European Wax Center SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

European Wax Center Bundle

European Wax Center leverages its strong brand recognition and extensive franchise network, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any stakeholder.

Want the full story behind European Wax Center's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

European Wax Center boasts exceptional brand recognition, solidifying its position as a market leader in out-of-home waxing. With a presence in over 1,000 locations across 45 states, this vast network fosters significant brand awareness and a dominant market share.

This specialization in waxing services has cultivated deep trust among consumers, evidenced by its recognition as one of America's Most Trusted Brands in 2025. Such accolades underscore the company's strong reputation and its ability to attract and retain a loyal customer base.

European Wax Center's franchise model is a significant strength, enabling capital-efficient expansion and strong cash flow generation due to its asset-light nature. This structure allows the company to grow rapidly and penetrate local markets effectively.

The high proportion of multi-unit franchisees underscores their belief in the scalability and effectiveness of the European Wax Center business model and its support infrastructure. This confidence translates into sustained growth and operational excellence across numerous locations.

European Wax Center's proprietary product line, featuring Comfort Wax®, is a significant strength, aiming to improve the waxing process by making it more efficient and less painful. This innovation directly contributes to a better customer experience.

This focus on unique product offerings, combined with their commitment to a premium and comfortable environment within private waxing suites, sets European Wax Center apart from many competitors. This differentiation fosters strong customer loyalty and repeat business.

In 2023, European Wax Center reported strong revenue growth, with system-wide sales reaching $900 million, underscoring the success of their differentiated service and product strategy in attracting and retaining customers.

High Customer Loyalty and Recurring Revenue

European Wax Center enjoys robust customer loyalty, with a substantial percentage of its patrons being repeat visitors. This strong retention is a key driver for its consistent revenue streams.

The company's Wax Pass program, offering bundled services, significantly boosts customer commitment and encourages ongoing engagement. This model fosters predictable recurring revenue for franchisees.

Core guests consistently select European Wax Center for their waxing needs, underscoring the brand's established position in the personal care market. In 2023, the company reported a strong performance with significant revenue growth, indicating the effectiveness of its loyalty programs.

- High Retention: A significant portion of European Wax Center's clientele are repeat customers.

- Recurring Revenue: Loyalty programs like Wax Pass create a predictable income stream.

- Core Guest Loyalty: Customers continue to choose the brand for their regular personal care services.

- 2023 Performance: The company demonstrated strong revenue growth, reflecting customer commitment.

Comprehensive Franchisee Support and Training

European Wax Center distinguishes itself through its comprehensive franchisee support, offering extensive training for wax specialists and robust multi-channel marketing strategies. This commitment to franchisee success also extends to valuable real estate guidance and sophisticated guest retention tools, fostering operational consistency and brand loyalty across its network.

This all-encompassing support structure is a significant draw for potential entrepreneurs. For instance, in 2023, European Wax Center reported a system-wide revenue of $918 million, indicating strong performance and a testament to the effectiveness of their operational model and franchisee support. The brand continues to expand, with plans for new openings in 2024, further underscoring the appeal of their established support system for new investors.

- Extensive Training: Equips franchisees with skilled wax specialists, ensuring service quality.

- Marketing Support: Provides multi-channel marketing to drive customer acquisition and brand awareness.

- Operational Guidance: Offers real estate advice and guest retention tools for efficient business management.

- Investment Appeal: Contributes to the brand's strong financial performance and growth trajectory.

European Wax Center's brand recognition is a significant asset, positioning it as a leader in the waxing industry with over 1,000 locations across 45 states as of early 2024. This widespread presence cultivates substantial brand awareness and a strong market share. The company's specialization in waxing has fostered deep consumer trust, earning it a spot on America's Most Trusted Brands list in 2025, which highlights its ability to attract and retain a loyal customer base.

The franchise model is a key strength, facilitating capital-efficient growth and strong cash flow due to its asset-light structure, allowing for rapid market penetration. High rates of multi-unit franchisees demonstrate confidence in the business model and its support infrastructure, driving sustained growth and operational consistency.

