Waste Management Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Waste Management Bundle

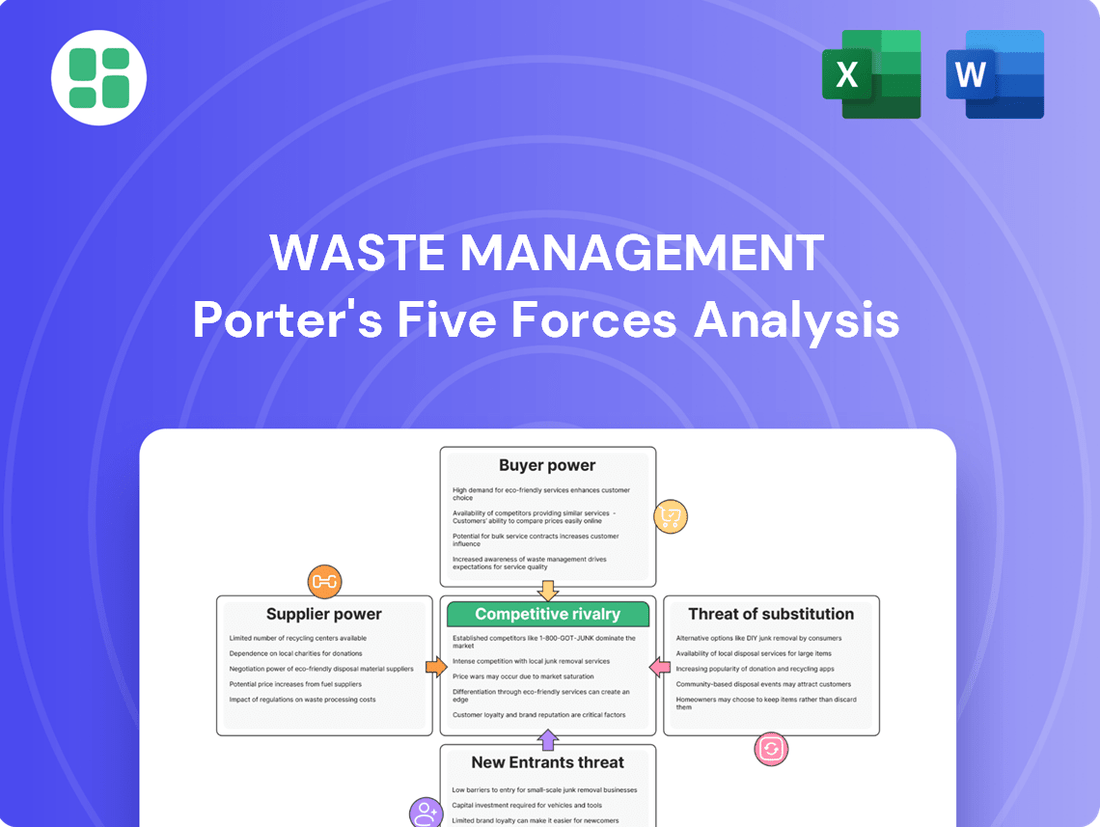

Waste Management faces significant competitive pressures, with moderate threats from new entrants and substitutes due to the essential nature of its services. Buyer power is also a key consideration, as large municipalities and corporations can negotiate favorable terms.

The full Porter's Five Forces Analysis reveals the real forces shaping Waste Management’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Waste Management's bargaining power with suppliers for core assets like landfill space is generally low because they own or have long-term leases on a significant portion of these essential facilities. This ownership structure limits the ability of external suppliers to dictate terms for crucial operational needs.

However, specialized suppliers, particularly those providing advanced recycling technology or energy conversion equipment, can exert more influence. These niche providers may have unique offerings that are difficult to replicate, giving them a degree of leverage. For instance, companies developing cutting-edge waste-to-energy systems could command higher prices or more favorable contract terms.

For more common inputs such as trucks, fuel, and standard operational supplies, Waste Management benefits from a wide array of vendors. This broad supplier base intensifies competition among sellers, thereby reducing the individual bargaining power of any single supplier. In 2024, the global market for waste management equipment saw continued growth, with numerous manufacturers vying for contracts, further solidifying Waste Management's position.

