European Wax Center Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

European Wax Center Bundle

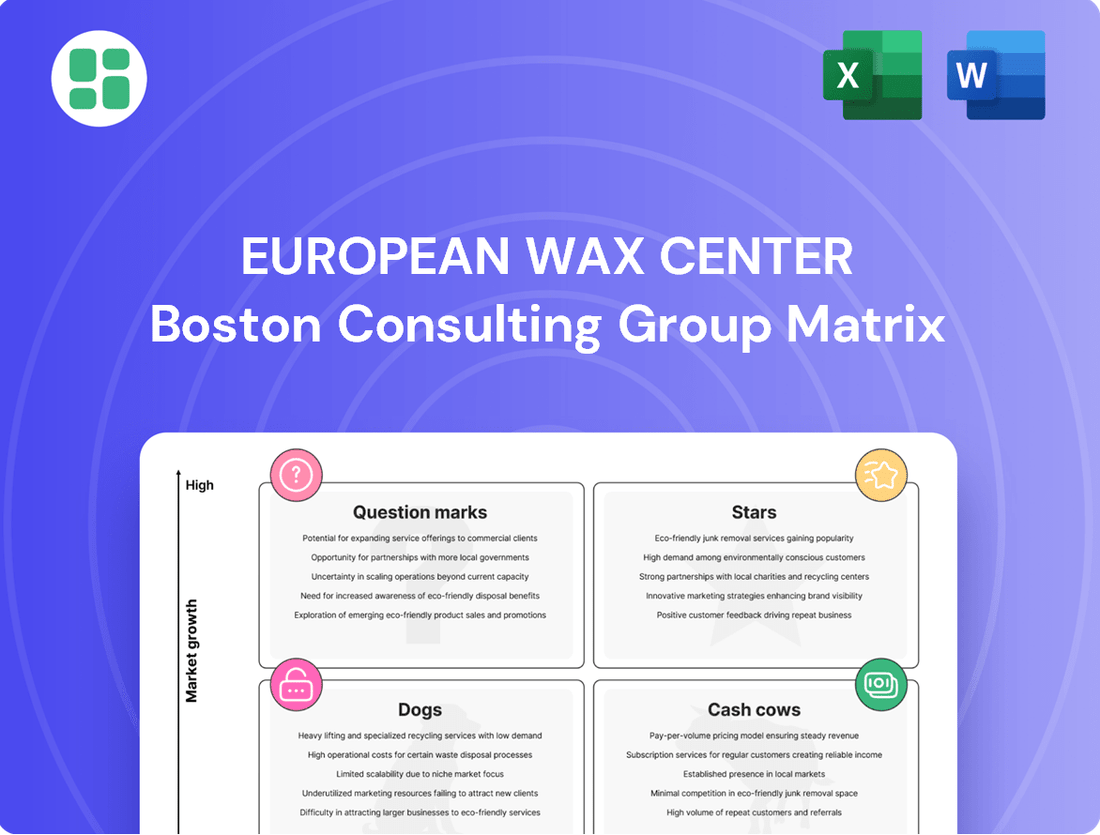

Curious about European Wax Center's product portfolio? Our BCG Matrix preview highlights their potential Stars and Cash Cows, but understanding the full strategic picture requires more.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Brazilian waxing services are undeniably the stars of European Wax Center's portfolio. This service holds a dominant market share, both within EWC and the wider out-of-home waxing industry. Its popularity continues to draw in new customers and foster loyalty, reflecting the increasing demand for specialized personal grooming.

Brow waxing and tinting are significant drivers of customer engagement for European Wax Center, fostering repeat business and strong loyalty. These services align perfectly with the prevailing beauty trend emphasizing sculpted eyebrows, placing them in a high-growth category. European Wax Center's expertise in specialized brow techniques and its premium service model solidify its market leadership in this area.

European Wax Center's exclusive Comfort Wax® and its proprietary skincare line are key differentiators, driving growth and enhancing the customer experience. These products are vital for guest satisfaction and retention, fostering repeat business and solidifying EWC's premium brand image. The unique Comfort Wax® formulation aims to make the waxing process more comfortable, attracting and keeping a loyal customer base within the expanding beauty product sector.

