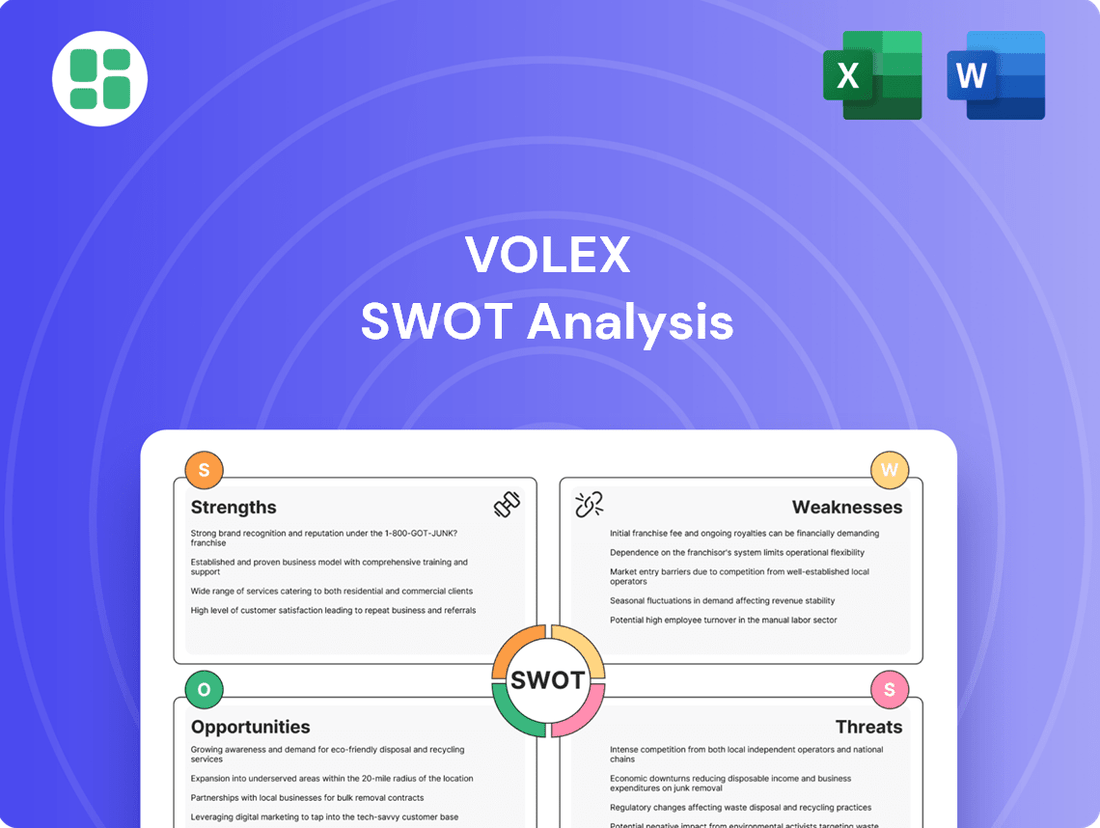

Volex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Volex Bundle

Volex's robust manufacturing capabilities and established global presence present significant strengths, but also highlight potential vulnerabilities in supply chain diversification. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Volex's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Volex stands as a premier global supplier of power products and cable assemblies, catering to diverse sectors like consumer electronics, medical, industrial, and the rapidly expanding electric vehicle market. This wide reach across critical industries shields the company from localized economic fluctuations.

With an impressive network of 27 manufacturing sites strategically located in 25 countries, Volex boasts a truly global operational footprint. This extensive presence ensures business continuity and allows for localized production, enhancing supply chain efficiency and customer responsiveness.

The company's revenue is generated from a variety of sources, minimizing reliance on any single market segment. Volex's strong positions in specialized niches, often characterized by high customer loyalty and switching costs, foster predictable revenue streams and support ongoing expansion.

Volex has achieved a significant milestone, surpassing $1 billion in revenue for the first time in FY2025, alongside an underlying operating profit exceeding $100 million. This financial strength is underpinned by a consistent track record of maintaining its underlying operating margin between 9% and 10% for five consecutive years. This sustained profitability highlights the company's effective cost management and resilience against inflationary pressures, providing a solid foundation for future growth and shareholder value.

Volex demonstrates a keen strategic advantage by concentrating its efforts on rapidly expanding markets. The company's focus on sectors like Electric Vehicles (EV), data centers, and medical cable assemblies allows it to capitalize on significant secular growth trends.

