Zheshang Development Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zheshang Development Group Bundle

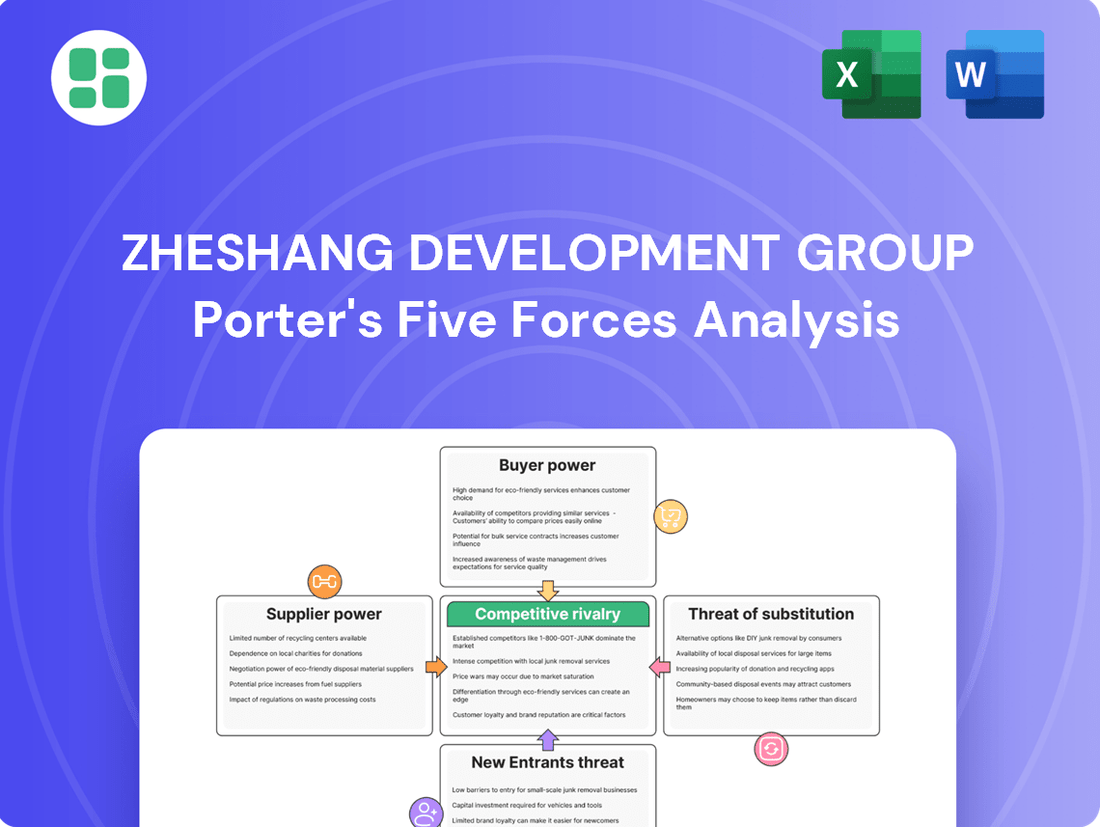

Zheshang Development Group faces a dynamic competitive landscape, with moderate bargaining power from both suppliers and buyers. The threat of new entrants is a significant factor, while the intensity of rivalry within the industry demands constant strategic adaptation. Understanding these forces is crucial for navigating Zheshang's market successfully.

The complete report reveals the real forces shaping Zheshang Development Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Zheshang Development Group, as an investment and asset management firm, depends significantly on capital providers like institutional investors and banks. The bargaining power of these suppliers is considerable, particularly when Zheshang pursues unique or large-scale investment opportunities where capital is in high demand.

In 2024, the cost of capital remained a critical factor. For instance, benchmark interest rates, such as the Federal Reserve's target rate, influenced borrowing costs across the financial sector. High demand for capital in burgeoning markets or for innovative projects can further amplify supplier leverage, allowing them to negotiate more favorable terms, including interest rates and equity participation, directly impacting Zheshang's profitability and investment capacity.