New Guest Acquisition Programs

New guest acquisition programs are the engine driving European Wax Center's (EWC) expansion, akin to a Stars category in the BCG Matrix. Initiatives like the 'First Wax Free' offer are vital for drawing in first-time customers, a strategy focused on capturing significant market share in both established and emerging locations. This approach is key to converting new visitors into repeat clients, thereby sustaining the franchise's growth trajectory.

These programs represent a high-growth, high-investment strategy. For instance, in 2023, EWC reported a 16% increase in system-wide sales, partly fueled by effective new guest acquisition. The cost of acquiring a new customer is a significant consideration, but the long-term value of a loyal guest often justifies the initial outlay. This focus on bringing in new demand is crucial for EWC to maintain its leading position in a highly competitive beauty services market.

Key aspects of EWC's new guest acquisition include:

- Targeted Marketing Campaigns: Utilizing digital and local advertising to reach potential new clients.

- Introductory Offers: The 'First Wax Free' program significantly lowers the barrier to entry for new customers.

- Referral Programs: Encouraging existing guests to bring in friends and family, expanding the customer base organically.

- Seamless Onboarding: Ensuring a positive first experience from booking to service completion to foster loyalty.

Strategic Franchise Expansion (Historically)

Historically, European Wax Center has demonstrated a strong commitment to strategic franchise expansion. In fiscal year 2024, the company achieved a notable growth of 23 net new centers. This aggressive expansion highlights their strategy to capture a significant market share within the burgeoning beauty and personal care industry.

This consistent growth in new locations is a direct reflection of sustained franchisee interest and a healthy development pipeline. It underscores the brand's appeal and the perceived viability of its business model for new operators.

While fiscal 2025 anticipates net closures, the company's forward-looking objective is to achieve net unit growth by the close of fiscal 2026. This indicates that strategic expansion remains a central 'Star' initiative, crucial for securing long-term market leadership.

- Fiscal 2024 Net New Centers: 23

- Strategic Focus: High market share in a growing industry

- Franchisee Demand: Robust and sustained

- Long-Term Goal: Net unit growth by end of fiscal 2026

European Wax Center's expansion strategy, particularly its new unit development, firmly places it in the 'Stars' category of the BCG Matrix. This means it operates in a high-growth market and holds a significant market share, requiring substantial investment to maintain this position.

The company's aggressive franchise expansion is a testament to this 'Star' status. For instance, in fiscal year 2024, European Wax Center successfully opened 23 net new centers, demonstrating a clear commitment to capturing market share in the expanding beauty services sector.

This focus on growth is supported by strong franchisee interest, indicating confidence in the brand's business model and market potential. While there might be a projected net closure in fiscal 2025, the overarching goal remains net unit growth by fiscal 2026, reinforcing its 'Star' positioning.

| BCG Category | European Wax Center Initiative | Market Growth | Market Share | Investment Strategy |

|---|---|---|---|---|

| Stars | New Unit Development & Franchise Expansion | High | High | High Investment to Maintain Growth |

| Key Metric (FY24) | Net New Centers Opened | N/A | N/A | 23 |

| Outlook | Strategic Growth Objective | N/A | N/A | Net unit growth by end of FY2026 |

What is included in the product

This BCG Matrix overview analyzes European Wax Center's service offerings, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

A clear BCG Matrix visually identifies European Wax Center's service portfolio, easing strategic decisions.

This matrix offers a simplified view of their offerings, alleviating the complexity of resource allocation.

Cash Cows

The core waxing services, such as leg, arm, and facial waxing, form the bedrock of European Wax Center's revenue. These established offerings boast a high market share within the mature waxing industry, ensuring consistent and substantial profit margins. In 2023, the US waxing market was valued at approximately $1.5 billion, with European Wax Center holding a significant portion of this segment.

Franchise royalty fees represent a significant cash cow for European Wax Center. The company generates substantial and consistent revenue from over 1,000 franchise locations operating across 45 states.