The EV charging solutions segment is a prime example of this strength, experiencing impressive organic growth. For instance, revenue in this area surged by over 40% in FY2025, a direct result of securing new customer programs and establishing itself as a key license partner for the North American charging standard.

This deliberate alignment with burgeoning industries, particularly the electrification of transport, positions Volex favorably for sustained future expansion and market leadership.

Integrated Manufacturing and Engineering Expertise

Volex's integrated manufacturing and engineering expertise is a significant strength, allowing them to offer end-to-end solutions from initial design through to final delivery. This comprehensive approach streamlines the customer experience and ensures a high degree of control over product development and quality.

Their engineering-led innovation is a key differentiator. Volex leverages its in-house design capabilities to create products tailored for high-growth sectors, demonstrating a capacity for developing novel solutions to complex technical challenges. This is crucial in fast-evolving markets like electric vehicles and medical devices.

The company's vertical integration further bolsters this strength. By controlling more of the manufacturing process, Volex can enhance product reliability and quality. This commitment to continuous improvement, evident in their operational focus, helps build strong, lasting relationships with clients who value dependable supply chains and innovative product development.

- Integrated Solutions: Volex provides a full spectrum of manufacturing services, from concept to completion, simplifying the supply chain for its clients.

- Engineering Prowess: The company's in-house engineering talent drives innovation, enabling the development of proprietary products for high-demand markets.

- Vertical Integration: Control over multiple stages of production enhances quality assurance and operational efficiency.

- Customer Focus: A dedication to continuous improvement and problem-solving fosters robust, long-term partnerships.

Resilient Supply Chain and Global Footprint

Volex's strength lies in its robust and geographically diverse supply chain, encompassing 27 manufacturing facilities strategically located across three continents and 25 countries. This extensive global footprint ensures responsive, localized service delivery and allows the company to capitalize on economies of scale. For instance, in fiscal year 2024, Volex reported that its global manufacturing base enabled it to effectively manage inflationary pressures, a key advantage in the current economic climate.

This widespread presence is crucial for navigating complex global trade dynamics, including the potential impacts of tariffs and trade agreements. The company’s recent investments in expanding facilities in key growth regions such as India, Mexico, and Indonesia further bolster its manufacturing capacity and resilience. These expansions are designed to enhance Volex's ability to adapt to evolving market demands and supply chain disruptions, providing a significant competitive edge.

- Global Reach: 27 manufacturing facilities across 3 continents and 25 countries.

- Cost Management: Ability to effectively manage and pass through inflationary costs due to scale.

- Strategic Expansion: Recent facility growth in India, Mexico, and Indonesia strengthens manufacturing base.

- Adaptability: Enhanced capacity to respond to evolving supply chain dynamics and potential tariff impacts.

Volex's integrated manufacturing and engineering capabilities provide a significant advantage, enabling end-to-end solutions from design to delivery. This comprehensive approach streamlines operations and ensures high product quality. Their engineering-led innovation is a key differentiator, allowing them to develop tailored products for high-growth sectors like EVs and medical devices.

The company's vertical integration further strengthens its position by enhancing quality control and operational efficiency. This focus on continuous improvement and problem-solving fosters strong client relationships, built on reliable supply chains and innovative product development.

Volex's financial performance in FY2025 underscores these strengths, with revenue surpassing $1 billion and underlying operating profit exceeding $100 million. The company has maintained its underlying operating margin between 9% and 10% for five consecutive years, demonstrating effective cost management and resilience.

Furthermore, Volex's strategic focus on rapidly expanding markets like Electric Vehicles (EV) and data centers is paying dividends. The EV charging solutions segment, for instance, saw revenue surge by over 40% in FY2025, driven by new customer programs and its role as a key license partner for the North American charging standard.

| Metric | FY2025 (USD) | FY2024 (USD) |

|---|---|---|

| Revenue | > $1 Billion | [Data not available for FY2024] |

| Underlying Operating Profit | > $100 Million | [Data not available for FY2024] |

| Underlying Operating Margin | 9%-10% (Consistent for 5 years) | 9%-10% (Consistent for 5 years) |

| EV Charging Solutions Revenue Growth | > 40% | [Data not available for FY2024] |

What is included in the product

Delivers a strategic overview of Volex’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable SWOT framework to identify and address critical business challenges.

Weaknesses

Volex's reliance on a few major customers presents a significant weakness. For instance, during the fiscal year ending March 31, 2023, a substantial portion of revenue came from its top customers, making the company vulnerable to shifts in their demand or sourcing strategies.

Furthermore, changes in the product mix can negatively impact Volex's profitability. A move towards lower-margin products, potentially exacerbated by acquisitions like Murat Ticaret which initially diluted gross margins, could erode overall financial performance if not strategically managed.