The specialized nature of equity investment, asset management, and financial services means that highly skilled professionals are critical suppliers to Zheshang Development Group. Think of fund managers and financial advisors; their expertise is essential.

The scarcity of top-tier talent, especially those with a proven history of success, grants these individuals considerable bargaining power. This translates into demands for higher salaries, bonuses, and even equity stakes in the firm, directly impacting Zheshang's operational costs.

For instance, in 2024, the average compensation for a senior fund manager in China's competitive financial sector could easily exceed 2 million RMB annually, a figure that reflects the high demand and limited supply of proven talent.

Zheshang's capacity to attract and retain these highly sought-after individuals is therefore a pivotal factor in its ability to maintain a competitive edge and deliver strong performance.

Suppliers of exclusive investment opportunities, like private companies seeking funding or unique distressed assets, wield significant influence. Zheshang Development Group's reliance on a narrow set of these specialized sources means those suppliers can dictate higher fees or more advantageous terms for bringing deals forward. For instance, in 2024, the private equity deal flow market saw increased competition, with successful sourcing often requiring premium advisory fees.

Technology and Data Providers

Technology and data providers wield significant influence over Zheshang Development Group. The modern financial sector relies heavily on sophisticated platforms for portfolio management, risk analysis, and market intelligence. Vendors offering these critical, often proprietary, solutions can command strong bargaining power.

High switching costs are a major factor; once Zheshang integrates a provider's technology, migrating to an alternative can be complex and expensive. Furthermore, the essential nature of these services means Zheshang has limited alternatives if a key provider raises prices or experiences service disruptions. For instance, in 2024, the global financial technology market was valued at over $1.3 trillion, indicating the substantial economic weight of these technology suppliers.

- High Switching Costs: Implementing new financial software often requires extensive data migration, system integration, and employee retraining, making it costly and time-consuming to switch providers.

- Critical Nature of Services: Zheshang's operational efficiency and competitive edge depend on reliable access to advanced data and analytical tools, giving providers leverage.

- Limited Provider Pool: For highly specialized or cutting-edge financial technologies, the number of capable vendors may be limited, concentrating bargaining power among a few key players.

- Data Dependency: Zheshang's reliance on accurate and timely market data from external providers means these suppliers have considerable influence over operational inputs.

Regulatory and Legal Compliance Services

The financial services sector, inherently complex and heavily regulated, grants significant bargaining power to suppliers of regulatory and legal compliance services. These entities, including legal experts and regulatory bodies themselves, dictate the operational framework for companies like Zheshang Development Group. Their interpretations and mandates directly influence operational costs and strategic maneuvering.

For instance, the increasing focus on data privacy and cybersecurity by regulators worldwide, a trend observed throughout 2024, necessitates substantial investment in compliance infrastructure and expertise. This elevates the cost of doing business and limits strategic agility for financial institutions.

- Regulatory bodies set stringent compliance standards, impacting operational costs.

- Legal and compliance service providers wield influence through their expertise and interpretation of laws.

- The evolving regulatory landscape, particularly in areas like ESG reporting and digital asset regulation, requires continuous adaptation and investment.

- Failure to comply, as highlighted by instances of regulatory warnings, can lead to significant financial penalties and reputational damage, underscoring supplier power.

The bargaining power of suppliers for Zheshang Development Group is considerable, impacting its operational costs and strategic flexibility. This power stems from various sources, including the availability of capital, the expertise of human talent, the exclusivity of investment opportunities, the necessity of technology and data, and the crucial role of regulatory and legal compliance services.