This asset-light model is highly advantageous, allowing EWC to profit from the extensive reach of its franchisees without bearing the direct operational expenses of each individual center. These royalty fees are a fundamental element of EWC's financial strength and ongoing profitability, contributing reliably to its bottom line.

Franchisee contributions to marketing funds are a cornerstone of European Wax Center's financial stability, acting as a predictable revenue stream. These mandatory payments, typically a percentage of gross sales, fuel national campaigns and local initiatives, ensuring consistent brand presence and customer engagement. For instance, in 2024, these contributions are projected to exceed $50 million, a testament to the robust franchisee network and its commitment to collective growth.

Wax Pass Program

The Wax Pass program at European Wax Center functions as a classic Cash Cow within the BCG matrix. By encouraging customers to pre-pay for multiple waxing services, it cultivates strong customer loyalty and generates predictable, recurring revenue. This program is instrumental in securing a high market share of repeat customers, thereby ensuring a consistent and stable cash flow.

This strategy effectively locks in future visits, significantly reducing customer churn and maximizing the lifetime value of their existing guest base. The predictability of income derived from the Wax Pass program makes it a highly efficient cash generator. Furthermore, the associated growth costs for this established program are notably low, amplifying its profitability.

- Customer Loyalty: The Wax Pass program fosters repeat business by incentivizing pre-payment for multiple services.

- Recurring Revenue: It creates a predictable income stream, a hallmark of a Cash Cow.

- High Market Share: European Wax Center leverages this program to maintain a strong hold on its loyal customer base.

- Low Growth Costs: The program's efficiency means minimal investment is needed to maintain its revenue generation.

Established Customer Base & Retention

European Wax Center benefits from a substantial and loyal customer following. High customer retention is a hallmark, stemming from dependable service quality and a premium customer journey. This existing customer base, frequently booked on recurring appointments, guarantees a steady revenue inflow with reduced customer acquisition expenses.

The company's significant market share in terms of customer visits creates a robust base for consistent cash generation. This allows European Wax Center to capitalize on these established gains, enjoying the advantages of stable visit frequency and spending patterns.

- Customer Loyalty: European Wax Center reports strong customer loyalty, with a significant portion of revenue coming from repeat clients.

- Predictable Revenue: The recurring appointment model ensures a predictable revenue stream, making financial planning more stable.

- Reduced Acquisition Costs: High retention means lower spending on acquiring new customers, boosting profitability.

- Market Dominance: A large customer base translates to a strong market position, enabling the company to leverage its existing success.

The core waxing services, such as leg, arm, and facial waxing, form the bedrock of European Wax Center's revenue. These established offerings boast a high market share within the mature waxing industry, ensuring consistent and substantial profit margins. In 2023, the US waxing market was valued at approximately $1.5 billion, with European Wax Center holding a significant portion of this segment.

Franchise royalty fees represent a significant cash cow for European Wax Center. The company generates substantial and consistent revenue from over 1,000 franchise locations operating across 45 states. This asset-light model is highly advantageous, allowing EWC to profit from the extensive reach of its franchisees without bearing the direct operational expenses of each individual center. These royalty fees are a fundamental element of EWC's financial strength and ongoing profitability, contributing reliably to its bottom line.

Franchisee contributions to marketing funds are a cornerstone of European Wax Center's financial stability, acting as a predictable revenue stream. These mandatory payments, typically a percentage of gross sales, fuel national campaigns and local initiatives, ensuring consistent brand presence and customer engagement. For instance, in 2024, these contributions are projected to exceed $50 million, a testament to the robust franchisee network and its commitment to collective growth.

The Wax Pass program at European Wax Center functions as a classic Cash Cow within the BCG matrix. By encouraging customers to pre-pay for multiple waxing services, it cultivates strong customer loyalty and generates predictable, recurring revenue. This program is instrumental in securing a high market share of repeat customers, thereby ensuring a consistent and stable cash flow. The predictability of income derived from the Wax Pass program makes it a highly efficient cash generator. Furthermore, the associated growth costs for this established program are notably low, amplifying its profitability.