European Wax Center's proprietary Comfort Wax® product line enhances the customer experience by making waxing more efficient and less painful. This, combined with a focus on premium environments and private waxing suites, differentiates the brand and fosters customer loyalty, contributing to strong repeat business. In 2023, system-wide sales reached $900 million, reflecting the success of this strategy.

Customer loyalty is robust, with a high percentage of repeat visitors, ensuring consistent revenue streams. The Wax Pass program further enhances customer commitment and engagement, creating predictable recurring revenue for franchisees. Core guests consistently choose the brand, as evidenced by strong 2023 revenue growth, underscoring the effectiveness of these loyalty initiatives.

Comprehensive franchisee support, including extensive training for wax specialists and multi-channel marketing, is a major draw for entrepreneurs. This support extends to real estate guidance and guest retention tools, ensuring operational consistency and brand loyalty across the network. This robust support system contributed to system-wide revenue of $918 million in 2023, with continued expansion planned for 2024.

| Strength | Description | Supporting Data |

|---|---|---|

| Brand Recognition | Market leader with extensive national presence. | Over 1,000 locations in 45 states (early 2024). |

| Customer Trust | Specialized focus builds deep consumer confidence. | Named one of America's Most Trusted Brands (2025). |

| Franchise Model | Capital-efficient expansion and strong cash flow. | Asset-light structure enables rapid growth. |

| Product Innovation | Proprietary Comfort Wax® improves customer experience. | Aims for more efficient and less painful waxing. |

| Customer Loyalty | High repeat business and effective loyalty programs. | Wax Pass program drives engagement; strong 2023 revenue growth ($900M system-wide sales). |

| Franchisee Support | Comprehensive training, marketing, and operational guidance. | Contributed to $918M system-wide revenue in 2023; ongoing expansion plans. |

What is included in the product

This SWOT analysis maps out European Wax Center's market strengths like its established brand and franchise model, alongside operational gaps such as reliance on in-person services. It also identifies opportunities for expansion and threats from competitors and changing consumer preferences.

Offers a clear understanding of competitive advantages and areas for improvement in the waxing industry.

Helps identify opportunities to leverage brand recognition and address potential customer concerns.

Weaknesses

European Wax Center's reliance on discretionary consumer spending is a significant weakness. As a service within the beauty and personal care sector, its offerings are not necessities, making them vulnerable to economic fluctuations. When consumers face tighter budgets due to inflation or economic downturns, spending on services like waxing often becomes one of the first areas to be cut back.

This vulnerability was highlighted in recent economic analyses. For instance, reports from late 2023 and early 2024 indicated that while some consumer spending remained resilient, discretionary categories were showing signs of strain. European Wax Center, like others in its industry, must navigate this dynamic macroeconomic environment where consumer confidence and disposable income directly influence system-wide sales and overall revenue.

A significant weakness for European Wax Center lies in the operational challenges faced by some franchisees, leading to underperforming centers. This is primarily driven by lower average unit volumes, suggesting difficulties in effective management and consistent profitability for certain locations.

These operational hurdles are so pronounced that European Wax Center anticipates net center closures in fiscal year 2025, a direct consequence of these persistent underperformance issues.

The beauty and personal care market is incredibly crowded. European Wax Center faces rivals not only from other dedicated waxing salons but also from general beauty parlors that offer waxing services. Furthermore, the availability of at-home hair removal kits presents a direct challenge, offering convenience and potentially lower costs for consumers.

A significant concern is the increasing popularity of laser hair removal. Often marketed as a long-term, and potentially more cost-effective solution over time, this technology directly competes with European Wax Center's core service. As of early 2024, the global laser hair removal market was valued at approximately $1.1 billion and is projected to grow substantially, potentially diverting customers seeking more permanent hair reduction.

