Key considerations for Zheshang Development Group include:

- Global Growth Projections: Monitoring forecasts from institutions like the IMF and World Bank for 2024-2025 to gauge overall market demand.

- Supply Chain Resilience: Assessing the impact of geopolitical events and logistical challenges on the cost and availability of raw materials and finished goods.

- Trade Policy Shifts: Staying informed about new trade agreements, tariffs, and regulatory changes in key international markets.

- Capital Flows: Understanding trends in foreign investment and currency exchange rates that could affect financing and international operations.

China's economic trajectory remains paramount for Zheshang Development Group, directly influencing investment climates and asset management opportunities. The nation's GDP growth, projected by the IMF to be around 4.5% for 2024, provides a foundation for market expansion. However, shifts in monetary policy, such as the People's Bank of China's adjustments to its benchmark lending rates, currently around 3.45% for the one-year loan prime rate, impact borrowing costs and investment attractiveness.

Inflationary pressures, with CPI figures in China hovering around 0.7% year-on-year in early 2024, affect real returns on investments and necessitate careful valuation. Global economic conditions, including projected global growth of 3.2% for 2024 by the IMF, also shape demand and supply chains, as evidenced by increased shipping costs due to geopolitical events in late 2023 and early 2024.

| Economic Factor | 2023/Early 2024 Data | Implication for Zheshang Development Group |

|---|---|---|

| China GDP Growth | 5.2% (2023), IMF projects ~4.5% (2024) | Supports investment activity and market expansion. |

| PBOC Benchmark Lending Rate (1-Year LPR) | 3.45% (early 2024) | Influences cost of capital and investment returns. |

| China CPI Inflation | 0.7% YoY (early 2024) | Impacts real returns on assets; lower inflation may pressure nominal returns. |

| Global GDP Growth | IMF projects 3.2% (2024) | Affects international demand for Zheshang's investments and operations. |

| Shipping Costs (Example) | Increased >100% on some routes (late 2023/early 2024) | Highlights supply chain vulnerabilities and operational cost impacts. |

What You See Is What You Get

Zheshang Development Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Zheshang Development Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the complete picture of the forces shaping this influential Chinese conglomerate.

Sociological factors

China's demographic landscape is undergoing significant shifts, with an aging population and a burgeoning middle class actively shaping investment behaviors. By the end of 2023, China's population aged 60 and above reached 296.97 million, representing 20.9% of the total population, highlighting an increasing demand for retirement planning and healthcare-related investments. This demographic evolution, coupled with a growing middle class that saw disposable income rise, fuels a greater need for sophisticated wealth management and diversified asset allocation services.

As wealth continues to accumulate, particularly among younger generations and the expanding middle class, the demand for tailored financial products and advisory services is escalating. For Zheshang Development Group, this presents a clear opportunity to align its product development and service strategies with these evolving demographic and wealth management trends, potentially offering specialized investment vehicles for retirement, education, and intergenerational wealth transfer.

Consumer and investor confidence in China plays a crucial role in shaping financial market participation. When confidence is high, individuals and institutions are more likely to invest in equities and utilize financial services, as seen in the surge of retail investor accounts in early 2024. Conversely, a dip in confidence, perhaps due to economic uncertainties, can prompt a shift towards safer investments and potentially reduce demand for Zheshang Development Group's offerings.

China's rapid urbanization continues to fuel infrastructure and industrial expansion, particularly in its burgeoning new urban centers and established regional economic hubs. This trend presents Zheshang Development Group with dynamic investment prospects as it navigates the evolving landscape of Chinese development.

However, the uneven pace of development across China's vast geography creates significant regional disparities. While some areas boom, others lag, meaning Zheshang Development Group must carefully analyze these differing growth trajectories to pinpoint strategic investment opportunities and mitigate potential risks.

For instance, by mid-2024, urban populations in China had reached over 66% of the total, a figure projected to climb further, indicating sustained demand for urban infrastructure and services. Zheshang's strategic focus on regional economies necessitates a deep understanding of these urbanization patterns to identify high-growth areas and capitalize on concentrated development.