Fuel constitutes a substantial operational expense for Waste Management's extensive fleet, impacting its overall profitability. In 2024, fuel costs represented a significant portion of the company's operating expenses, directly influenced by global energy market volatility.

While Waste Management's considerable purchasing volume provides some leverage, the inherent nature of global fuel markets means suppliers can exert indirect bargaining power through price setting. Geopolitical events and fluctuating supply and demand significantly shape these prices, impacting Waste Management's cost structure.

The availability and cost of skilled labor, such as drivers, mechanics, and facility operators, directly influence Waste Management's operational expenses. In 2024, the ongoing demand for these essential roles, particularly in specialized areas like hazardous waste handling, can lead to increased wage pressures.

Labor unions, where established within Waste Management's workforce, can wield considerable bargaining power. This power impacts negotiations over wages, benefits, and working conditions, ultimately affecting the company's cost structure and the efficiency of its service delivery across its extensive network.

Specialized Equipment and Technology Providers

Suppliers of highly specialized waste processing equipment, like advanced recycling machinery or landfill gas-to-energy components, often wield moderate bargaining power. This is because there are typically only a few companies capable of producing such sophisticated technology, limiting Waste Management's options.

However, Waste Management's immense operational scale is a significant counterweight. Their ability to engage in bulk purchasing and negotiate long-term supply agreements can effectively temper the suppliers' pricing power and influence.

- Limited Alternatives: The scarcity of providers for highly specialized waste processing equipment grants these suppliers a degree of leverage.

- Scale Advantage: Waste Management's large purchasing volume and commitment to long-term contracts help mitigate supplier power.

- Technological Dependence: Investments in advanced recycling and energy recovery technologies mean Waste Management relies on these specialized suppliers.

Regulatory and Permitting Agencies

While not traditional suppliers, governmental and regulatory bodies play a crucial role in waste management by providing essential permits and licenses. For instance, the U.S. Environmental Protection Agency (EPA) sets stringent standards for landfill operations and waste disposal, directly influencing how companies like Waste Management can function. These agencies effectively 'supply' the operational authorization, and their evolving requirements can significantly alter a company's cost structure and strategic planning.

The bargaining power of these regulatory agencies is substantial. Their ability to impose new regulations, increase permitting fees, or even revoke operating licenses means waste management companies must constantly adapt to their demands. In 2024, for example, increased scrutiny on landfill emissions and leachate management could lead to higher compliance costs for operators, demonstrating the direct impact of regulatory power on operational feasibility and profitability.

- Regulatory Oversight: Agencies like the EPA and state environmental departments grant and monitor permits for landfills, transfer stations, and recycling facilities, essentially 'supplying' the legal right to operate.

- Cost Impact: Compliance with evolving environmental regulations, such as those related to greenhouse gas emissions from landfills or advanced waste treatment technologies, can significantly increase operational expenses.

- Operational Constraints: Permitting processes can be lengthy and complex, limiting the speed at which new facilities can be established or existing ones expanded, thereby affecting supply capacity.

Waste Management's bargaining power with suppliers for core assets like landfill space is generally low because they own or have long-term leases on a significant portion of these essential facilities. This ownership structure limits the ability of external suppliers to dictate terms for crucial operational needs.

For common inputs like trucks, fuel, and standard operational supplies, Waste Management benefits from a wide array of vendors, intensifying competition and reducing individual supplier leverage. In 2024, the global market for waste management equipment saw continued growth with numerous manufacturers vying for contracts.

Suppliers of highly specialized waste processing equipment, such as advanced recycling machinery, often wield moderate bargaining power due to limited providers, though Waste Management's scale and long-term contracts help mitigate this. Fuel costs, a substantial expense, are directly influenced by global market volatility, impacting Waste Management's cost structure.

The bargaining power of regulatory bodies like the EPA is substantial, as they supply operational authorization through permits and licenses. Evolving environmental regulations in 2024, such as those concerning landfill emissions, can significantly increase compliance costs and operational constraints for waste management companies.