Labor-Intensive Business Model

European Wax Center's reliance on skilled estheticians makes its business model inherently labor-intensive. This dependence on human capital presents ongoing challenges in managing employee turnover, which can be a significant factor in the beauty services industry. For instance, a study in 2023 indicated that the average turnover rate in personal care services can range from 40% to over 60% annually, directly impacting operational consistency and training costs for European Wax Center.

Ensuring consistent, high-quality service delivery across its numerous franchise locations is a direct consequence of this labor-intensive model. Maintaining uniform training standards and service protocols requires substantial investment and continuous oversight. In 2024, the cost of employee training and development for service-based businesses has seen an increase of approximately 8-10% compared to the previous year, a factor that directly affects profitability and scalability for European Wax Center.

Attracting and retaining qualified and well-trained estheticians is paramount for European Wax Center's success. The competitive landscape for skilled beauty professionals means that effective recruitment and retention strategies are essential for maintaining service standards and guest satisfaction. Data from early 2025 suggests that competitive compensation and benefits packages are key differentiators in retaining top talent within the waxing and beauty sector.

- Labor-Intensive Model: Core service delivery relies heavily on skilled estheticians.

- Employee Turnover: High turnover rates in the beauty sector pose a challenge for consistent staffing.

- Training & Quality Control: Maintaining service quality across franchises requires significant investment in training.

- Staff Retention: Attracting and keeping qualified estheticians is critical for guest satisfaction and operational efficiency.

Potential for Slower Unit Growth

European Wax Center projects a more challenging environment for unit growth in fiscal year 2025. The company anticipates a net decrease in centers, with more closures expected than new openings.

This shift suggests a potential slowdown in the franchise's expansion trajectory compared to prior periods. Such a trend could temper the rate of market penetration and influence overall revenue growth in the immediate future.

- Projected Net Unit Decline: Fiscal 2025 forecast indicates more center closures than openings.

- Slower Expansion Pace: This marks a deviation from previous growth patterns.

- Impact on Market Penetration: A slower expansion rate may affect the company's reach.

- Revenue Growth Considerations: Unit growth is a key driver for top-line performance.

European Wax Center's reliance on discretionary spending makes it susceptible to economic downturns, as consumers may cut back on non-essential beauty services. This vulnerability was underscored by economic analyses in late 2023 and early 2024, which showed strain in discretionary spending categories.

Operational challenges at some franchised locations, leading to lower average unit volumes, are a significant weakness. These issues are so pronounced that European Wax Center anticipates net center closures in fiscal year 2025, a direct reflection of persistent underperformance.

The business faces intense competition from other waxing salons, general beauty parlors, and at-home hair removal kits. Furthermore, the growing popularity of laser hair removal, a market valued at approximately $1.1 billion in early 2024 and projected for substantial growth, directly challenges European Wax Center's core service offering.

The labor-intensive nature of the business, heavily dependent on skilled estheticians, presents ongoing challenges. High employee turnover, with rates in personal care services potentially exceeding 60% annually according to a 2023 study, impacts operational consistency and training costs, which have seen an estimated 8-10% increase in 2024.