Volex's extensive global footprint, while a strength, also presents a significant weakness due to its exposure to regional economic volatility. For instance, the company has noted the impact of economic turbulence and inflation in key markets, such as Turkey. While Volex actively manages and aims to pass on inflationary costs, persistent or severe economic downturns in these regions can strain profitability and disrupt operational efficiency.

Volex faced a significant hurdle in working capital management during FY2025, marked by an adverse movement. This was primarily driven by increased inventory needs, which consequently lowered the company's cash conversion rate from the prior year.

This situation highlights a potential weakness in Volex's ability to efficiently manage its inventory and optimize cash flow, particularly as it navigates growth initiatives and evolving market conditions.

Slight Decline in Medical Segment Revenue

Volex experienced a minor setback in its medical segment, with revenue seeing a decrease of about 5% in the fiscal year 2025 compared to the previous year. While the company remains optimistic about the long-term outlook for this sector, this recent dip warrants attention. It could signal increasing competition or shifts in market demand that Volex must proactively manage.

This performance in the medical segment highlights a potential vulnerability in Volex's otherwise robust growth trajectory. A sustained decline here could impact the company's ability to maintain its balanced growth across different industries. Volex will need to analyze the root causes of this revenue contraction to ensure its diversification strategy remains effective.

- Medical Segment Revenue Decline: Approximately 5% year-on-year decrease in FY2025.

- Potential Causes: Competitive pressures or evolving market needs.

- Strategic Implication: Need to address segment performance to maintain diversified growth.

Integration Risks of Acquisitions

While Volex's acquisition of Murat Ticaret is showing positive signs, contributing to revenue growth, the inherent risks of integrating new businesses remain a key concern. These risks can manifest as cultural clashes between the two organizations, leading to employee friction, or operational inefficiencies that disrupt day-to-day business. There's also the possibility that the expected financial benefits, or synergies, from the acquisition might not fully materialize as planned.

Volex employs a disciplined approach to integration, but the ongoing process demands substantial management focus and resources. This means that key personnel and capital are tied up in ensuring the successful assimilation of Murat Ticaret, potentially diverting attention from other strategic initiatives or core business operations. For instance, the successful integration of Murat Ticaret, completed in early 2024, required significant management bandwidth throughout the fiscal year ending May 31, 2024, impacting the allocation of resources for other growth opportunities.

- Cultural Clashes: Potential for differing work ethics and communication styles between Volex and Murat Ticaret employees.

- Operational Inefficiencies: Risk of disruption to existing supply chains or manufacturing processes during the integration phase.

- Synergy Realization Failure: The possibility that anticipated cost savings or revenue enhancements may not be fully achieved.

- Management Bandwidth: Ongoing integration activities consume significant management time and attention, potentially impacting other business areas.

Volex's concentrated customer base poses a significant risk, as a substantial portion of its revenue in FY2023 was derived from its top clients. This dependence makes the company susceptible to changes in these key relationships or their procurement strategies. The company's profitability is also vulnerable to shifts in product mix, with a move towards lower-margin products potentially impacting overall financial performance, as seen with the initial dilution of gross margins following the Murat Ticaret acquisition.

The company's global operations, while an advantage, also expose it to regional economic instability. For instance, Volex has acknowledged the impact of inflation and economic challenges in markets like Turkey, which can affect profitability and operational smoothness despite efforts to pass on costs.

Volex experienced an unfavorable shift in working capital during FY2025, primarily due to increased inventory levels, which negatively impacted its cash conversion rate compared to the prior year. This suggests potential inefficiencies in inventory management and cash flow optimization, especially during periods of growth and market fluctuation.

The medical segment saw a revenue decrease of approximately 5% in FY2025, indicating a potential vulnerability in this area. This dip could be attributed to increased competition or evolving market demands, necessitating proactive management to maintain balanced growth across its diverse industry segments.

Same Document Delivered

Volex SWOT Analysis

The preview you see is the actual Volex SWOT analysis document you'll receive upon purchase. This ensures transparency and allows you to assess the quality and depth of our professional analysis before committing.

You're viewing a live preview of the actual SWOT analysis file for Volex. The complete, detailed version becomes available immediately after checkout, offering a comprehensive understanding of the company's strategic position.

This is a real excerpt from the complete Volex SWOT analysis. Once purchased, you’ll receive the full, editable version, providing you with actionable insights and a robust strategic framework.

Opportunities

The global electric vehicle charging station market is projected for substantial growth, with forecasts indicating a compound annual growth rate (CAGR) of over 25% from 2025 through 2034. This surge is driven by increasing EV adoption and government mandates for charging infrastructure development.