Social Responsibility and ESG Expectations

In China, there's a noticeable surge in investor and public demand for companies to prioritize Environmental, Social, and Governance (ESG) factors. This trend means businesses, especially investment firms like Zheshang Development Group, are increasingly held accountable for their social responsibility and commitment to sustainable operations. For instance, by the end of 2023, China's ESG disclosure landscape saw significant growth, with many listed companies beginning to report on their ESG performance, reflecting this societal shift.

Zheshang Development Group's proactive engagement with ESG principles can significantly bolster its public image and attract a growing segment of investors who are keen on socially responsible ventures. This focus can also shape the group's internal investment selection criteria, favoring projects that align with sustainability goals.

- Growing ESG Awareness: Investor and public scrutiny of ESG performance is intensifying in China, influencing corporate behavior.

- Reputational Enhancement: Demonstrating social responsibility and sustainable practices can improve Zheshang Development Group's standing.

- Investor Attraction: A strong ESG commitment can draw in socially conscious investors, potentially increasing capital access.

- Investment Screening: ESG considerations are becoming integral to how investment opportunities are evaluated and selected.

Talent Pool and Labor Market Dynamics

The availability of skilled professionals in finance and investment management is paramount for Zheshang Development Group's success. As of late 2024, China's financial sector continues to see robust demand for talent, with reports indicating a 15% year-over-year increase in job postings for financial analysts and portfolio managers in major hubs like Shanghai and Shenzhen. This heightened demand, however, also intensifies competition.

Wage trends are a significant factor; average salaries for experienced investment managers in Tier 1 cities saw an estimated 8-10% increase in 2024, directly impacting operational costs for Zheshang. Labor mobility also plays a role, with a notable trend of talent moving between domestic firms and international financial institutions, creating both opportunities and challenges for talent retention.

To maintain its competitive edge, Zheshang Development Group must prioritize strategic talent acquisition and robust retention programs. This includes offering competitive compensation packages, continuous professional development opportunities, and fostering a strong organizational culture.

- Talent Demand: China's financial sector job market experienced a significant upswing in demand for skilled finance professionals in 2024, with some reports showing a 15% increase in relevant postings.

- Wage Inflation: Average salaries for experienced investment managers in major Chinese financial centers saw an estimated 8-10% rise in 2024, impacting labor costs.

- Labor Mobility: Increased movement of financial talent between domestic and international firms highlights the need for effective retention strategies.

China's societal values are increasingly emphasizing environmental consciousness and corporate social responsibility, directly impacting investment preferences and regulatory expectations. This growing awareness means companies like Zheshang Development Group must integrate ESG principles into their core strategies to maintain market relevance and investor trust.

The evolving consumer and investor sentiment, driven by a desire for ethical and sustainable practices, presents a significant sociological factor. By mid-2024, surveys indicated that over 60% of Chinese investors considered ESG factors when making investment decisions, a clear signal for Zheshang to align its operations and offerings with these values.

Furthermore, shifts in lifestyle and consumption patterns, such as the growing preference for health and wellness products and services, create new market opportunities. Zheshang Development Group can capitalize on these trends by identifying and investing in sectors that cater to these evolving societal demands.

Technological factors

FinTech innovation is rapidly reshaping the financial landscape, with digital payments, online lending, and robo-advisors becoming mainstream. For Zheshang Development Group, this means a critical need to adopt digital transformation to boost efficiency and client satisfaction.

By integrating cutting-edge FinTech solutions, Zheshang Development Group can unlock significant competitive advantages. For instance, the global FinTech market was valued at approximately $1.2 trillion in 2023 and is projected to reach $3.5 trillion by 2030, indicating immense growth potential for early adopters.

Big data analytics and AI are transforming how investment decisions are made, offering deeper market insights and more accurate risk assessments. For Zheshang Development Group, this means the ability to process vast datasets to identify subtle patterns and predict market movements with greater precision than traditional methods.

The application of AI in investment analysis allows for the development of sophisticated predictive models and automated trading strategies, potentially leading to enhanced portfolio optimization. For instance, AI algorithms can analyze news sentiment, economic indicators, and company financials in real-time, a capability that became even more critical in the volatile markets of 2024.