In 2024, the cost of capital, influenced by benchmark interest rates, remained a key factor. Similarly, the scarcity of top-tier financial talent, with average compensation for senior fund managers exceeding 2 million RMB annually in China, granted individuals significant leverage. Exclusive investment opportunities and essential technology/data providers also commanded higher fees and terms due to market dynamics and high switching costs.

| Supplier Type | Key Factors Influencing Bargaining Power | Illustrative 2024 Data/Impact |

|---|---|---|

| Capital Providers (Banks, Investors) | Demand for capital, benchmark interest rates | Federal Reserve target rate influenced borrowing costs; high demand in burgeoning markets amplified leverage. |

| Skilled Professionals (Fund Managers, Advisors) | Scarcity of proven talent, specialized expertise | Senior fund manager compensation in China exceeded 2 million RMB annually. |

| Exclusive Investment Opportunities | Limited deal flow, specialized assets | Increased competition in the private equity deal flow market led to higher advisory fees for successful sourcing. |

| Technology & Data Providers | High switching costs, critical nature of services, limited provider pool | Global FinTech market valued over $1.3 trillion; reliance on proprietary platforms creates dependency. |

| Regulatory & Legal Compliance Services | Complexity of regulations, evolving landscape | Increased investment in data privacy and cybersecurity compliance due to regulatory focus in 2024. |

What is included in the product

This analysis delves into the competitive intensity and profitability potential for Zheshang Development Group by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly identify and address competitive threats by visualizing the Zheshang Development Group's Porter's Five Forces landscape, enabling proactive strategy adjustments.

Customers Bargaining Power

Zheshang Development Group's primary customers are the companies it invests in and supports financially. These portfolio companies are not without options; they can often secure funding through traditional bank loans, by issuing shares on public markets, or by partnering with other private equity and venture capital firms. This access to alternative capital sources significantly strengthens their negotiating position.

The presence of these alternatives empowers Zheshang's customers to negotiate better terms, including lower investment fees or more attractive financing structures. They can also demand specialized support or strategic guidance from Zheshang, knowing they have other avenues for capital if their needs aren't met. For instance, in 2024, the global private equity market saw continued robust activity, with deal volumes remaining high, indicating ample alternative funding opportunities for businesses seeking capital.

When Zheshang Development Group manages funds for external investors, these limited partners become a crucial customer segment. A broad investor base, encompassing both institutional players like pension funds and individual retail investors, introduces varied demands and expectations.

Large institutional investors, often allocating substantial capital, possess considerable bargaining power. For instance, as of early 2024, major institutional investors have increasingly leveraged their scale to negotiate lower management fees, with some large funds securing fees below 0.50% for certain asset classes, impacting profitability for fund managers.

These significant investors can also push for greater transparency in reporting and request customized investment mandates tailored to their specific risk profiles or ethical considerations, forcing asset managers to adapt their offerings.

In Zheshang Development Group's financial services, particularly in areas like financial leasing, commercial factoring, and supply chain financing, customers possess significant bargaining power. This is largely due to the ease with which they can switch between a broad spectrum of competing financial institutions.

Customers can readily move to providers offering more favorable terms, adaptable products, or enhanced service, thereby increasing their leverage. For instance, in 2024, the average switching cost for a small to medium-sized enterprise seeking supply chain financing was estimated to be less than 1% of the transaction value, underscoring the low barriers to changing providers.

Regional Economic Support Focus

Zheshang Development Group's emphasis on regional economic support means its customers, often government-backed entities or development initiatives, can wield considerable bargaining power. This is particularly true when these customers are crucial for accessing key projects or securing favorable operating conditions within a region.

The strategic importance of these customers can translate into negotiated terms that may favor regional development goals over maximizing immediate financial returns for Zheshang. For instance, in 2024, several regional development projects in China, where Zheshang operates, saw government entities negotiate for lower service fees in exchange for long-term commitments and preferential market access.

- Governmental Influence: Local governments often act as key customers for development groups, influencing contract terms through their regulatory authority and project allocation power.

- Strategic Partnerships: Zheshang's alignment with regional economic strategies can empower customers who are integral to these plans, giving them leverage in negotiations.

- Project Access: Customers who control access to vital regional development projects can negotiate more favorable terms, potentially impacting Zheshang's pricing and profit margins.