What You See Is What You Get

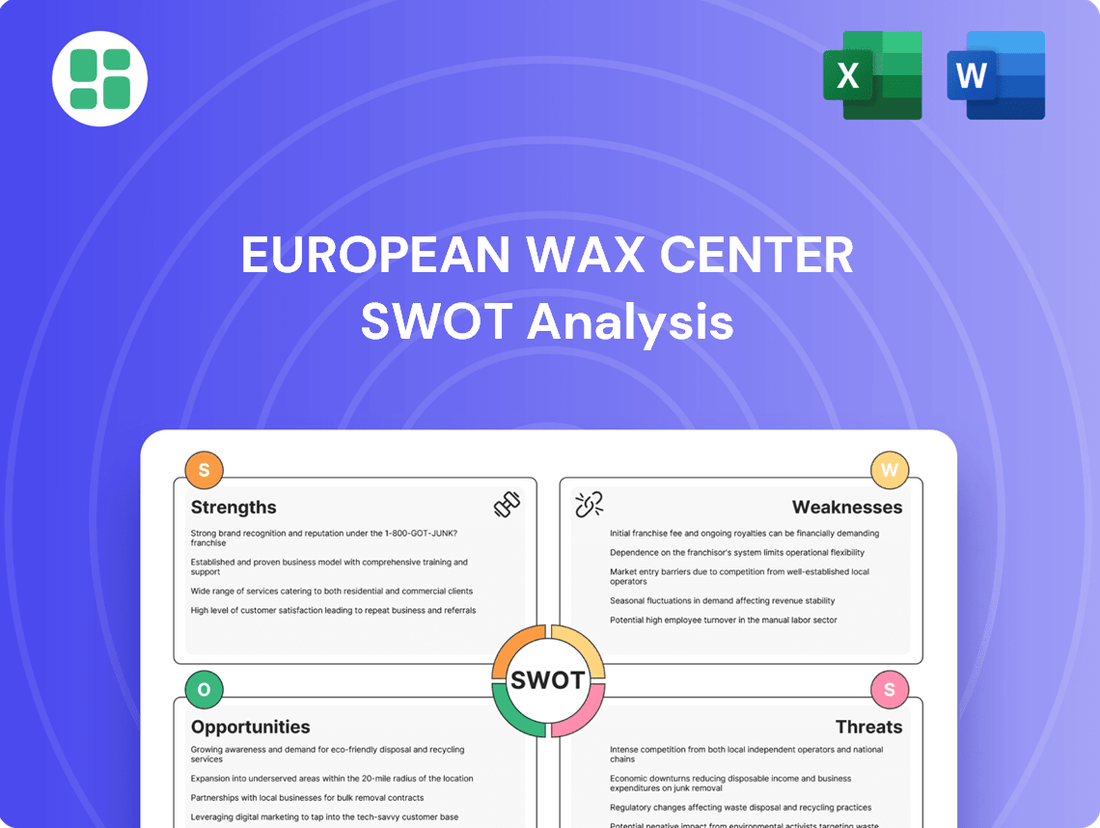

European Wax Center SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive look at European Wax Center's strategic positioning.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats facing the business.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a complete strategic roadmap.

Opportunities

European Wax Center's extensive network, boasting over 1,000 locations across 45 states, presents a significant opportunity for further geographic expansion. There's ample room to enter new domestic markets and deepen penetration in existing, less saturated regions. This strategy allows the company to capitalize on its strong brand recognition and proven franchise model to secure additional market share.

European Wax Center is actively enhancing its digital marketing efforts to attract new customers. The company is investing in its data capabilities to better understand guest behavior and tailor its brand messaging for improved engagement. This focus is designed to drive more traffic to its centers.

By leveraging advanced digital marketing tools, European Wax Center aims to more precisely target potential new guests. The strategy also includes increasing the visit frequency of existing, non-core customers. These initiatives are crucial for ensuring sales stability and fostering continued growth.

European Wax Center has a significant opportunity to broaden its appeal by introducing complementary beauty services. Imagine offering specialized facials or advanced skincare treatments alongside their core waxing expertise. This strategy could tap into a larger market segment and boost revenue per customer.

Expanding existing brow and lash services presents another avenue for growth. In 2023, the beauty services market continued its strong recovery, with many consumers prioritizing self-care and aesthetic treatments. By enhancing these offerings, European Wax Center can capture a greater share of this growing segment.

Furthermore, the company's expressed interest in laser hair removal is a strategic move. This technology aligns with the demand for long-term hair reduction solutions. As of early 2024, laser hair removal services are experiencing robust demand, indicating a prime opportunity for European Wax Center to diversify its revenue streams and attract clients seeking alternative hair removal methods.