By integrating AI and big data, Zheshang Development Group can gain a significant competitive edge in identifying emerging investment opportunities and managing risks more effectively. The global AI market in financial services was projected to reach over $25 billion by 2025, highlighting the substantial investment and growth in this area.

As financial services increasingly move online, strong cybersecurity and data protection are absolutely essential for Zheshang Development Group. The company manages a lot of sensitive financial data, making it a target for cyberattacks. Protecting this information from breaches is key to keeping customer trust and following all the rules. For instance, global spending on cybersecurity is projected to reach over $230 billion in 2024, highlighting the significant investment required.

Blockchain Technology and Distributed Ledgers

Blockchain technology and distributed ledgers offer significant potential to transform Zheshang Development Group's operations. By providing enhanced transparency, security, and efficiency, blockchain can streamline transactions and record-keeping, potentially reducing costs and increasing trust. For instance, the global blockchain market was valued at approximately $11.1 billion in 2023 and is projected to grow substantially in the coming years, indicating increasing adoption across industries.

Zheshang Development Group should actively investigate blockchain applications within its financial services. This could involve exploring its use in asset management for more secure and transparent record-keeping, or in supply chain finance to improve efficiency and reduce risk for all parties involved. Such exploration is timely, as many financial institutions are already piloting or implementing blockchain solutions for cross-border payments and trade finance, with some reporting significant reductions in transaction times and costs.

The strategic integration of blockchain could lead to innovative value propositions for Zheshang Development Group. Consider these potential benefits:

- Enhanced Security: Immutable transaction records reduce the risk of fraud and data tampering.

- Increased Efficiency: Automating processes through smart contracts can speed up settlements and reduce administrative overhead.

- Improved Transparency: Shared, verifiable ledgers can foster greater trust among stakeholders in financial dealings.

Automation and Operational Efficiency

Automation, particularly through robotic process automation (RPA), is significantly boosting operational efficiency in financial services. This technology streamlines repetitive back-office tasks, leading to fewer errors and reduced operating expenses. For instance, by 2024, many financial institutions reported cost savings of up to 25% through RPA implementation, allowing their staff to focus on higher-value, strategic work.

Zheshang Development Group can leverage these advancements to enhance its competitive position. Implementing automation across its asset management and financial services operations can unlock substantial gains. By automating tasks like data entry, reconciliation, and customer onboarding, the group can achieve faster processing times and improved accuracy.

- Reduced Operational Costs: Automation can cut operational expenses by an estimated 20-30% in financial services back-office functions.

- Enhanced Accuracy: RPA minimizes human error, leading to a significant improvement in data integrity.

- Increased Speed: Automated processes can execute tasks much faster than manual methods, improving turnaround times.

- Resource Reallocation: Freeing up employees from repetitive tasks allows them to engage in more complex analysis and client interaction.

The rapid advancement of artificial intelligence and big data analytics offers Zheshang Development Group unparalleled opportunities for deeper market insights and more precise risk assessment. By leveraging these technologies, the group can process extensive datasets to identify complex patterns and forecast market trends with enhanced accuracy, a crucial advantage in the dynamic financial markets of 2024.

The global AI market in financial services was projected to exceed $25 billion by 2025, underscoring the significant investment and growth in this sector. Zheshang Development Group's strategic adoption of AI can lead to sophisticated predictive models and automated trading, optimizing portfolio performance and identifying emerging investment opportunities more effectively.

Blockchain technology is poised to revolutionize Zheshang Development Group's operations by offering enhanced security, transparency, and efficiency in transactions and record-keeping. The global blockchain market, valued at approximately $11.1 billion in 2023, is experiencing substantial growth, signaling increased industry-wide adoption and potential for cost reduction.