- Long-Term Commitments: In exchange for preferential treatment or lower costs, customers may offer Zheshang long-term contracts, providing stability but potentially limiting flexibility.

Exit Opportunities for Portfolio Companies

The bargaining power of customers, in the context of Zheshang Development Group's portfolio companies, is significantly influenced by the available exit opportunities. If the market for initial public offerings (IPOs) or mergers and acquisitions (M&A) is robust, portfolio companies might find it easier to negotiate favorable terms during these exit events, thereby increasing their leverage.

For instance, in 2024, the global M&A market saw a notable rebound, with deal volumes increasing compared to the previous year, offering more avenues for profitable exits. This environment can empower portfolio companies to push back against Zheshang if the proposed exit terms are not aligned with their valuation expectations.

Conversely, if a portfolio company faces internal resistance to certain exit strategies, such as a strong desire to remain independent or a preference for a specific type of buyer, this can also enhance its bargaining power. Zheshang must then consider these preferences to ensure a successful divestment, potentially leading to more favorable terms for the company.

- Limited exit avenues: A constrained IPO or M&A market in 2024 could reduce the options for Zheshang's portfolio companies, potentially weakening their bargaining position.

- Company autonomy: Portfolio companies with strong management teams and clear strategic visions may exert greater influence over exit strategies and terms.

- Market conditions: Favorable market conditions for specific industries or company types in 2024 could allow portfolio companies to demand higher valuations during exits.

- Strategic alignment: Zheshang's ability to align its exit strategy with the long-term goals of its portfolio companies is crucial for mitigating customer bargaining power.

Customers of Zheshang Development Group, particularly its portfolio companies, benefit from a competitive capital landscape. The availability of alternative funding sources like bank loans, public markets, and other private equity firms allows these companies to negotiate better terms, including lower fees and more favorable financing structures. This access to diverse capital options significantly bolsters their bargaining power.

For external investors, especially large institutional ones, their substantial capital allocation grants them considerable leverage. In 2024, these investors increasingly negotiated lower management fees, with some securing rates below 0.50% for certain asset classes, directly impacting fund manager profitability. They also demand greater transparency and customized mandates, pushing asset managers to adapt their offerings.

In Zheshang's financial services such as leasing and factoring, customers can easily switch providers due to low switching costs, estimated at under 1% of transaction value for SMEs in 2024. This ease of transition empowers them to secure more favorable terms and adaptable products from competitors.

Government-backed entities and regional development initiatives, often key customers for Zheshang, wield significant bargaining power due to their strategic importance. In 2024, these entities in regions where Zheshang operates negotiated lower service fees in exchange for long-term commitments and preferential market access, reflecting a prioritization of regional development goals.

| Customer Segment | Bargaining Power Drivers | 2024 Data/Trend |

|---|---|---|

| Portfolio Companies | Access to alternative capital, exit opportunities | Robust M&A market rebound, increased IPO activity |

| Institutional Investors | Scale of investment, demand for transparency | Negotiating management fees below 0.50% for select assets |

| Financial Services Clients | Low switching costs, competitive market | SME switching costs for supply chain finance < 1% of transaction value |

| Regional Development Entities | Strategic importance, government backing | Negotiated lower fees for long-term commitments and market access |

Same Document Delivered

Zheshang Development Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Zheshang Development Group Porter's Five Forces Analysis details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

Zheshang Development Group faces intense competition from a broad array of players, including other diversified investment firms, established asset managers, private equity funds, and venture capital entities. This diverse competitive set, often backed by significant capital and strong market reputations, creates a challenging environment across all of Zheshang's operational areas.

The investment and asset management landscape, especially in China, is characterized by significant fragmentation, with numerous firms competing for investment opportunities and capital. This means Zheshang Development Group faces intense rivalry, necessitating continuous differentiation through specialized investment strategies, targeted industry expertise, and superior value-added services to capture both investee companies and investor capital. For instance, the Chinese asset management market saw its total assets under management reach approximately RMB 14.5 trillion (around USD 2 trillion) by the end of 2023, highlighting the sheer number of participants and the competitive pressure to secure market share.