European Wax Center benefits from a substantial and loyal customer following. High customer retention is a hallmark, stemming from dependable service quality and a premium customer journey. This existing customer base, frequently booked on recurring appointments, guarantees a steady revenue inflow with reduced customer acquisition expenses. The company's significant market share in terms of customer visits creates a robust base for consistent cash generation. This allows European Wax Center to capitalize on these established gains, enjoying the advantages of stable visit frequency and spending patterns.

| Revenue Source | Description | Market Position | Profitability | 2024 Projection/Data |

| Core Waxing Services | Established, high-demand services | High Market Share in Mature Market | Consistent & Substantial Margins | US Waxing Market ~$1.5B (2023) |

| Franchise Royalty Fees | Fees from 1,000+ locations | Extensive Network Reach | High & Stable Income Stream | Contributes reliably to bottom line |

| Marketing Fund Contributions | Percentage of franchisee sales | Supports Brand Presence & Engagement | Predictable Revenue | Projected >$50 Million |

| Wax Pass Program | Pre-paid multi-service packages | Strong Customer Loyalty & Retention | Recurring Revenue, Low Growth Costs | Maximizes Customer Lifetime Value |

| Existing Customer Base | Loyal clients with recurring appointments | Dominant Market Share in Visits | Steady Inflow, Reduced Acquisition Costs | High Retention Rate |

What You See Is What You Get

European Wax Center BCG Matrix

The European Wax Center BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, devoid of watermarks or demo content, is ready for immediate strategic application and professional presentation.

Rest assured, the BCG Matrix analysis for European Wax Center shown here is the identical, premium file you will download post-purchase. It's a meticulously crafted document, designed for immediate use in your business strategy, offering clear insights without any need for further editing.

What you see is the actual, finalized European Wax Center BCG Matrix document you’ll get upon purchase. This professionally designed, analysis-ready file is instantly downloadable, allowing you to seamlessly integrate its strategic insights into your business planning.

Dogs

Underperforming franchise locations within European Wax Center's network are categorized as Dogs in the BCG Matrix. The company anticipates closing between 28 and 50 centers in fiscal year 2025, a move that highlights these specific locations as underperformers.

These centers likely struggle with low market share and insufficient growth or profitability in their respective local markets. This ties up valuable capital and can negatively impact the overall brand image.

The strategy to divest or close these units is designed to remove these cash drains, thereby improving the health and profitability of the entire European Wax Center franchise network.

Niche or less popular ancillary services at European Wax Center, such as specialized treatments or less common waxing areas, might fall into the question mark category of the BCG matrix. These services often require dedicated resources and marketing efforts but may not attract a substantial customer base, leading to low demand and potentially thin profit margins. For instance, if a particular service sees less than 5% of total service bookings in a given quarter, it could be considered a question mark.

Ineffective local marketing spend by European Wax Center franchisees often falls into the Dog quadrant. These are initiatives like poorly targeted local flyers or social media ads that don't resonate with the community, leading to minimal customer sign-ups or repeat business. For instance, a campaign costing $500 might only bring in 5 new clients, a clear sign of low ROI.

Outdated Center Formats or Locations

European Wax Center locations that feature outdated center formats or suboptimal physical layouts may be struggling to attract and retain customers. These centers might employ operational models that are no longer considered best-in-class within the beauty services industry. This can lead to a diminished competitive edge against newer, more modern establishments.

Centers situated in declining retail areas or those with layouts that don't align with current customer expectations for ambiance and efficiency can experience reduced foot traffic. This directly impacts market share. For example, if a center's design feels cramped or lacks modern amenities, it might deter clients who are accustomed to more spacious and updated environments offered by competitors.

- Declining Foot Traffic: Centers in less desirable retail zones or with unappealing layouts often see fewer walk-in customers.

- Reduced Market Share: Failure to adapt to modern aesthetics and operational efficiency can cause a loss of customers to competitors.