Automation, particularly through robotic process automation (RPA), is a key technological factor driving efficiency in financial services, with many institutions reporting up to 25% cost savings by 2024. Zheshang Development Group can significantly boost its competitive edge by implementing automation in areas like data entry and reconciliation, leading to faster processing and improved accuracy.

| Technological Area | Key Impact on Zheshang Development Group | Market Growth/Adoption Data (2023-2025 Projections) |

| FinTech Innovation | Enhanced efficiency, customer satisfaction, competitive advantage | Global FinTech market: ~$1.2T (2023) to ~$3.5T (2030) |

| AI & Big Data Analytics | Deeper market insights, accurate risk assessment, predictive modeling | AI in Financial Services: Projected to exceed $25B by 2025 |

| Blockchain Technology | Improved security, transparency, efficiency, reduced costs | Global Blockchain market: ~$11.1B (2023) |

| Automation (RPA) | Operational efficiency, reduced costs, increased accuracy, resource reallocation | Cost savings of up to 25% reported by institutions by 2024 |

Legal factors

Zheshang Development Group, operating as a significant entity in China's financial landscape, faces rigorous compliance demands under Chinese corporate governance and securities laws. Adherence to regulations covering transparent disclosures, safeguarding shareholder rights, and maintaining appropriate board compositions is paramount for sustaining investor trust and preventing legal repercussions. For instance, China's Securities Law mandates timely and accurate information disclosure, with violations potentially leading to substantial fines and reputational damage.

Zheshang Development Group operates within China's heavily regulated financial industry, necessitating licenses for its diverse operations including equity investment, asset management, and broader financial services. For instance, the China Securities Regulatory Commission (CSRC) oversees many of these activities, and compliance with their evolving guidelines is critical.

Recent regulatory shifts, such as the People's Bank of China's ongoing efforts to manage financial risk and promote market stability, directly influence Zheshang's asset management products and cross-border investment strategies. The group must continuously adapt to new rules concerning capital adequacy, data privacy, and consumer protection, which can affect its operational flexibility and increase compliance costs.

China's intensified focus on anti-monopoly and fair competition, particularly evident in 2023 and early 2024, presents a significant legal consideration for Zheshang Development Group. The State Administration for Market Regulation (SAMR) has been actively enforcing these regulations, leading to substantial fines for non-compliance. For instance, in 2023, SAMR imposed fines totaling billions of yuan across various sectors for anti-competitive practices.

Zheshang Development Group must meticulously ensure all investment strategies and market operations adhere to China's evolving fair competition landscape. This includes rigorous due diligence on mergers and acquisitions, as these are prime areas for regulatory scrutiny, to prevent perceived market dominance and potential penalties. Failure to comply could result in investigations, significant financial penalties, and reputational damage.

Data Privacy and Cybersecurity Laws

China’s legal landscape concerning data privacy and cybersecurity is rapidly evolving, with significant implications for companies like Zheshang Development Group. The Personal Information Protection Law (PIPL), effective November 1, 2021, sets stringent rules for how personal information can be collected, processed, and transferred, mirroring global standards like GDPR. This necessitates robust data governance frameworks to ensure compliance.

The increasing volume of digital financial transactions handled by Zheshang Development Group means adherence to these laws is paramount. Non-compliance can lead to substantial fines, reputational damage, and operational disruptions. For instance, PIPL can impose penalties of up to 50 million yuan or 5% of the previous year's annual turnover for serious violations.

- PIPL Enforcement: Strict adherence to PIPL is required for data collection, storage, processing, and cross-border transfer.

- Cybersecurity Law: Compliance with the Cybersecurity Law (CSL) is crucial for protecting network infrastructure and sensitive data.

- Data Localization: Certain types of data may be subject to localization requirements, impacting how Zheshang Development Group manages its data infrastructure.

- Penalties: Significant fines and business restrictions can be imposed for violations, underscoring the need for proactive compliance measures.

Contract Law and Dispute Resolution

The legal framework for contracts and dispute resolution is fundamental to Zheshang Development Group's operations, ensuring the enforceability of agreements with its diverse stakeholders. A predictable legal system in China, where the group primarily operates, is essential for safeguarding investments and fostering reliable business relationships.