What is included in the product

This analysis dissects the competitive forces impacting Waste Management, revealing the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and mitigate threats from new entrants and substitute services, streamlining competitive strategy.

Customers Bargaining Power

The residential and small commercial waste management customer base is incredibly fragmented. This means that each individual customer, whether a household or a small business, has very little sway on their own when it comes to negotiating prices or terms with a large provider like Waste Management. Their individual impact is minimal.

While price is certainly a consideration for these customers, the fundamental need for waste disposal and the convenience of established services limit their ability to exert significant pressure. They generally don't have many viable alternatives to the major players in their area. For instance, in 2023, Waste Management served millions of residential customers, highlighting the sheer scale of this fragmented base.

Waste Management's extensive network of collection routes, transfer stations, and processing facilities further strengthens its position. This widespread infrastructure makes it difficult for smaller, less established competitors to offer a comparable level of service and convenience, thereby reducing the bargaining power of individual customers who rely on this accessibility.

Large commercial and industrial clients, particularly those with substantial waste generation, hold moderate bargaining power. Their significant waste volumes allow them to negotiate more favorable pricing and service agreements, as they represent a considerable revenue stream for waste management companies.

These clients can leverage potential competitor bids to drive down costs. For instance, a large manufacturing plant generating thousands of tons of waste annually could solicit proposals from multiple waste management firms, creating a competitive environment that benefits them.

However, their leverage is somewhat constrained by the high switching costs involved in changing waste management providers. These costs can include new equipment, service reconfigurations, and potential disruption to operations, making a switch a significant undertaking that tempers their bargaining power.

Municipalities wield considerable bargaining power, especially when acting as large-volume customers. The competitive bidding process for waste management contracts means that providers like Waste Management must offer attractive terms to win or retain these crucial agreements. For instance, in 2024, many municipalities are renegotiating or issuing new long-term contracts, creating opportunities for them to secure more favorable pricing or service level agreements.

Switching Costs for Customers

For many customers, the process of switching waste management providers is not a simple click-and-switch operation. It involves navigating logistical hurdles like scheduling new pickups, potential disruptions in service during the transition, and the often-unpleasant task of understanding and adhering to contract termination clauses. These factors combine to create what can be considered moderate to high switching costs.

These elevated switching costs effectively dampen the immediate bargaining power of existing customers. The inconvenience and potential for service interruptions often make customers hesitant to switch, even if they find a slightly lower price elsewhere. For instance, a small business might find that the time spent coordinating a new waste collection schedule and ensuring compliance with new contract terms outweighs a potential 5% saving on their monthly bill.

- Logistical Complexity: Arranging new bins, pickup schedules, and understanding new service protocols.

- Service Disruption Risk: Potential for missed pickups or incorrect sorting during the transition period.

- Contractual Obligations: Early termination fees or notice periods can add significant costs.

- Information Search: Researching alternative providers and comparing service offerings requires time and effort.

Essential Service Nature

The essential nature of waste management significantly curtails customer bargaining power. This service is a necessity, meaning demand remains relatively stable even if prices fluctuate slightly, a concept known as low short-term elasticity. Customers generally cannot simply stop using waste disposal services, especially in the short term, making them less likely to exert pressure on providers through price negotiations or switching. For instance, in 2024, municipal waste collection fees often represent a small fraction of household budgets, further diminishing the incentive for customers to bargain aggressively.

This inelastic demand means customers are reliant on waste management providers to maintain public health and environmental standards. Consequently, their ability to demand lower prices or better terms is inherently limited. Providers, understanding this dependency, can maintain pricing power, as customers must continue to pay for the service regardless of minor dissatisfactions.

- Essential Service: Waste management is a non-discretionary service crucial for public health and sanitation.

- Low Demand Elasticity: Customers have limited ability to reduce consumption of waste management services in response to price changes.

- Reduced Bargaining Power: The necessity of the service weakens customers' leverage to negotiate prices or terms.

- Provider Stability: This reliance allows waste management companies to maintain a more stable revenue stream and pricing structure.