The financial services sector, including areas like asset management and financial leasing where Zheshang Development Group operates, is characterized by intense competition. This rivalry frequently translates into significant price sensitivity among customers, pushing for lower costs on services.

Competitors often resort to fee compression, reducing their charges to secure business. This strategy directly impacts Zheshang's profitability, potentially eroding margins, especially when the company's financial performance, such as its reported net income decrease in 2024, is under pressure and closely watched by the market.

Regulatory Environment and State Influence

Zheshang Development Group operates within a landscape where state influence significantly shapes competition. The presence of numerous state-owned enterprises (SOEs) in the investment sector means competition isn't solely driven by market forces but also by strategic government alignments and policy support. This can create unique challenges and opportunities, as state backing can provide advantages not available to purely private entities.

For instance, as of late 2024, China's state-owned financial institutions continue to play a dominant role in key sectors, often directing capital towards strategic industries. This environment means Zheshang Development Group must navigate not only traditional market competition but also the influence of policies that may favor SOEs. The group’s affiliation with Zhejiang Transportation Group itself highlights this dynamic, offering a degree of inherent strategic advantage.

- State-Owned Enterprise Dominance: SOEs continue to hold significant market share across various investment and financial services sectors in China, influencing overall competitive intensity.

- Policy-Driven Competition: Competitive advantages can stem from government policy support and strategic alignments rather than purely market-driven factors, requiring adaptable strategies.

- Strategic Affiliations: Zheshang Development Group's ties to Zhejiang Transportation Group provide a notable advantage, illustrating how strategic state affiliations impact competitive positioning.

Innovation and Digital Transformation

The financial landscape is rapidly evolving due to digital transformation, with AI and big data reshaping asset management. Competitors embracing innovative platforms and data analytics for superior investment decisions are gaining a distinct advantage. For instance, in 2024, global investment in fintech solutions reached an estimated $150 billion, highlighting the urgency of technological adoption.

Zheshang Development Group's capacity to invest in and seamlessly integrate these cutting-edge technologies is paramount for maintaining its competitive standing. Those who are quicker to adapt digital services and leverage data insights will likely capture greater market share.

- Digital Adoption Rate: Many traditional financial institutions are still playing catch-up, with some reporting that less than 25% of their core processes are fully digitized as of early 2024.

- AI in Investment: By the end of 2024, it's projected that over 60% of asset managers will be utilizing AI for at least one aspect of their investment process, from research to portfolio construction.

- Customer Experience: Companies offering enhanced digital customer service, such as personalized financial advice via AI chatbots, saw a 15% increase in customer retention rates in 2024.

Competitive rivalry for Zheshang Development Group is fierce, driven by a fragmented market and aggressive strategies like fee compression. The group must continually differentiate itself through specialized strategies and superior service to attract capital and clients in a landscape where many firms vie for market share.

State-owned enterprises (SOEs) significantly influence the competitive environment, often benefiting from government policy support, which Zheshang must navigate. Furthermore, rapid digital transformation, including the adoption of AI and big data, is creating new competitive advantages, making technological investment crucial for Zheshang to maintain its edge.

| Factor | Impact on Zheshang | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | Intense competition for capital and clients | Chinese asset management assets under management reached ~RMB 14.5 trillion by end-2023 |

| Fee Compression | Pressure on profitability and margins | Competitors frequently lower fees to gain business |

| SOE Influence | Uneven playing field due to policy support | SOEs dominate key sectors, often with strategic government backing |

| Digital Transformation | Need for technological investment to stay competitive | Global fintech investment ~ $150 billion in 2024; >60% of asset managers to use AI by end-2024 |

SSubstitutes Threaten

Companies needing capital have many options besides relying on Zheshang Development Group's investment or financial services. These alternatives, such as traditional bank loans or issuing corporate bonds, offer direct financing routes. For instance, in 2024, corporate bond issuance globally reached significant figures, providing substantial capital without equity dilution.