Zheshang Development Group's reliance on contract law means that understanding the specifics of Chinese contract regulations and the available avenues for resolving disagreements is paramount for effective risk management. This includes navigating the intricacies of contract formation, performance, and termination, as well as the procedures for arbitration and litigation.

- Contract Enforcement: In 2023, Chinese courts reported handling over 35 million civil and commercial cases, highlighting the active legal environment and the importance of well-drafted contracts for Zheshang Development Group.

- Dispute Resolution Mechanisms: China's arbitration centers, such as the China International Economic and Trade Arbitration Commission (CIETAC), processed thousands of cases annually, offering an alternative to traditional court proceedings for international and domestic disputes.

- Regulatory Compliance: Adherence to evolving contract laws and consumer protection regulations is critical for maintaining Zheshang Development Group's reputation and operational integrity.

Zheshang Development Group must navigate China's dynamic legal environment, which includes strict adherence to evolving data privacy laws like PIPL, with potential fines up to 5% of annual turnover for serious violations. Compliance with the Cybersecurity Law is also critical for data protection. Furthermore, the group must ensure its operations and investments align with China's anti-monopoly regulations, as enforced by bodies like SAMR, which imposed billions in fines in 2023 for anti-competitive practices.

Environmental factors

China's drive towards carbon neutrality by 2060, a commitment reinforced by policies enacted throughout 2024 and projected to intensify, presents a dual challenge and opportunity for Zheshang Development Group. This national agenda is reshaping industrial landscapes, pushing for cleaner production methods and creating substantial demand for green technologies.

By strategically investing in sectors aligned with these environmental objectives, such as renewable energy infrastructure and companies pioneering sustainable manufacturing processes, Zheshang Development Group can navigate regulatory shifts and tap into burgeoning market segments. For instance, China's renewable energy capacity saw significant growth in 2023, with solar and wind power installations expanding rapidly, indicating a clear market direction.

China's commitment to green finance is accelerating, with the People's Bank of China and other regulatory bodies actively encouraging financial institutions to channel funds into sustainable projects. This push is evident in the growth of green bond issuance, which reached approximately 1.5 trillion yuan in 2023, demonstrating a significant market opportunity for companies like Zheshang Development Group to align their strategies with national environmental goals.

Zheshang Development Group can capitalize on these green finance initiatives by developing innovative green financial products, such as green loans or sustainability-linked bonds, to attract environmentally conscious investors. Furthermore, strategic investments in eco-friendly technologies and active participation in the burgeoning green bond markets, which saw a 20% year-on-year increase in issuance in early 2024, can enhance the group's environmental credentials and financial performance.

Navigating the evolving landscape of green finance regulations is paramount for Zheshang Development Group. As China refines its disclosure requirements and standards for green investments, adherence to these evolving rules will be crucial for maintaining market access and investor confidence, ensuring the group remains compliant and competitive in a rapidly greening financial sector.

Growing global awareness of resource scarcity, particularly concerning water and crucial raw materials like rare earth elements, poses a significant challenge to the long-term sustainability and profitability of many sectors. For Zheshang Development Group, this means critically evaluating the resource dependencies within its diverse portfolio companies.

To navigate this, Zheshang Development Group should prioritize investments in businesses actively promoting resource efficiency and embracing circular economy models. For example, companies specializing in advanced water treatment technologies or those focused on recycling critical minerals could offer both environmental benefits and a hedge against future supply disruptions. As of early 2025, the global market for water treatment chemicals alone is projected to reach over $150 billion, highlighting the scale of this opportunity.

Pollution Control and Environmental Compliance

Stricter environmental regulations are increasingly impacting industrial operations. For instance, China's Ministry of Ecology and Environment has been progressively tightening standards for air and water emissions. Companies like those within Zheshang Development Group's portfolio face compliance costs associated with upgrading equipment and implementing new pollution control technologies. This trend is evident in the rising investments in environmental protection as a percentage of GDP, which reached approximately 1.5% in China in 2023, a figure expected to grow.

Zheshang Development Group needs to proactively assess environmental compliance risks. This involves scrutinizing companies within its investment portfolio for their adherence to evolving pollution control mandates. Favoring businesses that demonstrate robust environmental management systems and sustainable operational practices is crucial. This approach not only mitigates potential fines and operational disruptions but also enhances long-term reputational capital, a key factor in today's market.