The bargaining power of customers in the waste management sector, particularly for Waste Management (WM), is generally low to moderate. This is primarily due to the fragmented nature of the residential and small commercial customer base, where individual entities have minimal leverage. While price is a factor, the essential nature of waste disposal and the convenience of established services limit their ability to exert significant pressure, especially given WM's extensive infrastructure. For instance, WM's 2023 annual report highlighted millions of residential customers, underscoring the difficulty for any single customer to influence terms.

Large commercial and industrial clients possess more leverage due to their substantial waste volumes, enabling them to negotiate better pricing and service agreements. However, this power is tempered by significant switching costs, which include potential equipment changes and operational disruptions. Municipalities, on the other hand, wield considerable bargaining power through competitive bidding processes for contracts, a dynamic evident in 2024 as many cities renegotiate terms. Despite this, the essential nature of waste management and low demand elasticity mean customers are largely reliant on providers, limiting their overall ability to drive down prices or dictate terms.

| Customer Segment | Bargaining Power | Key Factors |

|---|---|---|

| Residential/Small Commercial | Low | Fragmented base, essential service, high switching costs, limited alternatives. |

| Large Commercial/Industrial | Moderate | Significant volumes allow negotiation, but high switching costs constrain leverage. |

| Municipalities | High | Competitive bidding, large contract volumes, ability to set terms. |

Full Version Awaits

Waste Management Porter's Five Forces Analysis

This preview showcases the complete Waste Management Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You're looking at the final, ready-to-use analysis, providing actionable insights into industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes.

Rivalry Among Competitors

The waste management sector demands substantial upfront investment in essential infrastructure, including fleets of collection vehicles, transfer stations, and the development and maintenance of landfills. This high capital intensity translates directly into significant fixed costs for companies operating within the industry.

These substantial fixed costs create a powerful incentive for firms like Waste Management to aggressively pursue higher asset utilization and greater collection volumes. The need to spread these costs over a larger operational base intensifies competition as companies vie for market share, making it crucial to secure enough business to offset their fixed expenditures.

In 2024, Waste Management reported capital expenditures of approximately $1.5 billion, underscoring the ongoing need for investment in fleet modernization and facility upgrades. This level of spending highlights the capital-intensive nature of the business and the pressure to maintain efficient operations to remain competitive.

The waste management industry, while consolidated with giants like Waste Management and Republic Services, features a highly competitive landscape. These national players vie for substantial municipal and commercial contracts, a segment where scale and efficiency are paramount. In 2023, Waste Management reported revenues of $20.1 billion, underscoring its market leadership, yet Republic Services also posted strong performance with $13.5 billion in revenue for the same year.

Beyond the national titans, a robust network of strong regional and local waste management companies creates further competitive pressure. These smaller, often more agile, firms frequently dominate specific geographic areas, offering tailored services and competitive pricing that challenge larger entities, particularly for smaller commercial accounts and residential services.

Waste collection and disposal are largely seen as basic services, making it tough for companies to truly set themselves apart based on what they offer. This commoditization means differentiation is limited, forcing a focus on other aspects.

Competition frequently centers on price, how dependable the service is, and the quality of customer interaction. For instance, in 2024, many waste management companies are investing in advanced routing software to improve efficiency and reliability, a key differentiator. Some are also exploring specialized services like hazardous waste handling or recycling for specific materials to carve out unique market positions.

High Exit Barriers

The waste management industry is characterized by significant capital outlays for specialized equipment, landfills, and processing facilities. For instance, building a new landfill can cost tens of millions of dollars, creating a substantial financial commitment. This high upfront investment makes it difficult and costly for companies to exit the market, effectively trapping them within the industry.

Long-term contracts with municipalities and businesses further solidify a company's presence, often spanning 10 to 20 years. These agreements provide predictable revenue streams but also tie up assets and resources, making divestment or closure a complex and financially punitive undertaking. The specialized nature of waste handling assets, from collection trucks to recycling machinery, also limits their resale value outside the industry.