The availability and cost-effectiveness of these substitutes directly impact the demand for Zheshang's offerings. Public stock offerings (IPOs) and even innovative methods like crowdfunding present further avenues for companies to secure funding. In 2023, the global crowdfunding market was valued at billions of dollars, demonstrating its growing importance as a financing alternative.

Investors looking at Zheshang Development Group’s offerings have a vast array of substitute investment vehicles. For instance, as of late 2024, the global exchange-traded fund (ETF) market alone surpassed $10 trillion in assets under management, showcasing a significant alternative for diversified exposure that might otherwise go into actively managed funds.

Direct investments in public markets, such as buying individual stocks or bonds, present a strong substitute. In 2024, trading volumes on major exchanges remained robust, indicating continued investor participation in direct market access, potentially drawing capital away from pooled investment products.

Furthermore, real estate and commodities markets offer tangible asset classes that appeal to investors seeking diversification or inflation hedges. The global real estate market, valued in the trillions, and commodity markets, with significant trading activity, represent substantial avenues for capital allocation that bypass traditional fund managers like Zheshang.

Large corporations, particularly those in industrial sectors, possess the financial muscle and strategic imperative to develop in-house investment and asset management functions. This internal capability acts as a potent substitute for external asset managers like Zheshang Development Group. For example, by 2024, many of the world's largest conglomerates, with assets under management potentially in the hundreds of billions of dollars, are increasingly exploring insourcing to gain greater control and potentially reduce fees.

This 'make or buy' decision is driven by a desire for greater customization, direct oversight of investment strategies, and alignment with core business objectives. Companies like Berkshire Hathaway have long demonstrated the success of this model, managing vast sums internally. The ongoing trend suggests that as these large entities grow, their capacity and inclination to bypass external providers will only increase, presenting a significant competitive threat.

Commodity Trading and Supply Chain Integration by End-Users

The threat of substitutes for Zheshang Development Group's commodity trading and supply chain integration services is significant, particularly from large industrial end-users. These major players, often with substantial purchasing power and existing logistical capabilities, may opt for backward integration. This means they could bring commodity sourcing and supply chain management in-house, thereby eliminating the need for external service providers like Zheshang. For instance, a large automotive manufacturer might establish direct relationships with metal suppliers and manage its own shipping, bypassing intermediaries.

This vertical integration by end-users directly erodes Zheshang's market share and reduces the demand for its specialized trading and logistics expertise. Such a move is often driven by a desire for greater control over costs, quality, and delivery timelines. In 2024, global supply chain disruptions have further incentivized many large corporations to explore more direct control over their sourcing and logistics, making in-house solutions a more attractive proposition.

- Vertical Integration by End-Users: Large industrial consumers may bring commodity sourcing and supply chain management in-house.

- Cost and Control Motivations: End-users seek to reduce costs and gain greater control over quality and delivery.

- Impact on Zheshang: This reduces Zheshang's market opportunities and revenue streams.

- 2024 Trend: Supply chain volatility in 2024 has accelerated the trend of end-users exploring direct control over their operations.

Government Funds and Policy-Driven Investments

Government funds and policy-driven investments present a significant threat of substitution for Zheshang Development Group. In 2024, many governments globally continued to channel substantial capital into strategic sectors through state-backed investment funds. For instance, China's state-owned enterprise reforms and targeted industrial policies in 2024 aimed to bolster domestic champions, potentially diverting opportunities from private entities like Zheshang, especially in areas like advanced manufacturing and green energy.

These government initiatives can offer capital and financial support under specific mandates, often with more favorable terms than those available from private or semi-private financial institutions. This creates a competitive pressure by reducing the addressable market for Zheshang's services, particularly in sectors designated for national development or regional economic upliftment. For example, the European Union's continued focus on the Green Deal in 2024 saw significant public funding allocated to renewable energy projects, acting as a direct substitute for private investment capital.