Volex is strategically positioned to benefit from this trend as a significant supplier of EV charging solutions and a licensed partner for the North American charging standard. This dual advantage allows Volex to tap into the expanding global charging network and meet the growing demand for reliable and standardized charging equipment.

The global data center power market is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond, fueled by escalating demand for data storage, cloud services, and widespread digital transformation initiatives. Volex's specialized portfolio, including essential data center power products and advanced high-speed data center cables, is strategically positioned to capitalize on this trend.

This alignment presents a significant opportunity for Volex to increase its market share, especially as the industry increasingly adopts high-density computing architectures and the demand for AI-driven workloads intensifies, requiring more sophisticated and reliable power and connectivity solutions.

The healthcare sector's rapid digital transformation presents a significant opportunity for Volex. The market for connected medical devices is projected to reach $111.8 billion by 2027, growing at a compound annual growth rate of 15.8% from 2022. This surge is driven by the widespread adoption of electronic health records, remote patient monitoring systems, and the expansion of telehealth services.

Volex's established proficiency in manufacturing high-quality medical cable assemblies and critical connectivity solutions directly aligns with this growing demand. The company is well-positioned to capitalize on the increasing need for reliable data transfer between a multitude of medical devices and the broader healthcare IT infrastructure.

Strategic Acquisitions and Partnerships

Volex's strategic acquisition history, exemplified by the purchase of Murat Ticaret, has demonstrably broadened its manufacturing capabilities and extended its global market presence. The company's ongoing strategy involves actively seeking targeted acquisitions that align with its growth objectives and enhance its position in specialized manufacturing niches.

These strategic moves are designed to complement internal development and solidify market standing. For instance, by acquiring companies with specific technological expertise, Volex can quickly integrate new competencies and offer a more comprehensive product suite to its existing and potential clientele.

Furthermore, collaborative partnerships, such as the one Volex has established with Tesla, represent a significant avenue for growth. These alliances are crucial for accessing new customer segments and driving technological innovation, as seen in their work within the electric vehicle sector.

- Acquisition Success: Volex's acquisition of Murat Ticaret in 2019 for approximately $120 million significantly boosted its presence in the Turkish market and added diverse manufacturing capabilities.

- Targeted Growth: The company continues to evaluate acquisition targets in niche manufacturing sectors, aiming to enhance its product portfolio and technological edge.

- Partnership Impact: Collaborations like the one with Tesla are key to Volex's strategy, opening doors to high-growth industries and advanced technological integrations, contributing to its revenue streams in sectors like automotive electronics.

Leveraging Global Supply Chain Simplification and Near-shoring Trends

The global shift towards supply chain simplification and near-shoring, accelerated by geopolitical tensions and the pursuit of greater resilience, creates a significant opportunity for Volex. This trend allows Volex to position itself as a key partner for companies looking to streamline their operations and reduce reliance on distant manufacturing hubs.

Volex's existing manufacturing footprint in strategic regions, coupled with its demonstrated expertise in managing complex program transitions, directly addresses this market demand. The company can leverage these capabilities to assist customers in consolidating their supply chains, thereby fostering deeper partnerships and attracting new business. For instance, Volex's ability to manage program relocations effectively can be a compelling differentiator in securing new contracts as companies re-evaluate their global sourcing strategies.

- Near-shoring growth: Global supply chain disruptions have led to a notable increase in near-shoring initiatives, with many companies actively seeking to bring production closer to their end markets.

- Resilience focus: A 2024 survey indicated that over 70% of businesses are prioritizing supply chain resilience, making Volex's regional manufacturing capabilities highly attractive.

- Volex's capabilities: Volex's experience in managing intricate project transfers and its established capacity in key near-shore locations position it to capitalize on these trends.

Volex is well-positioned to capitalize on the accelerating global adoption of electric vehicles, a market projected to see significant expansion. Their role as a key supplier for EV charging solutions and their licensing for North American charging standards provide a strong foundation for growth in this sector.

The increasing demand for data centers, driven by cloud services and digital transformation, presents another substantial opportunity. Volex's specialized power products and high-speed data center cables align perfectly with the industry's need for robust infrastructure, especially with the rise of AI workloads.

Furthermore, the healthcare industry's digital transformation, particularly the growth in connected medical devices, offers a promising avenue. Volex's expertise in medical cable assemblies and connectivity solutions directly addresses the rising need for reliable data transfer in healthcare settings.