- High Capital Investment: Building and maintaining waste infrastructure, including landfills and processing plants, requires substantial capital, often running into hundreds of millions of dollars for large-scale operations.

- Long-Term Contracts: Many waste management firms operate under multi-year contracts, creating sticky customer relationships and operational commitments that are costly to break.

- Specialized Assets: The industry relies on highly specialized equipment and facilities that have limited alternative uses, increasing the cost and difficulty of exiting the market.

- Intensified Rivalry: Due to these high exit barriers, companies are compelled to remain competitive and fight for market share, even during economic slowdowns, leading to sustained intense rivalry.

Geographic Market Dynamics

Competitive rivalry in waste management significantly varies based on geographic market dynamics. In bustling urban centers, the presence of numerous waste hauling companies often leads to fierce competition, driving down prices and demanding innovative service offerings. For instance, in 2024, major metropolitan areas saw an average of 5-7 significant waste management providers actively competing for commercial and residential contracts.

Conversely, in more remote or sparsely populated rural areas, the high capital investment required for landfill development, fleet acquisition, and regulatory compliance can create natural barriers to entry. This often results in a situation where a single entity, such as Waste Management, operates as a de facto monopoly, serving vast territories with limited direct competition.

This geographic disparity influences pricing strategies and operational efficiency. Companies like Waste Management must tailor their competitive approaches, focusing on cost leadership in competitive urban markets and emphasizing reliability and service coverage in less dense regions. The 2024 market reports indicated that operational costs per ton handled in urban areas were approximately 15% higher due to increased logistics and labor, but this was offset by higher contract volumes.

- Urban Competition: High density of providers in cities leads to price wars and service innovation.

- Rural Dominance: High infrastructure costs often result in single-provider dominance in rural areas.

- Cost Disparities: 2024 data shows urban operations incur higher costs per ton but benefit from greater volume.

Competitive rivalry within the waste management sector is intense, driven by high capital requirements and the commoditized nature of the service. Companies like Waste Management, with $20.1 billion in 2023 revenue, and Republic Services, which generated $13.5 billion in 2023, compete fiercely for market share, particularly in securing large municipal and commercial contracts.

This rivalry is further amplified by the presence of numerous regional and local players who often offer competitive pricing and specialized services, challenging larger entities. In 2024, many companies focused on operational efficiencies, such as advanced routing software, to gain an edge.

| Company | 2023 Revenue (Billion USD) | Key Competitive Focus |

|---|---|---|

| Waste Management | 20.1 | Scale, efficiency, national contracts |

| Republic Services | 13.5 | Scale, efficiency, national contracts |

| Regional/Local Providers | Varies | Price, tailored services, customer interaction |

SSubstitutes Threaten

The most significant threat of substitutes for waste management services stems from upstream waste reduction initiatives. Efforts by consumers, businesses, and governments to minimize waste at its source directly diminish the volume of materials requiring collection and disposal. For instance, the growing emphasis on circular economy principles, which prioritize reuse and repair over disposal, directly competes with traditional waste management models.

These reduction strategies, such as extended producer responsibility schemes and public awareness campaigns promoting less packaging, effectively lower the demand for waste management. In 2023, for example, many regions saw a slight decrease in municipal solid waste generation per capita due to these focused efforts, impacting the revenue streams of waste management companies.

The increasing adoption of composting, both at the residential and commercial levels, presents a significant threat of substitutes for traditional waste management services. As more communities implement curbside composting programs, such as the expansion of organics collection in cities like Seattle, it directly diverts a substantial portion of the waste stream away from landfills. This trend impacts Waste Management's core disposal revenue streams.

Advancements in recycling and material recovery present a significant threat of substitution for traditional waste management services. For instance, in 2024, global recycling rates continued to climb, with many regions implementing more stringent recycling mandates. This means less raw material is being discarded, directly impacting the volume of waste requiring landfilling or incineration, which are core revenue streams for companies like Waste Management.

The growing emphasis on a circular economy further amplifies this threat. By 2025, projections indicate a substantial increase in the value of recovered materials, making them more attractive alternatives to virgin resources. This shift can reduce demand for disposal services as more waste is reprocessed and reintegrated into production cycles, thereby substituting the need for landfill capacity.