- High Turnaround Costs: Significant renovations or complete overhauls of older formats can be prohibitively expensive, making a turnaround financially unfeasible for some locations.

- Customer Retention Issues: Outdated facilities can negatively impact the overall customer experience, leading to lower repeat business.

Non-Core Retail Products with Low Sales

Within European Wax Center's proprietary product line, specific SKUs that consistently show low sales volume and market penetration are classified as Dogs. These products, failing to capture customer interest, represent inefficient use of resources.

These underperforming items tie up valuable inventory and prime shelf space without contributing meaningfully to revenue or the brand's premium image. For instance, if a particular exfoliating scrub SKU, despite being part of the core offering, only accounted for 0.5% of total product sales in 2023 and saw no growth, it would fit this category.

- Low Sales Volume: Products with consistently minimal unit sales compared to the overall product portfolio.

- Low Market Penetration: Items that are not widely adopted or purchased by the customer base.

- Inventory and Shelf Space Tie-up: Products occupying resources without generating proportional returns.

- Brand Perception Impact: Underperformers can dilute the premium positioning if not managed effectively.

Underperforming franchise locations, often characterized by declining foot traffic and reduced market share, are classified as Dogs within European Wax Center's BCG Matrix. These centers may struggle with outdated formats or suboptimal layouts, impacting customer experience and competitive positioning.

The company's strategic plan to close between 28 and 50 centers in fiscal year 2025 directly addresses these underperforming units. This move aims to reallocate resources from these low-growth, low-market share locations to more promising areas of the business.

These locations represent a drain on capital and can dilute the brand's overall strength. By divesting from these Dogs, European Wax Center seeks to improve the financial health and operational efficiency of its network.

| BCG Category | European Wax Center Example | Key Characteristics | Strategic Action |

|---|---|---|---|

| Dogs | Underperforming Franchise Locations | Low market share, low growth, declining foot traffic, outdated formats | Divestment or closure |

Question Marks

European Wax Center's expansion into new states or metropolitan areas where it has a limited or no presence falls under the Question Mark category. These new markets require substantial initial investment to set up franchises and build brand recognition. The success of these ventures is uncertain, with initial market share and return on investment being difficult to predict.

For example, in 2024, European Wax Center continued its strategic expansion, opening new locations in states like Idaho and Arkansas, areas where its footprint was previously minimal. These moves are characterized by high upfront costs for real estate, build-out, and initial marketing campaigns. The company aims for rapid customer acquisition in these nascent markets, hoping to transform them into profitable Stars.

European Wax Center (EWC) is investing heavily in its digital platforms and guest technology. This includes upgrading its mobile app and online booking systems. For example, in 2024, EWC continued to roll out enhancements to its app, aiming for a more seamless booking and loyalty program experience for its customers.

These technological upgrades are designed to boost customer engagement and streamline operations. By leveraging data analytics, EWC seeks to personalize guest experiences, offering tailored promotions and services. While these initiatives hold significant potential for future growth and customer retention, their direct impact on market share and immediate profitability is still developing.

The substantial investments required for these digital advancements represent a high-risk, high-reward strategy. EWC is essentially betting on technology to drive future customer loyalty and operational efficiency, but the tangible returns on these investments are not yet fully guaranteed, placing them in a category that requires careful monitoring.

Exploring advanced skincare treatments or launching significantly innovative product lines beyond current proprietary offerings would position European Wax Center (EWC) within the Question Mark quadrant of the BCG Matrix. These ventures, such as introducing medical-grade facials or high-tech serums, represent potential new revenue streams but also carry substantial research and development costs and require extensive market testing. The beauty industry saw global skincare market revenue reach approximately $146 billion in 2023, indicating a large but competitive landscape for new entrants.

Success for these advanced skincare initiatives hinges on EWC's ability to effectively capture new market segments and gain consumer acceptance, especially against established premium brands. For instance, the demand for personalized skincare solutions is growing, with the global personalized skincare market projected to reach over $30 billion by 2030, offering a potential avenue for EWC's innovation. However, the high initial investment and uncertain return on investment are characteristic of Question Mark products, demanding careful strategic evaluation.