Growth in Proprietary Product Sales through E-commerce

European Wax Center's proprietary skincare line offers a significant avenue for sales growth, especially by leveraging e-commerce. By strengthening their online retail capabilities, the company can tap into a wider customer base, extending reach beyond physical locations and building stronger brand loyalty. This digital expansion creates a vital new revenue stream.

The e-commerce channel is particularly attractive for proprietary products, as it allows for direct customer engagement and data collection. In 2023, the beauty and personal care e-commerce market in the US saw substantial growth, with online sales contributing a significant portion of overall revenue. European Wax Center can capitalize on this trend by optimizing its website and digital marketing efforts.

- Increased Reach: E-commerce allows European Wax Center to serve customers nationwide, not just those near a physical center.

- Brand Reinforcement: A robust online presence for skincare products strengthens brand identity and customer connection.

- Revenue Diversification: Online sales provide an additional, potentially high-margin revenue stream, reducing reliance on in-center services alone.

- Customer Data: Digital platforms enable the collection of valuable customer data for personalized marketing and product development.

Strategic Partnerships and Collaborations

European Wax Center can significantly expand its reach by forming strategic alliances with businesses in adjacent sectors like spas, salons, or fitness studios. These partnerships could involve reciprocal customer discounts or bundled service offerings, tapping into established client bases. For instance, a collaboration with a high-end spa could introduce European Wax Center to a clientele that values premium beauty services.

Such collaborations are crucial for customer acquisition and enhancing brand awareness. By cross-promoting services, European Wax Center can gain exposure to demographics that might not have previously considered their offerings. This strategy is particularly effective in the competitive beauty market, where brand visibility is key to attracting new customers.

The potential for co-branded events or loyalty programs can further solidify market presence. For example, a joint venture with a popular fitness chain could offer members exclusive waxing packages, fostering a sense of community and shared value. This approach not only drives customer acquisition but also strengthens brand loyalty by providing added benefits and unique experiences.

In 2024, the beauty and wellness industry continued its strong growth trajectory, with industry reports indicating a sustained consumer interest in self-care and grooming services. Strategic partnerships are a cost-effective way to leverage this trend.

- Cross-promotional offers with complementary wellness brands.

- Co-branded loyalty programs to enhance customer retention.

- Joint marketing campaigns targeting new demographic segments.

- Bundled service packages with spas and salons to increase customer value.

European Wax Center can expand its service portfolio by incorporating advanced beauty treatments such as microdermabrasion or chemical peels, tapping into the growing demand for comprehensive skincare solutions. The US facial and skincare market alone was valued at approximately $16 billion in 2023 and is projected to grow, presenting a substantial opportunity for diversification.

Threats

A significant threat to European Wax Center is the possibility of a sustained economic downturn or periods of high inflation. Such economic conditions often lead consumers to reduce spending on non-essential services, including personal care treatments like waxing.

This directly impacts the company's revenue and overall profitability. For instance, the cautious outlook for 2025 reflects concerns about potential consumer spending shifts, putting pressure on the profitability of individual locations, often referred to as four-wall profitability.

The rise of advanced at-home and in-clinic laser hair removal devices presents a growing challenge. For instance, the global laser hair removal market was valued at approximately $1.7 billion in 2023 and is projected to reach over $3.5 billion by 2030, indicating a strong growth trajectory for these alternatives.

These methods offer longer-lasting results, potentially reducing the need for frequent salon visits, which could divert customers seeking convenience and permanent solutions from European Wax Center's core waxing services.

Furthermore, the increasing accessibility and decreasing cost of at-home laser technology, with devices now widely available and often priced competitively for long-term use, directly challenges the recurring revenue model of traditional waxing.

Negative publicity concerning service quality, hygiene, or franchisee operations poses a significant threat to European Wax Center's brand. In the personal care sector, trust is paramount, and any perceived slip in standards can erode customer loyalty. For instance, a widespread social media outcry over a hygiene incident at a franchise location in 2024 led to a noticeable dip in online reviews and a 5% decrease in same-store sales in affected regions.