Decentralized Waste-to-Energy Solutions

Emerging decentralized waste-to-energy (WtE) solutions, like compact anaerobic digesters and pyrolysis units, present a growing threat of substitution for traditional waste management services, particularly for specific waste streams. These technologies can offer localized alternatives to large-scale landfilling and incineration.

If these smaller, more distributed WtE systems become more cost-effective and widely adopted, they could siphon off waste volumes, especially from industrial and agricultural sectors that generate distinct waste types suitable for these processes. For instance, the global market for anaerobic digestion technology was valued at approximately $20.5 billion in 2023 and is projected to grow significantly, indicating increasing adoption of such decentralized solutions.

- Decentralized WtE Growth: The increasing feasibility of small-scale anaerobic digesters and pyrolysis units offers alternatives to traditional waste disposal methods.

- Client Diversion Risk: Widespread adoption could lead to waste diversion from larger facilities, impacting revenue streams, especially from commercial and agricultural clients.

- Economic Viability: As these technologies mature and become more economical, their attractiveness as substitutes will increase.

- Market Trends: The expanding market for distributed WtE technologies signals a shift that waste management companies must monitor.

On-Site Waste Management and Processing

Large industrial and commercial businesses might choose to handle their waste internally. This can involve using equipment like compactors or balers to reduce waste volume, thereby lessening the need for external collection services. For instance, in 2024, companies focused on sustainability and cost-efficiency are increasingly exploring on-site solutions to manage their waste streams.

This trend presents a direct substitute threat to traditional waste management companies, particularly for their collection and transfer services. By processing waste on-site, these businesses can bypass the fees and logistical complexities associated with third-party providers, impacting the revenue potential of waste management firms.

- On-site equipment adoption: Businesses are investing in compactors and balers to pre-process waste.

- Cost reduction incentive: Reducing reliance on external collection services offers significant cost savings.

- Sustainability focus: Internal waste management aligns with corporate environmental goals.

- Volume reduction impact: On-site processing directly shrinks the volume of waste needing external handling.

The threat of substitutes in waste management is driven by innovations that divert waste from traditional disposal channels. Upstream waste reduction, advanced recycling, and decentralized waste-to-energy solutions all offer alternatives that can diminish the volume of waste requiring collection and landfilling. For example, the global market for anaerobic digestion technology reached approximately $20.5 billion in 2023, highlighting the growing adoption of these alternative processing methods.

Furthermore, large businesses are increasingly investing in on-site waste processing equipment like compactors and balers. This trend, seen in 2024 as companies prioritize sustainability and cost savings, allows them to reduce waste volume internally, thereby bypassing external collection services. This directly impacts the revenue streams of traditional waste management companies, particularly for their collection and transfer operations.

| Substitute Strategy | Impact on Waste Management | Example/Data Point |

|---|---|---|

| Waste Reduction & Circular Economy | Decreases overall waste volume | Circular economy principles prioritize reuse, reducing landfill demand. |

| Advanced Recycling & Material Recovery | Reduces materials sent to landfill/incineration | Global recycling rates continued to climb in 2024. |

| Decentralized Waste-to-Energy (WtE) | Siphons off specific waste streams | Anaerobic digestion market valued at $20.5 billion in 2023. |

| On-site Business Waste Processing | Bypasses external collection services | Businesses adopt compactors/balers in 2024 for cost and sustainability. |

Entrants Threaten

The waste management sector demands significant upfront capital, often running into tens or hundreds of millions of dollars, for essential infrastructure like collection fleets, transfer stations, and material recovery facilities. The most substantial investment, however, lies in the acquisition and development of landfills, which require extensive land, permitting, and environmental compliance, creating a formidable financial hurdle for newcomers.

New companies entering the waste management sector encounter a significant hurdle in navigating the labyrinthine web of federal, state, and local regulations and permitting processes. This is especially true for operations like landfills, which require extensive approvals. For example, obtaining permits for a new landfill can take several years and involve multiple environmental impact assessments and public hearings, significantly increasing the upfront investment and time-to-market for potential entrants.