- Government funding initiatives in strategic sectors can directly compete with private capital providers.

- Policy-driven investments may offer more advantageous terms, attracting businesses away from traditional financing.

- In 2024, sectors like green technology and digital infrastructure saw increased government investment, narrowing the scope for private players.

- This substitution threat can limit Zheshang's market share in key growth areas and regional development projects.

The threat of substitutes for Zheshang Development Group's services is substantial, stemming from a wide array of alternative financing and investment channels available to both companies and investors. These substitutes can range from traditional banking products to more innovative financial solutions, directly impacting Zheshang's competitive landscape.

For companies seeking capital, options like issuing corporate bonds or pursuing initial public offerings (IPOs) remain strong alternatives to Zheshang's investment services. The global corporate bond market, for instance, remained robust in 2024, offering companies direct access to funding without necessarily diluting equity. Similarly, crowdfunding platforms continued to grow, with the global market valued in the billions by 2023, providing an accessible funding avenue for smaller enterprises.

Investors also have numerous substitute options, including the vast exchange-traded fund (ETF) market, which surpassed $10 trillion in assets under management by late 2024. Direct investments in individual stocks and bonds, facilitated by high trading volumes on major exchanges in 2024, offer another significant alternative. Furthermore, tangible assets like real estate and commodities, with trillions invested globally, provide diversification and inflation-hedging opportunities that bypass traditional financial intermediaries.

| Substitute Category | Examples | 2024 Relevance/Data Point | Impact on Zheshang |

|---|---|---|---|

| Corporate Financing | Bank Loans, Corporate Bonds, IPOs | Global corporate bond issuance significant in 2024. | Reduces reliance on Zheshang for capital. |

| Investment Vehicles | ETFs, Mutual Funds, Direct Stock/Bond Purchases | Global ETF market exceeded $10 trillion by late 2024. | Diversifies investor capital away from Zheshang's products. |

| Alternative Assets | Real Estate, Commodities | Trillions invested globally in real estate and commodities. | Attracts capital seeking diversification and inflation hedges. |

| In-house Capabilities | Internal Asset Management | Large conglomerates with potentially hundreds of billions managed internally by 2024. | Erodes demand for external asset management services. |

Entrants Threaten

Entering the diversified investment and asset management sector, particularly in areas like equity investment and financial services, demands significant capital. For instance, establishing a fund management company often requires a minimum registered capital that can run into millions of dollars, a substantial hurdle for newcomers.

Navigating complex regulatory frameworks also presents a formidable barrier to entry. Companies must obtain various licenses and adhere to stringent compliance requirements, which can be time-consuming and costly. Zheshang Development Group itself has faced regulatory scrutiny, including receiving warning letters, underscoring the importance of robust compliance for all players in this space.

The investment and asset management sectors are built on trust, and a strong reputation is paramount. Newcomers struggle to gain this trust because they haven't yet demonstrated a history of successful investments or consistent returns. This lack of a proven track record makes it difficult to attract both investor capital and high-quality deal flow from companies seeking investment.

For instance, in 2024, many emerging asset managers found it challenging to compete with established players like Zheshang Development Group, which had decades of experience and a well-documented history of outperforming benchmarks. Securing significant assets under management (AUM) without this established credibility is a major hurdle, often requiring substantial initial capital and a long growth phase.

For Zheshang Development Group, access to deal flow and strong industry networks is a significant barrier to entry for new competitors. Established firms have cultivated deep relationships with businesses, entrepreneurs, and government bodies over many years, creating a pipeline of quality investment opportunities. In 2024, the competitive landscape for private equity deals saw a notable increase in competition for prime assets, with many established funds leveraging their existing networks to secure advantageous terms.

Talent Acquisition and Retention Challenges

The financial services sector, particularly in areas like fund management and investment analysis, demands highly specialized skills. This creates a significant hurdle for newcomers, as attracting and keeping top talent is difficult. Established players often offer more attractive compensation packages and clearer paths for career advancement, making it tough for new entrants to poach experienced professionals.