- Increased Compliance Costs: Companies face higher operational expenses due to investments in pollution abatement technologies and adherence to stricter emission standards, a trend observed across various industrial sectors in China.

- Regulatory Scrutiny: Environmental protection agencies are intensifying inspections and enforcement, leading to potential penalties for non-compliance, impacting profitability and operational continuity.

- Opportunity in Green Tech: Investments in companies with advanced environmental management and sustainable practices offer a hedge against regulatory risks and capitalize on the growing demand for eco-friendly solutions.

ESG Investing Trends and Investor Pressure

The growing emphasis on Environmental, Social, and Governance (ESG) principles is a significant environmental factor impacting Zheshang Development Group. Investors globally are increasingly demanding transparency and action regarding a company's environmental footprint. For instance, by the end of 2024, global ESG assets under management were projected to reach $33.9 trillion, highlighting the immense capital flow influenced by these factors.

This trend translates into direct pressure on Zheshang Development Group. Stakeholders, including institutional investors and even retail shareholders, are scrutinizing the group's environmental performance and its integration of ESG criteria into its core business strategies. Failing to demonstrate robust environmental stewardship and a clear commitment to sustainability could hinder capital attraction and damage the company's reputation in 2024 and beyond.

To navigate this evolving landscape, Zheshang Development Group must actively showcase its dedication to environmental responsibility. This includes clear reporting on emissions, resource management, and climate-related risks. For example, companies that score well on ESG metrics often see a lower cost of capital. A 2024 study by McKinsey indicated that companies with strong ESG performance were valued 6-12% higher than their peers.

- Growing ESG Investment: Global ESG assets are projected to exceed $33.9 trillion by the end of 2024.

- Investor Scrutiny: Increased demand for transparency in environmental performance from stakeholders.

- Reputational Risk: Poor ESG performance can negatively impact capital attraction and brand image.

- Valuation Impact: Companies with strong ESG performance may see valuations 6-12% higher, according to McKinsey research from 2024.

China's ambitious carbon neutrality goals by 2060, with policy intensification in 2024, create a significant market for green technologies and sustainable practices. Zheshang Development Group can leverage this by investing in renewable energy, which saw substantial growth in 2023, and by developing green financial products, tapping into the 20% year-on-year increase in green bond issuance seen in early 2024.

Resource scarcity, particularly in water and rare earth elements, necessitates a focus on resource efficiency and circular economy models. Investments in water treatment technologies, with a global market projected over $150 billion by early 2025, offer a strategic hedge against supply disruptions.

Stricter environmental regulations, including tightened emission standards in China, are increasing compliance costs but also present opportunities in green tech. Companies with robust environmental management systems are better positioned, as evidenced by China's increasing GDP allocation to environmental protection, reaching approximately 1.5% in 2023.

The escalating importance of ESG principles is driving investor demand for environmental transparency, with global ESG assets projected to exceed $33.9 trillion by the end of 2024. Strong ESG performance can lead to higher valuations, with 2024 research indicating a 6-12% premium.

| Environmental Factor | Key Data Point | Implication for Zheshang Development Group |

| Carbon Neutrality Goals | China's 2060 target, policy intensification in 2024 | Opportunity in green tech and renewables; need for sustainable operational alignment. |

| Resource Scarcity | Global water treatment market >$150B (early 2025 projection) | Invest in resource-efficient businesses and circular economy models. |

| Environmental Regulations | China's GDP allocation to environmental protection ~1.5% (2023) | Manage compliance costs; favor companies with strong environmental management. |

| ESG Investment Trends | Global ESG assets >$33.9T (end of 2024 projection) | Enhance ESG reporting and performance for capital attraction and valuation. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Zheshang Development Group is built on a foundation of diverse and credible data sources, including official government reports from China and international bodies, economic indicators from reputable financial institutions, and industry-specific market research. This ensures a comprehensive understanding of the macro-environmental factors influencing the group.