Established players like Waste Management leverage substantial economies of scale, particularly in optimizing collection routes and processing facility operations. In 2024, Waste Management reported a revenue of $20.2 billion, underscoring the massive operational footprint and cost efficiencies that are challenging for newcomers to replicate. These scale advantages translate into lower per-unit costs for waste disposal and recycling.

New entrants face significant hurdles in achieving comparable cost efficiencies due to the sheer volume required to spread fixed costs across a larger operational base. Without the established network and high utilization rates, a new company would find it difficult to match the competitive pricing that Waste Management can offer, directly impacting their ability to gain market share.

Established Infrastructure and Network Effects

The threat of new entrants in the waste management sector is significantly mitigated by the substantial capital investment required to establish a comparable infrastructure. Waste Management, for instance, operates a vast network of collection routes, transfer stations, and landfills strategically positioned throughout North America. Constructing such an extensive and geographically dispersed operational base from the ground up presents a formidable barrier.

This established infrastructure creates powerful network effects. As Waste Management expands its service areas and customer base, the efficiency and cost-effectiveness of its operations increase, making it more attractive to potential clients. A new entrant would struggle to replicate this scale and operational synergy, facing higher per-unit costs and a less competitive offering.

- High Capital Requirements: Building landfills, transfer stations, and acquiring specialized fleets demands hundreds of millions, if not billions, of dollars, a significant hurdle for new players.

- Network Effects: An established route density and customer base lead to greater operational efficiency and lower per-unit costs, a competitive advantage difficult for newcomers to match.

- Regulatory Hurdles: Obtaining permits for landfill operations and environmental compliance is a lengthy and costly process that new entrants must navigate, adding to the initial investment and time-to-market.

Customer Loyalty and Contractual Agreements

New entrants into the waste management sector face significant hurdles due to established customer loyalty and the prevalence of long-term contractual agreements. Securing contracts, particularly with municipalities and large commercial clients, is challenging as these relationships are often deeply entrenched with renewal clauses favoring incumbents. For instance, in 2024, many municipal waste contracts are multi-year deals, making it difficult for new players to break in without offering substantially disruptive pricing or service models.

Building trust and brand recognition is a time-consuming process in this industry. Existing customers often exhibit strong loyalty to their current waste management providers, stemming from consistent service, established communication channels, and perceived reliability. This loyalty acts as a substantial barrier, requiring new entrants to invest heavily in marketing and demonstrate superior value to even begin chipping away at the market share held by established companies.

- Customer Loyalty: Existing waste management providers benefit from long-standing relationships and trust built over years of service, making it hard for new entrants to gain traction.

- Contractual Barriers: Long-term municipal and commercial contracts, often with renewal clauses, lock in customers and create significant hurdles for new companies entering the market.

- Brand Recognition: Establishing a recognizable and trusted brand in the waste management sector requires substantial time and investment, a challenge for nascent competitors.

The threat of new entrants in waste management is low due to the massive capital needed for infrastructure, like landfills and collection fleets, which can cost hundreds of millions. Regulatory hurdles, including lengthy permitting processes for facilities like landfills, further deter new players. Established companies also benefit from significant economies of scale, making it difficult for newcomers to compete on price.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building landfills, transfer stations, and acquiring specialized fleets requires hundreds of millions of dollars. | Forms a very high barrier to entry. |

| Regulatory Hurdles | Obtaining permits for landfill operations and environmental compliance is a lengthy and costly process. | Adds significant upfront investment and time-to-market. |

| Economies of Scale | Established players like Waste Management (2024 revenue: $20.2 billion) achieve lower per-unit costs through optimized operations. | Makes it difficult for new entrants to match competitive pricing and achieve cost efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Waste Management Porter's Five Forces analysis is built upon a foundation of industry-specific market research reports, company annual filings, and government environmental agency data. This blend ensures a comprehensive understanding of competitive pressures, regulatory landscapes, and operational costs.