For instance, in 2024, the global financial services industry continued to face intense competition for talent. Reports indicated that average compensation for experienced financial analysts in major financial hubs like London and New York saw increases of 5-10% year-over-year, reflecting the ongoing demand. New firms often find it challenging to match these established salary benchmarks and the perceived stability of larger, well-known institutions.

- High Demand for Specialized Skills: Expertise in areas like quantitative analysis, risk management, and compliance is crucial and scarce.

- Compensation and Benefits Gap: New entrants struggle to match the comprehensive compensation and benefits offered by established financial groups.

- Limited Talent Pool: The pool of highly experienced and reputable financial professionals is finite, and they are often loyal to existing firms.

Economies of Scale and Diversification Advantages

Zheshang Development Group, like other established diversified conglomerates, enjoys significant economies of scale. This advantage is evident across its varied operations, from commodity trading to financial leasing and asset management. For instance, in 2023, the group reported total assets of ¥1.2 trillion, reflecting its substantial operational footprint. New entrants typically begin with a more limited scope, finding it challenging to match Zheshang's cost efficiencies and the breadth of services it offers due to this scale.

These scale advantages translate into a formidable barrier for potential new competitors. Zheshang can leverage its existing infrastructure, deep client relationships built over years, and streamlined operational processes to offer competitive pricing and a wider array of integrated services. A new entrant would need substantial capital investment to replicate even a fraction of this operational capacity, making it difficult to compete effectively from the outset.

Consider the financial leasing segment. Zheshang's ability to secure favorable financing terms due to its size and creditworthiness allows it to offer more attractive leasing rates than a smaller, less established player. Similarly, its diversified asset management arm can absorb operational costs more readily, subsidizing newer or less profitable ventures, a luxury not afforded to single-focus startups.

- Economies of Scale: Zheshang's ¥1.2 trillion in total assets (2023) allows for cost efficiencies across its diverse business units.

- Diversification Benefits: The group's presence in commodity trading, financial leasing, and asset management creates synergies and risk diversification.

- Barriers to Entry: New entrants struggle to match Zheshang's established infrastructure, client base, and operational expertise.

- Competitive Pricing: Scale enables Zheshang to offer more competitive pricing and a broader service portfolio, disadvantaging smaller competitors.

The threat of new entrants for Zheshang Development Group is moderate, primarily due to the substantial capital requirements and stringent regulatory landscape in its core sectors like investment and asset management. New players face significant hurdles in replicating the established trust, deal flow access, and specialized talent that Zheshang possesses. Furthermore, the group's considerable economies of scale, evidenced by its ¥1.2 trillion in total assets as of 2023, create a cost advantage that is difficult for newcomers to overcome.

| Barrier to Entry | Description | Impact on New Entrants | Zheshang's Advantage |

|---|---|---|---|

| Capital Requirements | High initial investment needed for licenses, operations, and attracting talent. | Significant hurdle for startups. | Established financial capacity. |

| Regulatory Compliance | Complex licensing and ongoing adherence to financial regulations. | Time-consuming and costly to navigate. | Expertise and resources for compliance. |

| Reputation & Trust | Building credibility and a track record takes time. | Difficulty attracting capital and clients. | Long-standing history and proven performance. |

| Deal Flow & Networks | Access to quality investment opportunities through established relationships. | Limited access to prime assets. | Extensive industry and government connections. |

| Specialized Talent | Demand for skilled professionals in finance, risk, and compliance. | Challenges in attracting and retaining top talent. | Competitive compensation and career paths. |

| Economies of Scale | Cost efficiencies derived from large-scale operations. | Inability to match pricing and service breadth. | Operational leverage and diversified revenue streams. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Zheshang Development Group is built upon comprehensive data from their annual reports, investor relations materials, and official company disclosures. This is supplemented by industry-specific market research reports and analyses from reputable financial data providers.