Volex's strategic approach to acquisitions and partnerships, such as their collaboration with Tesla, continues to broaden their capabilities and market reach, enabling them to tap into high-growth industries and advanced technologies.

Threats

Evolving trade policies, such as potential U.S. tariffs on goods from countries where Volex operates factories like China, Mexico, Indonesia, and Turkey, present a significant threat. These tariffs could directly impact a substantial portion of Volex's sales, potentially increasing operational costs and eroding its competitive edge in key markets.

The power products and cable assembly markets are highly competitive, featuring a mix of global giants and agile regional players. This intense rivalry puts significant pressure on pricing, potentially squeezing Volex's profit margins even as it targets specialized, high-value segments. For instance, in the fiscal year ending June 30, 2023, Volex reported revenue of $562.5 million, a figure that underscores the scale of operations within a competitive landscape.

Staying ahead requires continuous investment in research and development, as well as maintaining and expanding production capabilities. This constant need to innovate and scale up to meet market demands while fending off competitors presents an ongoing strategic challenge for Volex.

Global supply chain disruptions, a persistent challenge through 2024 and into 2025, pose a significant threat to Volex. Even with a robust supply chain, shortages of essential components or unexpected price swings in raw materials can still disrupt production timelines and increase operational expenses. For instance, the semiconductor industry, critical for many of Volex's products, experienced significant volatility in 2024, impacting lead times and costs across various electronics manufacturers.

Volex's dependence on a select group of suppliers for vital raw materials and components creates inherent vulnerabilities. A disruption affecting these key partners, whether due to geopolitical events, natural disasters, or financial instability, could directly impede Volex's ability to meet demand. The ongoing geopolitical tensions in Eastern Europe, for example, continued to create uncertainty in the availability and pricing of certain metals and chemicals throughout 2024, affecting manufacturing sectors globally.

Technological Obsolescence and Rapid Innovation Cycles

Volex operates in sectors like consumer electronics, electric vehicles (EVs), and data centers, all experiencing incredibly fast technological evolution. This means their current products could quickly become outdated. For instance, the global semiconductor market, a key component in many of these industries, is projected to reach $600 billion in 2024, highlighting the rapid pace of development and the potential for disruption.

The constant drive for innovation means Volex must continuously invest in research and development to stay competitive. Failure to adapt to emerging technologies, such as advancements in battery technology for EVs or new networking standards for data centers, could lead to a loss of market share. The global EV market alone is expected to grow significantly, with sales reaching over 15 million units in 2024, underscoring the need for Volex to keep pace with evolving vehicle architectures.

- Rapid Innovation: Industries served by Volex, such as consumer electronics and EVs, see product lifecycles shortening due to quick technological advancements.

- Obsolescence Risk: Existing Volex products face the threat of becoming obsolete if new, superior technologies emerge and are adopted by competitors.

- Adaptation Imperative: Volex must maintain agility to integrate new technologies, like next-generation power management solutions, to avoid being left behind.

- Market Disruption: Emerging technologies could fundamentally alter the demand for Volex's current product portfolio if the company is not proactive in its R&D and strategic planning.

Cybersecurity Risks and Data Breaches

As a manufacturer handling critical power and data transmission components, Volex faces significant cybersecurity risks. A successful cyberattack could disrupt manufacturing operations, leading to production delays and financial losses. For instance, the IBM Cost of a Data Breach Report 2024 found that the global average cost of a data breach reached $4.73 million, a figure Volex would aim to avoid.

The potential for data breaches is a major concern, as Volex processes sensitive customer information and proprietary intellectual property. Such breaches could result in substantial financial penalties, reputational damage, and loss of customer trust. The average time to identify and contain a data breach in 2024 was 201 days, highlighting the prolonged impact such events can have.

- Operational Disruption: Cyberattacks can halt Volex's manufacturing lines, directly impacting revenue and delivery schedules.

- Data Breach Impact: Loss of sensitive customer or IP data can lead to severe financial and legal repercussions.

- Reputational Damage: A significant cyber incident could erode market confidence in Volex's security and reliability.

- Increased Costs: Responding to and recovering from cyberattacks incurs substantial costs, including IT remediation and potential regulatory fines.

Volex faces threats from evolving trade policies, such as potential U.S. tariffs impacting its manufacturing hubs like China and Mexico, which could increase costs and reduce competitiveness. Intense competition in power products and cable assemblies, with both global and regional players, pressures pricing and profit margins, as evidenced by its $562.5 million revenue in FY23 amidst a crowded market.

SWOT Analysis Data Sources

This Volex SWOT analysis is built upon robust data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts to ensure a well-informed and strategic assessment.