Targeted Male Grooming Services Expansion

Expanding targeted male grooming services at European Wax Center aligns with the Question Mark quadrant of the BCG Matrix. This segment is experiencing substantial growth, with the global men's grooming market projected to reach $81.2 billion by 2024, according to Grand View Research. A strategic focus here could involve specialized marketing campaigns and service offerings to attract and retain male clientele, aiming to capture a larger market share.

- Market Growth: The men's grooming market is a rapidly expanding sector, presenting significant opportunity.

- Strategic Investment: Increased investment in tailored marketing and service development is needed.

- Uncertain Outcome: While potential is high, success hinges on effective execution and market reception.

Strategic Turnaround of Net Center Closures

European Wax Center's strategy to achieve net unit growth by the end of fiscal 2026, after anticipated net center closures in fiscal 2025, places its turnaround efforts squarely in the Question Mark quadrant of the BCG Matrix. This ambitious plan necessitates substantial capital allocation towards franchisee assistance, refined real estate site selection, and possibly updated financial models to transform underperforming locations into future growth engines.

The company's 2024 performance indicated a need for such a strategic pivot. For instance, while specific net closure numbers for 2025 are projected, the overall trend in the waxing industry and retail sector in 2024 highlighted increasing operational costs and evolving consumer preferences, making the success of this turnaround a significant undertaking.

- Projected Net Unit Growth Target: Aiming for positive net unit growth by the end of fiscal 2026.

- Fiscal 2025 Outlook: Anticipating net center closures in the preceding fiscal year.

- Investment Focus: Significant capital required for franchisee support and real estate strategy.

- Risk/Reward Profile: High-risk initiative with the potential for substantial long-term expansion benefits.

European Wax Center's foray into entirely new geographic regions or demographic segments where its brand recognition is minimal represents a classic Question Mark. These ventures demand significant upfront investment for market penetration and brand building, with uncertain outcomes regarding market share and profitability. For example, in 2024, EWC's expansion into less saturated markets like certain Midwestern states required substantial capital for new franchise development and localized marketing efforts.

The company's ongoing investment in advanced technology, such as enhancing its mobile app and online booking systems, also fits the Question Mark profile. While these digital upgrades aim to improve customer experience and operational efficiency, their direct impact on market share and immediate profitability remains to be fully realized. In 2024, EWC continued to roll out app enhancements, betting on technology to drive future loyalty and streamline operations, a strategy with high potential but unproven long-term returns.

Introducing innovative service lines, such as highly specialized treatments or premium product offerings, places EWC in the Question Mark category. These initiatives, while potentially tapping into growing market segments like personalized skincare, require considerable R&D investment and market validation. The global skincare market, valued at approximately $146 billion in 2023, shows the potential, but also the intense competition for new entrants.

European Wax Center's strategic goal of achieving net unit growth by the end of fiscal 2026, following anticipated net center closures in fiscal 2025, exemplifies a Question Mark. This turnaround effort requires substantial investment in franchisee support and optimized real estate strategies to convert underperforming locations into profitable centers. The company's 2024 performance underscored the need for such a strategic pivot, with the broader retail landscape in 2024 presenting challenges like rising operational costs.

| Initiative | BCG Category | Investment Required | Market Potential | Risk Level |

|---|---|---|---|---|

| Geographic Expansion (New States) | Question Mark | High (Franchise Setup, Marketing) | High (Untapped Markets) | High |

| Digital Platform Enhancements | Question Mark | High (App Dev, Tech Upgrades) | Medium-High (Customer Engagement) | Medium-High |

| Innovative Service Lines | Question Mark | High (R&D, Market Testing) | High (Growing Segments) | High |

| Net Unit Growth Turnaround | Question Mark | High (Franchisee Support, Real Estate) | High (Future Expansion) | High |

BCG Matrix Data Sources

Our European Wax Center BCG Matrix is built on verified market intelligence, combining financial data, industry research, and competitor analysis to ensure reliable, high-impact insights.