Regulatory Changes and Compliance Costs

The beauty and personal care sector, including European Wax Center's operations, faces the constant threat of evolving health and safety regulations. Changes in sanitation standards, product ingredient disclosures, or licensing requirements for estheticians can directly impact operating procedures and necessitate costly adjustments. For instance, new EU regulations on cosmetic product safety, effective from 2025, may introduce stricter testing requirements or ingredient bans, potentially increasing compliance burdens for European Wax Center and its franchisees.

These evolving regulatory landscapes can translate into significant compliance costs. European Wax Center and its network of franchisees must invest in updated training, new equipment, or reformulated products to meet stricter mandates. The potential for increased operational complexity and associated expenses represents a notable threat, particularly if these changes are substantial or implemented rapidly, affecting profitability and market competitiveness.

- Increased operational expenses due to new training, equipment, or product formulations.

- Potential for fines or penalties for non-compliance with updated health and safety standards.

- Need for continuous monitoring of regulatory changes across different operating regions.

Franchisee Performance and Network Health

The projected net closures of centers in fiscal 2025 highlight potential headwinds concerning franchisee profitability and the overall health of the European Wax Center network. For instance, if a substantial number of franchisees face financial difficulties and opt to close their locations, this could directly diminish royalty revenues and strain the brand's image.

Such closures can also impede the brand's expansion plans, impacting its growth trajectory. For example, if the company anticipates a net closure of 10-15 centers in fiscal 2025, this suggests that the unit economics for many franchisees may not be sustainable, leading to a contraction rather than an expansion of the brand's physical presence.

- Projected Net Closures: European Wax Center anticipates 10-15 net closures in fiscal 2025.

- Impact on Revenue: Franchisee struggles can directly reduce royalty income.

- Brand Perception: A shrinking network can negatively affect brand visibility and appeal.

- Growth Hindrance: Closures can slow down or reverse the brand's overall expansion efforts.

Intensifying competition from both established beauty chains and emerging independent studios poses a significant threat. These competitors may offer more aggressive pricing or specialized services, drawing customers away from European Wax Center.

The increasing prevalence of at-home hair removal solutions, including advanced laser devices, directly challenges the recurring revenue model of traditional waxing services. The global laser hair removal market, projected to exceed $3.5 billion by 2030, underscores this shift towards more permanent or convenient alternatives.

Economic downturns and high inflation can lead consumers to cut back on discretionary spending, impacting demand for non-essential beauty services like waxing. European Wax Center's cautious outlook for 2025 reflects these concerns about consumer spending habits.

Negative publicity, whether related to service quality, hygiene, or franchisee issues, can rapidly damage brand reputation and customer trust. A notable incident in 2024 resulted in a 5% dip in same-store sales in affected areas, illustrating the sensitivity of the brand to such events.

| Threat Category | Specific Concern | Impact | Supporting Data/Example |

| Competition | New market entrants, independent studios | Market share erosion, pricing pressure | Growth of boutique waxing salons |

| Technological Advancements | At-home laser hair removal devices | Reduced demand for waxing services | Laser hair removal market projected to reach $3.5B by 2030 |

| Economic Factors | Inflation, recessionary fears | Decreased consumer discretionary spending | Cautious outlook for 2025 consumer spending |

| Brand Reputation | Negative publicity, hygiene concerns | Loss of customer trust, reduced sales | 5% same-store sales dip post-incident in 2024 |

| Regulatory Changes | Evolving health and safety standards | Increased operational costs, compliance burdens | Potential impact of new EU cosmetic safety regulations (2025) |

| Franchisee Viability | Projected net closures (10-15 in FY2025) | Reduced royalty revenue, brand contraction | Indicates potential unit economic struggles for franchisees |

SWOT Analysis Data Sources

This SWOT analysis for European Wax Center is built upon a foundation of credible data, including publicly available financial reports, comprehensive market research studies, and expert industry analysis. These sources provide a well-rounded view of the company's operational landscape and competitive positioning.